10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

As a small business owner, you’re in the perfect position to leverage your business expenses to pay for your next family vacation. However, it’s important to find the right credit cards that provide a good return on your business spending.

When it comes to business credit cards, the definition for “small business owners” is not limited to those who own brick and mortar businesses with all the usual trappings of a conventional business. If you have a side-hustle, online job or small gig on the weekends, that could qualify you for a small business credit card.

Every business has its own unique spending habits. Nevertheless, if you’re a business owner, there are quite a few cards that can help you turn your business spending into a great family trip.

In this installment of our two-card trip series, we’re showing you how earning the welcome bonuses on two small business credit cards can fund an entire trip to Arizona and back. Whether it’s a trip to the Grand Canyon, Saguaro National Park, Monument Valley or one of Arizona’s other attractions, having the entire trip paid for with points makes a good trip better.

Skeptical? Read on.

The Two Cards to Get You to The Copper State

There are many small business credit cards and consumer cards that you could use to get to Arizona on points alone. However, in this article, we’ll be focusing on the following two cards:

- Ink Business Preferred® Credit Card

- Marriott Bonvoy Business® American Express® Card

Let’s check out what these two business credit cards have to offer.

Ink Business Preferred® Credit Card

The Ink Business Preferred Credit Card earns 3X points on the first $150,000 spent on shipping purchases, advertising purchases made with social media sites and search engines, internet, cable and phone services, and travel. After that, you’ll earn 1X point per dollar spent.

The card is free of foreign transaction fees and charges an annual fee of $95. To break even on the card’s annual fee, you’ll need to spend $2,534 in the 3X points category (assuming a point redemption value of up to 1.75 cents).

You can either redeem your Chase Ultimate Rewards points through Chase Travel℠ at an elevated rate of up to 1.75 or transfer them to any of Chase’s 14 hotel and airline partners. You’ll have access to the following list of transfer partners to whom you can transfer your points at a 1:1 ratio:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- IHG Rewards Club

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United MileagePlus

- Virgin Atlantic Flying Club

- World of Hyatt

This wide range of transfer partners offers some of the most popular loyalty rewards programs and gives you access to all three major airline alliances.

The card also offers a selection of travel insurance perks to keep you protected while traveling, including trip cancellation and interruption insurance and an auto rental collision damage waiver, as well as cell phone protection for everyday coverage.

What’s more, since it is a Chase card, you’ll need to ensure you’re under 5/24 to be approved.

Marriott Bonvoy Business® American Express® Card

The Marriott Bonvoy Business® American Express® Card offers lucrative bonus spending categories combined with competitive cardholder perks, for an annual fee of $125.

You’ll earn the following when spending with the card:

- 6X points at hotels participating in Marriott Bonvoy (see rates & fees)

- 4X points at restaurants worldwide

- 4X points at U.S. gas stations

- 4X points on wireless telephone services purchased directly from U.S. service providers

- 4X points on U.S. shipping purchases

- 2X points on all other purchases

This wide array of point multipliers makes it easy to accumulate Marriott points on your everyday spending as well as specific business expenses.

On top of these earning rates, you’ll have access to the following perks:

- Complimentary Marriott Gold Elite Status

- 7% discount on bookings when you book directly with Marriott through an eligible channel for a participating property under the Amex Business Card Rate

- Annual free night reward with the opportunity to receive a second free night reward after spending $60,000 within a calendar year, for use at hotels participating in Marriott Bonvoy with a maximum equivalent redemption level 35,000 points

- 15 Elite Night Credits issued to your account annually

- No foreign transaction fees

- Baggage insurance plan¹

- Car rental loss and damage insurance¹

Complimentary Marriott Gold Elite Status is one of the standout perks on this card, which would normally require you to spend 25 nights at Marriott properties within a calendar year. This unlocks a variety of perks for Marriott guests, including a 25% points boost on stays and priority late checkout (2 p.m.). The annual boost of 15 Elite Night Credits also puts you closer to Platinum Elite Status, reducing the number of required nights from 25 to 10.

Likewise, the annual free night reward worth 35,000 points, with the opportunity to earn a second after spending $60,000 within a calendar year, is another lucrative perk that can help you offset the card’s annual fee.

Applying for the Cards and Earning their Welcome Offers

Both the Ink Business Preferred and Marriott Bonvoy Business cards offer lucrative welcome offers. If you earn these welcome offers, you’ll get the best return on your spending and be able to fund your trip to Arizona entirely on the points you earn from them.

