10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Many travel rewards enthusiasts tout Chase Ultimate Rewards as the best rewards program offered by a bank, and the reason is their versatility.

Ultimate Rewards can be redeemed for merchant gift cards, as cash back, transferred to a number of hotel and airline loyalty programs and used to book travel via Chase’s own travel portal, which is quick and easy.

Depending on the Chase credit card you hold, booking various aspects of travel through the Chase Ultimate Rewards Travel Portal can provide more value than redeeming the same rewards for cash back or even booking a flight through a transfer partner.

“But how?” you might wonder.

Don’t worry. We’ll get there, but let’s start with the basics.

How to Earn Chase Ultimate Rewards

Ultimate Rewards-earning credit cards issued by Chase are easy to spot. They’re the cards that aren’t co-branded with a hotel or an airline. By keeping one of the following credit cards in your wallet, you have access to Ultimate Rewards and its travel portal.

Chase Sapphire Preferred® Card

60,000

bonus points

after you spend $4,000 on purchases in the first 3 months of account opening.

Annual Fee: $95

What Chase Ultimate Rewards Points Are Worth

Not all Ultimate Rewards points are created equal. Their value depends on the credit card you hold and is roughly correlated with the annual fee on each card. The higher the annual fee you pay, the more the points are worth when redeemed through the travel portal.

Here is a quick list of the value of each Ultimate Reward Point based on the card you have.

| Credit Card | Ultimate Rewards Points’ Value |

|---|---|

| Chase Sapphire Preferred | 1.25 cents per point |

| Chase Sapphire Reserve® | 1.5 cents per point |

| Chase Freedom Unlimited® | 1 cent per point |

| Chase Freedom | 1 cent per point |

| Chase Ink Preferred | 1.25 cents per point |

| Chase Ink Cash | 1 cent per point |

| Chase Ink Unlimited | 1 cent per point |

60,000

Chase Ultimate Rewards® Points

after you spend $4,000 in 3 months

Annual Fee: $550

Ways to Maximize Your Points’ Value by Using Multiple Cards

As a holder of multiple Ultimate Rewards-earning credit cards, you can maximize their value by transferring points from one card where their value is low to another where their value will increase.

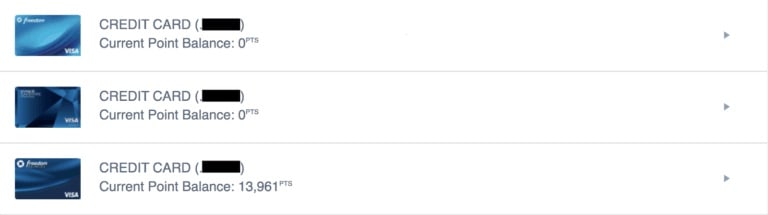

For example, let’s say you hold the Chase Freedom and the Chase Sapphire Preferred. Both cards show up in your Ultimate Rewards account, and you can toggle between them to see how many points are sitting in each account.

You can combine points by transferring them from the Chase Freedom to the Chase Sapphire Preferred to increase their portal redemption value from 1 cent each to 1.25 cents.

$200

Bonus

after you spend $500 on purchases in your first 3 months from account opening

Feel free to follow the same strategy when transferring points between spouses. Chase allows transferring Ultimate Rewards to a spouse or an authorized user in the same household at no cost.

If you hold the Chase Sapphire Preferred and your spouse holds the Chase Sapphire Reserve® and you wish to make a portal redemption, go ahead and transfer your points to your spouse’s account and book from there.

Finally, you can do the same thing with personal and business accounts. Combine Freedom Unlimited points with those earned with the Ink Business Preferred® Credit Card and increase their worth.

When You Should Redeem Ultimate Rewards Points Via Chase Travel Portal

When it comes to redeeming Ultimate Rewards points, utilizing transfer partners and their award charts are going to be your best bet in many cases. This strategy is especially true if you’re looking to fly in style in a business or first-class cabin overseas.

However, redeeming points in the Chase travel portal can make sense in certain circumstances. Let’s take a look at a list of scenarios when redeeming Ultimate Rewards points through the travel portal is the way to go.

