10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Citi is an advertising partner

All information about the Hilton Honors American Express Aspire Card has been collected independently by 10xTravel.

Many points and miles enthusiasts will recommend against buying points from frequent flyer or hotel rewards programs. And, in many cases, buying points will cost more money than the value you can extract for those points. For example, if you were to purchase 50,000 hotel points for $600 and then spend those 50,000 points on a hotel stay with a cash value of $500, you’d obviously be losing value by purchasing these hotel points. This is the case with a lot of points and miles purchases.

With that being said, there are instances in which purchasing hotel points can make sense and actually save you a lot of money. In general, the best times to purchase hotel points are when there’s a points sale, when you’re looking to stay at a super-luxury hotel or when you’re trying to save money on stays on highway-side budget hotels. Paying for a hotel stay with points that you’ve purchased can allow you to access a “fifth night free” perk, which can also provide great hotel point value. In these cases, purchasing hotel points can save you a ton of money.

For example, let’s imagine there’s a Hilton hotel stay that costs either 50,000 points or $700. However, you have the option to purchase 50,000 points through the Hilton Honors program for $600 (thus, essentially, allowing you to purchase the stay for $600). Is buying Hilton points worth it in this case? Well, if you’re willing to spend a few extra minutes to save $100, then it certainly is.

In this article, we’re going to look at a few of the instances in which you can save money by buying hotel points. And, hopefully, you can apply these strategies to your own travel planning and save yourself lots of money.

The Basics of Hotel Loyalty Programs and Points

Many of the world’s major hotel brands have rewards programs that offer points to members for completing certain activities. The most obvious way to earn hotel points through these programs is to stay at hotels that are part of that chain’s portfolio. For instance, if you wanted to earn Wyndham Rewards points, you could do so by staying at a Days Inn (as this is one of the brands under the Wyndham corporate umbrella).

In addition to earning points through hotel stays, many of these loyalty programs also allow you to earn points in a wide variety of other ways, such as renting cars, shopping online, dining at restaurants, spending money on hotel co-branded credit cards and more.

Most of these programs also offer the option to purchase points with cash. As mentioned above, purchasing points with cash is usually a poor idea because the value you’ll get out of those points is less than the cash value you’ll pay for them. However, there are instances in which the opposite is true and it’s actually a great idea to purchase hotel points.

Regardless of how you earn your hotel points, these hotel programs typically offer a wide range of options for redeeming those points, such as gift cards, car rentals, merchandise, vacation packages and more. However, in general, you’ll get the best hotel points value by redeeming them for hotel stays.

So, throughout this article, we’re going to focus on instances in which it makes sense to purchase hotel points with cash and then redeem those points for hotel stays.

Guide to Buying Hotel Points

Before we discuss the best scenarios in which to buy hotel points, we’re going to take a look at how to buy hotel points from major hotel rewards programs. The process is typically pretty simple. However, each program has its own minimum and maximum purchase amounts and purchase rates, which can complicate things.

How to Navigate Major Hotel Chain Point Purchase Platforms

In general, if you wish to purchase hotel points, you’ll need to have an existing account with the hotel chain from which you wish to purchase the points. With some hotel rewards programs, you can sign up and immediately purchase points. However, some hotel loyalty programs require you to have been an active member for a certain period of time before buying hotel points.

If you are eligible to purchase points, you can typically do so by visiting a hotel’s website, signing in to your account and navigating to the points purchasing page (usually found in the “Earn Points” section).

Then, you’ll be able to choose the number of points that you wish to purchase and see the cash price for those points. You should be aware that each hotel loyalty program has its own minimum and maximum purchase requirements.

For example, the Marriott Bonvoy program requires you to purchase a minimum 1,000 points per transaction. All purchase denominations must be in multiples of 1,000. You can purchase a maximum of 100,000 points per transaction and per calendar year. All hotel loyalty programs have unique minimum and maximum requirements when it comes to purchasing points, so you should be aware of these restrictions during your process.

When to Buy Points

In the following sections, we’re going to look at four types of scenarios that offer the greatest chance of saving you money through purchasing hotel points: points sales, fifth night free perks, super-luxury stays and budget hotel stays. It’s important to note that none of these scenarios are guaranteed to save you money. So, you should always do your own calculations before purchasing points.

Taking Advantage of Points Sales

One of the best ways to save money by purchasing hotel points is to look for points sales. With these sales, hotel rewards programs will offer points for purchase at discounted rates or offer bonus points when you purchase a certain number of points.

