10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Editors Note: Some of these credit card offers have changed. Please visit 10xtravel.com/creditcards for a list of up-to-date offers.

Hi Travel Junkies,

I love unapologetically bragging about how awesome my readers are.

And one of the ways I do this is by sharing reader success stories, which allows you to see just how powerful points/miles can be (and provides a blueprint for you to create a similar trip).

Today’s reader success story is of particular interest just because of the sheer amount of cheap travel that Leah and her family were able to book.

Over the last 12 months they have traveled to South Florida and Australia and already have another trip booked to spend a couple days in Canada. All for pennies on the dollar.

And today Leah is going to tell you how they did it.

Take it away, Leah.

Leah and her family in Sydney, Australia

The best thing about the points/miles hobby is that once you “get it” everything seems to fit together nicely.

Your view of how credit cards, frequent flyer miles, and other types of points all work completely shifts and you start to see opportunities everywhere.

That’s exactly what happened for me just a few months after I discovered Bryce’s blog, 10xtravel.com. His site has been a source of constant information for me, and I’ve been able to use his user-friendly step-by-step breakdowns to plan a number of family vacations for next to nothing.

Let’s start with our trip to Fort Myers, Florida

After reading Bryce’s article about the Southwest Companion Pass my husband and I decided to try to earn one. My husband is self-employed so we opted to get both the Southwest Rapid Rewards® Premier Credit Card and the Southwest® Rapid Rewards® Premier Business Credit Card, which allowed us to earn the companion pass.

We were approved for both, and easily met the minimum spending requirements (and more) thanks to the everyday expenses associated with having a family of 5 as well as running our own business.

The best thing about accumulating a great stash of miles within a few months with Southwest is that it earns you the sacred Companion Pass (cue the music)! This means that every time my husband gets to fly somewhere, I get to go for free.

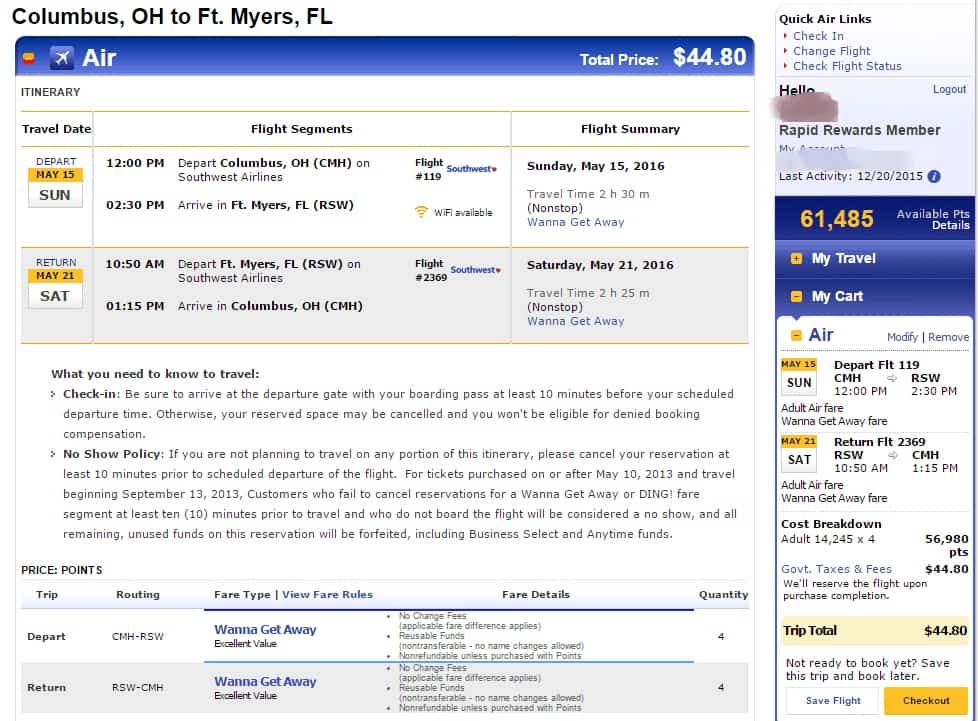

Thanks to Bryce’s blog our family of 5 flew to Fort Myers, Florida for just $56 TOTAL. Here’s a screenshot of our booking.

Notice how I only purchased 4 passengers! After the booking was completed, I went in to the reservation (My Account>>My Trips) and clicked “Add companion.” And just like that we got a 5th ticket for just the $11.20 in taxes and fees!

Meaning our total flight cost was just $56 for more than $600 worth of airfare!

Leah and her family in Ft. Myers, FL

The trip was fantastic, but we weren’t done there.

