10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Hi Travel Junkies,

Surely at some point in your points & miles journey you have wondered how you compare to other people in this hobby, right?

You’ve probably wondered if you earn more points & miles than the average person, or how your average monthly spend compares to others in the hobby, or whether anyone else is able to do this successfully with multiple children in tow, or if you are the only person on the entire planet who cannot seem to convince your partner that points & miles are not some sort of scam.

And at some point you’ve probably felt frustrated because you have convinced yourself that the incredible points & miles stories that you see in our Friday Brags and Reader Success Stories are typical, and that you are somehow failing at this because you haven’t used your hard-earned points to book a trip for your family of 4 to fly first class to Europe for the 3rd time this year.

We at 10xTravel often feel the same way. So we decided to conduct a large survey of our readers to help us understand who our readers are and how they typically engage in the points & miles hobby.

More than 2,500 readers participated in the anonymous survey and the results were both surprising and enlightening. At least to me, anyway.

Let’s start by taking a look at some of the key takeaways.

High Level Summary & Key Takeaways

Here are some of the key takeaways from the survey results:

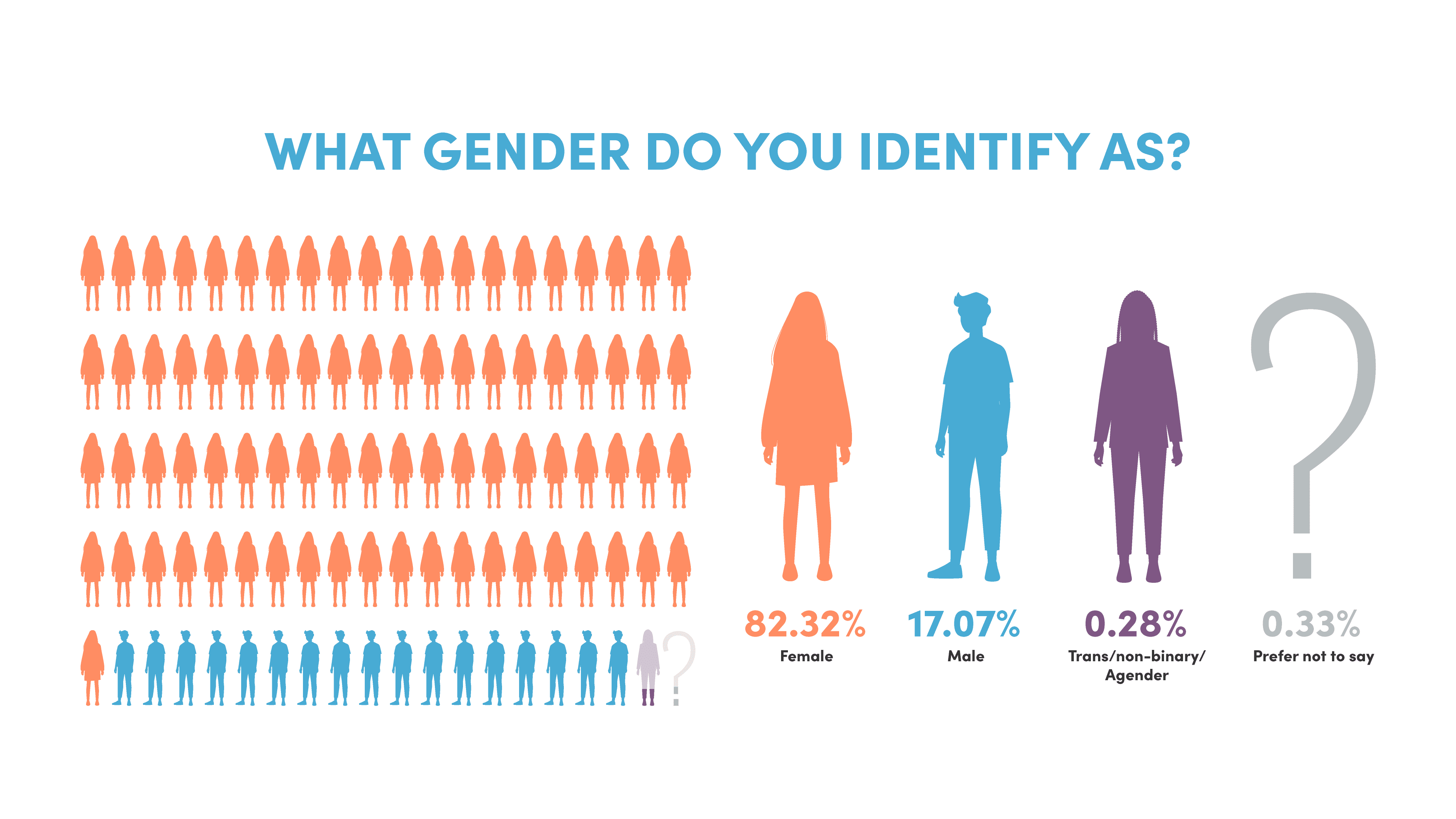

- Our readership is predominantly female (82.4%)

- Most readers are in their mid 30’s to early 40’s, with the median age being roughly 44 years old

