10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Capital One Miles, which you can earn by signing up for any Capital One Rewards credit card, are some of the most flexible rewards out there. While airline miles can only be redeemed for flights with certain airlines and hotel points can only be redeemed for hotel stays with a few different brands, Capital One Miles can be transferred to 18 different partners, giving you a world of different options for redeeming your miles.

Whether you don’t have enough miles to book a premium cabin award or you’re simply trying to stretch your miles for as many flights as possible, using Capital One Miles to book economy-class flights is one of the most practical ways that you can redeem these rewards. Plus, it’s much easier to find economy award space than premium cabin award space, so using your Capital One Miles for economy flights will also save you some time searching.

Although premium cabin awards tend to offer more value per mile than economy-class flights, you can still find some high-value economy redemptions by looking out for Capital One sweet spots. This means finding economy-class flights with high cash rates and relatively low award rates, which we’ll show you how to do later in this article.

So, let’s dive into the world of Capital One transfer partners and check out some of the ways that you can maximize Capital One Miles for economy-class flights.

What Are Capital One Miles and How Do They Work?

The Capital One Rewards program is one of the best rewards programs out there for earning miles that can be redeemed toward travel. By signing up for a credit card that earns Capital One Miles, you’ll have the opportunity to earn miles on nearly every purchase you make. Then, you can redeem those miles in a wide variety of ways, including cash back, merchandise, hotel stays, flights, rental cars and much more.

However, if you want to get the best possible value out of your Capital One Miles, the best way to do so is by redeeming them through transfer partners.

Capital One Rewards Credit Cards

It’s worth noting that not all Capital One credit cards earn miles that can be redeemed through transfer partners. The cards that earn transferable Capital One Miles include:

- Capital One® Spark Miles for Business Card

- Capital One® Spark Miles Select for Business Card

- Capital One® VentureOne® Rewards Credit Card

- Capital One® Venture® Rewards Credit Card

- Capital One® Venture X® Rewards Credit Card

With each of the cards listed above, you’ll earn a welcome bonus if you spend a certain amount on your new credit card within a specific amount of time after account opening. For example, here’s the welcome bonus currently being offered by the Venture X card:

Capital One Venture X Rewards Credit Card

75,000

Venture Miles

after you spend $4,000 in purchases in the first 3 months.

Annual Fee: $395

On top of that, each of these cards will earn at least 1X miles per $1 spent. And each of these cards also offers elevated spending bonuses in specific spending categories. For example, here are the spending bonuses offered by the Venture X card:

- 10X miles on hotels and rental cars booked through the Capital One travel booking site

- 5X miles on flights booked through the Capital One travel booking site

- 2X miles on all other purchases

The lineup of Capital One Rewards credit cards includes an option for every kind of consumer. The no-annual-fee VentureOne is great for entry-level consumers who want to start earning rewards without too much commitment. The Venture X ($395 annual fee) is an excellent option for expert travelers who want premium perks like airport lounge access and free Global Entry or TSA PreCheck. And the Venture card ($95 annual fee) is a good middle-tier option.

Regardless of which of the aforementioned Capital One Rewards credit cards you have, you’ll be able to redeem your miles through any of Capital One’s transfer partners.

Best Ways to Use Capital One Miles

Once you’ve got an eligible Capital One credit card in your wallet, you can begin earning miles on every single purchase you make with that card. You can use Capital One miles to book travel through the Capital One Travel portal or transfer miles to airline and hotel partners for greater value.

The first option for booking travel using Capital One Miles is to book through the Capital One travel booking site. Through this portal, you can sign in using your Capital One credentials and book hotels, flights and rental cars either with cash or Capital One Miles.

To book a flight, all you have to do is enter the number of travelers, your desired fare class, the type of flight (round-trip, one-way or multi-city), your origin and destination and your travel dates. Then, you’ll be presented with a list of flights that match your search query. And one of the great things about the Capital One travel booking site is that, if a flight can be booked with cash, it can also be booked with miles. That means that there’s a lot of award flight availability through the Capital One travel booking site, particularly in economy class.

However, you’ll always get exactly 1 cent per mile in value when redeeming through the Capital One travel booking site. By contrast, by using Capital One’s airline transfer partners (which is slightly more complicated than using the Capital One travel booking site), it’s possible to get significantly more than 1 cent per point in value for certain redemptions.

