10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

When it comes to credit card rewards programs, we, travel enthusiasts, are always looking for ways to maximize the value of our hard-earned points and miles. One of the most potent strategies for doing so is to use travel partners. The partnerships between credit card issuers and various airline and hotel loyalty programs offer cardholders the opportunity to get remarkable value from your rewards.

Let’s discuss the Capital One transfer partners in detail. Specifically, let’s look at ways you can redeem your miles for budget airline and hotel redemptions and luxurious first-class travel alike so that you have a good idea of which Capital One transfer partners you should target for your next vacation.

Overview of Capital One’s Transfer Partners

First, the basics. Capital One currently has 18 transfer partners:

- Aeroméxico Rewards

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- ALL – Accor Live Limitless

- Avianca LifeMiles

- British Airways Executive Club

- Cathay Pacific Asia Miles

- Choice Privileges

- Emirates Skywards

- Etihad Guest

- EVA Air Infinity MileageLands

- Finnair Plus

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

- TAP Air Portugal Miles&Go

- Turkish Airlines Miles&Smiles

- Virgin Red

- Wyndham Rewards

Note that this list of partners can change over time. For the latest information, refer to the official list provided by Capital One.

Airline Transfer Partners

To start off, let’s take a high-level overview of Capital One’s airline partners. Capital One has 15 total airline partners, and they’ll get you to just about anywhere in the world. You can use your points to book flights and cabin upgrades with any of these carriers.

Let’s clear up a common misconception with airline transfer partners. Some travelers may look at this list and immediately dismiss the ones that don’t appear to fit their travel plans. For example, if you’re based in the United States and looking to travel domestically or to a location like Japan, you’ll notice that there are no U.S.- or Japan-based airlines on this list. Does this mean that you should abandon Capital One completely?

Absolutely not. Because of airline alliances, you’ve got lots of options to book domestic flights within the U.S. or international flights to Japan and elsewhere. Capital One has airline partners in all three of the major alliances: Star Alliance, SkyTeam and Oneworld. So even if your favorite airline is not on this list, chances are, one of its alliance partners is.

For example, if you’re looking to fly domestically within the U.S., you can often find great value booking United Airlines flights via Turkish Airlines. This is possible because United and Turkish Airlines are both members of the Star Alliance.

You might notice multiple Star Alliance members on this list. For instance, you could also get United flights by booking through Air Canada Aeroplan, Avianca LifeMiles, EVA Air Infinity MileageLands, Singapore KrisFlyer or TAP Air Portugal Miles&Go, all of which are Capital One partners.

While this does give you more options, the points rate that each of these airlines charges to book the same United flight can differ wildly. This is why not all transfer partners are created equal—naturally, some sweet spots exist, and some partners should be avoided entirely. (More on this later.)

Margaritaville Vacation Club by Wyndham - St. Thomas VI | Photo Credit from Wyndham

Hotel Transfer Partners

Capital One’s portfolio of hotel transfer partners don’t include any of the “big three” in Hilton, Hyatt and Marriott. Instead, your choices include Accor Live Limitless, Choice Privileges and Wyndham Rewards.

All three of these chains own multiple well-known brands worldwide but have a somewhat smaller footprint in the United States:

- Accor Live Limitless is based in France and owns brands like Fairmont, Sofitel and Raffles.

- Choice Privileges owns brands like Radisson, Quality Inn and Comfort Inn.

- Wyndham is perhaps the best-known chain of the three in the U.S. They own brands like Ramada, Days Inn and Travelodge.

Is it worth it to transfer your Capital One Miles to these hotel partners? As a general rule of thumb, transferring any credit card rewards to hotel partners is usually worse than transferring them to airline partners (with the notable exception of transferring Chase Ultimate Rewards points to World of Hyatt). That being said, you might still find value with some of Capital One’s hotel partners, and we’ll explore this in the next sections.

The Best Capital One Transfer Partners

What makes a good transfer partner? Credit card enthusiasts like to look for “sweet spot” redemptions that offer outsized value compared to other redemptions of similar cost. Let’s take a look at six transfer partners that are some of the best partners to use with the Capital One Miles Program.

