10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

If you’re a U.S.-based traveler, chances are that you’ve flown with Southwest Airlines at one time or another. Southwest is currently the largest low-cost carrier in the United States by passengers served and operates routes to over 100 destinations in North America, Central America and the Caribbean. Plus, the Southwest Airlines Rapid Rewards program offers the opportunity to earn points on any flight you take with Southwest (and in several other ways). Those points can later be redeemed for free flights on Southwest.

The Southwest Rapid Rewards program is also one of the simplest frequent flyer programs to navigate. This program has no blackout dates for Southwest flights and every seat on every Southwest flight is available to book with Rapid Rewards points.

If you plan on using the Southwest Rapid Rewards program to book a flight in the future, you’ll need to understand the process of purchasing award flights through this program. So, in this article, we’re going to include step-by-step instructions on how to sign up for the Rapid Rewards program, how to book award flights and how to earn points.

Joining Southwest Airlines Rapid Rewards

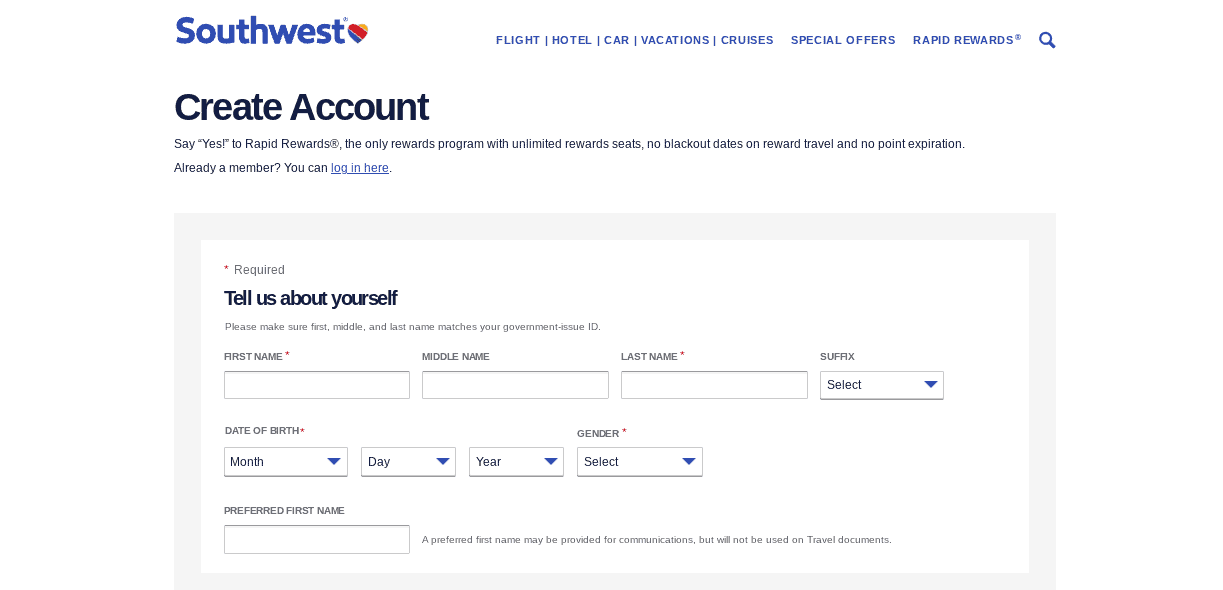

Before you start redeeming points for free flights through Southwest Rapid Rewards, you’ll first have to be a member of the program. To join, visit the Southwest Airlines website and click the “Create account” button in the top-right corner of the homepage.

Once you click that button, you’ll be redirected to a new page where you’ll be asked to provide personal information, including your name, title, date of birth, gender, home address, country of residence, phone number and email. You’ll also be asked to create a username, password and security questions that can be used to log in to your account in the future.

Once you enter all of your information, you can click the yellow “Create account” button on the bottom of the page. Once you’ve done that, you’ll get your unique account number, which you can use to earn points and log in to your Rapid Rewards account.

How to Earn Southwest Airlines Rapid Rewards Points

Once you’ve joined the Rapid Rewards program, you’ll be eligible to earn and redeem points. However, before you start buying award flights, you’ll first need to get some points in your account. Of course, the most obvious way to earn Rapid Rewards points is to take flights with Southwest Airlines. But there are many other ways to earn points that don’t involve flying.

In the following sections, we’ll take a brief look at some of the most effective ways to earn Rapid Rewards points so that you can quickly earn enough for an award flight.

Transfer Credit Card Points

Perhaps the most effective way to boost your Rapid Rewards points balance is to transfer points from the Chase Ultimate Rewards program. If you have a Chase credit card that earns Ultimate Rewards points, you can transfer those points at a 1:1 ratio to the Southwest Rapid Rewards program for free.

For example, let’s say that you had 40,000 Chase points in your Ultimate Rewards account. You could transfer those points to the Southwest Rapid Rewards program and have 40,000 Rapid Rewards points within seconds.

The Rapid Rewards program is also partnered with Bilt Rewards, so you can transfer from that credit card program as well.

Southwest Airlines Co-Branded Credit Cards

Another way to quickly earn a lot of Rapid Rewards points is to sign up for a Southwest Airlines co-branded credit card. There are currently five Southwest co-branded credit cards available to U.S. consumers (three personal and two business credit cards), all of which are issued by Chase.

