10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

The United℠ Explorer Card from Chase offers United Airlines flyers a host of valuable benefits for a modest $95 annual fee (waived the first year). The card gets you free checked bags and priority boarding, opens up additional award space on United-operated flights and comes with an attractive welcome bonus. Does it deserve a place in your wallet?

50,000

Bonus Miles

after you spend $3,000 on purchases in the first 3 months your account is open.

Annual Fee:

$0 for your first year, then $95.

What Benefits Do You Get with the United Explorer Card?

Welcome Bonus

The United℠ Explorer Card comes with a generous welcome bonus. The bonus fluctuates and often goes as high as 60,000 United miles. If you sign up for the card aboard a United flight, you may be able to get more United miles through a flight attendant referral.

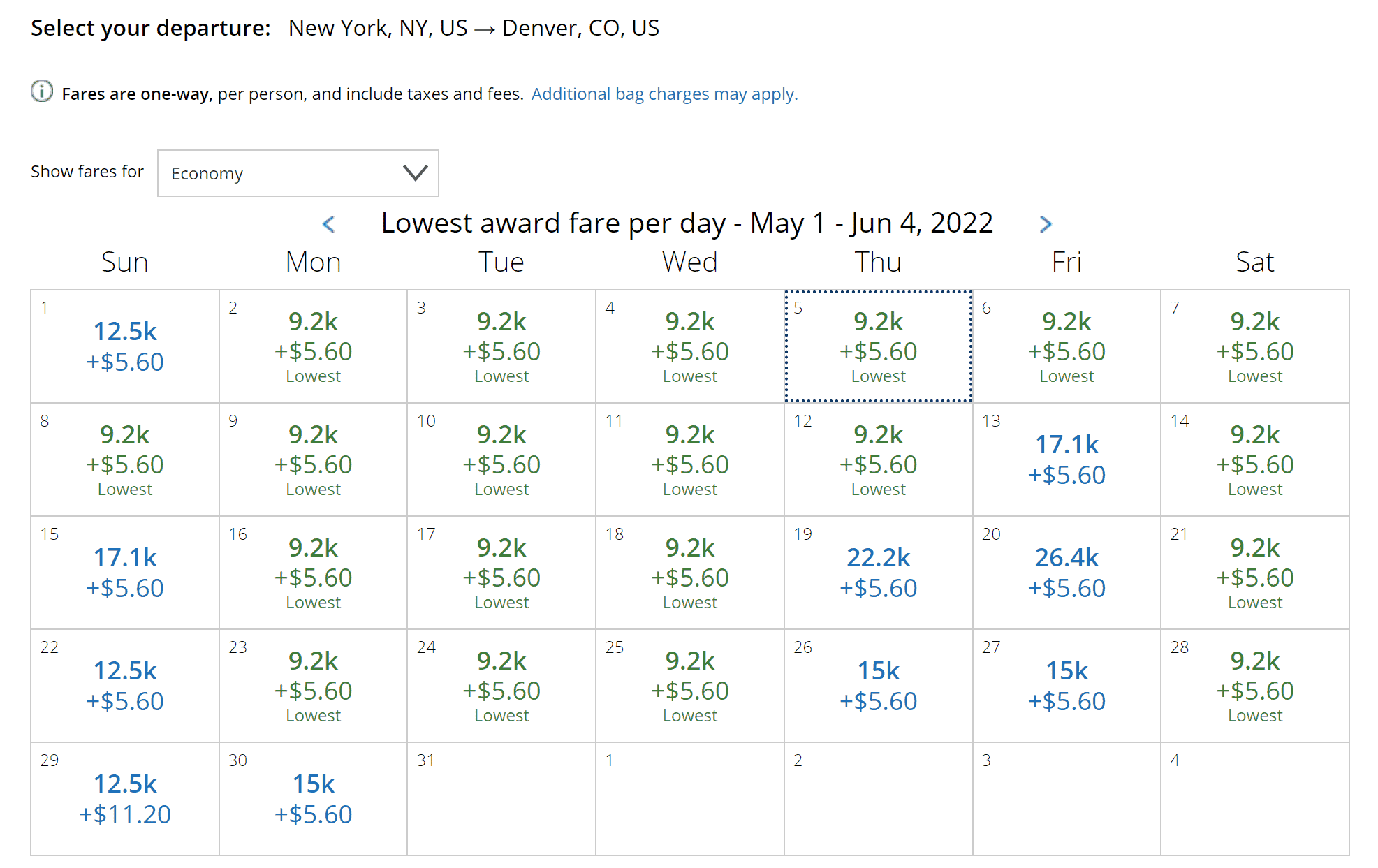

While United award rates can be difficult to count on because of their dynamic pricing model, it might be possible to book a one-way business class ticket to Europe or two round-trip economy tickets within North America with one sign-up bonus.

First Checked Bag Free

When you use your United Explorer card to buy a ticket for a United flight, you and one companion traveling on the same reservation can each check your first bag for free. If you otherwise would pay for checked bags, that’s a savings of up to $140 on a single round-trip flight.

