10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Editors Note: Some of these credit card offers have changed. Please visit 10xtravel.com/creditcards for a list of up-to-date offers.

We just got back from an insane almost 3 week trip to Australia to celebrate my wife and my 5th Anniversary along with my father in law’s 65th birthday. We flew business class and stayed in some insane hotels that we never would have had experienced without miles and points!

My wife and I first started collecting miles and points in early 2016. In just over the 2 years, we’ve been able to collect over 2 million points to put toward a variety of travels. Thanks to award travel, we haven’t paid directly out of pocket for flights and most hotels in almost 2 years, and we don’t plan on changing that anytime soon!

One trip I’d always wanted to do was an extended trip to Australia. So, in March 2018, my wife and I—as well as her parents—headed Down Under for a few weeks of fun!

The most famous landmark in Sydney from the Park Hyatt Sydney.

(Note: These all only cover my wife and my travel logistics/costs/etc)

Our Australia Adventure: An Overview

- Greensboro to New York City (positioning flight)

- JW Marriott Essex House (1 night) – New York City

- New York City to Seoul, South Korea to Sydney Australia

- Park Hyatt (2 nights) – Sydney

- Sheraton on the Park (2 nights) – Sydney

- Sydney to Cairns

- AirBNB (3 nights) – Port Douglas

- Cairns to Brisbane

- Brisbane Marriott (2 nights)

- Brisbane to Melbourne

- Park Hyatt (3 nights) – Melbourne

- Melbourne to Sydney

- Marriott Circular Quay (1 night) – Sydney

- Sydney to Seoul to Chicago

- Marriott Suites O’Hare (1 night) – Chicago

- Chicago to Greensboro

I had a few goals in mind for the Australia trip. I wanted to fly on an Airbus A380 (still haven’t as of yet!) in business or first class and I wanted to stay in some of the nicest hotels possible on points—most notably the Park Hyatt in both Sydney and Melbourne. Fortunately, we were able to do just that.

How We Earned The Points For A Luxury Trip To Australia

To save up for this trip (and other trips), we use a strategic credit card plan that involved opening the following cards to help build up our balances of mostly SPG and Chase Ultimate Rewards points. The number following the card will indicate if one or both of us opened it.

Editor’s note: Some of these bonuses have changed or are no longer available

- Chase Sapphire Reserve® Card (2) – 100,000 Ultimate Rewards points

- Chase Sapphire Preferred® Card (2) – 50,000 Ultimate Rewards points

- Chase Ink Business Preferred (1) – 80,000 Ultimate Rewards points

- Chase Ink Business Plus (1) – 60,000 Ultimate Rewards points (no longer available)

- Chase Ink Business Cash (1) – 30,000 Ultimate Rewards points

- Starwood Preferred Guest Credit Card from American Express (2) – 35,000 SPG Starpoints

- Starwood Preferred Business Guest Credit Card from American Express (2) – 35,000 SPG Starpoints

- Chase Hyatt Credit Card (1) – 2 free nights

Total Points:

- 550,000 Chase Ultimate Rewards points

- 140,000 SPG Starpoints

- 2 Free Nights at any Hyatt property worldwide

Along with the above cards, we eventually product-changed duplicate cards to the Chase Freedom to take advantage the 5x quarterly bonus categories when applicable. Further, once you start taking super nice trips, your friends start asking questions and want to get in on the secrets of free travel, and this opens up lots of referral opportunities that we’ve been able to use very well and earn points from!

On top of sign-up bonuses, we organized our everyday spending to maximize bonus categories. Since we eat out and travel a lot, we get great returns on the Chase Sapphire Reserve® Card thanks to its powerful bonus categories, earning 3X on dining and up to 8X points on travel.

We also charge almost everything on our various credit cards (mortgage, utilities, etc.) to maximize points earnings. However, it’s worth noting that we never carry a balance as the interest costs easily far outweigh the value of the points earned.

Where we were able to make the most ground up however is the fact that we’re both self-employed with online businesses (I do web development and my wife runs an Etsy store), and a number of the online services that we use allow us to earn 3X with our Chase Ink Business Preferred cards.

