10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

When you think about award travel and using credit cards to earn points, you probably think that you need to earn a bunch of different points right away just to get your foot on the plane, but it isn’t so.

Unless you plan an extensive sabbatical abroad, most simple trips can be taken by utilizing points earned from one or two credit cards. You won’t be hopping continent to continent in business class by any means, but it’s definitely possible to make these trips happen.

Don’t believe me? Let’s talk about a weekend trip to the Bahamas for you and your significant other, friend or sibling. I will show you how to get you both plane tickets and a few nights at a four-star beach resort. After reading this, you will book a trip to the beach in no time.

Emerald water idyllic beach at Nassau, The Bahamas in a sunny day.

Flights to Nassau for Two People in Economy Class

Flying to the Bahamas isn’t always cheap, especially not in high season. Escaping the winter blues will cost you a pretty penny. However, let’s look at how you can fly there and back with a plus one at a reasonable cost.

Both the Citi AAdvantage Platinum Select World Elite MasterCard and the AAdvantage Aviator Red World Elite MasterCard often offer up to 60,000 American Airlines after meeting certain spending requirements. The bonus isn’t always this high, but it does go up periodically. If you see a high offer like this, snag it. You’ll use these miles for your flights.

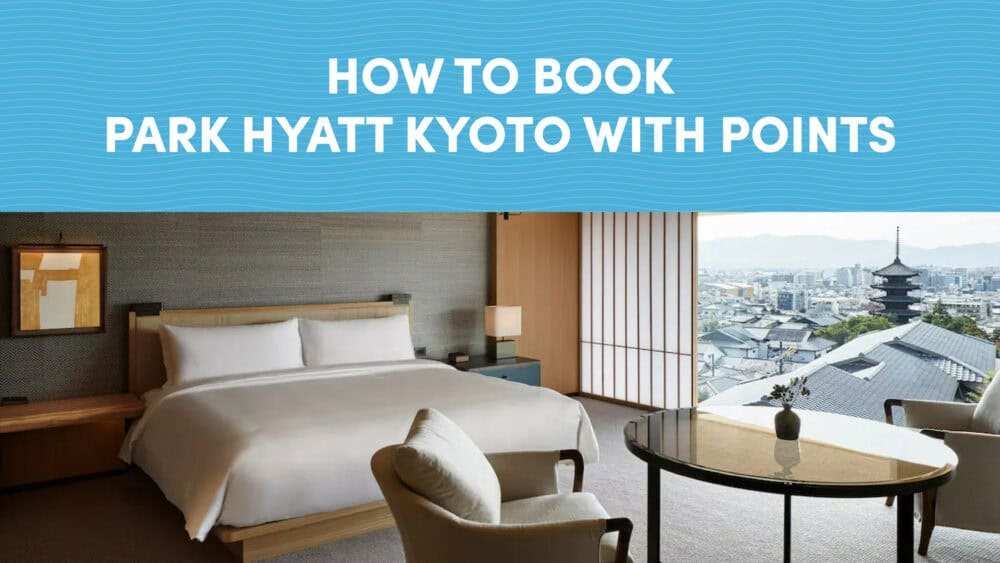

Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

50,000

American Airlines AAdvantage® bonus miles

after spending $2,500 in purchases within the first 3 months of account opening

Annual Fee: $99, waived for the first 12 months

The AAdvantage program has some of the most favorable redemption rates to the region. Although some one-way flights from the United States to the Caribbean go for 12,500 miles on off-peak dates, most flights will set you back 15,000 miles at the lowest redemption level. With ~60,000 AAdvantage miles, you can fly two people to Nassau and back.

Major carriers have launched basic economy fares to compete with budget carriers.

Keep in mind that you’ll pay taxes on your flight, which usually hover around $100 per person. These are charged by the Bahamas and unfortunately, aren’t avoidable. Still, the full cost of your round-trip flight would be a lot more had you paid for it with cash.

Now that we’ve got flights sorted out, let’s take care of lodging on the island.

The World of Hyatt Credit Card

Earn up to 60,000

Bonus Points

Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

Annual Fee: $95

Staying at Grand Hyatt Baha Mar

Your next step is signing up for the The World of Hyatt Credit Card.

The Grand Hyatt Baha Mar is a Category 5 property, and an award night there goes for 20,000 World of Hyatt points. After you meet the minimum spend requirement on the World of Hyatt Card and earn the full bonus, you’ll be able to book two to three nights at this four-star property located on Cable Beach. Suddenly, an extended weekend on a tropical island is within reach—all on points!

SLS Baha Mar is an enormous resort! You won’t believe you’re really staying at this hotel (for free) when approaching its high-rise towers in a cab. With seven pools on the property, some of which are heated, and private cabanas for rent, you will have no shortage of sunbathing options.

If you like marine life, one of the pools even has a swim-up aquarium where you can view sea turtles and nurse sharks through the glass. And once you try the food at the Grand Club (free for Globalist members), you will definitely be glad you signed up for this card.

Also, having status with the chain, albeit the lowest-tier status, can help you score an upgrade to a preferred room if one is available at check-in. Perhaps, you’ll get upgraded to a high floor or an ocean-view room just for being a co-branded card holder. Still, not too shabby for a three-night mini vacation.

The best part of redeeming points for a hotel stay in the World of Hyatt program is that room taxes and resort fees are waived when you book award nights. This means that your stay actually is completely free unless you decide to extend your weekend trip and add some paid nights to your heavily-subsidized vacation.

Grand Hyatt Baha Mar West Tower View Show Lake Fountains. Photo Credit: Grand Hyatt Baha Mar

In fact, now that you haven’t spent much money on your vacation to the Bahamas at all, why not add a paid night or two to lengthen your trip? Points and miles don’t always have to cover the cost of the entire holiday. If you cover most of the trip with points and miles, you’re leaps and bounds ahead of people who pay full price for travel.

Final Thoughts

Credit cards are a great tool to help pay for an otherwise unattainable vacation, and using this tool is incredibly easy for those with a great credit score and a bit of determination. Earning enough points and miles for an elaborate round-the-world trip is rewarding, yes, but such a complicated itinerary can take quite a bit of time to plan.

Not all of us travel the same way, though, and there’s something to be said about taking a simple weekend getaway with the help of just two credit cards. You can earn a bonus on each card by using them for all your everyday spending and paying off the balance every month. Before you know it, you’re sipping cocktails on a beach in the Bahamas!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.