10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Located on the southeast coast of the Persian Gulf, Dubai is a major tourist destination. Home to the world’s tallest building, Dubai ranks seventh on Euromonitor’s list of the Top 100 City Destinations in 2018, ahead of New York City, Kuala Lumpur and Shenzhen.

In addition to being so popular, it’s not cheap—it’s the 36th most expensive city in the world and is the most expensive city in the Middle East, according to the UBS Global Cities Ranking 2018.

Considering the fact that a vacation in the United Arab Emirates won’t be super cheap, you’ll probably like the idea of saving money on the flights there. Let’s take a look at which programs will get you to Dubai with points without much hassle.

Use Alaska Airlines MileagePlan to fly to Dubai on Emirates

Alaska Airlines Mileage Plan

The Dubai-based Emirates is the only airline that directly connects the largest emirate with the United States. The airline isn’t part of an alliance, but it partners with a number of frequent-flyer programs whose miles can be used to book an Emirates-operated flight.

How to Book with Alaska Miles

Alaska Airlines Mileage Plan is one of those programs. You will redeem the following number of miles for a one-way flight based on the class of service you want to fly.

- Economy: 42,500 miles

- Business: 82,500 miles

- First: 150,000 miles

Image Courtesy of Alaska Airlines

Additionally, Alaska Airlines doesn’t pass on fuel surcharges so the taxes/fees are minimal. You’ll pay $20 to $44 per ticket on top of miles on the way to Dubai and $62 per ticket on the way back.

Searching for Emirates award space with Alaska Airlines is pretty straightforward. You don’t need an account or be logged in to search for space, but you do need one to book, obviously. One-way redemptions are half the cost of a round-trip award ticket.

Emirates flies to a number of U.S. cities, including Boston, Chicago, Dallas, Fort Lauderdale, Houston, Los Angeles, Newark, New York City, Orlando, San Francisco, Seattle and Washington.

Keep in mind that if you don’t live in one of the cities that Emirates services, you can add an Alaska-operated segment to your itinerary for no extra miles.

Cards to Help You Earn Alaska Miles

Unfortunately, Mileage Plan doesn’t partner with any transferrable point programs, other than Marriott Bonvoy so the best ways to earn miles is by either flying Alaska and its partners or using a co-branded Alaska Airlines credit card issued by Bank of America — there’s a personal and a business version of the card.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Nights

(each night valued up to 50,000 points)

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

If you want to use your Marriott Bonvoy points to book an Emirates flight with Alaska miles, the transfer rate is 3:1 to Mileage Plan. You receive a 5,000-mile bonus when you transfer 60,000 Marriott points to an airline. This means you can get 25,000 Alaska miles by transferring 60,000 Marriott points.

Japan Airlines

JAL Mileage Bank

Japan Airlines Mileage Bank is another program that partners with Emirates. You’ll find its mileage rates quite favorable, but there’s one hiccup—JAL Mileage Bank passes on significant fuel surcharges on top of each award ticket. Let’s discuss the rates first so you can make an informed decision.

How to Book with JAL Miles

Mileage Bank used a distance-based award chart for award tickets booked on partners which means the longer the flight, the more miles you need to redeem. For this reason, not all city pairs price out the same. While it’s possible to book one-way awards, it’s not recommended because round-trip bookings receive a substantial mileage discount. The rates are as follows.

Total trip distance of 12,001 miles to 14,000 miles (based on a round-trip journey):

- Economy Class: 45,000 miles (one-way) / 55,000 miles (round-trip)

- Premium Economy: 59,000 miles (one-way) / 77,000 miles (round-trip)

- Business Class: 80,000 miles (one-way) / 110,000 miles (round-trip)

- First Class: 120,000 miles (one-way) / 165,000 miles (round-trip)

Total trip distance of 14,001 miles to 20,000 miles (based on a round-trip journey):

- Economy Class: 47,000 miles (one-way) / 70,000 miles (round-trip)

- Premium Economy: 62,000 miles (one-way) / 94,000 miles (round-trip)

- Business Class: 85,000 miles (one-way) / 130,000 miles (round-trip)

- First Class: 135,000 miles (one-way) / 190,000 miles (round-trip)

Image Courtesy of Japan Airlines

To perform an award search with JAL Mileage Bank, you must be logged in on the website. Hover over the Award Redemption (Air) tab and select “Book JMB Partner Airlines Award Ticket.” Enter your city pairs and dates and search as usual.

