10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Editors Note: Two Card Trips is a series of articles that show how you could book a trip using points/miles earned from just two different credit cards. Today’s two card trip takes us to Maui with points earned from the Chase Sapphire Preferred and United℠ Explorer Card.

Getting into points and miles can seem intimidating, but with just two travel credit cards you can already plan an amazing trip to Maui! Let’s take a look at how you could make this work.

Maui is an incredible place to visit, but unfortunately, it’s usually not that cheap. Luckily, it’s a great place to use points and miles to cover your hotel and airfare costs!

The Two Credit Cards

Today I’ll show you how you can use two Chase credit cards to visit Maui for almost nothing on points and miles: the Chase Sapphire Preferred Card and the United℠ Explorer Card.

The Chase Sapphire Preferred offers a welcome bonus of 60,000 Ultimate Rewards points when you spend $4,000 in the first three months from account opening.

The United℠ Explorer Card from Chase comes with a bonus of up to 70,000 United MileagePlus miles – you’ll earn 60,000 after spending $3,000 in the first three months and an additional 10,000 miles after spending a total of $6,000 in the first 6 months.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

70,000

Bonus Miles

after you spend $3,000 on purchases in the first 3 months your account is open.

Annual Fee: $0 for your first year, then $150.

Where to Stay

One of the great things about Chase Ultimate Rewards points is that they can be transferred to several airline and hotel loyalty programs, including World of Hyatt, Marriott Rewards, and IHG Rewards Club. This means you have a lot of flexibility when planning your travels!

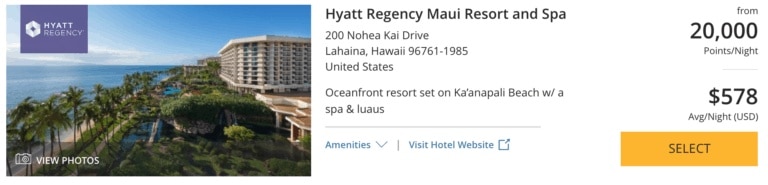

On Maui, there are two phenomenal Hyatt resorts: the Hyatt Regency Maui Resort and Spa, located on the northwest tip of the island, and the Andaz Maui at Wailea Resort, on the southern part of the island.

The Hyatt Regency Maui Resort and Spa offers six pool areas (including a 150’ lava tube waterslide!), oceanfront cabanas available to rent, and a whopping 10 on-site restaurants – including the best Asian/Pacific Rim restaurant on the entire island.

At 20,000 points per night, you can easily book a weekend trip with the welcome bonus from the Chase Sapphire Preferred card and still have points to spare.

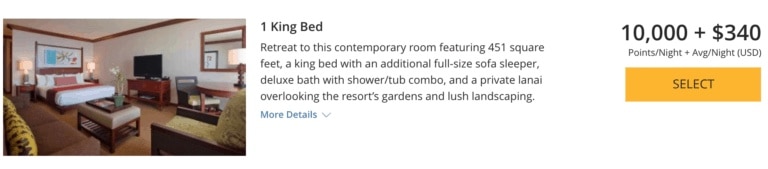

You can also stretch your points by using Hyatt’s Cash & Points rates, but note that in addition to a hefty amount of cash, you’ll have to pay a resort fee of $32 per night plus tax when booking with Cash & Points. However, resort fees are waived for Free Night Awards.

The Andaz Maui offers a more secluded experience, with sleek modern furnishings, five pools, and little to distract you from the gorgeous views. It’s also much smaller than the Hyatt Regency (301 rooms versus 806). You can even bring a pet along for a fee of $100 for the duration of your stay.

The Andaz is a bit more expensive at 25,000 points per night – but you can still cover that by transferring points earned from the welcome bonus from the Chase Sapphire Preferred card, and getting nearly $1,600 in value when transferring to Hyatt from a single credit card welcome bonus is nothing to sneeze at!

10xT Founder Bryce chilling in one of the many pools at the Andaz Maui

One thing to note – you may have to be very flexible with your dates if you’re looking to book the Andaz for just a couple of nights, as they’re known to impose significant minimum stay requirements on the basic category of rooms that is available for points redemption.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