Virgin Red

At the top of our list is Virgin Red, Virgin’s group-wide rewards club that includes the ability to book flights through the Virgin Atlantic Flying Club loyalty program. Points and miles enthusiasts are well aware that Virgin Atlantic houses one of the juiciest sweet spots in air travel— booking ANA business- and first-class flights.

Virgin Atlantic Flying Club currently uses the following award chart for pricing on ANA redemption flights.

What’s awesome about this chart is that it represents round-trip pricing. This means that it would cost you only 45,000 points to fly one way from the western USA to Japan in business class and 47,500 points from the East Coast.

Notably, the ANA first-class redemption rates saw a pretty big devaluation in March 2023. However, 72,500 points each way from the West Coast to Japan is still a pretty sweet deal (85,000 points from the East Coast).

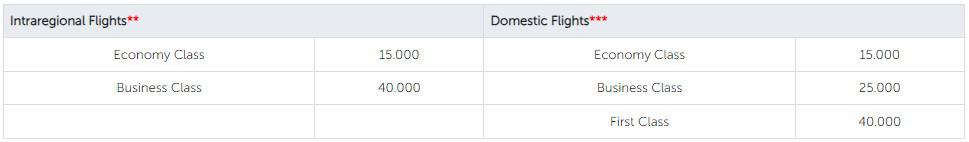

Turkish Airlines Miles&Smiles

The redemption example above is mandatory knowledge for those seeking aspirational travel. However, if you’re an everyday U.S. domestic traveler, you might not expect the Turkish Airlines Miles&Smiles frequent-flyer program to hold another one of the most valuable sweet spots in the game.

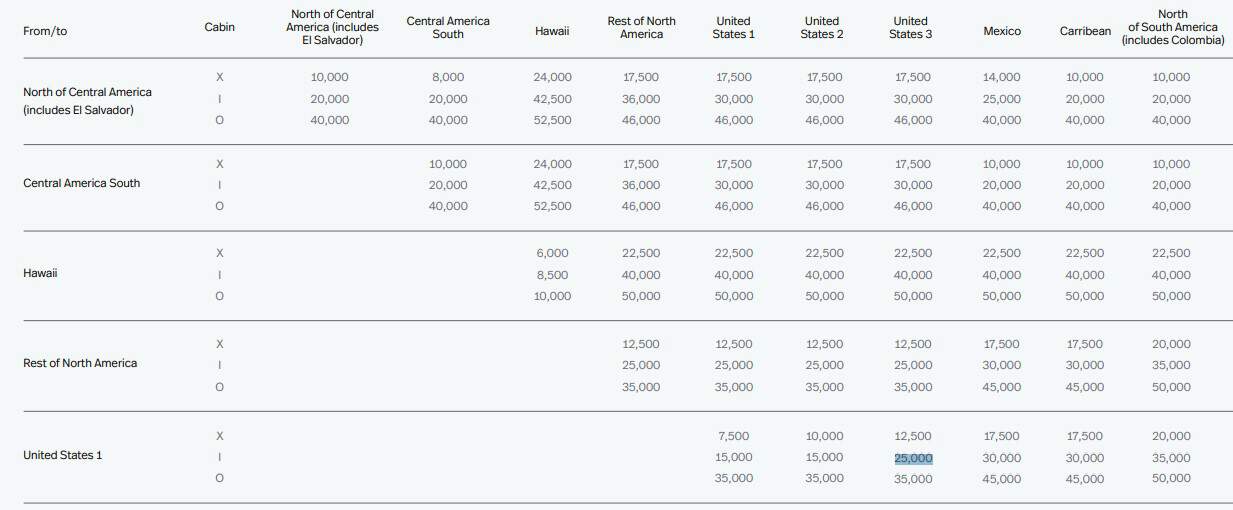

Of course, we’re talking about how you can redeem 15,000 Miles&Smiles miles for any economy round-trip domestic flight on United. Here’s the relevant section of Turkish Airlines’s current award chart:

Because “round-trip domestic” region in the U.S. includes Hawaii, the most obvious way to maximize this redemption is on flights to and from the islands. Even if you’re based in the East Coast, the pricing is still 15,000 Capital One Miles round trip, which is by far the cheapest way to get to Hawaii using points.

Note that the 15,000-mile rate requires that United release Saver award space for the flight, which might not always be available. In addition, you often have to call in to Turkish Airlines customer service to make the booking, which can be an extra hassle.

