10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

So you’ve opened all the right credit cards, learned to optimize your points earning strategy and are now sitting on a good stash of points. That’s the easy part, right? Now you’ve got to figure out how to actually use all of these points for travel. Just thinking about optimizing your redemptions might be overwhelming if you are new to the world of points and miles. But don’t worry, we’ve got you and we are here to help.

My friend recently reached out to me asking me to help her book an award ticket to Malaga, Spain. She’s got a good stash of Ultimate Rewards points and she’s got the following parameters for her trip:

- She’s an economy traveler

- She needs two tickets

- The dates aren’t flexible

- She wants to fly with one connection only

Let’s explore my thought process behind booking an award, which programs I’ve considered and how we booked my friend’s trip from Washington DC to Spain.

There really are no shortcuts and you do have to search and compare award rates on different partners if you want to get the value for your hard-earned points.

Which Points and Miles Do You Have?

The first step would be to take an inventory of all the points and miles at your disposal. If you have a family member who’s also collecting points and miles, check what they have too.

My friend told me that she’s recently opened the Chase Sapphire Preferred® Card and earned the 60,000 Ultimate Rewards points welcome bonus that was offered at the time. She also told me that her husband also had some Ultimate Rewards points earned with a business card. So my first question to her was, which business card? I had to ask this because there are three different Chase Ink cards:

- The Ink Business Cash® Credit Card (no annual fee)

- The Ink Business Preferred® Credit Card ($95 annual fee)

- The Ink Business Unlimited® Credit Card (no annual fee)

While all three cards, along with the Chase Sapphire Preferred® Card, earn Ultimate Rewards points, only the cards with an annual fee allow you to transfer to the hotel and airline partners and book travel through the Chase travel portal.

So let’s say my friend’s husband has the Ink Business Cash® Credit Card and that’s his only Ultimate Rewards earning card. He will then need to transfer his points to my friend’s Ultimate Rewards account associated with her Sapphire Preferred card before he can use these points for travel. It’s easy enough to do on the Ultimate Rewards portal, but if there are any issues, you can call or message Chase for help through the secure message link in your account.

Both of them also had some United miles in their respective United MileagePlus accounts.

Armed with all of this information, I went to work.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Should I Transfer Ultimate Rewards Points to a Partner Airline?

Should I transfer my Ultimate Rewards points to United? That was the first question my friend asked me. She’d booked United award flights before, so she’s familiar with at least one Chase airline transfer partner. However, I asked to not do anything until I checked my two favorite tools, Google Flights and Award Hacker.