The downside of using airline transfer partners, though, is that there’s significantly less award availability than through the Capital One travel booking site, which means you could spend more time searching for an award that fits your criteria.

Still, if you’re wondering how to redeem Capital One Miles for maximum value and get as many economy flights as possible out of them, the best way to do so is by utilizing transfer partners.

Book Travel Through Capital One’s Travel Booking Site

If you have a credit card that earns Capital One Miles, you have the option to transfer those miles to 18 different travel loyalty programs, including three hotel rewards programs and 15 frequent flyer programs. Most of these programs allow transfers at a 1:1 ratio but not all of them. Here are all of Capital One’s current transfer partners (partners with transfer ratios other than 1:1 will be noted):

- Accor Live Limitless (2:1 transfer ratio)

- Aeromexico Rewards

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLands (2:1.5 transfer ratio)

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Atlantic Flying Club

- Wyndham Rewards

Some of Capital One’s hotel transfer partners offer solid value per mile. However, since this article is focused on booking economy award flights with Capital One Miles, we’re going to focus only on Capital One’s airline transfer partners.

Not all of Capital One‘s airline transfer partners offer the same amount of value. For instance, the EVA Air Infinity MileageLands program tends to offer less value per mile than other transfer partners due to its unfavorable transfer ratio.

The Capital One airline transfer partners that tend to offer the most value are as follows:

- Turkish Airlines Miles&Smiles

- Air France-KLM Flying Blue

- Air Canada Aeroplan

- Avianca LifeMiles

- Singapore Airlines KrisFlyer

Of course, you can still find high-value redemptions through many of Capital One’s other airline transfer partners. And, while the programs listed above tend to provide the most value per mile on average, many of these other programs still have some great sweet spots.

Transfer Miles to Travel Partners

In case you’re unfamiliar, a “sweet spot” is essentially a certain type of flight or route that offers particularly high value per point or mile. In the case of Capital One Miles, sweet spots would include award flights that you could purchase through Capital One’s airline transfer partners that offer high value per mile.

Generally, premium cabin award flights tend to offer more value per mile than economy awards do. However, these premium cabin awards have less availability. And, if you want to prioritize quantity of flights over quality, then redeeming miles for economy flights is the right move.

So, let’s take a look at some specific economy-class sweet spots available with Capital One Miles.

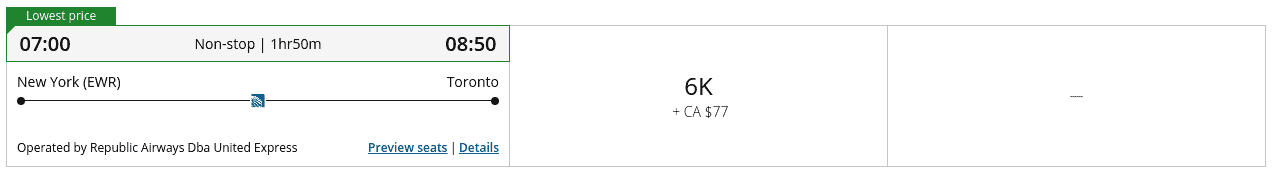

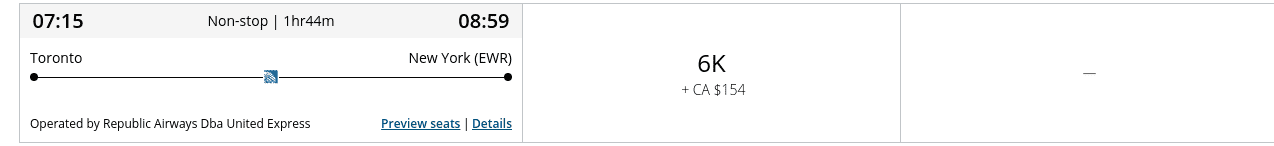

Economy Class Air Canada or United Airlines Flights Within North America for 6,000 Miles One-Way Through Air Canada Aeroplan

One of the highest-value and most practical ways for U.S. based travelers to redeem Capital One miles is to transfer them to the Air Canada Aeroplan program (at a 1:1 ratio) and redeem them for short-haul domestic flights either on Air Canada or United Airlines.