Earn an additional 1.5% cash back on everything you buy

(on up to $20,000 spent in the first year) - worth up to $300 cash back!

When you book an economy ticket: When paying cash, business class flights often cost triple or quadruple the price of a coach ticket and aren’t an option for the mere mortals. For this reason, most travelers opt for more affordable economy flights. Using Ultimate Rewards points as cash at a rate of 1.25 to 1.5 cents apiece is like using an alternative payment method to offset your cash cost.

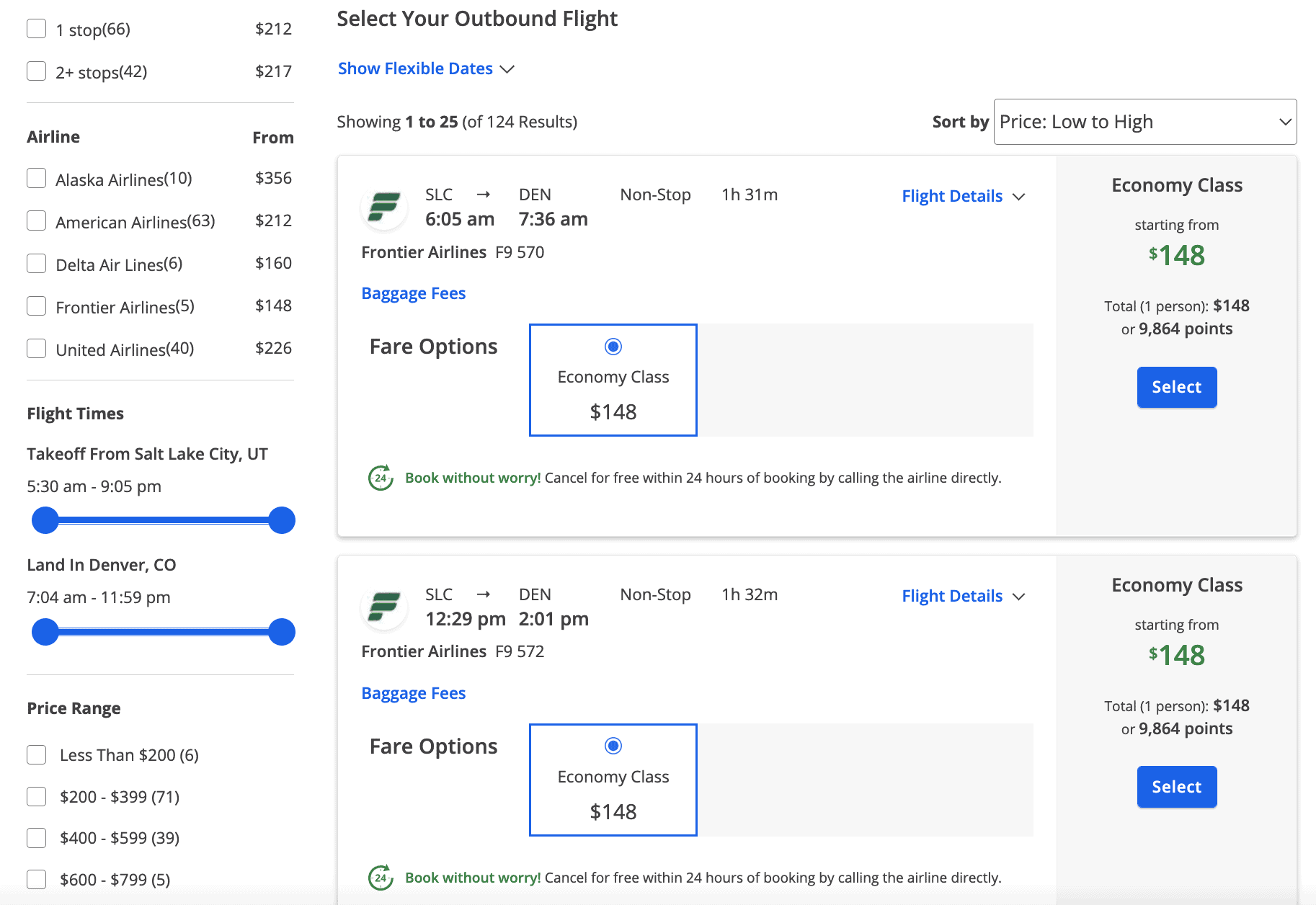

When cash prices are low: Whether they’re distance-based, region-based or revenue-based, most airline rewards programs implement award charts to price out their award flights. If you’ve been in this hobby long enough, you know roughly what an award should cost.

