10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Most U.S. bank rewards cards provide their customers with multiple ways of redeeming their points. Be it transferring points to a travel partner, exchanging them for gift cards or using them to book various travel components, there’s usually a plethora of options.

However, cardholders should beware that not all of these opportunities are good.

American Express Membership Rewards can be used to book flights, prepaid hotels, cruises, vacation packages, or upgrade an existing reservation and even offset federal excise taxes when transferring them to U.S. airline programs.

At first glance, American Express Travel® doesn’t provide as much value as the Chase Ultimate Rewards Travel Portal or the Citi Travel Rewards portal. However, there are ways to increase that value by using one of the booking engine’s features in conjunction with the right credit card.

How to Earn American Express Membership Rewards Points

American Express issues a number of cards that earn Membership Rewards points instead of hotel points or airline miles—these are the flexible points that can be transferred to airlines or used in the American Express Travel® portal.

You may be eligible for as high as 100,000

Membership Rewards® Points

after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$325

Some Amex cards earn cash back and don’t offer the option of using the travel portal. Holding the cards below gives you access to the American Express Travel® portal.

- American Express Blue Business Cash™ Card

- American Express® Business Gold Card

- American Express® Gold Card

- Blue Cash Preferred® Card from American Express

- The Blue Business® Plus Credit Card from American Express

- The Business Platinum Card® from American Express

- The Platinum Card® from American Express

What Amex Membership Rewards Points Are Worth?

Amex Membership Rewards points are worth different amounts when redeemed for flights, hotels, upgrades, etc. It doesn’t matter which card you use to accumulate them—the points are worth the same (with the exception of the Amex Business Gold and the Amex Business Platinum cards).

| Redemption Option | Cents per point |

|---|---|

| Flights | 1 cent |

| Prepaid Hotels | 0.7 cent |

| Cruises | 0.7 cent |

| Vacations | 0.7 cent |

| Upgrade with Points | 1 cent |

| Fine Hotels & Resorts | 1 cent |

As you probably noticed, we did not include transferring American Express Membership Rewards points to airlines as an option. The value in doing so varies depending on how many points you’d need for an award ticket and how much the cash cost of said ticket would have been.

American Express® Green Card

40,000

Membership Rewards® Points

after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. All information about the American Express® Green Card has been collected independently by 10xTravel.

Annual Fee:

$150

Airline Bonus With Amex Business Cards

American Express offers its Business Platinum Card members a great perk. Any time you Pay with Points to book a business or a first class flight through the American Express Travel® portal, you receive a 35% rebate.

The benefit also applies to economy flights operated by your airline of choice—the same one that you select every year in January for the airline fee credit. The rebate is limited to 500,000 Membership Rewards points per calendar year.

When you take advantage of the airline bonus rebate, American Express points are worth ~1.54 cents apiece.

The Business Gold Card members enjoy a 25% rebate, which is ~1.33 cents each, which is still higher than the standard value of 1 cent per point. The rebate limit for the Business Gold Card holders is 250,000 points per calendar year.

| Business Card | Amex Points’ Value After Airline Bonus Rebate |

|---|---|

| American Express® Business Gold Card | ~1.33 cents |

| The Business Platinum® Card from American Express | ~1.54 cents |

Remember that you must have the total number of points available in your account necessary to book the original flight, not just the net amount after the rebate. Although the terms state that you’d get your points back in your account within six to 10 weeks, some data points show that they post within a day or two after the reservation is processed.

The Platinum Card® from American Express

You may be eligible for as high as 175,000

Membership Rewards® Points

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$695

When You Should Redeem Amex Membership Rewards Points via American Express Travel® Portal

Believe it or not, transferring points to airlines isn’t always the best use of rewards. In some cases, you’re better off redeeming them through a portal. Let’s take a look at such scenarios.

When carriers run airfare sales: From time to time, airlines post pretty great deals on airfare to various destinations. It’s not unheard of to spot economy flights between the United States and Europe for $300, for example.

Many of these deals can be reserved through the portal for a fraction of what an award ticket booked with airline miles would cost. The taxes and fuel surcharges are included, too. For this reason, it might be best to redeem points through a portal instead of utilizing a transfer partner.

When you hold the Business Gold/Platinum Card: Because of the airline bonus, Membership Rewards points are worth more after you receive a 35% rebate. It’s not just economy deals, though. You find business class deals as well. With the rebate, you can take advantage of the fare deal and the higher redemption value at the same time by redeeming points via the American Express Travel® portal.

