10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Sydney, Australia’s second largest city, is on many travelers’ bucket lists. The city has fun, youthful energy and isn’t short on tourist attractions. Who hasn’t seen pictures of the iconic Sydney Opera House or the Sydney Harbour Bridge?

Let’s look at a few Sydney hotel options that you can book with points. Sydney, and Australia in general, is quite pricey, but has a good selection of hotels with reasonable redemption rates. Here we picked a few centrally located properties that won’t break the (points) bank.

Sydney is not a cheap travel destination, so it’s refreshing to see so many hotels with very reasonable redemption rates. By strategically using credit card welcome bonuses and the annual free nights that come with some of these cards, you’ll be able to easily cover a few nights in this exciting city.

Hyatt

It’s easy to find great redemption opportunities within Hyatt’s network of hotels and Sydney is no exception. However, not all hotels will offer the best value for points. There are two Hyatt properties in Sydney – one offers an amazing, outsized value and another one often has reasonable cash rates so redeeming points at this property might not be the best idea, especially if you are traveling during the low season.

Park Hyatt Sydney

Park Hyatt Sydney | Photo courtesy of Hyatt.com

This is one of the most coveted redemptions among Hyatt enthusiasts. I’ve stayed at this hotel and I can attest to its incredible location, beautifully appointed modern rooms and great service. Having a view of the famous Sydney Opera House, one of the world’s most recognized landmarks, from your balcony isn’t something you’ll easily forget.

If you are going to Sydney and have World of Hyatt or Ultimate Rewards points to spare, stay at least one or two nights at this iconic property.

The cash rates at Park Hyatt Sydney hover around $1,000/night but you can book it with just 30,000 World of Hyatt points a night.

Hyatt Regency Sydney

Hyatt Regency Sydney is located near the Darling Harbour, in the Central Business District. This is a mega hotel with close to 900 guest rooms. The location is great, and all of Sydney’s major attractions are within the walking distance.

The cash rate at this hotel fluctuates widely depending on the demand, so if you are going to spend 20,000 points/night there, make sure you are getting a great deal. Otherwise, for just 10,000 more points, stay at the Park Hyatt Sydney where the cash rates are usually four or five times higher.

Cards to Help You Earn Hyatt Points

Chase’s The World of Hyatt Credit Card comes with a generous welcome bonus and great earning rate on Hyatt stays.

The Chase Sapphire Preferred® Card is one of our favorite cards. It comes with a generous welcome bonus and great travel benefits such as rental car and trip delay insurance.

For a small business owner, the Chase Ink Business Preferred® Credit Card might be a great choice. The huge welcome bonus is enough to cover a few nights in Sydney and if your business spends a good amount in the 3X categories, such as online advertising, you’ll be able to quickly accumulate even more points to cover a few more stops down under.

Marriott

Marriott has a few centrally located properties in Sydney. Considering how popular Sydney is as a tourist destination, it’s quite surprising that all of them are category 5 or below.

Marriott has standard, peak and off peak rates, so consult the award chart to see how many points exactly you’ll need for your stay. The price in points will change based on the time of year and the overall demand.

And if you are sitting on a couple of 35,000 points annual free night certificates that come with some of Marriott’s co-branded credit cards and can find standard rates, Sydney is an excellent place to use these as the cash prices tend to be quite high.

Don’t forget that when you book four nights with points, you will get the fifth night free.

Sydney Harbour Marriott Hotel at Circular Quay

Sydney Harbour Marriott Hotel at Circular Quay | Photo courtesy of Marriott.com

The location is excellent and if you can snag a room on a higher floor, you’ll get sweeping views of the Sydney Harbor. This hotel is a great value even at peak rates when cash prices approach $400.

This is a category 5 hotel.

Sheraton Grand Sydney Hyde Park

Sheraton Grand Sydney Hyde Park | Photo courtesy of Marriott.com

If you stay at Sheraton Grand Sydney Hyde Park, you’ll be right in the heart of the city, close to all the major shopping and dining destinations and right next to a beautiful park. This is another property where you can redeem your 35,000/night certificates. The cash price in high season can be as high as $600+, so even at peak rates of 40,000 points/night, you’ll be getting a great value.

