10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

As if using miles to reduce the cost of air travel wasn’t enough, United Airlines offers special discounts on its award flights, subject to availability.

United saver awards offer the opportunity to make your miles go further, giving you increased redemption value. They also offer the opportunity to save thousands of miles, which you can keep for your next vacation or award flight.

If you’re equipped with a co-branded United credit card or have United Premier elite status, you can already buckle up for a saver award flight today.

Let’s look at how to find United saver award flights, how they work and some insider tips and tricks for getting the most value out of them. We’ll also cover the best United Airlines credit cards to help you get increased saver award availability.

What Are United Airlines Saver Awards?

United Airlines saver awards are discounted award tickets on United- and United Express-operated flights.

United saver awards are available to members of the United MileagePlus program as well as holders of United Airlines credit cards.

When booking flights, United MileagePlus members and United credit cardholders will benefit from expanded availability for Economy Class award fares. If you have Premier Platinum, 1K or Global Services status, you can also access expanded availability for First and Business Class saver award fares.

Despite not being advertised by United or Chase, saver awards are hugely lucrative and can save you thousands of miles when booking flights with United. By knowing how to find and take advantage of them, saver awards can enable you to travel more often for fewer miles — if you know where to look, that dream vacation could become a reality.

Key Features of United Airlines Credit Cards

United Airlines offers six co-branded cards in partnership with Chase. There are four personal cards and two business cards to choose from, with the following annual fees:

- United Gateway℠ Card – $0

- United℠ Explorer Card – $0 in the first year; $150 thereafter

- United Quest℠ Card – $350

- United Club℠ Card – $695

- United℠ Business Card – $0 in the first year; $150 thereafter

- United Club℠ Business Card – $450

These cards come with a range of benefits, offering options for any traveler who flies with United once a year or once every week.

The ability to earn United miles on everyday purchases as well as receive a 25% discount for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks (issued as a statement credit), are perks included with every United credit card.

Aside from these perks, the benefits vary from card to card. The more you pay annually, the more lucrative the perks become, ranging from complimentary United Club membership, Avis President’s Club® membership and IHG® One Rewards Platinum Elite status, to Global Entry or TSA PreCheck® statement credits, the ability to earn Premier Qualifying Points (PQP) on daily spending, priority boarding and free checked bags.

These are just a handful of the perks you can expect to enjoy as a United cardholder — not to mention, no foreign transaction fees and a bunch of travel insurance benefits.

However, an underrated perk shared by all United cardholders — whether it’s the Gateway or Club Card — is the ability to access expanded award availability, in the form of saver award flights.

How to Find United Saver Award Flights

The first step to finding United saver award flights is logging into your United MileagePlus account.

Since United MileagePlus members and co-branded United credit cardholders are the only ones with access to expanded saver award availability, it’s essential to begin your search by logging into your account.

You’ll want to select to book your flight using miles. Put in your destination and departure airports, chosen dates and any other details, and hit the search button.