According to the Air Canada Aeroplan award chart, Air Canada-operated flights within North America between 0 and 500 miles in distance cost between 6,000 and 10,000 Aeroplan points. United-operated flights within North America between 0 and 500 miles in distance always cost 6,000 miles Aeroplan points.

Flights that fall within this distance range, for example, could include:

- San Francisco (SFO) to Las Vegas (LAS)

- Washington, D.C. (IAD) to Charlotte (CLT)

- Toronto (YYZ) to New York City (JFK)

- Denver (DEN) to Albuquerque (ABQ)

- New Orleans (MSY) to Atlanta (ATL)

If you can find domestic economy flights that have high cash rates, you should be able to get great value out of your Capital One Miles by redeeming them for these types of short-haul domestic flights.

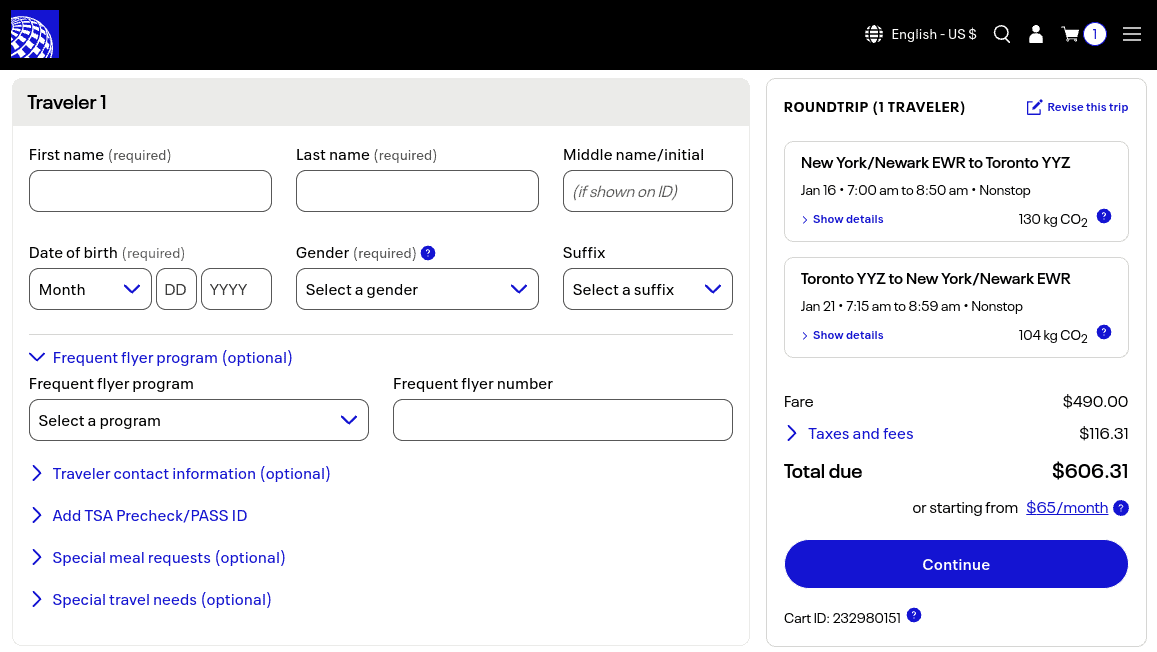

For example, we found a United-operated round-trip economy award flight from Newark (EWR) to Toronto (YYZ) for 12,000 Aeroplan points (6,000 points for each direction) and 231 Canadian dollars in taxes and fees (about $169).

If you were to book the exact same round-trip flight on the same dates with cash through the United Airlines website, it would cost you slightly over $606.

Thus, by booking this flight with your Capital One Miles through the Air Canada Aeroplan program rather than paying for it with cash, factoring in the taxes and fees, you’d be getting a value of about 3.6 cents per mile (($606 – $169) / 12,000 miles = 3.6 cents per mile). That’s excellent value, particularly for an economy-class award.

Economy Class American Airline Flights Between the U.S. and the Caribbean for 12,000 Miles One-Way Through British Airways Executive Club

Another economy-class sweet spot that may appeal to many U.S. based travelers is purchasing economy-class flights between the U.S. and destinations in the Caribbean on American Airlines through the British Airways Executive Club program. British Airways doesn’t publish a public award chart. However, these flights consistently cost 12,000 Avios one-way through this program.