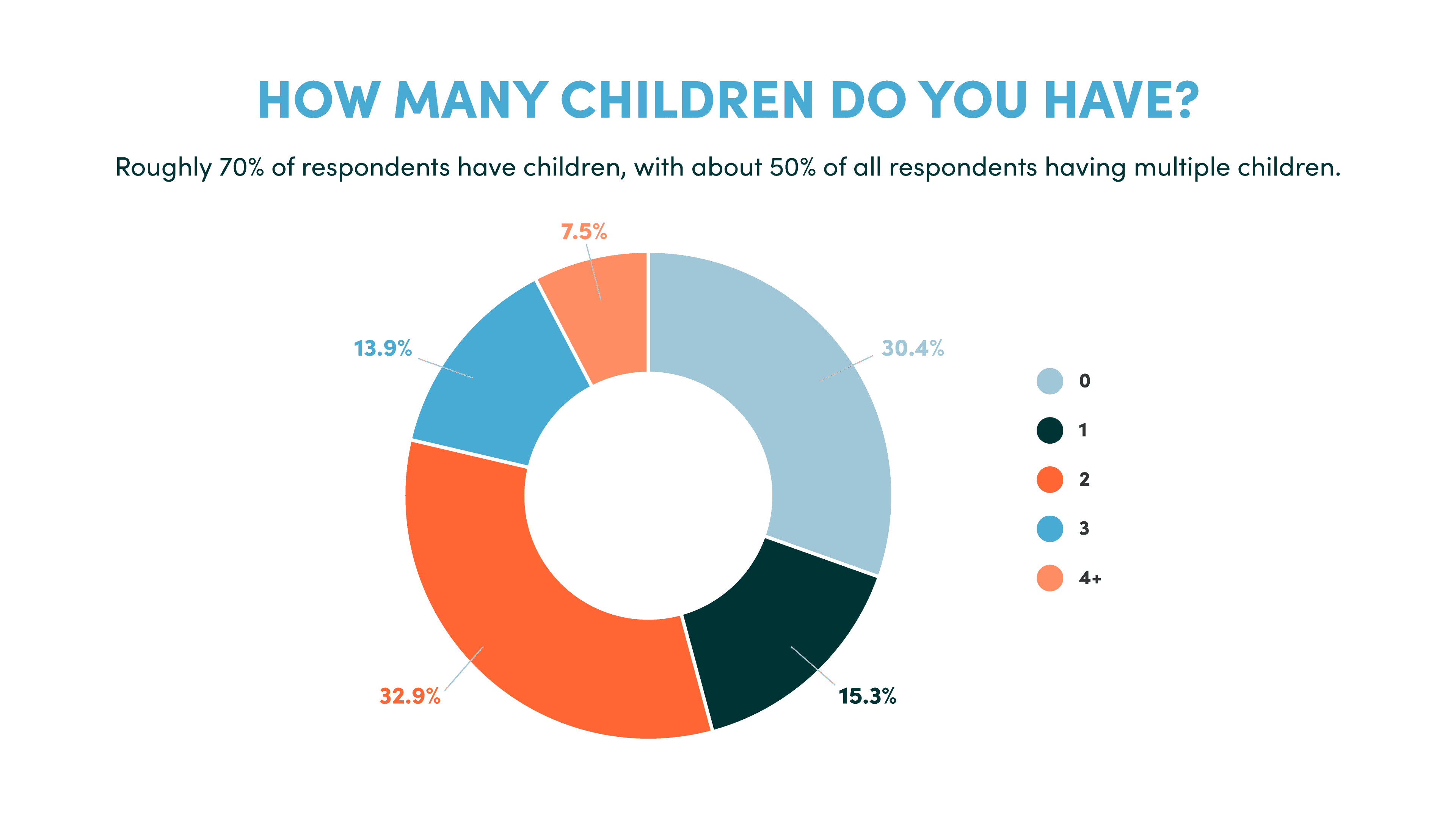

- More than 70% of our readers have children, over 50% of which have multiple children

