10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

There’s a lot of great cards out there to choose from, but let’s flip the tables. Rather than opening as many cards as you want, what one card would the 10xTravel team choose if they could only pick one? Let’s hear from the team members about what they think would be the best card they could pick, given the limit of only choosing one.

Anya Kartashova

All right. For entertainment purposes, I’m willing to imagine a crazy scenario in which I’d only have one credit card, but let’s be frank. This is as unrealistic as traveling to Europe from the United States was for most of 2020. In other words, impossible.

If I lived in a fantasy world, in which I could teleport, read another person’s mind and have only one credit card, I’d hold on to the Chase Sapphire Reserve®.

First of all, the card’s $300 travel credit is super easy to use. All I have to do is whip out the Chase Sapphire Reserve® to pay for a flight, a hotel room or an Uber ride, and the credit is applied automatically. No hoops to jump through and no restrictions.

Second, access to airport lounges is akin to having access to oxygen at this point, and having Priority Pass Select membership for me and up to two guests is key.

Unlike Priority Pass Select membership offered by American Express cards, the Chase Sapphire Reserve® still comes with dining credits at Priority Pass restaurants, which means I can get up to $56 off my bill at participating airport restaurants.

I honestly have no idea how I survived airport layovers before I had lounge access, but I love it.

Another reason I’d keep the Chase Sapphire Reserve® only is, I don’t shy away from an economy cabin and often find great flight deals that I can book through the Ultimate Rewards Travel portal at a rate of 1.5 cents per point.

In many cases, round-trip flights booked through the portal end up costing fewer points than they would if I were to transfer points to an airline program. Plus, I still earn airline miles on the ticket and avoid paying taxes on top of the points.

Additionally, having trip protections, such as auto rental collision damage waiver, trip cancelation / interruption insurance and baggage delay, add peace of mind to a frequent traveler like me.

So, there you have it. For me, the Chase Sapphire Reserve® makes the most sense as the sole travel rewards card.

Earn 100,000

bonus points + $500 Chase Travel℠ promo credit

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Anna Zaks

This is an unimaginable scenario! How can one survive with just one credit card? Oh, the horror! But OK, if some strange circumstances forced me to choose which card to keep, I think I know the answer.

For me, it would be the The Blue Business® Plus Credit Card from American Express (Rates & Fees). This humble workhorse of a card earns 2X on all purchases up to $50,000 a year (and afterwards 1X) and has a $0 annual fee (see Rates & Fees). In my opinion, this is one of the best cards in Amex’s portfolio and if you are a small-business owner, you definitely need to get it.

So, potentially, I could earn up to 100,000 Membership Rewards points each year. There are no spending categories to fuss with, so this is as simple as it gets. And unlike Chase, Amex lets you transfer points to travel partners even from the no annual fee cards.

There are so many things I could do with the Amex points, especially if I had 100,000 points in my disposal. The 10X team has tons of good ideas on what to do with all this bounty, but I’d probably book a trip to Europe, my favorite travel destination. Thanks to American Express’s many great travel partners, there are quite a few ways to use Membership Rewards to get to Europe, even in business class.

I can’t imagine not traveling now and I think that thanks to the fact that this card earns 2X, I’d have the most options for free travel with Blue Business Plus.

Emily Jaeckel

In the sad, sad world where I only get to keep one credit card in my wallet, my choice would be the Chase Sapphire Preferred® Card. While this card has a lot of great benefits, there are a few that make it the obvious choice for me.

The first is the lower annual fee. This was the first card I signed up for in my foray into points and miles, and at $95, it was affordable compared to some of the higher-end cards and earned me 80,000 Ultimate Rewards points at the time.

There’s a lot you can do with 80,000 Ultimate Rewards and some of the best redemptions can be made through Chase’s transfer partners. For starters, you could book an all-inclusive four-night stay at the Hyatt Ziva Los Cabos just by making a quick transfer from your Ultimate Rewards to your Hyatt account. In short, there’s a ton of amazing redemptions within your grasp.

Having the Chase Sapphire Preferred also gets you better redemption rates when using the Chase Travel Portal to book travel. It’s always a good idea to compare portal rates to flight or hotel rates directly with the partners because sometimes you can uncover a bargain. Using the portal also gives you the option to use points to book independent hotels not affiliated with larger chains.

One of the other perks that sneakily came in handy during COVID-19 quarantine was the $60 Peloton membership credit. The membership is $39 per month, so the $60 credit isn’t making a huge dent, but I’ll never say no to a discount.

With these perks and the low annual fee, the Chase Sapphire Preferred is the card you’ll catch me with if I’m ever forced to give the rest of them up.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

John Tunningley

When asked what would be the one card I would have if I could only have a single card, my mind instantly jumped to the Chase Sapphire Reserve®. Although the last year has been tough for travel, I typically get huge value out of the Priority Pass membership, get a lot of benefits from having TSA Precheck and also love that the travel credit applies automatically.