Bryce also helped our family save over $4000 dollars on our trip to Australia as well!

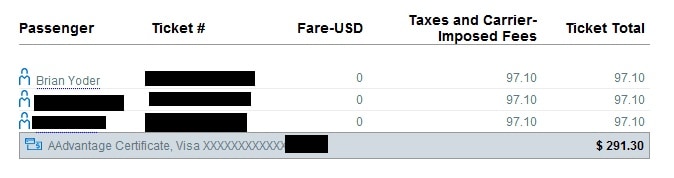

We booked this trip with American Airlines miles earned from a combination of various co-branded credit cards.

Our flights home from Hobart cost just 37,500 AA miles and $97.10 each.

(Bryce note: AA changed their award chart on March 22, 2016 so don’t take this price as gospel going forward)

Unfortunately we were not able to find availability to use our AA miles for the flights to Australia so we had to pay out of pocket for those one-way tickets.

The good news though is that we still had 100,000+ American Airlines miles left for another trip (which is a good problem to have).

Realizing that these were going to expire in early 2017, I knew that now would be the time to plan something. Staying at the Fairmont Lake Louise has been on my Bucket List for some time so I signed up for the Fairmont Chase card.

(Bryce note: You can easily avoid mileage expiration with these simple tricks)

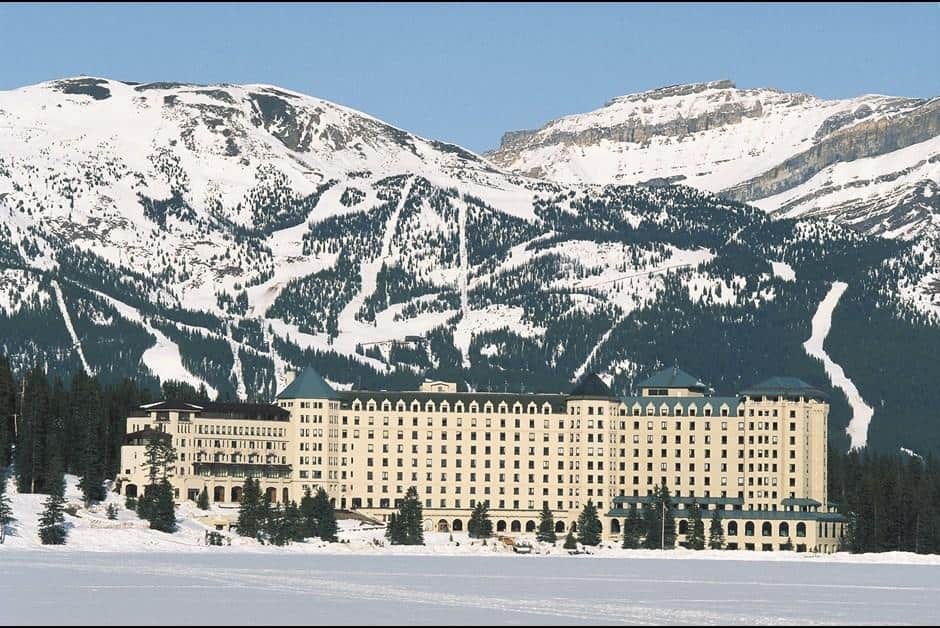

Image courtesy of FairmontMoments.com

The Fairmont card was offering a signup bonus of 2 free nights at any Fairmont property at the time (some blackout dates applied) as well as a few other perks like suite upgrade certificates and dining credits.

Once we received the letter saying that we’d met the initial spend and earned the two free nights, I perused the Fairmont website that shows blackout dates for each individual hotel.

To reserve the stay I had to call Fairmont hotels directly. Luckily, they had rooms available for our dates!

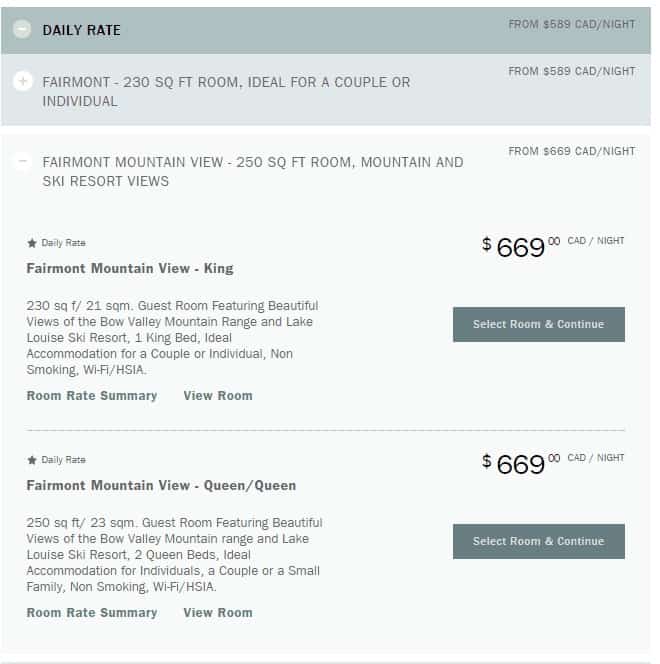

The cash price would have been $669 CAD per night (~$472 USD). Meaning our two free nights saved us about $944 after paying a $13/night resort fee!

