10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Capital One has made a name for itself as one of the best credit card issuers for travel enthusiasts. In 2021, Capital One released its Capital One Venture X Rewards Credit Card, a travel-focused premium credit card with airport lounge access, travel credits, TSA PreCheck and Global Entry perks and more. In that same year, the Capital One travel booking site (powered by Hopper) was also unveiled, allowing Capital One cardholders to redeem their miles directly for travel purchases, including flights from most major airlines.

So, if you have a Capital One credit card (including cash back cards such as the Capital One Quicksilver Cash Rewards Credit Card), you’ll be able to redeem the rewards miles that you earn for flights through Capital One’ own travel booking site.

In this article, we will explain everything you need to know about buying flights through Capital One, including who is eligible to use the Capital One portal, earning miles on flights through Capital One booking site and redeeming miles for flights through Capital One.

What Is the Capital One’s Travel Booking Site?

The Capital One’s travel booking site is an online booking engine through which eligible Capital One cardholders can book flights, hotel and rental cars either with cash, rewards miles or a combination of both cash and rewards miles.

This portal launched in 2021 in partnership with Hopper. At first, the Capital One portal had some issues, but, over the years, this booking engine has made major improvements and is now a great way to book your travel.

Who Can Access the Capital One Travel Booking Site?

No matter which Capital One rewards credit card you have in your wallet, you’ll be able to access the Capital One Rewards portal. Some Capital One credit cards are specifically travel-focused, such as the following:

- Capital One Spark Miles for Business Card ($0 intro annual fee for 12 months; then $95)

- Capital One Spark Miles Select for Business Card ($0 annual fee)

- Capital One VentureOne Rewards Credit Card ($0 annual fee)

- Capital One Venture Rewards Credit Card ($95 annual fee)

- Capital One Venture X Business ($395 annual fee)

- Capital One Venture X Rewards Credit Card ($395 annual fee)

Of course, all of these cards include access to the Capital One travel site and the rewards earned with these cards can be redeemed for travel through the Capital One as well as in a variety of other ways (such as transferring miles to partner loyalty programs, covering recent travel purchases, purchasing gift cards, redeeming for cash back and more).

Of course, all of these cards include access to the Capital One portal and the rewards earned with these cards can be redeemed for travel through the Capital One portal, as well as in a variety of other ways (such as transferring miles to partner loyalty programs, covering recent travel purchases, purchasing gift cards, redeeming for cash back and more).

Capital One also issues several cash back cards that are not specifically geared towards travel, such as the following:

- Capital One Quicksilver Cash Rewards Credit Card ($0 annual fee)

- Capital One QuicksilverOne Cash Rewards Credit Card ($39 annual fee)

- Capital One Savor Cash Rewards Credit Card ($0 annual fee)

- Capital One Spark Cash ($95 annual fee)

- Capital One Spark Cash Select for Business Card ($0 annual fee)

Despite the fact that these are cash back credit cards, the rewards that you earn with the cards above can still be redeemed for travel through the Capital One portal. You also have the option to purchase flights, hotels and rental cars with cash through Capital One if you have one of these cards.

How to Book Flights Through the Capital One Travel Booking Site

In order to book flights through the Capital One portal, you must first sign in using your Capital One online account credentials.

You can then select whether you want to search for Hotels, Cars, Flights or Premium Stays. Once you’ve clicked on Flights, you’ll be asked to input the information for your flight, including how many people are traveling, the type of flight (round-trip, one-way or multi-city), the fare class, whether you require nonstop only flights and your origin and destination.