For round-trip flights, you won’t find redemption rates this good with another airline program. However, as mentioned above, fuel surcharges are enough to bring you down to earth quickly. Each round-trip ticket will run you an additional $604 in economy class to $1,718 in business and first class.

Cards to Help You Earn JAL Miles

Another downside of the program is that JAL Mileage Bank miles are difficult to earn as its co-branded credit card doesn’t have any bonus categories. The easiest way for many to obtain these miles are by transferring Marriott Bonvoy points to JAL at a ratio of 3:1. As usual, you will receive a 5,000-mile bonus for every 60,000-point transfer.

Marriott Bonvoy Brilliant® American Express® Card

Earn 100,000

Marriott Bonvoy® bonus points

after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership.

Annual Fee:

$650

Air Canada

Air Canada Aeroplan

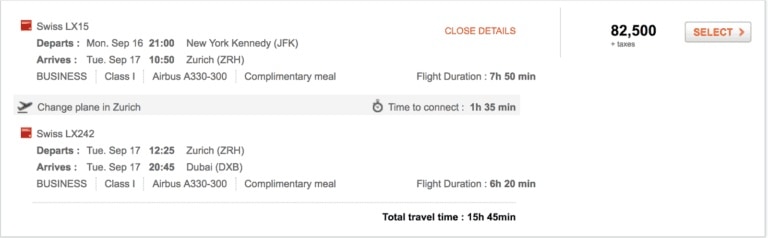

If you don’t mind a layover or two, Air Canada’s Aeroplan program is a good option for Star Alliance enthusiasts. It’s the largest airline alliance in the world and is a great way to get you where you need to go. Partners, such as EgyptAir, SWISS International Air Lines and Turkish Airlines, among others, all fly to Dubai.

How to Book with Aeroplan Miles

One-way award flights between North America and the Middle East & North Africa region go for the following rates.

- Economy Class: 40,000 miles

- Premium Economy: 67,500 miles

- Business Class: 82,500 miles

- First Class: 115,000 miles

Image Courtesy of Aeroplan

Be mindful of carrier-imposed surcharges when making a booking via Aeroplan. Some partners pass on high fees, and others don’t. You have to click on each option to determine how high the taxes are on each itinerary option — SWISS is a great option to avoid the surcharges.

Cards to Help You Earn Aeroplan Miles

Aeroplan is a transfer partner of American Express Membership Rewards. If you hold Membership rewards-earning Amex cards, you can transfer their points at a ratio of 1:1. There are several cards with very useful bonus categories that make earning points easy.

The Blue Business® Plus Credit Card from American Express

15,000

Membership Rewards®

after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

It’s also a transfer partner of Capital One. Miles earned with the Capital One® Venture® Rewards Credit Card and the Capital One® Spark® Miles for Business Card can be transferred to Aeroplan at a ratio of 2:1.5. Because these cards earn 2X miles for each dollar spent, you essentially earn 1.5X airline miles per dollar.

Capital One Venture Rewards Credit Card

LIMITED-TIME OFFER: Enjoy $250

to use on Capital One Travel

in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

Annual Fee: $95

$2,000

Cash Bonus

after you spend $30,000 in the first 3 months

Annual Fee: $150

Avianca LifeMiles

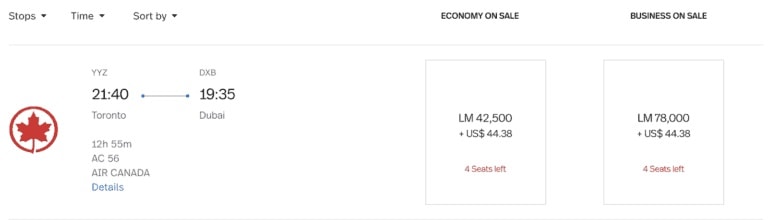

For those sitting on a stash of Avianca LifeMiles, or some transferable points, we have an option for you as well. Avianca is another Star Alliance member whose miles are underrated and yet valuable.

Avianca Airlines

How to Book with Avianca LifeMiles

Avianca’s redemption rates are quite reasonable.

