10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Let’s cut to the chase; if you’re wondering about American Airlines miles’ value you can expect to get around two cents per mile. American Airlines miles’ value can vary depending on a number of factors. Sometimes you can get a lot more, and other times you’ll be better off using other programs.

Don’t worry, as we’re going to go into detail about what causes American Airlines miles value to vary. By the time we’re done, you’ll know everything you want to know about American Airlines miles and what impacts the value you’ll get from redeeming them.

Before Starting, What Are American Airlines Miles?

American Airlines miles are the currency of American Airlines’ award program: AAdvantage. American Airlines miles’ value is determined by comparing the number of miles you need to redeem versus the cash price of those same flights.

Since American Airlines miles have a value of roughly two cents per point, you can use this benchmark to determine if your flight is a good deal. Simply compare the cash price to the number of points you’ll need to redeem.

Demonstration of American Airlines Miles Value Through Example

It wouldn’t be fair to just throw a value out there without giving you some examples to justify American Airlines miles’ value. Taking a look at these examples is a case study in establishing the value of American Airlines miles.

To help set the stage, we will need to look at a number of examples. These examples will range from domestic flights in economy to long-haul international flights in premium cabins. You’ll be able to see how American Airlines miles’ value can vary depending on the flight you’re taking.

Our methodology is simple: find an award flight and find a cash flight, and calculate the value of your American Airlines miles needed to redeem to book the same flight. However, we will slightly modify the cash price. When redeeming miles, you still have to pay taxes and fees. Since you’re not eliminating the entire cash cost, subtract the taxes and fees from the cash price to see how much value you’re really getting.

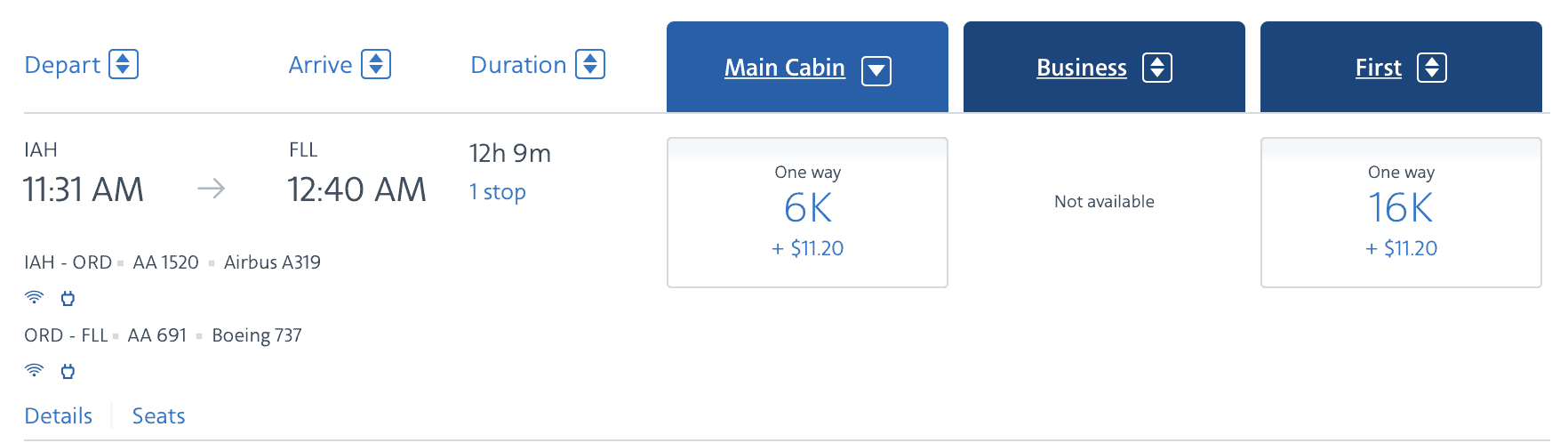

In our first example, you can use miles to fly from Houston to Miami with a connection in Chicago in economy class for 6,000 American miles or for 16,000 American miles in first class. Taxes and fees in both classes of service are $11.20.