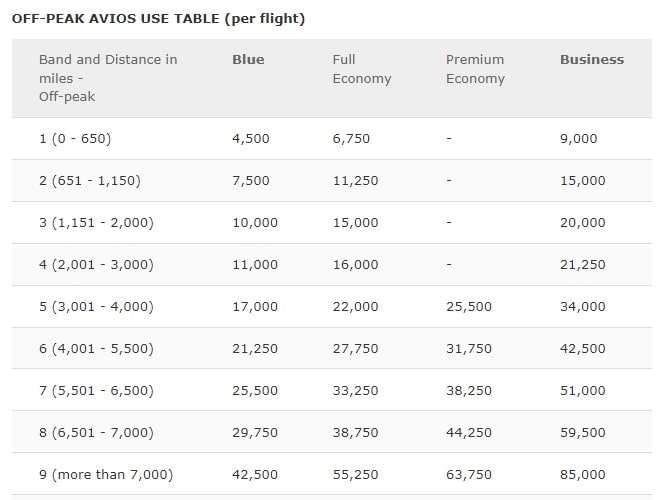

British Airways Executive Club

Another well-known aspirational travel redemption is available using Capital One Miles, and this time it’s with British Airways Executive Club. Because British Airways and Iberia share the same Avios currency, converting Capital One Miles to Avios unlocks a popular transatlantic redemption on Iberia in business class.

On off-peak dates, the one-way rate for business class in Iberia from select U.S. cities to Madrid is just 34,000 Avios.

This redemption takes advantage of the fact that airports in cities like New York (JFK) and Boston (BOS) are in the 3,001 to 4,000 mileage range from Madrid (MAD).

While Iberia might not be the most luxurious business class in the skies, 34,000 miles is still an extremely good deal to experience higher-end travel: airport lounge access, lie-flat seats and just an overall more comfortable way to fly to Europe.

Air Canada Aeroplan

Air Canada Aeroplan is a favorite amongst travel enthusiasts for its abundance of valuable redemption options and lack of fuel surcharges. It helps that Air Canada is a transfer partner of many U.S. credit card issuers, making Aeroplan points relatively easy to accumulate.

So if you’ve got a stash of Capital One Miles, refer to Aeroplan’s Flight Reward Chart for redemption rates. For example, here’s the current chart for flights between North America and Asia Pacific.

According to this chart, partner airline redemptions in business class in the 5,000 to 7,500 mileage range cost 75,000 Aeroplan points. Multiple routes with Air Canada’s Star Alliance partners fit within this range.

For example, you could fly from San Francisco (SFO) to Taipei, Taiwan (TPE), on EVA Air for 75,000 Capital One Miles. EVA Air has an excellent business class that is pretty expensive to book otherwise, so booking through Aeroplan is often one of the most cost-efficient ways to fly this product with points.

Avianca LifeMiles

Like with Aeroplan, Avianca LifeMiles members don’t have to face hefty fuel surcharges when they book award flights with Star Alliance partners, which makes it another loyalty program to watch.

LifeMiles has a fairly intricate award redemption chart, but you can book many sweet spots with your Capital One Miles. Let’s focus on the following highlighted area of the chart below.

Currently, travel from “United States 1” (which includes New York) to “United States 3” (which includes Los Angeles) costs just 25,000 LifeMiles in business class. This is a pretty affordable way to experience United Polaris on a transcontinental flight.

Air Canada Aeroplan and Avianca LifeMiles are two programs that often offer the best point redemption deals on many Star Alliance carriers. If you’re looking to fly on Star Alliance, it’s always a good idea to check the redemption rates on both of these airlines to see which one is the lowest.

Wyndham Rewards

Last but not least, let’s highlight Wyndham Rewards, the only hotel partner that made our list. Wyndham often gets overshadowed by other larger hotel chains in the U.S., and understandably so—redemptions at most Wyndham properties just don’t really give us the value we’re looking for. So why did we list Wyndham as a top-tier Capital One transfer partner?

The answer lies in Wyndham’s partnership with Vacasa, a vacation rental company, which unlocks a special sweet spot that’s only applicable to those with Wyndham points.