A one-way domestic flight should cost no more than 12,500 miles, and a one-way economy flight to Europe should require no more than 30,000 miles each way. You can decrease redemption rates significantly by using the travel portal when airlines run fare sales.

For example, you find a round-trip flight from the United States to Europe for $450. When booked through the portal, you need 30,000 Ultimate Rewards to book it. When booked through a transfer partner, such as United MileagePlus, you need double the miles to book a similar round-trip, plus you’ll be on the hook for taxes.

Booking through the portal in this case can get you two award tickets for the regular rate of one. Make a habit of running multiple searches and comparing partner redemption rates with those of the portal before clicking “Book.”

Chase Ink Business Preferred® Credit Card

100,000

Chase Ultimate Rewards Points®

after you spend $8,000 on purchases in the first 3 months after account opening

Annual Fee: $95

When you can’t find an award flight: In a perfect world, the most ideal flights with the best layovers and travel times magically could be booked with miles at the lowest redemption rates.

Unfortunately, the world isn’t perfect, and the awards we do find include multi-hour connections (sometimes overnight) and intricate itineraries (those who have ever traveled from the West Coast to Midwest via Atlanta on Delta Air Lines know what I’m talking about).

Despite what big-time credit card bloggers lead you to believe, perfect award itineraries don’t just appear at the snap of a finger, and you must settle for a cash booking when you want to minimize your travel time and arrive at your destination at a reasonable hour.

This is where flexible points come in—use them as cash to book any available flight via the Chase travel portal. As a result, the money stays in your pocket and you still earn frequent flyer miles on your reservation. It’s a win-win.

When you’re cash-poor and points-rich: Say, you maxed out the Chase 5/24 rule and are swimming in Ultimate Rewards. Way to go! In addition to making us all jealous, you can save cash and book a bunch of free travel, such as flights, hotels and activities. This is a good option for those who have more points than they know what to do with and, perhaps, not as much cash. Save it for the food you’re about to devour in a new destination.

Chase Ink Business Cash® Credit Card

Earn $350

bonus cash back when you spend $3,000 on purchases

in the first three months and additional $400 when you spend $6,000 on purchases in the first six months after account opening

How to Use Chase Travel Portal to Book Travel

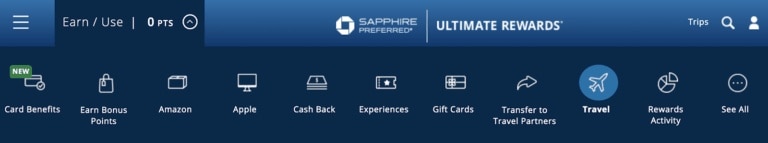

When redeeming points via the Chase Ultimate Rewards Travel Portal, remember that the engine acts as an online travel agency. In fact, the portal is powered by cxLoyalty, which has access to a large catalogue of travel providers. It’s possible to book airfare, hotel rooms (including Luxury Hotel & Resort Collection), activities, cruises and car rentals through the portal.

Flights

Flights booked via the Ultimate Rewards Travel Portal are considered cash flights—even if you used Chase points—and earn frequent flyer miles. Make sure to credit these flights to a loyalty program of your choice and earn miles back in a frequent flyer account.

