10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Good Morning Travel Junkies,

It’s been a great couple months in the points/miles game and today’s news only contributes to our recent success

Last week, Citibank upped the bonus on their Citigold checking account to 50,000 AA miles.

You read that right, 50,000 American Airlines miles simply for opening a checking account and jumping through a couple hoops.

(Check out this page for the entire list of terms and conditions)

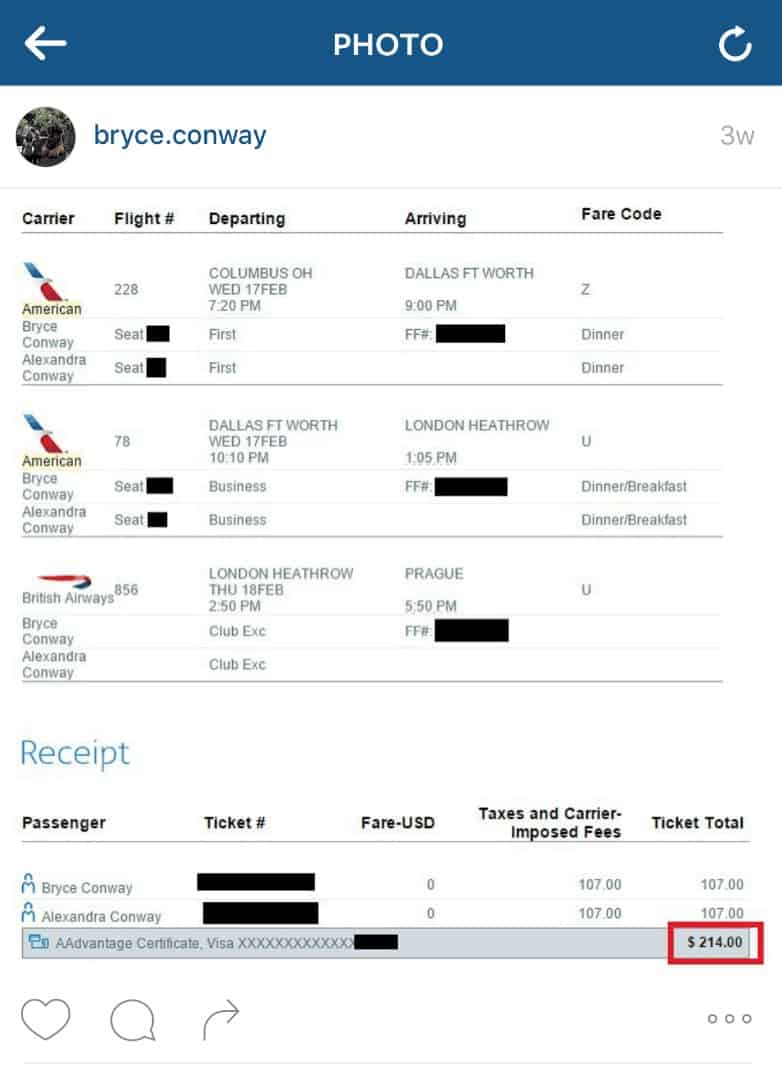

I hate to beat a dead horse here, but I did just used 50,000 American Airlines miles to book a $7,000 business class flight to Europe.

So there is some serious value to be had here.

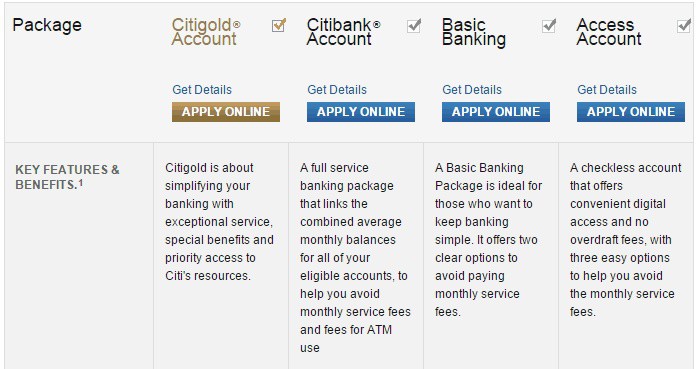

To qualify for the bonus, simply head over to Citi’s website and open a Citigold Interest Checking Account using offer code 42ERCWNQU6.

This promotion expires on December 31, 2015 and is only available to AAdvantage Platinum MasterCard cardholders. So if you have been thinking about picking up that card, now is the time.

To earn the 50,000 checking account bonus you will have to spend $1,000 on the debit card within 60 days and complete a bill pay in two consecutive months.

The Citigold Checking Account has a $30 monthly fee that is waived for the first 2 months. $30 a month is a lot to pay for a checking account so you might consider downgrading or closing the account after earning the bonus.

And lastly, Citi allows you to fund your checking account with a credit card (Visa or MasterCard only) up to $100,000.

Meaning that you could use this as an opportunity to meet the minimum spending requirement on the Citi AAdvantage Platinum MasterCard and earn more than 100,000 AA miles in less than a month.

Doctor of Credit maintains a list of credit cards that don’t count this transaction as a cash advance so give that a look before choosing which card you use. As of this writing it seems that the Citi AAdvantage card is not currently counting this as a cash advance.

It would be a good idea to lower your cash advance limit to $0 before attempting this transaction, just in case.

Lastly, just a heads up that Citi has issued 1099 forms in the past for checking account bonuses. I have yet to see any reports of them doing so for this particular account but that is always a possibility.

Regardless, this is still a fantastic opportunity that I will personally be taking advantage of. I highly recommend you do the same!

As always, email me with questions. (bryce[at]10xtravel[dot]com or contact me here)

Happy Travels,

Bryce

Image: Citi.com

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.