When you combine bonus category spending, our businesses’ spending and other personal spending, we were really able to build up large points balances very quickly.

Here We Go!

With our points in hand, we set out to put together an itinerary that would allow us to have a trip throughout eastern Australia. We wanted to be sure we were able to cover a lot of ground and see all of the various sites we wanted to see at a relaxing pace.

We knew that we couldn’t see all of Australia in one trip, so we’ve left plenty to come back for on future trips. We also wanted to take advantage of some super nice accommodations on this trip.

Highlights Of Our Australia Adventure

We live in North Carolina, which isn’t great for accessing long-haul international flights to anywhere but Europe. Because of this, and by taking advantage of British Airways’ distance based award chart, we used a quick 15,000 British Airways Avios transferred from Chase Ultimate Rewards to position ourselves in New York City.

We mainly chose to position in New York City because we were flying on a separate ticket the day before we left for Sydney. If for whatever reason this flight was cancelled, delayed, moved, etc, it’s only about an 8 hour drive. If we were hit with a big storm, we would still be able to make our flight by driving to New York. We also chose New York (JFK) because it has flights to almost anywhere in the world on every carrier you can imagine.

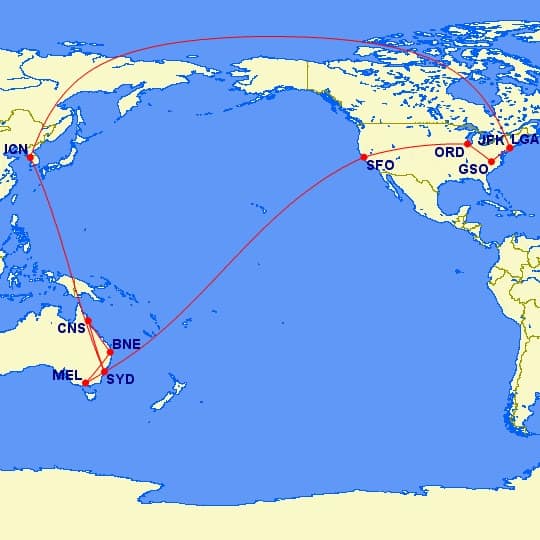

Saver award space to Australia is notoriously difficult to find, very expensive or requires routing through Asia. Because of this, we took Asiana Airlines from JFK to Seoul (ICN) then ICN to Sydney (SYD) for a total travel time of just under 27 hours. This seems like a major detour, but it was only about 2 hours longer than my in-laws route of Charlotte (CLT)-Los Angeles (LAX)-SYD which took about 24 hours. In lie-flat beds in business class, we hardly even noticed the difference in time!

Once in Australia, British Airways Avios really shine thanks to their distance-based award chart. We were able to make use of some super cheap redemptions on Qantas at 4,500 Avios per person in economy class from Melbourne (MEL) to SYD and 10,000 Avios per person from SYD up to Cairns (CNS).

By being able to book far in advance, we were able to snag some cheap flights on Virgin Australia through the Chase travel portal. At the time, they redeemed Ultimate Rewards at a fixed rate of 1.5 cents per point, a feature that has since evolved into the Points Boost program, which can offer even more value—up to 2x—on select travel. We flew from CNS to Brisbane (BNE) for 8,520 Ultimate Rewards points (~$127) each and then BNE to MEL for 6,200 Ultimate Rewards points (~$93) each.

Business Class Flights To Australia

Long-haul international flights are much more tolerable in business class in lay-flat beds and eating delicious food!

The famed Bibimbap meal in business class on Asiana Airlines. It was delicious!

- Greensboro (GSO) to New York (LGA) on American Airlines (positioning flight) – 15,000 British Airways Avios transferred from Chase Ultimate Rewards + $11.20 instead of ~$410.

