10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

If you have a family of four plus, you might feel like redeeming your points for a vacation is an uphill battle.

After all, you only have two adults attempting to earn points for four (or more) total people. It may feel like the points won’t go as far as you’d want them to.

But it’s possible to travel with points and miles regardless of what size family you have. Redemption strategies for a family of four (or more) are not that different from redemption strategies for anyone else. The things families look for when they travel differ only slightly from solo travelers or couples.

Hotel Redemption Strategies for a Family of Four (Or More)

Many hotel rooms only have two double beds in a single room. This may fit your family of four, but such rooms can feel cramped for larger families. There are a few properties with multi-room or additional bed lay-outs that you can book with points.

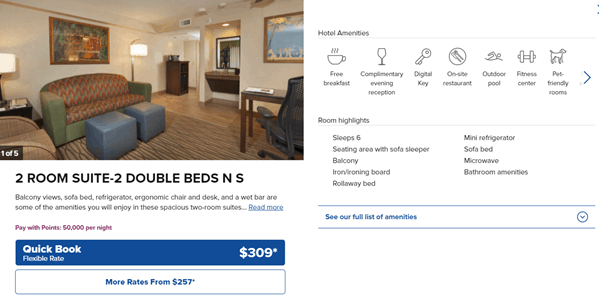

Embassy Suites

Embassy Suites is a Hilton brand hotel. At most of their properties each room comes with an amazing feature for traveling families—a door.

Embassy Suites’ rooms divide the sleeping area and the living area with a door, allowing families to close off the bedroom so a little one (or a grown-up) can take a nap. This also creates natural barriers for some much-needed privacy when traveling as a large party.

In the living area is typically a sleeper sofa, allowing for an (arguable) comfortable sleeping of six in any Embassy Suites’ room. Because Embassy Suites’ standard rooms come with this layout, you should have no problem getting a room for up to six people booking with points.

For instance, if you wanted to stay in Miami in May 2022, you could book this two-room suite at Embassy Suites Miami International for 50,000 points per night.

Marriott Properties

Residence Inn and Fairfield Inn hotels are both Marriott branded properties that have two-bedroom suite layouts. However, because these rooms are not the base rate room on most properties, you won’t be able to book them directly with points.

If you have status with the Marriot Bonvoy program, you may be able to get an upgrade from a base room (without a door) to one of the larger suites. This is not a guarantee and you would not find out until check in. If you plan on attempting to get an upgrade, you’ll need a backup plan. Think about booking two rooms under different names in case you aren’t able to get the upgrade.

You can also book a Residence Inn or Fairfield Inn property on the Chase or American Express Travel portal or simply “erase” your purchase with a card like the Capital One® Venture® Credit Card.

Adjoined Rooms

Because you’re paying with points you may be able to afford to book two rooms instead of one.

After booking your reservation, call the hotel front desk and ask for adjoined rooms. Not all hotel properties offer adjoining rooms. Depending on the age of your kids, it may be just as practical to split the family between two rooms.

If you request adjoined rooms, be sure to confirm at check-in that the hotel is able to honor your request.

Capital One Venture Rewards Credit Card

75,000

Miles

after you spend $4,000 on purchases within 3 months from account opening.

Annual Fee: $95

Flexible Points and Miles Redemption Strategies for a Family of Four (or more)

Using points and miles currencies that can transfer to multiple hotel and airline programs is an essential component for redemption strategies for families.

Because families generally only have two adults earning the points, sometimes you need to top off a redemption to complete it. Chase Ultimate Rewards Points, American Express Membership Rewards Points and Capital One Venture Miles are extremely helpful to have when falling short on a redemption.

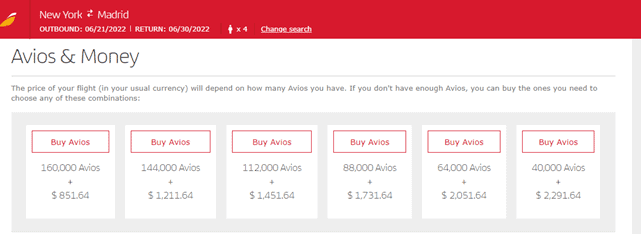

For instance, if you wanted to spend a week in Madrid this June, four economy tickets might cost you 160,000 Avios round trip + $851.64 in taxes and fees (or 40,000 Avios +$212.91 taxes fees each ticket) on Iberia. If for some reason only one of the adults in your family could open a British Airways Visa Signature® Card, which earns Avios points, you would earn 75,000 Avios as a bonus. As a result, you would be short the 85,000 Avios for this trip.

