10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Among all the hotel rewards programs out there, the IHG loyalty program, known as IHG One Rewards, is sometimes overlooked. However, this program has a lot to offer, including a valuable Milestone Rewards program that rewards members every time they complete 10 qualifying nights at a qualifying IHG location and the ability to redeem points for award stays all over the world.

Plus, the IHG membership is entirely free to join, so there’s really no downside to signing up, especially if you plan on staying at an IHG-owned hotel in the future.

The Evolution of IHG and Its Loyalty Program

The story of InterContinental Hotels Group, also known as IHG Hotels & Resorts, goes all the way back to 1777, when a U.K. man named William Bass decided to use his small brewery as a hotel.

This operation would turn into a company called Bass Hotels, which purchased the international division of the Holiday Inn chain in 1988 and then the North American division in 1990. In 1998, Bass Hotels acquired the InterContinental Hotels chain.

In 2003, these brands were consolidated under the InterContinental Hotels Group umbrella alongside the newly formed Holiday Inn Express, Candlewood Suites and Staybridge Suites brands.

In 2013, IHG unveiled its Rewards Club loyalty program, which was one of the first and largest hotel loyalty programs at the time. However, over the years, other hotel chains began to launch loyalty programs that were much more lucrative than the IHG Rewards Club program, causing the program to fade into relative obscurity.

In response, IHG overhauled its loyalty program in 2022, renaming the program IHG One Rewards and adding new milestone benefits, free breakfast and better points-earning rates. These changes have put the IHG rewards program back on the map.

IHG Hotel Brands

Today, IHG consists of 19 brands with a total of more than 6,000 properties across six continents, making it one of the largest hotel chains in the world. Here are the brands that are currently part of the IHG portfolio:

| Atwell Suites | Holiday Inn Club Vacations | Regent Hotels & Resorts |

| Avid Hotels | Holiday Inn Express | Six Senses |

| Candlewood Suites | Hotel Indigo | Staybridge Suites |

| Crowne Plaza Hotels & Resorts | HUALUXE | Vignette Collection |

| EVEN Hotels | Iberostar Beachfront Resorts | voco Hotels |

| Garner Hotels | InterContinental Hotels & Resorts | |

| Holiday Inn | Kimpton Hotels & Restaurants |

With so many different properties scattered across the globe, there are ample opportunities to earn IHG rewards points, the rewards currency of the IHG One Rewards program.

The IHG portfolio includes a wide variety of property types, including IHG resorts for families, budget hotels, ski resorts, luxury properties in some of the world’s finest cities, beachfront resorts and more.

How the IHG One Program Works

The basic idea of the IHG One Rewards program is that members can join for free, earn rewards points whenever they stay at an eligible IHG hotel and then redeem those points for stays at IHG hotels. Plus, by staying at IHG hotels frequently, you can earn IHG One elite status, which entitles you to special benefits other customers may have to pay for or not be able to access.

However, there’s a whole lot more to the IHG One Rewards program than what I’ve described thus far. Staying at IHG hotels is far from the only way to earn rewards points through this program, and these rewards points can be redeemed for much more than just hotel stays.

In this article, we’re going to look at everything you need to know about the IHG One Rewards program, plus ways to achieve elite status and the benefits that come with those statuses, so you can make the most of this program and all it has to offer.

Key Features of the IHG One Rewards Program

In discussing the IHG One Rewards program, it simplifies things to break the program down into its key features. For the purposes of this article, we’re going to regard the following key features of this program: earning elite status, earning IHG points and redeeming IHG points.

IHG One Rewards Elite Status

In addition to awarding rewards points (which can be redeemed for award nights and more), you will also earn elite qualifying nights and elite qualifying points when staying at eligible IHG locations. These are the metrics you need to achieve elite status.

Each elite status tier has different prerequisites and benefits, some of which can dramatically increase the number of IHG rewards points you’ll earn or the perks you’ll get when staying at IHG-owned properties.

How to Earn IHG Elite Status

There are four basic ways to earn elite status with IHG:

- Complete enough elite qualifying nights within a calendar year.

- Earn enough elite qualifying points within a calendar year.

- Sign up for the IHG One Rewards Premier Credit Card (which comes with automatic IHG Platinum Elite status) or the IHG One Rewards Traveler Credit Card (which comes with automatic IHG SIlver Elite status).

- Purchase an InterContinental Ambassador membership for $200 per year and receive automatic IHG Platinum Elite status.

If you’re in the market for a new credit card anyway and you tend to stay with IHG more than other hotel chains, getting an IHG co-branded credit card could be worthwhile, especially when the annual fee for the IHG Rewards Premier card is just $99. And, while the $200 annual fee for an InterContinental Ambassador membership is a bit pricey, it could be worth it if you mostly stay at InterContinental-branded hotels.

IHG One Rewards Premier Credit Card

Offer Ending Soon! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Elite qualifying nights are earned on nights booked directly through IHG, and which are not booked at discounted or corporate rates. Here are some other rates that don’t earn elite qualifying nights:

- Employee discount rates

- Hotel-provided complimentary rooms

- Rooms booked through online travel agencies or other third parties

- Rates provided by a tour operator or wholesaler

It’s worth noting that members of the IHG One Rewards program will receive elite qualifying nights for award nights.

Elite qualifying points are slightly more complicated. They include points earned on rates paid for qualifying nights (per the criteria above for elite qualifying nights), points earned through spending on IHG co-branded credit cards, points earned through spending with IHG Business Rewards and points earned from bonus points packages.

If you spend a lot of nights at low-cost IHG hotels, then completing qualifying nights is probably your best bet for earning elite status. If you stay at high-end IHG properties, then you’ll be more likely to achieve elite status by earning elite qualifying points (since staying at high-end properties will earn you a lot of points quickly).

Whether you’re planning on earning elite status by accumulating elite qualifying nights or by earning elite qualifying points, here’s how many you’ll need to achieve each tier.

| Status tier | EITHER elite qualifying nights required | OR elite qualifying points required | OR other ways to earn |

|---|---|---|---|

| Club | N/A | N/A | Just sign up for IHG One Rewards. |

| Silver Elite | 10 | N/A | Sign up for the IHG® Rewards Traveler Credit Card. |

| Gold Elite | 20 | 40,000 | Spend $20,000 in a calendar year on the IHG® Rewards Traveler Credit Card. |

| Platinum Elite | 40 | 60,000 | Sign up for the IHG® Rewards Premier Credit Card. |

| Diamond Elite | 70 | 120,000 | Spend $40,000 in a calendar year on the IHG® Rewards Premier Credit Card. |

IHG One Rewards Premier Credit Card

Offer Ending Soon! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

Signing up for an IHG co-branded credit card is probably the simplest and cheapest way to achieve elite status with IHG. However, elite status earned this way won’t get you any closer to the higher tier levels.

For instance, if you have Platinum Elite status because you have the IHG Rewards Premier Credit Card, you would still need to complete 70 elite qualifying nights or earn 120,000 elite qualifying points starting from zero to achieve Diamond Elite status.

Benefits of IHG Elite Status

All members of IHG One Rewards, even Club-level members, receive certain perks, including free internet, access to member rates and member promotions and 2 p.m. checkout (subject to availability).

Silver Elite status members with IHG One Rewards earn a 20% bonus on base points earned. Points earned by elite members also never expire (whereas points earned by Club-level members will expire if your account becomes inactive for a period of 12 months or longer). Silver Elite status members also receive priority check-in.

Gold Elite status members earn a 40% bonus on base points earned plus all of the perks that come with Silver Elite status. Plus, Gold Elite members can rollover nights toward next year’s status.

