10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

These days, credit card rewards programs allow you to redeem your points or miles in a wide variety of ways, such as for flights, hotels, rental cars, merchandise, experiences, dining and more. However, not all of these redemption options offer the same amount of value for your points. For instance, while certain redemption options may only give you a value of about 0.5 cents per point, other redemptions can provide several cents per point in value. So, it’s important to pay attention to the amount of value that each redemption option provides.

In general, you’ll get the most value by redeeming points or miles through transfer partners (and we have plenty of articles about how to maximize the value of credit card points through transfer partners). However, in this article, we’re going to look at the redemption methods that provide the least value per point so that you can avoid them at all costs when you go to redeem your points or miles.

1. Gift Cards and Shopping Purchases

Most credit card points can be redeemed for gift cards from certain retailers or for shopping purchases from Amazon. These redemptions tend to offer, in most cases, less than 1 cent per point in value, which is terrible compared to the value that you can get from other redemption methods.

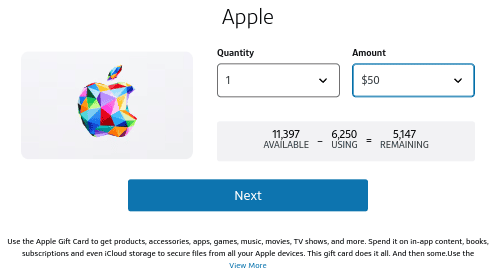

For example, Capital One Rewards gives you the option to redeem miles for Apple gift cards (as well as gift cards from a wide variety of other retailers).

You have the option to purchase a $50 gift card for 6,250 Capital One miles. So, this redemption option would yield a value of 0.8 cents per mile, which is very poor.

Similarly, you can use Citi ThankYou points (as well as several other credit card rewards currencies) to make purchases through Amazon.com. When you redeem in this way, you’ll get $8 off of your Amazon purchases for every 1,000 Citi points that you spend. Thus, this redemption would give you a value of 0.8 cents per point, which is poor compared to the value that you can get out of Citi points in other ways.

Many hotel and airline rewards programs also allow you to redeem points or miles for gift cards or Amazon.com purchases. However, doing so is almost always a bad idea.

2. Transferring to Partners With Poor Transfer Ratios

One of the best features of credit card rewards programs is that they allow you to make points transfers to partner airline and hotel loyalty programs. And, once you’ve transferred these points to partner rewards programs, you can often find outsized value redemptions that offer more than 1 cent per point in value.

However, you should definitely pay attention to which transfer partner you utilize because, while some transfer partners can offer outstanding value, others may offer very poor value. In particular, you should almost never utilize transfer partners that have transfer ratios of less than 1:1.

For example, the Capital One Rewards program has more than 15 transfer partners, most of which offer a 1:1 transfer ratio. However, Capital One miles transfer to the EVA Infinity MileageLands frequent flyer program at a 2:1.5 ratio. That means that, if you were to transfer 10,000 Capital One miles to the EVA Infinity MileageLands program, you’d receive 7,500 EVA miles.

By transferring points or miles to transfer partners that have unfavorable transfer ratios, you’re quickly diminishing the value of your credit card points. And, once that value has been diminished, it’s going to be much harder to get good value out of your credit card points or miles. Instead, you should consider saving those credit card points for a transfer to another program that offers a better transfer ratio.

As another example, the Marriott Bonvoy program allows you to transfer Bonvoy points to partner frequent flyer programs such as Air Canada Aeroplan, American Airlines AAdvantage, British Airways Executive Club, Delta SkyMiles and many others. However, Marriott Bonvoy points transfer to all partner frequent flyer programs (with the lone exception of Air New Zealand Airpoints) at a ratio of 3:1. So, if you were to transfer 30,000 Marriott Bonvoy points to Southwest Rapid Rewards, you’d only receive 10,000 miles.

Generally, you can get a whole lot more value out of your Bonvoy points by redeeming them for hotel stays in their native program rather than transferring them at a 3:1 ratio. For instance, if you were to transfer Marriott Bonvoy points to a frequent flyer program at a 3:1 ratio and then redeem those airline miles for a redemption that offered 1 cent per mile in value, you’d essentially be getting slightly over 0.3 cents per Marriott Bonvoy point, which is extremely poor considering Bonvoy points are worth about 0.9 cents per point on average.

So, while utilizing transfer partners can give you the best possible value available in some cases, using transfer partners that offer poor transfer ratios can sometimes actually lead you to get very poor value per point.