This is a category 5 hotel.

Pier One Sydney Harbour, Autograph Collection

This is a truly unique property located directly on the waterfront, with harbour views throughout the hotel. You can’t get any closer to the Sydney Harbour Bridge, unless you actually climb it (which could be a really fun activity for someone who’s not afraid of heights). With cash rates as high as $450, cashing in your 35,000 points certificates would be a real great deal.

This is a category 5 hotel.

Cards to Help You Earn Marriott Points

Marriott partners with both Chase and American Express. The Marriott Bonvoy Boundless® credit card comes with a generous welcome bonus and a free annual night award that you can use on stays that cost 35,000 Bonvoy points or less. So if you can find standard rates at any of Sydney’s category 5 properties, you can book them with the annual free night certificate and save your points for another trip.

The Marriott Bonvoy Business® American Express® Card is a great card for the small business owner. The card has solid bonus earning categories such as U.S. restaurants, U.S. gas stations and wireless services and comes with an annual free night that can be redeemed on stays up to 35,000 points.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Nights

(each night valued up to 50,000 points)

after spending $3,000 on eligible purchases within 3 months of account opening with your Marriott Bonvoy Boundless® Credit Card. Certain hotels have resort fees.

Annual Fee: $95

Marriott Bonvoy Business® American Express® Card

Earn 3 Free Night Awards

after you use your new Card to make $6,000 in eligible purchases within the first 6 months of Card Membership. Each Free Night Award has a redemption level up to 50,000 Marriott Bonvoy® points, for a total potential value of up to 150,000 points, at hotels participating in Marriott Bonvoy®.

Annual Fee:

$125

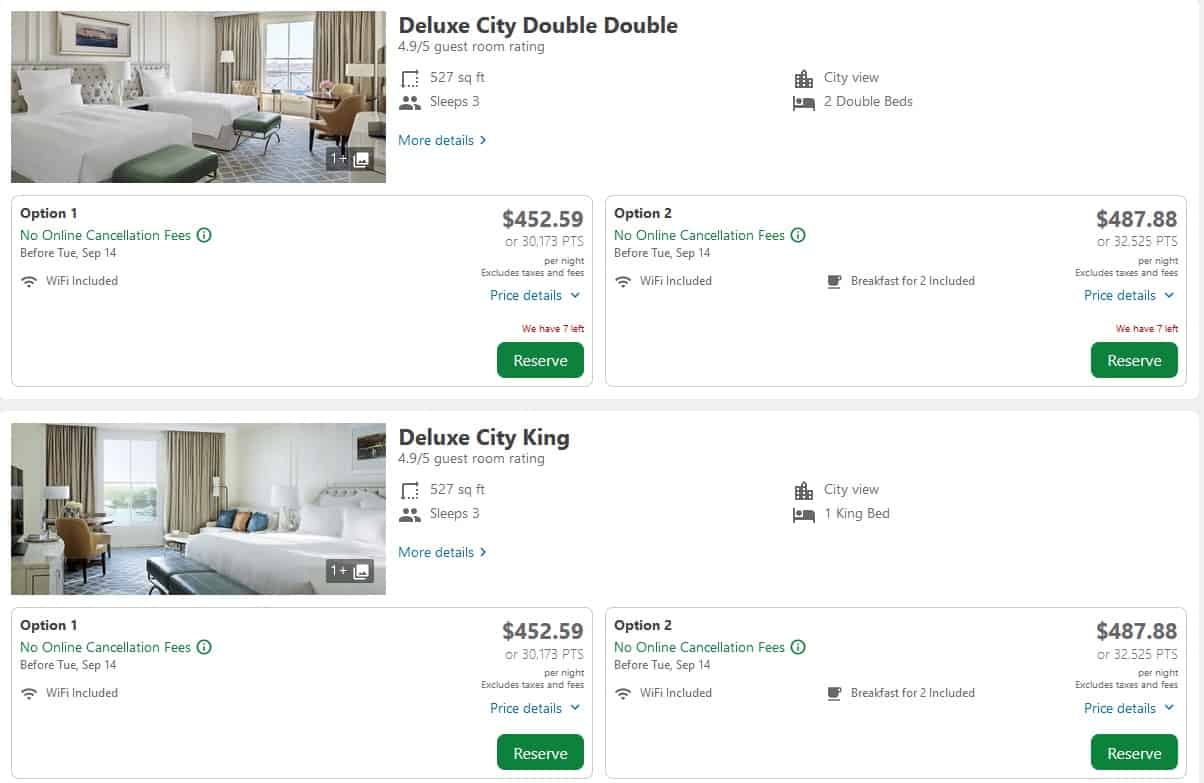

Hilton

Hilton doesn’t have an award chart anymore, so the number of points needed usually depends on the demand and the cash price at each property. Silver, Gold or Diamond Elite Hilton Honors members who book a five night stay will get the fifth night free. Hilton Honors elite status can be earned with a number of Hilton’s co-branded American Express credit cards.

Hilton’s mid-tier Gold status is very rewarding and comes with free breakfast – a great benefit, because Sydney is an expensive city and you’d be glad to have at least one meal covered as part of your award stay.

Hilton has just two properties in Sydney and both are quite high end and have excellent locations.

Hilton Sydney

Hilton Sydney | Photo courtesy of Hilton.com

Hilton Sydney is located at the heart of Sydney’s Central Business District, adjacent to the Queen Victoria Building shopping arcade and is within easy walking distance to Darling Harbor, the Sydney Opera House and the Royal Botanic Gardens.

You can expect to pay as little as 37,000 points and possibly quite a bit more during the high season.

West Hotel Sydney, Curio Collection by Hilton

West Hotel Sydney, Curio Collection | Photo courtesy of Hilton.com

Curio Collection hotels are usually fun, unusual properties that really reflect the character and personality of their locations. This property is no exception as it’s located in the western district, near the iconic Darling Harbour and the cultural and commercial hub of Barangaroo. You’ll be within 10 minutes of Wynyard Station, Sydney Opera House and Art Gallery of New South Wales.

You can expect to pay from 30,000 to 48,000 Hilton Honors points a night – very reasonable rates for such an expensive city.

Cards to Help You Earn Hilton Honors Points

Thanks to Amex’s three personal cards and one business co-branded card, it’s fairly easy to earn a good stash of Hilton Honors points and easily obtain the elite status needed to get the free breakfast benefit.

One of our favorite cards is the Hilton Honors American Express Aspire Card. We love the generous welcome bonus, valuable Hilton Honors Diamond status and airline and resort credits that help offset its $550 annual fee. Rates & fees. All information about the Hilton Honors American Express Aspire Card is collected independently by 10xTravel.

For a small business owner, there’s The Hilton Honors American Express Business Card. It comes with an excellent welcome bonus and valuable Gold status.

Hilton Honors American Express Aspire Card

150,000

Hilton Honors Bonus Points

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership.

Annual Fee:

$550

The Hilton Honors American Express Business Card

Earn 130,000

Hilton Honors Bonus Points

after you spend $6,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership.

Annual Fee:

$195

IHG

IHG has eliminated the award chart and now has dynamic award pricing. That means the award rates will change, just like cash rates, based on demand. If you have an IHG credit card, and use points to book your stay, you’ll get the fourth night free.

Intercontinental Sydney

Intercontinental Sydney | Photo courtesy of IHG.com

Located in the hub of it all, near Circular Quay, you’ll have all the major Sydney attractions within walking distance and you’ll be minutes away from one of the largest ferry terminals. Sydneysiders use ferries to get around and to commute to work, so if you want to visit other areas of the city or one of its famous beaches, you won’t have to go too far to catch a ferry.