British Airways Visa Signature® Card

Limited time offer! 75,000

Avios

Earn 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. 5x Avios on up to $10k in gas, grocery stores, and dining purchases for first 12 months!

Annual Fee: $95

Enter your Ultimate Rewards points or Membership Reward points. You could simply transfer 85,000 UR or MR points to your Avios account and complete the trip.

Constantly earning flexible points and miles is key to being able to execute redemption strategies for families of four or more.

60,000

Chase Ultimate Rewards® Points

after you spend $4,000 in 3 months

Annual Fee: $550

Vacation Rentals

Let’s face it. Your family doesn’t fit in a hotel room, and the kids need space to get away from each other (and you). Booking vacation rentals is the go-to move for families of four that travel, and there are a handful of cards that let you do this easily.

Travel Portals

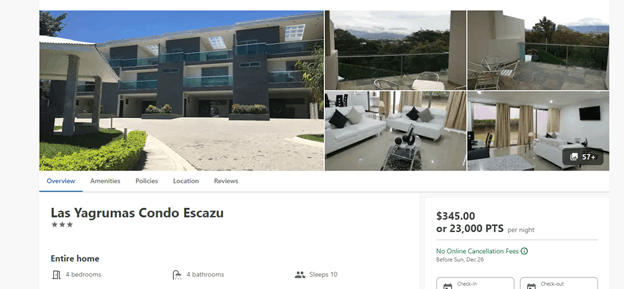

Chase, American Express and Capital One have travel portals that allow you to book vacation rentals with points and miles. The selection can be limited and it seems that most properties are not designed for large families, but it’s worth flipping through your destination to see if you can find a decent property for your family of four or more.

While you can often do better on redemption rates than booking through the travel portal, sometimes it’s worth using points to keep your cash in your pocket while booking travel.

Want to spend the week between Christmas and New Year in Costa Rica? This four-bedroom house will run you just 23,500 Ultimate Rewards Points per night (if you book with your Chase Sapphire Reserve®). That will fit a family of four for sure.

Use Cost Erasure Strategies

With the Chase Pay Yourself Back feature, any vacation rental website becomes a travel portal as for the time being you can simply book your vacation rental with your Chase Sapphire Preferred® Card or Chase Sapphire Reserve® and use your points and miles to Pay Yourself Back for groceries, fuel or home improvement for the amount of your trip.

This feature is set to expire on Sep. 30, 2021, but that date has been pushed back multiple times.

The power of the Capital One® Venture® Credit Card is this feature. Any purchase that codes as travel can be erased via the Capital One website simply by selecting the charge and indicating that you’d like to redeem points for the charge. This opens up a wide swath of properties on vacation rental sites like Airbnb, where you can book properties with more room for your large family to spread out.

Southwest Companion Pass

The Southwest Companion Pass allows the holder to bring a companion on any flight on which they are a passenger. Many couples will alternate getting a Southwest Companion pass so that one of them is always the other’s companion, but for a family of four or more, the ability to bring a free companion on any flight can cut your airline expenditures in half if you do it right.

If both players hold the Southwest Companion Pass in the same year, a family of four can redeem miles for the two travelers with the pass and the other two members would fly free.

Redeeming Southwest Rapid Rewards points for a large family trip becomes much easier when you aren’t paying for two of the tickets.

There’s More Than Points and Miles

Sometimes families fret that they can’t pay for ALL their trip on points and miles so they lose hope. When redeeming points and miles for your family, keep in mind that the goal is to travel, not to have the highest cent per point redemption. If you can pay for three or four of the plane tickets or a handful of nights in a hotel with points and have to pay for the remaining with cash, that’s still a win!

Points and miles can help reduce the cost of a trip instead of eliminate it. This can help you and your family take longer vacations than you typically take or to reach destinations that were before out of your reach.

Think about the trip you want to go on and then use points and miles to help get you there.

Final Thoughts

There are plenty of points and miles redemption strategies for a family of four (or more).

Use hotel points to stay in larger rooms, or to book multiple rooms, where you can. Use flexible point currencies to top off redemptions and utilize travel portals and erasure features of travel cards.

Look into the Southwest Companion Pass and see if it makes sense to earn it next year.

Remember that no one is keeping score. Paying cash for some of the travel is OK. Use your points and miles for redemptions that your family will enjoy and make memories for a lifetime!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months of account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $4,000 on purchases within 3 months from account opening.

after you spend $4,000 on purchases in the first 3 months of account opening.

Earn 75,000 Avios after you spend $5,000 on purchases within the first three months of account opening. 5x Avios on up to $10k in gas, grocery stores, and dining purchases for first 12 months!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.