10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

On June 23, Chase launched a new business credit card for Chase’s Sapphire family, the Sapphire Reserve for Business℠ and revamped the Chase Sapphire Reserve® personal card. With these changes, Chase overhauled the eligibility rules for the cards in the Sapphire family (Chase Sapphire Preferred® Card, Chase Sapphire Reserve® and the Sapphire Reserve for Business℠) and left points and miles enthusiasts confused on how these new rules will impact eligibility moving forward.

This guide will explain the new rules, make sense of them and help you decide whether these new cards are right for you.

Sapphire Reserve for Business℠

Earn 150,000

bonus points

after you spend $20,000 on purchases in your first 3 months from account opening.

Annual Fee: $795

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Previous Eligibility Rules

Before June 23, previous eligibility rules were pretty straight forward from the terms and conditions of the Chase Sapphire Reserve® and Chase Sapphire Preferred® Card:

The product is not available to either (i) current card members of any Sapphire credit card, or (ii) previous card members of any Sapphire credit card who received a new card members bonus within the last 48 months.

This meant that:

- You won’t get approved for a card in this card family while holding any other card in the Sapphire family.

- You won’t get approved for a card if you have got the welcome bonus for either the Chase Sapphire Preferred or Chase Sapphire Reserve in the last 48 months.

New Eligibility Rules

The 48-month rule has been eliminated and you can now hold the Chase Sapphire Preferred (CSP) or Chase Sapphire Reserve (CSR) at the same time. Whether you are eligible for the bonus is now based on new eligibility rules.

The new language in the terms and conditions reads as:

- Chase Sapphire Reserve and Chase Sapphire Preferred: This credit card is unavailable to you if you currently have one open. The new cardmember bonus may not be available to you if you currently have any other personal Sapphire cards open, previously held this card or received a new cardmember bonus for this card. We may also consider the number of cards you have opened and closed, as well as other factors in determining your bonus eligibility.

- Sapphire Reserve for Business: This card does not have any eligibility rules in its terms and conditions. You are eligible for the welcome bonus and can get approved even if you are holding either or both of the personal Sapphire cards.

Now let’s decode what these terms and conditions mean for the cards in the Sapphire family.

Sapphire Reserve for Business

Let’s start with the Sapphire Reserve for Business since this is the most straightforward. You are eligible for the new cardmember bonus as long as you have never had the Sapphire Reserve for Business before.

Example: If you are a cardholder of a CSP or CSR, you are still eligible to apply for the Sapphire Reserve for Business and receive the bonus.

Sapphire Reserve for Business℠

Earn 150,000

bonus points

after you spend $20,000 on purchases in your first 3 months from account opening.

Annual Fee: $795

Chase Sapphire Preferred and Chase Sapphire Reserve

Now here is where things get muddy but we’ll break it all down for you.

If you currently hold a CSP or CSR, and try to apply for the other personal card, even though you would be able to have both at the same time, you would NOT be eligible for the welcome bonus.

We are seeing mixed data points on the ability to get welcome offers on the CSR. But if you’d like to try, you would close out or downgrade your CSP or CSR and allow enough time for it to clear out of Chase’s systems (we recommend at least a week for online applications, 4 weeks for in-branch applications), you can then apply for the other personal card and might be eligible for the welcome bonus. This brings us to discussion of a new lifetime rule.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Lifetime Rule

With the new statement “The new cardmember bonus may not be available to you if you previously held this card or received a new cardmember bonus for this card” Chase has seemingly introduced a once-per-lifetime welcome bonus rule for the two personal Sapphire cards. This has drawn comparison to similar lifetime language from the terms and conditions of American Express credit cards, whose “may not be available” language is pretty stringent and can be read as will not be available.

However, we do not yet have enough information about how this vague “may not be available” language from Chase will be implemented and enforced. What this lifetime rule really means is yet to be determined. Reports from our 10xTravel Insiders Facebook page indicate that it is not a strict interpretation of this language. There are reports of people who have “previously held this card” and also those who have “received a new cardmember bonus” for the Chase Sapphire Reserve who were able to get a new cardmember bonus since June 23.

These data points seem to indicate that it is possible to get a Chase Sapphire Reserve or a Chase Sapphire Preferred if you’ve had the card in the past and if you’ve received the bonus previously, whether it was within the last 48 months or beyond that. While the language says it “may not be available,” it may be worth trying to apply to see if you’ll receive a welcome bonus on these Chase Sapphire personal cards despite this lifetime rule.

But please note that since early August 2025, there have been increased reports of people who have previously had a Sapphire personal card receiving a pop-up window saying that they are not eligible for a new welcome offer. Eligibility for a new welcome offer may be more limited now than it was between June 23 and early August.

However, moving forward, we are not sure how this once-per-lifetime rule will be implemented and enforced. It was clear that Chase intended some sort of change in policy, but according to various data points, this has not been a strict policy.