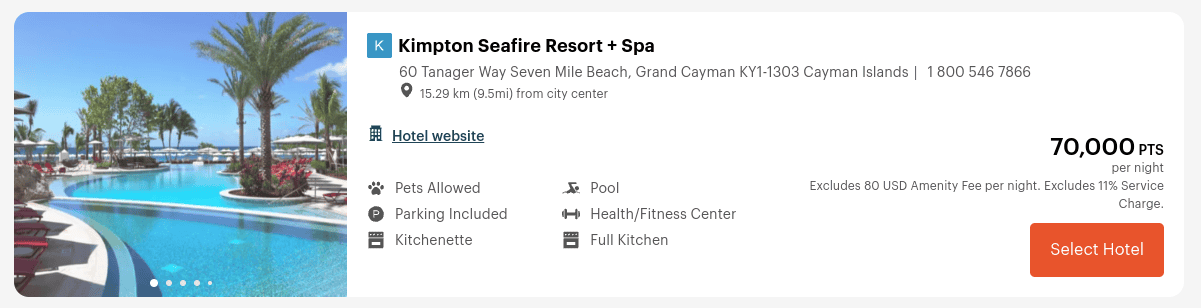

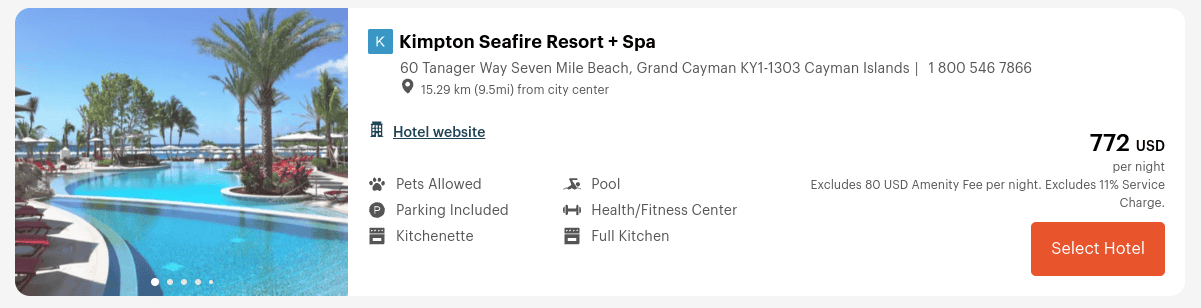

Let’s look at an example of saving money by purchasing hotel points using an IHG One Rewards points sale. Let’s say that you wanted to book a three-night stay at the Kimpton Seafire Resort + Spa in the Cayman Islands, which is part of the IHG One Rewards program. We found that a room at this location was available for 70,000 IHG points per night in late September 2025. So, your three-night stay would require 210,000 points if you were to purchase it with IHG points.

If you were to book this same stay with cash, it would cost you $772 per night. So, you’d have to spend $2,316 to book a three-night stay in late September 2025 with cash.

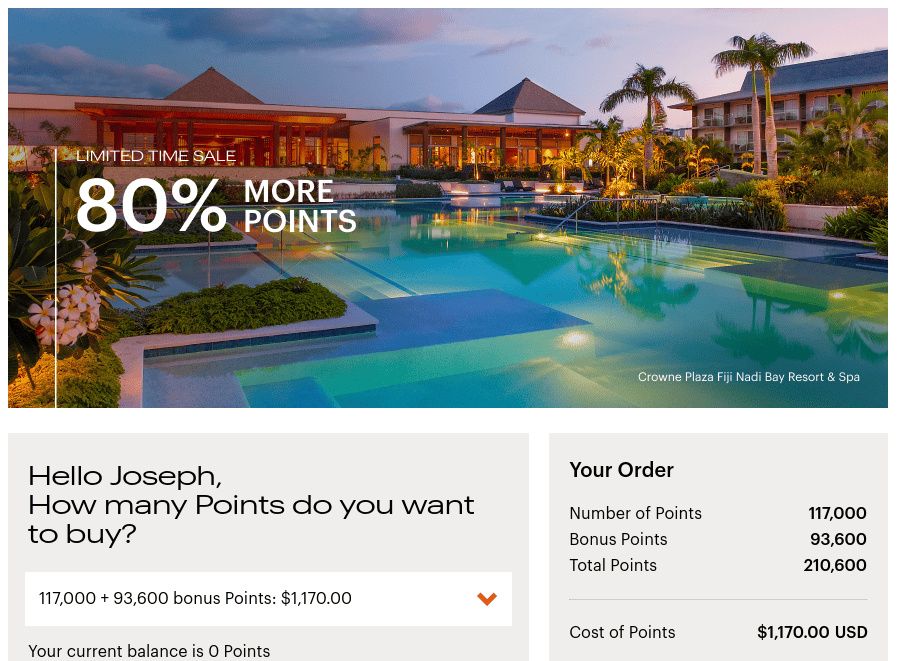

Normally, using an IHG points purchase to cover the cost of this hotel stay wouldn’t make sense because IHG One Rewards sells points for 1.35 cents apiece. However, IHG has run points sales that offers 80% bonus points when you purchase more than 5,000 points at a time.