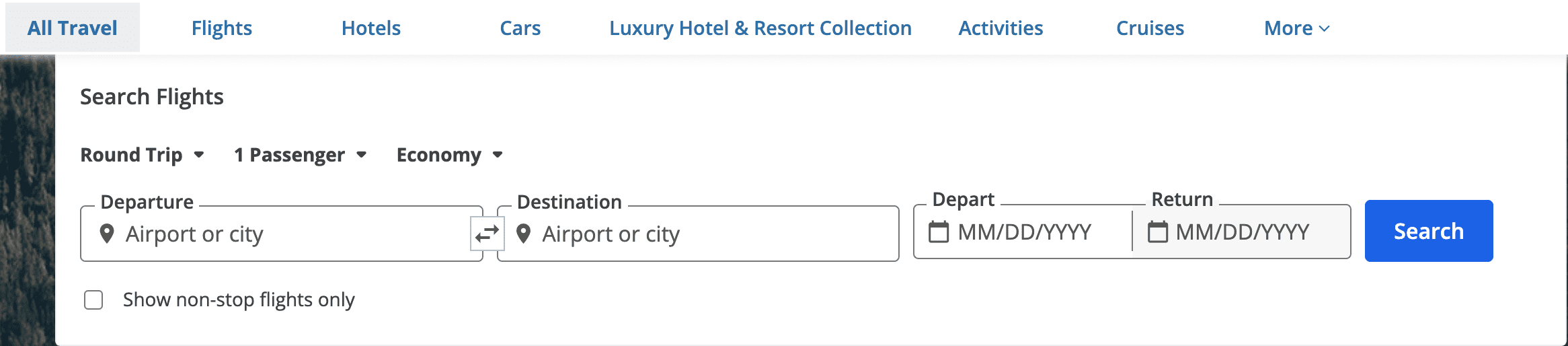

To redeem Ultimate Rewards points for a flight, log in to your Ultimate Rewards account and access the travel portal from the card whose points are worth the most (see table above). The search engine doesn’t look any different from what you’ve seen on any other online travel agency’s website.

To begin your search, enter the city pair, travel dates and how many passengers are traveling. Check whether you’re flying round-trip, one-way or multi-city and click “Search.”

The flight options will display price in cash and in points. In case you select a basic economy fare, you’ll be given a notification stating so and an option to upgrade. Here you can also filter results by price, number of stops, operating airlines, etc.

At checkout, you’ll be asked whether you want to pay for the trip with a credit card or with points. If you don’t have enough points in the account, it’s possible to make a partial payment with rewards and bill the remainder to your card. The points’ value stays the same.

Something else worth mentioning is if you want to use your Ultimate Rewards to book a Southwest Airlines flight and don’t want to transfer points to Rapid Rewards, you can book it via the portal, but you have to call. A Chase travel specialist can reserve a Southwest flight for you over the phone at 1-855-234-2542.

The reason to book a Southwest flight via the travel portal and not via the Rapid Rewards program directly is if the redemption rate is close to that of the portal’s when taxes are included, but you want to earn points on the booking.

