10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Relaxing in airport lounges can be a great way to destress before boarding a flight, whether you’re at your point of departure or during a layover. However, without a membership to an airport lounge network like Priority Pass, accessing these lounges can be rather expensive.

Let’s take a look at all the different credit cards that provide Priority Pass benefits (organized by issuer) and identify the benefits associated with each card.

What is Priority Pass?

Priority Pass is a membership program offering access to airport lounges and various travel perks. With a Priority Pass membership, you can experience amenities like comfortable seating, complimentary refreshments, Wi-Fi access, and more at airport lounges worldwide.

Priority Pass offers multiple membership tiers, including Standard, Standard Plus, and Prestige, each offering different benefits and lounge access.

Note that Priority Pass and Priority Pass Select are often used interchangeably, but there is a slight difference between the two. Priority Pass is the name of the lounge network and can also refer to the membership itself. Priority Pass Select is the name of the membership access you get from certain credit cards.

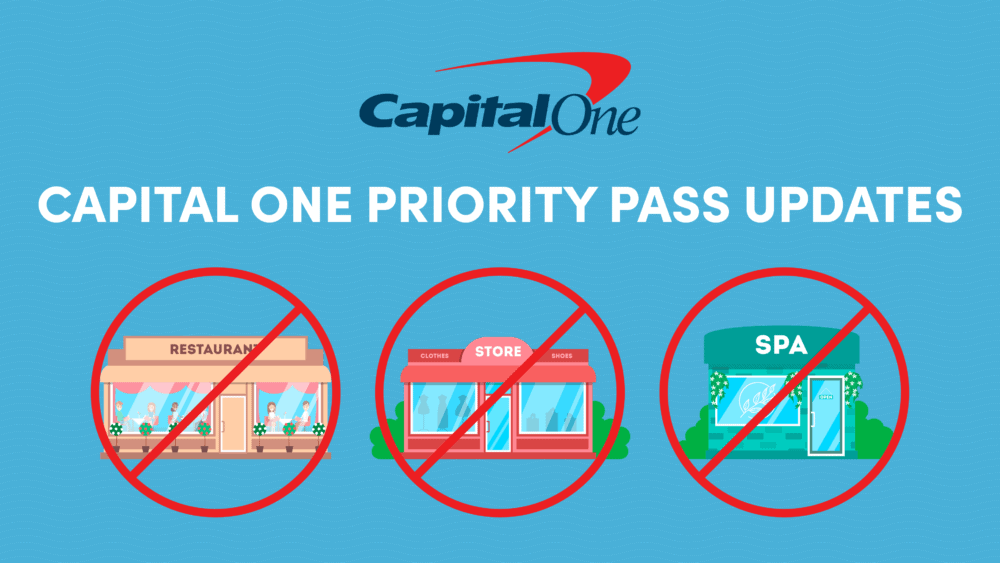

It’s also worth mentioning that, while Priority Pass Select memberships through certain credit cards used to come with non-lounge benefits like access to spas and credit at certain airport restaurants, these benefits have been removed from all credit cards. So, if you have a Priority Pass Select membership through a credit card, that membership will only get you lounge access.

How Much Does a Priority Pass Membership Cost?

Priority Pass offers three membership levels for lounge access:

- Standard: $99 per year (includes visits for $35 each for the member and any guests)

- Standard Plus: $329 per year (includes 10 free visits per year with subsequent visits for $35 each, and all guest visits cost $35)

- Prestige: $469 per year (includes unlimited free visits for the member, and all guest visits cost $35)

As evident, accessing Priority Pass lounges can get pricey. Fortunately, many U.S. credit cards offer Priority Pass Select memberships, with some providing individual access and others including free priority pass guest visits. The specific Priority Pass perks included in your Priority Pass Select membership will depend on your credit card.

Taking the time to learn which cards offer which Priority Pass benefits is worthwhile. Considering the cost of food, drinks and other amenities at airports, having access to complimentary airport lounges can offer significant value.