If you have multiple Membership Rewards-earning cards, the points pool into the same place, making it easier to transfer Amex points from one card to another. You just have to make sure you log into your Business Platinum Card account to redeem them.

When you don’t have any Chase or Citi points: I hate to say it, but unless you hold either the Business Gold Card or the Business Platinum Card, redeeming Amex points through the travel portal shouldn’t be your first choice, especially when you redeem them for prepaid hotels or car rentals.

American Express points are worth 0.7 cent to 1 cent when used to book travel elements via its travel portal. In comparison, the Chase Ultimate Rewards portal has moved to a ‘Points Boost’ system where points can be worth up to 2 cents each on select premium travel, though its baseline value for other bookings is now lower. The math is now more situational, but can still work out in Chase’s favor, especially on high-end redemptions. It’s better to use the other two banks’ currency.

However, if you’re above 5/24 and can’t get approved for any Chase cards or award availability isn’t there, you have to work with what you’ve got in the effort to save money on travel.

The Blue Business® Plus Credit Card from American Express

15,000

Membership Rewards®

after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

How to Use American Express Travel® Portal to Book Travel

Any time you make a reservation for either a flight or a hotel through American Express Travel®, remember that the booking isn’t made directly with a travel provider. The portal is essentially an online travel agency, but instead you use your points to substitute cash.

Flights

Flights are one of the travel components you can book in the American Express Travel® portal for the maximum value of 1 cent per point.

To begin your search, log in with your American Express account information, enter your departure and arrival airports, travel dates, number of passengers and class of service. For nonstop flights only, check the corresponding box. Search as usual, sort your results by price in cash or points, duration and departure time, and select your options.

Keep in mind that Delta Air Lines flights are presented first, unless you filter your results by lowest price, because it’s a partner airline of American Express. You can fix that by filtering your results by price if that’s the most important factor.

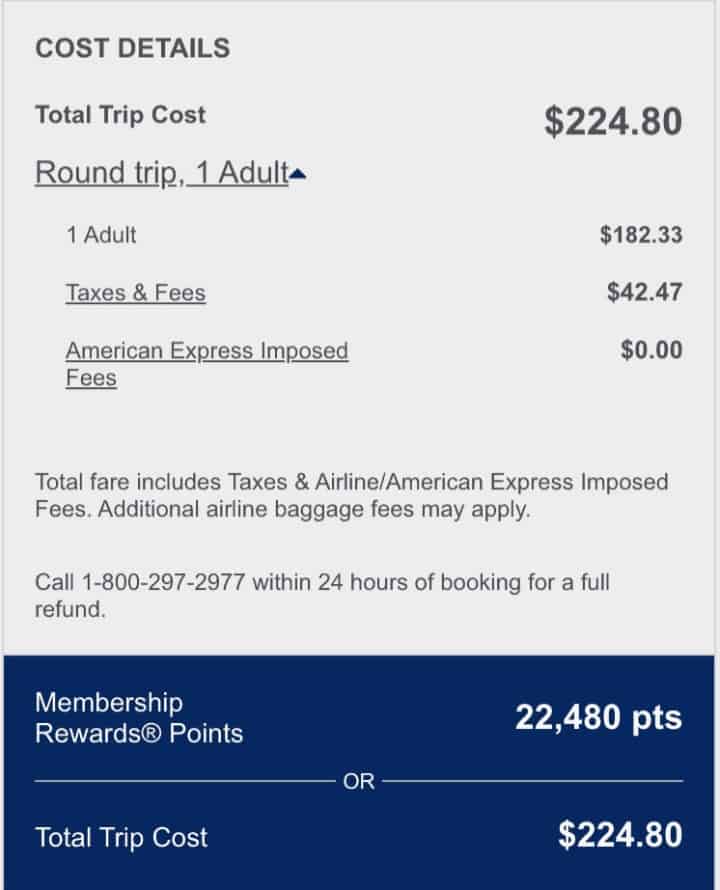

When you’ve completed your itinerary selection, choose whether you prefer to pay in cash or to redeem Amex points. Enter traveler information and continue with your booking.

