How to Use Balance Transfer Cards to Eliminate Credit Card Debt

14 Minute Read

10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.

Terms Apply.

17 Minute Read

Our Take

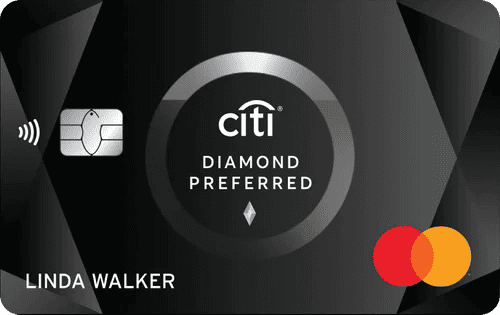

The Citi® Diamond Preferred® Card offers a no-annual-fee option that caters primarily to those seeking balance transfer solutions rather than rewards enthusiasts. This straightforward card doesn’t provide cash back, points, or travel rewards, placing it at a disadvantage compared to many competitors in today’s rewards-driven credit card market. While it serves adequately as a balance transfer vehicle, consumers would likely benefit from exploring alternatives that combine similar balance transfer terms with reward-earning capabilities.

One distinctive feature is access to Citi Entertainment, which provides cardholders with opportunities to purchase tickets to thousands of events, including presale access and exclusive experiences spanning concerts, sporting events, and dining. Despite this perk, the card’s lack of a rewards structure makes it difficult to recommend for most consumers, except those specifically focused on balance transfers.

The information related to Costco Anywhere Visa® Card by Citi has been collected by 10xTravel and has not been reviewed or provided by the issuer or provider of this product or service.