Platinum Elite status members earn a 60% bonus on base points earned plus all of the perks that come with Gold Elite status. Plus, they receive reward night discounts, guaranteed room availability (up to 72 hours), complimentary room upgrades (subject to availability), a welcome amenity at check-in (either bonus points or a drink/snack) and early check-in (subject to availability).

Diamond Elite status members earn a 100% bonus on base points earned plus all of the perks that come with Platinum Elite status. Plus, they receive dedicated Diamond support, exclusive Hertz Gold Plus Rewards® Five Star® Upgrade and free breakfast (at full-service hotels and resorts).

InterContinental Ambassador Program

Another way to earn elite status with the IHG One Rewards program is to enroll in the InterContinental Ambassador program. As mentioned before, this membership has an annual fee of $200 and comes with automatic IHG Platinum Elite status. It’s worth noting that IHG One Rewards members can purchase an InterContinental Ambassador membership for 40,000 IHG points per year. However, this membership is worth paying attention to for more than just IHG elite status.

The best benefit of Ambassador status is probably the complimentary weekend night certificate. This certificate can be used on the second night of a minimum two-night paid weekend stay, based on the Ambassador Complimentary Weekend Night Rate at most InterContinental properties worldwide. Generally, weekend nights are considered Friday, Saturday or Sunday night.

To be clear, the complimentary weekend night certificate that comes with Ambassador status can be used only at three brands in IHG’s portfolio: InterContinental, Kimpton and Regent. Originally, the complimentary weekend night certificate could be used only at InterContinental Hotels & Resorts properties on weekend nights. However, in 2020, IHG expanded this perk so that it could be used at Kimpton and Regent properties any day of the week.

All complimentary weekend nights are valid for 12 months from the date they’re issued (which should be the same day you enroll in the program). You can use these complimentary weekend night certificates to book rooms that would otherwise cost $200 or more, meaning this perk alone can offset the annual fee charged for an InterContinental Ambassador membership immediately.

Here are some of the other perks that come with an InterContinental Hotels & Resorts membership:

- Guaranteed one-category room upgrade

- Automatic IHG Platinum Elite status

- Guaranteed 4 p.m. checkout

- Complimentary mineral water and internet

- Single room rate for double occupancy

All of the previously listed perks apply only to InterContinental Hotels & Resorts locations and may not be honored at Regent or Kimpton properties. However, InterContinental Ambassadors are entitled to the following perks at any property in IHG’s portfolio:

- Complimentary room upgrades (subject to availability)

- Guaranteed room availability

- Extended checkout (subject to availability)

- Elite rollover nights

- 50% bonus earnings on top of base points

- Free internet

In addition, Ambassador status members are entitled to some special perks at Six Senses, a chain of luxury five-star hotels, resorts and spas acquired by IHG in 2019:

- Complimentary breakfast every day in the main restaurant

- A signature amenity of either a complimentary 50-minute massage for two or a local experience once per stay

- Complimentary one-category room upgrade (subject to availability)

- 4 p.m. checkout (subject to availability)

- 10 a.m. check-in (subject to availability)

The InterContinental Ambassador program is unique in the hotel loyalty industry as it’s the only elite status you can purchase. And, as you can see, you can easily offset the $200 annual fee if you take advantage of all the perks offered through this program.

Kimpton Inner Circle

Before the Kimpton Hotels & Restaurants brand was absorbed by IHG, this hotel chain had its own loyalty program with its own elite status. And, while the Kimpton Karma Rewards loyalty program was replaced by IHG One Rewards in 2018, Kimpton Inner Circle status still exists.

Kimpton Inner Circle status is invite-only and, unlike with IHG One elite status, there are no qualification requirements published for earning this status. However, based on crowdsourced data, we know you need to be an IHG One Diamond Elite member in order to score an invite to Kimpton Inner Circle. You also have to show loyalty to the Kimpton brand, but it’s not entirely clear what that means.

If you’re lucky enough to get an invite to this exclusive elite status, you’ll receive the following benefits:

- Complimentary in-room snack and drink of your choice for each stay

- Complimentary chef’s taste (usually appetizer or desert) when you eat at Kimpton restaurants

- One new hotel free night certificate each calendar year (in a deluxe category room)

- Guaranteed one-category room upgrade

- Guaranteed early check-in (from 10 a.m.) and late checkout (until 4 p.m.)

- Waived amenity fees

- Premium internet

- VIP phone line

So, while it’s not entirely clear what you need to do to earn Kimpton Inner Circle status, this status definitely comes with some valuable perks.

How to Earn IHG Points

To earn IHG points, the very first thing you’ll need to do is go to the IHG One Rewards website and sign up for an account. Enrolling in the IHG One Rewards program is free and takes only a few minutes.

Once you’ve signed up, you can start earning IHG points by staying at IHG-owned properties, through special promotions, with IHG partners, by spending on IHG co-branded credit cards and more.

Hotel Stays with IHG Properties

All IHG One Rewards members earn 10X base IHG points per dollar spent on qualifying stays at most IHG hotels, except Staybridge Suites and Candlewood Suites, where you earn 5X base IHG points.

If you have elite status with IHG, you’ll earn a percentage bonus on the base points. Here are the points bonuses for each elite status tier:

- Silver Elite: 20%

- Gold Elite: 40%

- Platinum Elite: 60%

- Diamond Elite: 100%

So, for example, if you were to spend $200 on a stay at a Hotel Indigo, you would earn 2,000 IHG points if you had Club status in the IHG One Rewards program. However, if you had Gold Elite status and you completed the same stay, you would earn 2,800 IHG points (with the 40% bonus).

Milestone Rewards Celebrating Your Loyalty Journey

On top of the bonus points you earn by being an elite member, you earn even more rewards with a program feature that was introduced earlier in 2022 known as Milestone Rewards. These are rewards that all IHG One Rewards members can earn every time they complete 10 qualifying nights at IHG locations, starting at 20 nights.

Here are the different reward options for each 10 nights:

| Number of nights | Number of rewards you can choose | Reward options |

|---|---|---|

| 20 nights | One | • 5,000 bonus points • Two $20 food and beverage rewards • One confirmable suite upgrade |

| 30 nights | One | • 5,000 bonus points • Two $20 food and beverage rewards |

| 40 nights | Two | • 10,000 bonus points • Five $20 food and beverage rewards • One confirmable suite upgrade • One annual lounge membership |

| 50 nights | One | • 10,000 bonus points • Five $20 food and beverage rewards |

| 60 nights | One | • 10,000 bonus points • Five $20 food and beverage rewards |

| 70 nights | Two | • 10,000 bonus points • Five $20 food and beverage rewards • Two confirmable suite upgrades • One annual lounge membership |

| 80 nights | One | • 10,000 bonus points • Five $20 food and beverage rewards |

| 90 nights | One | • 10,000 bonus points • Five $20 food and beverage rewards |

| 100 nights | One | • 10,000 bonus points • Five $20 food and beverage rewards |

Any nights that are considered elite qualifying nights will be counted toward your Milestone Rewards. When it comes to choosing your Milestone Rewards, you should consider that IHG points are typically valued at around 0.5 cent apiece.

So, given the choice between 5,000 bonus points (a value of $25) or two $20 food and beverage rewards (a value of $40), the food and beverage rewards would be the more valuable option.

Likewise, given the choice between 10,000 bonus points (a value of $50) and five $20 food and beverage rewards (a value of $100), the food and beverage awards would still be the more valuable option.

Spending With IHG Credit Cards

Another fantastic way to nab IHG points quickly is to sign up for an IHG co-branded credit card and get the welcome bonus that each card offers for hitting certain spending thresholds. IHG is currently offering three credit cards (two personal cards and one business card), all of which are issued by Chase.