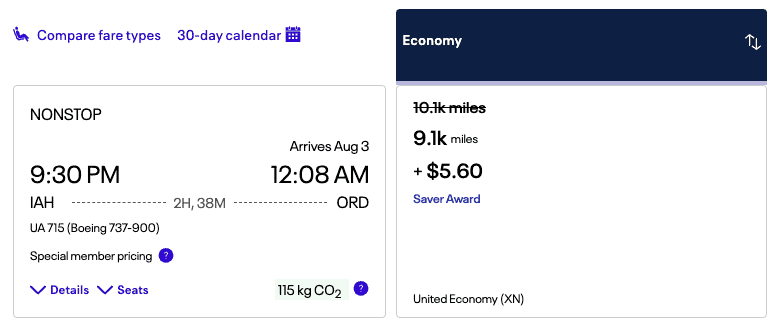

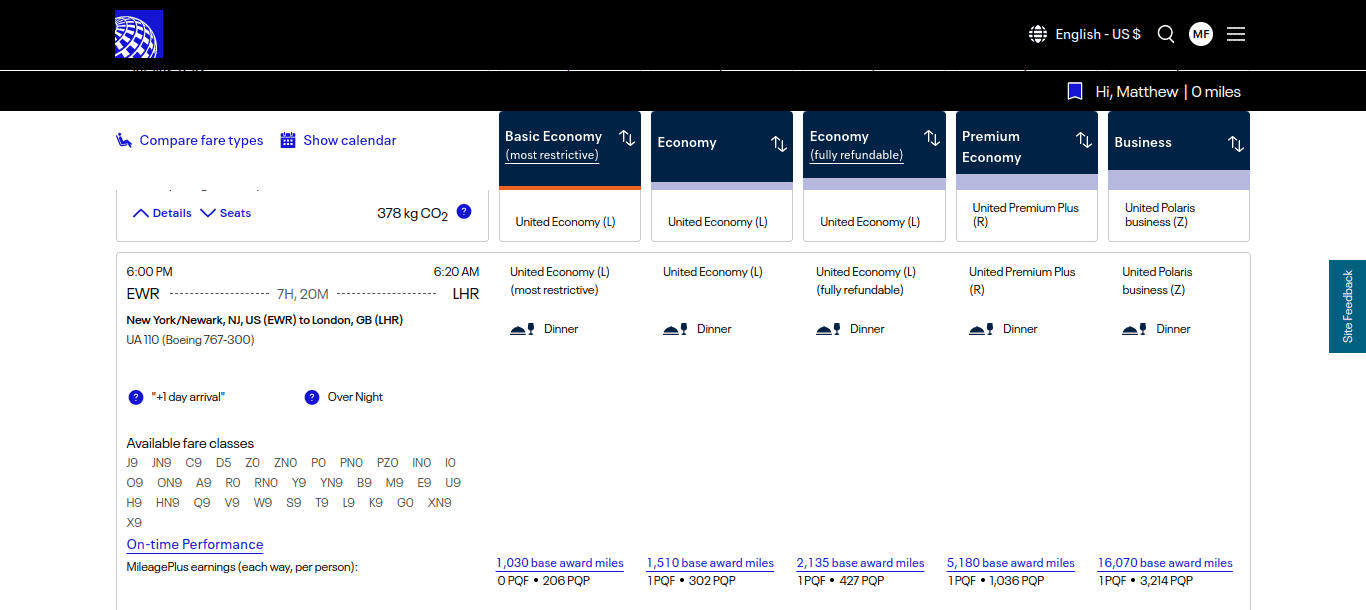

As you can see in the screenshot above, there’s saver award space availability on this particular flight.

Next to where it says “United Economy” you can see the fare class for this ticket, which is “XN.” XN is the United fare class designation for saver award tickets that are available to Premier MileagePlus members and United cardholders exclusively.

If you didn’t hold a United credit card or have Premier elite status, that same flight from Houston-Intercontinental (IAH) to Chicago-O’Hare (ORD) would cost you 10,100 miles instead of 9,100 miles — savings of 1,000 miles.

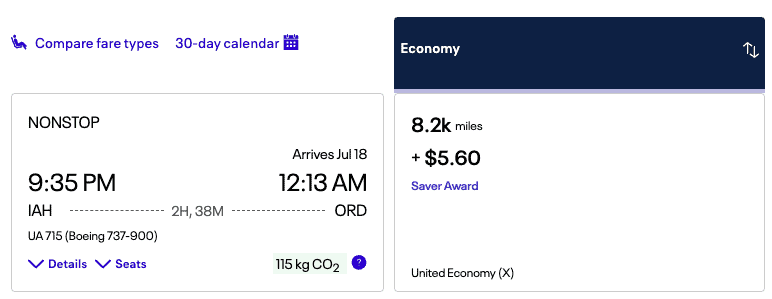

United MileagePlus Basic members can still access saver award availability, although the number of miles they’ll save will typically be less compared to those with Premier elite status or a United credit card. United designates these types of saver awards as “X” fares, which are available to non-cardholders, those with less than Premier elite status and those booking United flights through partner airline programs.

For example, if you were taking advantage of Capital One transfer partners by booking a United flight through Turkish Airlines Miles&Smiles, you’d be able to access X fares only.

Typically, there’s more award availability for XN fares compared to X fares.

If you have Premier Platinum, 1K or Global Services elite status, you can also enjoy expanded award availability for First and Business Class fares too. These saver awards are designated as “IN” fares.

Those without Premier Platinum, 1K or Global Services elite status have access to a different type of Business and First Class saver award fare. These saver awards are designated as “I” fares by United, and are available to those with Premier Gold status or lower, as well as those booking United flights through partner airlines.

Usually, United publishes more award availability for IN fares compared to I fares.

Overall, as long as you’re logged in, finding saver awards under your elite status level is easy.

Maximizing United Saver Awards With MileagePlus

If you’re lucky, United saver awards can sometimes save you a few thousand miles. This is particularly so when it comes to booking multiple companions on your reservation.

If you have United Premier elite status or hold a United credit card, all companions booked on the same reservation can benefit from the same saver award fares as you — assuming there’s enough availability.

That’s where the value of United saver awards truly shines. As long as there’s award space availability, nothing is stopping your companions from enjoying saver award fares too.

Leveraging the United Explorer Card for Saver Awards

If you want to access saver award flights and a host of additional perks, applying for the United Explorer Card is a solid option.

