10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

UPDATE:

9/27/2024 — Alaska Airlines completed its acquisition of Hawaiian Airlines last week, and has just announced that you can now transfer miles between the two programs at a 1:1 ratio. You can transfer a minimum of 50 miles and a maximum of your total account balance. However, you can only transfer a maximum of 500,000 miles per transaction, so if you have more than that you will need multiple transactions. Transfers may take up to 72 hours to complete. Note that there have been some technical glitches, so be patient while they work out the kinks.

The airlines are working toward a combined loyalty program, but more information about that will be coming in 2025. You can read more about this merger between the two airlines on Alaska’s website and on Hawaiian’s website.

(Original article published Dec 7, 2023)

Alaska Airlines has revealed that it will be acquiring Hawaiian Airlines at $18 per share, coming out to a whopping total of $1.9 billion. The merger between these two airlines (the flagship carriers of the 49th and 50th states) will most likely unlock more destinations for consumers and will make the resulting company a more competitive player in the U.S. airline industry.

However, while both Seattle-based Alaska Airlines and Honolulu-based Hawaiian Airlines have come to an agreement and are ready to go forward with the deal, the merger still faces the threat of being blocked by the U.S. Department of Justice, which has been quick to strike down airline deals that it views as anticompetitive.

In March 2023, the Justice Department sued to block JetBlue Airways’ $3.8 billion acquisition of low-cost carrier Spirit Airlines. So, there’s a chance that the Alaska-Hawaiian merger could meet the same fate.

However, should this deal go through, it will have major implications on the airline industry as a whole as well as for travelers who often fly with these two airlines.

Lihue Airport (LIH) in Kauai, Hawaii, USA, is captured from above.

What Will Happen to These Airlines?

In case you were wondering whether the Hawaiian Airlines fleet would be getting a paint job, the answer is no. According to the Alaska Airlines press release, both brands will remain separate in name. However, in many ways, Alaska Airlines and Hawaiian Airlines will function as a single airline.

The two brands will share a single operating platform, meaning that consumers will be able to book a flight on either airline through the same online portal or customer service phone line. Plus, many aspects of the on-board experience will be consistent across both brands.

Perhaps most importantly, the route networks of these two airlines will become highly integrated, which is supposed to increase the number of destinations reached by both airlines.

If combined, the two airlines will offer service to 138 destinations worldwide, including nonstop service to 29 international destinations in the Americas, Asia, Australia and the South Pacific. This is largely due to the fact that Alaska Airlines will begin using Honolulu as a strategic hub between the U.S. West Coast and the Asia-Pacific region.

This deal will also largely increase the Hawaiian Islands’ connectivity with the rest of the North American continent. According to Alaska Airlines, the merger will triple the number of destinations throughout North America that can be reached from the Hawaiian Islands either nonstop or with one stop.

Alaska Airlines' $1.9 billion plan to acquire Hawaiian Airlines awaits Department of Justice approval, with potential benefits including separate brand operations, a Honolulu hub for Alaska, expanded routes, consolidated frequent-flyer programs, a unified rewards currency, a joint credit card, and shared airline partners.

What Will Happen to Their Loyalty Programs?

Currently, both Alaska and Hawaiian operate their own frequent-flyer programs: Alaska Airlines Mileage Plan and Hawaiian Airlines HawaiianMiles.

“The transaction will connect Hawaiian Airlines’ loyalty members with enhanced benefits through an industry-leading loyalty program for the combined airline, including the ability to earn and redeem miles on 29 global partners and receive elite benefits on the full complement of Oneworld Alliance airlines, expanded global lounge access and benefits of the combined program’s co-brand credit card,” according to the press release.