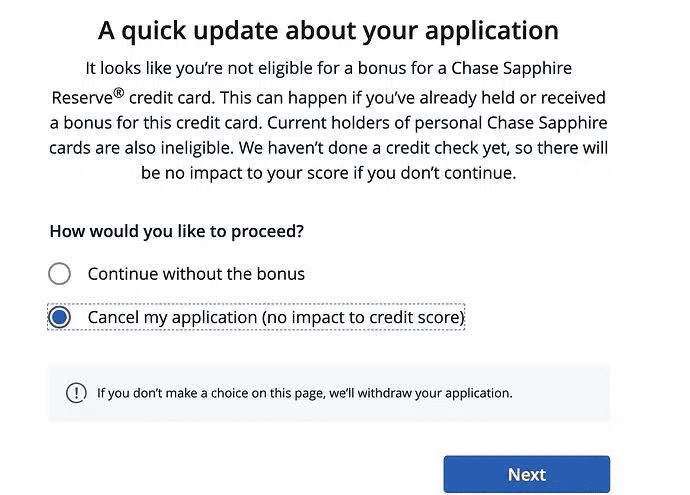

Approval No Longer Equates to Receiving the New Cardmember Bonus

Chase has traditionally operated with this policy: if you were approved for a card, you would receive the new cardmember bonus. This is no longer strictly the case. During the application process, you may now see a pop-up window indicating that, while you can be approved for the card, you might not receive the new cardmember bonus.

It is important to pay close attention during the application process to any pop-up windows discussing your eligibility for the card and the new cardmember bonus.

Should I Get These Cards?

After all of this discussion about eligibility and whether you can get the welcome bonuses on these cards, there remains the question of: should I apply?

We think these are great options to add to a card portfolio, even with the $795 annual fees on the CSR and Sapphire Reserve for Business. While Chase promises $2,500+ of value from both of their premium Sapphire cards, from our perspective, it could be hard for some cardholders to get that much value out of the card. But with our conservative estimate, you can realistically get at least $1,000 worth of value from the cards, which more than makes up for the annual fees. Since these $795 annual fee cards come with a $300 travel credit you only need to get $495 worth of value from the credits to be able to break even on the cards.

Benefits of Holding Sapphire Reserve Cards

$300 Annual Travel Credit

This is one of the most valuable and flexible benefits on the Chase Sapphire Reserve and the Sapphire Reserve for Business. It automatically applies to a wide range of travel purchases throughout your cardmember year:

Airlines and Air Travel

- Airline tickets and taxes on award tickets

- Seat assignment fees and checked bag fees

- Onboard snacks and meals

- Flight upgrades and change fees

- Lap infant fees

Ground Transportation

- Rideshare services like Uber and Lyft

- Taxis, limousines, and car services

- Public transportation including buses, trains, and subways

- Parking lots and garages (including monthly parking fees)

- Highway tolls and bridge tolls

Accommodation

- Hotels and motels

- Airbnb and VRBO (home rental platforms)

- Timeshares

- Campgrounds

Other Travel Services

- Car rental agencies

- Cruise lines and deposits

- Travel agencies and discount travel sites

- Passenger ferries

Let’s go over the rest of the card benefits and we will analyze the additional credits after.

Lounge Access

Sapphire Reserve cardholders get access to Chase Sapphire Lounges and Priority Pass lounge access for themselves and up to two guests. With the recent changes to the Capital One Venture X lounge policy, this is a more favorable card for those traveling with a spouse, partner or family. A lesser known lounge policy benefit from these cards is access to Air Canada Maple Leaf lounges when traveling on a flight operated by Air Canada or any other Star Alliance member.

Status Benefits

Reserve cardholders will receive IHG Platinum elite status (until 12/31/2027) which includes a 60% bonus points on IHG stays, complimentary upgrades (subject to availability), early check-in, 2 p.m. late checkout (subject to availability). Hertz Five Star status is also automatically available which grants a one-class car upgrade, 25% more points on all rentals, access to a wider range of cars from a Hertz location with an Ultimate Choice lot.

Additional Credits

The value you’ll extract from the Sapphire cards depends heavily on the city you live in and your personal spending habits. These factors influence the amount of credits you can realistically use and benefit from and can vary significantly from person to person. Urban dwellers with access to diverse dining and travel options may find it easier to maximize the various statement credits, while those in smaller markets or with different spending patterns might struggle to use all the available benefits effectively.

Chase Sapphire Reserve

- Up to $500 in annual The Edit credit: Cardholders receive $250 biannually to use on The Edit via Chase Travel booking. It is important to note that it requires a 2 night stay to get the credit to activate. While on the surface, it may not seem that useful to the average points and miles consumer with that caveat there is some good news. Many of The Edit affiliated hotels qualify for Points Boost, which means they’ll be at a 2 CPP valuation. For example, if a hotel costs $500 for the 2-night stay, you can use points + cash: 12,500 points + $250 ($250 will be rebated by the credit). Not a bad deal for a high end hotel stay especially since Edit hotel stays come with perks:

- Daily breakfast for two

- Up to $100 property credit (typically includes dining, spa or other activities at the property)

- Room upgrade if available

- Early check-in and late checkout if available

- Complimentary Wi-Fi

- Up to $300 in annual StubHub and Viagogo credit: Cardholders receive up to $150 biannually to use on event tickets at StubHub. If you attend any concerts or sporting events, this is an easy credit to make use of.