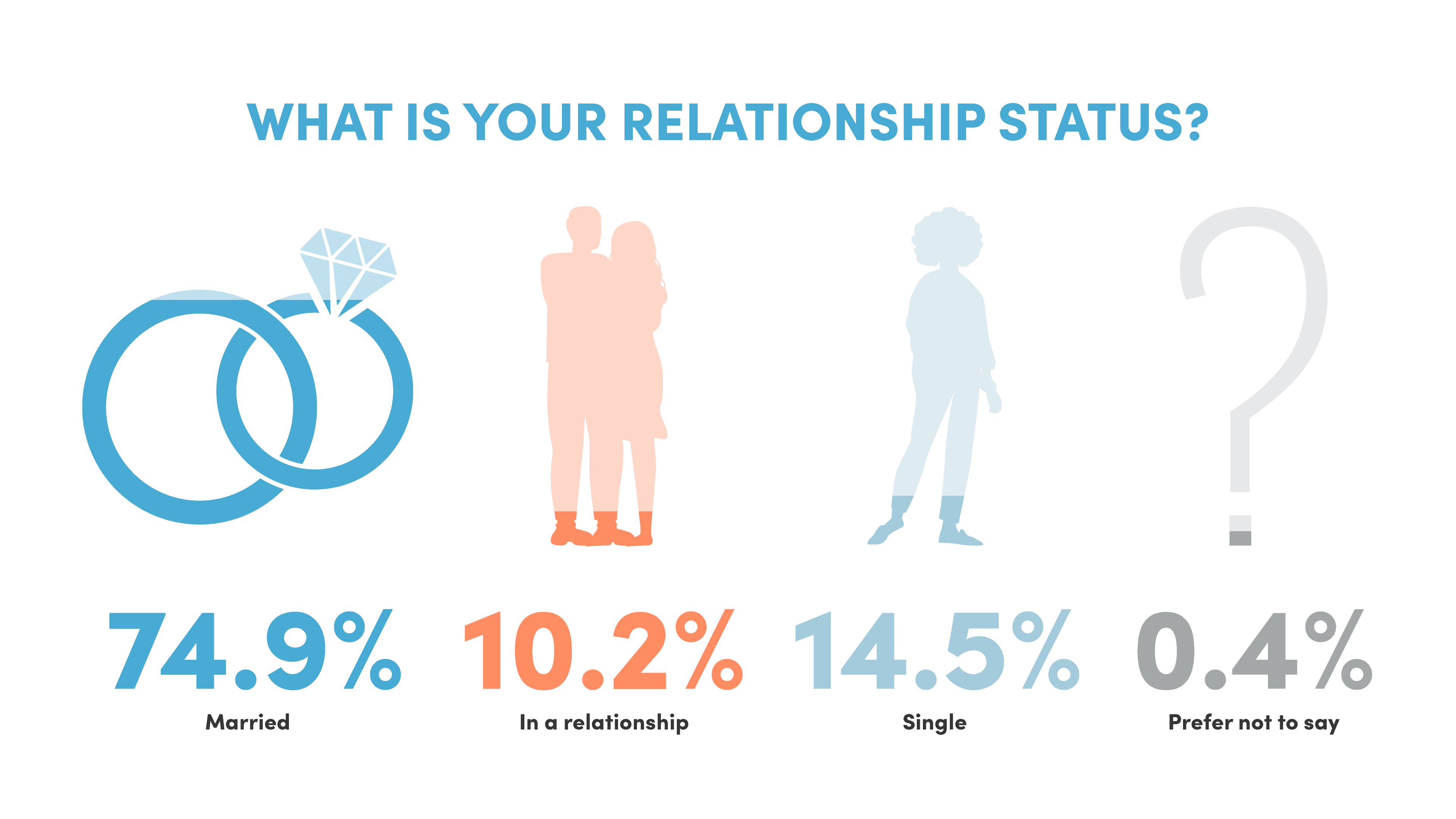

- 75% of our readers are married and another 10% are in a relationship

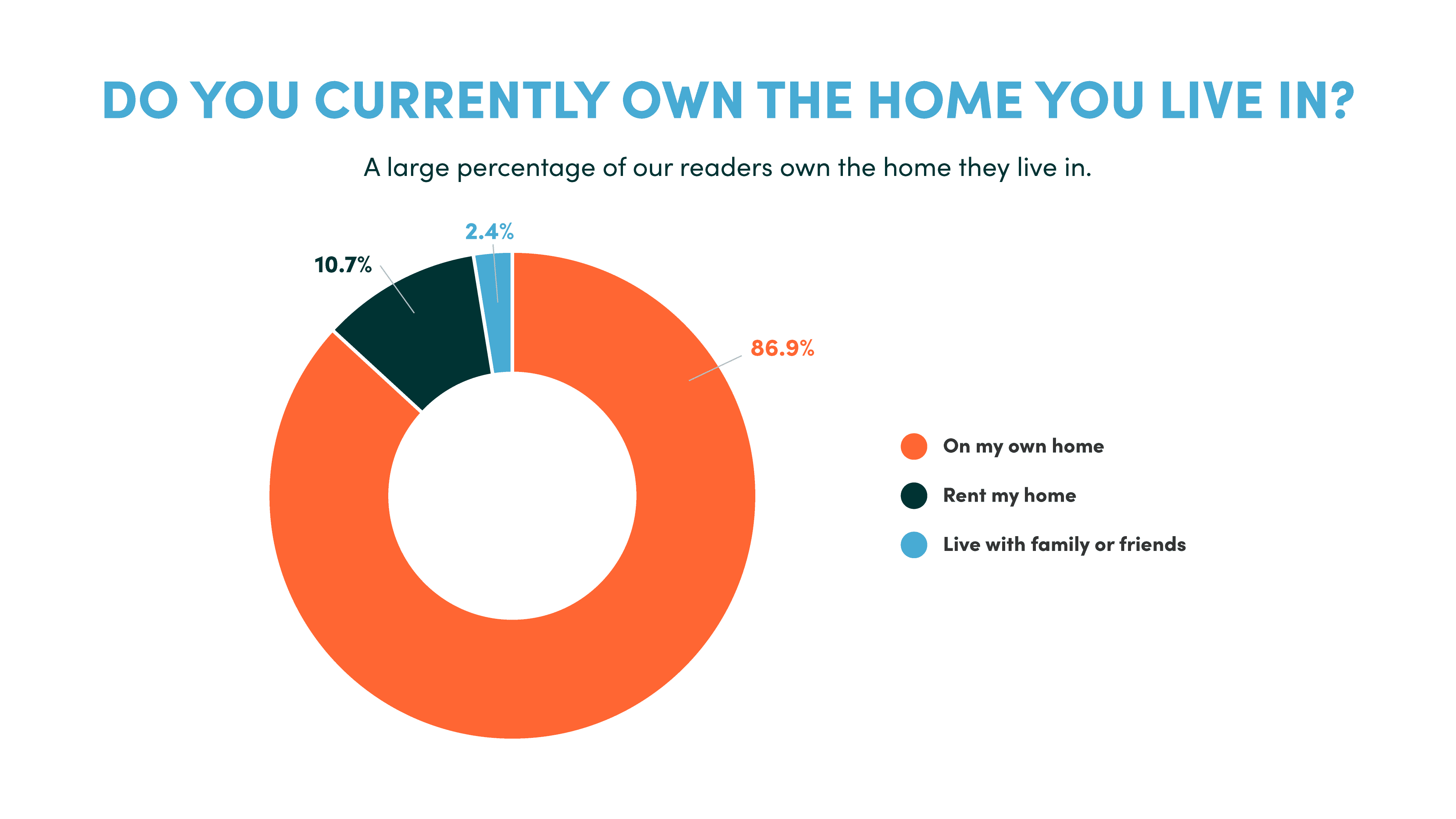

- Our readers have an average household income of $197,000, and over 80% of them own the home that they live in