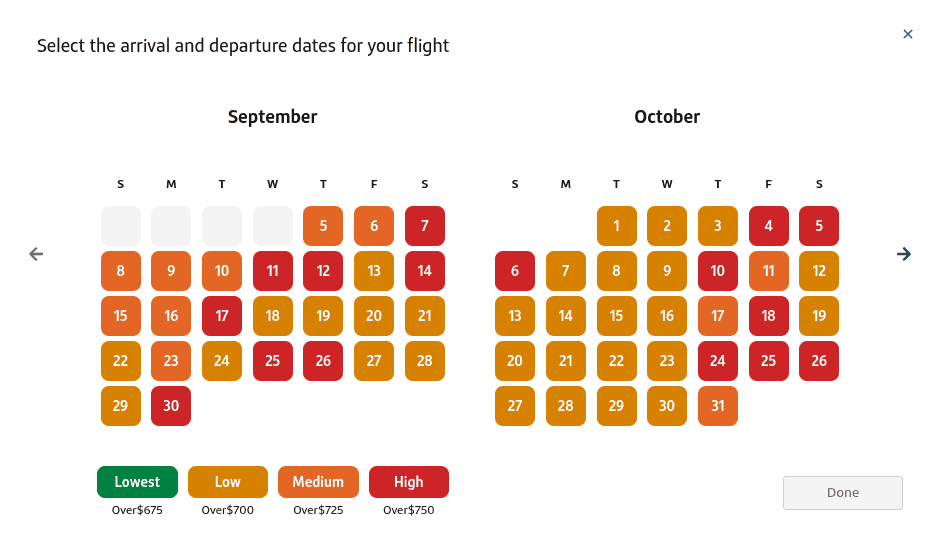

Upon entering all of that information, you’ll be redirected to a calendar where you can select your travel dates.

One excellent feature of the Capital One portal is that the dates on this flight calendar are color-coded to allow you to easily see which dates are in each price range. This can be useful if you’re flexible with your travel dates and you want to get the best deal possible.

Once you’ve selected your travel dates, you’ll be redirected to a list of flights that match your search query. The Capital One travel booking site includes flight results from most major airlines. However, some airlines that aren’t listed on Capital One (we’ll get to that later).

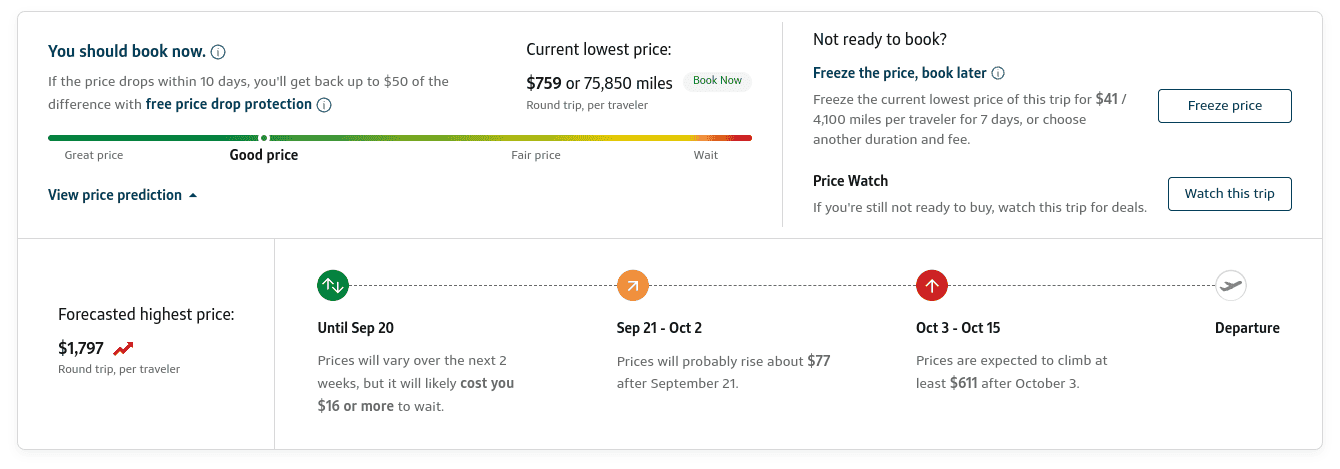

The portal also has other great deal-finding features. For one, the Capital One portal makes price predictions and recommends whether you should buy the flight now or wait until the price drops in the future. It will even tell you what the predicted maximum future price will be and when price changes will occur.

Plus, flight purchases made through the Capital One travel booking site include free price drop protection. So, if the price of your flight drops within 10 days of you purchasing it, you’ll be refunded up to $50 of the difference.

For example: if you were to purchase a flight for $500 and then the price of the flight dropped down to $400 in the next few days, you’d get a refund of $50.

