10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

In 2024, United Airlines flew 173.6 million passengers. If every one of these passengers was equipped with a co-branded United credit card, a significant number of miles would’ve been earned.

If you fly frequently with the Chicago-based carrier and you’ve already got a number of flexible point-earning travel rewards cards in your wallet, you should consider the value of a co-branded Chase United credit card.

Let’s look at which United credit card is best suited to your travel habits and goals as well as how they stack up against general travel rewards credit cards.

Best United Credit Cards 2025

Here’s an overview of the best United credit cards of 2025, including their annual fees and what they have to offer.

| Card | Annual Fee | Best For |

|---|---|---|

| United Gateway℠ Card | $0 | The ability to earn United miles without paying an annual fee |

| United℠ Explorer Card | $0 in the first year; $150 thereafter | Solid perks with a reasonable annual fee for casual United flyers |

| United Quest℠ Card | $350 | Premium perks for frequent United flyers |

| United Club℠ Card | $695 | United Club membership |

| United℠ Business Card | $150 | A balance between perks and fees for the casual United flyer |

| United Club℠ Business Card | $695 | United club membership for small business owners |

Let’s dive into the details of each of these cards.

United Gateway℠ Card

If you don’t want to pay an annual fee but still want to benefit from United perks, the United Gateway℠ Card will suit your needs.

You’ll earn 2X miles on purchases with United, as well as on gas stations, local transit and commuting purchases. This enables you to earn miles on everyday spending as well as on United flight-related purchases.

This card comes with a 25% discount for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks, issued as a statement credit.

This card has a limited range of travel-related insurances which pump up its value.

You’ll receive rental car insurance when you decline the rental car company’s collision damage waiver and charge the entire cost of the rental to your United card. This will cover you up to the actual cash value of the car in instances of collision damage or theft in the United States and abroad.

You’ll also receive up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, when your trip is canceled or interrupted for a covered reason such as inclement weather, sickness or injury.

Pros

- 2X miles on purchases with United, including in-flight food, beverages and Wi-Fi, tickets, Economy Plus® seats, baggage service charges and other eligible purchases

- 2X miles on hotel stays prepaid through United Hotels

- 2X miles at gas stations

- 2X miles on local transit and commuting purchases, including ride-hailing apps, taxis, train tickets, tolls and mass transit

- 1X miles on all other purchases

- Two free checked bag certificates when you charge $10,000 to your card within a calendar year

- Access to expanded award availability after spending $10,000 on the card

- 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks

- No foreign transaction fees

- Rental car insurance

- Trip cancellation and interruption insurance up to $1,500 per person and $6,000 per trip for your prepaid, non-refundable passenger fares (for covered reasons)

Cons

- Free checked bag perk and access to member pricing on award flights require minimum spend.

- No priority boarding

United℠ Explorer Card

United℠ Explorer Card offers the casual United flyer significant value for an annual fee of $150, which is waived in the first year of card membership.

You’ll earn 2X miles on United purchases as well as 2X miles on prepaid hotel stays booked through United Hotels. You’ll also earn 2X miles on dining (including eligible delivery services) and hotel accommodations purchased directly with the hotel. This gives you the ability to earn miles on both travel-related and everyday expenses.

When flying with United, you and up to one companion on the same reservation can check your first checked bags for free. Keep in mind that you’ll need to use your United card to pay for the flight to receive this perk.

This can save you up to $160 per round-trip itinerary, which means you can almost offset the annual fee with a single round-trip flight with a plus-one. Additionally, as a cardholder, you can bring a carry-on bag on a domestic flight booked in basic economy for free, saving you from having to gate-check a bag that is too big to fit under a seat and paying $65 at the gate. So whether you’re team carry-on or team checked baggage, this perk offers savings.

As an Explorer Card holder, you and all your companions traveling on the same reservation will receive priority boarding when flying on United-operated flights.

You’ll also receive two annual United Club℠ one-time passes, allowing you to relax in the airport lounge before your flight. Additionally, the Explorer Card offers a statement credit every four years for a Global Entry, Nexus or TSA PreCheck® application fee when charged to your card through an eligible enrollment provider.

United℠ Explorer Card also offers more than $400 worth of annual statement credits.

You can receive up to $100 in annual statement credits toward hotel stays booked through United Hotels, issued in $50 increments per hotel stay, and up to $60 in annual statement credits toward ride-hailing purchases, issued in $5 monthly increments (annual enrollment required).

If you rent a car with Budget or Avis, you can take advantage of up to $50 in annual statement credits toward eligible rental purchases, issued in $25 statement credits per eligible rental purchase (a minimum rental period of two days is necessary to earn the statement credit).

Cardholders can also take advantage of a $100 annual statement credit for purchases with JetSuiteX (JSX) as well as up to $120 in annual Instacart credits, issued in $10 monthly increments, when you make at least a single purchase of $10 or more per month.