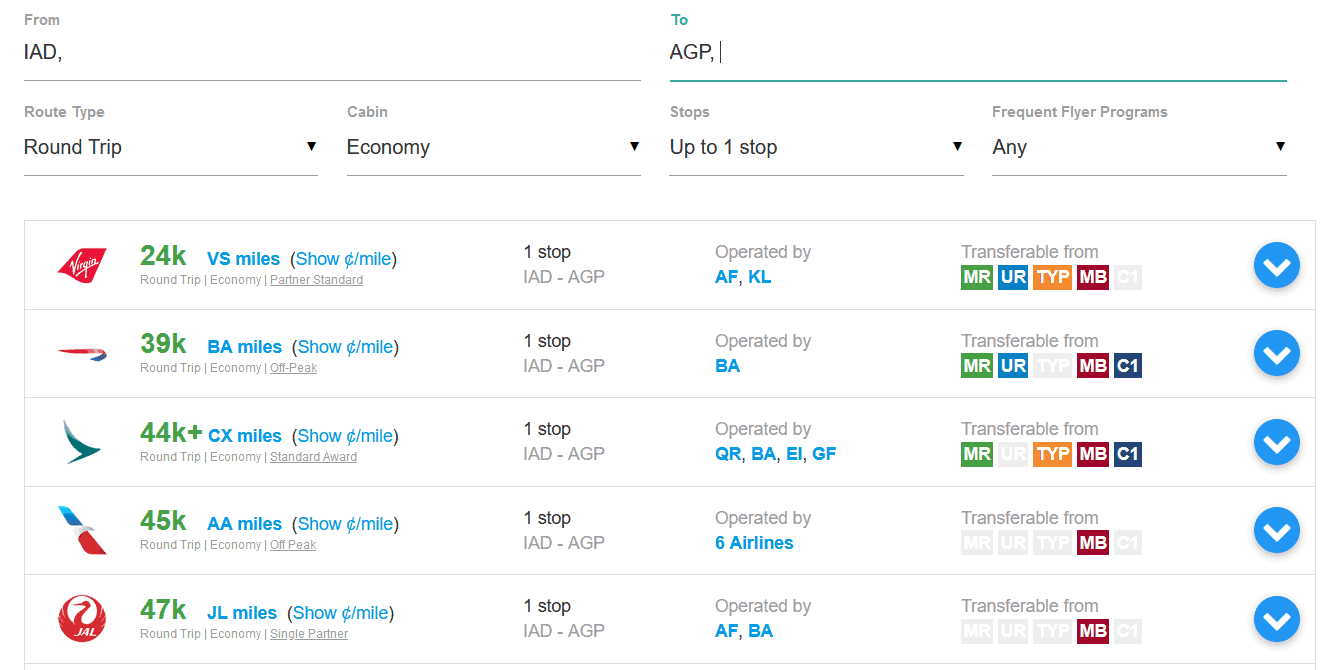

I checked Google flights to see possible routes with one connection. My friend lives near a major international airport and I know she’d want a one-stop itinerary. Award Hacker isn’t an award search tool, so it won’t tell you which airline has award space. It is, however, a very useful tool to tell me which airlines have the best redemption rates for any specific route. It doesn’t have the most up to date information all the time, but it’s a useful tool nonetheless.

Chase Ink Business Cash® Credit Card

Earn $750

bonus cash back

when you spend $6,000 on purchases in the first three months after account opening

Chase has 10 airline transfer partners, but that doesn’t mean that you’ll necessarily have to fly on one of them, or that you are limited to redemptions on just these 10 airlines. This is where knowing a little bit about airline alliances could be really useful.

You can book an award flight with points of Airline A but fly on Airline B. And what’s even more amazing about this, often the best redemptions for domestic flights, or flights originating in the U.S., are through foreign airlines’ programs.

This table will show which partners can potentially book our flights to Spain, but don’t worry, we don’t have to check all 10 for award space.

Chase Ink Business Preferred® Credit Card

100,000

bonus points

after you spend $8,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

| Chase Partner | Airline Alliance | Airline You'll Fly |

|---|---|---|

| British Airways | OneWorld | BA, American |

| Air France/KLM Flying Blue | SkyTeam | Air France, KLM, Delta |

| Singapore Airlines | Star Alliance | United, Air Canada, Lufthansa, Austrian, TAP |

| Southwest | n/a | n/a |

| United Airlines | Star Alliance | United, Air Canada, Lufthansa, Austrian, TAP |

| Virgin Atlantic | n/a | Virgin Atlantic, Delta. Air France, KLM |

| Air Canada | Star Alliance | Air Canada, United, Lufthansa, Austrian, TAP |

| Aer Lingus | n/a | n/a |

| Emirates | n/a | n/a |

| Iberia | OneWorld | Iberia, American |

Chase Ink Business Unlimited® Credit Card

Earn $750

bonus cash back

after you spend $6,000 on purchases in the first 3 months from account opening

By cross-referencing Google flights and Award Hacker, I was able to narrow it down to three partners: British Airways, United and Air Canada. Google flights showed me a good number of flights to Malaga, but I was able to eliminate the majority of them because they either had two connections or the connections were too long to make sense. So what was left was to check each of these partners and see which one, if any, we should use to book my friend’s trip.

British Airways charges per segment, and it’s best to use the program for nonstop flights. I wasn’t happy with the routing either, because connecting in London Heathrow airport means huge surcharges. So I started checking the other partners.