How to Use Priority Pass Select

Regardless of which card you have, you should be aware that you can’t just walk up to a Priority Pass lounge and present your credit card and receive your benefits. You’ll first have to enroll in the program through a link that you can find in the “Benefits” section of your credit card account.

After following the link, you’ll be asked to enter your credit card number. Within minutes, you’ll be enrolled in Priority Pass Select. It can take up to two weeks for your Priority Pass membership card to arrive in the mail, so we recommend enrolling in Priority Pass Select as soon as you get your credit card. However, if you want to access a lounge before your physical card arrives, you can download the Priority Pass app and get a digital membership card, which can be used at nearly all of their facilities.

Most Priority Pass lounges require you to present a boarding pass for your flight to enter and won’t allow entry more than three hours before your flight’s scheduled departure.

Which Credit Cards Have Priority Pass Select?

American Express

American Express offers Priority Pass Select membership with two of its own cards and several of its co-branded cards as well.

The Platinum Card® from American Express

The Platinum Card® from American Express is Amex’s top-of-the-line premium credit card with an annual fee of $695 (see rates & fees). Travelers who prioritize lounge access and frequent United Airlines flights may benefit from comparing this card to the best United Airlines credit card for maximizing travel perks. So, it’s no surprise that this card comes with premium travel benefits like Priority Pass Select membership. With the Amex Platinum card, you’ll get unlimited free access to more than 1,300+ Priority Pass lounges for yourself and one guest. Any additional guests will need to pay the standard guest entrance fee.

Authorized users on your Amex Platinum card also can enroll in their own Priority Pass Select membership. When adding an authorized user, you must choose whether they receive a Platinum Card or a Gold Card. Only those who are added with a Platinum Card are eligible to receive their own Priority Pass Select membership.

Amex Platinum cardholders must pay an additional annual fee of $195 per authorized user added to their account as Platinum Card members. There’s no fee to add them as Gold Card members, but they won’t be eligible for their own Priority Pass membership. There will also be an additional $195 annual fee added for any more authorized users after those three.

Unfortunately, American Express has removed access to all non-lounge experiences through its Priority Pass Select memberships. Thus, the Amex Platinum Card will get you into lounges for free, but it won’t do you any good at restaurants, spas or other non-lounge businesses.

The Platinum Card® from American Express

You may be eligible for as high as 175,000

Membership Rewards® Points

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$695

The Business Platinum Card® from American Express

The Priority Pass benefits offered by The Business Platinum Card® from American Express which also has an annual fee of $695 (rates & fees) mirror those offered by the Amex Platinum personal card (as detailed above). The only distinction is the cost for adding authorized users to your Amex Business Platinum card account, which is $350, compared to the $175 annual fee for adding up to three authorized users to your Amex Platinum personal card.

The Business Platinum Card® from American Express

150,000

Membership Rewards® Points

after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

Annual Fee:

$695

Hilton Honors American Express Aspire Card

175,000

Hilton Honors Bonus Points

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership. Offer ends 8/13/2025.

Annual Fee:

$550

Hilton Honors American Express Surpass® Card

130,000

Hilton Honors Bonus Points

after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership. Offer Ends 8/13/2025.

Annual Fee:

$0 introductory annual fee for the first year, then $150

The Hilton Honors American Express Business Card

Limited time offer: Earn 150,000

Hilton Honors Bonus Points

after you spend $8,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership. Plus earn an additional 25,000 Hilton Honors Bonus points after you spend an additional $2,000 in purchases on your card within your first 6 months of card membership. Offer Ends 8/13/2025.

