10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

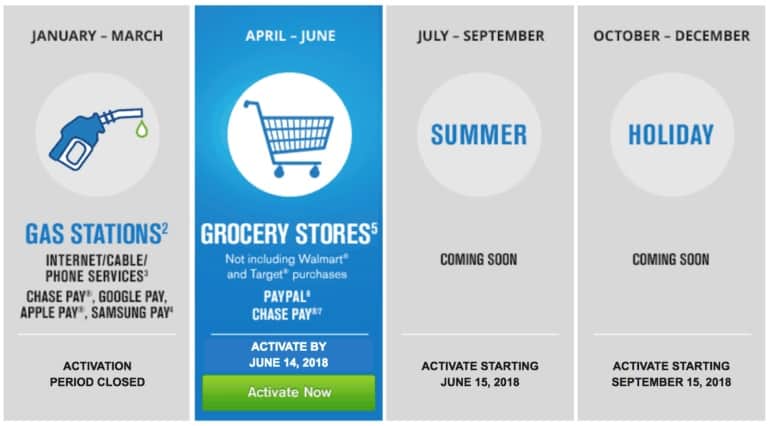

The Chase Freedom—no-annual-fee—is attractive to many miles and points enthusiasts because of its quarterly bonus categories. For each quarter of the year, Chase announces categories that will earn 5% cash back on up to $1500 in purchases.

This “cash back” is actually provided in the form of Chase Ultimate Rewards points, meaning you get 5X Ultimate Rewards points per dollar spent—if you also have a Chase Sapphire Reserve®, Chase Sapphire Preferred or Chase Ink Business Preferred, you can combine your Ultimate Rewards points and transfer them to airline partners. You can learn about these cards and more by visiting our credit cards page.

This also works if you happen to have one of the no-longer-available business cards – the Chase Ink Plus or Chase Ink Bold.

If you maximize the bonus categories every quarter, you’ll earn 30,000 points per year—worth up to $600 toward select travel via Chase Travel℠ if you have the Chase Sapphire Reserve®, or 30,000 points to transfer to airlines such as United Airlines, Southwest Airlines, British Airways or Korean Air.

Very important: these bonus categories are not automatic, so you must manually activate them. You have until about two weeks before the end of the quarter to register. As long as you register before the deadline, you will receive bonus points for all transactions made during the quarter—even ones made before you registered.

This year’s 2nd quarter bonus categories are Grocery Stores, PayPal and Chase Pay, and the bonus points apply to purchases made in April, May,and June. (The terms specifically note that “grocery stores” does not include Target, Wal-Mart, discount stores or warehouse clubs like Costco and Sam’s Club).

What is Chase Pay?

Chase Pay is Chase’s response to online payment networks like Amex Express Checkout, Mastercard Masterpass and Visa Checkout. It allows you to make purchases on supported websites and apps by logging into your Chase account instead of providing your card details directly to the merchant.

You can also use the Chase Pay mobile app to complete purchases in-person by showing a QR code at supported stores—mostly restaurants and gas stations. You can find the full list of participating merchants on the Chase website.

How to Spend $1,500 in Three Months

Spending $1,500 in specific categories in three months can seem challenging at first, so here are some ideas on how to maximize these bonus categories for this quarter:

Buy groceries

This one may seem obvious, but if you’re buying groceries—and who isn’t?—use your Freedom card to earn 5X Ultimate Rewards points for every dollar spent. According to the USDA, the average 2-person household spends between $400 and $700 per month on food at home!

While not all of that spending happens at grocery stores—remember that Target, Walmart, and warehouse clubs are excluded—there’s a good chance that your regular grocery spending could go a long way toward maxing out this quarter’s bonus categories.

Use Chase Pay at supported websites and stores

Chase says you can use Chase Pay at thousands of places, although they only highlight a handful on their website. This includes major websites like eBags and Walmart.com, grocery stores like Shoprite and Pricerite, Starbucks (both in the Starbucks app and in-store with the Chase Pay app) and lots of restaurants. So, keep an eye out for the Chase Pay logo in-store and online.