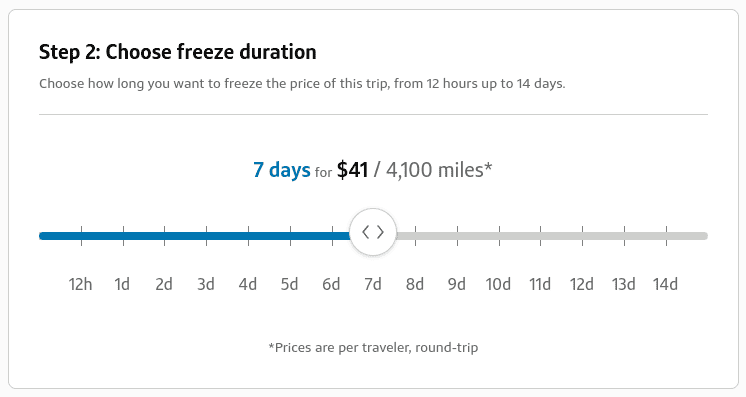

You can also elect to freeze the price of a flight for a fee, with the option of as little as 12 hours or as long as 14 days. By freezing the price of a flight, you’ll ensure that you can buy that flight at that specific price point for a certain duration of time.

The longer you choose to freeze the price, the higher the fee will be. Freezing the price of a flight could help you save money in the event that a flight’s price increases dramatically. You can pay for the freeze either with cash or with Capital One miles. However, you’ll need to decide for yourself whether the money (or miles) you saved from the price change offsets the fee you paid.

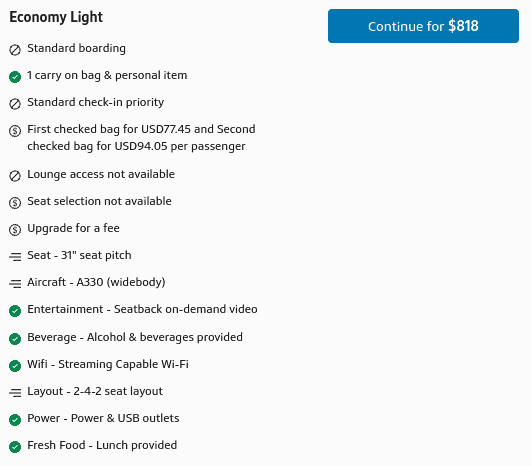

When you click on a flight that you might want to book, the Capital One portal will give you all of the necessary information about the amenities included with the fare class you selected.

Knowing all this will help you understand your baggage allowance, lounge access and other included amenities. For example, there may be one flight available for $150 that doesn’t include checked baggage allowance and checking a bag with that airline costs $75.

However, there may be another flight for $200 that does include checked baggage allowance. In this case, it would be better to select the second flight for $200 because the first flight would actually be more expensive when you consider the $75 checked baggage fee. The Capital One portal is great for helping make these decisions.