Here are the three IHG co-branded credit cards and their main features:

| Card name | Annual fee | Spending bonuses | Other notable benefits |

|---|---|---|---|

| IHG One Rewards Premier Business Credit Card | $99 | • 10X points on qualifying purchases made at IHG hotels • 5X points on other travel and hotels • 5X points at gas stations • 5X points at restaurants (including takeout and eligible delivery) • 5X points on social media and search engine advertising and at office supply stores • 3X points on everything else | • Automatic Platinum Elite status • Ability to earn Diamond Elite status by spending $40,000 in a calendar year • Free night award worth up to 40,000 points every cardmember anniversary • A $100 statement credit and 10,000 bonus points after spending $20,000 each calendar year • An additional free night award worth up to 40,000 points when you spend $60,000 in a calendar year • Redeem for three nights, get the fourth night free • Application fee reimbursement for TSA PreCheck or Global Entry • Up to $50 United Airlines TravelBank cash every calendar year • 20% discount when you buy IHG points through IHG.com |

| IHG One Rewards Premier Credit Card | $99 | • 10X points on qualifying purchases made at IHG hotels • 5X points on other travel and hotels • 5X points at gas stations • 5X points at restaurants (including takeout and eligible delivery) • 3X points on everything else | • Automatic Platinum Elite status • Ability to earn Diamond Elite status by spending $40,000 in a calendar year • Free night award worth up to 40,000 points every cardmember anniversary • A $100 statement credit and 10,000 bonus points after spending $20,000 each calendar year • Redeem for three nights, get the fourth night free • Application fee reimbursement for TSA PreCheck or Global Entry • Up to $50 United Airlines TravelBank cash every calendar year • 20% discount when you buy IHG points through IHG.com |

| IHG One Rewards Traveler Credit Card | $0 | • 5X points on qualifying purchases made at IHG hotels • 3X points at gas stations • 3X points at restaurants (including takeout and eligible delivery) • 3X points on utilities, internet, cable and phone services and select streaming services • 2X points on everything else | • Automatic Silver Elite status • Ability to earn Gold Elite status by spending $20,000 in a calendar year • 10,000 bonus points after spending $10,000 each calendar year • Redeem for three nights, get the fourth night free • 20% discount when you buy IHG points through IHG.com |

It’s worth noting that both the Premier card and the Premier business card offer 10X points on stays at IHG hotels and also offer automatic Platinum Elite status, which offers an additional 6X points on stays at IHG hotels. Plus, all IHG One Rewards members get a baseline of 10X points on stays at IHG hotels. So, if you pay for a stay at an IHG hotel with one of these cards, you’ll receive 26X points.

The IHG Rewards Traveler Credit Card also offers some great benefits for a card with no annual fee, particularly the ability to achieve Silver Elite status instantly. Plus, the IHG Rewards Traveler card offers some excellent spending bonuses.

Unfortunately, in the world of hotel loyalty points, IHG points aren’t all that valuable, meaning the points you earn with these cards aren’t worth as much as with some other hotel loyalty credit cards.

That said, the $99 IHG Rewards Premier Credit Card offers some perks that can easily offset its cost. For one, the annual free night award worth up to 40,000 points can easily be redeemed for a value of over $99. You can also combine IHG points from your account with the free night award to exceed the 40,000-point limit.

Additionally, the reimbursement the TSA PreCheck, Global Entry or Nexus applications and the $50 United Airlines TravelBank cash instantly offset the annual fee. On top of all that, the IHG Rewards Premier card comes with automatic Platinum Elite status, which comes with a 60% bonus to your IHG points earnings.

For any small business owners out there, the IHG Rewards Premier Business Credit Card is a solid option. It’s essentially the same thing as the IHG Rewards Premier personal card, except you’ll earn 3X points on social media and search engine advertising as well as office supply stores, and you’ll also have the ability to earn a second free night award by spending $60,000 each a calendar year.

Finally, if you’re interested in signing up for an IHG co-branded credit card, you should check where you are regarding Chase’s 5/24 rule first. If you’re over the 5/24 limit, then you may be rejected for one of these cards even if you have qualifying credit.

Transfer Points From Chase Ultimate Rewards

If you aren’t super loyal to IHG or you just don’t stay in hotels often, it could be difficult to rack up points with the IHG One Rewards program without signing up for an IHG co-branded credit card, which you may not want to do.

Luckily, you can transfer points from the Chase Ultimate Rewards program to the IHG One Rewards program at a 1:1 ratio. This is probably the best option for boosting your IHG points balance if you aren’t an IHG loyalist.

Chase points can be transferred via your online Chase account or through the Chase app by logging in and navigating to the “Rewards” section. From there, you can go to the “Earn/Use” drop-down menu and click the “Transfer to Travel Partners” option. Finally, choose the partner you wish to transfer to (such as IHG One Rewards) and the number of points you wish to transfer.

Promotions

IHG sometimes offers promotions that can help IHG One Rewards members accumulate points quickly for meeting a certain set of conditions. Usually, the promotion will offer a certain number of bonus points for staying a certain number of nights at IHG-owned hotels. However, they’ll occasionally run promotions that offer bonus points for other things, such as booking tours or activities through IHG.

To take advantage of these promotions, you can go to IHG’s website and click on the “Offers” tab on the top of the homepage. Then, you’ll need to register for whatever promotion you’re interested in to receive any bonus points.

IHG One Rewards Dine & Earn

Like most hotel loyalty programs, IHG One Rewards has its own dining program, IHG One Rewards Dine & Earn, that allows you to earn points for dining at partnered restaurants. The program is free to join. All you have to do is sign up and link a credit card. Then, every time you make a purchase at a partnered restaurant, you’ll earn IHG points. You can also go on the IHG One Rewards Dine & Earn website and search for partnered restaurants.

When you join the program, you will be a basic member and earn 1X IHG point per dollar spent at participating restaurants. However, if you simply opt in to receive emails from IHG One Rewards Dine & Earn, you can quickly become a Select member and boost your earnings to 5X points per dollar. If you opt in for emails and complete 11 qualifying transactions in a year, you’ll become a VIP member and start earning 8X points per dollar.

It’s worth noting that any IHG points you earn through IHG One Rewards Dine & Earn will be in addition to whatever points or miles you’re earning with your linked credit card. So, when setting up your IHG One Rewards Dine & Earn account, you should link the card with the best dining rewards.

Other Partners

You can earn IHG points by spending money with certain partners. For instance, as an IHG One Rewards member, you can earn 2,000 points per qualifying stay at The Venetian Resort in Las Vegas (and receive a discounted room rate). You can also earn 10,000 IHG points by booking a getaway with Holiday Inn Club Vacations.

You can earn 1,500 IHG points for each qualifying car rental through Hertz plus even more points per day. You can earn up to 500 points on qualifying food deliveries from Grubhub. And, finally, you can earn up to 500 points for completed dining reservations with OpenTable.

Buying IHG Points

IHG One Rewards members can purchase up to 150,000 points every year. Note that you can also gift up to 150,000 points per year, and there’s no limit to how many points you can receive.

Buying points (from IHG One Rewards or any other rewards program) is typically not a good deal. The normal price at which IHG sells points is 1 cent per point. Considering that IHG points are valued at 0.5 cent per point, you’re actually losing a lot of value on this deal. Plus, since all points sales are processed by Points.com, purchasing points won’t trigger any travel-related spending bonuses.

Occasionally, IHG runs promotions offering bonus points or discounts when you purchase points, but we’d still recommend not purchasing points in these cases.

IHG One Rewards Traveler Credit Card

Offer Ending Soon! Earn 90,000

Bonus Points

after spending $2,000 on purchases within the first 3 months from account opening and up to 30,000 more points by earning 3 additional points in the first 6 months from account opening on purchases that earn 2x and 3x on up to $10,000 spent

IHG One Rewards Premier Credit Card

Offer Ending Soon! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

How to Redeem IHG Points

Of course, the most obvious way to redeem IHG points is for hotel stays. However, there are several other ways to redeem your IHG points that you may want to consider. And while the IHG One Rewards program doesn’t have as many redemption options as some other hotel loyalty programs, there are definitely still some places where you can find real value within the program.