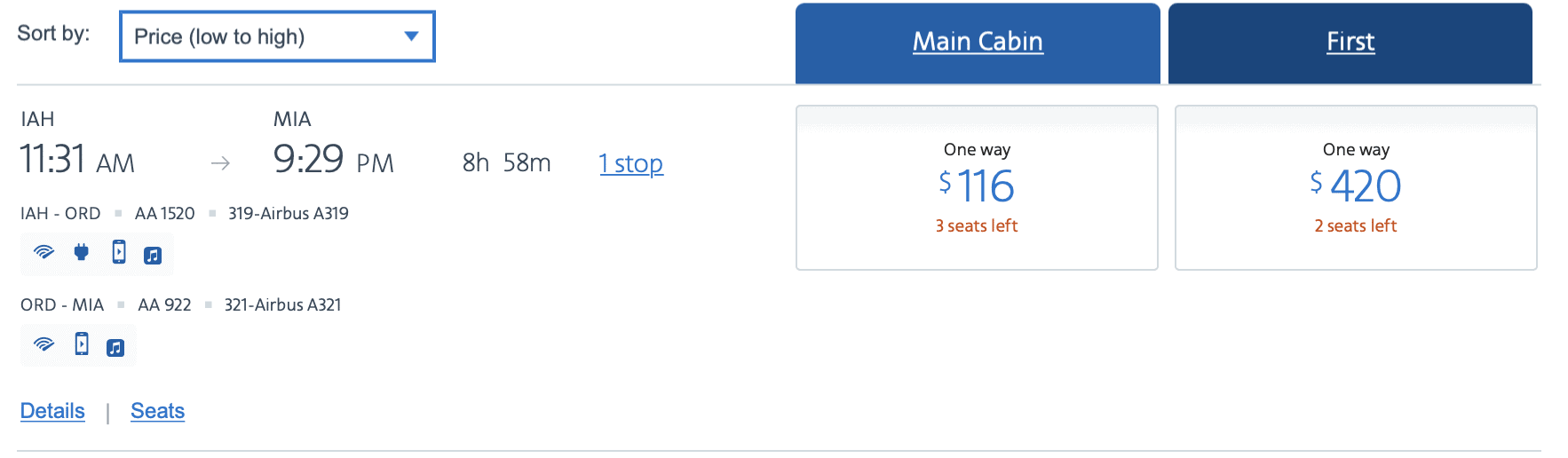

You could also book this same ticket in cash for $116 in the main cabin, or $420 in first class. Adjusted for taxes and fees that works out to $104.80 in the main cabin, or $408.80 in first class.

This works out to 1.75 cents per point in economy or 2.56 cents per point in first class.