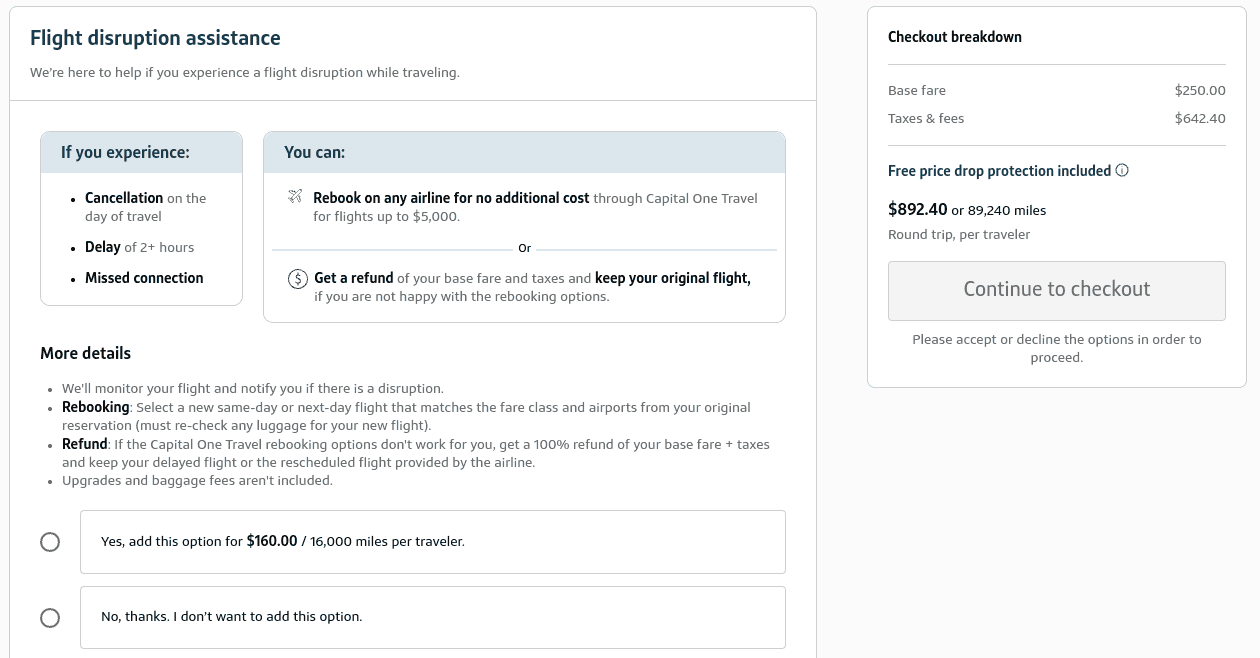

Once you’ve selected the flights that you want to purchase, you’ll be redirected to another page where you’ll have the opportunity to purchase flight disruption assistance.

With flight disruption assistance, if you experience a cancellation, a delay of more than two hours or a missed connection, you can rebook another flight to your destination through the Capital One travel booking site for flights up to $5,000. Additionally, if you aren’t satisfied with any of the rebooking options, you can get a refund of your base fare and keep your original flight. You can either pay for flight disruption assistance with cash or with Capital One miles.

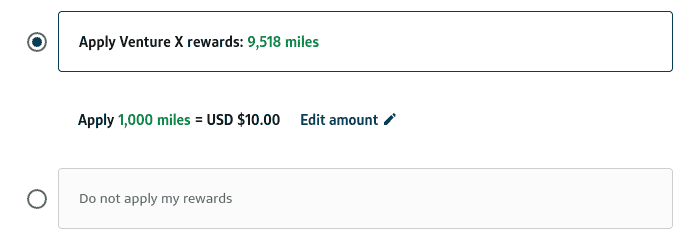

Once you select whether or not to purchase flight disruption assistance, you can click the “Continue to checkout” button. On the checkout page, you can enter your traveler information, select your seats and choose whether you want to pay with cash, with miles or with a combination of both.

If you elect to pay for your flight entirely or partially with Capital One miles, those miles will all be worth exactly 1 cent per point. So, if you were to apply 1,000 miles to the price of your flight, they’d be worth $10.

Finally, you can click the “Confirm and Book” button to complete your booking. All flight bookings made through the Capital One travel booking site include free cancellation for 24 hours (some restrictions apply). Once you complete your booking, you should receive a confirmation email including your confirmation number and flight details.

Booking with Cash

If you book your flight with cash through the Capital One travel booking site with your eligible Capital One credit card, you’ll earn Capital One miles on that purchase. Certain Capital One credit cards earn elevated spending bonuses on flights purchased through the Capital One portal.

For example, the Venture X and Venture X Business cards earn 5X miles on flights purchased through the Capital One portal. So, for example, if you were to purchase a flight for $500 through the portal, you’d receive 2,500 miles for that purchase.

Capital One miles usually arrive in your account within a few days of the transaction.

In general, you can still earn airline miles if you book a flight through Capital One. To do this, you can simply add your frequent flyer number to your booking when you check in for your flight.

Booking with Miles

If you decide to book your flight with miles, those miles will be deducted from your account immediately. Just like when booking with cash, you can get a full refund if you cancel your flight within 24 hours (some restrictions apply).

You can also earn airline miles when booking flights through Capital One with miles. Likewise, you can simply input your frequent flyer number when checking in for your flight.

Booking Over the Phone

You can book flights through Capital One over the phone by calling (844) 422-6922. However, you may be charged a $25 phone booking fee for each flight itinerary you book over the phone. In general, it’s much easier and cheaper to book online.

Advantages to Booking Flights Through Capital One

As previously mentioned, the Capital One portal has improved dramatically over the past few years. Here are a few reasons why booking flights through the Capital One portal might be a good idea.