Annual Fee:

$195

Marriott Bonvoy Brilliant® American Express® Card

The Marriott Bonvoy Brilliant® American Express® Card, with an annual fee of $650 (see rates & fees), also offers a complimentary Priority Pass Select membership. Unlike the Amex Platinum and Amex Business Platinum cards, which allow only one guest into lounges free-of-charge, the Marriott Bonvoy Brilliant card permits two guests to accompany you into lounges at no additional cost. Any guests beyond these two will incur the standard guest entrance fee. Naturally, the primary cardholder is entitled to unlimited complimentary visits to Priority Pass lounges.

Regrettably, similar to all other Amex cards, the Marriott Bonvoy Brilliant doesn’t offer benefits at non-lounge locations.

Marriott Bonvoy Brilliant® American Express® Card

Earn up to 150,000

Marriott Bonvoy® bonus points

Earn 100,000 points after you spend $6,000 and an extra 50,000 points after you spend an additional $2,000 in purchases on the Card within your first 6 months of Card Membership.

Annual Fee:

$650

Bank of America

Bank of America currently issues only one card that offers Priority Pass Select membership, and it’s their top-tier travel card.

Bank of America® Premium Rewards® Elite Credit Card

Bank of America’s top-of-the-line travel card, the Bank of America® Premium Rewards® Elite Credit Card, charges an annual fee of $550. This card grants Priority Pass Select membership for up to four individuals on the account, including the primary cardholder and up to three authorized users.

Each member will receive unlimited complimentary lounge visits for themselves and up to two guests. Any additional guests will be required to pay the standard guest entry fee.

The Bank of America Premium Rewards Elite card doesn’t offer any benefits at Priority Pass non-lounge locations.

Barclays

Barclays currently only offers one credit card that comes with Priority Pass Select benefits and it’s the top-of-the-line co-branded credit card from Emirates.

Emirates Skywards Premium World Elite Mastercard®

As the name suggests, the Emirates Skywards Premium World Elite Mastercard® is a premium card from Emirates. This card has an annual fee of $499, and it comes with unlimited complimentary visits to Priority Pass lounges for the primary cardholder and up to two guests per visit.

Any authorized users on your Emirates Skywards Premium card also can enroll in Priority Pass membership at no additional cost.

Unfortunately, this card doesn’t offer Priority Pass Select non-lounge benefits.

Capital One

Capital One currently offers only one credit card that comes with a membership to Priority Pass Select: the Capital One Venture X Rewards Credit Card. However, Capital One has revealed plans to issue a business version of this card that is expected to come with a Priority Pass Select membership as well.

Capital One Venture X Rewards Credit Card

The Capital One Venture X Rewards Credit Card, Capital One’s premium travel card with an annual fee of $395, offers a Priority Pass Select membership that includes unlimited complimentary visits to Priority Pass lounges for yourself and up to two guests. If you have more than two guests, the additional guests will need to pay the standard guest entry fee.

Unfortunately, Priority Pass non-lounge experiences are no longer included with the Venture X Card.

One noteworthy feature of the Venture X Card is the option to add up to four authorized users to the account at no additional cost. Each authorized user can also obtain their own Priority Pass Select membership.

As previously mentioned, Capital One has announced plans to issue a business version of the Venture X Card in the near-future. This card is expected to be almost identical to the consumer version of the Venture X Card, so it follows that it will probably also come with a Priority Pass Select membership.

Capital One Venture X Rewards Credit Card

75,000

Venture Miles

after you spend $4,000 in purchases in the first 3 months.

Annual Fee: $395

Chase

Chase also offers Priority Pass Select as a perk with their top-of-the-line travel cards only.

Chase Sapphire Reserve®

Among the currently available cards, the Chase Sapphire Reserve® card likely offers the best Priority Pass perks. This card includes unlimited complimentary visits to Priority Pass lounges for the cardholder and up to two guests.

Additionally, each authorized user can also receive a Priority Pass Select membership. However, adding authorized users to the Chase Sapphire Reserve card incurs a $195 annual fee per user, unlike the Capital One Venture X card, which allows up to four authorized users at no additional cost.