- The average reader has ~10 credit cards open at any given time (personal and business combined), adding roughly 3-4 new ones each year, and spending an average of $6,000 per month total on credit cards

The “Average 10xTravel Reader”, According to the Results

If you used the results to create the most “average” 10xTravel reader possible, that reader would be a 44 year old white woman from California, who is married with 2 children, owns the home she lives in, has an annual household income of $197,000, has roughly 10 credit cards open at any given time and opens 3-4 new ones each year, who spends approximately $5,000 to 6,000 on those credit cards in a typical month, who’s credit score is around 800, and she uses her points & miles to book travel for herself and two other people.

And if you feed that description into ChatGPT and ask it to create an image, you get this.

Behold, the “Average 10xTravel Reader”.

An image of the “Average 10xTravel Reader”, created by sharing the survey data with ChatGPT/DALL-E

But Don’t Let the Averages Fool You

I want to be sure to emphasize the fact that there was a very wide variety of responses to virtually every question on the survey.

Sure, our “average” reader is the 44 year-old woman who is married with two kids, a house, and ~10 credit cards that you just read about.

But that overly-simplistic persona doesn’t capture the fact that roughly 1 out of every 3 respondents don’t have any children at all, 1 in 4 are not married, and half of all respondents spend less than $4,000 per month on credit cards.

And of course you have to keep the scale in mind. Even if you find yourself among the relatively small percentage of respondents who are above the age of 60, do not own a home, and live in the State of Arizona, there are still thousands of other readers in your exact same situation.

So try not to look at these results and make the mistake of assuming that everybody else is perfectly aligned with these “average” responses. Average is just an aggregate measure of a wide variety of responses.

Speaking of responses, let’s take a look at the results for each question on the survey with some visual representations and quick thoughts for each.

Full Breakdown of Survey Responses

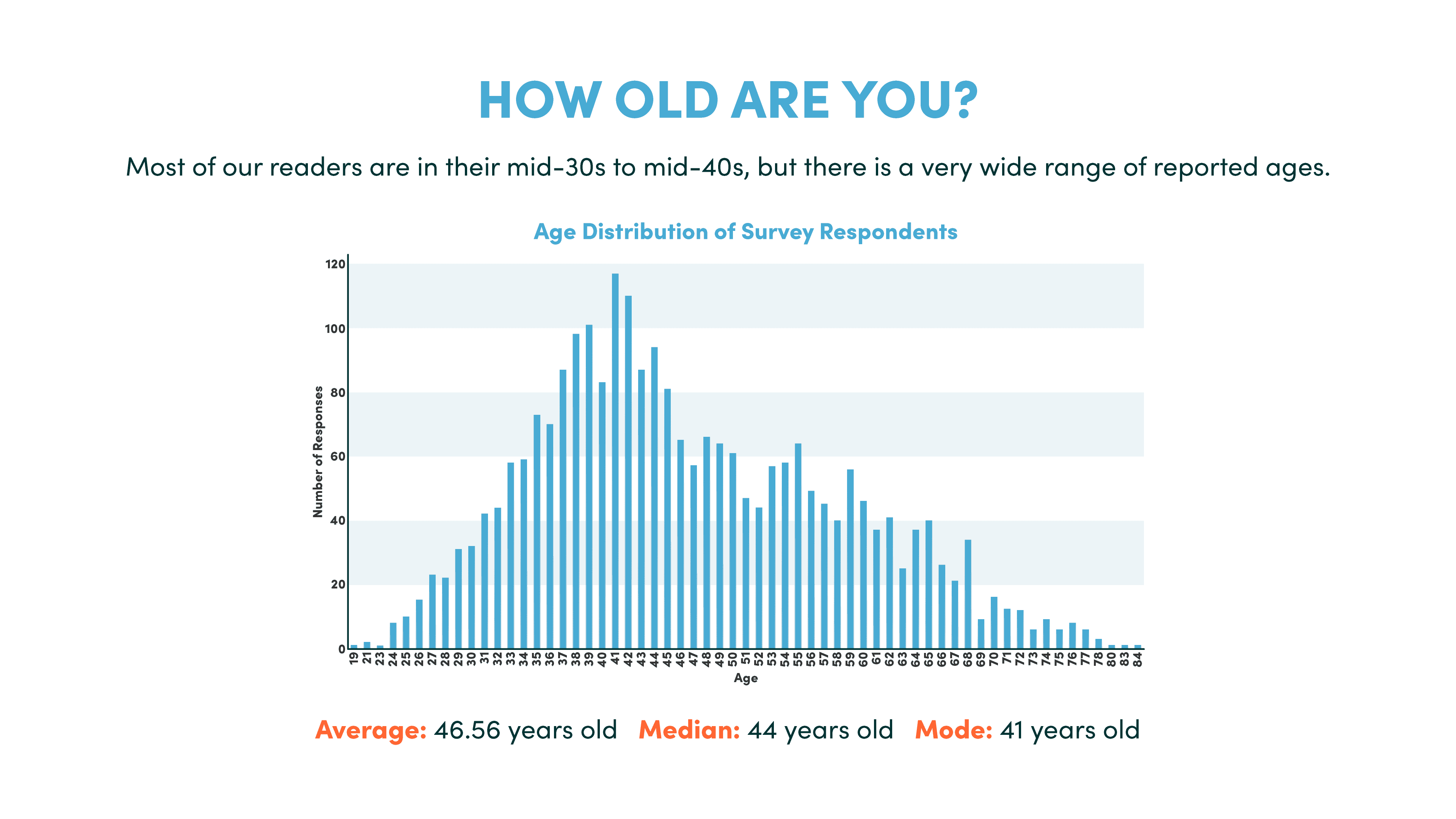

How Old Are You?