If you manage to charge $10,000 to your card within a calendar year, you’ll receive $100 in United TravelBank cash, and if you charge $20,000 to your card within a calendar year, you’ll also receive a 10,000-mile award flight discount.

Likewise, Explorer Card holders (and holders of all other United cards that charge annual fees) enjoy access to expanded award availability, increasing your chances of lucrative award travel redemptions.

In terms of status, you’ll earn 1X Premier Qualifying Point (PQP) for every $20 spent, up to a maximum of 1,000 PQPs per calendar year. If you already have MileagePlus Premier status, you and a companion traveling on the same reservation will be eligible for complimentary upgrades on select United- and United Express-operated flights (subject to availability).

In addition to the rental car and trip cancellation/interruption insurance offered on the Gateway card, the New United℠ Explorer Card offers trip delay, lost luggage and baggage delay insurance.

With such a wide range of perks, the semi-frequent United traveler will have little problem in offsetting this card’s annual fee.

Pros

- 2X miles on purchases with United, including in-flight food, beverages and Wi-Fi, tickets, Economy Plus and other eligible purchases

- 2X miles on prepaid hotel stays booked through United Hotels

- 2X miles on dining, including eligible delivery services

- 2X miles on hotel accommodations purchased directly with the hotel

- 1X miles on all other purchases

- Free first checked bag for the primary cardholder and one travel companion—savings of up to $160 per round trip

- Access to expanded award availability

- A statement credit for Global Entry, Nexus or TSA PreCheck application fee, every four years, when charged to your card through an eligible enrollment provider

- $100 in United TravelBank cash when you charge $10,000 to your card within a calendar year (valid for 12 months from the date of issuance)

- 10,000-mile award flight discount after you charge $20,000 to your card within a calendar year (valid for 12 months from the date of issuance)

- Up to $100 in annual statement credits toward hotel stays booked through United Hotels, issued in $50 increments per hotel stay

- Up to $60 in annual statement credits toward ride-hailing purchases, issued in $5 monthly increments when you use your Explorer Card to pay for a rideshare service.

- Up to $50 in annual statement credits toward eligible Budget or Avis rental purchases, issued in $25 statement credits per eligible rental purchase (a minimum rental period of two days is necessary to earn the statement credit)

- Up to $120 in annual Instacart credits, issued in $10 monthly increments, when you make at least a single purchase of $10 or more per month

- $100 annual statement credit for purchases with JetSuiteX (JSX)

- Priority boarding for you and all other travelers on your reservation on United-operated flights

- 25% discount, given as a statement credit, for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on premium drinks at United Clubs

- No foreign transaction fees

- Two annual United Club one-time entry passes

- If the primary cardmember has MileagePlus Premier status and is traveling on an award ticket, they’re eligible for complimentary premier upgrades on select United- and United Express-operated flights, subject to availability (up to one companion that is traveling on the same reservation can also qualify for an upgrade).

- 1X PQP per $20 spent, up to a maximum of 1,000 PQPs toward Premier status qualification per calendar year

- Rental car insurance

- Trip cancellation and interruption insurance up to $1,500 per person and $6,000 per trip for your prepaid, non-refundable passenger fares (for covered reasons)

- Baggage delay insurance reimbursement of up to $100 per day for three days for essential item purchases when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

Cons

- Free first checked bag covers you and one eligible companion only. Other co-branded cards cover more companions.

United Quest℠ Card

If you’re a frequent flyer with United but don’t care for a United Club membership, the New United Quest℠ Card will be your best bet.

The Quest card earns 3X miles on United purchases. You’ll also earn 5X miles on prepaid hotel stays booked directly through Renowned Hotels and Resorts as well as 2X miles on all other travel purchases, dining (including eligible delivery services) and on select streaming service purchases.

The card offers a whopping $700+ worth of annual statement credits, making offsetting the annual fee a breeze.

You’ll receive an annual statement credit of $200 for eligible United purchases, a $150 annual statement credit for prepaid bookings with Renowned Hotels and Resorts, and a $150 annual statement credit for purchases with JetSuiteX (JSX).

You’ll also receive up to $100 in annual statement credits toward ride-hailing app purchases, issued in $8 monthly increments with a bonus of $12 in December of each year, and up to $80 in annual United TravelBank cash for purchases with Budget and Avis, issued in $40 increments per eligible rental car booking (minimum rental period of two days).

Instacart fans will also benefit from up to $180 in annual Instacart credits, issued in one $10 and one $5 monthly credit, when you make at least a single purchase of $10 or more per month.

United Quest℠ Card takes it up a notch from the Explorer Card, offering both you and up to one travel companion a first and second checked bag for free. That works out to savings of up to $360 per round-trip itinerary.

Likewise, as with the Explorer Card, you’ll receive a statement credit every four years for a Global Entry, Nexus or TSA PreCheck application fee when it’s charged to your card through an eligible enrollment provider.