Note that unlike with other airline cards, this benefit is rather restrictive. In addition to including your MileagePlus number on the reservation, you have to purchase your ticket directly from United and use your Explorer Card to pay for it.

This means that tickets for United flights booked through a partner airline’s mileage program, such as Avianca LifeMiles, Air Canada Aeroplan or Singapore KrisFlyer, won’t qualify for free checked bags. Tickets booked through a third-party travel agency, such as American Express Travel or the Chase, Citi or Capital One travel portals aren’t eligible for the free bag benefit, either.

Enhanced Award Availability

When making seats available for purchase with miles, United sets aside some economy seats exclusively for members who are either MileagePlus Premier flyers or hold a co-branded United card, such as the United Explorer, the United Quest℠ Card or the United Club℠ Infinite Card. This additional award space can make a huge difference when trying to use your miles, especially during busy travel periods.

60,000

Bonus Miles

plus 500 Premier Qualifying Points after you spend $4,000 on purchases in the first 3 months your account is open.

Annual Fee: $250

80,000

Bonus Miles

after you spend $5,000 on purchases in the first 3 months from account opening

Annual Fee: $525

Priority Boarding

As the primary cardmember, you and any companions traveling on the same reservation will be invited to board United-operated flights in Group 2. Unlike the free checked bag benefit, priority boarding is tied to your MileagePlus number and does not depend on using the card to purchase your ticket.

2X Bonus Categories

The United Explorer Card earns 2X points per dollar spent in the following categories:

- United purchases, including tickets, seat assignments, checked bag fees, in-flight food, beverages and Wi-Fi, one-time United Club passes and more

- Restaurants and eligible delivery services, including Grubhub, Caviar, Seamless and DoorDash

- Hotel accommodations when purchased directly with the hotel

The card earns 1X on all other purchases.

25% Rebate on In-Flight Purchases

When you use your United Explorer Card to pay for food, drinks or Wi-Fi on board a United-operated flight, you’ll get 25% back as a statement credit. With United’s new contactless payment system, you don’t even have to remember to carry the card with you—simply set it as your preferred form of payment for onboard purchases in the United app, and your in-flight purchases will be charged to the card automatically.

Two United Club Passes

Shortly after opening the card and every year after your account anniversary, you’ll receive two United Club one-time passes. These are loaded automatically to your United account and can be redeemed through the United app. You can also gift them to a friend or family member by sharing a screenshot.

Note that you’ll need to show a same-day boarding pass for a United or other Star Alliance flight to access the lounge, and one-time passes may not be accepted when a lounge is near capacity.

Primary Rental Car Insurance

If you rent a car and pay with your United Explorer card, you can decline the collision damage insurance offered by the rental car company. As long as your rental is for 31 days or fewer, Chase will provide that coverage automatically anywhere in the world, and you won’t have to file a claim with your personal auto insurance.

Rental car agencies usually charge between $10 and $30 per day for their collision damage waiver (CDW). If you need to rent a car while traveling, this benefit can save you a lot of money quickly.

Purchase and Travel Protection Benefits

The United Explorer Card, like many Chase cards, offers a variety of purchase and travel protection benefits just for using your card.

For example, when you make travel purchases with the Explorer Card, you’ll automatically get coverage for trip interruptions or cancellations, as well as reimbursement for expenses related to trip delays or delayed baggage.

And when you purchase physical goods, you’ll benefit from purchase protection (up to $500 in coverage against theft or damage for 120 days from purchase) and up to an extra year of extended warranty coverage (up to $10,000 per claim).

In many cases, it takes just one covered delay or cancellation, or one damaged or stolen item, for the card to pay for itself many times over.

Global Entry or TSA Precheck Enrollment Credit

Global Entry and TSA Precheck make traveling a whole lot more pleasant. When you charge the application (or renewal) fee for either program to the United℠ Explorer Card, you’ll get up to $100 as a statement credit every four years.

Earn Premier Qualifying Points

Are you chasing United elite status but likely to come up a little short at the end of the year? You’ll earn 500 Premier Qualifying Points (PQPs) for every $12,000 you spend on purchases on your card, up to 1,000 PQPs per calendar year.

No Foreign Transaction Fees

While this is standard for credit cards with an annual fee, it’s particularly important for frequent travelers, since otherwise foreign transaction fees (around 3% in most cases) typically negate the value of any rewards earned by using a card for purchases abroad. All United credit cards are free of foreign transaction fees.

So Is the United Explorer Card Worth It?

At this point, you’ve got what you need to decide if the United Explorer Card is worth it. Let’s recap:

- The welcome bonus can easily be worth $500 to $800.

- You can save up to $140 in baggage fees on every round-trip flight with a plus one.

- Every year, you get two United Club one-time passes, which regularly cost $59 each.

- You get $100 toward Global Entry or TSA Precheck.

- Rental car insurance saves you $10 to $30 per rental day.

- If you use the card to buy food, beverages or Wi-Fi on United flights, you’ll get 25% back as a statement credit.

- The annual fee is waived for the first year.

What Other Cards Should You Consider in the Same Price Range?