The Ink Business Preferred has a typical welcome offer of 90,000 to 120,000 points after spending $8,000 within the first three months of card membership. That works out to an effective rate of 11X to 15X points per dollar spent.

If redeemed through Chase Travel℠, you’d get a value of at least $1,125 to $1,500. If transferred to airline or hotel partners, you could easily double this value.

Similarly, the Marriott Bonvoy Business Card has a typical welcome offer of 75,000 to 100,000 points after spending $3,000 to $5,000 or more within the first three months of card membership. That means you’ll get an effective rate of 20X to 25X points per dollar spent.

Occasionally, the Marriott Bonvoy Business Card offers up to five free night awards as a welcome offer after spending a certain amount within the first six months of card membership — an equally lucrative offer that could pay for your stay in Arizona.

When you apply for the cards, you’ll need to keep Chase’s 5/24 rule in mind . This unofficial rule states that Chase will reject your application if you’ve opened five or more cards with any issuer within the last 24 months. For this reason, it’s best to prioritize the Ink Business Preferred Card first and then apply for the Marriott Bonvoy Business Card afterward. While business cards don’t add to your 5/24 count (as they’re associated with your business’s credit report), your 5/24 count is still considered when applying for a business card.

Likewise, when applying for the Marriott Bonvoy Business Card, you should take note of its welcome offer eligibility requirements that you can find in the rates and fees agreement.

Basically, if you already hold a Marriott card with Chase and have received its welcome bonus within the last 24 months, you’ll need to consider a different credit card.

While there’s nothing stopping you from applying for both cards in the same month, you need to consider the minimum spending thresholds for each cards’ welcome offer.

Spending $5,000 or even $8,000 over three months is definitely manageable for the average household or business, but hitting $13,000 in three months could be a challenge without overspending. Therefore, unless you have a high monthly expenditure, it’s likely best to keep your card applications spread apart, making it easier to hit the minimum spends individually.

Similarly, keep in mind that Amex has a one welcome offer per card per lifetime policy. That means it’s essential to time your card application for when the welcome offer is historically high on the Marriott Bonvoy Business Card. That might mean waiting a few months between card applications to secure the most lucrative welcome offer available.

If you’re struggling to earn a card’s welcome bonus, check out some ways you can hit the minimum spending requirement through natural expenditure.

How to Book Award Flights to Arizona with Chase Ultimate Rewards Points

Getting to Arizona is the first half of the two-card trip puzzle.

The number of points you’ll have at your disposal will vary depending on when you apply for the Ink Business Preferred Card and whether or not you’re pursuing a two-player mode strategy.

Let’s say you’ve earned an average of 100,000 Ultimate Rewards points. If your P2 also opened the Ink Business Preferred Card and earned its welcome offer, then you have a mighty 200,000 Ultimate Rewards points combined.

Staying flexible with your dates is the number one way to secure the lowest priced award flights. If you can travel during off-peak seasons, your points will take you even further.

Let’s see how you can book award flights using your points.

Chase Travel℠

Your first option to consider is booking award flights through Chase Travel℠.

Your redemption value through Chase Travel℠ is now variable, thanks to the new Points Boost feature. This replaces the old fixed redemption rate with rotating offers that can be worth up to 1.75x on select premium cabin flights with a card like the Ink Business Preferred.

Booking your award flights through Chase Travel℠ can be an especially strong option when you find a boosted fare, or when cash prices are low, as the cost in points is tied to the cash price.

Flights booked through Chase Travel℠ also come with the added bonus that airlines treat the booking as a cash fare, meaning you’ll earn miles on your flight.

Southwest Airlines

If you decide to transfer your Ultimate Rewards points to one of Chase’s airline partners instead of redeeming them through Chase Travel℠, Southwest Airlines is a solid choice when it comes to affordable flights.

