10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Nobody enjoys tax season, but it’s one of those necessary annual pop-ups that we all go through together. While tax season blossoms in tandem with daffodils and tulips, we typically garner far less gratification from doing our taxes than we do from collecting a colorful bunch of flowers.

Nevertheless, there is a sunny side to tax season. If done correctly, you may stand to earn a fair bit of points and miles when you pay taxes with a credit card. Before you know it, you’ll be able to book a much-needed vacation using the extra points and miles you earn.

If this sounds like a good deal to you, read on!

How to Pay Taxes With a Credit Card

You can use Plastiq to pay many bills you have that don’t accept credit cards, and that includes your taxes. You could use Plastiq to pay your taxes with its 2.9% processing fee, but there are three payment processors offered on the IRS website with fees between 1.82% and 1.98% of the total payment.

Payment Processor Options

Each payment processor has its own fee structure for both debit card and credit card payments. Additionally, each accepts a number of digital wallet payments.

| Processor | Debit Card Fee | Credit Card Fee | Digital Wallets Accepted |

|---|---|---|---|

| Pay1040.com (Link2GovCorporation) | $2.50 flat fee | 1.87%; minimum fee $2.50 | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, AFFN, Cirrus, Interlink, Jeanie, Shazam, Maestro, Click to Pay |

| PayUSAtax.com (WorldPay US, Inc.) | $2.14 flat fee | 1.82%; minimum fee $2.69 | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, Accel, Paypal, Click to Pay |

| ACIPayOnline.com (ACI Payments, Inc.) | $2.20 flat fee | 1.98%; minimum fee $2.50 | Visa, Mastercard, Discover, American Express, STAR, Pulse, NYCE, PayPal, Click to Pay, Pay with Cash |

Using PayUSAtax is the best option if you’re paying with a credit card as it has the lowest processing fee at 1.82%. This will be the easiest fee to offset with the rewards earned from a credit card.

For those paying quarterly estimated taxes, you can make two payments per quarter as well as two payments for your annual payment. While not officially stated, this two-payment limit seems to be per processor. Although this might not be necessary for most, it might be useful to a few of you who submit multiple payments.

None of these options will hit you with a cash advance fee so you can rest assured that you will earn points.

Want to learn more about paying your taxes with a credit card? Check out Episode 19 of Takeoff: A Points and Miles Podcast by 10xTravel, where we discuss this further.

Why Should You Pay Taxes with a Credit Card?

When it comes to earning points and miles, taxes are no different than any other large purchase you can use as good earning potential. With fees ranging from 1.82% to 1.98%, there is ample opportunity to offset the fee with the rewards you can earn. If you can make the numbers work for you, why let this opportunity pass you by?

In case you aren’t convinced yet, here is a list of the perks of using your credit card to pay your taxes this year.

Knock Out a Minimum-Spending Requirement to Earn a Welcome Offer

Without a doubt, earning a welcome offer when paying taxes with a credit card is going to yield the best return. If you’ve played your cards right (literally), you might consider opening a new account in early spring and taking care of the minimum spending requirement immediately upon filing your taxes.

This can be especially useful when working on a higher minimum spending requirement for cards like the Business Platinum Card® from American Express, Chase Ink Business Cash® Credit Card or Chase Ink Business Unlimited® Credit Card.

Chase Ink Business Cash® Credit Card

Earn $350

bonus cash back when you spend $3,000 on purchases

in the first three months and additional $400 when you spend $6,000 on purchases in the first six months after account opening

The Business Platinum Card® from American Express

120,000

Membership Rewards® Points

after you spend $15,000 on eligible purchases with the Business Platinum Card within the first 3 months of Card Membership

Annual Fee: $695 Terms Apply. | Rates & Fees.

Earn Valuable Miles and Points

If you’re not working toward a minimum spend, one card stands out as the best option for paying taxes: the Blue Business® Plus Credit Card from American Express. Every year, you will earn 2X Membership Rewards points per dollar on up to $50,000 per calendar year and 1X thereafter.