A one-bedroom Vacasa rental will cost you only 15,000 Wyndham points, regardless of the cash price. Given that the cash rate can sometimes go upwards of $500 or $600, this can prove to be an extremely valuable way to stay in a desirable vacation destination like Hawaii for cheap without compromising on comfort.

The bottom line is to not transfer your Capital One Miles over to Wyndham with the intention of booking Wyndham properties. Instead, you’ll find the best value with Vacasa rentals.

The Worst Capital One Transfer Partners

In contrast to the previous list, these are the Capital One transfer partners that offer less value than the others. We recommend avoiding them completely.

EVA Air Infinity MileageLands

While EVA Air is a great airline, transferring your Capital One Miles to EVA Air is like throwing your points down the drain. Objectively, it’s probably the worst Capital One transfer partner in terms of value you’d get from your miles.

There are two main reasons for this. The first is that EVA Air is part of the Star Alliance—and we’ve already seen that Air Canada Aeroplan and Avianca LifeMiles offer the best rates on Star Alliance redemptions. In comparison, EVA Air’s rates are almost always more expensive.

And second, Capital One Miles transfer to EVA Air at a 4:3 ratio, which is less than the 1:1 rate you’re getting with Air Canada and Avianca, which makes matters worse. All in all, there’s no real reason why you’d want to transfer rewards to Infinity MileageLands.

Aeroméxico Rewards

Transferring to Aeroméxico typically results in lower value redemptions as well. For our list of the best Capital One transfer partners, the common element that made them so valuable was that they use a fixed award chart. Instead of pricing awards based on approximate mileage flown, Aeroméxico uses a dynamic pricing model. This means that if the underlying cash rate for a redemption is high, you’ll end up paying more points for the flight as well.

A second reason to avoid Aeroméxico is that Capital One Miles transfer to Aeroméxico at just a 1:1 ratio. You can get a much better transfer rate with American Express, since Membership Rewards points transfer to Aeroméxico Rewards at a 1:1.6 ratio.

Etihad Guest

Redemptions with Etihad Guest and all of its partner airlines are, in a single word, expensive. That’s thanks to a major devaluation to the program in March 2023, which completely eliminated many of Etihad’s previously beloved sweet spots.

Now, while the new award charts are much simpler to understand and apply to all of Etihad’s partners equally, they’re also ridiculously priced. A one-way long-haul flight (6,001+ miles) in business class now starts at 140,000 miles—and that’s just the starting redemption rate according to the chart. When you actually perform the search, the pricing can potentially be much higher.

Overall, due to the lack of valuable redemptions in Etihad’s program, we’d advise you to look elsewhere with your Capital One Miles.

Finnair Plus

Finnair Plus is also guilty of having too many overpriced redemptions. While they offer separate award charts for each of their Oneworld alliance partners, there are no sweet spots that are worth considering.

To give you an idea of how overpriced Finnair’s rewards are, let’s recall that we could fly on Iberia business class from the U.S. to Madrid for 34,000 Avios on one-way booking through the Avios system. On Finnair, the same flight would cost you 132,000 miles.

To be fair, Finnair Plus will be switching to the Avios currency in early 2024, and some award rates should be going down as a result of the change.

Capital One Venture Rewards Credit Card

75,000

miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Annual Fee: $95

Accor Live Limitless

Accor Live Limitless has an interesting redemption model, but is it worth transferring Capital One Miles to?

The answer is probably not. With Accor properties, you can redeem 2,000 points at a time, which provides you with 40 euros off your stay (currently about $42.50). However, Capital One Miles transfer to Accor at a 2:1 ratio, so you’ll need 4,000 miles to get 40 euros off. This yields a value of about 1 cent per mile, which is around what you’d get redeeming Capital One Miles directly through Capital One’s travel booking site.

Given that we can do much better with our Capital One Miles with other transfer partners, we don’t recommend transferring to Accor Live Limitless.

Capital One VentureOne Rewards Credit Card

20,000

Bonus Miles

after you spend $500 in the first 3 months

How to Earn Capital One Miles

You can earn Capital One Miles through welcome bonuses and spending on Capital One credit cards. However, don’t just use any Capital One card—use only the following cards to earn miles (instead of cash back):

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Capital One Venture X Business

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

Having one of these cards also gives you access to all the Capital One transfer partners. Note that while the Savor cards earn cash back, you can convert it to Capital One Miles if you hold a Venture or a Spark card.