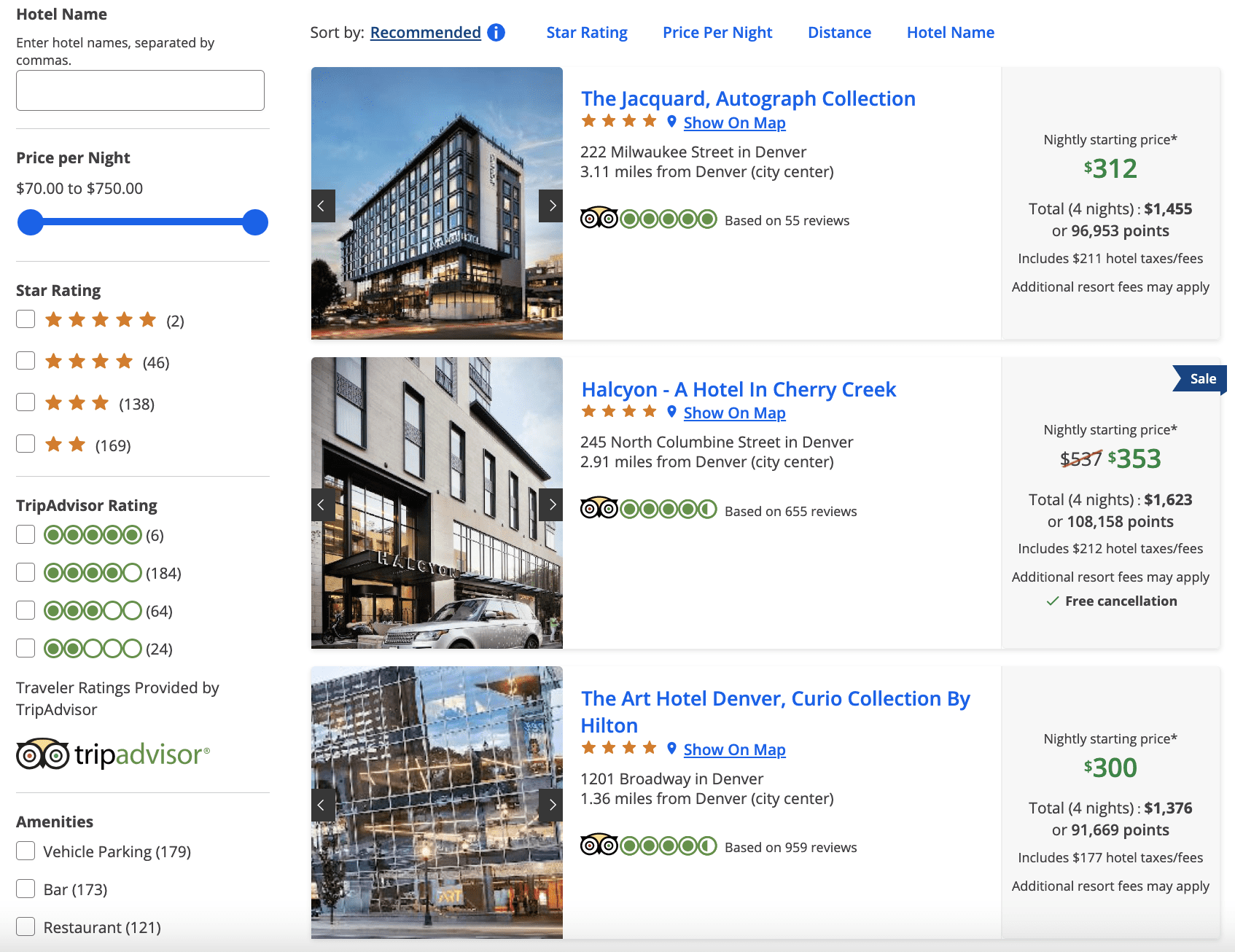

Hotels

When it comes to hotel rooms, the Ultimate Rewards travel portal has no shortage of options for your stay. From mom-and-pop guesthouses to chain hotels and vacation rentals, you’re guaranteed to find something to your liking. Filter your results even further by star rating, price, amenities, etc.

The process is similar to the flight search. Simply enter your destination, number of nights and travel dates, click “Search” and voilà—you don’t have to sleep on the beach or in the car on your vacation. In some cases, the number of points at a chain hotel is fewer than if you were to book directly.

Keep in mind that hotel reservations made through the Ultimate Rewards Travel Portal typically don’t earn elite credits toward status. In some cases, your existing status might be recognized and you can receive some perks, but don’t count on it. It’s worth considering when choosing to go with the portal or the hotel itself when making a booking.

If you hold the Chase Sapphire Reserve®, you also have access to the Luxury Hotel and Resort Collection. When booking these properties, some amenities, such as daily breakfast for two, room upgrades and early check-in/late checkout, are included.