Hotel Stays

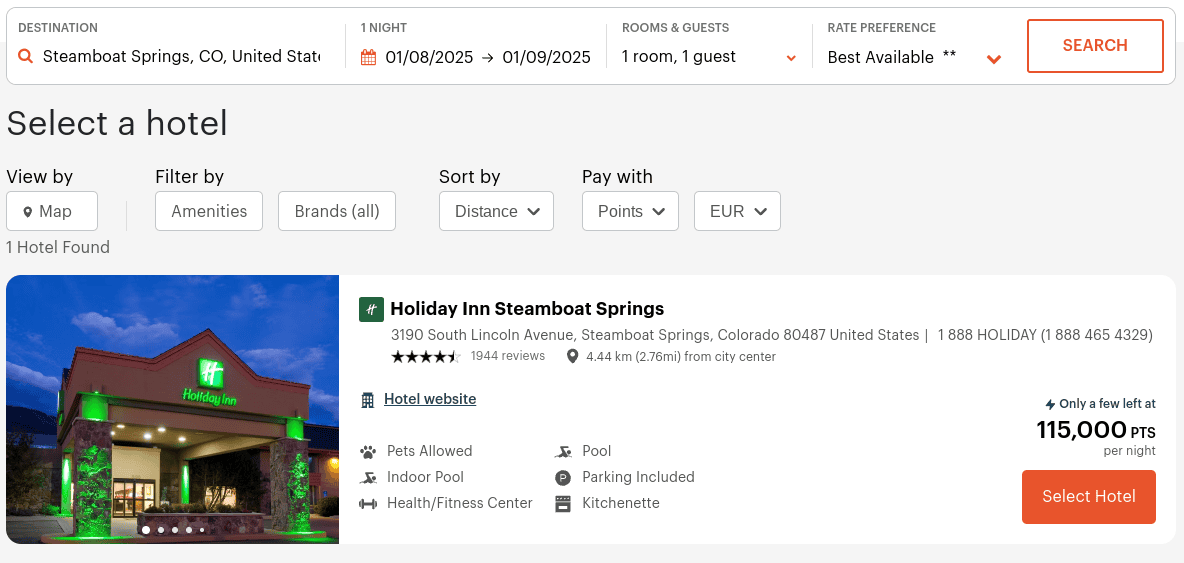

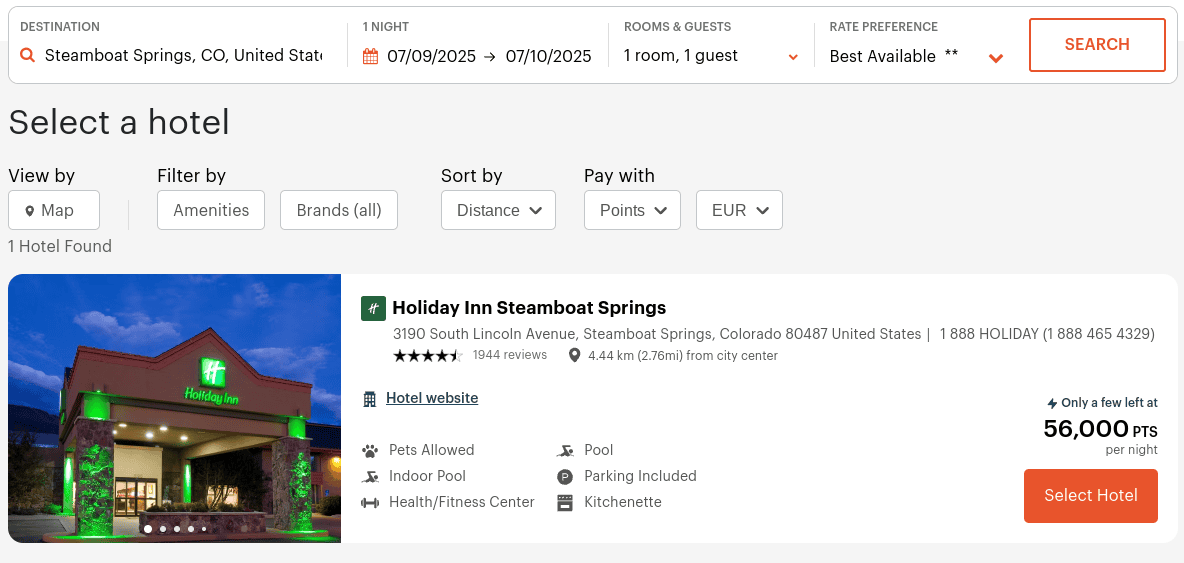

Because IHG uses dynamic award pricing, the redemption rates for the same hotel room can vary heavily throughout the year. For instance, we conducted a search that showed that a room at the Holiday Inn Steamboat Springs (one of the best IHG ski resorts) starts at 115,000 points on January 8, 2025.

However, on July 9, 2025, a room at the Holiday Inn Steamboat Springs starts at 56,000 points.

This is probably because January 8 is during peak season, whereas July 9 is during off-peak season. If you want to find the cheapest possible redemption rates, it’s better to search for award stays during off-peak times. However, IHG doesn’t publish peak and off-peak dates, so you’ll have to conduct some searches to find out which dates fit into which category.

To search for award stays, you can simply navigate to the IHG website, put in your desired dates and location and click the “Search” button. Once the results are displayed, you need to click on the “Display Price in” drop-down menu and select the “Points” option. You will then be shown the rates in points for your results.

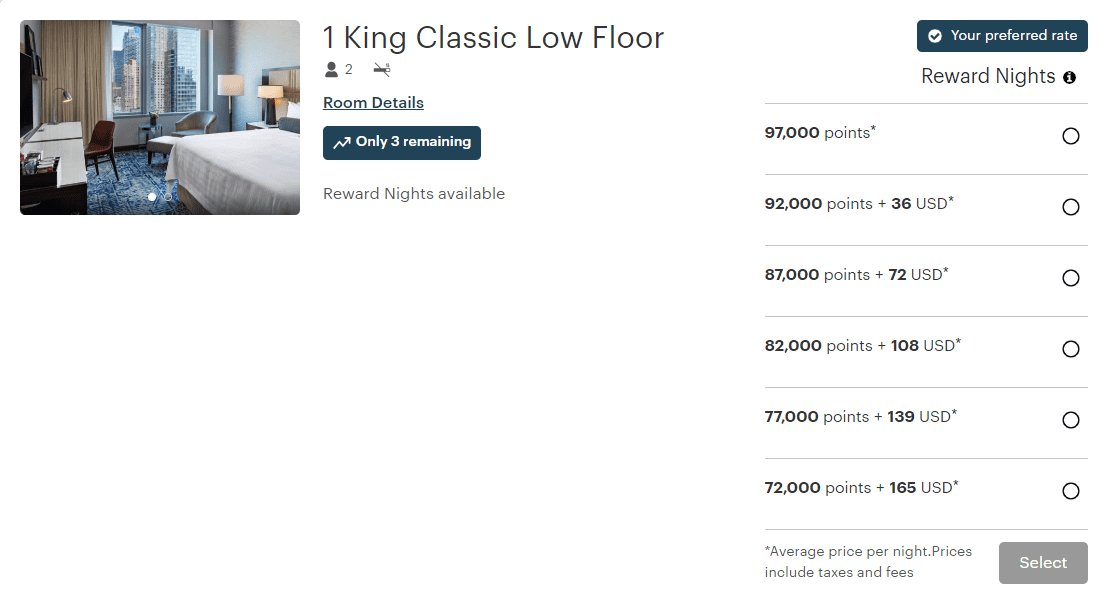

Points+Cash

In addition to booking hotel rooms entirely with points or entirely with cash, IHG gives you the option to book stays with a combination of points and cash. To do so, instead of selecting “Points” from the “Display Price in” drop-down menu, select “Points + Cash.”