Most of our readers are in their mid-30s to mid-40s, but there is a very wide range of reported ages.

Average: 46.56 years old

Median: 44 years old

Mode: 41 years old

Where do you live?

Our readers are distributed pretty evenly across the United States.

What gender do you identify as?

What is your relationship status?

How many children do you have?

Roughly 70% of respondents have children, with about 50% of all respondents having multiple children.

What is your ethnicity?

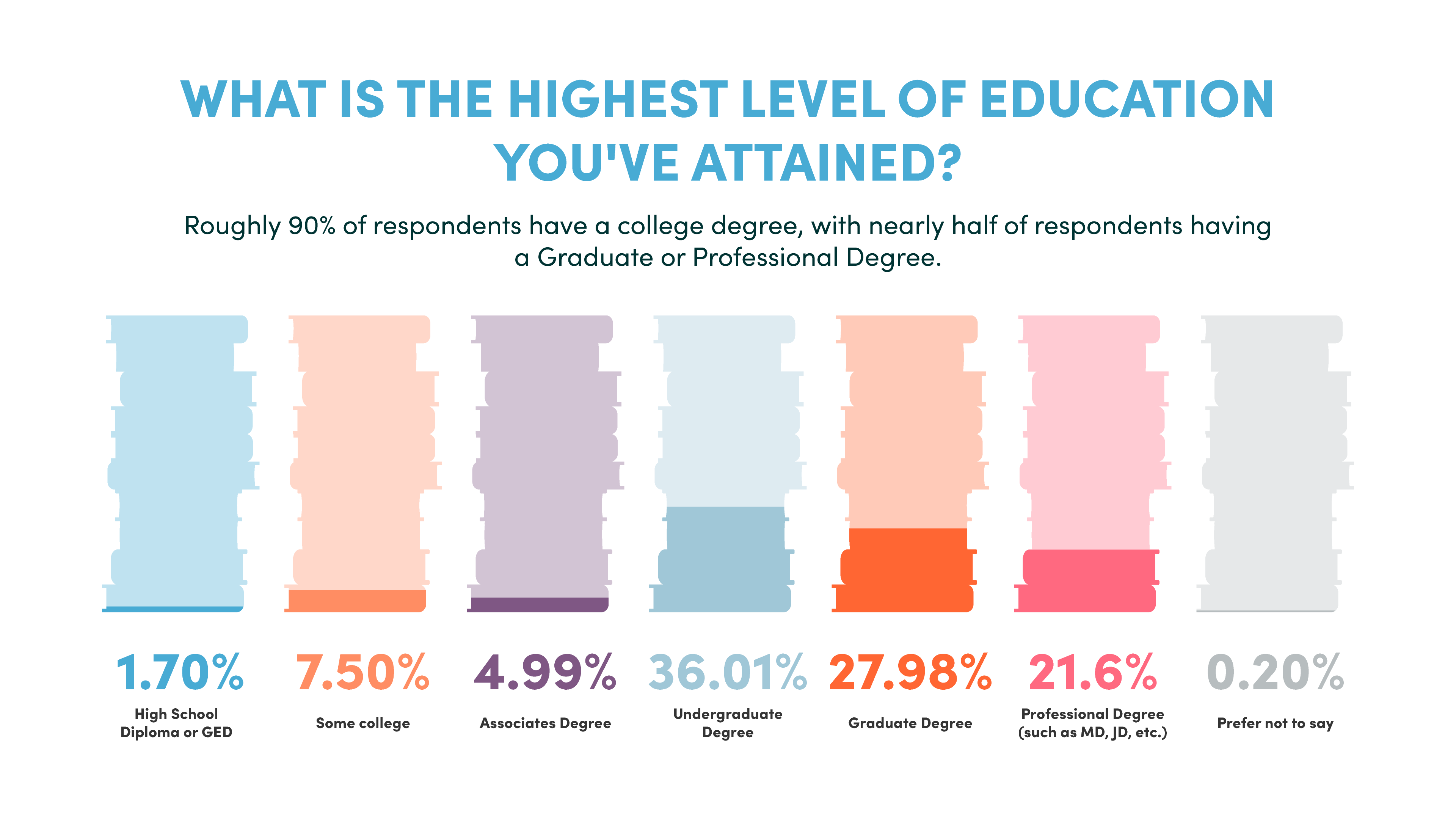

What is the highest level of education you’ve attained?

Roughly 90% of respondents have a college degree, with nearly half of respondents having a Graduate or Professional Degree.

What is your total annual household income?

Average: $197,122.54

Median: $162,000

Mode: $200,000

Do you currently own the home you live in?

A large percentage of our readers own the home they live in.

What is your FICO credit score?