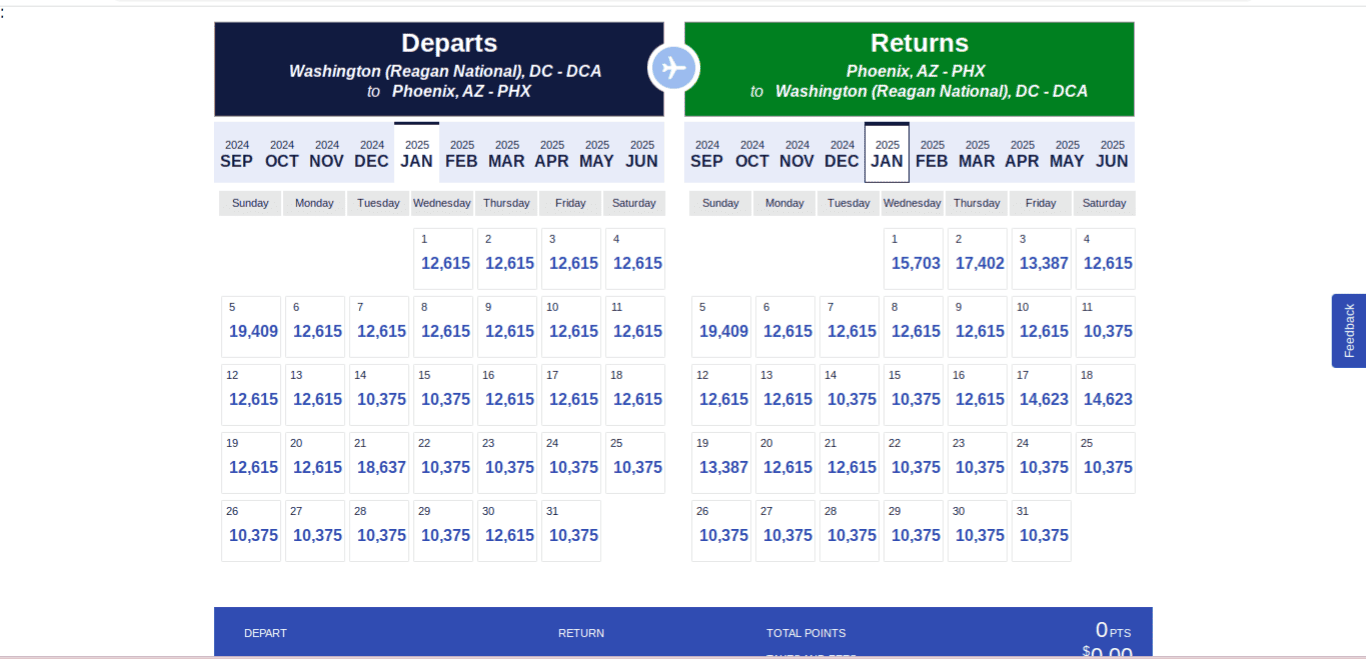

You can transfer your Ultimate Rewards points to Southwest 1:1 and take advantage of its Low Fare Calendar to find the cheapest award flights. You can search by month using the calendar view, which makes it easy to find the best offer and cheapest dates to fly on.

For example, a flight from Washington-National (DCA) to Phoenix (PHX) can cost as little as 10,375 Rapid Rewards points + $5.60 in taxes one-way. That works out to 20,750 points + $11.20 in total for a round-trip per person. At that price, the Ink Business Preferred’s average welcome bonus of 100,000 points could pay for almost five return award tickets, allowing you to easily fly the whole family out and back.