Unfortunately, Chase has removed access to all non-lounge experiences through its Priority Pass Select memberships. Thus, the Chase Sapphire Reserve® card will get you into lounges for free, but it won’t do you any good at restaurants, spas or other non-lounge businesses.

Earn 100,000

bonus points + $500 Chase Travel℠ promo credit

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

The Ritz-Carlton™ Credit Card

Though The Ritz-Carlton™ Credit Card is no longer open to new applicants, you can still obtain it by signing up for one of the three Chase-issued Marriott Bonvoy cards (the Marriott Bonvoy Bold® Credit Card, the Marriott Bonvoy Boundless® Credit Card or the Marriott Bonvoy Bountiful™ Credit Card) and then converting your Marriott card to The Ritz-Carlton card. To qualify, your Chase-issued Marriott card account must be open for at least 12 months with a credit line of at least $10,000.

If you meet these requirements, obtaining The Ritz-Carlton card could be an excellent choice, particularly if you desire a Priority Pass Select membership.

The Ritz-Carlton card differs from the Chase Sapphire Reserve® card in that it allows the addition of authorized users at no extra cost. Although authorized users on this card don’t receive all the same perks as the primary cardholder, they can obtain their own Priority Pass Select membership with full benefits.

Citi

Citi’s only credit card that offers Priority Pass benefits is their top-tier travel card the Citi Prestige Card, which was meant to rival cards like the Chase Sapphire Reserve®. However, as the popularity of the Citi Prestige Card declined, Citi decided to phase it out, and applications for this card are no longer being accepted. In fact, Citi no longer allows customers to product change any cards to the Prestige Card.

Citi Prestige Card

Although you can’t obtain the Citi Prestige Card, if you already possess it, you should be aware of its Priority Pass benefits. The Prestige Card, with an annual fee of $495, includes a Priority Pass Select membership, which provides complimentary access to Priority Pass lounges for yourself, immediate family members and up to two guests.

Unlike many other cards mentioned, the Citi Prestige Card still features Priority Pass non-lounge benefits. Additionally, for an extra annual fee of $50 per person, you can add authorized users to your card, allowing each authorized user to obtain their own Priority Pass Select membership with identical benefits.

If you don’t currently hold the Citi Prestige Card, you haven’t missed much. The card experienced a massive devaluation when Citi raised its annual fee without altering its benefits, resulting in its discontinuation. Far better premium travel card options are still available.

U.S. Bank

U.S. Bank offers two personal credit cards and one business card that come with Priority Pass benefits. In terms of the cheapest cards with complimentary Priority Pass lounge access, the U.S. Bank Altitude® Connect Visa Signature® Card and the U.S. Bank Business AltitudeTM Connect World Elite Mastercard® are your best options. So, if you want to enjoy airport lounge access without paying a high annual fee, then the U.S. Bank might be the right issuer for you.

U.S. Bank Altitude® Connect Visa Signature® Card

The U.S. Bank Altitude® Connect Visa Signature® Card is the most affordable card offering Priority Pass Select benefits. With a $0 introductory annual fee for the first year and a $95 annual fee thereafter, this card includes a Priority Pass Select membership that grants four complimentary visits to Priority Pass lounges each membership year. Note that your membership year starts when you enroll in Priority Pass Select, not when you sign up for the U.S. Bank Altitude Connect card.

Regrettably, Priority Pass Select membership is restricted to one person per account, meaning authorized users on the U.S. Bank Altitude Connect Card can’t obtain their own complimentary Priority Pass Select membership.

It’s also important to note that bringing guests into Priority Pass lounges with you will count against your four annual complimentary visits. For instance, if you and a guest enter a Priority Pass lounge during your trip, it will count as two of your annual complimentary visits. Standard guest rates apply once all annual complimentary visits are exhausted.

Similar to most other cards mentioned, the U.S. Bank Altitude Connect Card doesn’t offer non-lounge Priority Pass benefits.