You’ll also benefit from a 10,000-mile award flight discount every card anniversary year as well as the opportunity to earn a second 10,000-mile award flight discount after you charge $20,000 to your card within the same calendar year. And if you charge $40,000 to your card within a calendar year, you’ll receive two global Economy Plus® seat upgrades.

If you’re a MileagePlus Premier elite member, you and your companion traveling on the same reservation will be eligible for complimentary premier upgrades on award flights. Cardmembers enjoy an annual bonus of 1,000 PQPs every year as well as the ability to earn 1X PQP per $20 spent, up to a maximum of 18,000 PQPs per year.

The United Quest℠ Card also comes with the exact same travel insurance benefits as the Explorer card, including rental car, trip delay, baggage delay, lost luggage and trip cancellation and interruption insurance.

For a mid-range annual fee of $350, the Quest Card offers premium perks that the frequent United flyer can utilize.

Pros

- 5X miles on prepaid hotel stays booked directly through Renowned Hotels and Resorts

- 3X miles on United purchases

- 2X miles on all other travel purchases

- 2X miles on dining, including eligible delivery services

- 2X miles on select streaming services

- 1X miles on all other purchases

- 10,000-mile award flight discount every card anniversary

- Additional 10,000-mile award flight discount after you charge $20,000 to your card within a calendar year (valid for 12 months from the date of issuance)

- Free first and second checked bags—savings of up to $360 per round trip

- Receive two global Economy Plus seat upgrades after charging $40,000 to your card within a calendar year

- Annual bonus of 1,000 PQPs

- 1X PQP per $20 spent, up to a maximum of 18,000 PQPs per year

- $200 annual statement credit for United purchases

- $150 annual statement credit for prepaid bookings with Renowned Hotels and Resorts

- Up to $100 in annual statement credits toward ride-hailing purchases, issued in $8 monthly increments when you pay for a ride-hailing service, with a bonus of $12 in December of each year

- Up to $80 in annual United TravelBank cash for purchases with Budget and Avis, issued in $40 increments per eligible rental car booking (minimum rental period of two days)

- Up to $180 in annual Instacart credits, issued in one $10 and one $5 monthly credit, when you make at least a single purchase of $10 or more per month

- $150 annual statement credit for purchases with JetSuiteX (JSX)

- Priority boarding for you and all companions on your reservation for United-operated flights

- 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks

- A statement credit for a Global Entry, Nexus or TSA PreCheck application fee, every four years when you charge it to your card through an eligible enrollment provider

- If the primary cardmember has MileagePlus Premier status and is traveling on an award ticket, they’re eligible for complimentary premier upgrades on select United- and United Express-operated flights, subject to availability (up to one companion who is traveling on the same reservation can also qualify for an upgrade).

- Access to expanded award availability

- No foreign transaction fees

- Rental car insurance

- Trip cancellation and interruption insurance up to $1,500 per person and $6,000 per trip for your prepaid, non-refundable passenger fares (for covered reasons)

- Baggage delay insurance reimbursement of up to $100 per day for three days for essential item purchases, when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

Cons

- No lounge access perks

- No companion certificates as offered by premium co-branded cards issued by other major airlines

United Club℠ Card

United Club℠ Card comes with heavyweight perks for United frequent flyers.

This card’s main appeal is its complimentary annual United Club membership. This has an equivalent value of $750, which is enough to offset the annual fee from the get-go—assuming you visit United Clubs often.

Cardholders also have the opportunity to earn United Club All Access membership by either earning United Premier Gold status or charging $50,000 to your card within a calendar year.

All Access membership gives you Star Alliance lounge access and allows you to bring either up to two adult guests into United Clubs or one adult guest plus any dependents younger than 18 years old. Additionally, if you earn United Club All Access membership and add an authorized user, you’ll receive four one-time United Club passes (to use the passes, the authorized user must be traveling with you).

United Club℠ Card enables you to earn 4X miles on United flight purchases and all other eligible purchases with United. You’ll also earn 5X miles on prepaid hotel bookings through Renowned Hotels and Resorts as well as 2X miles on all other travel purchases and dining (including eligible delivery services).

The card comes with more than $600 worth of annual statement credit perks, including a $200 annual statement credit for hotel stays booked directly with Renowned Hotels and Resorts, a $200 annual statement credit for purchases with JetSuiteX (JSX) and up to $240 in annual Instacart credits, issued in two $10 monthly credits, when you make at least a single purchase of $10 or more per month.

You’ll also get up to $150 in annual statement credits toward ride-hailing purchases, issued in $12 monthly increments with a bonus of $18 in December of each year, as well as up to $100 in annual United TravelBank cash for purchases with Budget and Avis, issued in $50 increments per eligible rental car booking (minimum rental period of two days).