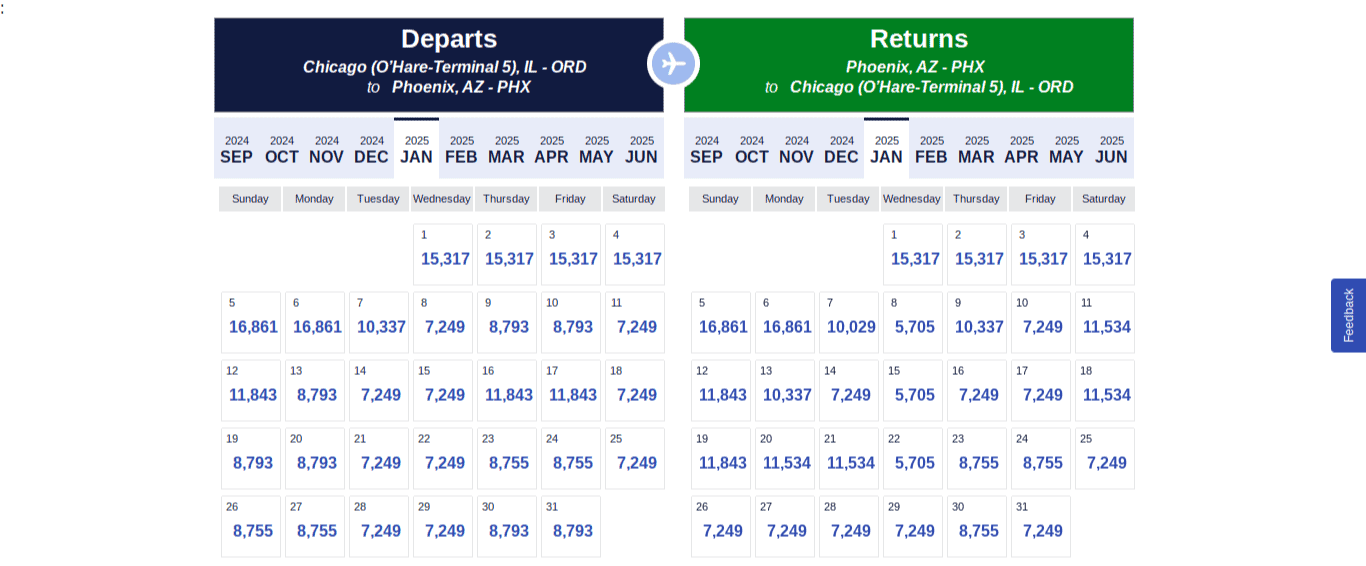

Alternatively, a flight from Chicago-O’Hare (ORD) to Phoenix can cost around 7,249 Rapid Rewards points + $5.60 in taxes one-way. For the return flight, you can find fares as low as 5,705 points + $5.60 in taxes.