In order to get enough points to purchase the three-day stay at Kimpton Seafire Resort + Spa, you’d only need to spend $1,170. If you compare that to the price you’d have to pay to purchase this hotel stay in cash outright, you’d be saving nearly $1,150.

As you can see, staying aware of these points sales could help you save a ton of money, particularly if you redeem those points toward ultra-luxury stays or budget hotels.

Of course, the IHG One Rewards points sale described above was a limited-time offer (as are all other points sales). So, if you see a points sale that you believe could save you some money, it’s important to act quickly before it expires.

Utilizing Fifth Night Free Perks

Another instance in which purchasing hotel points can save you money is when you utilize a “fifth night free” perk. This perk allows you to pay for only four nights when you make a booking of five or more nights with points. There are currently three hotel rewards programs that offer this perk. The following table includes these three programs, how their “fifth night free” perk works and the requirements for accessing it:

| Hotel rewards program | Free night benefit | Requirements |

|---|---|---|

| Hilton Honors | • Receive a free fifth night for every four consecutive nights you book with points • Limit of four free nights on a 20-night stay | • Must be a Hilton Honors elite status member (which you can achieve by having the no-annual-fee Hilton Honors American Express Card) |

| IHG One Rewards | • Receive a free fourth night for every three consecutive nights you book with points | • Be a cardholder of the IHG One Rewards Premier Credit Card, IHG One Rewards Traveler Credit Card or IHG One Rewards Premier Business Credit Card |

| Marriott Bonvoy | • Receive a free fifth night for every four consecutive nights you book with points • No limit to the number of free nights (for example, you could receive five free nights on a 25-night stay) | • Must be a member of the Marriott Bonvoy program |

These kinds of “fifth night free” perks aren’t available when you book hotel stays with cash. So, in certain cases, you can save money by purchasing points and then utilizing these benefits instead of purchasing hotel stays with cash.

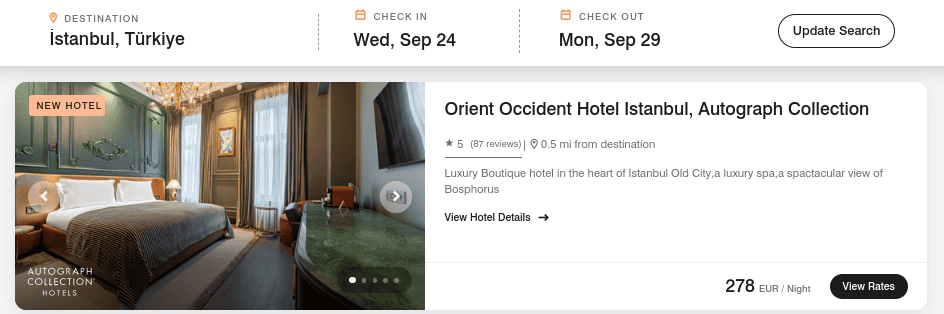

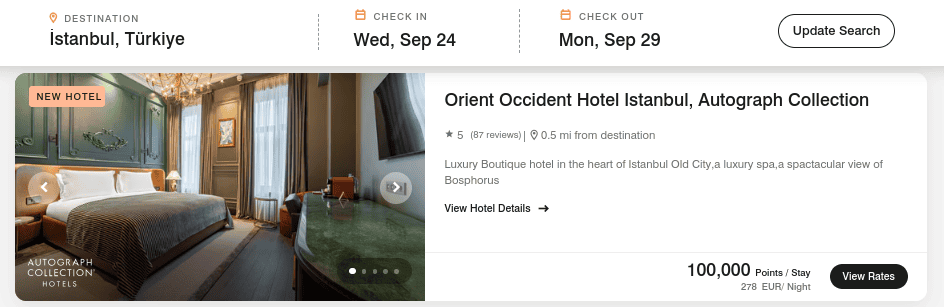

Let’s look at an example where you can purchase points and then use the Marriott Bonvoy’s fifth night free perk in order to save money on a hotel stay. Let’s say you wanted to book a five-night stay at Orient Occident Hotel Istanbul, Autograph Collection in Turkey in late September 2025. If you were to book this stay with cash, it would cost you 278 euros per night (about $301), meaning that the entire five-night stay would cost you about $1,505.