You can get a 10,000-mile award flight discount after you charge $20,000 to your card within a calendar year, with the opportunity to earn a second 10,000-mile discount after spending another $20,000 within the same calendar year.

Cardholders will enjoy an annual bonus of 1,500 PQPs and have the ability to earn 1X PQP per $15 spent, up to a maximum of 28,000 PQPs per calendar year.

You and your companion on the same reservation will receive the same free first and second checked bag benefit as seen on the United Quest Card, saving you up to $360 per round-trip journey.

The United Club℠ Card also comes with benefits similar to the Quest Card, including a 25% statement credit discount on in-flight purchases, a statement credit for Global Entry, Nexus or TSA PreCheck, and complimentary upgrades for MileagePlus Premier status holders flying on award flights (subject to availability).

The card also offers complimentary Avis President’s Club® membership as well as complimentary IHG® One Rewards Platinum Elite status.

United Club℠ Card cardholders will receive Premier Access® travel services, unlocking preferential priority check-in, security screening, boarding and baggage handling privileges (subject to availability). You’ll also enjoy a 10% discount on economy award flights on United or United Express within the United States and Canada.

The United Club℠ Card offers the same range of travel insurances as the Quest Card, but with a higher limit of $10,000 per person and $20,000 per trip for trip cancellation and interruption insurance.

If you’re ready to use the perks to their max, you’ll reap significant value out of the United Club℠ Card, offsetting its annual fee of $695 by a long shot.

Pros

- 5X miles on prepaid hotel stays booked directly through Renowned Hotels and Resorts

- 4X miles on United purchases

- 2X miles on all other travel purchases

- 2X miles on dining including eligible delivery services

- 1X miles on all other purchases

- Complimentary United Club membership with the ability to bring up to one guest and depends younger than 18 with you

- Opportunity to earn United Club All Access membership when you have United Premier Gold status or charge $50,000 to your card within a calendar year—giving you Star Alliance lounge access and allowing you to bring up to two adult guests into United Clubs or one adult guest plus any dependents younger than 18. If you earn United Club All Access membership and add an authorized user, you’ll receive four one-time United Club passes (to use the passes, the authorized user must be traveling with you).

- Free first and second checked bags for you and up to one companion—savings of up to $360 per round trip

- 10,000-mile award flight discount after you charge $20,000 to your card within a calendar year (valid for 12 months from the date of issuance) with the opportunity to earn a second 10,000-mile discount after spending another $20,000 within the same calendar year

- $200 annual statement credit for hotel stays booked directly with Renowned Hotels and Resorts

- Up to $150 in annual statement credits toward ride-hailing purchases, issued in $12 monthly increments with a bonus of $18 in December of each year

- Up to $100 in annual United TravelBank cash for purchases with Budget and Avis, issued in $50 increments per eligible rental car booking (minimum rental period of two days)

- Up to $240 in annual Instacart credits, issued in two $10 monthly credits, when you make at least a single purchase of $10 or more per month

- $200 annual statement credit for purchases with JetSuiteX (JSX)

- Complimentary Instacart+ membership through Dec. 31, 2027, or for a minimum one-year term, whichever is longer (after that, you’ll automatically be billed at $99 per year or the then current rate)

- 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on premium drinks at United Clubs

- Annual bonus of 1,500 PQPs (bonus PQPs will be awarded within six to eight weeks after Feb. 1 of each year, starting in 2026)

- 1X PQP per $15 spent, up to a maximum of 28,000 PQPs per calendar year

- A statement credit for a Global Entry, Nexus or TSA PreCheck application fee every four years when charged to your card through an eligible enrollment provider

- If the primary cardmember has MileagePlus Premier status and is traveling on an award ticket, they’re eligible for complimentary premier upgrades on select United- and United Express-operated flights, subject to availability (up to one companion that is traveling on the same reservation can also qualify for an upgrade).

- No foreign transaction fees

- Premier Access® travel services including preferential priority check-in, security screening, boarding and baggage handling privileges (subject to availability)

- Access to expanded award availability

- Complimentary Avis President’s Club® membership

- Complimentary IHG® One Rewards Platinum Elite status

- 10% discount for United economy Saver award flights on United or United Express within the United States and Canada

- Rental car insurance

- Trip cancellation and interruption insurance up to $10,000 per person and $20,000 per trip for your prepaid, non-refundable passenger fares (for covered reasons)

- Baggage delay insurance reimbursement of up to $100 a day for three days for essential item purchases, when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

Cons

- High annual fee

- No companion certificates as offered by premium co-branded cards with other airlines

United℠ Business Card

United℠ Business Card is ideal for semi-frequent United business flyers who want to earn United miles on a small-business card.

You’ll earn 2X miles on United purchases, on dining (including eligible delivery services), at gas stations, office supply stores and on local commuting and transit purchases. You’ll also earn 2X miles on prepaid hotel stays booked through United Hotels. This enables you to earn on everyday typical business spending as well as on travel-related expenses.