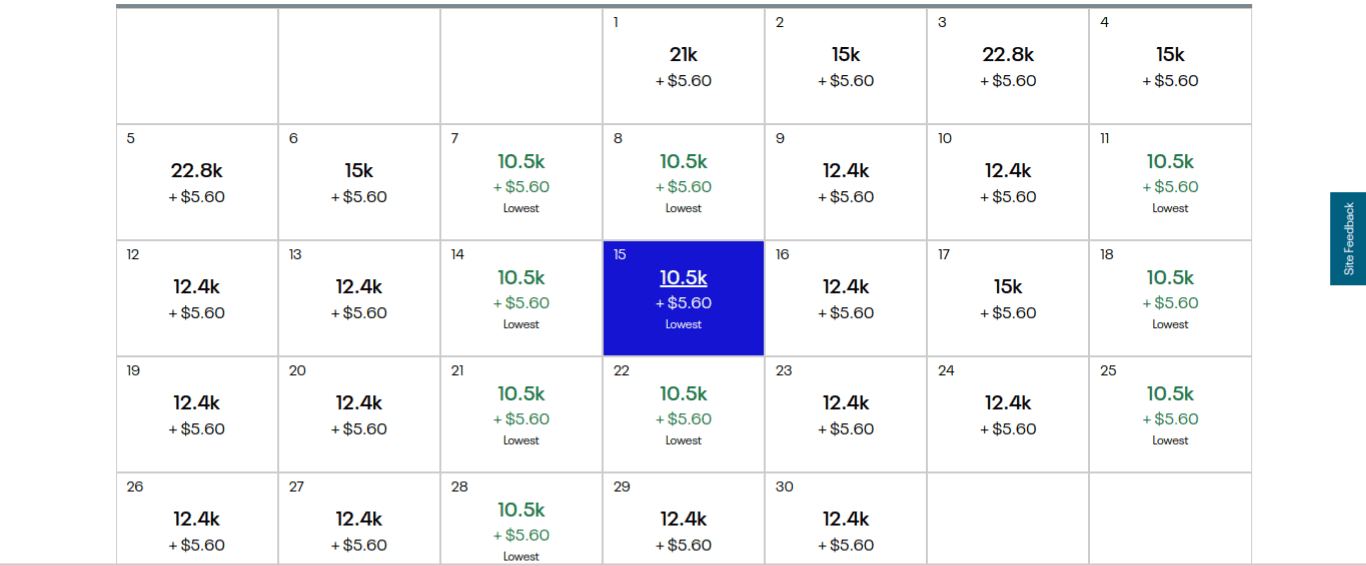

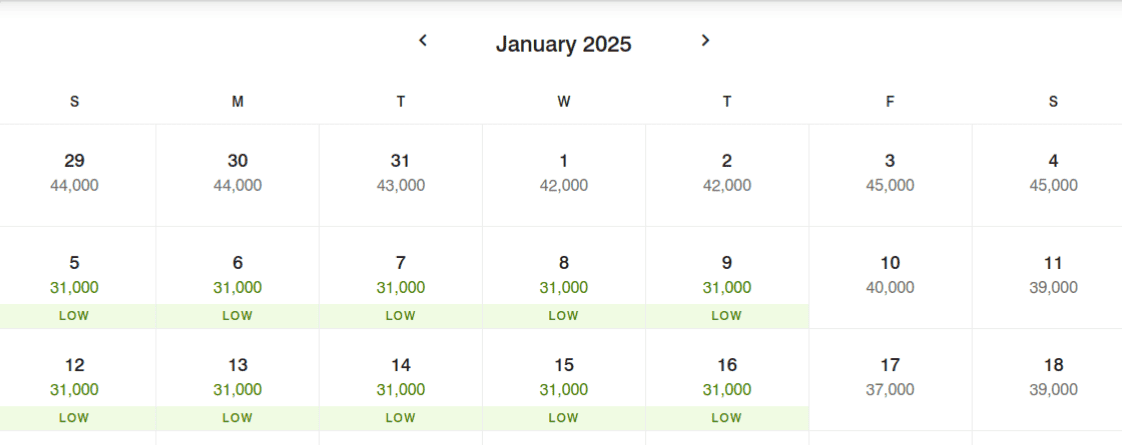

As you can see in the image below, this is where flexibility with your dates is key to securing the lowest rate possible. By flying a week later, you could save more than 10,000 points per way.

The Ink Business Preferred’s welcome bonus could easily pay for up to seven return award fares in this case. If it’s just you and your significant other flying — or if you’re flying solo — you’ll have thousands of points leftover for your next vacation by flying with Southwest.

