10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

All information about Ink Business Premier® Credit Card has been collected independently by 10x Travel. Ink Business Premier® Credit Card is no longer available through 10xtravel.com.

There are two types of rewards that Chase credit cards can earn: Chase Ultimate Rewards points and cash back. Chase Ultimate Rewards points can be redeemed in various ways that aren’t directly available for cash back-earning cards, such as transferring to travel partners and redeeming through the Chase Travel℠ portal. If you have a cash back-earning credit card, your points are only redeemable for gift cards, as statement credits, as offsets for online or travel purchases or by check or deposit.

Earning Chase Ultimate Rewards points is more desirable for most people because, while cash back points are always worth exactly 1 cent per point, Chase Ultimate Rewards points can be worth up to 1.75 cents per point when redeemed through Chase Travel℠ and possibly even more if you transfer them to travel partners.

The following table lays out which Chase credit cards earn Chase Ultimate Rewards points and which ones earn cash back:

| Chase Ultimate Rewards cards | Cashback cards |

|---|---|

| •Chase Sapphire Preferred® Card • Chase Sapphire Reserve® • Ink Business Preferred® Credit Card | • Chase Freedom Flex® • Chase Freedom Rise® Credit Card • Chase Freedom Unlimited® • Chase Slate Edge® Credit Card • Ink Business Cash® Credit Card • Ink Business Premier® Credit Card • Ink Business Unlimited® Credit Card |

However, there is an important loophole that you should know about if you’re open to signing up for multiple Chase credit cards to maximize your rewards. If you have one of the Chase Ultimate Rewards-earning cards listed above in addition to a Chase cashback card, you can transfer cashback points from most cards into your Chase Ultimate Rewards-earning account, and those cashback points can then be used through the Chase Travel℠ portal or with transfer partners.

In this article, we’re going to look at how you can transfer points between Chase credit card accounts as well as the one exception to this rule: the Ink Business Premier Card.

Can You Transfer Chase Points Between Card Accounts?

If you have multiple Chase credit cards, most Chase cards give you the option to transfer points (either cash back or Ultimate Rewards points) between accounts. For instance, if you have both the Chase Freedom Flex and the Ink Business Cash (both of which earn cash back), you can transfer points between these accounts to consolidate your cash back in a single account.

However, you can also use this feature to convert cash back into Chase Ultimate Rewards points if you have the Sapphire Reserve, Sapphire Preferred or Ink Business Preferred. For example, if you had 20,000 cash back points in a Chase Freedom Unlimited account, you could transfer those points to your Chase Sapphire Preferred account and then redeem them through the Chase Travel℠ portal or transfer partners.

It’s worth noting that, even if you already have a large balance of cash back sitting in an account, you can sign up for the Sapphire Reserve, Sapphire Preferred or Ink Business Preferred card today and convert that cash back to Chase Ultimate Rewards points.

There is, however, one exception to this rule: the Ink Business Premier Credit Card. While all other Chase cashback credit cards allow you to transfer points between card accounts, the Ink Business Premier doesn’t offer this option to cardmembers (most of the time).

The Exception: Ink Business Premier

For reasons that aren’t very clear, the Ink Business Premier card ($195 annual fee) doesn’t allow you to transfer rewards to other Chase card accounts. This means that any cash back earned with the Ink Business Premier can only be redeemed for gift cards, as statement credits, as offsets for online or travel purchases or by check or deposit (regardless of whether or not you also have a Chase Ultimate Rewards-earning credit card).

It is worth noting that some Ink Business Premier cardholders reported that the option to transfer points to a Sapphire card or the Ink Business Preferred card was available at a certain point in 2023. However, other users have reported that that option is no longer available in 2024.

So, if you were hoping to sign up for the Ink Business Premier, earn its welcome bonus and then transfer those points to a Sapphire or Ink Business Preferred account, you’ll probably want to hold off. Chances are you’ll only be able to redeem those points as cash back.

Why Should You Transfer Chase Points Between Accounts?

Converting cash back to Ultimate Rewards points (by transferring it into a Sapphire Reserve, Sapphire Preferred or Ink Business Preferred account) can dramatically increase the value you can get out of the rewards you’ve earned from your Chase cashback card. This is because Chase Ultimate Rewards points can be redeemed through the Chase Travel℠ portal or with transfer partners.

Chase Travel℠ Portal

If you have either the Sapphire Preferred Card or the Ink Business Preferred, your Chase Ultimate Rewards points can be worth up to 1.75 cents when redeemed for travel through the Chase Travel℠ portal. If you have the Chase Sapphire Reserve, your Ultimate Rewards points are worth up to 2.0 cents per point on select premium air tickets and hotels when redeemed through Chase Travel℠ with the Points Boost feature. These value boosts also apply to any cashback points that you’ve transferred into your Sapphire Reserve, Sapphire Preferred or Ink Business Preferred account.