The card offers more than $500 worth of annual statement credits, making it easy to put a dent in its $150 annual fee.

You’ll receive a $125 annual United travel credit when you make five United flight purchases (each worth $100 or more) within a calendar year. You also get up to $25 in annual statement credits for FareLock purchases on United- and United Express-operated flights, and up to $100 in annual statement credits toward hotels booked through United Hotels, issued in $50 increments per hotel stay.

Cardholders benefit from a $100 annual statement credit for purchases with JetSuiteX (JSX), up to $100 in annual statement credits toward ride-hailing purchases, issued in $8 monthly increments with a bonus of $12 in December of each year.

The credits don’t stop there. You also get up to $50 in annual statement credits toward eligible Budget or Avis rental purchases, issued in $25 statement credits per eligible rental purchase (a minimum rental period of two days is necessary to earn the statement credit), and up to $120 in annual Instacart credits, issued in $10 monthly credits, when you make at least a single purchase of $10 or more per month.

When flying with United, you and up to one companion on the same reservation will have your first checked bags fly for free, saving you $160 per round-trip flight with a plus-one. You and all your companions on the same reservation will also enjoy priority boarding.

Each year you hold the card, you’ll receive two annual one-time United Club passes. You’ll also receive a 5,000-mile boost each year you hold the United Business Card and a personal United card.

If you charge $25,000 to your card within a calendar year, you’ll receive two complimentary continental U.S. Economy Plus seat upgrades. Cardholders also earn 1X PQP per $20 spent, up to a maximum of 4,000 PQPs per calendar year.

The United Business Card comes with rental car, trip delay, lost luggage, baggage delay, and trip cancellation and interruption insurance.

For a business owner who is a casual United flyer, offsetting the card’s $150 annual fee shouldn’t pose an issue with such a wide range of benefits up for grabs.

Pros

- 2X miles on United purchases

- 2X miles on hotel stays prepaid directly through United Hotels

- 2X miles on dining, including eligible delivery services

- 2X miles at gas stations, office supply stores and on local transit and commuting purchases

- 1X miles on all other purchases

- First checked bag free for you and up to one companion on the same reservation—savings of up to $160 per round-trip flight

- $125 annual United travel credit when you make five United flight purchases each worth $100 or more within a calendar year

- Up to $25 in annual statement credits for FareLock purchases on United- and United Express-operated flights

- Up to $100 in annual statement credits toward hotel stays booked through United Hotels, issued in $50 increments per hotel stay

- Up to $100 in annual statement credits toward ride-hailing purchases, issued in $8 monthly increments with a bonus of $12 in December of each year

- Up to $50 in annual statement credits toward eligible Budget or Avis rental purchases, issued in $25 statement credits per eligible rental purchase (a minimum rental period of two days is necessary to earn the statement credit)

- Up to $120 in annual Instacart credits, issued in $10 monthly credits, when you make at least a single purchase of $10 or more per month

- $100 annual statement credit for purchases with JetSuiteX (JSX)

- 1X PQP per $20 spent, up to a maximum of 4,000 PQPs per calendar year

- Two annual United Club one-time entry passes

- 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks

- Priority boarding for you and all companions on the same reservation

- 5,000-mile boost each year you hold the New United Business Card and a personal Chase United card

- Access to expanded award availability

- No foreign transaction fees

- Free employee cards

- Two complimentary continental U.S. Economy Plus seat upgrades after you charge $25,000 to your card within a calendar year

- Complimentary Instacart+ membership for three months, then 25% off through Dec. 31, 2027 (you’ll be automatically billed at the then current rate thereafter)

- Rental car insurance

- Trip cancellation and interruption insurance up to $1,500 per person and $6,000 per trip for your prepaid, non-refundable passenger fares for covered reasons

- Baggage delay insurance reimbursement of up to $100 a day for three days for essential item purchases when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

Cons

- No Global Entry, Nexus or TSA PreCheck statement credit as seen on the personal United cards

United Club℠ Business Card

United Club℠ Business Card is United’s premium business card, offering complimentary United Club membership—worth $750 in annual value.

Cardholders have the opportunity to earn United Club All Access membership by either earning United Premier Gold status or charging $50,000 to their card within a calendar year. Just like with the personal United Club Card, you’ll receive four one-time United Club passes when you add an employee card and have United Club All Access membership.

The card earns 2X miles on United purchases, 5X miles on prepaid hotel stays booked through Renowned Hotels and Resorts, and 1.5X miles on all other purchases.

United Club Business Card offers more than $700 worth of annual statement credits, making it easy to offset its $450 annual fee.

You receive a $200 annual statement credit for Renowned Hotels and Resorts and a $200 annual statement credit for purchases with JetSuiteX (JSX).