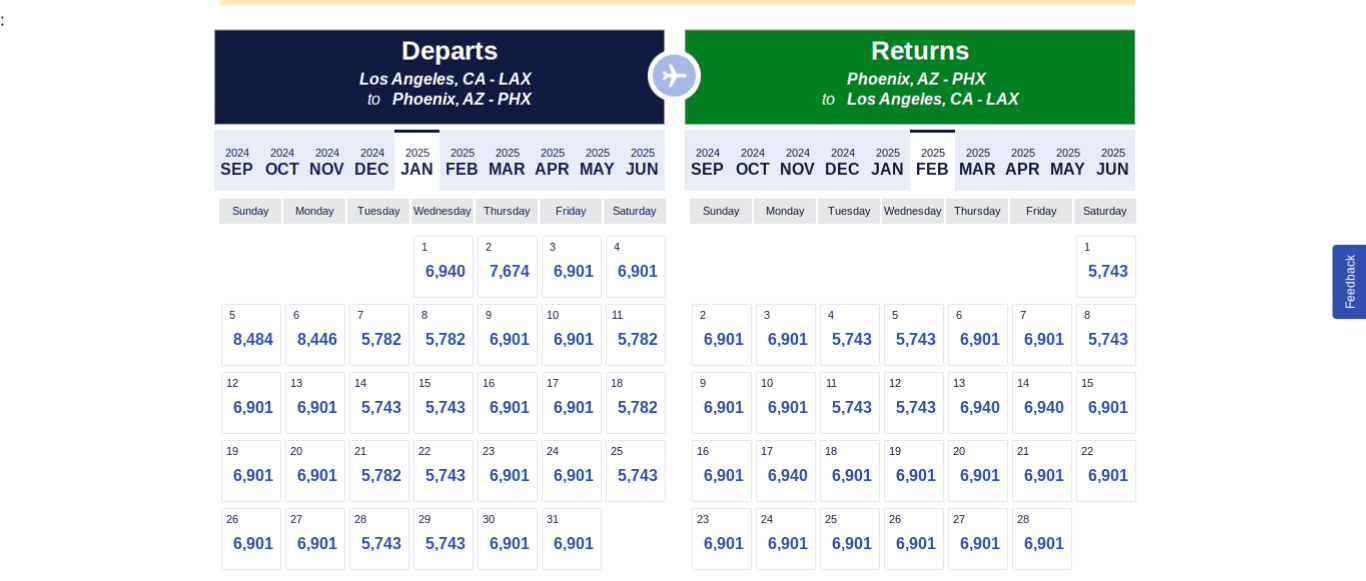

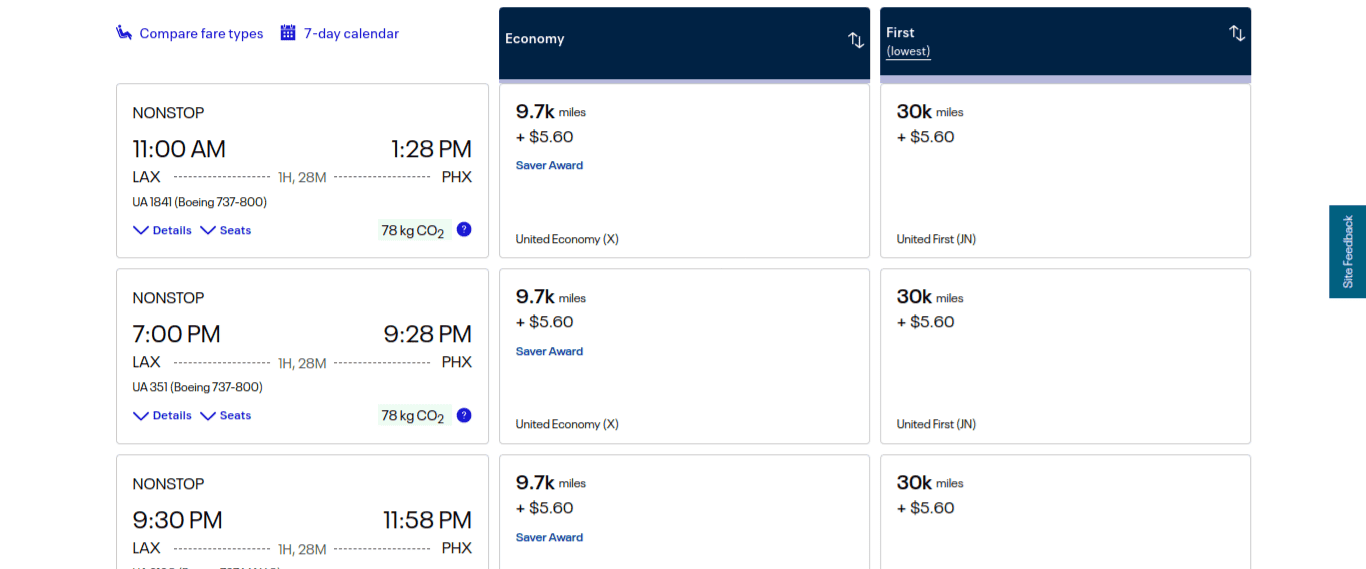

Finally, if you’re based on the West Coast, a one-way award flight with Southwest from Los Angeles (LAX) could cost you as little as 5,743 points + $5.60 in taxes.

Southwest is a great option when it comes to affordable award flights and value for money. Southwest also allows you to take up to two checked bags per person for free. Similarly, if you’ve managed to earn yourself a Southwest Companion Pass, you can have your companion fly for just $5.60 in taxes and fees one-way, reducing the cost of your flights even further.

If both you and your P2 have Southwest Companion Passes, you could each fly one of your kids for just $5.60 in taxes and fees.

United Airlines

While Southwest is an affordable option with a great value proposition, they don’t offer much in the way of luxury. That’s where you might want to go with United Airlines instead.

You can transfer your Ultimate Rewards points to United 1:1 and use its monthly search tool to get an overview of the cheapest award fares. You can take advantage of United Saver Award fares to get the lowest price possible. When searching for award and Saver Award fares with United, it’s always best to log into your United MileagePlus account as members are often presented with greater availability.