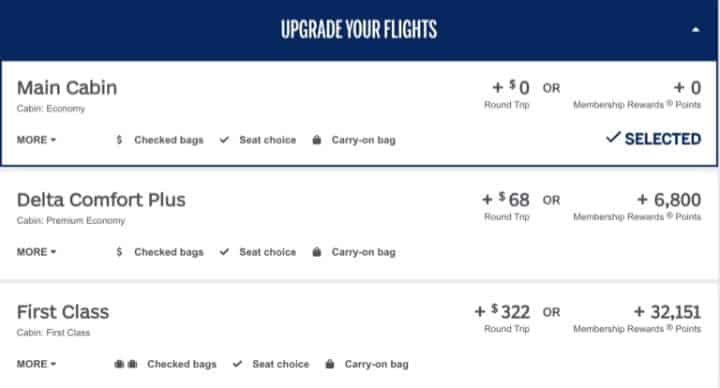

The travel portal doesn’t display basic economy seats, so you know you can count on a regular economy seat, which usually includes a carry-on bag and a seat selection, at the very least. If you seek a higher class of service, you’ll have an opportunity to upgrade. Please note that you will earn frequent flyer miles on these flights.

You must redeem at least 5,000 Membership Rewards for a Pay with Points booking through the portal, and if you don’t have enough to cover the entire cost, you can cover the rest with a credit card. Earning points while holiday shopping can help you quickly reach this threshold.

The full dollar amount will be charged to your American Express card, but a credit will apply within 48 hours once the points are deducted. Charges made to The Platinum Card from American Express or the Business Platinum Card will earn 5X points per dollar spent.

The Business Platinum Card® from American Express

150,000

Membership Rewards® Points

after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

Annual Fee:

$695

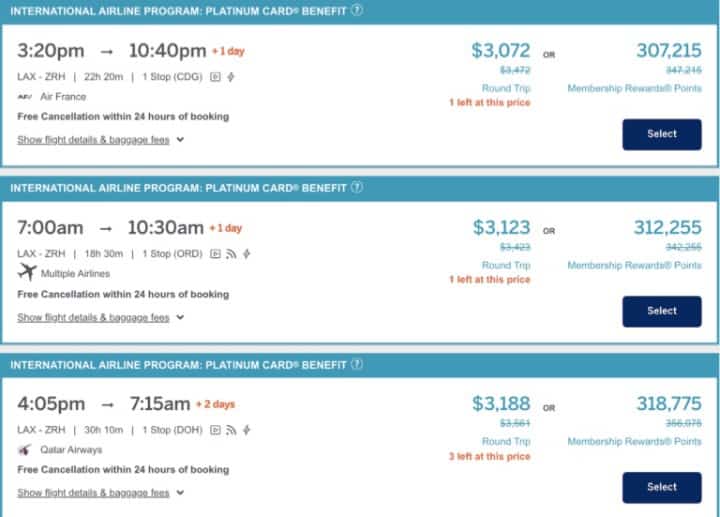

International Airline Program

The International Airline Program (IAP) is available if you have the Amex Platinum or Amex Business Platinum cards. With the IAP, you’ll have access to discounted flights in premium economy, business class and first class on select airlines. In fact, you can get great deals on 20 airlines including:

- Aeroméxico

- Air China

- Air France

- Air New Zealand

- Alitalia

- Asiana Airlines

- Austrian Airlines

- British Airways

- Brussels Airlines

- Cathay Pacific

- China Airlines

- Delta Air Lines

- Emirates

- Etihad Airways

- Iberia

- Japan Airlines

- KLM

- LATAM

- Lufthansa

- Qantas

- Qatar Airways

- Singapore Airlines

- South African Airways

- Swiss International Air Lines

- Virgin Atlantic

You can use Amex points to book these flights (and get the rebate) or book with your Platinum or Business Platinum card to earn 5X Membership Rewards points.

The International Airline Program options will be indicated in the search results. All you have to do is run a search for a premium cabin flight, and any options available will be shown to you. The discount will be reflected in the price you see. If an itinerary presented includes The Centurion Lounge at a connecting airport, you’ll be notified of that, too.

The redemption rate is 1 cent per point here but, again, you’ll get a 35% rebate after the fact. You can book these flights online via the travel portal or over the phone, but a phone booking is subject to a $39 service fee per ticket. The limit is eight tickets per booking.

If you’re thinking about using an International Airline Program option, you’ll want to compare how many points you’ll need in the American Express Travel® portal (after the rebate) to the number of miles required for a similar flight booked as an award ticket.