Almost every U.S. airline has a credit card that costs around $100 and offers a free checked bag, priority boarding and rebates on in-flight purchases. If you’re not a United flyer, it probably makes more sense to look at similar card(s) offered by your airline(s) of choice.

American Airlines flyers will be looking at the AAdvantage® Aviator® Red World Elite Mastercard® or the Citi® / AAdvantage® Platinum Select World Elite Mastercard.

For Delta Air Lines, it’s the Delta SkyMiles® Gold American Express Card, and JetBlue has the JetBlue Plus Card.

Southwest Airlines flyers would be looking at the Southwest Rapid Rewards® Premier Credit Card (though we generally prefer the slightly more expensive Southwest Rapid Rewards® Priority Credit Card).

And if you fly Alaska Airlines, you’ll be eyeing the Alaska Airlines Visa Signature Card, which comes with Alaska’s famous Companion Fare allowing you to buy one economy ticket and get the second for just $99 plus taxes.

If you’re going to spend only $100 per year on one credit card, though, we’d recommend the Chase Sapphire Preferred® Card. With this card, you’ll earn:

- 5X Ultimate Rewards points on travel booked through the Ultimate Rewards travel portal

- 3X on restaurants, online grocery delivery and streaming services

- 2X on all other travel purchases

- 1X on all other spending

You can transfer those points 1:1 to nearly a dozen airlines, including United, and three hotel loyalty programs. On top of that, it has an annual $50 hotel credit that offsets a good chunk of the annual fee.

Chase Sapphire Preferred® Card

60,000

bonus points

after you spend $4,000 on purchases in the first 3 months of account opening.

Annual Fee: $95

When Would It Make Sense to Pay for a More Expensive Card?

For frequent United travelers, Chase offers two premium United cards that offer enhanced travel benefits.

The United QuestSM Card offers 3X MileagePlus miles per dollar spent on United and 2X miles on all other travel, as well as 2X on dining and select streaming services.

Its $250 annual fee is offset by a $125 annual credit toward United purchases, a rebate of 5,000 miles on each of your first two award bookings every year and two free checked bags for you and one companion on the same reservation when flying United, on top of the other benefits offered by the Explorer Card.

If you’re spending at least $125 per year on United, at the end of the day, this card really only costs $30 more than the United Explorer card. And it gets you a second free checked bag and up to 10,000 miles rebated every year—using either of those benefits once more than makes up for the difference in cost.

If you also want access to United Club airport lounges when traveling, you can go for the United ClubSM Infinite Card. It gives you full access to United Club locations and participating Star Alliance partner lounges worldwide when flying on United or a Star Alliance airline, with up to two adult guests (or one adult and your dependent children under 21).

The card also offers a whopping 4X miles per dollar spent on United purchases (and 2X on dining and non-United travel purchases), access to priority check-in and security with United Premier Access, two free checked bags for you and a companion plus the other benefits offered with the United Explorer card, such as a $100 Global Entry/TSA Precheck credit and 25% rebate on in-flight purchases.

60,000

Bonus Miles

plus 500 Premier Qualifying Points after you spend $4,000 on purchases in the first 3 months your account is open.

Annual Fee: $250

80,000

Bonus Miles

after you spend $5,000 on purchases in the first 3 months from account opening

Annual Fee: $525

When Does a No-Annual-Fee Credit Card Make More Sense?

Chase offers the no-fee United Gateway Card, which offers some basic benefits: 25% off in-flight purchases with United and 2X miles per dollar spent on United, gas, local transit and commuting.

It has no foreign transaction fees, which is unusual for a no-fee card. However, given the lack of benefits compared with the Explorer card (and others in the United lineup) and the fact that it has a similarly lackluster welcome offer, it really isn’t a particularly compelling option.

If you want United miles, a better option may be the no-fee Chase Freedom Unlimited®. That card earns 5X Chase Ultimate Rewards points per dollar spent on travel purchases made through Ultimate Rewards, 3X on dining and at drugstores, and 1.5X (marketed as 1.5% cash back) on all purchases.

Points earned with the Freedom Unlimited can be combined with the Chase Sapphire Preferred® Card, the Chase Sapphire Reserve® or the Chase Ink Business Preferred® Credit Card and then transferred to United MileagePlus or other airline and hotel partners.

$200

Bonus

after you spend $500 on purchases in your first 3 months from account opening

Earn an additional 1.5% cash back on everything you buy

(on up to $20,000 spent in the first year) - worth up to $300 cash back!

Chase Ink Business Preferred® Credit Card

100,000

Chase Ultimate Rewards Points®

after you spend $8,000 on purchases in the first 3 months after account opening

Annual Fee: $95

Bottom Line

The United Explorer Card offers a lot of value to people who fly United somewhat frequently—enough to get use out of the United-specific benefits, but not enough to earn elite status (which makes many of the card’s benefits redundant). However, consider an upgrade to the United Quest card for more United benefits or the Chase Sapphire Preferred® Card for more travel flexibility.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months of account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $3,000 on purchases in the first 3 months your account is open.

plus 500 Premier Qualifying Points after you spend $4,000 on purchases in the first 3 months your account is open.

after you spend $5,000 on purchases in the first 3 months from account opening

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.