If you were to instead book this same stay with Marriott points, it would cost you a total of 100,000 points for the five-night stay with the fifth night free perk (which, again, is available to all Marriott Bonvoy members).

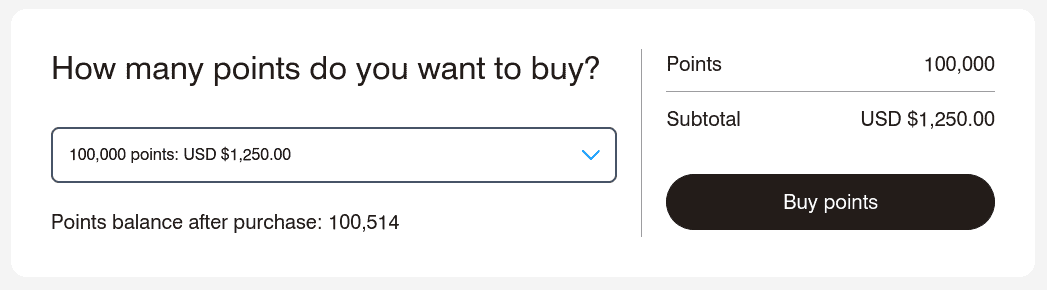

The 100,000 points required for this redemption would cost you $1,250.

So, compared to purchasing this stay outright with cash, which would cost you $1,505, you could pay $1,250 to purchase enough points to book the exact same stay as an award. Thus, you’d be saving yourself $255 on this stay by purchasing Marriott Bonvoy points and utilizing the program’s fifth night free perk.

So, anytime you’re thinking of booking stays with Hilton, IHG or Marriott, you should consider whether or not you can use that hotel’s fifth night free perk and whether you might be better off purchasing points instead of paying cash directly.

Booking Luxury Stays With Super High Cash Prices

Sometimes, even if you don’t utilize a points sale or a “fifth night free” perk, you can still save yourself a lot of money by purchasing hotel points, particularly when it comes to luxury stays with super high cash prices.

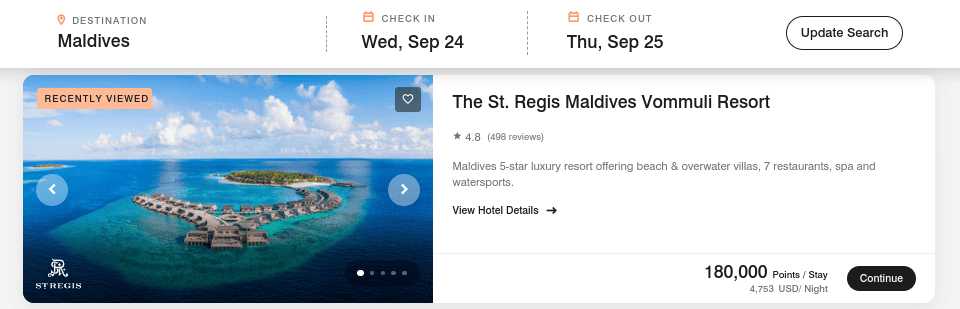

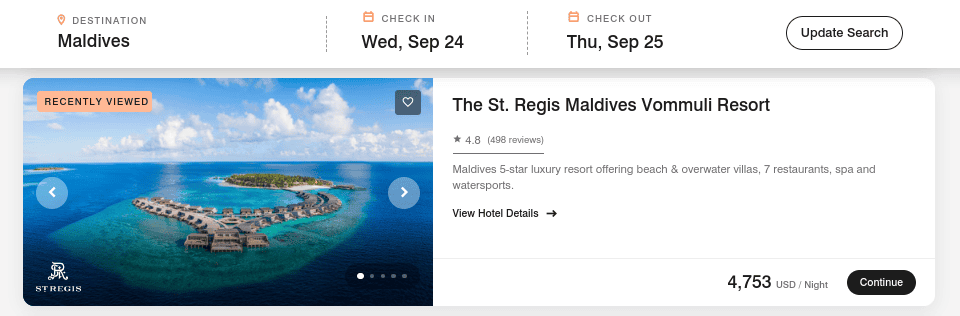

Let’s look at an example in which you can use the Marriott Bonvoy program’s fifth night free perk to save money on booking a hotel stay that has a particularly high cash price. Let’s say that you’re interested in booking a one-night stay at the St. Regis Maldives Vommuli Resort in late September 2025.

One night at this location would cost you 180,000 points. While that’s definitely a lot of points for a single night, compared to the cash price of this stay on the same date, it’s a great deal.

If you were to book this stay with cash, it would cost a whopping $4,753 for the night.

