10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

If Europe has been on your radar, here’s a great way to get there for two people with just one card.

Why Citi Premier® Card?

The Citi Premier® Card is a somewhat underrated card, but in addition to its valuable welcome bonus, the card has great bonus spending categories. Let’s have a quick look at why you should be paying attention to the Citi Premier.

This card comes with a great welcome bonus that could be enough to fly two people in economy to Europe. The annual fee is just $95 and the card has no foreign transaction fees.

The card earns 3X ThankYou points in some of the most valuable (and most used) categories:

- Restaurants

- Supermarkets

- Gas Stations

- Air Travel

- Hotels

And unlike some other cards that earn more than 1X in these categories, you can earn 3X worldwide, not just in the U.S. So anyone planning a trip abroad who anticipates spending a significant amount in these categories should have the Citi Premier in their wallets.

The card earns 1X on all other purchases.

Are Citi ThankYou points valuable?

The short answer is yes, absolutely.

Citi has great transfer partners, including 14 airlines:

| Aeromexico Club Premier | JetBlue TrueBlue |

| Air France-KLM Flying Blue | Qantas Frequent Flyer |

| Avianca LifeMiles | Qatar Airways Privilege Club |

| Cathay Pacific Asia Miles | Singapore Airlines KrisFlyer |

| Emirates Skywards | Thai Airways Royal Orchid Plus |

| Etihad Guest | Turkish Airlines Miles&Smiles |

| EVA Air Infinity MileageLands | Virgin Atlantic Flying Club |

And two hotel partners:

- Choice Privileges

- Wyndham Rewards

Redeeming ThankYou points isn’t as straightforward as redeeming Ultimate Rewards, but if you are willing to invest a little time and learn about Citi’s transfer partners, you’ll be able to redeem ThankYou points for some very valuable rewards.

Watch out for occasional transfer bonuses to airline partners. If you come across one, you can get even more value out of your Citi ThankYou points.

Let’s have a look at how you can book two economy tickets by transferring ThankYou points to Air France-KLM frequent-flyer program Flying Blue.

How to Transfer ThankYou Points to Flying Blue

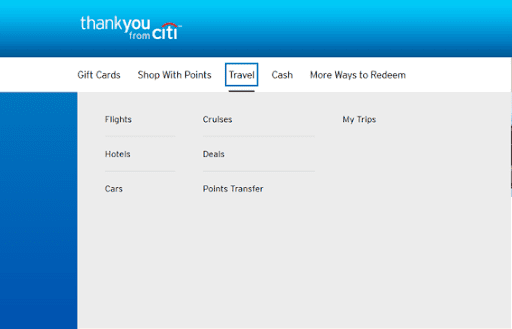

ThankYou points transfer to Flying Blue at a 1:1 ratio and the transfer is usually instant. Just navigate to the Citi ThankYou website and login with your Citi account credentials and go to the Rewards tab.

Hover with your mouse over the travel tab, then click on Points Transfer.

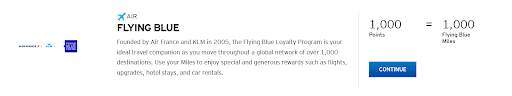

Scroll down to Flying Blue and click continue.

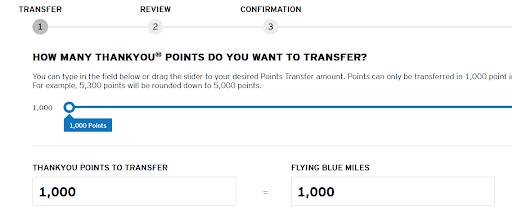

You’ll see this handy slider on the next page.

A word of caution, don’t transfer flexible credit card points to an airline before you find award space. The transfer is one-way only, so you don’t want to have your flexible “currency” converted into miles or points that you can’t use.

Air France-KLM Flying Blue

If Europe is on your radar, you should be paying attention to the combined frequent-flyer program of Air France and KLM. Not only does the program have reasonable redemption rates for European travel, but they often run monthly Promo Rewards that make already reasonable redemptions even more affordable.