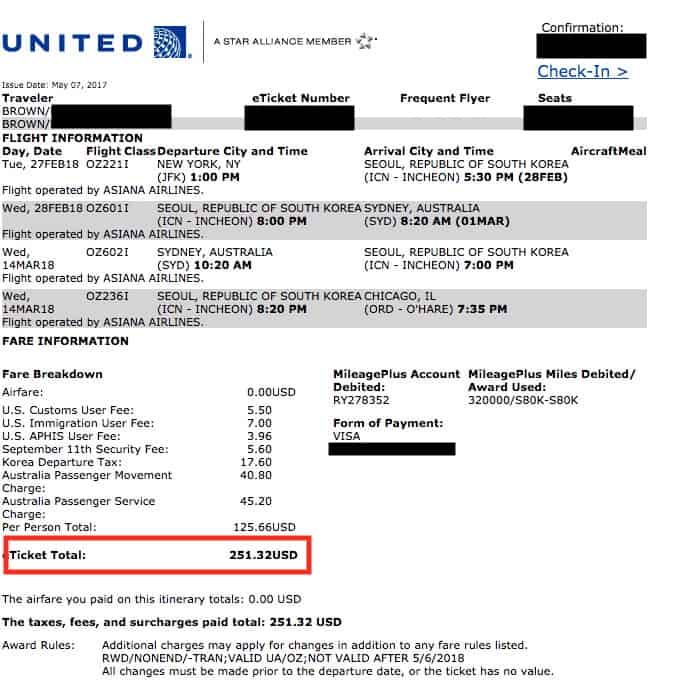

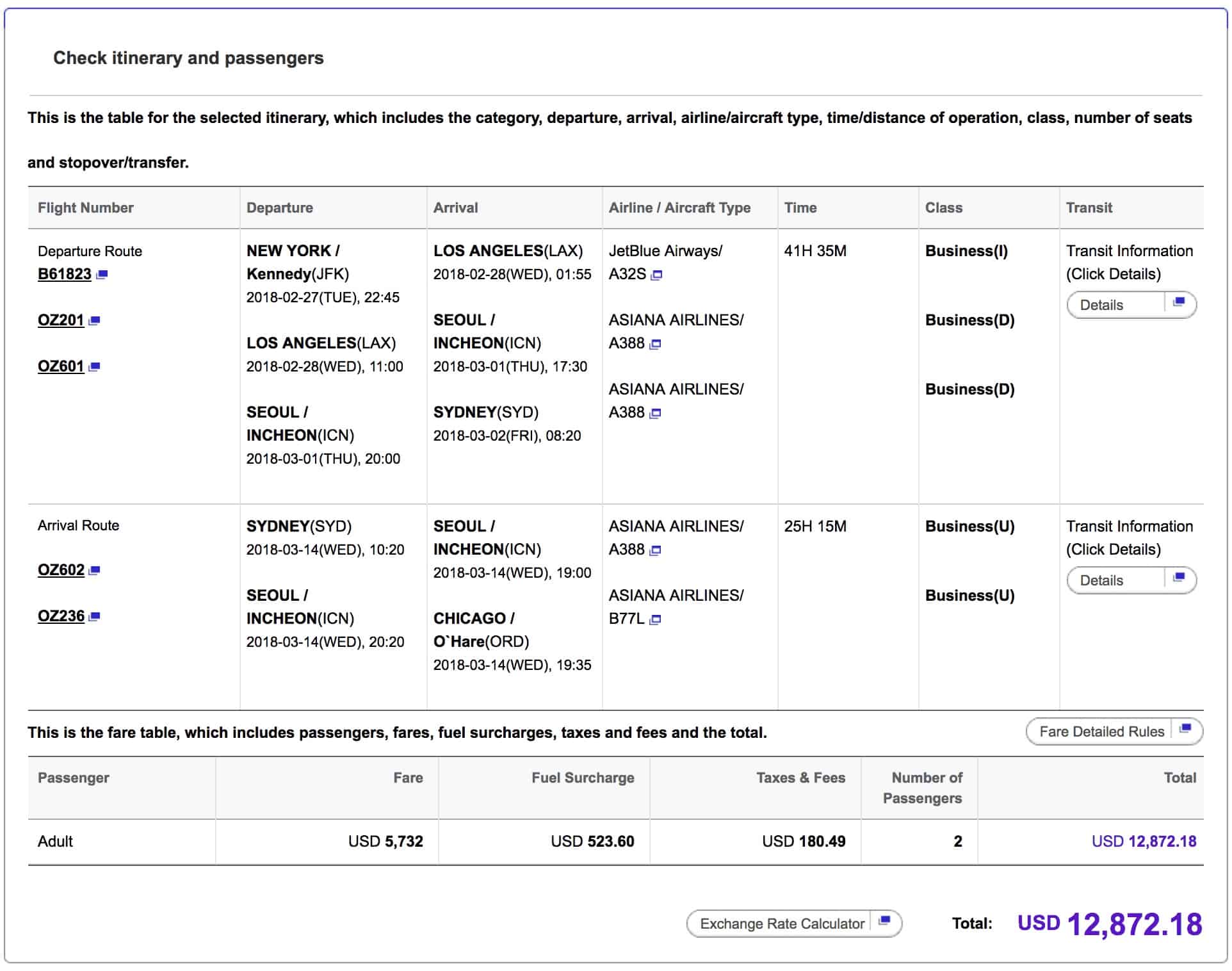

- JFK to ICN to SYD on Asiana and SYD to ICN to Chicago (ORD) on United – 320,000 United MileagePlus miles transferred from Chase Ultimate Rewards + $251.32 instead of ~$12,870

- We ended up rebooking our return flight while on our trip when Saver space opened up to SYD-SFO-ORD, but for the same mileage cost

- SYD to CNS on Qantas – 20,000 Avios transferred from Chase Ultimate Rewards + $42.32 instead of ~$300

- CNS to BNE on Virgin Australia – 17,040 Chase Ultimate Rewards points (via Chase travel ortal) instead of ~$255

- BNE to MEL on Virgin – 12,506 Chase Ultimate Rewards Points (via Chase travel portal) instead of ~$185

- MEL to SYD on Qantas – 9,000 BA Avios transferred from Chase Ultimate Rewards + $27.76 instead of ~$220

- ORD to GSO on United – 20,000 miles transferred from Chase Ultimate Rewards + $11.20 instead of ~$465

Flight Totals

- 44,000 British Airways Avios

- 340,000 United MileagePlus miles

- 29,546 Chase Ultimate Rewards points (portal)

Total – 413,546 points + $343.80 (taxes/fees) instead of $14,712.28

Roundtrip Business Class flights for 2 for 320,000 United Miles + $251.32 in taxes/fees.

If we were going to pay cash, this is what the same flights for the 2 of us would’ve cost.

25,763 miles is a lot of flying for just $343.80 out of pocket!