Meanwhile, the American Express Blue Business Cash™ Card earns 2% cash back on the first $50,000 in annual spending (and 1% back thereafter).

The Blue Business® Plus Credit Card from American Express

15,000

Membership Rewards®

after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

Terms Apply. | Rates & Fees.

If you’re OK with waiting a little while for your bonus, the Citi Double Cash Card® offers 2X ThankYou Points per dollar, but you earn 1X point when you spend and 1X point when you pay off your balance.

It’s best practice to pay your bills in full anyway, and Citi has a great way to incentivize that. These points can be redeemed for cash back at a rate of 1 cent per point, meaning you’re effectively earning 2% cash back. This means you’ll come out slightly ahead when using any of the three IRS-authorized payment processors.

You also have a few options for earning 1.5X points per dollar. With the Chase Freedom Unlimited®, you can earn valuable Ultimate Rewards points, which can be transferred to airline and hotel partners if you also have the Chase Sapphire Reserve®, the Chase Sapphire Preferred® Card or the Chase Ink Business Preferred® Credit Card.

Business owners with larger tax bills should consider the Business Platinum Card® from American Express as it earns 1.5X on eligible purchases of $5,000 or more on up to the first $2 million spent per year and 1X after that.

$200 cash back

after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

Chase Ink Business Preferred® Credit Card

100,000

Chase Ultimate Rewards Points®

after you spend $8,000 on purchases in the first 3 months after account opening

Annual Fee: $95

Progress Toward Additional Offers and Card Benefits

In some specific circumstances, it might be worth paying taxes with a credit card that will help you earn an additional offer or benefit. Several cards provide offers or benefits once you earn a certain number of points or reach a spend threshold.

Southwest Companion Pass

One of the most popular perks among 10xTravel readers is the Southwest Companion Pass that allows you to book two-for-one tickets whether you’re paying with cash or booking an award flight. To obtain the Companion Pass, you need to earn 135,000 Rapid Rewards points within a calendar year.

Many people apply for two of the co-branded Southwest cards issued by Chase at the beginning of the year:

Southwest Rapid Rewards® Plus Credit Card

Earn 50,000

Bonus Points

after spending $1,000 on purchases in the first 3 months from account opening.

Annual Fee: $69

Southwest Rapid Rewards® Premier Credit Card

Earn 50,000

Bonus Points

after spending $1,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Southwest Rapid Rewards® Priority Credit Card

Earn 50,000

Bonus Points

after spending $1,000 on purchases in the first 3 months from account opening.

Annual Fee: $149

Southwest® Rapid Rewards® Performance Business Credit Card

80,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening

Annual Fee: $199

Southwest® Rapid Rewards® Premier Business Credit Card

60,000

bonus points

after you spend $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

The information for the Southwest Rapid Rewards Premier Credit Card has been collected independently by 10XTravel.com. The card details on this page have not been reviewed or provided by the card issuer.

Earning the Southwest Companion Pass early in the year will provide you with the pass for the remainder of the year plus the following year. Sometimes, the sign-up bonuses on two of the cards are high enough to get you the Companion Pass outright, but if not, paying taxes can help you earn the necessary 135,000 Rapid Rewards points.

Delta Elite Status

If you are looking to earn elite status with Delta, spending on Delta cards can help you earn status faster. This might be a good option for those who travel for work. If your employer is paying for your travel, it sometimes makes sense to pick a carrier and earn elite status. However, most U.S.-based airlines have added spending requirements, so even if you’ve reached the qualifying flight miles requirement, you might not earn elite status.

Delta Air Lines flyers have four credit card options that can help earn you status:

Delta SkyMiles® Platinum American Express Card

50,000

Bonus Miles

after you spend $3,000 in purchases on your new Card in your first 6 months.

