10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

For many people, paying rent is one of the largest monthly expenses. However, most landlords don’t accept rent payments by credit card, and the ones that do typically charge a hefty service fee for the option. This means that it’s usually either impossible or not worth it to pay rent with a credit card to earn points or miles.

Luckily, Bilt Rewards has created an easy-to-use platform that allows you to earn points for paying rent without incurring any additional transaction fees. This is great news considering rent can amount to thousands of dollars every year.

If you live in one of Bilt’s more than 2 million affiliated rental properties, then you can pay your rent directly through the Bilt app and earn points. If your current rental isn’t part of Bilt’s affiliate network, don’t worry. You can still sign up for the Bilt Rewards Mastercard® (terms & conditions) and earn points on rent payments via online clearing house.

On top of all that, the Bilt Rewards Mastercard doesn’t have an annual fee. It’s also good for much more than just rent, offering generous spending bonuses in other categories and is fully functional wherever Mastercard is accepted.

If you spend heavily on rent, then you’ll definitely want to consider enrolling in the Bilt Rewards program. Let’s take a look at all that this program has to offer and whether it’s right for you.

Earning Bilt Rewards Points

One of the best things about the Bilt Rewards program is that you don’t need to sign up for a credit card to earn points. Enrolling in the Bilt Rewards program is completely free and only takes a matter of minutes. All you have to do is go to BiltRewards.com and enter some basic information. Then, you can download the Bilt Rewards mobile app and use it to pay your rent and earn points.

It’s worth noting that you can earn points on rent only if your current rental is part of the Bilt Rewards affiliate network (unless you hold the Bilt Rewards Mastercard). If your rental is an affiliate of Bilt, they’ll reward you with 250 points per month that you pay your rent on time, regardless of how much your rent is. This means that you can earn a maximum of 3,000 points per year.

This may not be a large number of points, but when all you have to do is pay your rent through the Bilt app, why wouldn’t you?

Transferring your points to one of Bilt’s hotel or airline partner programs is the best way to maximize the value of your points.

Bilt Rewards Mastercard

While signing up for the Bilt Rewards free program through their website is one way to earn points on rent, if you really want to get the greatest benefit possible, the best way to do so is by signing up for the Bilt Rewards Mastercard. Even if you don’t live in a Bilt-affiliated property, you can use this card to pay your rent and earn valuable rewards points.

The Bilt Rewards Mastercard allows you to pay your rent via online clearing house payment through the Bilt app. Essentially, this means that Bilt will charge your credit card and then send an electronic funds transfer straight to your landlord for your rent.

If your landlord accepts payment by check only, Bilt thought of a solution for that, too. You can still pay your rent through the Bilt app, and they’ll send a check directly to your landlord each month. All of these services come without any additional fees.

As mentioned before, the Bilt Rewards Mastercard doesn’t have any annual fees, which means you can earn Bilt points without having to worry about making up for an annual cost.

Cardholders earn 1X point per dollar spent on rent, up to 100,000 points annually. It’s worth noting that you won’t exceed that 100,000-point cap unless you’re paying more than $8,333 in rent per month.

One small thing to be aware of, though, is that you must make at least five transactions on your card each statement period to earn any points. However, one of those transactions should already be taken care of with your rent payment. And, since the Bilt Rewards Mastercard also offers generous earnings in other bonus categories, making those other four transactions shouldn’t be much of a burden.

Here are the spending bonuses for the Bilt Rewards Mastercard:

- 3X points on dining

- 2X points on travel purchases

- 1X points on other purchases (including rent)

Additionally, on the first day of every month, cardholders earn double points on all non-rent spending categories, up to 1,000 bonus points. That means that you’d earn 6X points on dining, 4X points on travel and 2X points on all other non-rent purchases made on Rent Day.

These spending bonuses make it easy to quickly rack up Bilt points, which can be used for a variety of redemptions. In addition to the ability to earn points, the Bilt Rewards Mastercard also comes with some other lucrative perks.

Here are some of the other main benefits of the Bilt Rewards Mastercard:

- Get up to $800 of cell phone protection when you pay your monthly cell phone bill with your eligible Bilt Mastercard (subject to a $25 deductible). Terms apply

- Purchase protection up to $1,000 annually for items purchased in the past 90 days

- Take 3 rides in one calendar month, get a $5 Lyft credit with your Bilt Mastercard

- World Elite Mastercard concierge service open 24/7

When you take into account that the Bilt Rewards Mastercard comes with statement credits (something that many premium credit cards don’t even offer), it’s hard to believe that this card has no annual fee.

The one major drawback of the Bilt Rewards Mastercard is that it counts toward the Chase’s 5/24 card number (which states that you can’t open a Chase card if you signed up for five credit cards in the last 24 months) and doesn’t offer a sign-up bonus. If you want to sign up for Chase credit cards in the near future, you may want to hold off on the Bilt Rewards Mastercard.