Use Paypal for your online purchases

Paypal is one of the largest payment networks in the world, and is supported by a wide variety of websites. There’s a good chance that if you’re buying something online, you can pay for it via Paypal including big names like Apple, Best Buy, eBay, Overstock, Sears, Target, Walmart, and Wayfair.

What if that’s not enough?

If you’ve exhausted your spending for the quarter, here are a few backup strategies that can help you maximize your rewards.

Buy gift cards for future purchases at your local grocery store

Almost all grocery stores sell their own gift cards, so if you know you’ll be buying groceries later this year, you can buy a gift card from your favorite grocery store to get your 5X Ultimate Rewards points now, then use the gift card for your groceries after the end of June.

Many grocery stores also offer a wide variety of other merchant gift cards—clothing stores, airlines, gas stations, and more—so, if you think you’ll use those faster than a grocery store gift card, buying a gift card for a different merchant can also be a good way to lock in those bonus points.

This amounts to paying for your groceries (or other goods) ahead of time.

Buy gift cards from PayPal online

PayPal has its own online gift card store, PayPal Digital Gifts, where you can buy gift cards for merchants like Airbnb, Home Depot, Hotels.com, Southwest Airlines and Uber. You can often find gift cards at a discount to get an even better deal.

This is one of our favorite ways to save money on Airbnb stays. Check out 5 tricks to save money and earn the most points possible with Airbnb.

These gift cards are sent immediately to your email (or someone else’s, if you’re buying them as a gift), so there’s no card to lose and it’s easy to redeem them online; you can also redeem gift cards in person by showing the card’s barcode on your phone, or printing out the barcode and handing it over in store.

Pay your taxes via PayPal

Did you know you can pay your federal taxes online with a credit card? The IRS works with three authorized payment vendors to accept online tax payments, and one of those – PayUSATax – accepts PayPal.

There’s a 1.97% fee for credit card payments, but the 5X Ultimate Rewards points you’ll earn are worth significantly more than that. If you’ve already paid your taxes for 2017, you can make an “estimated payment” toward next year’s taxes—just make sure to keep the receipt for your records, and remember to record that you’ve already made a payment at tax time next year.

If you’re self-employed, you’re probably used to paying estimated taxes at this point so this could be a great option for you.

Pay back friends and family via PayPal

This is the most expensive option, but you can send anyone money with a credit card via PayPal for a fee of 2.9% + $0.30 per transaction. If you get really stuck and don’t want to buy a gift card for future use, you can use your Freedom card to send money to friends or relatives via PayPal. The 5X Ultimate Rewards points you’ll earn for each dollar spent will still outweigh the relatively high PayPal fees. We’d strongly encourage you to choose cheaper options though.

What if I don’t have a Freedom card?

The Chase Freedom card is subject to Chase’s 5/24 rule, so you won’t be able to sign up for it if you’ve opened 5 or more personal credit cards with any bank (plus business card with Capital One or Discover) in the past 24 months.

Even if that isn’t the case, you probably don’t want to use up a 5/24 slot for it, since its sign-up bonus is only 15,000 Ultimate Rewards points. You’d be better off signing up for a Chase Sapphire Preferred or Chase Sapphire Reserve® card with a higher sign-up bonus.

Keep in mind that Chase announced a new Sapphire rule last year. You will only be able to sign up for a Sapphire card if you don’t currently have any Sapphire card and you haven’t received a sign-up bonus for any Sapphire card in the past 24 months.

Final Thoughts

If you have the Chase Freedom, you have an easy way to earn 7,500 Ultimate Rewards points each quarter if you max out the $1,500 spend. Some quarters are easier than others, but most people will be able to take advantage of at least two or three of them.

The 2nd quarter of 2018 let’s you meet that $1,500 spend at grocery stores, PayPal and Chase Pay. For many cardholders, spending close to $1,500 at grocery stores won’t be out of the question, so this will be a fun quarter!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.