You also get up to $150 in annual statement credits toward ride-hailing purchases, issued in $12 monthly increments with a bonus of $18 in December of each year, and up to $100 in annual United TravelBank cash for purchases with Budget and Avis, issued in $50 increments per eligible rental car booking (minimum rental period of two days).

You’ll also enjoy up to $240 in annual Instacart credits, issued in two $10 monthly credits, when you make at least a single purchase of $10 or more per month.

If you charge $40,000 to your card within a calendar year, you’ll also get two complimentary global U.S. Economy Plus seat upgrades.

You and your companion (when traveling on the same reservation) will enjoy free first and second checked bags, saving you up to $360 each round trip. You’ll also enjoy Premier Access travel services, including preferential priority check-in, security screening, boarding and baggage handling privileges (subject to availability).

In addition to complimentary United Club membership, you’ll receive complimentary Avis President’s Club membership.

When spending with your card, you’ll earn 1X PQP per $15 spent, up to a maximum of 28,000 PQPs per calendar year. If you’re a MileagePlus Premier elite member, you and one companion on the same reservation will be eligible for complimentary upgrades on select United- and United Express-operated flights (subject to availability).

This card also confers rental car, trip delay, lost luggage, delayed baggage and trip cancellation and interruption insurance. Limits are higher on the United Club Business Card for trip cancellation and interruption insurance, reimbursing you up to $10,000 per person and $20,000 per trip.

For hardcore United flyers wanting a small-business card, the United Club Business Card is a great option. You’ll also be able to offset the annual fee of $695 through frequent perk usage.

Pros

- 5X miles on prepaid hotel stays booked directly through Renowned Hotels and Resorts

- 2X miles on United purchases

- 1.5X miles on all other purchases

- 5,000-mile annual boost if you hold the New United Club Business Card and a personal Chase United card

- Complimentary United Club membership

- Opportunity to earn United Club All Access membership when you have United Premier Gold status or charge $50,000 to your card within a calendar year—giving you Star Alliance lounge access and allowing you to bring up to two adult guests into United Clubs or one adult guest plus any dependents younger than 18. If you earn United Club All Access membership and add an employee card, you’ll receive four one-time United Club passes (to use the passes, the authorized user must be traveling with you).

- $200 annual statement credit for Renowned Hotels and Resorts

- Free first and second checked bags for you and up to one companion on the same reservation

- Up to $150 in annual statement credits toward ride-hailing purchases, issued in $12 monthly increments with a bonus of $18 in December of each year

- Up to $100 in annual United TravelBank cash for purchases with Budget and Avis, issued in $50 increments per eligible rental car booking (minimum rental period of two days)

- Up to $240 in annual Instacart credits, issued in two $10 monthly credits, when you make at least a single purchase of $10 or more per month

- $200 annual statement credit for purchases with JetSuiteX (JSX)

- Complimentary Instacart+ membership through Dec. 31, 2027, or for a minimum one-year term, whichever is longer (after that, you’ll automatically be billed at $99 per year or the given rate)

- Two complimentary global U.S. Economy Plus seat upgrades after you charge $40,000 to your card within a calendar year

- Premier Access travel services, including preferential priority check-in, security screening, boarding and baggage handling privileges (subject to availability)

- Employee cards for free

- 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks

- Complimentary Avis President’s Club membership

- No foreign transaction fees

- If the primary cardmember has MileagePlus Premier status and is traveling on an award ticket, they’re eligible for complimentary premier upgrades on select United- and United Express-operated flights, subject to availability (up to one companion who is traveling on the same reservation can also qualify for an upgrade).

- 1X PQP per $15 spent, up to a maximum of 28,000 PQPs per calendar year

- Rental car insurance

- Trip cancellation and interruption insurance up to $10,000 per person and $20,000 per trip for your prepaid, non-refundable passenger fares for covered reasons

- Baggage delay insurance reimbursement of up to $100 a day for three days for essential item purchases when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

Cons

- High annual fee

- No companion certificates as offered by premium co-branded cards with other airlines

- No Global Entry, Nexus or TSA PreCheck statement credit as seen on the personal United cards

United Credit Card Welcome Bonuses

Welcome bonus offers and minimum spend requirements vary – here are the current welcome offers.

To be eligible to earn a welcome bonus on a United credit card, you can’t have earned the bonus on the same card previously within the last 24 months. Likewise, you can’t be a current cardholder.

Are United Credit Cards Worth It?

If you fly with United at least twice every year, you could benefit from holding a United credit card.

The more you fly with United, the more sense it makes to hold a co-branded credit card. Likewise, the more you fly with United and use your co-branded card, the easier it is to offset any annual fee.

However, as strange as it may sound, a non-United card may be better for earning United miles than a co-branded United credit card. That’s because general travel rewards credit cards typically offer higher earning rates on bonus category spending, enabling you to earn more rewards on the same purchases and transfer these to your MileagePlus account.