Purchasing this stay with points is a better idea than purchasing it with cash, even if you don’t have any Marriott Bonvoy points in your account. In that case, we’d recommend purchasing points and then redeeming them for this stay rather than purchasing this stay outright with cash.

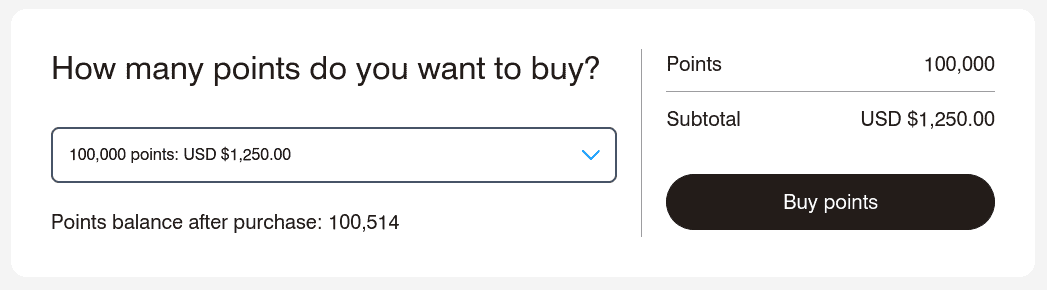

The maximum number of points you can buy per year through the Buy Points page on the Marriott Bonvoy website is 100,000, which costs $1,250. So, your first step would be to purchase those 100,000 points.

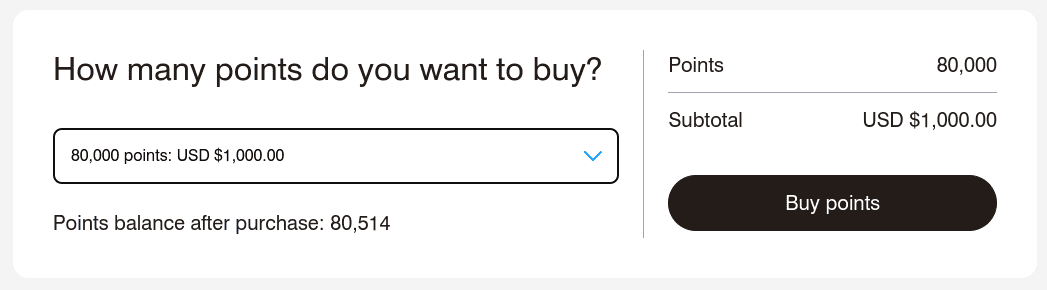

However, according to the Marriott Bonvoy website, “Members may purchase up to an additional 100,000 Points annually while booking a hotel stay through the reservation path on marriott.com.” So, when you go to book this stay, you’ll need to purchase another 80,000 points, which will cost you an additional $1,000.

In total, the 180,000 points needed to book this one-night stay at the St. Regis Maldives Vommuli Resort would cost $2,250. If you compare that to the cash price you’d have to pay if you booked the same night outright with cash, you’d be saving just over $2,500 (more than a 50% discount).

Booking Stays at Budget Hotels

There are also times when purchasing hotel points to book stays at budget hotels (many of which are located off highways or in unpopular or uneventful locations) makes sense. Through some programs, these budget hotels have high cash rates and low award rates, so much so that it makes sense to buy points and book award stays.