The United Explorer Card offers the following perks and earning rates:

- 2X miles on purchases with United, including in-flight food, beverages and Wi-Fi, tickets, Economy Plus and other eligible purchases

- 2X miles on United® purchases, dining, and hotel stays when booked with the hotel

- 1X mile on all other purchases

- First checked bag flies free for you and up to one companion

- A statement credit for Global Entry, Nexus or TSA PreCheck application fee, every four years, when charged to your card through an eligible enrollment provider

- Priority boarding for you and all other travelers on your reservation on United-operated flights

- 25% discount, given as a statement credit, for in-flight purchases of food, beverages and Wi-Fi on board United-operated flights and on Club premium drinks

- No foreign transaction fees

- Two annual United Club one-time entry passes

- If the primary cardmember has MileagePlus Premier status and is traveling on an award ticket, they’re eligible for complimentary upgrades on select United- and United Express-operated flights, subject to availability (up to one companion that is traveling on the same reservation can also qualify for an upgrade)

- 25 PQP for every $500 spent in purchases (including purchases made by authorized users) up to a maximum of 1,000 PQP in a calendar year

- Rental car insurance

- Trip cancellation and interruption insurance up to $1,500 per person and $6,000 per trip for your pre-paid, non-refundable passenger fares, for covered reasons

- Baggage delay insurance reimbursement of up to $100 a day for three days for essential item purchases, when common carrier delays exceed six hours

- Lost luggage reimbursement of up to $3,000 per passenger

- Trip delay reimbursement of up to $500 per ticket for you and your family when common carrier delays exceed 12 hours or require an overnight stay

The Explorer Card enables you to earn United miles on a range of expenses, from dining and hotel accommodations to flight purchases with United.

The card also makes your pre-flight experience a touch more luxurious. You can get a statement credit a Global Entry or TSA PreCheck application fee, every four years, enabling you to speed through immigration and security checks. That’s just as well, because the card also includes two annual United Club day passes, allowing you to relax before your flight.

On the day of your flight, you’ll benefit from priority boarding and a free checked bag for you and up to one companion on the same reservation.

The card also includes an extensive list of insurances such as delayed baggage insurance, lost luggage reimbursement, trip delay reimbursement, trip cancellation and interruption insurance and rental car insurance. These perks can save you hundreds of dollars compared to having to take out a separate insurance policy, offsetting the annual fee outright if used.

With the United Explorer Card, you’ll be able to save even more when it comes to flying, by accessing United saver award flights.

Tips for Finding United Saver Award Flights

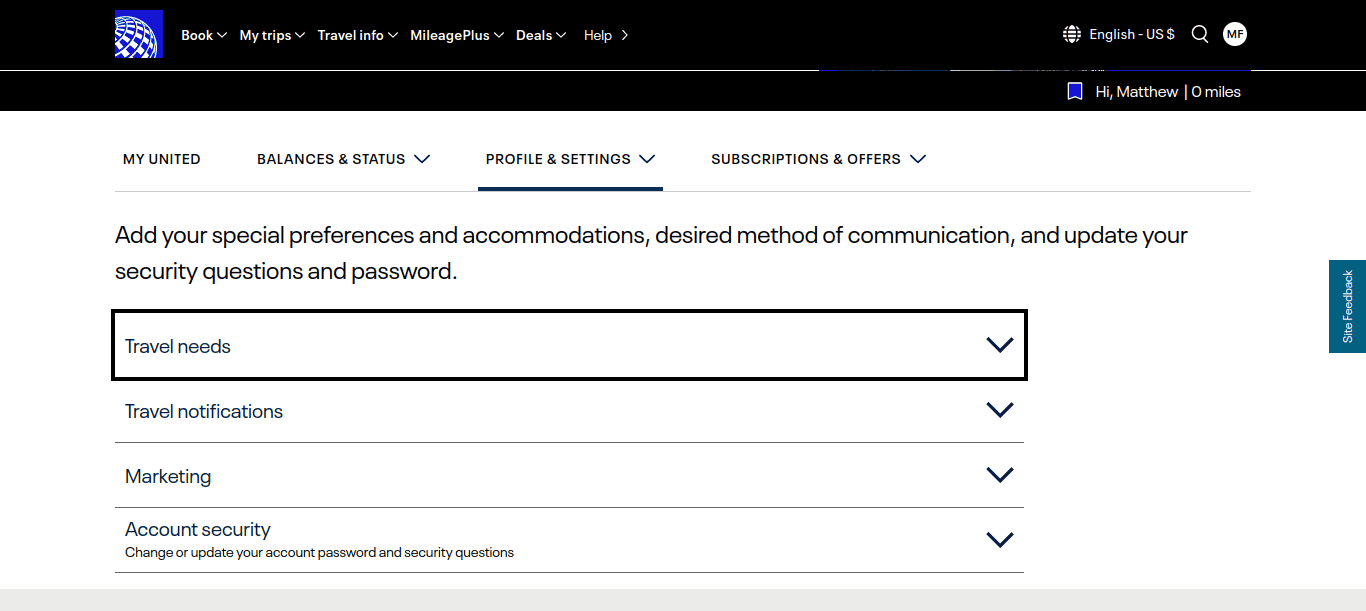

If you want to conduct a more in-depth search for United saver awards, you can enable “expert mode” in your account settings.