Bilt Rewards Elite Status

Those who sign up for the Bilt Rewards Mastercard have the opportunity to earn elite status with the program, which is based on the number of points you earn with the card per calendar year or the amount you spend on non-rent purchases on a Bilt Mastercard or other linked Mastercard, American Express or Visa card within the year. The idea is to encourage cardholders to spend more on their Bilt Rewards Mastercard to achieve elite status which, in turn, can help them earn more points.

Additional ways to fast-track your way to status include:

- Spend on SoulCycle classes booked in the Bilt app

- Spend at Bilt Dining restaurants with any card linked in your Bilt Wallet

- Spend on Lyft rideshare when Bilt is set as your rewards partner in the Lyft app

- Spend in the Bilt Travel Portal

Here is a quick summary of the different elite status tiers and their respective perks.

| Blue | Silver | Gold | Platinum | |

|---|---|---|---|---|

| Points needed (per calendar year) | All Bilt Rewards members | 50,000 points | 125,000 points | 200,000 points |

| OR dollar amount spent, excluding rent | All Bilt Rewards members | $10,000 | $25,000 | $50,000 |

| Earn interest on your points balance | No | Yes | Yes | Yes |

| Access to complimentary home ownership concierge | No | No | Yes | Yes |

| Bonus points on new leases or lease renewals | 0% | 10% | 25% | 50% |

| Gift from Bilt Collection | No | No | No | Yes |

One of the most lucrative aspects of achieving elite status with Bilt Rewards is the ability to earn interest on your points. The interest that you earn in a month is based on your average points balance for that month and the rate will be based on the FDIC national savings rate.

So, you probably won’t earn a ton of points from interest at first. However, as your point balance grows, you might start to notice a significant chunk of points from interest accumulating in your account. So, you can delight in knowing that your Bilt points are earning you even more points until you find your next redemption.

The ability to earn bonuses on new leases or lease renewals is also a nice perk that comes along with elite status. In terms of what the “gift” that comes along with achieving Platinum status is, Bilt Rewards has been fairly non-specific. However, it’s probably some sort of curated piece of decor or artwork from the Bilt Collection.

For most people, the perks that come along with Bilt Rewards elite status aren’t a good reason to spend more than they normally would on their Bilt Rewards Mastercard. Still, if you happen to achieve elite status, you should look into your elite status perks and use them to the fullest.

Redeeming Bilt Rewards Points

Bilt Rewards has a ton of redemption options, especially for a new player in the points and miles world.

However, some redemption options out there offer exceptionally low values per point, so always compare cash prices before confirming a redemption.

Here are some of the ways to redeem your Bilt Rewards points starting with the ones that offer the lowest value.

Low-Value Redemption Options

Bilt Rewards has set out to curate a wide variety of redemption options that will appeal to both casual credit-card rewards enthusiasts and points and miles junkies alike. However, some of these options offer little value. If you want to make the most out of your Bilt points, it’s best to avoid the following redemptions.

Paying your rent. Since Bilt Rewards has built its reputation around the ability to earn points for rent, you might expect that redeeming your points toward your future rent payments would be a high-value option. But this is far from the truth. Using your points this way yields a value of just 0.55 cent per point. Additionally, this option is available only if you live in a Bilt-affiliated property or for payments by check.

Amazon purchases. You can use your Bilt Rewards Mastercard as your payment method on Amazon and then use your points to cover all or a portion of your purchase at checkout. However, when redeemed this way, each Bilt point is worth just 0.7 cent, which is subpar compared to the 1.8-cent valuation mentioned earlier.

Shop the Bilt Collection. The Bilt Collection is a carefully curated array of home decor, art and apparel. Although the items listed on this portal are pretty cool, you can rarely find value exceeding 1 cent per point. Thus, it’s probably better to avoid this redemption option.

Fitness classes. You also can use your points to pay for brand-name fitness classes, including SoulCycle, Y7 Studio. The exact value of these redemptions varies based on which of these programs you choose. However, the value per point is usually somewhere around 1 cent per point.

Medium-Value Redemption Options

Some redemption options from Bilt offer decent value and are worth consideration if they apply to your financial situation. Most of the following options offer a value of a little more than 1 cent per point. And, while this isn’t terrible, there are still other options that provide more value. Here are some of the medium-value redemption options.

Save for a down payment. Unlike any other points or miles program out there, Bilt Rewards allows its members to save points toward a down payment on a mortgage. However, when you actually go to secure a mortgage, you’ll find that your Bilt points can be used only for financing that originated through Bilt, which could severely restrict your options. Points are worth about 1.5 cents apiece when used this way, which is pretty good, but be sure to compare your mortgage options with other lenders as well.

Redeem through Bilt Travel portal. Bilt Rewards has its own in-house travel portal known as Bilt Travel, which gives members the option to redeem their points for flights, hotels, rental cars or excursions. Points are worth an average of 1.25 cents apiece when redeemed this way, which isn’t bad. However, you probably can get far more value by transferring your points to one of Bilt’s airline or hotel partners. More on that below.