Annual Fee: $350 Terms Apply. | Rates & Fees.

Delta SkyMiles® Platinum Business American Express Card

Earn 65,000

Bonus Miles

after spending $6,000 in purchases on your new Card in your first 6 months of Card Membership.

Annual Fee: $350 Terms Apply. | Rates & Fees.

Delta SkyMiles® Reserve American Express Card

60,000

Bonus Miles

after you spend $5,000 in purchases on your new Card in your first 6 months.

Annual Fee: $650 Terms Apply. | Rates & Fees.

Delta SkyMiles® Reserve Business American Express Card

Earn 75,000

Bonus Miles

after spending $10,000 in purchases on your new Card in your first 6 months of Card Membership.

Annual Fee: $650 Terms Apply. | Rates & Fees.

To be clear, chasing status is not always worth it, so this is not going to apply to most travelers.

Bottom Line

As demonstrated above, there are several ways to make the most of paying taxes. Using your tax payments to hit a minimum-spending requirement is definitely the top choice, but if that’s not an option right now, you might be able to get some big value by using a credit card that earns 1.5X to 2X points per dollar.

Although tax season isn’t the most wonderful time of the year, it’s an excellent time to leverage the necessary payments to your maximum benefit. By finding a lucrative way to offset credit card fees with big rewards, you’re one step closer to a relaxing vacation in Hawaii where you can forget all about taxes for a while.

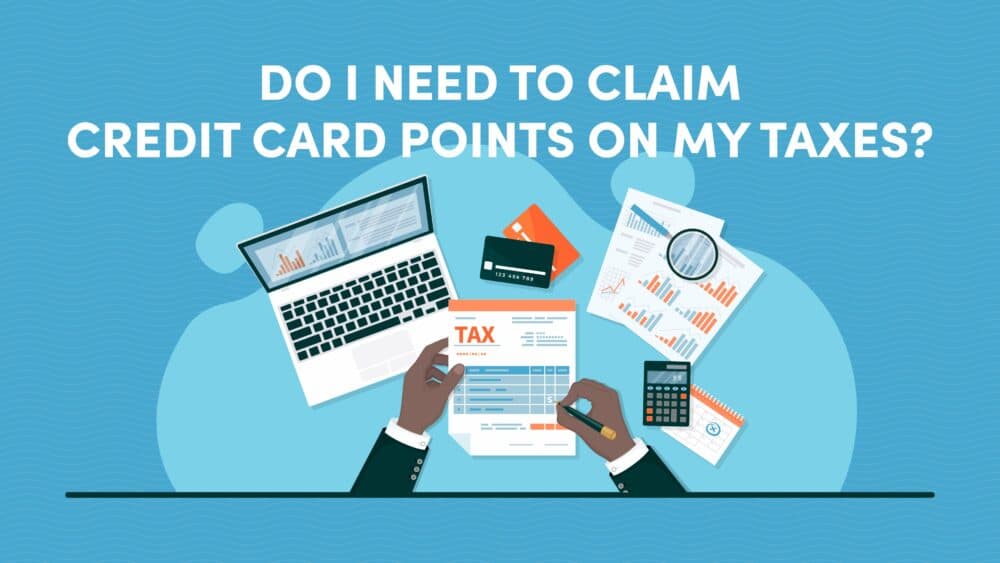

In the spirit of tax season, check out our article about claiming points/miles on your taxes.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months of account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after spending $1,000 on purchases in the first 3 months from account opening.

after spending $1,000 on purchases in the first 3 months from account opening.

after spending $1,000 on purchases in the first 3 months from account opening.

after you spend $3,000 on purchases in the first 3 months from account opening.

after you spend $5,000 on purchases in the first 3 months from account opening

in the first three months and additional $400 when you spend $6,000 on purchases in the first six months after account opening

after you spend $15,000 on eligible purchases with the Business Platinum Card within the first 3 months of Card Membership

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.