You can then pick your desired hotel and see your different options for paying with points and cash.

While this is a good way to get a higher-priced hotel room if you don’t have enough IHG points in your account to cover it, using the Points + Cash option is typically not the best way to get the most value out of your points. We recommend crunching the numbers first.

Convert to Airline Miles

The IHG One Rewards program allows you to convert your IHG miles to airline miles with certain frequent flyer programs. Unfortunately, this is a low-value redemption option as the transfer ratio between IHG and nearly all of its airline partners is 5:1. Click this link to see a full list of the airlines you can transfer your IHG miles to.

If you want to convert your IHG points into airline miles, you must initiate the process over the phone. You can do so by calling IHG customer service at 1-888-211-9874. Miles will be deposited in your account between 14 and 21 days in most cases.

As a side note, with all of the airlines on that list, you can elect to earn airline miles instead of IHG One Rewards points for your stays at IHG-owned hotels. In most cases, you’re better off earning airline miles on your stays in the first place rather than earning IHG points and then converting them into airline miles.

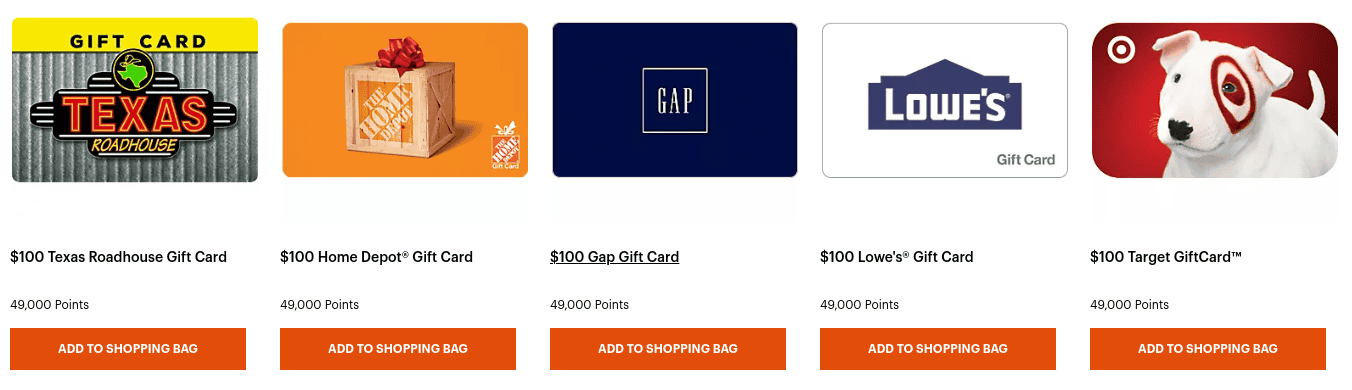

Gift Cards, Merchandise and Event Tickets

You also can redeem IHG points for gift cards, merchandise and event tickets through the IHG One Rewards shopping portal. However, the value of these redemptions is usually much lower than redeeming for an award stay. Still, if you don’t plan on redeeming your IHG points for hotel stays, this is a decent option.

For instance, you could redeem 49,000 points for a $100 gift card to any of the merchants shown above (Texas Roadhouse, Home Depot, Gap, Lowe’s and Target), which yields a value per point of slightly more than2 cents. That’s a very low value when you consider that other redemption methods can yield more than 1 cent per point in value.

Digital Rewards

It’s also possible to use IHG One Rewards points to purchase digital rewards, such as magazine subscriptions, eBooks, games, music, movies and more. Keep in mind that redeeming this way typically doesn’t provide good value per point.

Donate Points

IHG gives you the option to donate your points to one of its nonprofit charity partners. Some of these partners include No Kid Hungry, Goodwill, National Center for Civil and Human Rights, American Red Cross and more.

For most of the charities, you can donate in increments of either 2,500, 5,000 or 10,000 points. While this is a good way to use your points to help the world, it’s not the best way to get the most value out of your points.

Strategies to Maximize Your IHG Rewards

Now that we’ve glanced over all of the different ways you can redeem points through the IHG One Rewards program, let’s take a closer look at how you can maximize the value of your points.

Search for High-Value Properties

In general, you’ll always get the most value out of IHG points by redeeming them for hotel stays. However, within the IHG portfolio, award stays at certain hotels offer more value than others. To calculate how much value a particular redemption provides, you can divide the cash price of that redemption by the number of points required for that redemption. For instance, if you can book a hotel room for $100 or 10,000 points per night, then that redemption would provide a value of 1 cent per point ($100 / 10,000 points = $0.01).

If you want to maximize the value you get out of your IHG One Rewards points, you should compare redemption values by doing these calculations. To help you get started, we’re going to look at three of the locations in the IHG portfolio that tend to offer a lot of value per point.