Highest Value Redemption Options: Hotel and Airline Transfer Partners

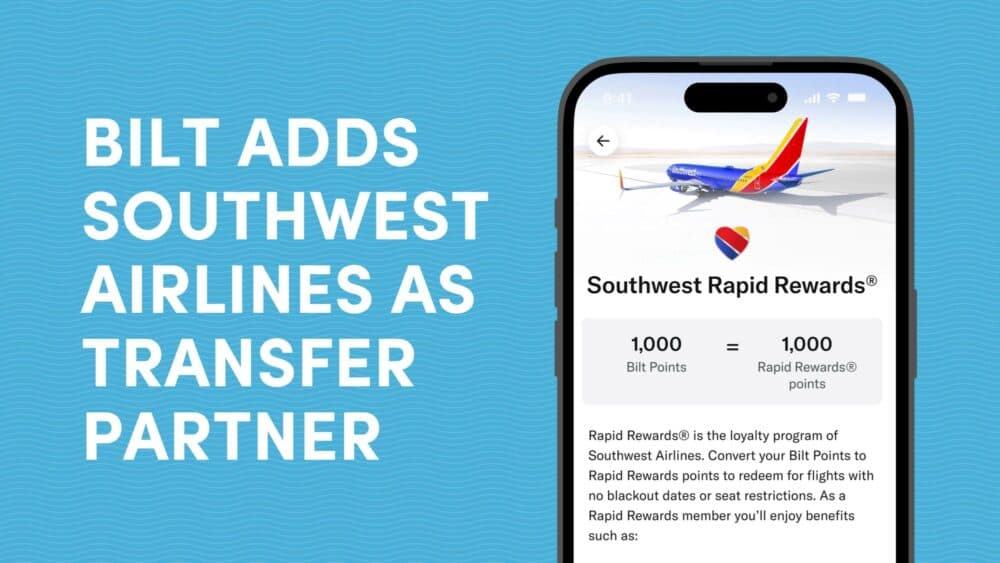

Transferring your points to one of Bilt’s long list of transfer hotel and airline partners is, by far, the best way to get the most value out of your points. Bilt partners with a number of programs, all of which receive transfers at a 1:1 ratio. On top of that, every major airline alliance is represented on Bilt’s list of transfer partners.

You can join all of these programs free of charge. Bilt gives cardholders 100 bonus points for every one of these accounts that they link to their Bilt account. That means that you can earn more than 2,000 miles just for signing up for a few programs and clicking a few buttons.

Here is the full list of Bilt’s transfer partners:

- Accor Live Limitless

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Alaska Airlines

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Emirates Skywards

- Hilton Honors

- Iberia Plus

- IHG One Rewards

- JAL Japan Airlines Mileage Bank

- Marriott Bonvoy

- Qatar Airways Privilege Club

- Southwest Rapid Rewards

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

As mentioned before, Bilt Rewards points transfer at a 1:1 ratio to all of these programs. There are particularly high-value redemptions within some of these programs that will get you the maximum value for your Bilt Rewards points.

For example, you could score a beach villa at the Park Hyatt Maldives (a five-star resort) for 30,000 points per night. The same night paid for with cash would cost you $585 or more, which means that this redemption has a value of 1.95 cents per point.

You can also transfer points from Bilt Rewards to Virgin Atlantic and book a Delta Air Lines-operated economy flight from New York City (JFK) to Tokyo (HND) for 42,500 points one way.

These are just a couple of many valuable award flight redemptions you can find through Bilt’s transfer partners.

Overall, transferring your points to one of Bilt’s hotel or airline partner programs is the best way to maximize the value of your points. And it feels pretty good when you’re on a vacation paid for entirely with the points you earned by paying rent.

if you’re currently paying a lot of money in rent, adding the Bilt Rewards Mastercard to your plastic portfolio is a great way to get some of that money back in the form of credit card rewards.

The Bottom Line

The Bilt Rewards program has made its own lane in the world of points and miles by offering members the opportunity to earn points by paying rent without incurring any additional transaction fees. And, since rent is one of the largest expenses for most people, earning points on rent is a big deal.

Adding the Bilt Rewards Mastercard to your wallet can increase your ability to earn points on your rent payments significantly, upping the annual maximum earnings from 3,000 points (which is the maximum you can earn without the card) to 100,000 points.

Bilt Rewards points have an estimated value of 1.8 cents apiece, which is high by any standards. It’s even possible to find redemptions that offer more value by transferring points to Bilt’s list of hotel and airline partners.

So, if you’re currently paying a lot of money in rent, adding the Bilt Rewards Mastercard to your plastic portfolio is a great way to get some of that money back in the form of credit card rewards. If you don’t want to sign up for another card, you might check out Bilt’s website and see if you could earn some rewards by paying your rent through the app.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.