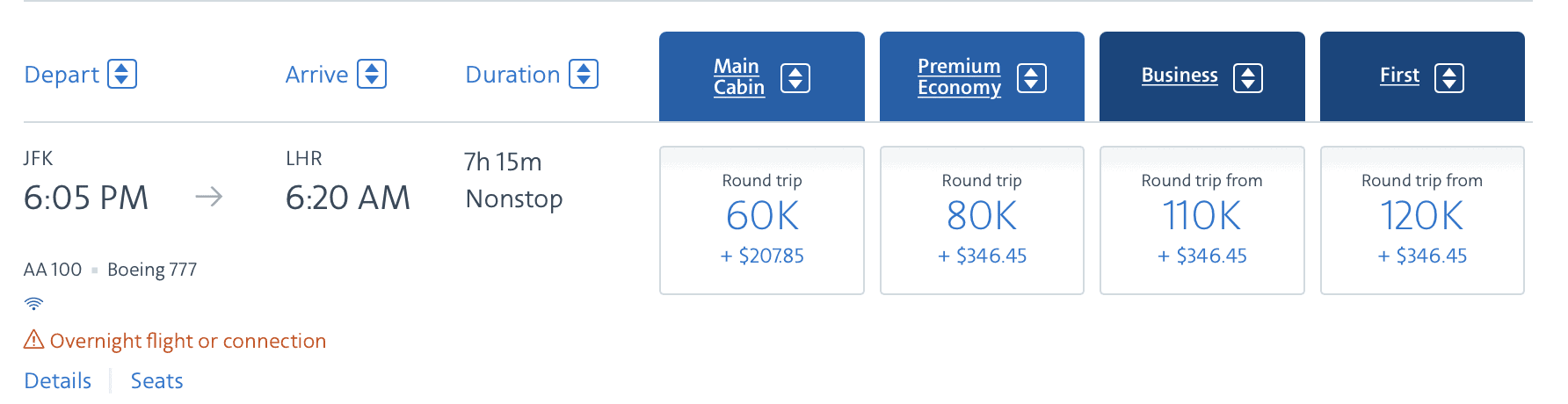

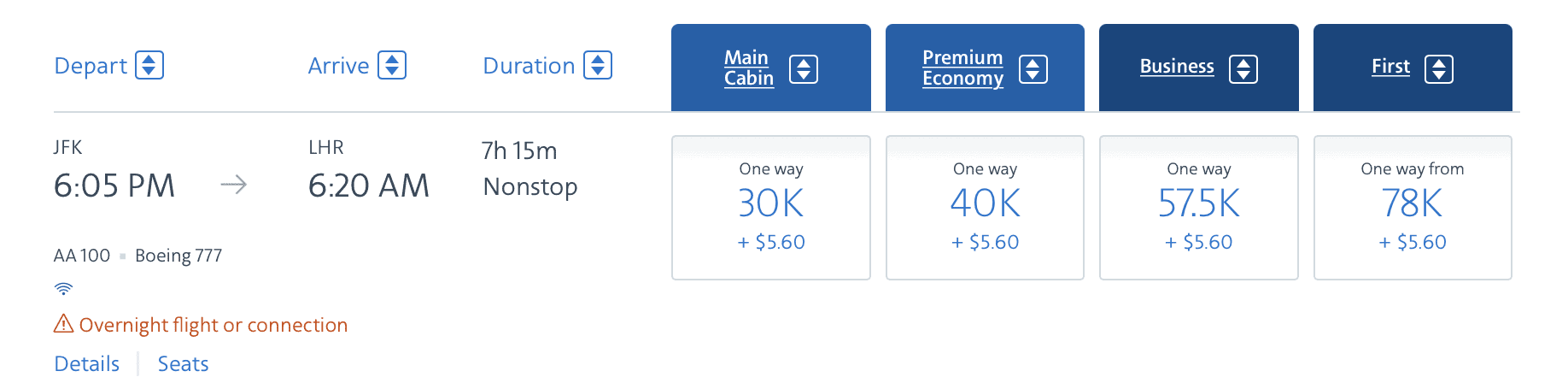

Next, let’s take a look at a slightly longer flight to see how many miles you’d need. If you were looking to fly round-trip from New York to London, you’d redeem 60,000 miles in economy, 80,000 in premium economy, 110,000 in business class, and 120,000 in first class.

Flying from New York to London would cost as low as $639 in economy, $1,390 in premium economy, $3,177 in business class, or $6,191 in first class. Keep in mind, the taxes and fees are a bit higher on this route. After adjusting for the taxes and fees we get a cost of $431.15 in economy, $1,043.55 in premium economy, $2,830.55 in business class and $5,844.55 in first class.

With the prices adjusted, we can see that if you booked in the main cabin you’d get a value of 0.72 cents per point in economy, 1.30 cents per point in premium economy, 2.57 cents per point in business class and 4.87 cents per point in first class.

Hopefully the point has been made; American Airlines miles value can vary wildly.

| Route | Cash Price | Taxes on Award Ticket | Adjusted Cash Price | Points Needed | Value of Your Points (cents per point) |

|---|---|---|---|---|---|

| Houston to Miami in Economy | $116 | $11.20 | $104.80 | 6,000 | 1.75 |

| Houston to Miami in First Class | $420 | $11.20 | $408.80 | 16,000 | 2.56 |

| New York to London in Economy | $639 | $207.85 | $431.15 | 60,000 | 0.72 |

| New York to London in Premium Economy | $1,390 | $346.45 | $1,043.55 | 80,000 | 1.30 |

| New York to London in Business Class | $3,177 | $346.45 | $2,830.55 | 110,000 | 2.57 |

| New York to London in First Class | $6,191 | $346.45 | $5,844.55 | 120,000 | 4.87 |

Taking the average of all these examples gives a value of about 2.3 cents per point. However, these were summer travel dates when prices tend to be a bit higher. However, as you can see, you can even get around 2 cents per point on domestic travel just as easily as you can on international travel in business class.