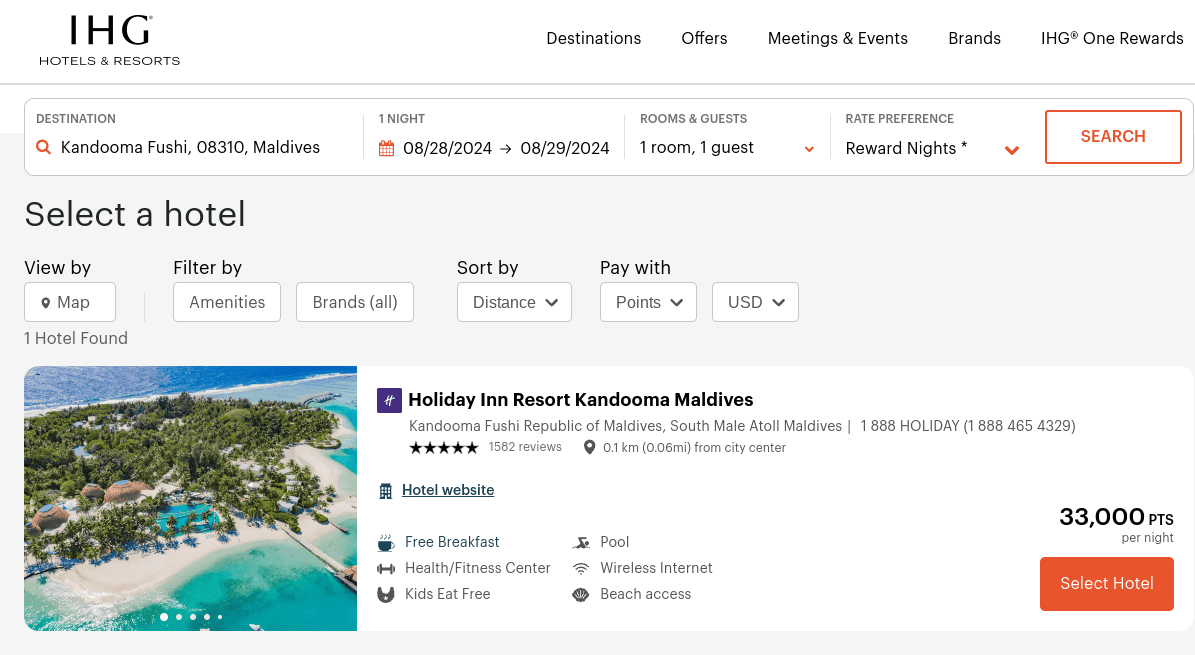

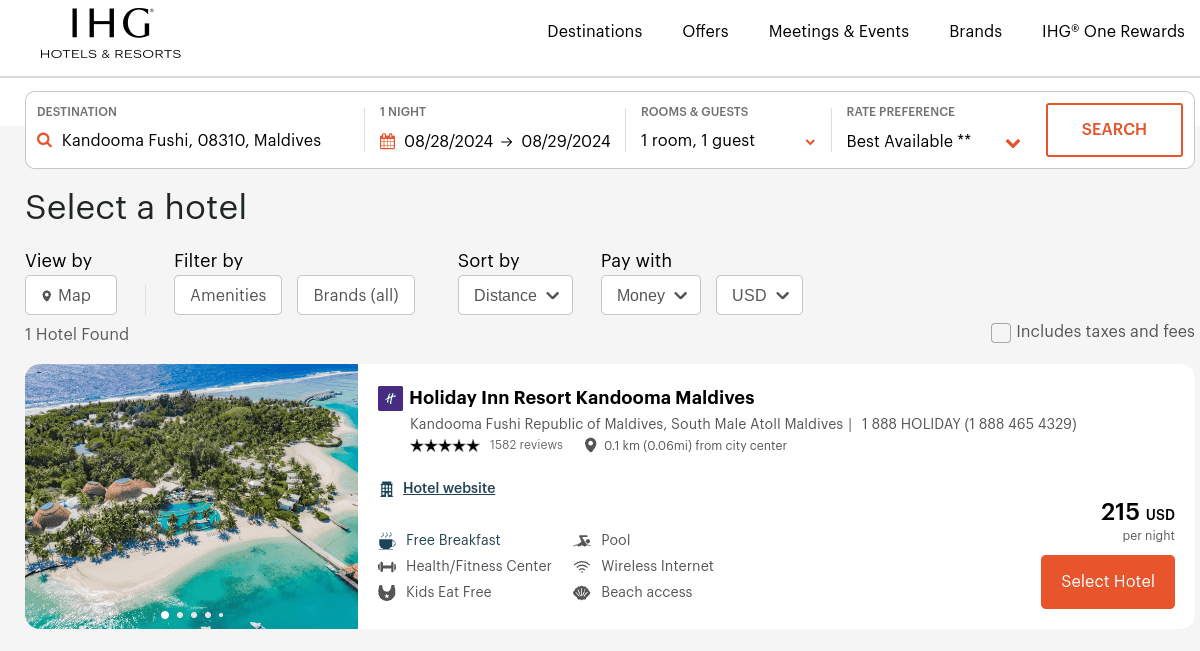

1. Holiday Inn Resort Kandooma Maldives

Not only is the Holiday Inn Resort Kandooma Maldives one of the finest IHG beach resorts, this location also tends to provide solid value per point at certain times of the year.

For instance, you can book a room at the Holiday Inn Resort Kandooma Maldives in late August for 33,000 points per night.

If you were to book the same room on the same night with cash instead of points, it would cost you $215.

Thus, this redemption would yield a value of nearly 0.7 cent per point, which is on the high side for IHG points.

Plus, this resort includes top-of-the-line amenities, including free breakfast, an on-site spa, PADI scuba diving courses, infinity pools and more. If you have a balance of IHG points saved up, booking a few nights at the Holiday Inn Kandooma Maldives would be a great way to spend them.

