10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Hey 10xT team,

Curtis Rummel here, the secret other half of 10xT.

My fiancée and I just got back from a last-minute weekend Vegas trip for my brother in-law’s birthday.

It was crazy (as Vegas always is), it was a blast and best of all I was able to save more than $975 by using points/miles. That’s a great feeling.

When you don’t have to care too much about the costs – you’re guaranteed to be a winner every time you go to Vegas. Which means you can splurge a little more.

Here’s how I did it.

Not too long ago I picked up a Capital One Venture Card, which is one of the cards that allow you to “erase” any travel purchase made with the card.

It also was offering a signup bonus of 40,000 points after you spend $3,000 in 3 months, which is worth $400 of free travel.

(You can read our full breakdown of the Capital One Venture card here)

We used our Venture cards to book flights on Frontier, which was not the best flying experience of my life, and arrived in Vegas early on Friday morning.

Thanks to my Capital One Venture card, we were able to erase $482 of the flight cost. (Here’s a screenshot of my redemption)

In Vegas we ended up staying in a Signature Balcony Suite at The Signature at MGM Grand, which was fantastic. Our two nights costed $626.

The balcony looked over the pools/mountains and the floor-to-ceiling windows in the bedroom had a great view of the strip. The room also featured a beautiful full kitchen that had absolutely zero pots or pans. (Seriously, does anyone cook in Las Vegas?)

Again, Nicole’s Capital One Venture card allowed us to erase $495 of the hotel’s cost.

In a move that was very “non-traditional Vegas”, we drove about 45 minutes from the Strip to Wild West Horseback Adventures, where we enjoyed a sunset horseback ride and fantastic steak dinner.

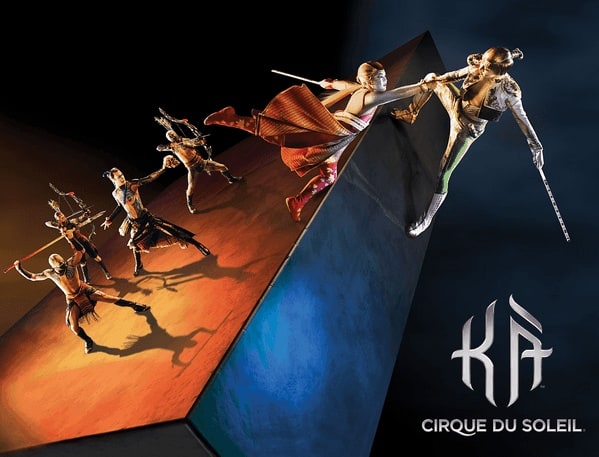

After getting back to the Strip we decided to check out Cirque du Soleil KÀ at the MGM Grand.

This is one of the best shows on the strip and a must see for any Vegas show enthusiasts.

All told, it was a fantastic trip and I can’t wait to go back.

When you pay next to nothing for flights and hotels it truly is impossible not to have a great time in Vegas. And that’s what this is all about, isn’t it?

Happy Travels!

Curtis

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.