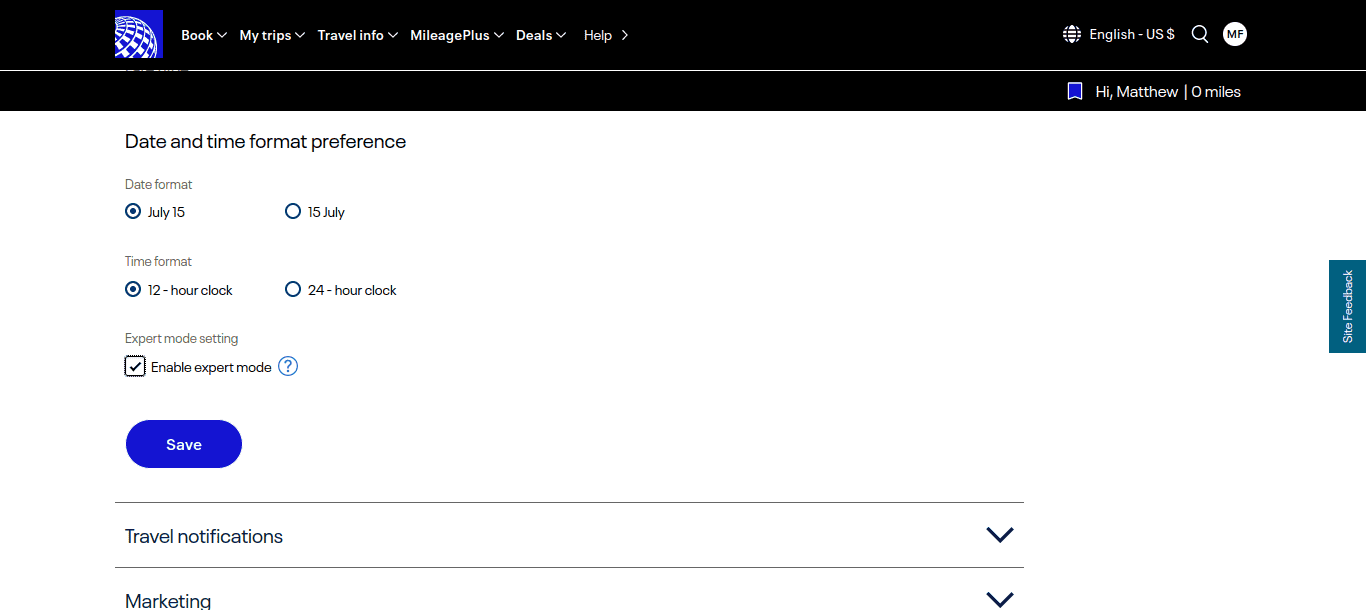

Once you’ve logged into your United MileagePlus account, navigate to your account settings. Here you can select “Travel needs” and scroll to the bottom of the dropdown, where you’ll find the option to “Enable expert mode.”

With expert mode enabled, you’ll be able to find out the availability of every single fare class type when browsing through flights. Simply change your filter to cash prices instead of miles and you can start searching.

When you expand a flight’s details, you’ll be able to view the number of available fare classes for each type. For instance, the example above states “XN9” and “X9.” This means that there are nine XN fares and nine X fares available on this flight. Similarly, it states “IN0” and “I0,” meaning that there are no saver award Business or First Class fares available on this flight.

By searching with expert mode enabled, you can instantly check award space and fare class availability on any flight, giving you a clearer overview of your options.

Another trick for finding saver awards is to use the Business and First Class saver award waitlist.

If you’ve got your heart set on a Business Class saver award ticket but there isn’t any availability, you can still go ahead and pay the number of miles required for a Business Class saver award fare (IN) while booking an Economy Class seat.

By doing this, you’ll gain a spot on the upgrade waitlist and will be first in line if a saver award IN fare becomes available. If no space becomes available 24 hours before departure, you’ll be added to the upgrade standby list for space-available upgrades. And if you don’t get a spot in Business Class, your unused miles will be redeposited in your MileagePlus account.

To make this kind of booking, you’ll need to do it over the phone with a United agent.

More Miles, More Adventures: Maximize Your Travel With United

Earning elite status with airlines isn’t always easy. But opening a co-branded credit card is doable — in fact, you can do it without even getting up off your sofa, let alone having to step foot on a plane.

United saver awards are a solid use of your miles and can save you tens of thousands of miles compared to booking standard award fares. And with the miles you save on saver award fares, you can fund your next luxury vacation abroad.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.