10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

You just won the Super Bowl…What are you going to do? I’m going to Disney World!!! Well, we may not have played in or won a Super Bowl, but a year ago, we decided to take our family of five, a grandparent and an in-law family of 4 to Disney World.

That’s a total of 5 adults and 5 children. Let me just say, this was only possible for us on points. Had we paid out of pocket, just for our family of 5 + 1 grandparent, our total cost would have been $8,114. Instead, we spent only $1,289 out of pocket.

Now that I have your attention, let’s get into the nitty-gritty of the details of the points. The fun part!

Booking the Walt Disney World Swan Hotel

First, we had to secure our hotel. We decided to stay at the Disney Swan, a Starwood hotel property — now part of Marriott. This property is not a “Disney resort” so the dining plan was not offered.

The Disney Swan is affiliated with Disney, so we still had certain perks. For example, we were able to book fast passes and dining reservations earlier, and they offered buses and ferries to the different parks.

We needed a total of three rooms for our party of 10. For my crew of six, all three adults go the personal version of Starwood Preferred Guest Card from Amex plus we opened one Starwood Business Card from Amex — prior to both being rebranded as Marriott cards. This gave us enough points, after merging all of them into one account, to book 2 rooms for 6 nights.

At the time of booking, the point cost was 80,000 points per room for 6 nights. Upon check-out, we had to pay the resort service package and taxes ($33/night) as well as $23/night for parking. This brought the 2 rooms grand total to 160,000 points redeemed, $492.52 cash.

Capital One Venture Rewards Credit Card

75,000

miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Annual Fee: $95

We used Capital One Venture points to offset off some of the resort fees ($166.84) which brought our cash cost quite a bit. Our total out of pocket for our hotel stay of 6 nights with 2 rooms came to $325.68.

Photo credit of Disney Swan website

Our Stay At Walt Disney World Swan Hotel

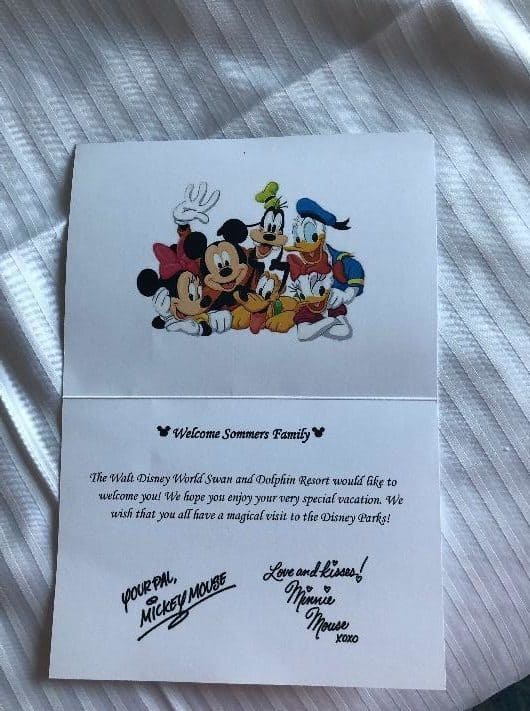

I can’t say enough about this property. Everyone was incredibly friendly and helpful during our entire stay. We wrote to the concierge before our arrival and asked for adjoining rooms, if possible, and anything else to make it extra magical for our kids’ first trip.

We were delighted to not only have adjoining rooms, but chocolate covered strawberries delivered to our room shortly after check-in, along with a note from Mickey & Minnie Mouse. I tried to snag a pic of those beautiful berries before the kids dug in, and only managed to get half of them in a photo as the others were being devoured!

The property boasts a grotto pool with slide & waterfall, two lap pools, a kiddie pool, four whirlpools, a beach with a playground and many more outdoor fun activities. We LOVED the grotto pool after a long day at the parks. They also had many on-site restaurants that were delish!

Photo credit Disney Swan website

Getting Disney Tickets

For our Disney tickets, we needed to purchase 5 adult tickets and 4 kid tickets. The fifth child was JUST under 3, so she had free park admittance. We paid for our tickets using a combination of card points.

We ordered our tickets through Undercover Tourist. We opted for the “Four Day Park Hopper Ticket with Extra Day” which gave us 5 days in the parks. Buying tickets from Undercover Tourist also meant the purchase would code as travel so we could erase the purchase with Capital One Venture miles.

Capital One Venture Rewards Credit Card

75,000

miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Annual Fee: $95

Due to the ages of all the kids — 8, 8, 5, 4 and 2, we knew we wanted to have a few days at the Magic Kingdom. We opted for 3 days at the Magic Kingdom, a day at Epcot and split up a day at the Animal Kingdom and Hollywood Studios. The cost fluctuates on the website but seemed to average around $460 for each ticket. Total cash price for tickets was $2,268.05. But wait….

We used the magic of points! For our party of 3 adults and 2 kids, we used points from three Capital One Venture cards to cover the cost. With that, we were able to offset the entire cost of the ticket with points. The total cash cost of the tickets came to exactly $0!

Dining At Disney World

You have to wait until you’re close to your trip to book any dining in the park. We knew we wanted to take the kids to Cinderella’s Royal Table to meet all the princesses, and from our research, we knew we wanted to score this reservation at breakfast because it was the “cheapest” option.

When the bill came for our party of 10, it was $503! We were very pleased when we saw it coded as “travel” on the Venture card bill. Thankfully, we had earned a lot of points, so our breakfast was completely covered with Venture miles. Again, the total cost out of pocket was exactly $0.

Last but not least, to keep our out of pocket to a minimum, we used the cashback from the Capital One® Spark® Miles for Business. By the time we got to Disney, we had $734.34 available to use towards food, souvenirs, gas, etc. This brought our total out of pocket expense for EVERYTHING from food to fun to resort fees down from $2,023.34 to $1,289!

It was a magical time for all of us, and knowing we did it for the same cost as going to the beach every year, it made it even more magical for this mom! We had so much fun meeting all the princesses — obviously traveling with 5 little girls this was a MUST, riding the rides and eating some great food!

I’d be remiss if I didn’t mention the best smores of all time at The Ganachery at Disney Springs. This is a must-have item when you find yourself in Orlando. Most of all, we had fun as a family just spending a week together surrounded by the magic of Disney!!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.