Luxury Hotels Across Australia

The location and views from the Park Hyatt Sydney are hard to beat!

Our upgraded room at the Park Hyatt Melbourne. Rooms are always better with an office and sitting area. Not pictured – the huge walk-in closet and enormous bathroom.

- JW Marriott Essex House New York – 1 Night for 45,000 Marriott Rewards points (transferred 15,000 SPG Starpoints) instead of $429.23

- Park Hyatt Sydney – 2 Nights for 2 free night certificates instead of $1,845.83/room

- Sheraton on the Park – 2 Nights for 27,000 SPG Points instead of $1,061.19/room

- AirBNB Port Douglas – 3 Nights for ~$475 = ~47,500 Capital One Venture Rewards miles

- Brisbane Marriott – 2 Nights for 25,060 Chase Ultimate Rewards points instead of $356.25

- Park Hyatt Melbourne – 3 Nights for 65,996 Chase Ultimate Rewards points instead of $989.94

- Marriott Circular Quay Sydney – 1 Night – 27,798 Chase Ultimate Rewards points instead of $416.97

- Marriott Chicago Suites O’Hare – 1 Night – 11,962 Chase Ultimate Rewards points instead of $179.44

Hotel Totals

- 42,000 SPG Starpoints

- 129,506 Ultimate Rewards points

- 47,500 Venture Rewards miles

Total – 219,006 points instead of $5,753.85

How Many Points We Used

All said and done, we pulled together a trip that would have cost $20,466.13 for 632,552 points and miles + $343.80.