You can expect to pay around 50,000-60,000 points a night at this property.

Crowne Plaza Sydney Darling Harbour

Darling Harbour is a really fun and cool area of the city. Crowne Plaza hotels are usually geared more toward business travelers, but they are also a bit more affordable than Intercontinental hotels. This property will set you back about 30,000 IHG points/night.

Holiday Inn Darling Harbour

If you’d like a more budget option, Holiday Inn Darling Harbour might be a good fit. The location is very good, close to lots of restaurants and bars, and the rates in the 17,500-20,000 IHG points/night range are a very good deal.

Cards to Help You Earn IHG Points

The IHG One Rewards Premier Credit Card comes with a substantial welcome bonus and a generous earning rate at IHG hotels. As a cardmember, you’ll also get one free night on your account anniversary. And here’s a unique benefit – only IHG cardholders get fourth night free when they redeem points for any stay of four or more nights.

IHG One Rewards Premier Credit Card

Lmited Time Offer! Earn 175,000

Bonus Points

after spending $5,000 on purchases in the first 3 months from account opening

Annual Fee: $99

Chase Travel℠

The Chase Travel has a wide range of properties, offering a wide choice of hotels, from basic to some really nice, charming and affordable non-chain hotels. If you have the Chase Sapphire Preferred® card or the Ink Business Preferred® Credit Card, you can redeem Ultimate Rewards points up to 1.75 cents each. If you have the Chase Sapphire Reserve®, your points can be worth up to 2 cents each for select premium travel booked with Points Boost.

And here’s another advantage to booking hotels through the portal – you can book any room type, for more than the typical two guest maximum that chain hotels chains allow. So book a room for as many people as you need and you are in charge of which amenities (like breakfast) you want to add. Families especially will find the portal very useful.

And you know how hotel loyalty programs like to play with award nights availability? If your heart is set on a specific property, you won’t need to worry about that when using the Chase travel portal because it’s essentially like making a cash booking.

If you want to pull all the stops and book something super luxurious that’s an option too. The Langham Sydney is one of the best properties in Sydney but it’s not a points hotel. But if you have a good stash of Ultimate Rewards, you can book a luxury stay in Sydney for yourself and your someone special.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Chase Ink Business Preferred® Credit Card

100,000

bonus points

after you spend $8,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Cards to Help You Earn Ultimate Rewards Points

Chase is one of our favorite banks and Ultimate Rewards points are one of our favorite transferable currencies. Thanks to a number of excellent Ultimate Rewards earning cards, you can accumulate a big stash of points for your Sydney hotel stay. To get the best value out of the travel portal redemptions, you’ll need to have the Chase Sapphire Reserve®.

If you are a small business owner then definitely consider one of the no fee cards, such as the Ink Business Cash® Credit Card or Ink Business Unlimited® Credit Card. Both have excellent earning rates and you can combine the points earned on these cards with the points earned on one of the premium cards (i.e. cards with an annual fee) and use these points for travel portal redemptions.

Earn 125,000

bonus points

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Chase Ink Business Cash® Credit Card

Earn $750

bonus cash back

when you spend $6,000 on purchases in the first three months after account opening

Chase Ink Business Unlimited® Credit Card

Earn $750

bonus cash back

after you spend $6,000 on purchases in the first 3 months from account opening

Final Thoughts

Sydney is not a cheap travel destination, so it’s refreshing to see so many hotels with very reasonable redemption rates. By strategically using credit card welcome bonuses and the annual free nights that come with some of these cards, you’ll be able to easily cover a few nights in this exciting city.

Travel well,

Anna

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

after you spend $8,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

after you spend $6,000 in purchases on the Hilton Honors Business Card within the first six months of Card Membership.

Annual Fee:

$195

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership.

Annual Fee:

$550

after spending $5,000 on purchases in the first 3 months from account opening

Annual Fee: $99

after you spend $6,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

when you spend $6,000 on purchases in the first three months after account opening

after you spend $6,000 on purchases in the first 3 months from account opening

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.