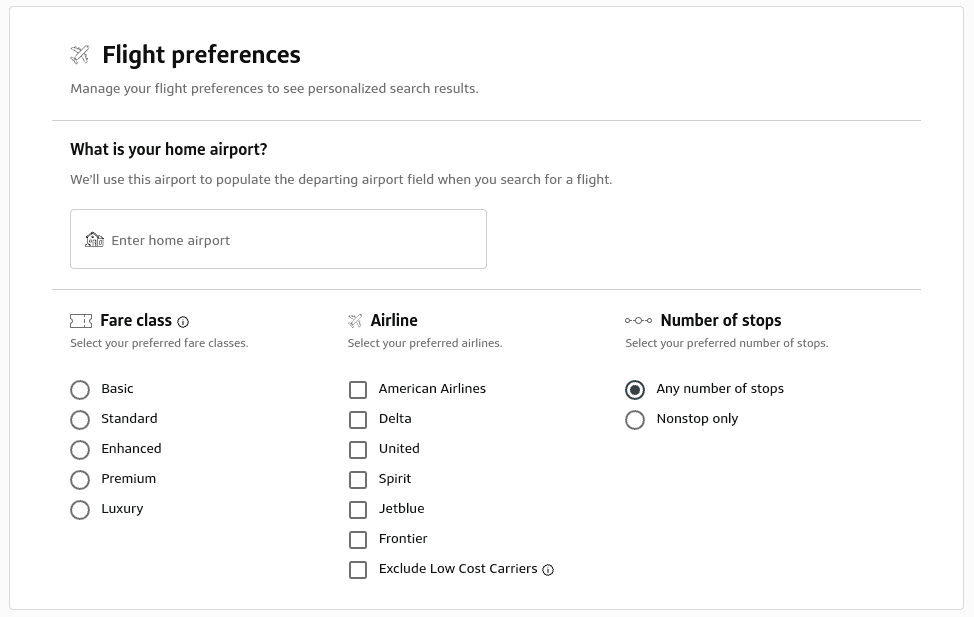

Personalize Your Flight Preference

One of the nice features of the Capital One portal that can save you a lot of time is the ability to save your flight preferences.

You can set your home airport so that it automatically loads as your departure airport when you go to search flights. You can also select your preferred fare class, your preferred airlines and whether you’re alright with layovers or you prefer nonstop flights only.

Pre-saving these preferences can save you a lot of time while conducting flight searches through the Capital One travel booking site.

Redeem Miles for Almost Any Available Flight

The Capital One portal also lets you use your miles for nearly any available flight. If you can buy a flight with cash through the Capital One travel booking site, you can purchase that same flight with miles.

By contrast, if you transfer miles to partner loyalty programs, it can be very difficult to find award availability that matches your criteria in many cases. So, if you aren’t willing to spend time searching for the right award flight through transfer partners, then booking award flights through the Capital One travel booking site is probably the better option.

Price Match Guarantee

If you book a flight through the Capital One travel booking site and then find the exact same flight cheaper elsewhere and then contact Capital One within 24 hours, you can get a refund for the difference with Capital One Travel’s Price Match Guarantee.

For a flight to qualify for a Price Match Guarantee refund, the following conditions must be met:

- Flight is an exact match to the original itinerary that was made within the last 24 hours (including the cancellation policy).

- Flight is priced in U.S. Dollars, including taxes and fees.

- Flight is available to the general public. For example, this means that the rate doesn’t require the customer to log into a site or have a special membership.

- Flight is available at the time the customer contacts us. Our agent must be able to verify that the lower price exists.

The only way to submit a Price Match Guarantee is to call Capital One at 844-422-6922. But, if your flight matches the conditions above, Capital One will refund the difference, ensuring you always get the lowest price available for a flight.

Drawbacks of Booking Flights Through the Capital One Travel Booking Site

While the Capital One portal is an excellent place to purchase award flights and cash flights for many reasons, there are some drawbacks to this portal that you should be aware of.

Certain Airlines Not Marketed on Capital One

While flights from most major airlines are marketed on the Capital One portal, there are some airlines that you won’t find on the Capital One travel booking site. Typically, the airlines excluded from Capital One’s booking site are small, low-cost airlines.

However, the most notable airline excluded from the Capital One travel booking site is Southwest Airlines. So, if you’re looking to book a domestic flight in the U.S. through the Capital One travel booking site, you may want to see if you can fly even cheaper on the same route with Southwest before completing your booking.

Potentially Better Value Per Mile Through Transfer Partners

The biggest downside of using your Capital One miles through the Capital One portal is that you can typically get much more value out of your miles by redeeming them through transfer partners. However, it should be noted that doing so usually requires more time and more know-how.

When redeeming Capital One miles through the Capital One portal, each mile is always worth exactly 1 cent. However, it’s possible to get several cents per mile in value by transferring miles to partner loyalty programs.

