10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

As a credit-card newbie, it’s difficult to imagine booking reward flights or hotel nights without having to amass a ton of points and miles and waiting until the sun rises in the west and sets in the east to accumulate enough for a trip. Earning free nights and flights seems intimidating at first, but it doesn’t have to take ages, and you can book a simple trip by applying for just two credit cards.

In this installment of the series, we’re going to book a hypothetical trip to Los Cabos in Mexico with the help of two credit cards: the Southwest Rapid Rewards® Priority Credit Card and the IHG One Rewards Premier Credit Card.

Arch of Cabo San Lucas Mexico

Flight to Los Cabos

Southwest Airlines flies to Los Cabos International Airport, which serves both the San Jose del Cabo and Cabo San Lucas areas, from many airports directly, including Austin, Denver, Houston, Los Angeles, Oakland, Santa Ana and San Diego. Of course, if Southwest flies to your preferred airport, you can book connecting flights to Los Cabos from most departure cities.

Aeropuerto Internacional de Los Cabos (Los Cabos International Airport)

Southwest Rapid Rewards® Plus Credit Card

Earn Companion Pass through 2/28/27 and 20,000

bonus points

after spending $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Southwest Rapid Rewards is the airline’s frequent flyer program, and its points can be used to book any open seat on any Southwest flight. Because the airline has a revenue-based award program, the number of points required for a flight varies based on its cash cost at the time of booking. More expensive flights require more points; less expensive flights require fewer points.

Southwest Rapid Rewards® Priority Credit Card

Earn Companion Pass through 2/28/27 and 40,000

bonus points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $229

Because flight award rates depend on how much a flight costs, there’s no set price. Depending on your route and travel dates, it’s possible to find flights to Los Cabos for 3,500 (yes, you read that right) to 15,000 miles per leg. One bonus easily can cover one, two or more round-trip flights to Mexico. If you’re flexible with your travel dates, don’t be afraid to play with the search calendar to find the lowest prices.

La Playa Escondida Islas Marietas Puerto Vallarta. The hidden beach in Marietas Islands, Puerto Vallarta, Mexico.

Southwest Rapid Rewards® Plus Credit Card

Earn Companion Pass through 2/28/27 and 20,000

bonus points

after spending $3,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

The Southwest Rapid Rewards® Priority Credit Card comes with a $229 annual fee, but it comes with tons of perks. You get to enjoy priority boarding, unlimited upgrades to an extra legroom seat within 48 hours prior to departure and free checked bags.

Lodging in San Jose del Cabo

Did you know that you can book all-inclusive resorts, just like regular hotels, with points? This strategy saves you money you’d otherwise spend on food, drinks and entertainment and keeps more cash in your wallet for day trips and excursions. For budget travelers, all-inclusive hotels are the way to go.

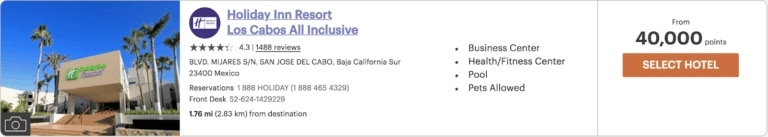

Mexico is full of some amazing all-inclusive properties, and if you’re sitting on a stash of IHG Rewards points, you can stay at Holiday Inn Resort Los Cabos without spending a dime. A reward night here goes for 40,000 points per night in a standard garden-view room and provides accommodation for two adults and up to two kids ages 12 and under who stay for free.

Photo Courtesy of IHG Rewards

If you happen to have collected no IHG points, don’t fret because you can easily obtain them by applying for the IHG One Rewards Premier Credit Card. Depending on when you apply, the card offers 80,000 to 140,000 points for a welcome offer, which means you can earn enough points to book two to three nights at the Holiday Inn Resort Los Cabos for you and your family.

IHG One Rewards Premier Credit Card

Offer Ending Soon! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Besides points, the IHG Premier Credit Card offers Platinum Elite status to cardholders, an anniversary free night upon each renewal and an opportunity to book four reward nights for the price of three. So, if you’re able to earn 120,000 IHG points, your three free nights turn into four! Extending your vacation at no additional cost has never been this easy.

IHG ALL-Inclusive Resorts – A Great Option For Families

The card has an annual fee of $89, which isn’t waived for the first year, but it’s a small price to pay for a few nights at an all-inclusive hotel in Mexico.

A vacation full of sun, sand and sea is yours to enjoy with a little strategy and minimum time investment.

Swimming Pool. IHG ALL-Inclusive Resorts – A Great Option For Families

Application Restrictions

Keep in mind that Chase restricts applicants by an unwritten rule called “5/24” among those in the know. If you’ve opened more than five credit card accounts with any bank in the last 24 months, you likely can’t get approved for any Chase credit cards at the moment.

Both the Southwest Rapid Rewards® Priority Credit Card and the IHG Premier Credit Card are restricted by the rule, and getting both of these cards isn’t an option for those who have dabbled in the hobby recently. However, if your recent credit history is clean and you have a good to excellent credit score, then the door is wide open and you can start opening Chase cards to your heart’s desire.

IHG One Rewards Premier Credit Card

Offer Ending Soon! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Make sure you plan out your spending strategy, meet all the minimum-spending requirements and pay off the balance in full every month. A free vacation is anything but free when you carry a balance on your credit cards as the fees quickly negate your rewards.

Playa del Amor or Lovers Beach, Cabo San Lucas, Baja California Sur, Mexico

Final Thoughts

Mexico is already one of the most affordable vacation destinations, especially for those in the United States, but credit card rewards make it even more economical. After you cover the cost of flights, lodging, food and drinks with points, all you have to pay for are activities. Los Cabos has plenty to do, including taking a boat trip to the famous Arch of Cabo San Lucas, snorkeling at Playa del Amor or sailing at sunset, which sure sounds nice right about now.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.