For those seeking access to Priority Pass lounges at a low cost, the U.S. Bank Altitude Connect Card is the best choice. Many people with Priority Pass Select memberships don’t visit Priority Pass lounges more than four times per year. As such, accessing these lounges for a modest annual fee of $95 (waived for the first year) rather than paying for a premium travel card charging $400 or $500 annually is an attractive option.

U.S. Bank Business Altitude™ Connect World Elite Mastercard®

The U.S. Bank Business Altitude™ Connect World Elite Mastercard® offers a $0 introductory annual fee and then $95 annually for every year after that, making it one of the two least expensive cards that comes with Priority Pass Select benefits.

With this card, you’ll get four complimentary visits to Priority Pass lounges every membership year. Once again, your membership year will begin when you enroll in Priority Pass Select, not when you sign up for the U.S. Bank Business Altitude Connect card.

Just like with the personal version of this card, Priority Pass Select membership is limited to one person per account and authorized users can’t get their own Priority Pass Select memberships. Likewise, each guest that you bring into a lounge with you will count towards your total of four complimentary visits per year.

Unfortunately, the U.S. Bank Business Altitude Connect Card doesn’t come with non-lounge benefits.

The Business Altitude Connect Card is a great option for those who want to get into Priority Pass lounges for free without signing up for a high-annual-fee credit card. Unfortunately, you have to be a small business owner to get this card. Keep in mind that gig economy workers, freelancers, independent contractors and sole proprietors should be able to qualify for this card (or any other business card).

U.S. Bank Altitude® Reserve Visa Infinite® Card

The U.S. Bank Altitude® Reserve Visa Infinite® Card, this issuer’s premium travel card with an annual fee of $400, also includes a Priority Pass Select membership. However, like the Altitude Connect Card, the Altitude Reserve Card doesn’t permit authorized users to obtain their own Priority Pass Select membership.

This membership grants four complimentary visits per membership year and four complimentary guest visits per membership year. Keep in mind that a membership year commences when you enroll in Priority Pass Select, not when you sign up for the Altitude® Reserve Card.

This Priority Pass Select membership excludes non-lounge benefits.

Considering the premium travel card’s $400 annual fee, the limit of four complimentary lounge visits per membership year is somewhat disappointing. In contrast, the Capital One Venture X Card has an annual fee of $395 and provides unlimited complimentary visits for yourself and up to two guests. Additionally, unlike the U.S. Bank Altitude® Reserve Visa Infinite® Card, the Capital One Venture X Card allows adding up to four authorized users at no extra cost, and each authorized user can obtain their own Priority Pass Select membership free of charge.

U.S. Bank Altitude® Reserve Visa Infinite® Card

50,000

Bonus Points

after you spend $4,500 in the first 90 days

Annual Fee: $400

The Bottom Line

If you wish to maximize the value that you and your friends and family can get out of a Priority Pass membership through a credit card, we recommend signing up for the Capital One Venture X Card ($395 annual fee). That’s because this card allows you to “share the wealth” by adding up to four authorized users to your account at no extra cost. Each authorized user can obtain their own Priority Pass Select membership, granting unlimited complimentary lounge visits for themselves and up to two guests. In comparison, the Chase Sapphire Reserve® charges $195 for each authorized user on the account.

However, if your goal is to obtain Priority Pass lounge access at the lowest possible cost, consider the U.S. Bank Altitude Connect Card. This card offers four complimentary lounge visits per year for a standard annual fee of $95, which is waived for the first cardmember year. Although these complimentary visits exclude guests, this card is the only option in this price tier currently offering complimentary Priority Pass lounge access.

Ultimately, whichever card you choose, a Priority Pass Select membership can be one of the most valuable credit card benefits for frequent flyers. The ability to enjoy free food, free drinks and a place to relax at the airport can translate to hundreds or thousands of dollars in annual savings.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $5,000 on purchases in the first 3 months from account opening.

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership. Offer Ends 8/13/2025.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.