Average: 795

Median: 803

Mode: 800

How many credit cards do you currently have open in your name? (Personal & Business)

Average: 10.29

Median: 8

Mode: 7

How many new credit cards have you opened in the past 12 months? (Personal & Business combined)

Average: 3.73

Median: 3

Mode: 2

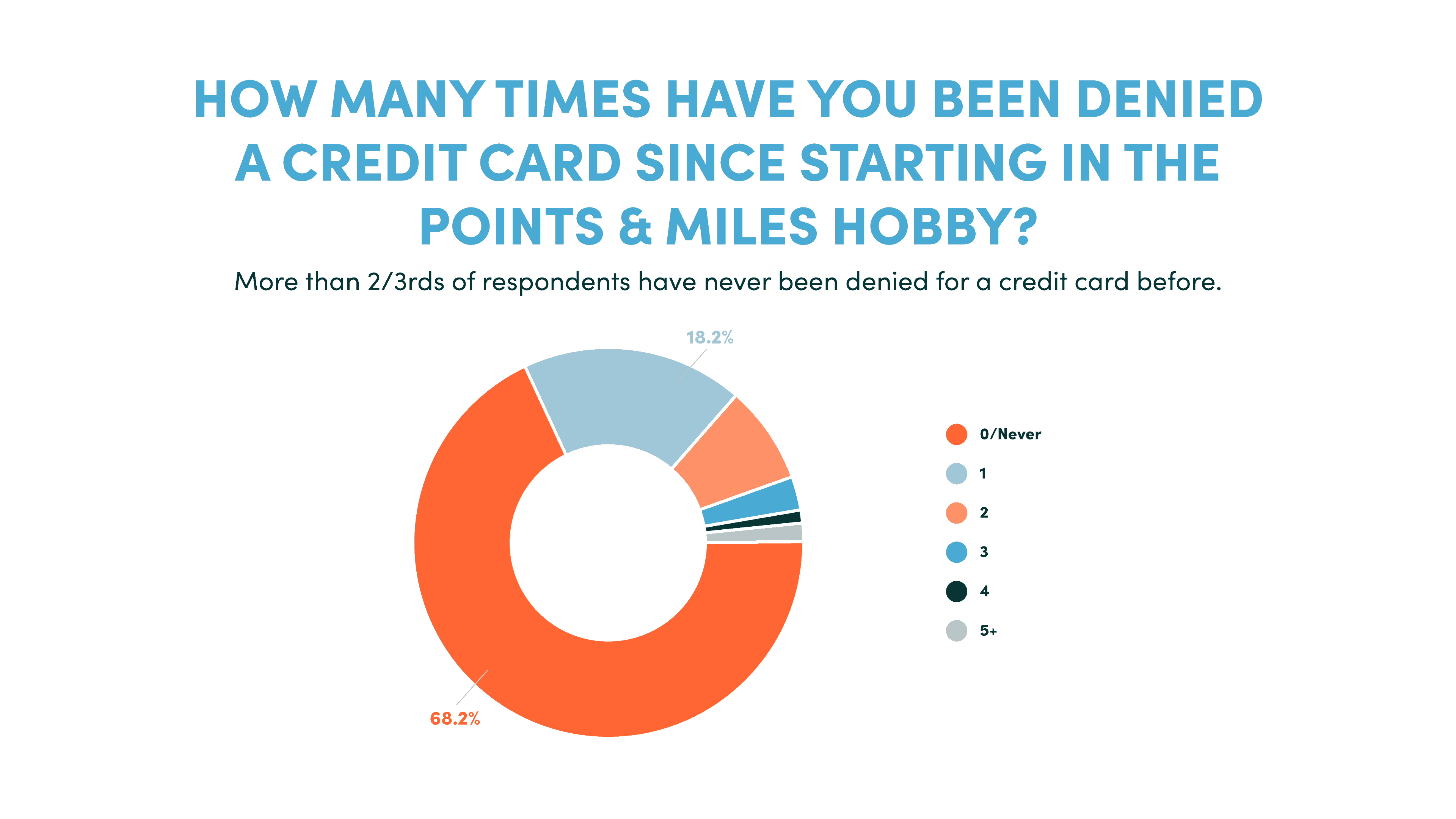

How many times have you been denied a credit card since starting in the points & miles hobby?

More than 2/3rds of respondents have never been denied for a credit card before.

Roughly how much do you spend on credit cards in a typical month? (Personal & Business)

Average: $5,966

Median: $4,000

Mode: $3,000

Most respondents spend between $2,000 to $5,000 on credit cards in a typical month. The average is a bit deceptive on this one, as it is being skewed higher by a few outliers.