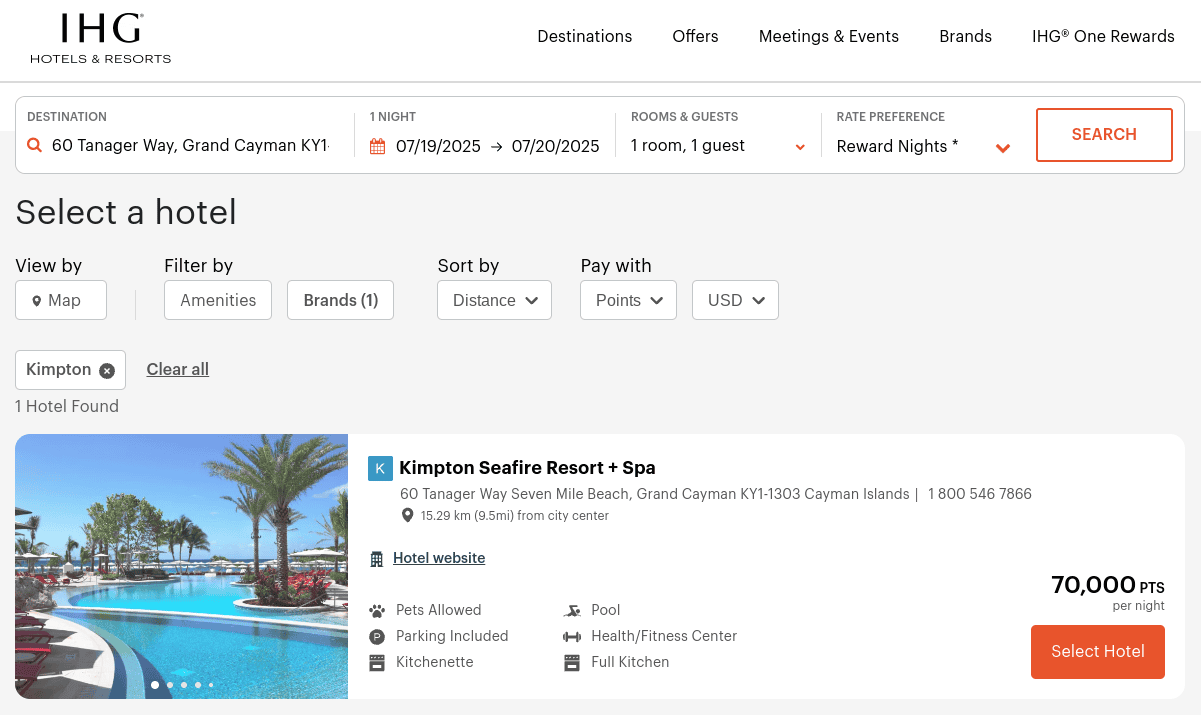

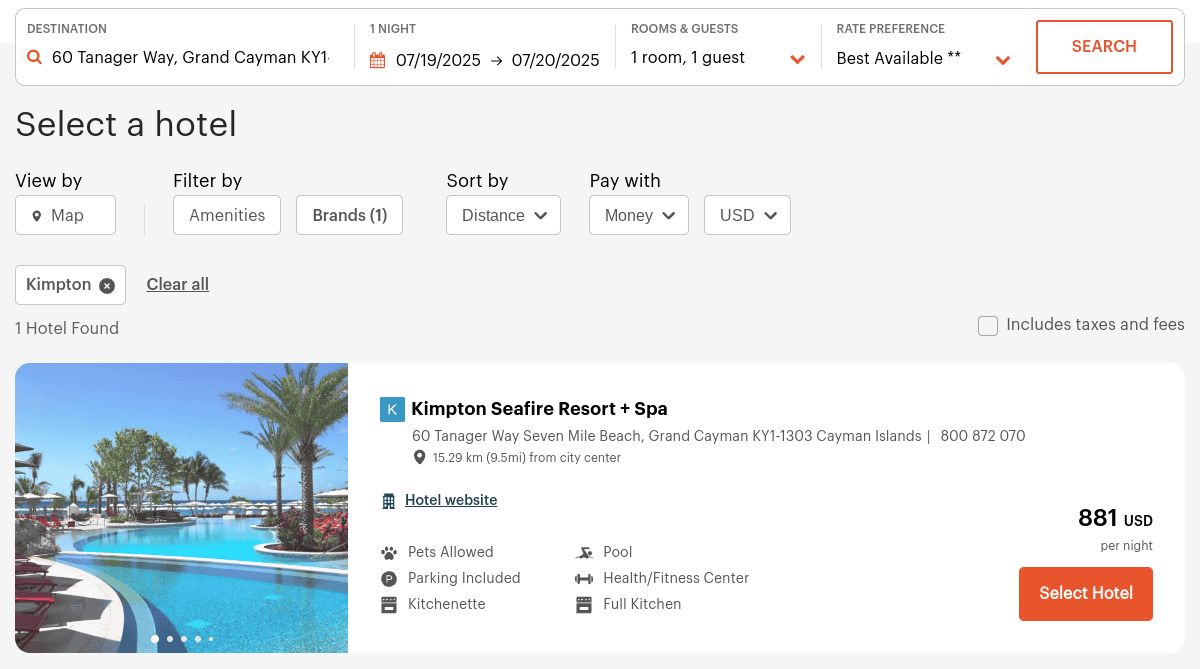

2. Kimpton Seafire Resort + Spa

One property in the IHG portfolio that tends to offer amazing value is Kimpton Seafire Resort + Spa, located in Grand Cayman in the Cayman Islands. This is both an incredible vacation destination and an excellent way to get outsized value out of your IHG points.

For example, we found a room available at the Kimpton Seafire Resort + Spa for 70,000 points per night.

If you were to book the same room on the same night with cash instead of points, it would cost you $881.

Thus, this redemption would yield a value of nearly 1.3 cents per point, which is excellent for IHG One Rewards points.

Plus, all rooms and suites at this location offer floor-to-ceiling windows and spectacular views of Seven Mile Beach. The resort also features several on-site restaurants serving a wide variety of cuisines. If you want to maximize the value of your IHG points and experience an incredible beachfront resort, visiting the Kimpton Seafire Resort + Spa in Grand Cayman is a great idea.

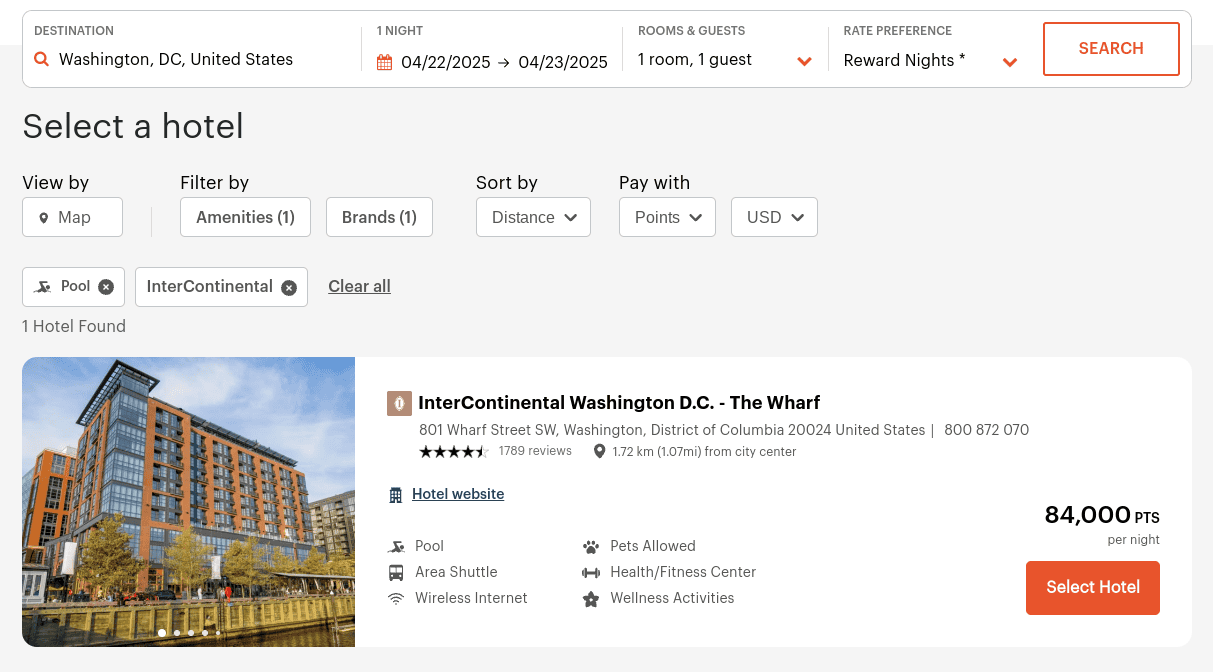

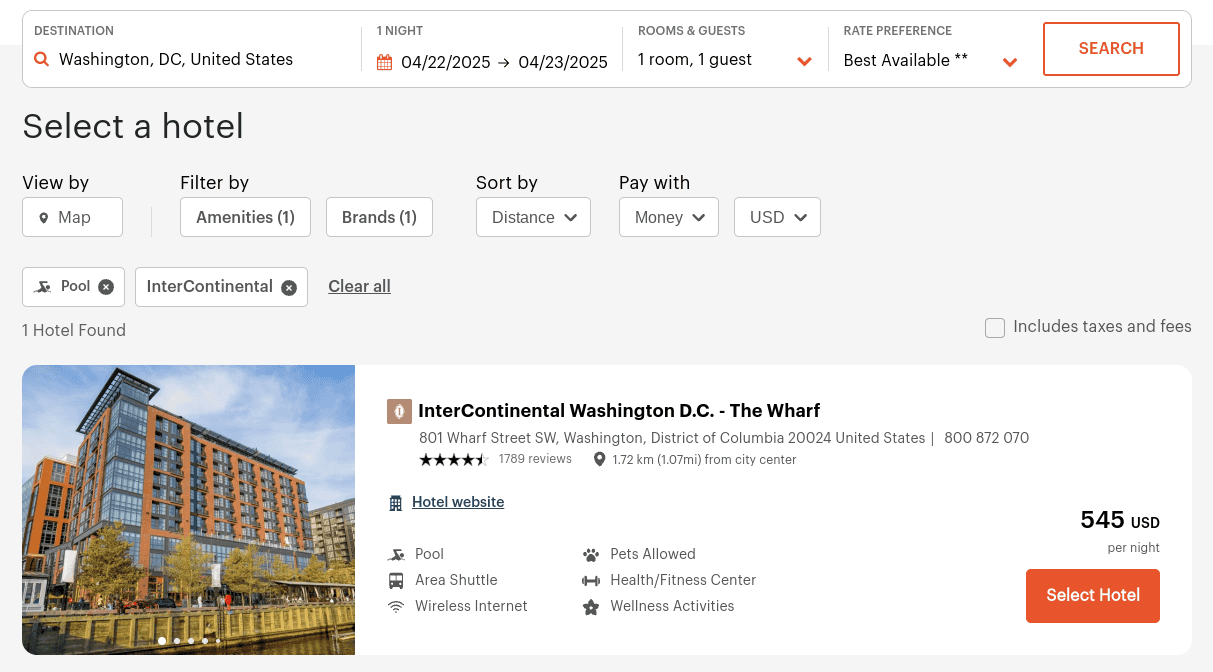

3. InterContinental Washington D.C. – The Wharf

For some reason, reward stays at IHG hotels in the Washington, D.C. area tend to provide above-average value per point. And, one of the properties that consistently offers high value in this area is the InterContinental Washington D.C. – The Wharf.

For example, we found an offer for a reward stay at this property for 84,000 points per night.

If you were to book the same room on the same night at this location with cash instead of IHG points, it would cost you $545.

So, this redemption would give you a value of over 0.6 cent per point, which is above average for IHG One Rewards points.

The InterContinental Washington D.C. – The Wharf is also located in one of the hippest parts of the city, overlooking the water and surrounded by bars and restaurants. If you’re looking to spend time in Washington, D.C. and you want to get above-average value for your IHG points, booking an award stay at this location is a great way to do so.