Chase Ink Business Preferred® Credit Card

100,000

Chase Ultimate Rewards Points®

after you spend $8,000 on purchases in the first 3 months after account opening

Annual Fee: $95

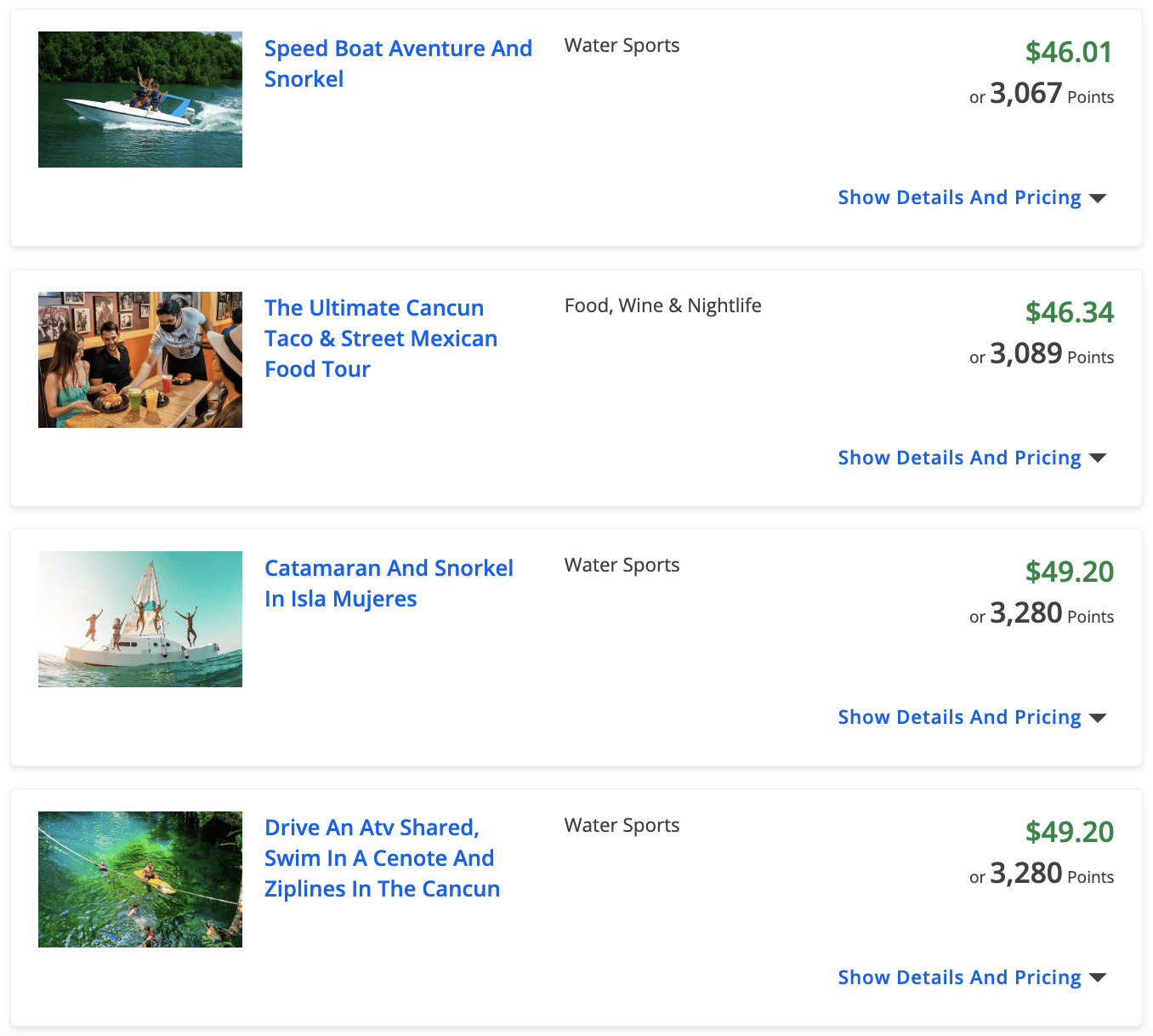

Activities

Going to Cabo and aren’t sure what to do once there? No worries. The Chase Ultimate Rewards Travel portal has got you with Things to Do, aka activities and excursions.

Enter your destination and dates, and an array of activities bookable with either cash or points will be presented on the next page.

Things to Do are available in many popular destinations and include various activities, such as sunset cruises, snorkeling excursions, city tours, cooking classes, airport transfers, and many more. Filter results by interests, private/group tours and whether you’re looking for a family friendly activity.