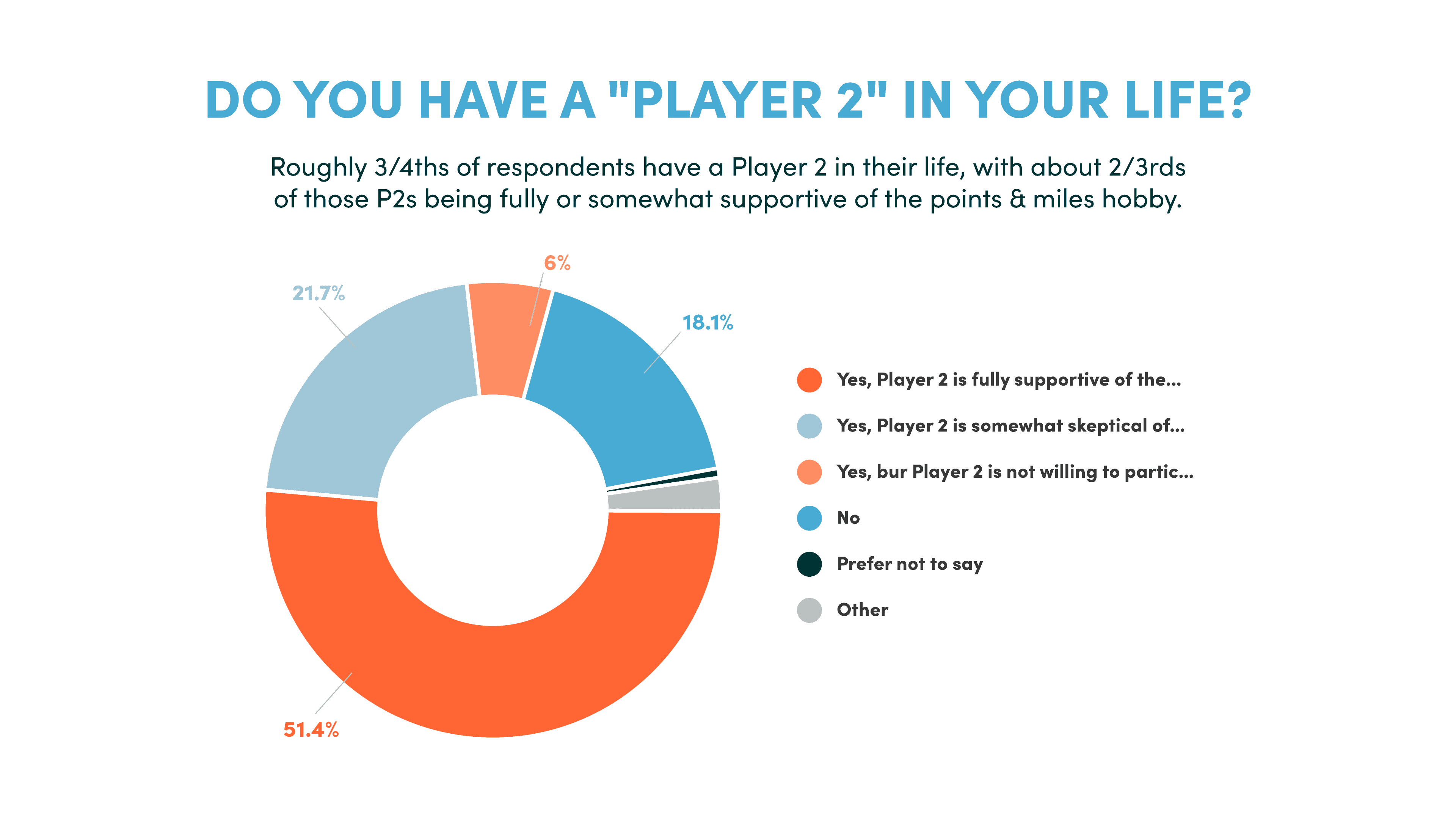

Do you have a “Player 2” in your life?

Roughly 3/4ths of respondents have a Player 2 in their life, with about 2/3rds of those P2s being fully or somewhat supportive of the points & miles hobby.