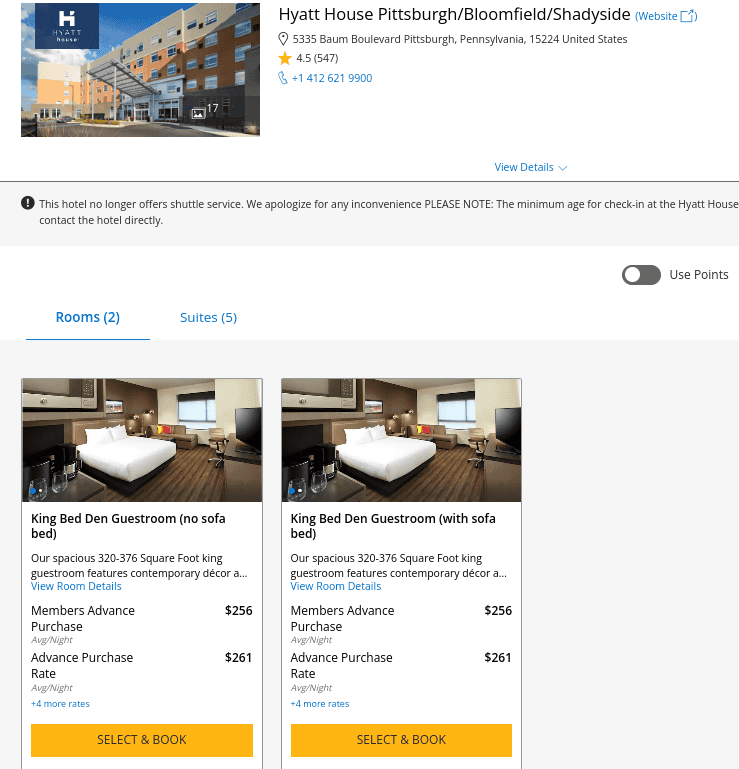

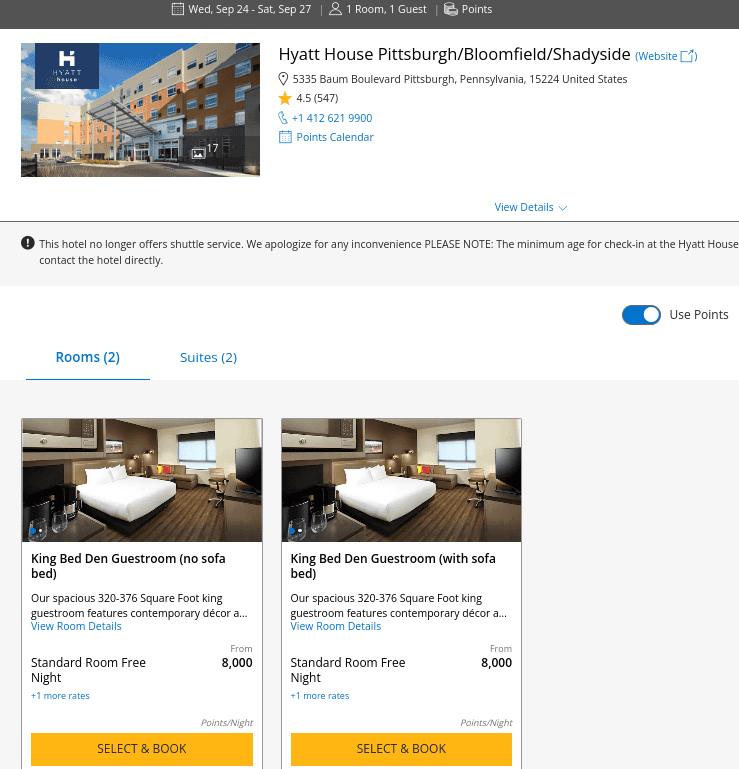

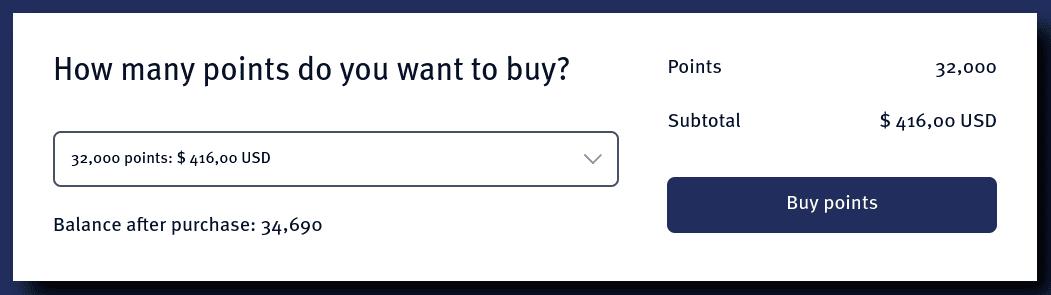

For example, if you wanted to book a four-night stay at the Hyatt House Pittsburgh/Bloomfield/Shadyside in late September 2025, it would cost you $1,024.

However, if you were to book this same stay with Hyatt points instead of cash, it would cost you 32,000 points for the four nights. According to the Hyatt hotel points chart, this is the applicable rate for a Category 2 standard room during standard season.

Purchasing 32,000 Hyatt points would cost you $416. It’s worth noting that you can only purchase up to 55,000 Hyatt points per calendar year (whether they’re for yourself or a gift for someone else).

By purchasing 32,000 points and then redeeming them for this stay at the Hyatt House Pittsburgh/Bloomfield/Shadyside, you’d be saving over $600. So, is buying Hyatt points worth it in this case? Considering you’d only have to spend a few extra minutes to save about $600, the answer is absolutely.

There are plenty of stays at budget hotels where it makes more sense to buy points and then redeem them than it does to purchase the stay with cash outright. So, you should compare these costs before you book your next stay at a budget hotel.

Alternative Methods to Increase Your Hotel Point Balance

Although this article is primarily about purchasing hotel points to save yourself money when booking hotel stays, we’d like to mention that you should always assess your other options for earning hotel points before making a points purchase.