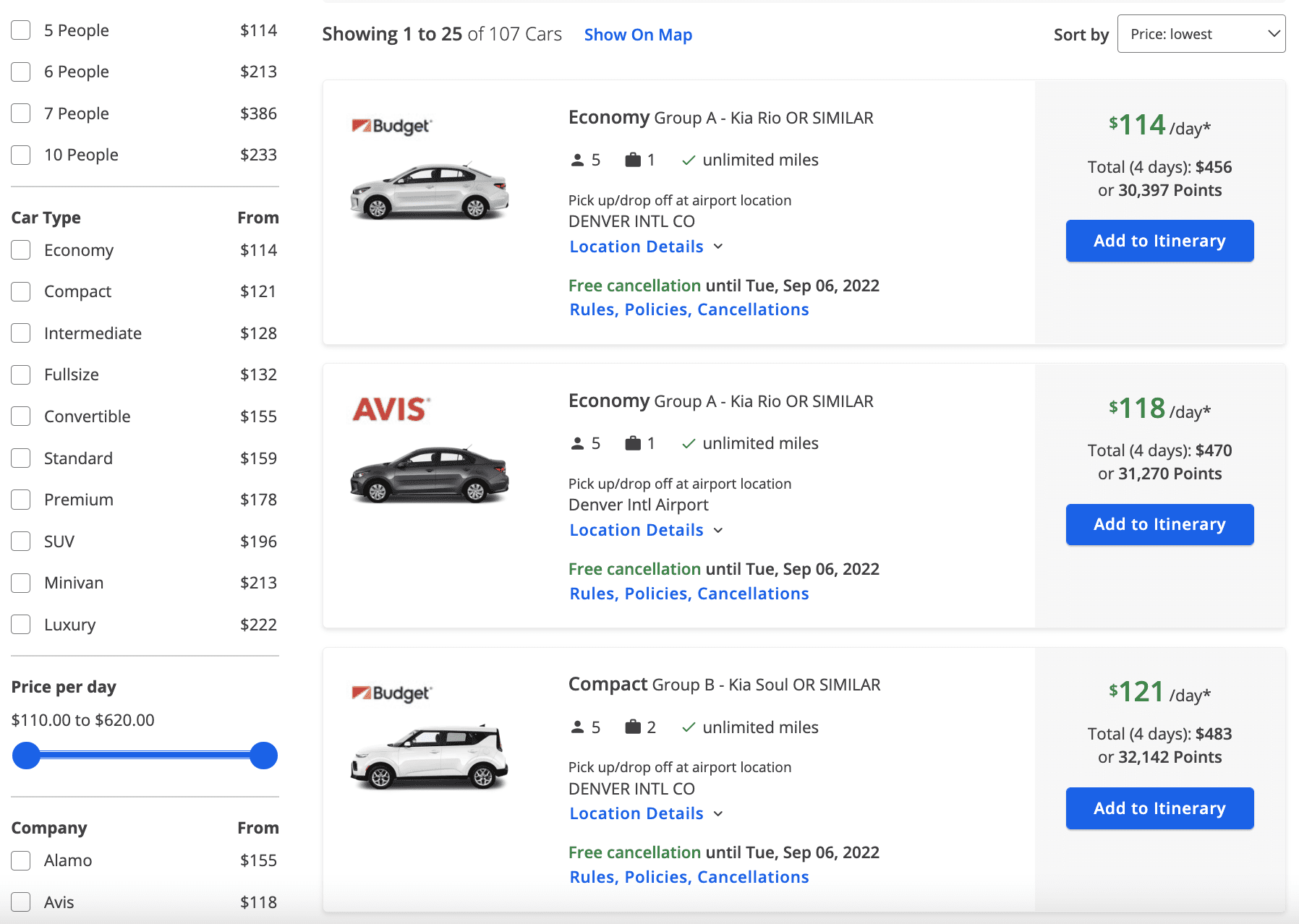

Car Rentals

Just like all the other vacation components, rental cars can be booked with either cash or points. Enter your destination and dates, filter results by car type, price, preferred rental company and other specs (can you drive stick?), and you’ve got yourself some wheels.

