10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

When you just start your points and miles journey, it might be really hard to figure out what cards are really worth your attention and what cards are just fluff and creative marketing. You’re bombarded with ads, mailers and unsolicited advice about the best credit cards. It does take focus and determination to stay on track and to not get distracted by all the shiny things along the way.

There are a couple of reasons why a credit card can be considered a newbie trap. First, there’s Chase’s 5/24 rule that we all need to consider when applying for cards. The question you need to ask is this: Will getting a non-Chase personal card now lock me out of more lucrative offers down the road? If the answer is yes, pause and think about what other Chase cards you’d like to get before you move on and stop worrying about the 5/24 rule.

Secondly, there’s the omnipresent marketing. Banks and credit card companies spend a lot of money on new customer acquisition, so you’ll be constantly bombarded with “limited time” and “special” offers. More often than not, the offer isn’t anything special and most “limited-time” offers come around every few months, so you don’t need to jump on one before carefully considering all the other available options.

And finally, there’s an appeal to our vanity. Who wouldn’t be tempted by something so exclusive that, presumably, only a select few can access? We’ll burst your bubble—only the ultra-wealthy individuals can get access to the exclusive “by invitation only” products. The rest of us mere mortals can access pretty much any mass-marketed credit card.

Let’s look at a few cards to avoid while you’re still new to this hobby. Not all of the cards below are necessarily bad, but they can wait till you wade much deeper into the points and miles pool.

Delta SkyMiles® Gold American Express Card

This isn’t necessarily a bad card, but it’s one that gets asked about a lot. On the surface, the welcome offer might seem huge, especially when you get a mailer that says “limited time offer” or “increased bonus”. However, just because a credit card welcome bonus sounds high, it doesn’t mean that the bonus is indeed valuable.

Not all points are created equal, and 40,000 Delta SkyMiles aren’t the same as 40,000 Ultimate Rewards points or 40,000 United MileagePlus miles. It helps to think about airline and hotel points as currencies—$1,000 isn’t the same as 1,000 Mexican pesos or 1,000 Japanese yen.

Most of the time the “increased offer,” won’t take you far. There’s no award chart; Delta’s award rates could be unpredictable; and availability is scarce. So if you get targeted by one of these offers, hold off until you’ve got more valuable cards first.

The Delta SkyMiles® Gold American Express Card is a personal card, so it’ll take a 5/24 slot and potentially prevent you from getting more valuable cards. And trust us when we say that this “limited time offer” will come around again and again.

Delta SkyMiles® Gold American Express Card

50,000

Bonus Miles

after you spend $2,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

Annual Fee:

$0 introductory annual fee for your first year, then $150.

Hilton Honors American Express Card

The Hilton Honors American Express Card is another card that often has an increased welcome bonus marketed as a “limited time” offer. The welcome bonus on this $0 annual fee card (see Rates & Fees) varies and could go into low six-figure number.

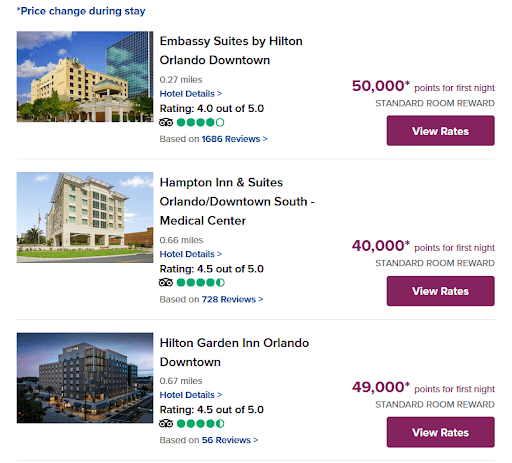

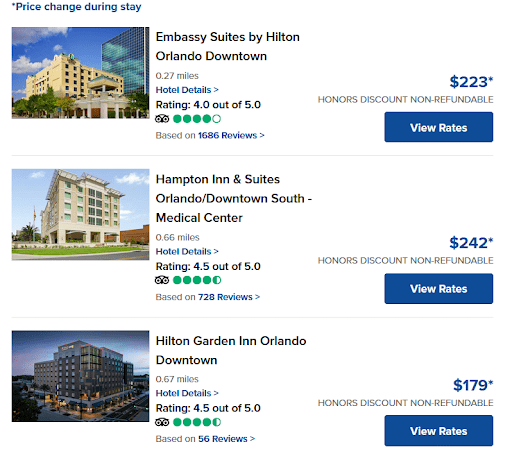

When newbies see the high five-figure to low six-figure point welcome bonus, they might think that it’s better than, for example, 60,000 Ultimate Rewards points they can earn with the Chase Sapphire Preferred® Card. A six-figure bonus might look alluring, but you’ll need a lot of Hilton points to book almost any property in Hilton’s portfolio, even the mid-tier or lower-tier hotels.