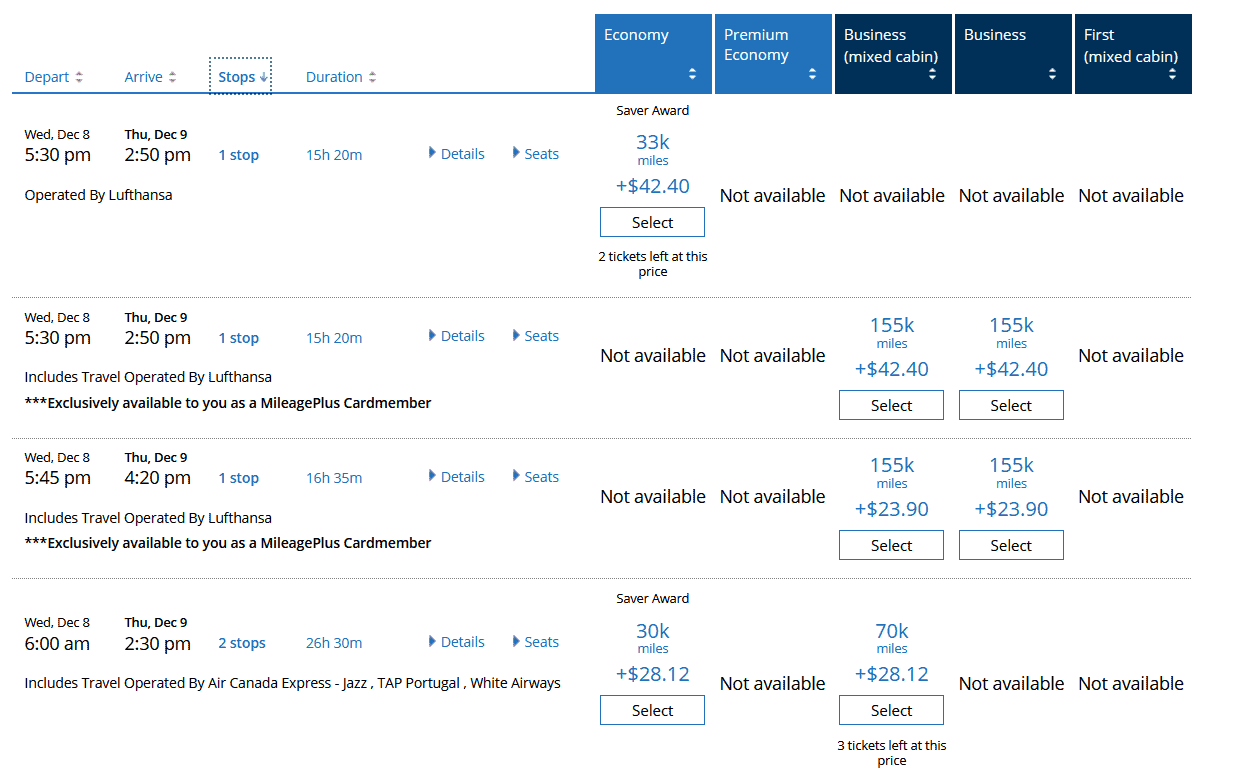

United eliminated its award chart a while ago, but the lowest economy one-way award to Europe should be 30,000 United MileagePlus miles.

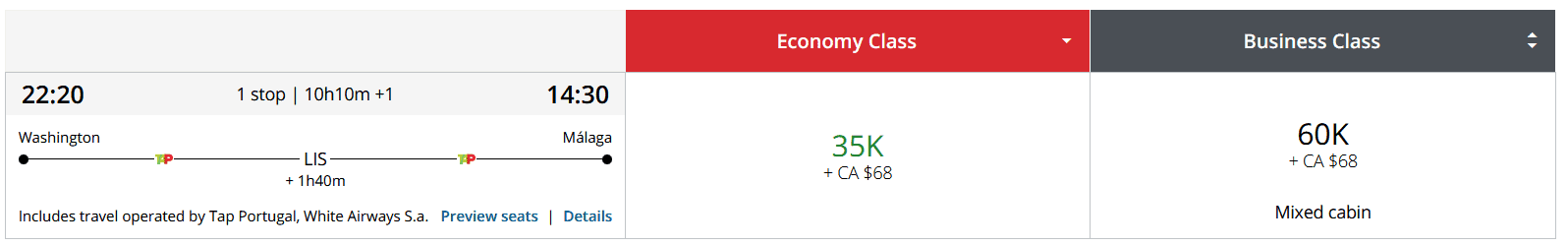

Aeroplan, another Star Alliance carrier, charges 35,000 miles for a one-way award to Europe in economy.