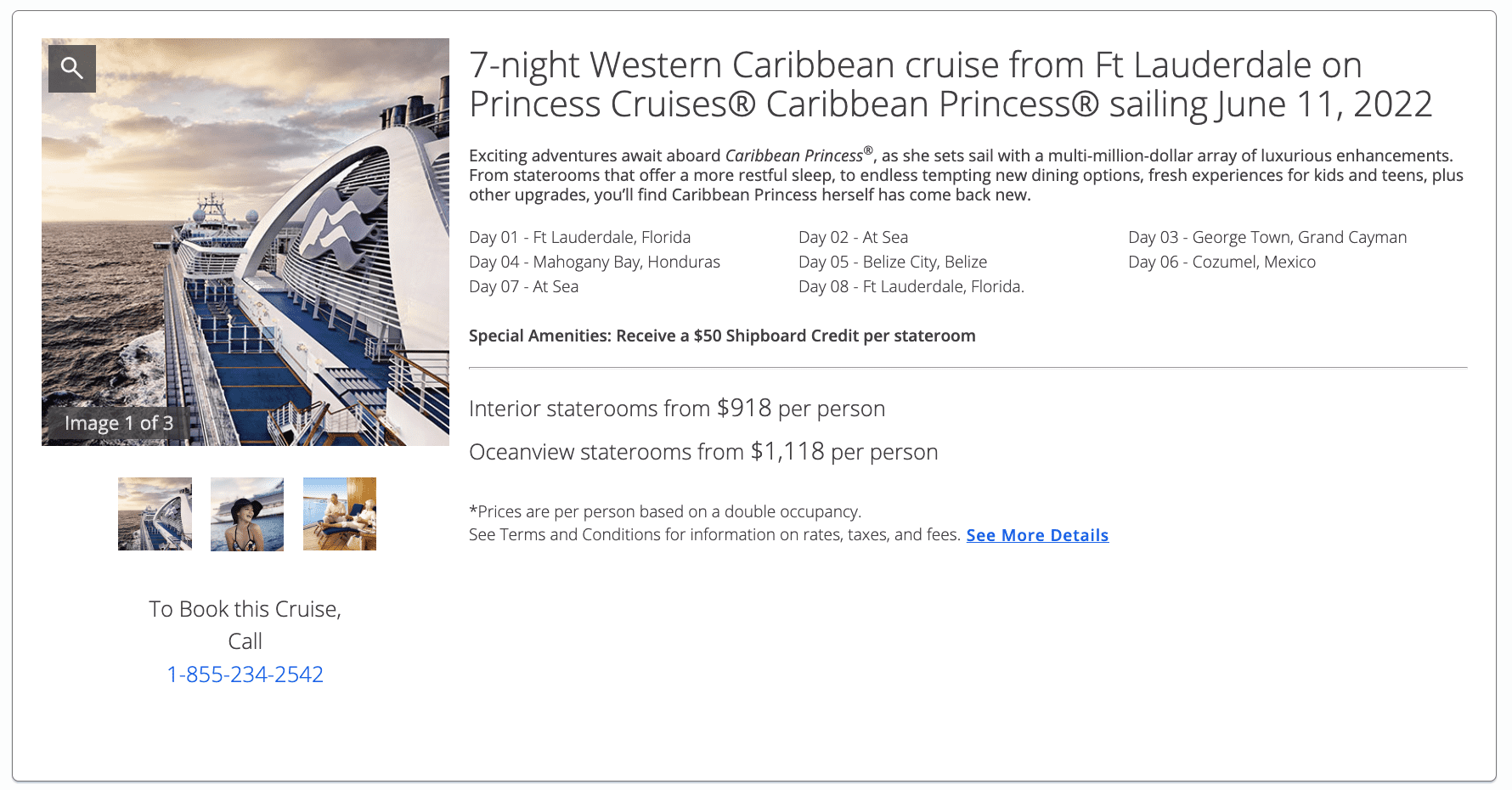

Cruises

Cruise lines are a special kind of animal. If you’re looking to set sail by covering your trip with points, call 1-855-234-2542 to book a sea voyage. You can search for itinerary options and pricing via the travel portal by entering the destination, but a travel specialist should be able to book any cruise itinerary available to the public even if you don’t see it in the portal.

Final Thoughts

For some travelers, redeeming Chase Ultimate Rewards through the travel portal doesn’t provide much value. However, if you don’t care to fly up front and your goal is to save money on a trip, using Ultimate Rewards points at an elevated value of 1.25 to 1.5 cents can yield more budget for dinners, tours and shopping.

So, what are you waiting for? An affordable holiday is just a few clicks away.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months of account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.