So, for instance, let’s say that you want to buy a flight through the Chase Travel℠ portal that costs $1,500 in cash. If you had either the Chase Sapphire Preferred or the Ink Business Preferred, you could pay for this flight with about 120,000 Ultimate Rewards points. If you had the Chase Sapphire Reserve, and the booking was eligible for the maximum Points Boost offer, you could pay for this flight with as few as 75,000 Ultimate Rewards points (a value of 2.0 cents per point).

Transfer Partners

It’s possible to get even more value out of Chase Ultimate Rewards points by transferring them to Chase’s transfer partners. These partners include the following:

- Aer Lingus AerClub

- Air Canada Aeroplan

- Air France-KLM Flying Blue

- British Airways Executive Club

- Emirates Skywards

- Iberia Plus

- IHG One Rewards

- JetBlue TrueBlue

- Marriott Bonvoy

- Singapore Airlines KrisFlyer

- Southwest Airlines Rapid Rewards

- United Airlines MileagePlus

- Virgin Atlantic Flying Club

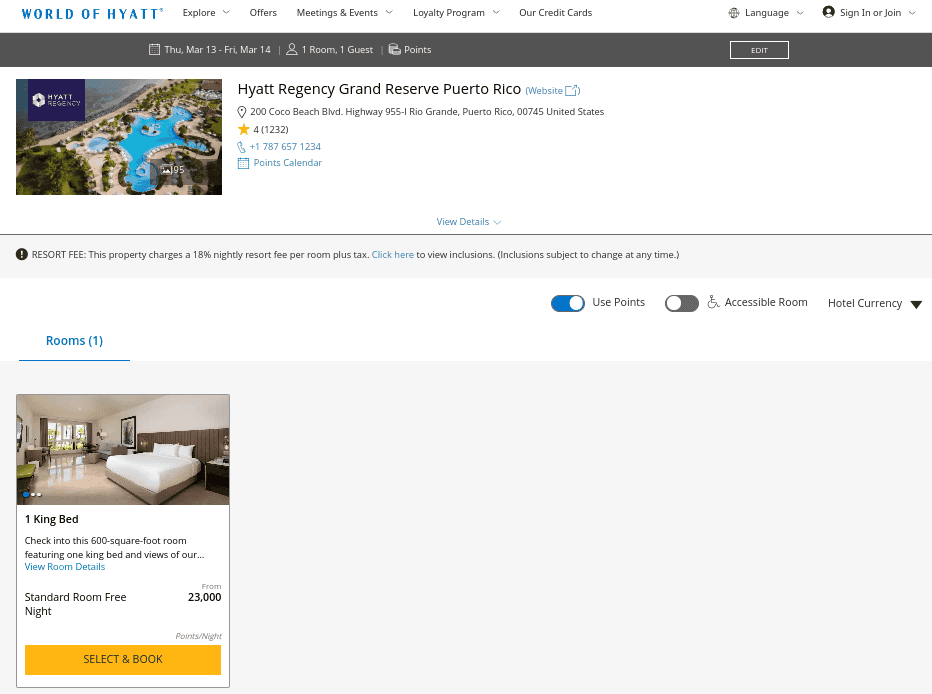

- World of Hyatt

All of the programs above offer a 1:1 transfer ratio. So, if you transfer 10,000 Chase Ultimate Rewards points to any of these programs, you’ll receive 10,000 points or miles in that program’s currency.

With some of these partners, it’s possible to find redemptions that offer value exceeding 2.0 cents per point (which means that utilizing transfer partners can still be more lucrative than redeeming through Chase Travel℠, even with the Sapphire Reserve card’s new Points Boost feature).