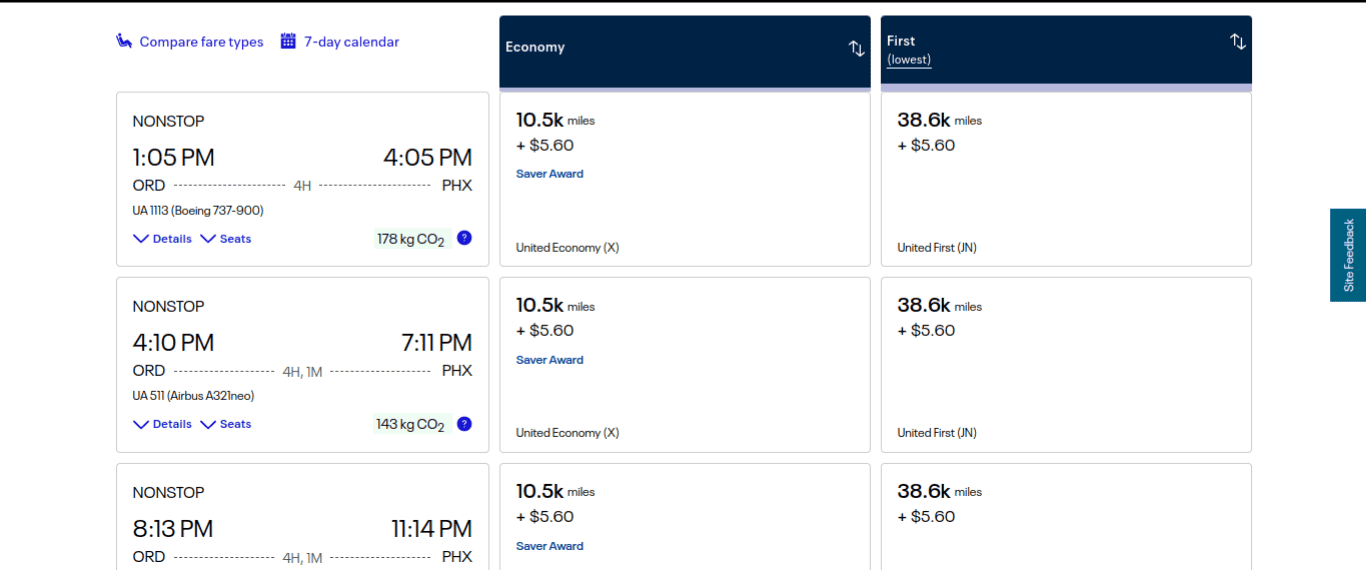

You can pay as little as 10,500 United miles + $5.60 in taxes for a one-way Economy award flight from Chicago-O’Hare to Phoenix.

Alternatively, you could fly United First Class for 38,600 miles + $5.60 in taxes one-way. If your P2 also earned the Ink Business Preferred’s welcome bonus, you could both fly United First Class to Arizona and back, and still have around 45,000 Ultimate Rewards points combined leftover.

From Los Angeles, you can find Saver Award Economy fares for as low as 9,700 miles + $5.60 in taxes. If you want to fly in First Class, you can find return fares for a total of 60,000 miles + $5.60 in taxes. If both you and your P2 flew First Class using your collective Ink Business Preferred welcome bonuses, you’d still have a total of 80,000 points leftover for your next vacation — enough to fly the whole family in Economy to Arizona and back once more.

Where to Stay in Arizona on Points

Remember, Arizona is small, and with so many things to see and do, it can be hard knowing where to start.

Luckily, Marriott Bonvoy has a large footprint across Arizona, meaning you’re well equipped regardless of where you end up going.

Marriott abandoned its award chart long ago, switching to dynamic pricing. That means the price you’ll pay in points is fixed to the cash price of the property, as well as the category of hotel and room type.

Here are some places in Arizona you can stay and pay for using your Marriott Bonvoy Business Card welcome offer. We’ll assume you’ve earned the welcome offer at 100,000 points — although 75,000 points would also suffice for most properties, depending on the length of your stay.

Residence Inn Phoenix West/Avondale

The Residence Inn Phoenix West/Avondale offers an affordable stay conveniently located off the I-10 in Avondale.

The property is close to the Phoenix Raceway, good news for NASCAR fans, and NFL and baseball fans will enjoy how close it is to the State Farm Stadium and the Goodyear Ballpark. Likewise, Camelback Ranch and Luke Air Force Base aren’t too far either.

You’ll enjoy spacious studios and suites with fully equipped kitchens, giving you full autonomy during your stay. Wi-Fi is complimentary and you’ll enjoy a free breakfast everyday. The hotel also offers an outdoor pool, BBQ patio area and fitness center to keep you occupied when you’re not hitting the town.

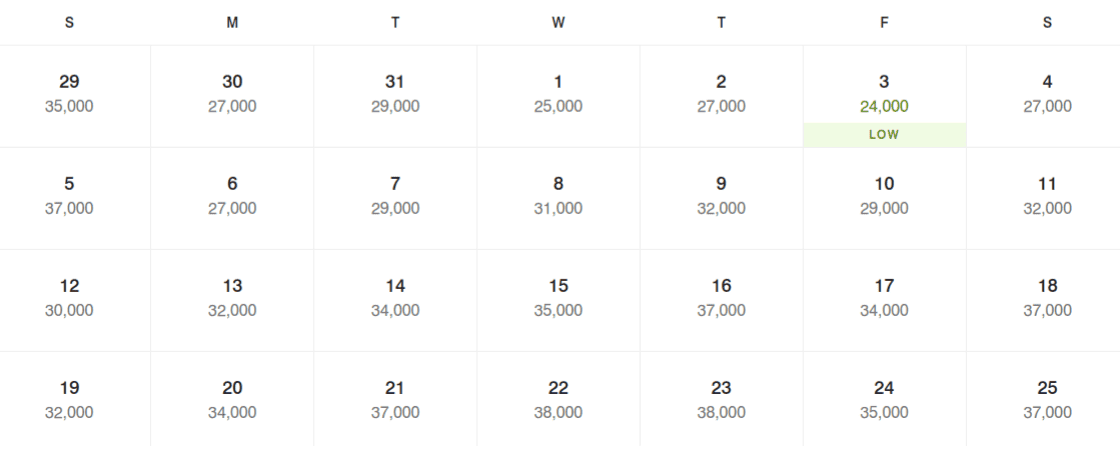

You can find award stays starting at 24,000 points per night.