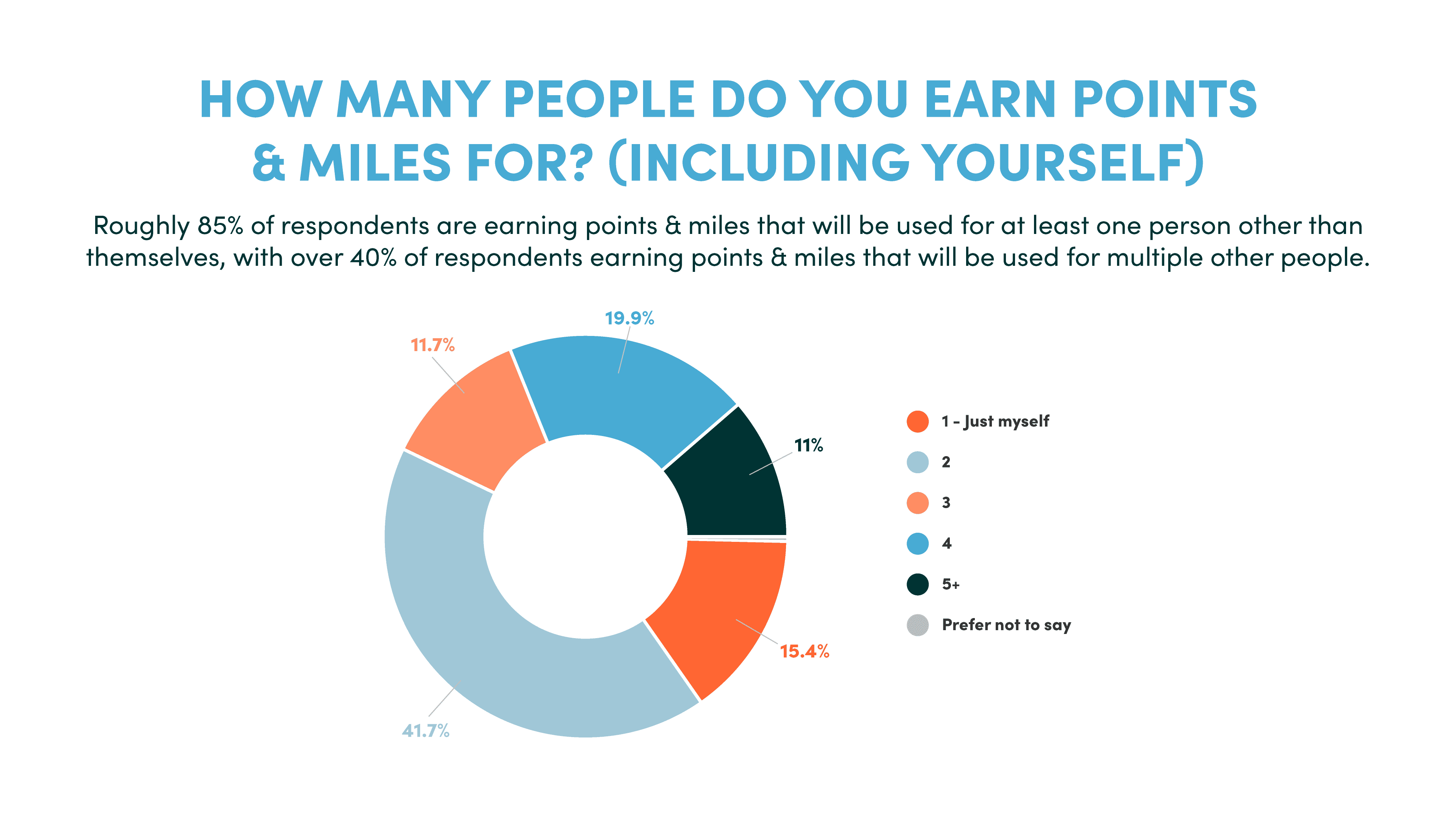

How many people do you earn points & miles for? (Including yourself)

Roughly 85% of respondents are earning points & miles that will be used for at least one person other than themselves, with over 40% of respondents earning points & miles that will be used for multiple other people.

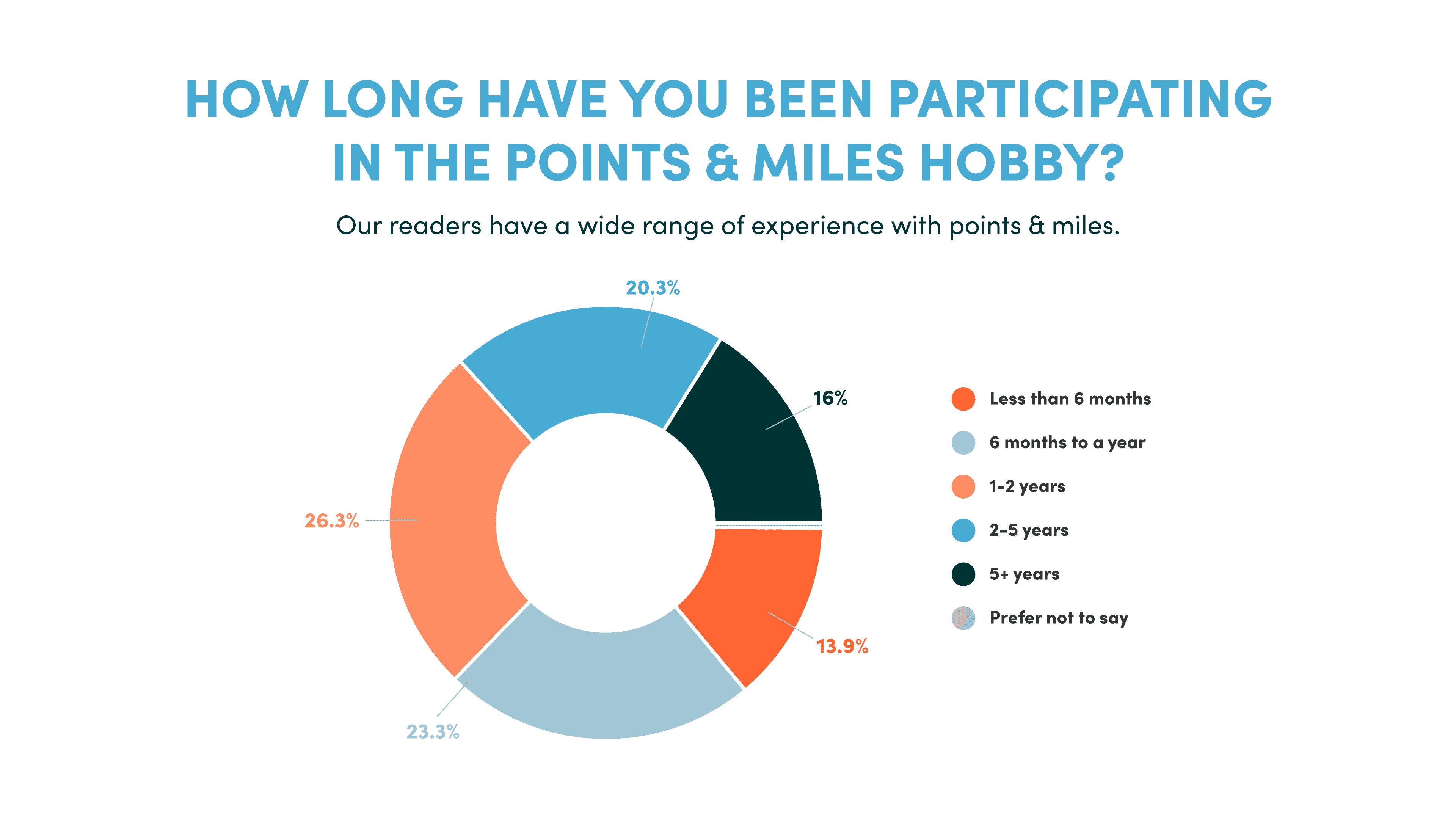

How long have you been participating in the points & miles hobby?

Our readers have a wide range of experience with points & miles.

Bottom Line

I hope these results help to give you a more accurate picture of who your fellow points & miles enthusiasts are and how they engage in the hobby.

Thanks again to everyone who took the time to respond to the survey! We hope to do more of these in the future if you find them helpful.

Want to see the most recent reader demographic survey? Check out our 2024 Reader Demographic Survey Results.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.