Specifically, Chase Ultimate Rewards can be converted to United MileagePlus miles at a ratio of 1:1. They’re also a much more flexible points currency because you can transfer them to 10 other airlines and three hotel loyalty programs.

Take the Chase Sapphire Preferred® Card, for example. It earns:

- 5X points on travel purchased through Chase Travel℠ (excluding hotel purchases that qualify for the $50 annual hotel credit)

- 5X points on Lyft rides (through September 2027)

- 2X points on other travel purchases

- 3X points on dining, including eligible delivery services, takeout and dining out

- 3X points on online grocery purchases, excluding Target, Walmart and wholesale clubs

- 3X points on select streaming service purchases

- 1X points on all other purchases

That’s a much wider range of bonus spending categories than the New United Explorer offers for a lower annual fee.

Let’s say you were to spend $3,000 annually on dining purchases on both cards, which is slightly under what the average American spends on dining. You’d earn 6,000 MileagePlus miles with the New United Explorer Card and 9,000 Ultimate Rewards points with the Chase Sapphire Preferred Card. You could then transfer these points to your MileagePlus account, giving you a greater opportunity for award booking redemptions.

Another difficulty with co-branded United credit cards is that despite having hundreds of dollars worth of statement credits, they aren’t the easiest to use.

For example, the New United Quest Card offers up to $100 in annual statement credits toward ride-hailing app purchases. However, the credits are issued in monthly increments of $8 (with a bonus of $12 in December of each year), meaning you’d need to use ride-booking services every single month of the year to fully maximize the credit.

Likewise, you can get up to $80 in annual United TravelBank cash for purchases with Budget and Avis. However, the credit is issued in $40 increments per eligible rental car booking with a minimum rental period of two days, meaning you’d need to rent at least twice per year to fully maximize the credit.

Similarly, although United Quest cardholders get a $150 annual statement credit for purchases with JetSuiteX (JSX), you’d need to fly with JSX at least once per year to maximize this perk—an airline that may not serve your desired destinations.

That said, United credit cards—and all co-branded airline credit cards, for that matter—aren’t all bad.

While you can typically earn a higher rate of transferable points on general travel rewards cards, none of them can offer the airline-specific perks that you’ll find on United credit cards, such as free checked bags or priority boarding.

So if you’re a frequent United flyer, holding a United credit card for the perks can be totally worth it. For example, the free first and second checked bag policy found on premium United cards can save you and a companion up to $360 per round trip. If you fly frequently with checked bags, that can amount to a massive amount of savings.

Complimentary United Club membership, annual one-time United Club passes, seat upgrades, in-flight savings and more make United credit cards well worth it for frequent flyers.

Overall, if you’re focused solely on earning as many miles as possible, you’d be better off with a general travel rewards credit card that earns a transferrable rewards currency. However, if perks play a major role in your decision making, a United card is still a great addition to your wallet.

How to Choose the Best United Credit Card

As with any credit card strategy, choosing the best United credit card begins with self-reflection. Specifically, you need to analyze your spending and travel habits.

That starts with answering the following question: How often do you fly with United?

The more frequently you fly with United, the better the position you’ll be in to use card perks and offset any annual fees.

If you fly at least semi-frequently with United, the New United Explorer Card is a solid option with a relatively low annual fee. You’ll benefit from United-related perks, such as priority boarding, two annual United Club one-time entry passes and a 25% discount given as a statement credit for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on premium drinks at United Clubs.

On top of that, you’ll receive a statement credit for Global Entry, Nexus or TSA PreCheck application fees every four years when charged to your card through an eligible enrollment provider.

The annual fee is waived in the first year, giving you an even greater return potential in your first year of card membership. For subsequent years, the annual fee increases to $150, which can easily be offset by the “first checked bag flies free” perk for you and one companion, which can save you $160 per round trip.

If you want to up the perks by a notch and save even more money when flying with United, the New United Quest Card is an excellent choice.

It comes with many of the same perks seen on the United Explorer Card in addition to some premium offerings and hundreds of dollars worth of statement credits. For example, the “first and second checked bags fly for free” policy can save you and your companion up to $360 per round trip, instantly offsetting the annual fee of $350.

However, you’ll need to consider the extent to which you’ll use each specific perk. For example, if you never make in-flight purchases, the 25% discount (issued as a statement credit) offers little value. In such a case, you’ll need to rely on other perks to offset the card’s annual fee.

If you want access to United Club lounges, the New United Club℠ Card will be your best option. In addition to the perks seen on lower tier cards, the New United Club℠ Card offers complimentary United Club membership, offsetting the annual fee every year. That’s assuming you use United Club lounges—if you don’t, you’ll need to make full use of the card’s statement credit perks to offset its annual fee.

United Club℠ Card also offers complimentary Avis President’s Club membership as well as complimentary IHG One Rewards Platinum Elite status. If you can take advantage of these perks, this card could be worth holding.