Capital One Venture X Rewards Credit Card

75,000

Venture Miles

after you spend $4,000 in purchases in the first 3 months.

Annual Fee: $395

How to Transfer Capital One Miles

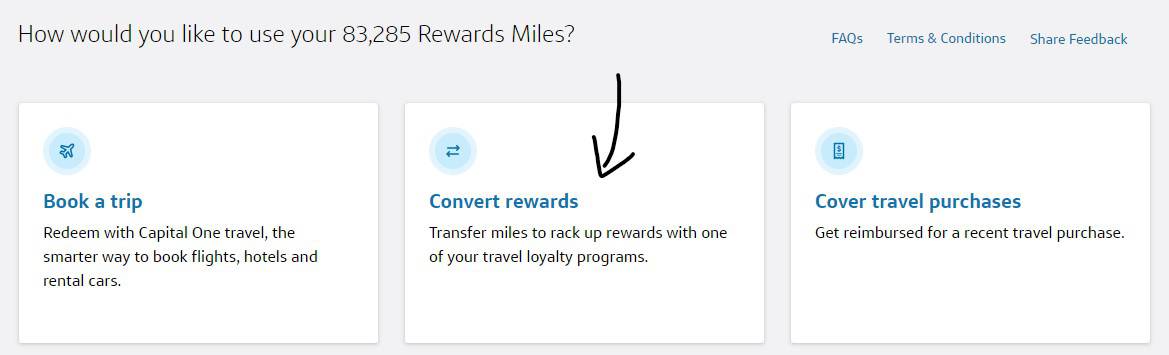

Transferring your Capital One Miles to travel partners is incredibly easy. From your credit card, go to the Rewards page. You should see a “Convert rewards” panel.