There are plenty of ways to earn hotel points through each of the major hotel loyalty programs. So, instead of purchasing points, you should first investigate whether there’s another method that would allow you to earn those points for free or at a much lower cost. Let’s look at some of the best ways you can earn hotel points quickly and cheaply instead of purchasing them.

Leveraging Credit Cards to Turn Daily Expenses Into Travel Rewards

One of the best ways to quickly earn hotel points is to sign up for a co-branded credit card from your hotel loyalty program of choice. Many of these credit cards don’t charge an annual fee, making them a cost-effective way to earn points. And most of these cards offer a welcome bonus of tens of thousands of points for new cardholders that sign up and spend a certain amount of money on their card, which is one of the best ways to earn hotel points quickly.

Nearly all of the major hotel chains have a co-branded credit card issued by a major bank. In determining which of these credit cards might be a good option for you, you should consider factors such as the card’s annual fee, spending bonuses and additional perks (such as statement credits, fifth night free benefits, automatic elite status and more).

Although the question of which hotel credit card is best for you depends on your spending habits and hotel preference, here are a few of the best hotel credit cards for the average consumer:

| Credit card name | Annual fee | Spending bonuses | Other notable features |

|---|---|---|---|

| Hilton Honors American Express Aspire Card | $550 | • 14X points on Hilton hotels and resorts purchases • 7X points on select travel (including flights booked through airlines and AmexTravel.com and car rentals • 7X points on dining at U.S. restaurants (including takeout and delivery) • 3X points on all other purchases | • Automatic Hilton Honors Diamond status • $400 in annual Hilton resort credits (up to $200 semi-annually) • Annual Free Night Award • Earn a second Free Night Award when you spend $30,000 in calendar year and a third Free Night Award at $60,000 • $200 in annual flight credits (up to $50 quarterly) • $209 in annual statement credits to cover the cost of a CLEAR Plus membership |

| IHG One Rewards Premier Credit Card | $99 | • 10X points on IHG hotels and resorts purchases • 5X points on other travel and hotels • 5X points at gas stations • 5X points on dining (including takeout and delivery) • 3X points on all other purchases | • Automatic IHG One Rewards Platinum status • Ability to reach Diamond elite status when you spend at least $40,000 in a calendar year • Anniversary Free Night worth up to 40,000 IHG points • Earn a $100 statement credit credit and 10,000 bonus points after spending $20,000 each calendar year • Receive up to $50 in United TravelBank Cash each calendar year • Save 20% on IHG points purchases |

| Marriott Bonvoy Brilliant® American Express® Card | $650 ( See Rates and Fees) | • 6X points on Marriott hotels and resorts purchases • 3X points at restaurants worldwide • 3X points on flights booked directly with airlines • 2X points on all other purchases | • $300 Brilliant dining credit (includes up to $25 per month in statement credits for eligible dining purchases) • Free Night Award worth up to 85,000 Marriott Bonvoy points • Automatic Marriott Bonvoy Platinum status • Ability to choose Earned Choice Award after spending $60,000 per calendar year (choose between five nightly upgrade award, one Free Night Award or $1,000 off any bed at a Marriott Bonvoy brand • Up to $120 application fee credit for either TSA PreCheck or Global Entry • Up to $100 property credit for qualifying charges at The Ritz-Carlton or St. Regis when you book direct (2-night minimum) • 25 Elite Night Credits towards next elite status tier • Complimentary Priority Pass Select lounge access |

| The World of Hyatt Credit Card | $95 | • 4X points on Hyatt hotels and resorts purchases • 2X points on dining, airline tickets purchased directly from airlines, local transit, commuting, fitness clubs and gym memberships • 1X points on all other purchases | • Automatic World of Hyatt Discoverist status • One free night at any Category 1-4 Hyatt hotel or resort each cardmember anniversary • Earn a second free night if you spend $15,000 in a calendar year • Five tier-qualifying night credits toward your next elite status tier every year • Earn two additional tier-qualifying night credits every time you spend $5,000 on your card |

| Wyndham Rewards Earner® Card | $0 | • 5X points on Wyndham hotels and resorts purchases • 2X points on dining and at grocery stores (excluding Target® and Walmart®) • 1X points on all other purchases (excluding Wyndham Timeshare resort down payments) | • Automatic Wyndham Rewards Gold status • Earn 7,500 bonus points each anniversary year if you spend $15,000 on eligible purchases • 10% points discounts on award stay bookings • Cardmember booking discounts on cash bookings |

As you can see, all of the major hotel loyalty programs offer co-branded credit cards that allow you to rack up hotel points every time you use them. These credit cards can be a great way to save up points for a particular redemption instead of purchasing points.