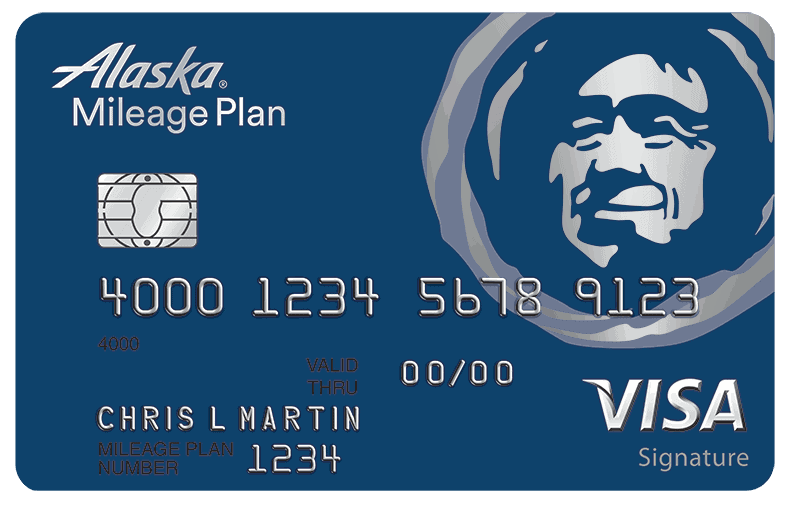

Alaska Airlines Visa Signature® Card

60,000

Bonus Miles

plus a 30% flight discount code after you spend $3,000 in the first 90 days

Annual Fee: $95

This statement seems to imply that the two frequent-flyer programs will be combined. In all likelihood, both Alaska Airlines and Hawaiian Airlines will share a single loyalty currency, have the same airline partners (and possibly other partners), have a shared co-branded credit card, have shared lounge access benefits and probably even have a shared elite status program.

Alaska Airlines Visa® Business Card

60,000

Bonus Miles plus Alaska’s Famous Companion Fare™ ($99 fare plus taxes and fees from $23)

after you spend $4,000 in the first 90 days

Annual Fee: $70

For current members of Hawaiian Airlines HawaiianMiles, this merger will significantly increase the number of airline partners with which members can earn and redeem reward miles. Currently, Hawaiian Airlines has just five airline partners. However, if this merger is completed, that number will be increased to 29, including all of the member airlines of Oneworld alliance.

And, while Alaska Airlines is already a Oneworld member of and has an extensive network of airline partners, a few more partners will be added to that list if the airline’s acquisition of Hawaiian Airlines is completed. Additionally, Mileage Plan members would also gain increased accessibility to Hawaiian Airlines airport lounges and increased perks aboard Hawaiian Airlines flights.

So, it seems as though this merger would be a good thing for current members of both frequent-flyer programs.

Will This Deal Actually Close?

According to spokespeople from Alaska Airlines and Hawaiian Airlines, this deal should take between 12 and 18 months to finalize. However, analysts around the airline industry have expressed skepticism that this deal will ever be finished due to resistance from the U.S. Department of Justice.

As previously mentioned, the DOJ sued to block the $3.8 billion acquisition of Spirit by JetBlue. Then, a few months later, in July 2023, the DOJ sued to block a strategic partnership between JetBlue and American Airlines over concerns that the alliance would give the two airlines too much control over the U.S. Northeast region.

So, it’s clear that the Justice Department is willing to block deals in the airline industry that it believes to be anticompetitive. Nonetheless, Alaska Airlines spokespeople seem to remain optimistic that their deal will get the green light.

“We’re confident that this is unique from others that are pursuing combinations,” Alaska Airlines CFO Shane Tackett said in an interview with CNBC. “We have very similar product offerings and we have very limited network overlap.”

Tackett stated that the two airlines had only 3% overlap with seats and 12 routes. For this reason, Alaska is hoping that the current administration won’t see the deal as anticompetitive.

Once again, this deal is set to be finalized between 12 and 18 months from now, which would push it past the upcoming presidential election. That means that, when it comes time to finalize the deal, the DOJ may have an entirely different posture toward airline mergers.

The Bottom Line

Alaska Airlines announced its plan to acquire Hawaiian Airlines for $1.9 billion. While the boards of directors of both airlines have already approved the deal, it remains to be seen whether the Department of Justice will block the merger as it’s done with several similar deals in recent history. However, Alaska Airlines argues that this deal is different due to the lack of overlap between Alaska’s and Hawaiian’s route networks.

Should the deal go through, it seems as if the two airlines would continue to operate as two separate brands but share most aspects of their operations. Alaska Airlines would begin using Honolulu as a hub connecting its route network to the Asia-Pacific region, the two airlines would share an operating platform and there would be significantly more routes between the Hawaiian Islands and North America.

It also seems as though the two programs would combine their frequent-flyer programs, begin using a single rewards currency and even offer a joint co-branded credit card. The two carriers would also share airline partners, which would significantly increase the ability to earn rewards miles for current members of both the Mileage Plan and the HawaiianMiles programs.

All in all, while the U.S. Department of Justice has expressed concerns about airline mergers, it seems as though the Alaska-Hawaiian merger could be a good thing for consumers. According to Alaska Airlines, though, the deal should take between 12 and 18 months to close. So, we’ll have to wait until then to see how the DOJ reacts and how exactly this deal will affect both airlines.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.