10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

The information for the Bilt Mastercard has been collected independently. The card details have not been reviewed or approved by the issuer.

Bilt just launched a major update to their rent payment platform—and it could be a big win for anyone trying to meet a minimum spend or earn more points.

Here’s everything you need to know about the new changes, how it works, and when it might make sense to take advantage of it.

What’s New?

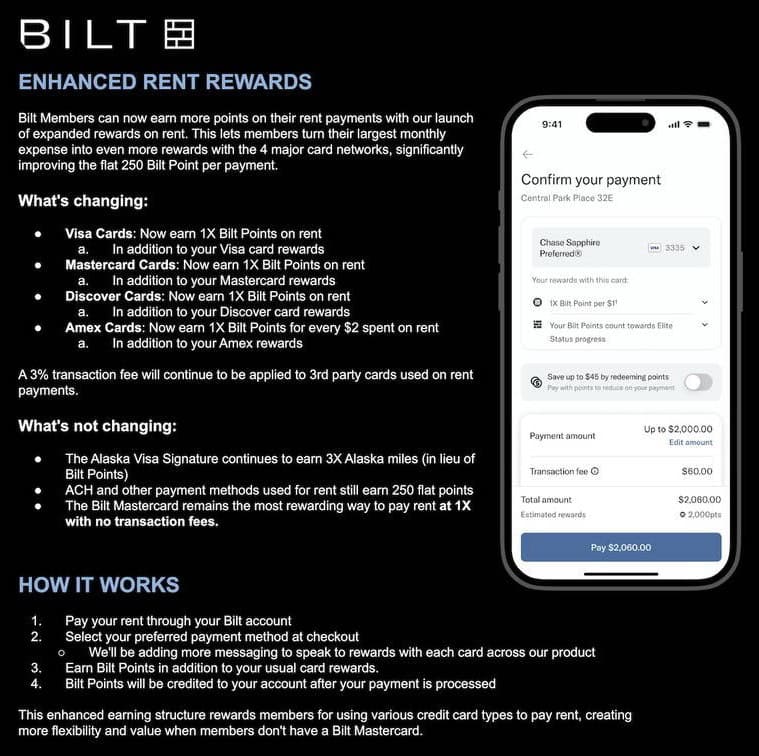

Previously, Bilt only awarded points (up to 100,000 Bilt Points in a calendar year) if you paid rent using their own Bilt Mastercard® (rates & fees). Now, Bilt is letting members earn both Bilt Points and the usual rewards from their Visa, Mastercard, Discover, or Amex cards. But it comes with a catch: a 3% transaction fee.

Here’s how it works now:

- Visa, Mastercard, Discover: Earn 1X Bilt Point per dollar spent on rent, in addition to your regular card rewards.

- Amex: Earn 1X Bilt Point per $2 spent on rent, in addition to your Amex rewards.

Note: This comes with a 3% transaction fee.

For example: If your rent is $3,000 and you use the Capital One Venture X Rewards Credit Card (2X), you’d earn:

- 6,000 Capital One miles

- 3,000 Bilt Points

- Pay a $90 transaction fee (3%)

Not a bad deal if you’re working toward a welcome offer or need a boost in your monthly spending.

What’s The Same?

- The Alaska Airlines Visa Signature® Card still earns 3X Alaska miles on rent payments (in lieu of Bilt Points), up to $50,000 annually. This is part of a special partnership between Alaska and Bilt.

- Rent payments via ACH or debit card will continue to earn 250 Bilt Points per rent payment.

- The Bilt Mastercard remains the only way to pay rent with no transaction fee.

How to Use This New Feature

- Pay rent through your Bilt account.

- Choose your preferred payment method during checkout.

- Earn points from your credit card + Bilt Points after the payment processes.

When It Makes Sense

Paying a 3% transaction fee won’t make sense for everyone, but here’s when it might:

- You’re trying to meet a minimum spending requirement on a new card that you couldn’t otherwise meet.

- This could be good if you want to earn points on rent payments and don’t want to open the Bilt credit card due to 5/24 count.

Final Thoughts

Bilt’s new setup opens up a lot of flexibility for renters who want to double dip on rewards. If you’re strategic—especially with minimum spend requirements—this could be a powerful tool in your points-earning toolkit.

Just make sure the fee makes sense for your specific goals.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.