Hilton doesn’t publish an award chart, so it’s hard to say how many points you’ll need for your stay until you start looking for properties that fit your parameters, but usually 1 Hilton Honors point is worth about 0.5 cents.

Hilton Honors American Express Card

100,000

Hilton Honors Bonus Points and a $100 Statement Credit

after you spend $2,000 in purchases on the Hilton Honors American Express Card in your first 6 months of Card Membership. Offer Ends 8/13/2025.

And let’s compare the point prices to actual cash prices. Here are the cash prices for the same properties.

So let’s say you come across a 100,000-point welcome bonus marketed as a “limited time offer.” Judging by the example above, the bonus is worth less than $500. We can do better, and there’s plenty of cards that come with better welcome offers.

Hilton Honors points could be valuable, especially outside the U.S., but there are other, better cards you should get first if you’re after Hilton points.

And don’t forget about the 5/24 card limit from Chase. If you’re new to this hobby, skip the Hilton Honors American Express Card until you’ve gone further down the list of the best cards.

Hilton Honors American Express Surpass® Card

This is another example of a card that’s not actually bad, but because it offers a six-figure welcome bonus, it could be a newbie trap.

This low annual fee card (see rates & fees) has good benefits, such as Hilton Honors Gold status and the ability to earn a free night reward at any Hilton property after you spend $15,000 in a cardmember year. The free night can be used at almost any Hilton property, including some pricey resorts, such as the Waldorf Astoria Maldives Ithaafushi where the cash rates top $1,000 per night.

However, we recommend skipping this card while you’re still under 5/24 with Chase. You can always apply for it later.

Hilton Honors American Express Surpass® Card

130,000

Hilton Honors Bonus Points

after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

Annual Fee:

$0 introductory annual fee for the first year, then $150. Offer ends for the intro annual fee 8/13/2025

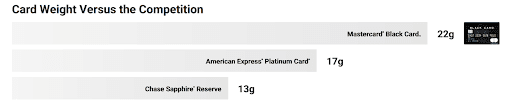

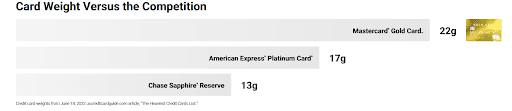

Mastercard® Black Card

Well, what can we tell you about a card that has the words “luxury card” in the URL for its landing page or one that’s bragging about its weight? Did you know it’s a whole 9 grams heavier than the Chase Sapphire Reserve®? We’re not sure why it’s a selling point, but here we are.

And we’re, apparently, supposed to be impressed by 70 patents related to the metal used to make the actual card. When you don’t offer any benefits, you have to brag about something.

We’d rather be impressed by a nice welcome bonus, a solid earning rate and valuable perks. You get none of that for the whooping $495 annual fee.

To be clear, not all high-annual fee cards are bad, but the Mastercard Black card is designed to impress the easily-impressed without providing any value.

We won’t go on much longer about the Black card here because there’s already a comprehensive (and also very funny) piece about this card written by 10xTravel founder and CEO Bryce Conway. It’s a classic, and everyone should read it.

Let’s just say, if you get a mailer touting all the “luxury” benefits of this glorified cashback card, put it straight in your recycling bin.

Mastercard® Gold

This is another vacuous card designed to impress. The first thing you see when you go to the Mastercard Gold’s website is a brag about the card’s metal, not benefits or welcome bonus or perks.

Again, the card’s gold plating is supposed to impress us. You can have this “precious metal” of a card for just $995 annual fee. The card is all about the hype and the appearance without any substance behind it.

The Mastercard Gold card is just an overpriced, glorified cashback card, and not even a good one.

It’s another heavy metal card, as if anyone cares about this stuff in the age of mobile wallets.

Final Thoughts

Banks and credit card companies employ a lot of gimmicks and clever marketing in the crowded credit card space to grab our attention. It’s our job as informed consumers to see through the hype and zero in on the best banking products that will give us the most benefits and offer a good return.

The card’s weight or what it’s made of shouldn’t be a consideration. A six-digit welcome bonus can be deceiving too, as not all points and miles have the same value. When choosing the right card for you, focus on its benefits and the value of the points instead of the flashy, yet insignificant, details.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $2,000 in eligible purchases on your new Card in your first 6 months of Card Membership.

after you spend $2,000 in purchases on the Hilton Honors American Express Card in your first 6 months of Card Membership. Offer Ends 8/13/2025.

after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.