With all of the money we saved on hotels, we could easily splurge on this awesome, but very reasonably priced, AirBNB for our 3 nights in Port Douglas.

Hotel And Airport Lounge Experiences (Plus Priority Pass Select)

Not only did we save thousands of dollars on our flights and hotels, but we saved additional money on food and drink in a country where food and drink is generally more expensive than our hometown.

Thanks to my Gold status with Starwood Preferred Guest and Marriott, we had access to the lounge at each Marriott. We also had Club Level access thanks to concierge upgrades at the Park Hyatts.

These lounges provided delicious breakfast buffets, access to food and drinks throughout the day, and heavy hor d’oeuvres and cocktails each evening. So each day, we had at least one meal (breakfast) as well as snacks and drinks covered also literally for free. Additionally, our bookings at both Park Hyatt properties included a $100 food and beverage voucher each, so we enjoyed two delicious meals at the hotel along with club food.

When not eating in the lounges we got to enjoy delicious food such as KANGAROO STEAKS!

We certainly didn’t sit around and eat hotel food all day everyday, but having some of the more basic meals covered allowed us to be more adventurous for lunches and dinners, especially in Melbourne and Sydney. When not eating in the lounges, we got to enjoy delicious food like Kangaroo Filet Steaks.

We also spent a lot of time in airports transiting from city to city. Thankfully, our Priority Pass Select membership through the Chase Sapphire Reserve® provided access to many airport restaurants. Each time we went to the airport with a participating restaurant, we each had $36AUD to spend on food.

This breakfast was not only delicious, but all $127.90AUD (food, coffees, pastries and bottled water) of it was covered by the Priority Pass thanks to our $144AUD allowance each time.

We ate 3 meals totaling over $100AUD each at airports when traveling. They were all 100% FREE thanks to the Priority Pass that comes with the Chase Sapphire Reserve®.

This breakfast was not only delicious, but all $127.90AUD (food, coffees, pastries and bottled water) of it was covered by the Priority Pass thanks to our $144AUD allowance each time.

Reaching Out To Hotels For Special Occasions

If you’re a member of the 10xTravel Facebook Group, you know that contacting the hotel concierge or guest relations manager when celebrating a special occasion can do wonders.

Well, I contacted 6 of the 7 hotels for our trip and each hotel went out of their way to acknowledge our 5th anniversary, usually with a bottle of champagne and some dessert pastries. They also recognized my father-in-law’s birthday with the same treatment.

Welcome Champagne, chocolate-covered strawberries and flowers at the Park Hyatt Sydney.

We even scored some sweet room upgrades thanks to my email to the hotel concierge which took things to another level.

We got upgraded to this sick Terrace Suite at the JW Marriott Essex House. It included not only a 1200sq ft room but also a 300sq ft terrace.

Activities In Australia

Snorkeled with Sea Turtles on the Great Barrier Reef!

Snorkeling on the Great Barrier Reef

Hung out with Tigers at the Australia Zoo…

…and koalas too!

Swimming on the famed Bondi Beach.

Driving 100+ miles along the beautiful and scenic Great Ocean Road outside Melbourne.

The famed 12 Apostles rock formation along the Great Ocean Road

Feeding Kangaroos

Final Thoughts

Without points and miles, this once-in-a-lifetime luxury adventure wouldn’t have been possible. As you can see, our flights and hotels could have cost over $20,000. I don’t know about you, but at 29 years-old, I’m in no shape to be dropping $20,000 on a vacation.

By taking care of our travel costs with points, we were able to enjoy some great meals and activities without worrying about the cost We even paid a little extra to rent Mercedes and BMW SUVs instead of the cheapest option because we could!

The beauty of all this is that points and miles allowed us to take a trip that we could only imagine for a fraction of the cash cost.

Now, we just need to figure out our next adventure. I’m ready for more champagne!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.