To sum it up, the best options for my friend, based on her preference of a one-stop itinerary and the number of miles she has, were award flights booked with either United or Aeroplan miles. We would need between 33,000 to 35,000 miles one-way, so at least 66,000 miles round-trip in economy plus about $80 in taxes per person.

That’s pretty standard, but because I first checked Google flights I had another idea.

Chase Travel℠

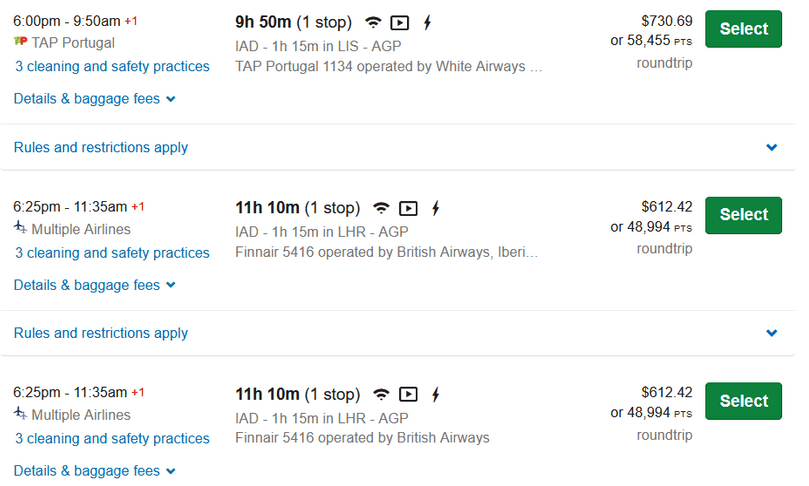

Because the cash prices were so low, the best deal for my friend would be to book her trip through the Chase Travel because I found a few itinerary options that would require fewer points than transferring to partners.

Your points can be worth more when you book in the portal with cards like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® or the Ink Business Preferred® Credit Card, which offer a “Points Boost” for a higher redemption value on select travel. So when the cash prices are low, it often makes sense to use the portal rather than transfer points to partners.

In addition to potential savings there’s another advantage of the travel portal. You don’t need to search for award space, which could be sparse, or settle for a less than ideal routing. Airlines often release just a couple of award seats, but if you are booking your flights through the portal you can book the whole family on the same flights.

The cheapest option I found had a short 75-minute connection in London Heathrow. Because London Heathrow is a huge airport I told my friend, personally, I wouldn’t be comfortable with such a tight connection. In addition to all the usual “joys” of connecting in LHR, you now also have to factor in the time for the airline staff to check the COVID-19 entry requirements, which creates additional bottlenecks.

The next best option costs just over 58,455 points round-trip, much better than the rates we found if we were to transfer Ultimate Rewards to one of the partner airlines. By using the portal, my friend saved at least 7,545 miles per person and there’s no cash component at all.

Travel Restrictions

In the spirit of the times, I feel compelled to write a short segment on travel restrictions. When traveling internationally, it is imperative to check restrictions and requirements not only at your destination, but also at all connecting airports. You might find that you don’t need to do anything more strenuous than show your vaccine card at your final destination, but the connecting airport might require you to fill out additional forms.

To check European travel restrictions I like to use reopen.europa.eu, but any official site will do. The airline check in staff will check the requirements such as vaccine documents, passenger locator forms and tests, if they are required, and they won’t let you check in if something’s out of order.

Final Thoughts

Hopefully walking you through my thought process will help you in your quest for free travel and you could replicate the process with your own trip. There really are no shortcuts and you do have to search and compare award rates on different partners if you want to get the value for your hard-earned points. But as you get more practice, learn about airline alliances and learn how to use different airlines’ search engines, the process will become much easier.

Travel well,

Anna

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.