Use the Fourth Night Free Perk from IHG Credit Cards

One of the best ways to get good value out of IHG One Rewards points is to utilize the “fourth night free” perk that comes with all IHG co-branded credit cards. Essentially, if you have an IHG credit card and you book a reward stay of four or more consecutive nights at an IHG location, the fourth night will be free.

This works the same way whether you’re redeeming points for a stay at a $1,000-per-night luxury resort or a cheap budget hotel. It’s worth noting, however, that you’ll still be required to pay any applicable incidental fees (such as parking fees or mandatory resort fees) for your free night.

This “fourth night free” benefit can be used as many times per year as you like. If you have one of the three IHG One Rewards credit cards, this benefit will apply each time you book a reward stay of four or more consecutive days.

Top Off Free Anniversary Night Certificate With Points

The IHG One Rewards Premier and the IHG One Rewards Business Premier card both offer a free night certificate worth up to 40,000 points each cardmember anniversary. And the IHG One Rewards Business Premier card offers an additional free night certificate worth up to 40,000 points for cardmembers who spend $60,000 on their card in a calendar year.

If you have one of these free night certificates, IHG allows you to top it off in order to redeem it for reward nights that are greater than the 40,000 point threshold. For instance, if you wanted to purchase an award night for 50,000 points, you could do so by using your free night certificate plus 10,000 points from your account.

This is a great way to get good value out of your IHG One Rewards points and also to make sure you use your free night certificate to the fullest. For instance, if you were to use your free night certificate for an award night that only cost 35,000 points, then you’re essentially leaving 5,000 points unused on your certificate. But, by using your certificate for an award night that’s more than 40,000 points, you’re ensuring you use all 40,000 points of that certificate’s value.

Digital Convenience With the IHG App and Online Account

In order to get the most out of the IHG One Rewards program, we recommend downloading the IHG One Rewards app, available in the Apple Store and Google Play Store. This app allows you to quickly and easily search for stays at IHG properties, which can make it easier to identify sweet spots in the IHG One Rewards program.

Plus, you can use the IHG One Rewards app to get updates about your arrival, complete your checkout and even pay your bill.

However, if you prefer to search for hotel stays from a desktop, the IHG One Rewards website is very easy to use. Simply sign into your IHG One Rewards account and you can search for award stays by location, dates and more.

Answers to Common Questions About IHG One Rewards

We hope we’ve covered almost all of the pertinent information for understanding the IHG One Rewards program. However, to tie up any loose ends, we’re going to cover a few frequently asked questions about this loyalty program.

How Long Does It Take IHG Points to Show Up in Your Account?

As a member of the IHG One Rewards program, you’ll earn points every time you complete a paid stay at an eligible IHG property. However, these points may not arrive in your account immediately. You should allow up to five business days after you check out for your points to post to your account. If your points are still missing, you should fill out a Missing Points form on the IHG website.

If you earned points through a promotional bonus, such as a credit card welcome offer, it may take up to six weeks for those points to be posted to your account. If your points still haven’t arrived after six weeks, you should fill out a Missing Points form on the IHG website.

Can You Cancel a Reward Night and Get a Refund?

Whether you booked a reward stay entirely with points or with the Points+Cash option, if you cancel your stay in accordance with the Reward Night terms, you should get a full refund of the cash and points you spent on your stay.

For most reward bookings, you can cancel up to 24 hours before your check-in time and you will be eligible for a full refund.

If you cancel your reward stay in accordance with the Reward Night terms, you should see your points redeposited in your account immediately. However, if you canceled your stay on the date of your arrival, your refund may be subject to review and may be delayed.

Do IHG One Rewards Points Expire?

IHG One Rewards points expire after 12 months of inactivity if you don’t have elite status. If you’re an elite member, your points will never expire. If you have no status and want to keep your points from expiring, you’ll need to do at least one of the following every 12 months:

- Book an award stay.

- Use Points + Cash to book a room.

- Make a purchase with a co-branded IHG credit card.

- Purchase IHG One Rewards points.

- Make a purchase through the IHG One Rewards shopping portal.

- Make a dining purchase with the card connected to your IHG One Rewards Dine & Earn account.

If you’re desperate to keep your IHG One Rewards account active, we’d recommend making a dining purchase with the card connected to your IHG One Rewards Dine & Earn account. Almost everyone makes dining purchases once in a while anyway, so doing this won’t really cost you any additional money. Plus, you’ll keep your account alive and earn a few more IHG points in the process.

Can You Earn Points and Miles at the Same Time?

The IHG One Rewards program allows members to elect to earn airline miles on eligible hotel stays instead of IHG points. Unfortunately, you cannot earn both airline miles and IHG points on the same stay.

You can, however, choose to switch your earning preference at any time. So, for instance, if you earned airline miles on your last stay at an IHG property, you can change your preferences any time and earn IHG points on your next stay.

Choosing to earn IHG points for stays is almost always a better idea. You’ll earn at least 10X points per dollar spent. On the other hand, with most of IHG’s airline partners, you’ll earn 2X miles per $1 spent on eligible IHG hotel stays. And, even though airline miles are typically more valuable than IHG points, you’re still better off earning IHG points for these hotel stays.

Can You Convert Miles to Points?

As mentioned above, you can convert IHG points into rewards miles with over 40 different frequent flyer programs. However, if you wish to convert airline miles to IHG points, there are only two frequent flyer programs that allow this conversion: Finnair Plus and Virgin Atlantic Flying Club.

Each of these programs’ miles are much more valuable than IHG points, so it’s usually better to spend these miles through their native programs than to convert them to IHG miles.

Can I Earn Points When I Book Through a Third-Party Site?

In most cases, rates booked through third-party sites are not qualifying rates and will not earn you IHG points. So, if you want to earn IHG points for a stay, you’ll probably need to book that stay directly through the IHG app or website.

However, sometimes, it’s still worth booking through a third-party site (like Kiwi, Kayak or Expedia) if the price is considerably lower than the price on IHG’s website.

How Far in Advance Can You Book Stays With IHG?

Whether you’re trying to book a stay with cash or with points, you can view and book hotel rates up to 50 weeks in advance. The only exceptions to this rule are certain Iberostar Beachfront Resorts, which can be booked up to two years in advance.

Start Your IHG One Rewards Journey Today

While the IHG One Rewards program isn’t as popular as other hotel loyalty programs from larger chains, such as Hilton Honors or Marriott Bonvoy, there are still many valuable ways to take advantage of this program.

First of all, IHG is the only one of these hotel loyalty programs that gives you the option to buy elite status. And if you frequently stay at IHG-owned hotels, purchasing an InterContinental Ambassador membership might be well worth the $200 annual fee.

Plus, you can earn elite status with IHG One Rewards by signing up for any of IHG’s three co-branded credit cards, one of which has no annual fee.If you’re interested in getting an IHG credit card, we recommend going with the IHG Rewards Premier card or the IHG Rewards Premier Business card, both of which come with Platinum Elite status and an annual free night award worth up to 40,000 points.

When it comes to redeeming IHG points, the best way to get the most value out of your points (most of the time) is to redeem them for free hotel stays. But, since IHG uses a variable pricing model, you‘re going to want to be flexible with your award stays and book them during off-peak times when you can get them for cheaper.

All in all, because enrolling in the IHG One Rewards program is free, there’s really no reason not to sign up. You can rack up points every time you stay with one of IHG’s 19 brands and eventually save up enough for a free hotel stay

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after spending $4,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

after spending $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $99

after spending $2,000 on purchases within the first 3 months from account opening and up to 30,000 more points by earning 3 additional points in the first 6 months from account opening on purchases that earn 2x and 3x on up to $10,000 spent

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.