How to Get There

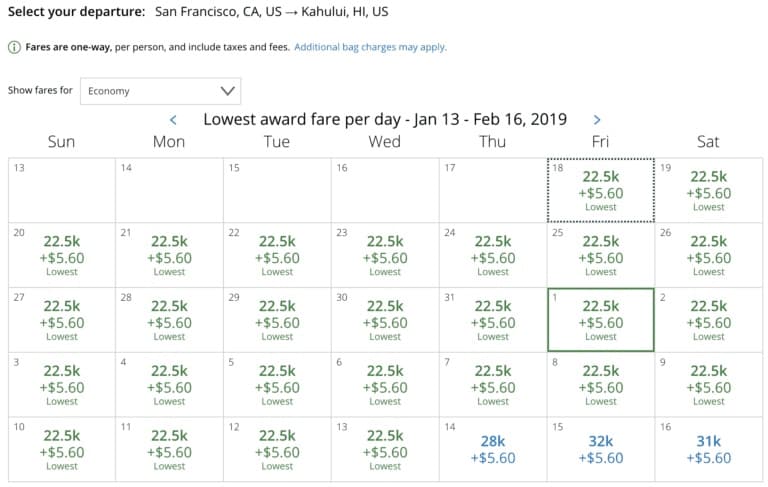

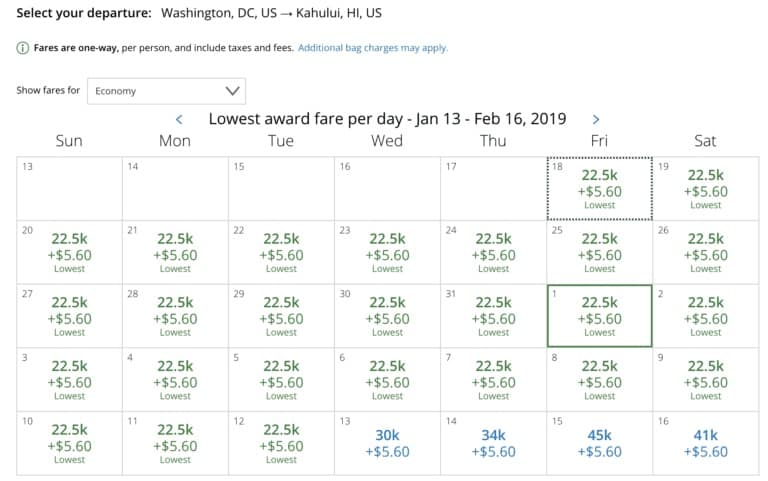

United flights between the US mainland and Hawaii start at 22,500 miles each way in economy and 40,000 miles each way in business. With the 40,000 miles you earn from the welcome bonus plus at least 4,000 more from meeting the minimum spending requirements, you’ll have plenty of miles for one round-trip economy ticket.

If you’re looking for an even more premium experience, long-haul international business class-configured flights from Denver, Chicago, Houston, Newark, and Washington cost 50,000 miles each way.

If you need to top up your mileage balance, you can transfer Ultimate Rewards points from your Chase Sapphire Preferred card to United MileagePlus; if you’re traveling with a companion, you can always use miles for part of the flights and cash for the rest.

One of the great things about United MileagePlus miles is that flight prices are the same no matter where you’re traveling from in the contiguous 48 states (except for the non-stop domestic first class flights mentioned earlier).

And as long as you’re booking at least 21 days in advance, you’ll only have to pay taxes of $5.60 each way. Flights booked within 21 days of travel will also be hit with a close-in booking fee of $75.

An added bonus of the MileagePlus Explorer Card is you’ll have access to additional economy award space that United only makes available to credit cardholders and MileagePlus elite members. Make sure you’re signed into your account when searching for flights!

Getting Around

Maui is challenging to get around without a car, so unless you’re planning to spend your entire vacation at the hotel, you may want to rent a car. Luckily, the Chase Sapphire Preferred includes primary Auto Rental Collision Damage Waiver coverage, so you don’t have to worry about collision insurance – just pay with your Chase Sapphire Preferred and you’ll be covered against theft and collision damage, up to the full cash value of the car, without filing a claim with your own auto insurance company.

You can even use your Ultimate Rewards points to pay for your rental car through the Ultimate Rewards travel website, where each point is worth 1.25 cents. That means a $200 car rental would cost 16,000 points. This isn’t necessarily the most valuable way to use your points but could make sense depending on your needs.

If you don’t want to (or can’t) rent a car, you can always use your Chase Sapphire Preferred card for taxis or in the Uber app to earn 2X Ultimate Rewards points for every dollar spent on your trips.

Welcome Bonus Restrictions

Both the Chase Sapphire Preferred and the United℠ Explorer Card are subject to Chase’s 5/24 rule, which means you will not be approved for the card if you have opened 5 or more personal credit cards with any bank in the past 24 months.

Bottom Line

Hawaii is an expensive vacation destination, especially if you want to stay at a nice hotel like the Hyatt Regency Maui Resort and Spa or the Andaz Maui at Wailea Resort, but the points earned from the sign-up bonuses from just the Chase Sapphire Preferred and the Chase United℠ Explorer Card can go a long way toward covering quite a few of the big ticket expenses!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.