Taking advantage of Marriott’s stay-for-five-pay-for-four policy, you could stay five nights at that price or six if you also redeemed your annual free night reward. Alternatively, you and your P2 could stay a maximum of 12 nights if you both redeemed your free night rewards.

Of course, the price per night varies by date, so you may not be able to stay as long as suggested here.

Courtyard Flagstaff

Located just 1.5 hours away from Grand Canyon National Park, the Courtyard Flagstaff offers a convenient and luxurious setting.

You can easily walk to Northern Arizona University, where you’ll find a wide range of bars and restaurants in the area. Arizona Snowbowl isn’t far either if you fancy some winter sports and Bearizona Wild Animal Park is just a 40 minute drive, where you can find wolves, bison, mountain goats, bears and more.

The hotel is also equipped with a restaurant, 24/7 fitness center and heated indoor pool, covering all of your needs. Its selection of rooms all include free Wi-Fi and some come with the option of private balconies. The hotel also prides itself on being pet-friendly, in case you want to bring your furry friend along with you.

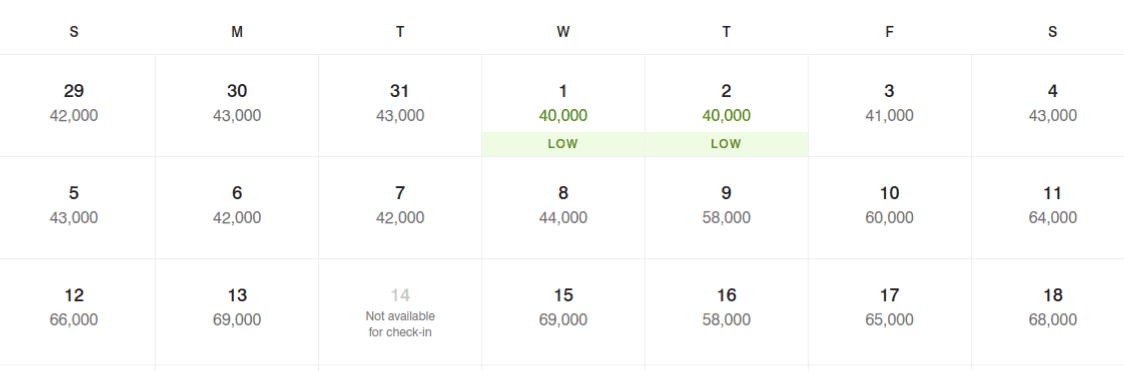

You can find standard rooms starting at 31,000 points per night.

You could stay for three nights at that price or four if you redeemed your annual free night reward. Two-player mode couples could stay seven nights at that price by taking advantage of Marriott’s fifth-night-free policy or even nine nights if both of you used your annual free night rewards.

The Westin Kierland Resort and Spa

The Westin Kierland Resort and Spa offers luxury in an idyllic setting.

You can enjoy a wide range of dining options, a 24/7 fitness studio, kids adventure waterpark and private pool for adults. The hotel also has its very own award-winning 27-hole golf course in addition to a full-service spa.

The hotel is conveniently located among local attractions including the Phoenix Zoo, Desert Botanical Garden and a variety of nature trails.

You can find standard rooms starting at 40,000 points per night.

You could stay two nights at this price or three nights if you used your free night award. For two-player mode families, you could stay a maximum of eight nights by taking advantage of both your annual free night rewards.

Final Thoughts

Utilizing the welcome offers of the Ink Business Preferred Card and Marriott Bonvoy Business Card means that you can take yourself and the whole family to Arizona and back, in style and entirely on points.

Whether you opt for affordable Economy flights and hotels or splurge on First Class tickets and luxurious stays, these two cards’ lucrative welcome offers make everything possible.

Just ensure you plan your card applications to give yourself enough time to earn each welcome offer comfortably. That way, you can leverage your natural business expenditure to cover your next vacation.

¹ Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.