That along with the slew of extra benefits and insurance made me gravitate towards the Chase Sapphire Reserve® initially even though I have not held the card in years (due to a shutdown). However, when I start thinking about it critically, I’m actually going to choose the Citi Premier Card.

Now you may be wondering why after talking about all those benefits from the Chase Sapphire Reserve® Card I would choose the Citi Premier Card. For me, it just comes down to math. If I’m forced to have just a single card (something I hope no one ever forces me to do), I want to make sure that I’m getting the most points per dollar spent.

Typically, I get a majority of my points through welcome bonuses offered by cards, but if I can only have a single card, I won’t be able to keep earning points from new products. Instead, I will have to earn all of my points from my day-to-day spend.

Now, it’s important to note that not all points are created equal, as we often discuss, and I want to make sure I am earning transferable points that will give me some flexibility in my travel choices so this rules out almost all co-branded cards.

Next, I took a look at what I typically spend my money on. Sure, I spend a lot at restaurants and on travel (both 3X categories for the Chase Sapphire Reserve® and Citi Premier Card), but I also spend a decent amount of money at supermarkets and at the gas station. The Citi Premier Card (unavailable to new applicants) is the only card I’m aware of with transferable points that earns 3X on all of these categories.

Additionally, the recent (though temporary) addition of American Airlines as a transfer partner is enticing and there are some lesser known benefits, such as $100 annual hotel benefit off a single hotel stay of $500 or more (excluding taxes and fees when booked through the Citi ThankYou Rewards portal).

Lastly, I’m incredibly lucky to work at a job that will pay for a lounge membership and also for TSA Precheck, so I know I have a way to cover those expenses that I get a good amount of use out of making it a relatively simple choice for me.

While I hope it never happens, if I could only have one card, it would be the Citi Premier Card for me.

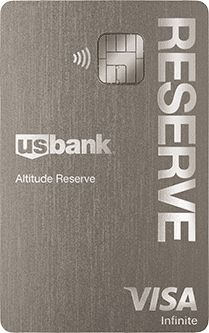

The card has benefits to compete with premium cards like the Chase Sapphire Reserve®, The Platinum Card® from American Express and the Citi Prestige Card, including Priority Pass Select membership, a quadrennial $100 TSA Precheck or Global Entry credit and no foreign transaction fees. Because the card is a Visa, I know it will be accepted almost anywhere.

So this begs the question, “Megan, why don’t you have the card now?” Although it’s been a card I’ve had my eye on, because I am able to have a diverse wallet of cards, this card has never quite fit a need that wasn’t better met by another card.

The card also requires you to have an existing relationship with the U.S. Bank, and the easiest way to do that is by opening a bank account. One needs to live in the U.S. Bank’s service area to have a banking relationship with the bank, which, as a New York City resident, I don’t.

I hope the day I’m forced to hold just one card never comes, but if it does, I’ll be trying my hardest to add the U.S. Bank Altitude Reserve to my wallet because it earns 3X on almost everything.

U.S. Bank Altitude® Reserve Visa Infinite® Card

50,000

Bonus Points

after you spend $4,500 in the first 90 days

Annual Fee: $400

Travis Cormier

Here I was thinking I was being so clever when proposing this idea to the 10xTravel Team, only to find that many think this is just another delusional thought experiment of mine.

Playing along, if I had to choose just one card I’d choose the American Express® Gold Card (Rates & Fees). This has easily become one of my favorite cards, and one that I recommend to many people who want “just one good card.” If I’m recommending it to others who are looking for just one card, it only makes sense to choose it as my only card.

The reason I’d pick the Amex Gold Card is because of its favorable airline partners and earnings rate.

American Express Membership Rewards are some of the most valuable points for flights. I often find flights to be the most challenging part of saving when booking a trip. Almost anywhere I go I can find a hotel for $100-200 per night or sometimes even less, but I put a lot of value on getting there comfortably. This means I’m often traveling in a premium cabin.

Getting a good price on a premium cabin can be challenging. For two people, this would mean flights cost around $4,000 total if I’m paying cash. When taking a two week trip, I could easily get a hotel for half this or less. As a result, I’d rather have points for flights than for hotels.

With access to partners like Emirates, Etihad, Virgin Atlantic, ANA and many more I can always find a great way to book flights with Amex Membership Rewards points.

The reason the Gold Card takes priority over other cards for me is its favorable earning rates. My biggest monthly expenses outside of my mortgage are groceries and dining. The Amex Gold Card earns 4X Membership Rewards per dollar spent at restaurants , including takeout and delivery. It also earns 4X per dollar at U.S. supermarkets on the first $25,000 spent per year (1X after that).

Although the Gold Card has a $325 annual fee (rates & fees) it has a dining credit up to $10 a month at participating restaurants (enrollment required), and up to $10 a month in Uber Cash. So long as I’m able to take advantage of these each month, which I often am, my annual fee is effectively $10.

Given the fact that Membership Rewards are good to use for flights, that the Gold Card has an easy way to earn lots of Membership Rewards for my daily spend, and that the credits can easily offset most of the annual fee it makes sense to be my one and only.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.