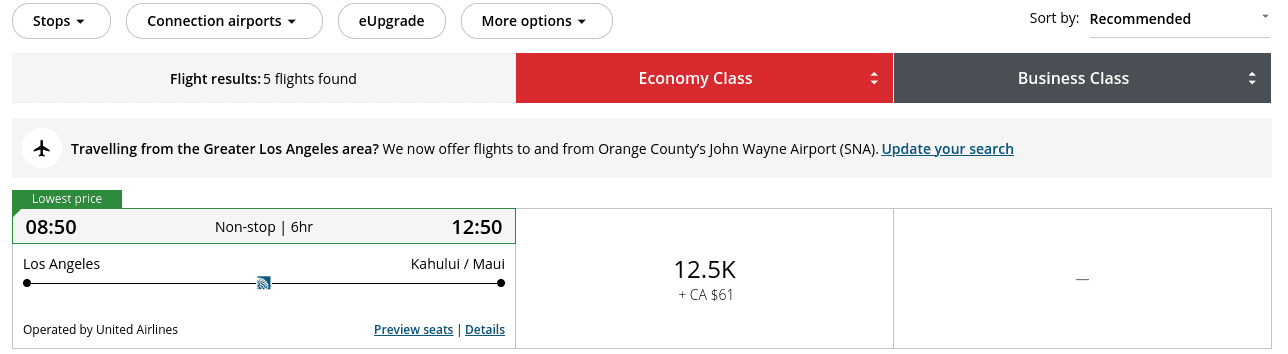

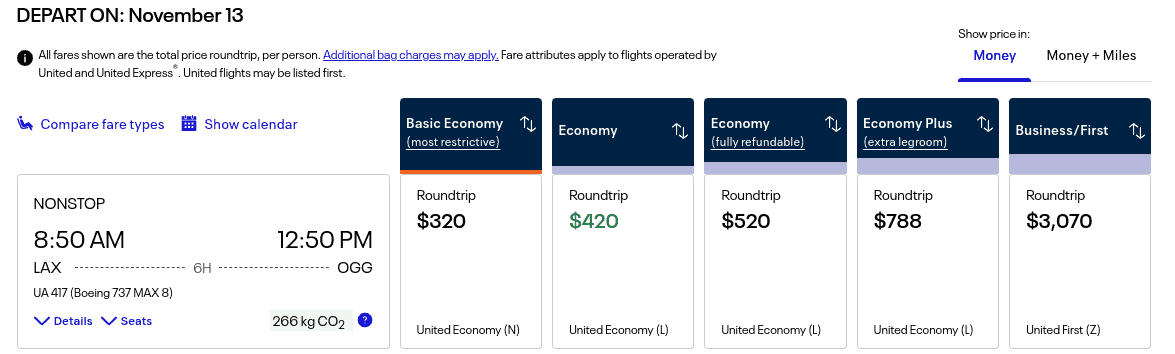

For example, one of Capital One’s best transfer partners is Air Canada Aeroplan. We found a United Airlines round-trip economy flight between Los Angeles (LAX) and Maui (OGG) available through the Aeroplan program for 12,500 Aeroplan points and 61 Canadian dollars (about $45) in taxes and fees.

If you were to purchase the same exact flight on the same dates through the United Airlines website, it would cost you $420.

By purchasing this flight with Aeroplan points (which you can earn by transferring Capital One miles), you’d be getting a value of 3 cents per point.

Since your Capital One miles are always worth exactly 1 cent per point through the Capital One portal, you can get three times as much value by redeeming your miles in the manner above. And, with certain redemptions from certain transfer partners, it’s possible to get even more than 3 cents per mile.

Redeeming miles through Capital One means that you’re missing out on the opportunity to get more value out of those miles through transfer partners.

Lack of Travel Packages

The Capital One Travel booking site currently doesn’t offer the option to book travel packages. Booking flights, cruises, accommodations and rental cars as travel packages can be a great way to get the best possible rate on each part of your itinerary.

The Bottom Line

All in all, if you have a Capital One credit card, the Capital One portal is one of the best places to book flights with cash. Capital One’s booking site has a Price Match Guarantee, meaning that you can rest assured that you’ll always get the lowest available cash price for any flight. Plus, when you use certain Capital One credit cards to purchase flights through the Capital One portal, you’ll be eligible to earn great spending bonuses. The Venture X and Venture X Business cards, for instance, earn 5X points on flights through Capital One’s booking site.

When it comes to redeeming Capital One miles for flights, using the Capital One portal will always yield a value of 1 cent per mile. And, while you can get much more value than that by transferring to certain partner loyalty programs, redeeming miles through the Capital One travel booking site is straightforward and easy whereas using transfer partners can sometimes be confusing and time-consuming.

Regardless of how often you plan to use this portal, if you have a Capital One credit card, you should be familiar with how to book flights through this travel portal both with cash and with miles.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.