After the Fairmont was booked, I went ahead and locked in the flights with American Airlines.

TIP: When booking with miles, American Airlines allows you to hold the schedule fee-free for 4 days! This was a great help when planning our Australia trip and now with booking to Calgary.

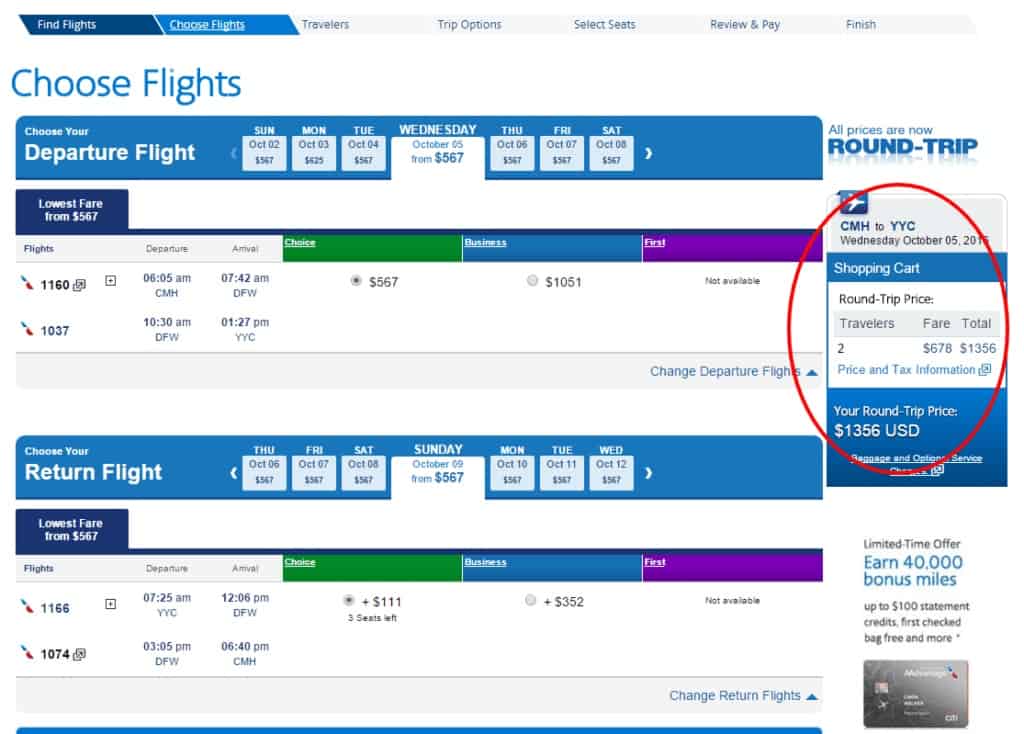

We found saver availability for 12,500 AA miles for the flight there and opted for standard availability (25,000 miles) for the flight home to take advantage of a better route.

Having little ones at home requires that I have a babysitter. Sometimes using more miles means better flight times and sanity for little ones (and the grown-ups). Hoarding miles doesn’t help me achieve my travel dreams, so I’d rather use them than lose them. 🙂

Leah and her son in Hobart, Australia

We ended up paying 32,500 AA miles and $61.80 each for our flights. The cash price was more than $670 per ticket.

Which brings the total for 2 flights to Canada + 2 nights in a swanky Fairmont to $149.60 USD- instead of $2,150.40.

Are you a believer in the power of points/miles yet?

Another important thing to note. We don’t use credit cards to accumulate debt or transfer balances, we use credit cards to create memories. This entire hobby only works if you do the same!

I’m very happy I found Bryce’s blog and grateful for all the help he provided over this past year!

Thanks Leah!

Happy Travels,

Bryce

—

P.S. Leah Yoder is the face behind Yoder Toter Blog. A high school exchange student to Australia, Leah was paid by her hometown newspaper to share her journeys. It was this experience that birthed in her a deep love for travel- and a knack for writing. Before she was a stay-at-home mom to her three little ones, she worked as a travel agent.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.