To transfer Capital One Miles to British Airways, log in to your Capital One account and navigate to the “Rewards” section. Once there, select the “Convert rewards” option and select British Airways Executive Club as the program that you want to transfer to. Finally, enter how many miles you wish to transfer. Once the Avios land in your Executive Club account, you should be able to redeem them immediately.

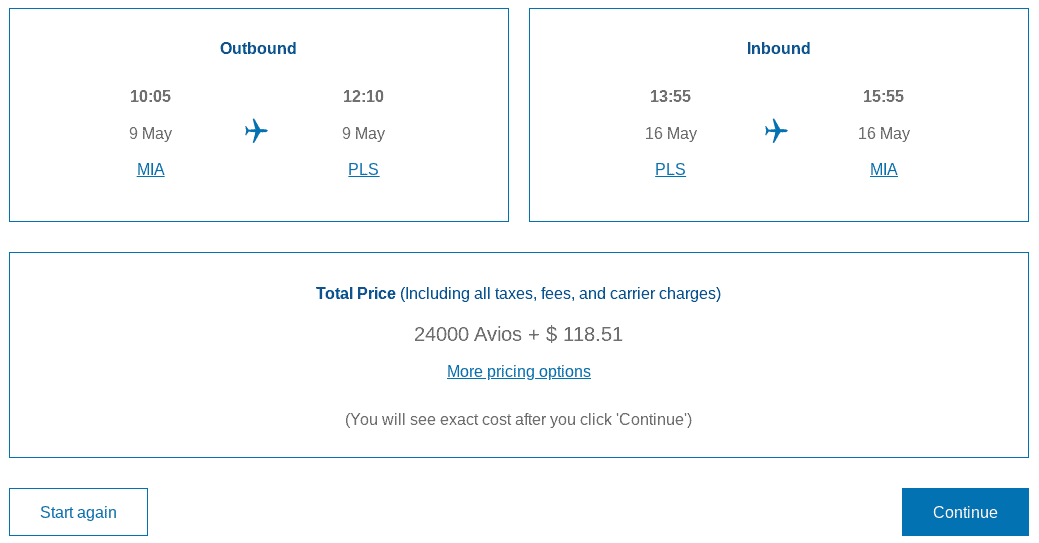

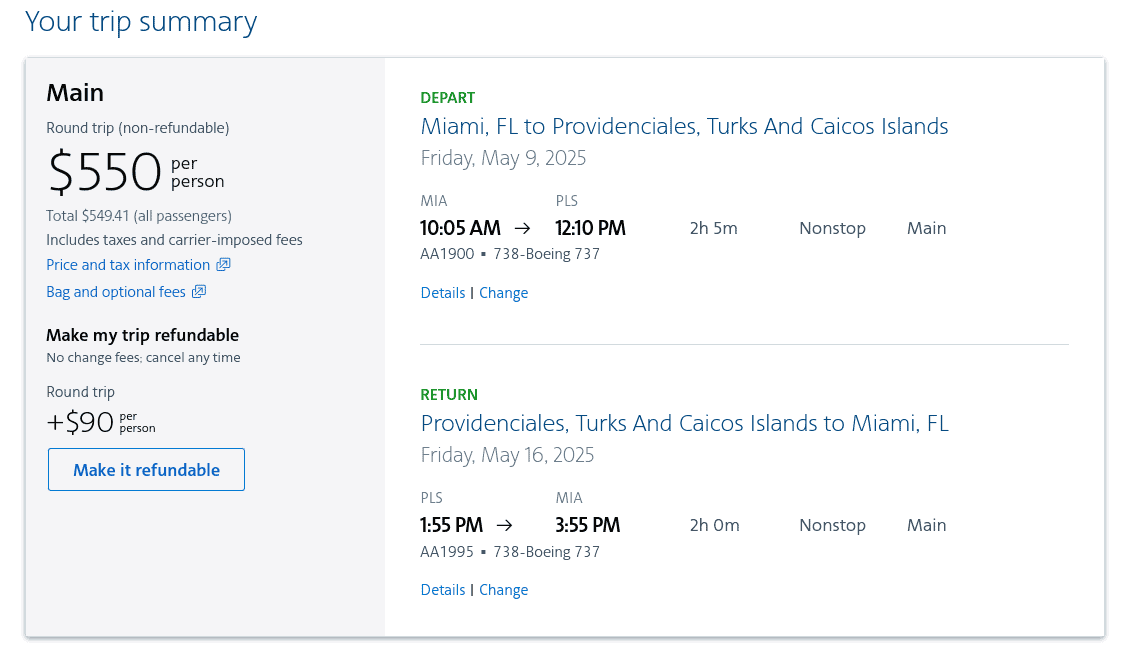

We found an American Airlines-operated economy-class flight between Miami (MIA) and Providenciales, Turks and Caicos (PLS) for 24,000 Avios round-trip plus about $118 in taxes and fees.