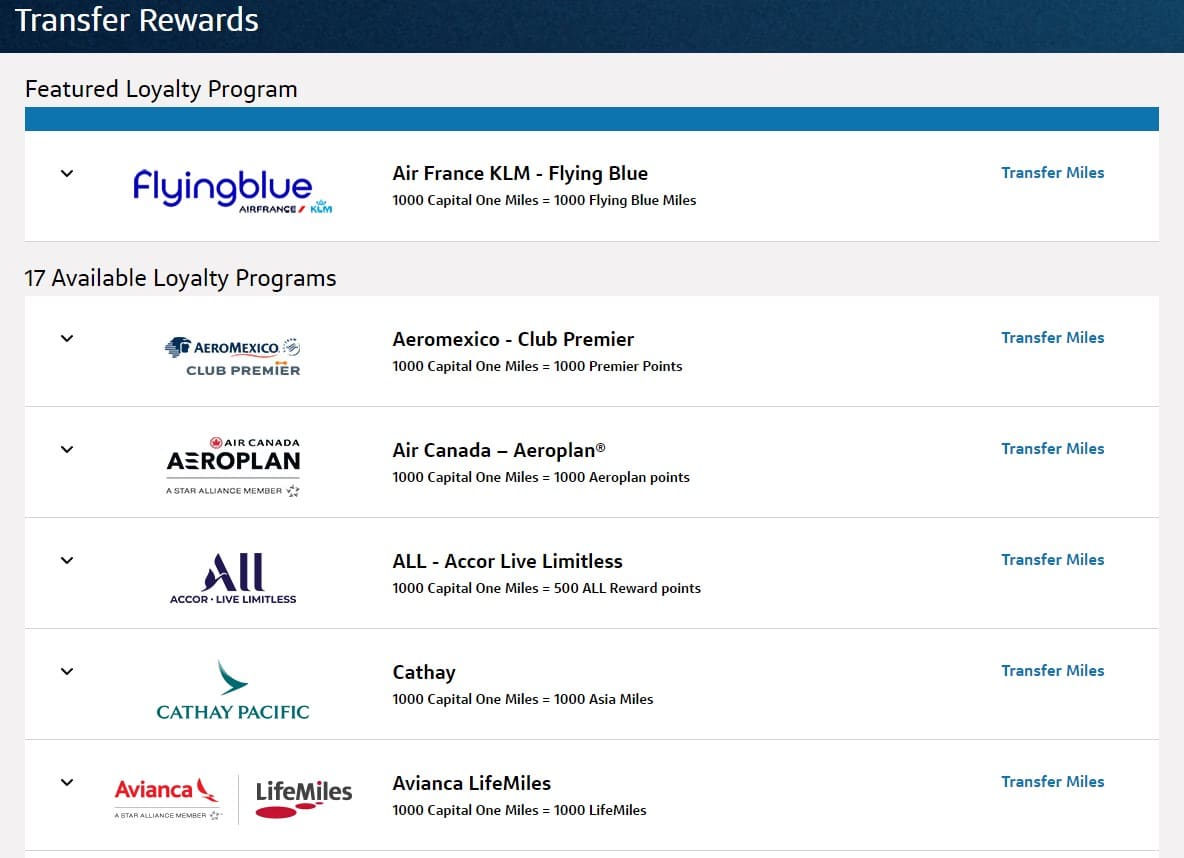

Once you click on this panel, you’ll be brought to the following page.

Here, you’ll see all of Capital One’s transfer partners along with their transfer rates. You can use the “Transfer Miles” button to transfer Capital One Miles to that partner’s loyalty program. Note that you must transfer in multiples of 1,000 Capital One Miles.

Also, you may see a “Featured Loyalty Program” at the top. In this case, Capital One is featuring the Flying Blue program, but it doesn’t necessarily mean it’s one of Capital One’s best partners. Don’t let the top banners trick you.

Capital One Venture X Business

Earn 150,000

Bonus Miles

once you spend $30,000 in the first 3 months from account opening

Annual Fee: $395

Tips and Strategies to Get the Most Out of Your Rewards

To get the best value from your Capital One Miles, try to target any of the sweet spots we covered in our list of the best transfer partners. You can’t go wrong with these redemptions.

You can also evaluate for yourself whether a redemption is worth it by calculating its cents-per-point (CPP) value.

For example, our first sweet spot was using the Virgin Atlantic Flying Club program to book a business-class ticket on ANA from the western U.S. to Japan for 45,000 points per direction. Suppose that you find a cash rate for this flight going for $5,000. When you divide 5,000 by 45,000, you get 0.11—this is technically dollars per point, so we can multiply this number by 100 to get a cents-per-point value of 11.1.

This kind of CPP is considered extremely high, which is why this is a real sweet spot in the points and miles game. You don’t have to get CPPs of 11.1 to get great value from your points. If that’s the case, what’s a good CPP benchmark?

In general, if you’re able to get at least two cents per mile of value on your Capital One Miles, that’s already a great return. Typically, you’ll see lower CPPs for economy redemptions and higher CPPs for aspirational redemptions.

Capital One Spark Miles for Business

50,000

Bonus Miles

after you spend $4,500 in the first 3 months

Annual Fee: $0 for your first year, then $95.

Common Pitfalls to Avoid

While the Capital One Rewards program can provide tons of valuable travel benefits, there are also some common pitfalls you should be aware of. Here are a few key considerations to avoid potential setbacks.

Point Devaluations

Typically, programs only get less valuable over time. We’ve seen this a number of times with Capital One partners, such as Virgin and Etihad. To mitigate this risk, it helps to stay informed about upcoming program devaluations by following the official websites and travel blogs.

Also, point devaluations is an argument against point hoarding. While it can feel great to have a huge stash of rewards saved up, realize that the ultimate goal here is to be able to use your points and miles for meaningful travel experiences or valuable rewards. Your mileage may vary, but sometimes it’s better to redeem rewards for a memorable trip rather than hoard them indefinitely.

Transfer Times

It’s essential to understand that transferring your rewards to loyalty programs may not be instantaneous. While most Capital One transfers occur instantly, some can take longer. One notable example is Cathay Pacific, where transfers can take 24 hours or longer.

Incomplete Research

Capital One has a lot of transfer partners. Once you execute a transfer, it’s final. So before pulling the trigger on any one of them, you should thoroughly research your transfer options. Each loyalty program has different redemption rates, availability and restrictions.

On a similar note, be sure to factor in any taxes and fees for redemptions. Certain programs pass on higher taxes and fees than others.