Another great way to earn hotel points using credit cards is to transfer points from one of the major credit card rewards programs to one of its hotel partners. The following table includes the hotel transfer partners of each of the major credit card rewards programs (all transfer ratios are 1:1 unless otherwise stated):

| Credit card rewards program | Hotel transfer partners |

|---|---|

| American Express Membership Rewards | • Choice Privileges • Hilton Honors (1:2 transfer ratio) • Marriott Bonvoy |

| Bilt Rewards | • Accor Live Limitless (3:2 transfer ratio) • Hilton Honors • IHG One Rewards • Marriott Bonvoy • World of Hyatt |

| Capital One Rewards | • Accor Live Limitless (2:1 transfer ratio) • Choice Privileges • Wyndham Rewards |

| Chase Ultimate Rewards | • IHG One Rewards • Marriott Bonvoy • World of Hyatt |

| Citi ThankYou Rewards | • Accor Live Limitless (2:1 transfer ratio) • Choice Privileges (2:1 transfer ratio for Citi Strata Premier® Card holders and 1:1.5 transfer ratio for other cardmembers) • I Prefer Hotel Rewards (1:4 transfer ratio) • Leaders Club (5:1 transfer ratio) • Wyndham Rewards (1.2 transfer ratio for Citi Strata Premier® Card holders and 1:0.96 transfer ratio for other cardmembers) |

| Wells Fargo Rewards | • Choice Privileges (1:2 transfer ratio) |

For example, if you wanted to earn a lot of Marriott Bonvoy points quickly, one way to do so would be to sign up for the Chase Sapphire Preferred® Card, earn that card’s welcome bonus (which is typically tens of thousands of Chase Ultimate Rewards points) and then transfer those points to the Marriott Bonvoy program at a 1:1 ratio.

So, before you purchase hotel points to redeem for a specific award stay, you should assess whether you could also earn enough points for that stay using a hotel co-branded credit card or by transferring points from one of the major credit card rewards programs.

Exploring Unique Partnerships and Promotions for Point Accumulation

Another way to earn hotel points toward your next award stay is through unique partnerships and promotions that hotel rewards programs offer. If you don’t want to spend money on hotel rewards points, these can be a great alternative for boosting your balance.

Many of these hotel loyalty programs offer the opportunity to earn points by renting cars from select car rental companies. For example, Marriott Bonvoy members can earn up to 700 Bonvoy points for car rentals through Hertz, Dollar or Thrifty.

Certain hotel loyalty programs also allow you to earn points for using car rideshare apps, which most people these days use often. For instance, the Hilton Honors program allows members to link their accounts to their Lyft account and earn Hilton points for completing rides.

Another great partnership worth paying attention to is the one between World of Hyatt and American Airlines AAdvantage. By linking your accounts from both programs, you can earn 1X Hyatt point per $1 spent on qualifying American Airlines flights in addition to earning AAdvantage miles on those flights. If you fly on American Airlines often, this could help you rack up a lot of Hyatt points.

So, by paying attention to partnerships and promotions such as the ones above, you should be able to earn enough hotel points for a free night for little or no money.

Weighing the Pros and Cons: Should You Buy Hotel Points?

Often, the amount of money you’ll have to pay for purchasing hotel points will exceed the worth of those points. However, there are some scenarios in which purchasing hotel points can actually help you save a ton of money.

Of course, if you already have hotel points in one of your hotel loyalty accounts, you should use those points first. However, it can make sense to purchase hotel points at times when hotel loyalty programs are offering points sales (offering discounts or bonus points).

Likewise, Hilton Honors, IHG One Rewards and Marriott Bonvoy all offer “fifth night free” or “fourth night free” awards when you book with points that aren’t available when you book with cash. And, in certain cases, it can make sense to purchase points and then redeem them using these benefits instead of buy a hotel stay in cash directly.

Finally, even when there are no points sales or “fifth night free” perks available, there are still instances when it makes more sense to purchase points and redeem them instead of booking directly with cash. These cases tend to be at ultra-luxury hotels and resorts as well as at budget hotels.

So, before you purchase your next hotel stay, you should check to see how many points that same hotel stay would cost and then calculate how much it would cost to purchase that number of points. You could end up saving yourself a lot of money.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $6,000 on eligible purchases on the Hilton Honors American Express Aspire Card within your first 6 months of Card Membership. Offer Ends 4/15/2026.

Annual Fee:

$550

after spending $5,000 on purchases in the first 3 months from account opening

Annual Fee: $99

after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

Annual Fee:

$650

Earn 30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening. Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Point, on up to $15,000 spent.

Annual Fee: $95

after spending $2,000 on purchases in the first 180 days

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.