If you were to book this same round-trip flight with cash through the American Airlines website, it would cost you $550.

So, by booking this flight with Capital One Miles through the British Airways Executive Club program instead of paying with cash, you’d be getting a value of about 1.8 cents per mile (($550 – $118) / 24,000 miles = 1.8 cents per mile). That‘s solid value for an economy-class flight. Plus, Turks and Caicos and many other destinations in the Caribbean are popular vacation spots for U.S. tourists.

Tips for Maximizing Capital One Miles by Booking Economy Flights

When it comes to redeeming your Capital One Miles for economy flights, there are a few tips that you should keep in mind to ensure that you get the most value possible out of your rewards. Looking out for transfer bonuses is an excellent way to ensure you get good value per mile. Checking award rates across several Capital One transfer partners can also help you find the best available rate. And being flexible with your travel dates, cabin class and origin and destination can be extremely helpful when trying to maximize your miles’ value.

How to Get the Best Value from Your Miles

One of the best tips for maximizing the value of your Capital One Miles is to look out for transfer bonuses. Essentially, these transfer bonuses will offer bonus miles when you transfer Capital One Miles to certain transfer partners.

For instance, in 2023, Capital One Rewards was offering a 20% bonus for miles transfers to Air France-KLM Flying Blue. So, if you were to transfer 100,000 Capital One Miles to the Air France-KLM Flying Blue program during that promotion, you’d have received 120,000 Flying Blue miles. Unfortunately, that transfer bonus is no longer active.

Using these transfer bonuses can help you get even more value out of your Capital One Miles. However, we still recommend only transferring miles to a transfer partner if you have a specific redemption in mind. It doesn’t make much sense to transfer miles to a loyalty program if you don’t know which flight you want to book.

It’s impossible to know when these transfer bonuses will become available. So, we’d recommend just checking the Capital One transfer partners page every once in a while. Capital One will also probably send out emails to cardmembers about any upcoming transfer bonuses.

And, of course, before you take advantage of any transfer bonuses or redeem miles for award flights, you should always calculate the amount of value that you get out of each potential redemption (as we’ve done in the two examples above in the “Uncover Hidden Gems With Capital One Sweet Spots” section).

When to Book for Maximum Savings

Another major factor that contributes to how much value you’ll get for your Capital One Miles is the timing of your flight. With certain frequent flyer programs, the mileage required for your award flight will change depending on whether that award flight occurs during off-peak or peak season. For instance, the ANA Mileage Club program prices ANA-oeprated award flights differently based on whether they occur during low season, regular season or high season.

In general, you’ll get better value from your Capital One Miles if you redeem them for off-peak season award flights. These award flights tend to have significantly lower mileage rates. For this reason, being flexible with your travel dates can help you get more value out of your miles. This is because, with certain frequent flyer programs, while one day may be considered peak season, the very next day could be considered off-peak season.

It’s also important to be flexible with other flight factors if you want to maximize the value of your miles. For example, being flexible with your departure and arrival airports (such as flying into or out of LaGuardia Airport rather than John F. Kennedy International Airport (which is also in New York City) can greatly increase your chances of finding a high-value award flight.

Common Mistakes to Avoid with Capital One Miles

When redeeming Capital One Miles for economy-class flights, there are several mistakes that you should try to avoid. Otherwise, you could end up wasting unnecessary miles on low-value redemptions.

Transferring to Low-Value Transfer Partners

One common misconception is that all Capital One transfer partners offer good value per mile. While some redemptions through Capital One transfer partners offer substantially more than 1 cent per mile (as demonstrated in the “Uncover Hidden Gems With Capital One Sweet Spots” section above), other transfer partners actually offer very poor value per mile on average and should be avoided.