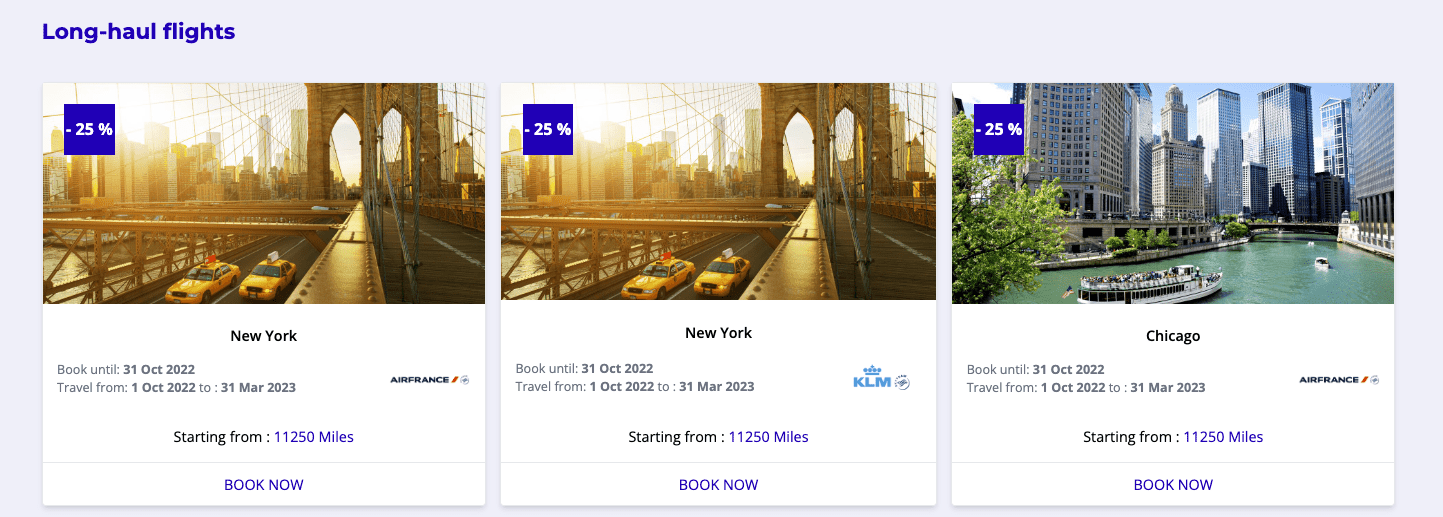

For example, here’s a snippet of some of this month’s promos:

Don’t live in one of the advertised cities? You should still run some award searches because Flying Blue often puts other, unadvertised, routes on sale too.

Not seeing any promo rewards that appeal to you? No problem, you can still redeem Flying Blue miles for great awards to Europe. Flying Blue doesn’t have an award chart, but you can use the Miles Price Estimator to find out what you can expect. The estimator doesn’t search for the lowest award space, it’s just a tool that shows you the lowest amount of miles needed to book a one-way ticket.

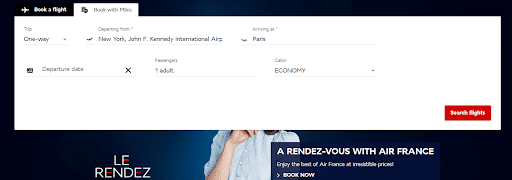

You’ll need to create an account with Air France or KLM to search for available award space. After you login, click to Book with Miles and enter your origin and destination.

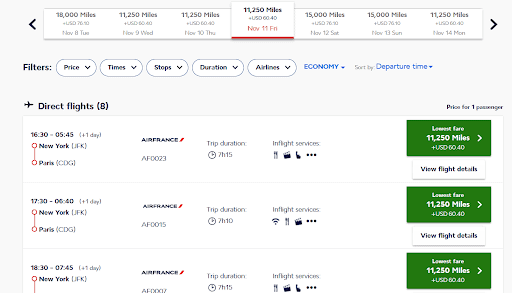

The site could be glitchy, and if there’s no award space on your date, you are likely to get the endless spinning circle when you try to change the date. To get around this annoying glitch, don’t click back and don’t click on the Change button, but instead just use the left and right arrows on the weekly calendar view.

The Air France app works great, and you can use it to search for the best and cheapest awards.

You won’t always find such low redemption rates, as 11,250 miles, and it’ll cost more to fly to Europe during peak times. It’s not unusual to see one-way economy award rates in the 25,000- 30,000 miles range, but if your schedule allows for any flexibility, you can book an affordable round-trip award to Europe for two people with just one welcome bonus earned with a Citi Premier card.

Final Thoughts

The Citi Premier® Card is an excellent card that doesn’t get enough attention. ThankYou points could be very valuable and the bonus categories are great for everyday spending. The best way to maximize the ThankYou points is to transfer them to one of the airline partners.

One of the best ways to use ThankYou points is to transfer them to Air Fraince-KLM Flying Blue for an economical way to book economy flights to Europe. One Citi Premier® Card welcome bonus could be enough to book a round-trip for two to Europe. And if you can go during the off-peak times, not only will you get a better experience and encounter fewer crowds, but you’ll also save a lot of points.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.