Average Isn’t Everything

To get the most value out of your American Airlines miles, it is important to understand the different tiers of redemptions in the American Airlines AAdvantage program.

The lowest number of points needed are web special awards. Web specials can only be booked on American Airlines operated flights. You can’t book a web special on a partner flight. Web special awards price lower than American’s published award chart. This is why you might expect to see a flight cost 10,000 American Airlines miles, only for it to end up costing 6,000.

For example, first class from New York to London on an American Airlines flight should cost 85,000 American Airlines miles according to the AA award chart. However, as seen in the example below, the ticket would only require 78,000 miles.

This first class ticket is a web special that costs less than the published number of miles.

Naturally, the next level of tickets are published levels. American Airlines miles’ value depends on the published level you book at. Booking a ticket as a MileSAAver ticket will be the lowest number of miles needed after web specials.

After that, American does technically publish an award chart, but it doesn’t necessarily follow it. Any award ticket that is not a web special or a MileSAAver ticket can vary drastically in pricing. Choosing an award ticket that requires a large number of miles will often mean you’re getting a low American Airlines mile value.

For example, on the same date as the web special above, you could book a flight that costs 307,000 American Airlines miles.

That’s about four times the number of miles needed for the web special. Naturally, your American Airlines miles’ value will be much less when booking the higher priced ticket.

How Flexible Are AA Miles?

Beyond the cash price, the flexibility of American Airlines miles adds a lot of value. American Airlines has permanently eliminated change and cancellation fees, so if your plans change, you can cancel and get your miles back at no cost.

Plus, as a member of the OneWorld alliance, you can book flights all over the world. The flexibility of booking a ticket with a number of partner airlines opens many more opportunities to put your American Airlines miles to use.

When Not To Use AA Miles

There are a few scenarios where using AA miles isn’t the best idea. Let’s take a look at some times when you should not use AA miles.

Award Tickets With High Surcharges

Some of American’s airline partners have high taxes and fees. British Airways is notorious for these high taxes and fees. If you book a ticket on a flight with high surcharges, you’ll quickly reduce your American Airlines miles’ value.

A round-trip ticket in economy from the U.S. to London on British Airways can have surcharges around $500 and will cost 60,000 miles at the MileSAAver level. If you paid cash instead, you could expect to pay around $700-$800. Remember, when determining the value you remove the taxes and fees from the cash price. This means you’re only getting about $250 worth of value from redeeming 60,000 points. That’s about 0.42 cents per point, which is way below American Airlines miles value of 2 cents per mile.

When Other Points Would Cost Less Points

It is important to always compare the number of points you need with other programs. American Airlines miles are usually pretty competitively priced. However, American has some restrictive routing rules that would make the amount of points you need much more.

For example, American partners with Etihad. You could fly Etihad all the way from the U.S. to Australia through Abu Dhabi. However, with American Airlines miles you would book this as two separate tickets. If you booked this in first class you’d need to redeem 215,000 American Airlines miles. Alternatively, you could book with Aeroplan for only 140,000 miles instead.

Credit Cards to Earn More AAdvantage Miles

No bank rewards currencies (Ultimate Rewards, Membership Rewards, etc.) transfers to American Airlines miles, so the best way to earn more American Airlines miles is with an AA co-branded credit card. Citi and Barclays both offer personal and business cards that make it easy to quickly build up your balance of American Airlines miles.