3. Cash Back

If you want to earn cash back for your credit card purchases, then you should probably sign up for a cash back credit card instead of a travel rewards credit card. If you redeem credit card points for cash back, in many cases, you’ll be getting only 1 cent per point in value. And, in other cases, you’ll get even less than that.

If you have the Chase Sapphire Reserve® for instance, you can redeem Chase points for cash back at a rate of 1 cent per point, which isn’t bad. However, by doing so, you’re leaving value on the table. With the Sapphire Reserve, Chase points might be worth more when redeemed through the Chase Travel℠ portal. And Chase points can be worth even more than that when redeemed through transfer partners.

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Additionally, the American Express Membership Rewards program allows members to redeem Amex points for Cover Your Card Charges, which is essentially the same as cash back in the form of statement credits. However, when redeeming this way, Amex points are only worth 0.6 cents apiece, which is very poor. When redeemed through transfer partners, Amex points can be worth 2 cents apiece or even more.

So, in general, unless you don’t plan on booking any more hotels or flights for the rest of your life, redeeming credit card points for cash back is usually a bad idea as you can get much more value by redeeming those points for travel instead.

4. Transferring Points or Miles to Friends or Family

Some credit card rewards programs, frequent flyer programs and hotel loyalty programs allow you to transfer points to friends or family members who also have an account with the same program. However, in many cases, making these transfers can provide very poor value per point/mile due to the fees that these programs charge to conduct transfers.

For example, the IHG One Rewards program charges a fee of $5 per 1,000 points transferred to friends or family (with the exception of certain status). Since IHG One points are typically considered to be worth slightly more than 0.5 cents apiece, paying this fee nearly cancels out all of the value that you can get out of these points.

Many of the rewards programs that allow points transfers to friends or family members don’t levy fees that are quite as high as those charged by IHG One Rewards. However, in many cases, the fees that you’ll have to pay to make a points transfer to a friend or family member make that transfer simply not worth it.

5. In-Flight WiFi (and Other In-Flight Purchases)

Many frequent flyer programs give you the option to redeem miles for in-flight WiFi and certain other in-flight purchases. At best, you’ll get 1 cent per mile in value for these types of redemptions. And, in many cases, you’ll get considerably less than that.

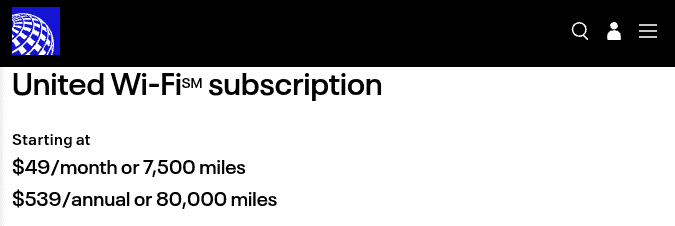

For example, United MileagePlus gives members the option to redeem 7,500 miles for a monthly in-flight WiFi pass, which costs $49 if you pay with cash. Thus, this redemption provides a value of under 0.7 cents per mile, which is very poor.

You can also purchase an annual subscription to United in-flight WiFi for 80,000 miles or $539. If you were to redeem your miles this way, you’d also get a value of under 0.7 cents per mile.

When you consider how much United miles could be worth when redeeming them for award flights, it’s clear that redeeming miles for in-flight purchases is a bad deal. The same goes for in-flight miles purchases with almost every frequent flyer program.

The Bottom Line

If you have a balance of credit card points, airline miles or hotel points, you should make sure to pay attention to the value that you get when redeeming those points. While many people think that they’ll get the same value no matter how they redeem their awards, this is far from the truth. Certain redemption options may provide several cents per point in value while others may offer less than 0.5 cents per point.

In general, if you have some airline miles, we’d recommend redeeming them for award flights. If you have hotel points, you should redeem them for hotel stays. And, if you have credit card points, the best way to maximize their value is to utilize transfer partners. Of course, everyone’s situation is unique and there are some exceptions to these rules. But, in general, these are the best ways to get the most value out of your rewards.

If you don’t want to redeem your rewards for flights or hotel rooms, there are some particularly low-value redemptions that you should avoid at all costs. Using points or miles for cash back, gift cards or shopping purchases (whether with Amazon or another shopping partner) tends to provide very little value per point. Transferring points to friends or family or to transfer partners with very poor transfer ratios is also a bad idea.

Of course, the worst way to use your points or miles is to not use them at all. Many people simply forget about their points or miles balances, letting their points and miles expire. Or they think that their points or miles will stay in their account forever. But, unfortunately, this is not the case.

All in all, your points and miles can save you a ton of money if used correctly, so don’t squander them by letting them expire or by redeeming them for very low value.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.