Southwest® Rapid Rewards® Performance Business Credit Card

Earn 80,000

points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $299

Southwest® Rapid Rewards® Premier Business Credit Card

60,000

bonus points

after you spend $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $149

Southwest Rapid Rewards® Plus Credit Card

Earn Companion Pass through 2/28/27 and 20,000

bonus points

after spending $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Southwest Rapid Rewards® Premier Credit Card

Earn Companion Pass® through 2/28/27 plus 30,000

bonus points

after you spend $4,000 in the first 3 months from account opening. Promotional Companion Pass valid through 2/28/27.

Annual Fee: $149

Southwest Rapid Rewards® Priority Credit Card

Earn Companion Pass through 2/28/27 and 40,000

bonus points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $229

Flying With Southwest Airlines

Of course, another way to earn Rapid Rewards points is to take flights with Southwest Airlines. Unlike with most other frequent flyer programs, you can’t earn Rapid Rewards for flying with any partner airlines.

When flying with Southwest, Rapid Rewards members will earn points relative to the cost of airfare and their fare class. Here’s how many points per dollar you’ll earn in each fare class:

- Basic: 2X points

- Wanna Get Away Plus: 6X points

- Anytime: 10X points

- Business Select: 14X points

So, for example, let’s say that you booked a flight in Southwest Airlines Anytime class that cost $200. You would earn 2,000 Rapid Rewards points for that flight ($200 x 10 = 2,000 Rapid Rewards points).

It’s worth mentioning that A-List elite status members earn 25% bonus points on all Southwest flights and A-List Preferred elite status members earn 100% bonus points on all Southwest flights.

Other Ways to Earn

In addition to the three methods described above, there are several other ways to earn Rapid Rewards points. Some of these earning methods include transferring points from hotel rewards programs, staying with hotel partners, booking rental cars, shopping online, dining and more. Unfortunately, none of these methods are very effective on their own.

However, if you’re going to be spending money in any of the aforementioned ways anyway, you may as well earn some Rapid Rewards points and get a little bit closer to your next award flight.

How to Book Award Flights Through Southwest Airlines Rapid Rewards

Now that you know how to sign up for the Southwest Airlines Rapid Rewards program and how to earn points, let’s look at how you can book an award flight through the Rapids Rewards program. The process of booking Southwest flights with Rapid Rewards points is very easy and similar to booking flights with cash.

The first thing you need to do is go to the Southwest Airlines website and look for the flight search tool.

On the right side of the flight search tool box, click the “Points” bubble instead of the “Dollars” bubble, thus telling the tool that you want to search for award flights.

From there, just search for flights as you normally would. You’ll need to enter your departure and arrival airports, your travel dates, whether you’re flying one-way or round-trip and the number of passengers. Once all of this information has been entered correctly, click the “Search” button.

From there, you’ll be shown a list of flight results that match your search query as well as their respective costs in Rapid Rewards points for each fare class. You can sort these results by number of stops, flight duration, price, arrival time and departure time. You can also filter the flight results for nonstop flights only as well as for their departure times.

Once you find a flight that suits your needs, click on the fare class that you want for that flight to add it to your cart. After you’ve selected your departing flight, click the “Select next flight” button at the bottom of the page and then select your return flight (if applicable).

After you’ve selected all of your flights, click the “Continue” button at the bottom of the page to proceed to the “Trip & Price Details” page where you can review the details of your selected flights as well as a breakdown of the required Rapid Rewards points and taxes and fees. You’ll also be given the option to add travel extras such as rental cars on this page.

If the itinerary and price look good, click the “Continue” button on the bottom of the page. Next, you’ll be asked to provide details for any passengers on the itinerary, such as name, date of birth, gender and address.

After that, you’ll simply need to enter some payment information to cover any applicable cash taxes and fees and then you can confirm your award flight booking. Once your booking is confirmed, you should receive a flight confirmation number, which you’ll need to check in to your flight. You should also receive an email containing this flight confirmation number.

Once you’ve purchased an award flight, your Rapid Rewards points balance should immediately be updated with the deduction.

The Bottom Line

All in all, the Southwest Rapid Rewards program isn’t as robust as other frequent flyer programs operated by larger U.S. airlines such as American Airlines AAdvantage or Delta SkyMiles. However, the Southwest Airlines Rapid Rewards program still has some great aspects.

For one, using the Rapid Rewards program is simple and easy. And you can quickly rack up points by transferring points from the Chase Ultimate Rewards program or Bilt Rewards, by signing up for one of the five Southwest co-branded credit cards or by flying on Southwest Airlines. And, since Southwest-operated flights can’t be credited to any other frequent flyer programs, you may as well rack up Rapid Rewards when flying with Southwest.

Once you have some Rapid Rewards points in your account, you can redeem those points in a variety of ways. However, if you want to maximize the value of your points, the best way to do so is by redeeming them for award flights on Southwest. And, if you ever have trouble with the award booking process, you can always refer to the instructions in this article.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $299

after spending $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

after you spend $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $149

after you spend $4,000 in the first 3 months from account opening. Promotional Companion Pass valid through 2/28/27.

Annual Fee: $149

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $229

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.