- Economy Class: 42,500 miles

- Business Class: 78,000 miles

Image Courtesy of Avianca LifeMiles

Look at these non-stop Air Canada flights from Toronto to Dubai—the taxes/fees are almost nonexistent, too. That’s because LifeMiles doesn’t pass on surcharges on any award tickets. While Aeroplan will make you pay when you book award tickets on airlines such as Lufthansa, LifeMiles won’t so you’ll only owe the standard taxes/fees.

Lufthansa Airlines

You can book partner awards online, but you do have to log in to your LifeMiles account first. One-way and round-trip bookings are possible. Once logged in, click on “Fly” at the top of the page and search for your trip.

Cards to Help You Earn Avianca LifeMiles

Avianca has a couple of co-branded credit cards for U.S. residents: the Avianca Vida Visa Card and the Avianca Vuela Visa Card. However, the program partners with three transferrable points programs.

If you want to earn Avianca LifeMiles, you can transfer American Express Membership Rewards, Citi ThankYou Points and Capital One Venture Miles to your account.

American Express Platinum Card®

You may be eligible for as high as 175,000

Membership Rewards® Points

after spending $12,000 in eligible purchases on your new Card in your first 6 months of Membership. Welcome offers vary and you may not be eligible for an offer.

Annual Fee:

$895

Capital One Venture Rewards Credit Card

LIMITED-TIME OFFER: Enjoy $250

to use on Capital One Travel

in your first cardholder year, plus earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening - that’s equal to $1,000 in travel

Annual Fee: $95

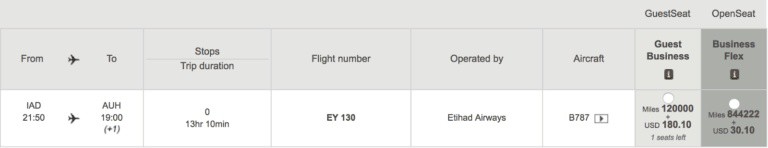

American Airlines

American Airlines AAdvantage

This one isn’t going to get you straight to Dubai, but it’ll get you close enough. American Airlines AAdvantage program is a partner of Etihad Airways, the second largest airline in the United Arab Emirates, whose hub is in Abu Dhabi. Once you land, drive for an hour and 20 minutes, and you’ll find yourself in Dubai.

Etihad Airways

How to Book with AAdvantage Miles

In the U.S., Etihad operates flights to Chicago, Los Angeles, New York City and Washington. The program itself charges unfavorable rates for its own awards, so we won’t get into the details here. Just trust us—they want a lot of miles! However, this is where the AAdvantage program comes in with the following redemption rates.

- Economy Class: 40,000 miles

- Business Class: 70,000 miles

- First Class: 115,000 miles

American Airlines only just recently started displaying Etihad award space via its online search. At this time, business and first class award space will not display unless you want to fly within 30 days. If you want to book further out, you’ll need to search on Etihad’s site.

You’ll need to find “Guest” availability — the equivalent of a saver-level seat — on Etihad’s site. You don’t have to log in to see award space.

Image Courtesy of Etihad Guest

Once you locate an open seat, write down your desired flight details, such as travel date, time and flight number, call American Airlines’ call center located in Australia at +61-2-91011948 and place the ticket on hold. You can then call the U.S. call center to pay the taxes/fees and have the ticket issued. Holds last for five days.

Cards to Help You Earn American Airlines Miles

The AAdvantage program doesn’t partner with any transferrable points program from any bank, though it does partner with Marriott Bonvoy. However, there are a bunch of co-branded AA credit cards issued by Barclays and Citi that can help you earn more miles.

Citi® / AAdvantage Business™ World Elite Mastercard®

Earn 65,000

American Airlines AAdvantage® bonus miles

after spending $4,000 in purchases within the first 4 months of account opening.

Annual Fee: $99, waived for the first 12 months

Citi® / AAdvantage® Executive World Elite Mastercard®

For a limited time, earn 100,000

American Airlines AAdvantage® bonus miles

after spending $10,000 in purchases within the first 3 months of account opening.

Annual Fee: $595

Modern skycrapers in Dubai marina, United Arab Emirates

Final Thoughts

With so many frequent-flyer programs on deck, you have no shortage of options flying to Dubai on points. All you have to do is pick an airline you want to fly, class of service and the miles to redeem. The next thing you know, you’re enjoying a bird’s-eye view from the 148th floor of the Burj Khalifa.

Be sure to also check out our recommendations for best hotels to book in Dubai with points.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.