10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Bilt Rewards, known for allowing renters to earn points on rent payments, has launched a new program designed to reward members for purchasing a home. By partnering with eXp Realty, Bilt now offers members the opportunity to earn one point for every $2 of a home’s purchase price.

For context, purchasing a $400,000 home through this program would yield 200,000 Bilt Points. While the earning rate may not rival traditional spending categories like credit cards, it’s a notable entry into a space where earning points on such significant expenses has previously been unavailable.

What Makes This Program Unique

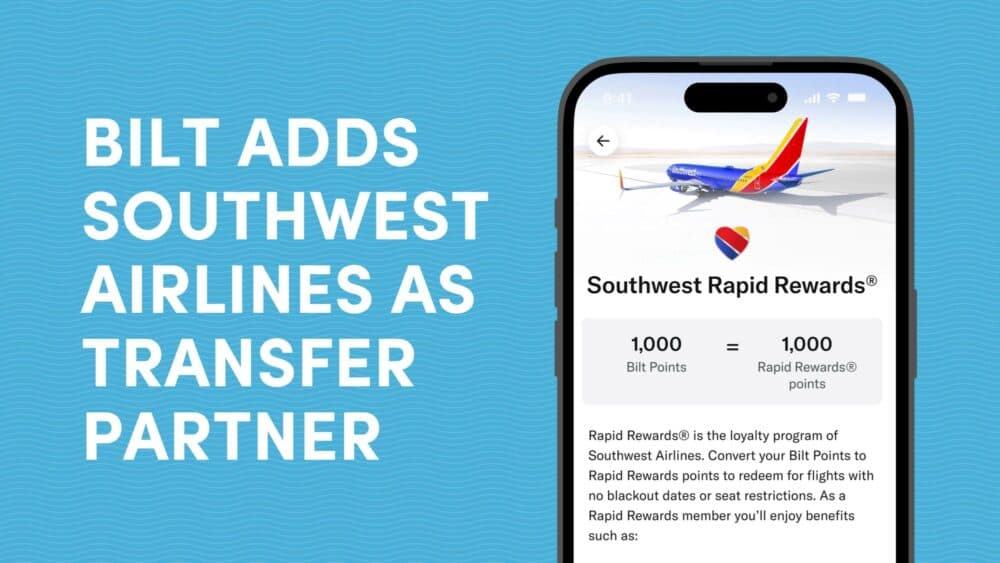

One of the standout features of Bilt Rewards is the high value of its points, especially when redeemed through its travel transfer partners. Members can convert Bilt Points at a 1:1 ratio with over 100 loyalty programs, including major airlines and hotels. Plus they offer the biggest transfer bonuses in the industry, offering between 50-150% bonus depending on the loyalty program and Bilt status.

This program gives homebuyers an opportunity to earn a meaningful stash of points to potentially use for future travel—an added perk for a purchase many people are already planning to make.

In addition to the rewards, Bilt’s program ties into its broader efforts to help renters transition to homeownership. This includes tools like rent reporting to credit bureaus to help build credit history and an app-based home search tool that simplifies the process of comparing monthly homeownership costs to current rent.

Weighing the Pros and Cons

This initiative opens up a new earning avenue, but it’s not without its trade-offs. The $2-to-1-point earning ratio is less lucrative compared to some high-earning credit card categories, but it’s still a meaningful option given the lack of similar rewards programs in the homebuying space. Additionally, to take advantage of the points-earning feature, buyers must work with an eXp Realty agent, which might limit flexibility for those already working with another agent or brokerage.

For renters already in the Bilt ecosystem, however, this program provides a unique way to boost point balances during the homebuying journey—something previously unavailable. It’s particularly appealing for those who value Bilt’s transfer partners and want to maximize the long-term value of their rewards.

Final Thoughts

While not a game-changer for everyone, this program adds another dimension to Bilt’s rewards ecosystem. By helping renters earn on their rent, build credit, and now earn on home purchases, Bilt continues to innovate in the housing and rewards space.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.