- Up to $300 in annual dining credit at Open Table: Cardholders receive up to $150 biannually at restaurants that are part of the Sapphire Reserve Exclusive Tables program. These are specifically curated, high-end establishments in major U.S. cities, many of which are Michelin-starred or critically acclaimed restaurants.

The above credits are split into two periods: January through June and July through December. You receive a fresh credit each six-month period, but unused credits don’t roll over to the next period, it’s a use it or lose it benefit.

- Global Entry, TSA PreCheck or Nexus credit: Cardholders receive an application fee credit every four years. If you don’t already have Global Entry or TSA, this credit is incredibly valuable since you can use this to offset the cost of Global Entry which includes TSA PreCheck. Say goodbye to those long lines at the airport when you are going through security and coming back from an international trip.

- Up to $250 annually in complimentary Apple TV+ and Apple Music subscriptions: This is one of the more straightforward annual credits, and is an easy use especially if you already are a subscriber of Apple TV+ or Apple Music. If you are instead a loyal Spotify listener, there are services that allow you to transfer your playlists over to Apple Music. And if you aren’t already watching the programs on Apple TV+ you should. It’s one of the highest quality streaming networks with amazing shows like Severance, The Morning Show and Ted. (One-time activation per service through chase.com or the Chase Mobile app required.)

- Up to $300 in annual promos with DoorDash: This is in my opinion the most tedious of the credits to you since it’s broken down as $25 in monthly promos with two $10 nonrestaurant promos and one $5 restaurant promo. You must activate the complimentary DashPass membership (normally $120/year value) to access these credits. The DashPass benefit is available through December 31, 2027 and must be activated by that date. It grants $0 delivery fees, reduced service fees on eligible orders over $12, and 5% back in DoorDash credits on eligible pickup orders.

- Up to $120 in annual in-app Lyft credits: Cardholders get $10 in ride credit each month through September 2027

- Up to $120 in Peloton credit: This credit is good through Dec. 31, 2027 (activation required. The good news is that you don’t have to own a Peleton to make use of this credit. The credit works on ALL Peloton subscription plans, including:

- All-Access Membership ($44/month) – Required for Peloton bike, treadmill, and rowing equipment owners

- App One ($12.99/month) – Mid-tier app-only membership with thousands of on-demand classes

- App+ ($24/month) – Premium app-only membership with unlimited access to all classes

- Guide Membership ($24/month) – Includes AI-powered personal training features

- Strength+ ($9.99/month) – Dedicated strength training app with customizable workouts

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Sapphire Reserve for Business

- Up to $500 in annual The Edit credit

- Up to $100 annual Giftcards.com credit: One of the more straightforward benefits, it provides statement credits for purchasing gift cards from a curated selection of popular brands, for employee rewards, client gifts, or personal purchases. No enrollment or registration required but you must purchase gift cards through the dedicated Chase portal at reservebusiness.giftcards.com.

- Up to $400 annual ZipRecruiter credit: business-focused benefit when you make qualifying purchases directly with ZipRecruiter and pay with your Sapphire Reserve for Business card. There’s no enrollment or registration required.

The above credits are split into two periods: January through June and July through December. You receive a fresh credit each six-month period, but unused credits don’t roll over to the next period, it’s a use it or lose it benefit.

- Up to $200 annual Google Workspace credit: Designed to help business owners offset their productivity and AI tool expenses by providing statement credits for purchases made directly with Google Workspace.The credit applies to:

- Google Workspace business plans (Business Starter, Business Standard, Business Plus, Enterprise)

- AI-powered features within Google Workspace

- Add-on services and premium features

- Productivity tools integrated into the Google Workspace ecosystem

- Up to $300 in annual promos with DoorDash

- Global Entry, TSA PreCheck or Nexus statement credit

Sapphire Reserve for Business℠

Earn 150,000

bonus points

after you spend $20,000 on purchases in your first 3 months from account opening.

Annual Fee: $795

Conclusion

Chase’s overhaul of the Sapphire family eligibility rules has introduced new complexity to what was once a straightforward application process. While the changes may seem confusing at first, there’s a clear roadmap to navigate them successfully. The Sapphire Reserve for Business remains the simplest option with no eligibility restrictions, while the personal cards now require more strategic timing and attention to application warnings. Despite the uncertainty around eligibility rules, these cards still offer excellent value that justifies their annual fees.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $20,000 on purchases in your first 3 months from account opening.

Annual Fee: $795

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.