In particular, you should avoid transfers to the EVA Air Infinity MileageLands program due to the fact that it offers a 2:1.5 transfer ratio. So, for instance, if you were to transfer 100,000 Capital One Miles to the Infinity MileageLands program, you’d only receive 75,000 EVA miles. Thus, by transferring Capital One Miles to this program, you’ll instantly be diminishing the value of your miles.

Also, certain Capital One airline transfer partners tend to offer low-value redemption despite the fact that they offer a 1:1 transfer ratio. In particular, Aeromexico Rewards and Etihad Guest (thanks to a major devaluation in 2023) generally offer fairly low value.

Using Miles Plus Cash on Flights

In general, we advise against redeeming miles for flights unless you have enough miles to cover the entire cost of that flight. Many frequent flyer programs offer the option to pay for flights with a combination of miles and cash. However, redeeming miles this way typically yields a value of 1 cent per mile or less.

Since you can get more than 1 cent per mile by redeeming miles for the entire cost of an award flight, getting 1 cent per mile or less by using the “miles plus cash” option isn’t the best way to use your miles.

Booking Through Capital One Travel Booking Site for Poor Value

While the Capital One’s travel booking site is easy to use and offers more award flight availability than any single loyalty program, when you redeem your miles through this portal, you’ll always get 1 cent per mile in value.

While 1 cent per mile isn’t terrible value, as we’ve demonstrated in this article, you can find redemptions that offer significantly more value than that through airline transfer partners. So, if you want to maximize the value of your miles, using transfer partners is a better bet than using the Capital One’s travel booking site.

Of course, if you don’t want to go through the hassle of comparing award rates through transfer partners, then the Capital One’s travel booking site might be a good option. You may also want to consider the 10xTravel Award Booking Service, which will find you the best available award flight through transfer partners.

Can You Use Capital One Miles for Premium Flights?

While redeeming Capital One Miles for economy class flights is undoubtedly the best way to stretch your miles for as many flights as possible, sometimes you may want to fly in a premium cabin. To make the most of your premium cabin experience, we’d recommend only redeeming miles for upper-class seats on long-haul flights (unless you have a ton of miles to burn).

Another strategy that many travelers use is to book cheap flights with cash and then redeem miles for cabin class upgrades. The amount of value you’ll get out of your miles when redeeming for cabin class upgrades can vary widely between frequent flyer programs and even between dates. However, redeeming miles this way can actually be a good deal on some occasions.

So, if you’re interested in upgrading from economy class to a higher cabin class on a future flight, it’s worth looking into the mileage rate for an upgrade award and then comparing it to the cash rate for that upgrade. You can use the same method that you use for calculating the value of an award flight.

For example, let’s say you’ve booked a cash flight with Avianca in economy class. If the price of an upgrade award from economy to business class costs 30,000 miles through the Avianca LifeMiles program, and the cash price to upgrade from economy to business class is $450, then that redemption would give you a value of 1.5 cents per mile ($450 / 30,000 miles = 1.5 cents per mile). These are the types of calculations that you can do if you want to know the value of an upgrade award.

It’s also worth mentioning that not all airlines provide the same quality in premium cabins. While some airlines (like Lufthansa and Qatar Airways) are renowned for providing excellent premium cabin experiences, many other airlines’ premium cabins lack impressive amenities. So, if you’re going to spend your hard-earned miles on a premium cabin flight, make sure that you research each airline’s premium cabin quality first.

Use Capital One Miles for Smarter Travel

Using the tips included in this article, you can use Capital One credit cards to earn welcome bonuses and spending bonuses and, ultimately, save up to redeem your miles for an award flight. However, if you want to stretch these miles for as many flights as possible, redeeming for economy-class flights is probably your best bet.

And, while redeeming miles for premium cabin awards tends to yield more value per mile, you can still find solid value by redeeming Capital One Miles through certain transfer partners. In particular, Turkish Airlines Miles&Smiles, Air France-KLM Flying Blue, Air Canada Aeroplan, Avianca LifeMiles and Singapore Airlines KrisFlyer tend to offer high-value economy-class awards.

Plus, you can get even more value by looking out for transfer bonuses and Capital One sweet spots. By redeeming Capital One Miles for economy flights and using these strategies to maximize their value, you can turn these rewards into unforgettable trip after unforgettable trip.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $4,500 in the first 3 months

after you spend $500 in the first 3 months

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

after you spend $4,000 in purchases in the first 3 months.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.