Alternatively, if you’re against paying any annual fees and can’t be persuaded otherwise, or if you fly with United infrequently, the New United Gateway Card would be the best option. That said, it has little in the way of United-related perks, meaning that in most cases you’d be better off opening a general travel rewards card and transferring your points to your MileagePlus account.

Keep in mind that all United cards are issued by Chase, meaning that the 5/24 rule applies. If you’ve opened five or more credit cards with any issuer in the last 24 months, your application will be denied by Chase.

For this reason, you’d probably be better off avoiding the low-value proposition offered by the New United Gateway Card in favor of a general travel rewards card with flexible rewards.

A better strategy would be to apply for the Chase Sapphire Preferred Card, whose Ultimate Rewards you can then transfer to your MileagePlus account at a 1:1 ratio. That way, you’ll have a more valuable card taking up a spot in your 5/24 count, putting you in a better position to earn and redeem rewards.

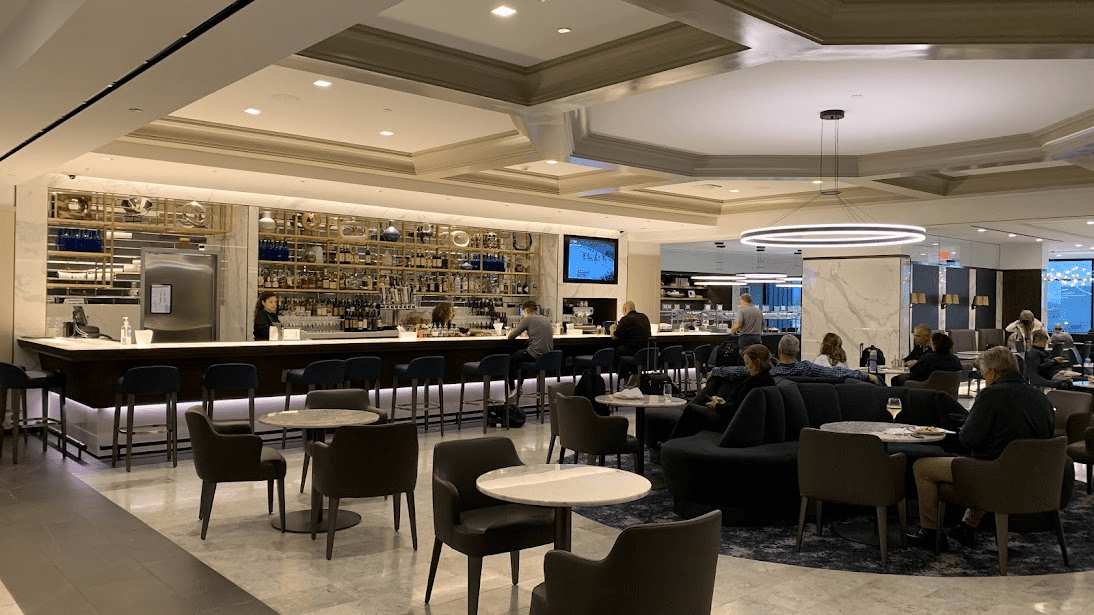

United Polaris Lounge at Washington-Dulles

How to Maximize Your United Credit Card

To maximize your United credit card, you’ll want to begin by applying for the card at a moment that maximizes your current spending. This is a combination of two factors: applying when the welcome bonus is historically on the higher end and when you’re in a position to meet the minimum-spending requirement organically.

If you have large expenses coming up, such as vacations, holiday shopping or bill payments, this is the perfect time to apply for a United card. Alternatively, you could prepay bills and insurance premiums to meet the minimum-spending requirement. Just be sure that doing so fits your budget.

Once you’ve secured the welcome bonus, the next step is continuing to reap value from the card year after year. This is a combination of frequent spending with the card plus perk usage.

Using perks like the 25% in-flight discount, free checked bags, statement credit perks and United Club passes is key to offsetting the annual fee. The more you can use these perks, the more you’ll come out ahead of the initial investment.

Similarly, by charging expenses to your card on a regular basis, you’ll earn a greater number of points. That makes award bookings more of a possibility.

Lastly, as with every credit card strategy, success and responsible card usage go hand in hand. You’ll need to ensure you always pay your balance off before its due date. That way, you’ll avoid late penalty fees and exorbitant interest charges, both of which will quickly annihilate the return value of perks and miles.

Final Thoughts

If you frequently find yourself on United flights, it’s a good idea to consider whether opening a United credit card would be beneficial.

The more often you fly with United, the more you could benefit from a United card. This is all the more so if what you’re after is perks, such as in-flight discounts, priority boarding and lounge access.

However, if your top priority is earning miles to redeem for United or other flights, then you’d be better off going for a general travel rewards credit card. That way, you’ll earn more points per dollar spent while maintaining maximum redemption flexibility.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.