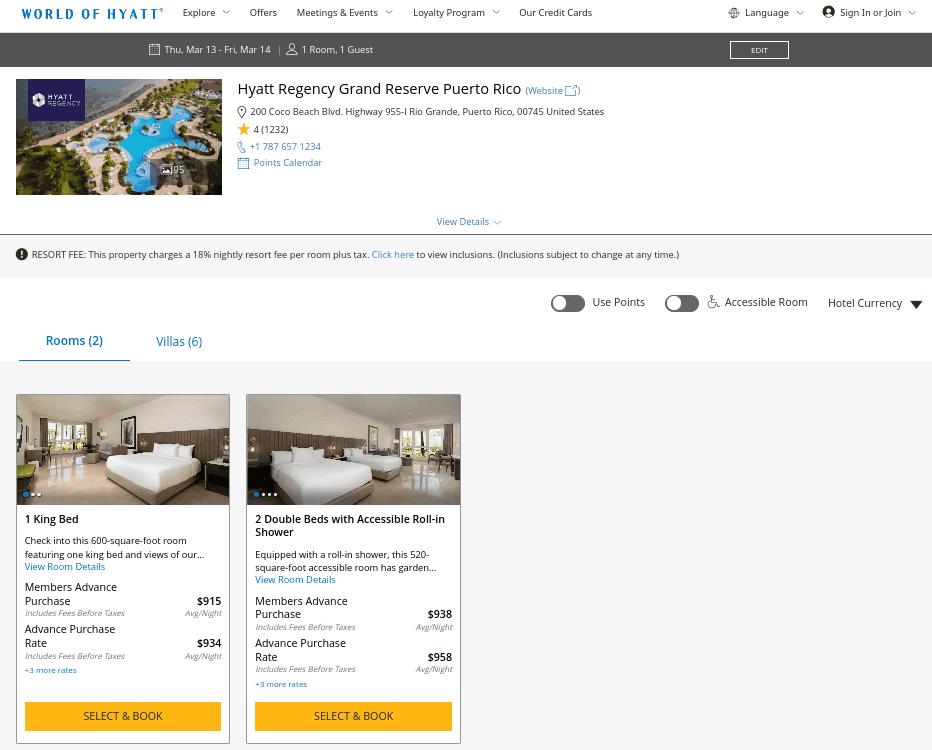

For example, the World of Hyatt program is often considered one of the best Chase transfer partners. Through this program, we found a 1 King Bed Room at the Hyatt Regency Grand Reserve Puerto Rico for 23,000 points per night.

If you were to book this same room on the same night with cash, it would cost you $915 at the Members Advance Purchase rate (the lowest available cash rate).

Thus, by transferring 23,000 Ultimate Rewards points to the World of Hyatt program and redeeming them for this stay, you’d get an outstanding value of nearly 4 cents per point.

So, while utilizing transfer partners can be more complicated and time-consuming, you can get considerably more value through transfer partners than you can through the Chase Travel℠ portal if you’re savvy.

Is the Ink Business Premier Card Worth It?

The fact that the Ink Business Premier Card doesn’t allow transfers to other Chase card accounts is definitely disappointing. This restriction means you can’t convert cash back earned with the Ink Business Premier Card to Ultimate Rewards points (which would allow you to access the Chase Travel℠ portal and transfer partners).

However, despite this drawback, there’s still a lot to love about the Ink Business Premier card. For one, this card offers a sizable welcome bonus, which you can earn by signing up for the card and then spending a certain amount of money in a certain period of time after account opening. Here’s the current welcome offer from the Ink Business Premier:

This card also offers normal spending bonuses and some other benefits. The following table includes all of the major aspects of the Ink Business Premier Card:

| Annual fee | $195 |

| Spending bonuses | • 2.5% cash back on every purchase of $5,000 or more • 2% cash back all other purchases |

| Other notable benefits | • Auto rental collision damage waiver • Travel and emergency assistance services • Roadside dispatch • Purchase protection up to 120 days and up to $10,000 per claim and $50,000 per account • Extended warranty protection of an additional year on U.S. manufacturers’ warranties of three years or less • Cell phone protection of up to $1,00 per claim • Employee cards at no additional cost |

All in all, the Ink Business Premier provides relatively low value for a card that charges a $195 annual fee. While this card does provide a baseline earnings rate of 2% cash back on all purchases, by comparison, the Ink Business Preferred Card offers arguably better spending bonuses and only charges an annual fee of $95. Plus, with the Ink Business Preferred, you have the option to utilize the Chase Travel℠ portal as well as transfer partners.

Plus, most cards that charge an annual fee of over $100 provide some kind of premium benefit, such as lounge access, statement credits, or automatic elite status. The Ink Business Premier Card does not include such additional benefits.

The Ink Business Premier Card does include certain travel and purchase protections. However, these protections are standard across almost all Chase credit cards, even those that don’t charge an annual fee.

So, if you’re looking to sign up for a new credit card, we’d recommend going with something other than the Ink Business Premier. This card simply doesn’t provide enough value for its annual fee compared to other credit cards on the market and even other credit cards within Chase’s lineup. Plus, any rewards you earn with this card can only be redeemed as cash back.

The Bottom Line

One of the best ways to maximize the value you can get from Chase’s lineup of credit cards is to transfer the rewards you earn from cashback cards to a Sapphire Preferred, Sapphire Reserve or Ink Business Preferred account. Thus, you can spend these points through either Chase Travel℠ (where the new Points Boost feature can make them worth up to 2.0 cents apiece depending on the card and booking) or through transfer partners (which can provide even more value in some cases).

However, the one exception to this rule is the Ink Business Premier Card. This card, which is a cash back card with a $195 annual fee, doesn’t allow points transfers to other Chase card accounts. So, the only way to redeem points earned with the Ink Business Preferred is for gift cards, as statement credits, as offsets for online or travel purchases or by check or deposit. These points will always be worth exactly 1 cent apiece using all these methods.

With this drawback in addition to the fact that the Ink Business Premier card doesn’t provide a lot of value for a card that charges a $195 annual fee, it’s hard to justify signing up for this card. There are other cards out there that earn better rewards and offer better benefits for a lower annual fee than the Ink Business Preferred.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.