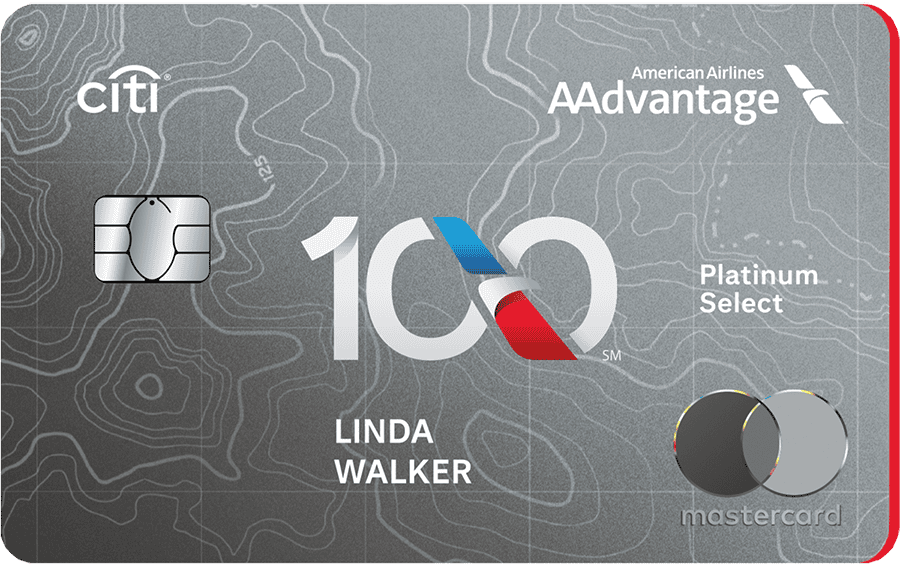

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

50,000

American Airlines AAdvantage® bonus miles

after spending $2,500 in purchases within the first 3 months of account opening

Annual Fee: $99, waived for the first 12 months

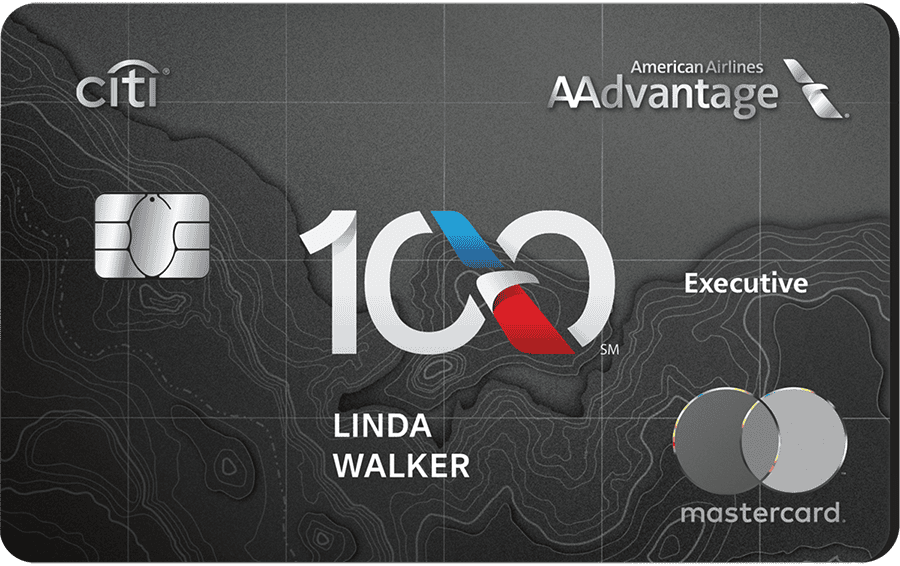

Citi® / AAdvantage® Executive World Elite Mastercard®

Earn 70,000

American Airlines AAdvantage® bonus miles

after spending $7,000 in purchases within the first 3 months of account opening.

Annual Fee: $595

Citi® / AAdvantage Business™ World Elite Mastercard®

For a limited time, earn 75,000

American Airlines AAdvantage® bonus miles

after spending $5,000 in purchases within the first 5 months of account opening.

Annual Fee: $99, waived for the first 12 months

Additional Ways to Earn American Airlines Miles

If you’re looking to add more American Airlines miles to your account, there are a few other ways to help build up your points.

One of the easiest ways to earn more American Airlines miles is through the AAdvantage shopping portal. Before making an online purchase, go to the shopping portal first (or install a browser extension) and get more points for every dollar you spend online.

You can also earn more AAdvantage miles every time you eat out with the AAdvantage dining program. Not all restaurants participate, but it never hurts to earn more miles on your next meal out.

Final Thoughts

As you can see, you can get a lot of different values from your American Airlines miles. Generally, American Airlines miles value at two cents each, but don’t be surprised if you’re getting more or less than that.

With a great partner network and flexibility to use your miles, hopefully you’ll get great value from your American Airlines miles, and more importantly, take fantastic, memorable trips.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.