Capital One Card Recommendations

If you want to earn a bunch of Capital One Miles, we recommend the following cards.

Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card is a good card to get yourself started in Capital One’s ecosystem. The card has a $0 annual fee and earns an unlimited 1.25X miles on every purchase, along with 5X miles on hotels and rental cars booked through Capital One’s travel booking site.

While these rewards are nothing crazy, it’s a good option for beginners. The fact that this card has no annual fee means that it’s a keeper card that you never have to consider canceling.

Capital One VentureOne Rewards Credit Card

20,000

Bonus Miles

after you spend $500 in the first 3 months

Capital One Venture X Rewards Credit Card

For more experienced travelers, the Capital One Venture X Rewards Credit Card hardly needs an introduction. It’s a premium travel card that comes with a ton of travel benefits, including travel protections, a Priority Pass membership and a TSA PreCheck/Global Entry credit.

While the card does have a $395 annual fee, it’s one of the few cards that actually has a negative effective annual fee if you’re able to properly utilize the credits. This is because the Venture X offers a $300 annual travel credit and 10,000 miles each cardmember anniversary (minimum $100 value). Effectively, Capital One is paying you $5 per year to hold the card.

The Venture X card earns 5X miles on flights and 10X on hotels and rental cars booked through Capital One’s travel booking site. Notably, it also earns an unlimited 2X miles on every purchase, making it a strong catch-all card.

And don’t forget about the welcome bonus, which only sweetens the deal. The welcome bonus on the Venture X itself is often high enough to get you a free business-class flight and more with some of the sweet spots we discussed in this article. Redeeming Capital One Miles for business class flights can unlock luxury travel experiences while maximizing value.

Capital One Venture X Rewards Credit Card

75,000

Venture Miles

after you spend $4,000 in purchases in the first 3 months.

Annual Fee: $395

Capital One Venture X Business

The Capital One Venture X Business is the business equivalent of the consumer version of Venture X card. The card shares many similarities with the regular Venture X: the same multipliers, annual fee and travel benefits.

The biggest difference is with the welcome bonus. Whereas it’s rather easy for new Venture X cardholders to meet the welcome offer spending requirements, it’ll be a lot harder on the Venture X Business. New Venture X Business cardholders can earn a more sizable bonus, but with a higher spend requirement.

Capital One Venture X Business

Earn 150,000

Bonus Miles

once you spend $30,000 in the first 3 months from account opening

Annual Fee: $395

Capital One Spark Miles Select for Business Card

Business owners also can consider the Capital One Spark Miles Select for Business Card for some extra miles. This card always comes with a decent welcome offer and earns 1.5X miles on every purchase.

The Spark Miles Select business card is nothing to write home about, particularly compared to the Capital One Venture X, but it comes with no annual fee, so it’s not a burden to keep in your wallet.

Bonus: Capital One Savor Cash Rewards Card

As an added bonus, if you hold any of the Venture or Spark cards, you should strongly consider getting the Capital One Savor Cash Rewards Card as well. This is because the Savor has multiple high-earning categories, and any cash back you earn with the Savor card can be converted to miles.

The Savor earns unlimited 4% cash back on dining, entertainment and popular streaming services. It also earns 3% back on groceries. Entertainment in particular is a category that other major credit card issuers seem to forget about, so the fact that Capital One offers you 4% here is a big advantage.

The Capital One Savor does come with a $95 annual fee, so make sure you can sufficiently take advantage of these earning categories before applying for this card.

Elevate Your Travel and Rewards Experience

As you saw in this article, Capital One’s transfer partners have a lot to offer. From incredible deals on U.S. domestic flights via Turkish Airlines to premium cabin redemptions on ANA via Virgin Atlantic, these are just some of the travel experiences you unlock with Capital One transfer partners.

Of course, as with each of the other major credit card reward programs, some of these transfer partners are better off avoided. You don’t want to be shelling out thousands of extra miles booking a Star Alliance flight through EVA Air when you have better options in Air Canada and Avianca.

Now that you know the full potential of Capital One Miles, your next step is to start earning them. Each of the credit cards we discussed earn Capital One Miles that you can use to elevate your next vacation. As you rack up miles for big redemptions, continue to follow us at 10xTravel for in-depth insights and strategies to make the most of your points and miles.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.