The Blue Business® Plus Credit Card from American Express

15,000

Membership Rewards®

after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

Hotels

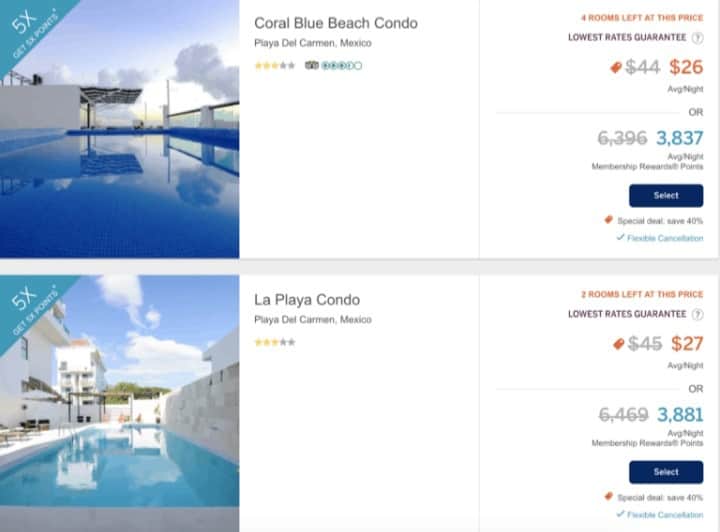

When you redeem Amex Membership Rewards points toward a prepaid hotel room, the per-point value drops to 0.7 cent. This redemption option isn’t recommended because of the low value you get in return. However, if you’re swimming in American Express points, you might find it worth it. This will apply to very few people.

If available at your destination, Fine Hotels & Resorts and The Hotel Collection options will pop up first. You’ll be able to see which ones they are by reading a disclaimer under each property. Sort by price, star rating and more to find all other rooms.

If you book via American Express Travel®, these room reservations are treated as third-party bookings, which don’t typically earn elite status or redeemable hotel points, so don’t count on that room upgrade if that’s your jam.

You can use points to submit a partial payment and pay the rest with any credit card. However, if you use the Amex Platinum or Business Platinum to cover the cash portion, you’ll earn 5X Membership Rewards on prepaid hotels.

The Amex EveryDay® Card

Not available to new applicants

All information about The Amex EveryDay® Credit Card has been collected independently by 10xTravel. The Amex EveryDay® Credit Card is no longer available through 10xTravel.

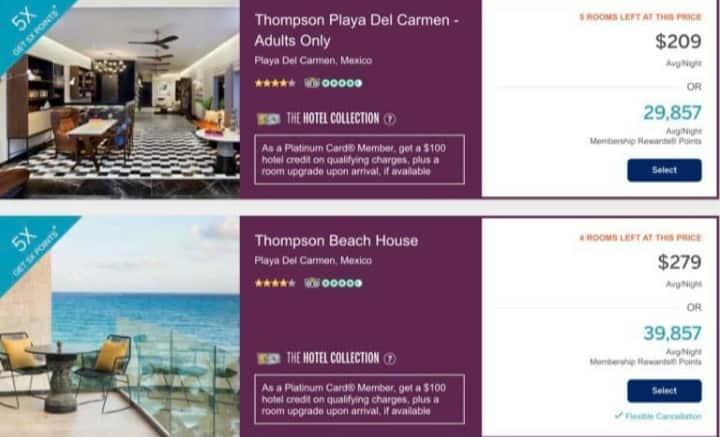

The Hotel Collection

If you hold any of the following American Express cards, you can book properties in The Hotel Collection portfolio:

- American Express Business Gold Card

- American Express Gold Card

- Centurion Card from American Express

- The Business Platinum Card from American Express

- The Platinum Card from American Express

If you book a stay at a property that’s part of The Hotel Collection for two or more nights, you qualify for additional benefits, such as room upgrades (if available at check-in), hotel credits of up to $100 and even discounts on room rates.

As long as you hold one of the aforementioned cards, you’re able to use Amex Membership Rewards to cover your room at a rate of 0.7 cent per point. Generally, you’re better off using The Hotel Collection when you plan to pay cash for a stay rather than using points.

American Express® Business Gold Card

100,000

Membership Rewards® Points

after spending $15,000 in the first 3 months. Terms apply.

Annual Fee:

$375

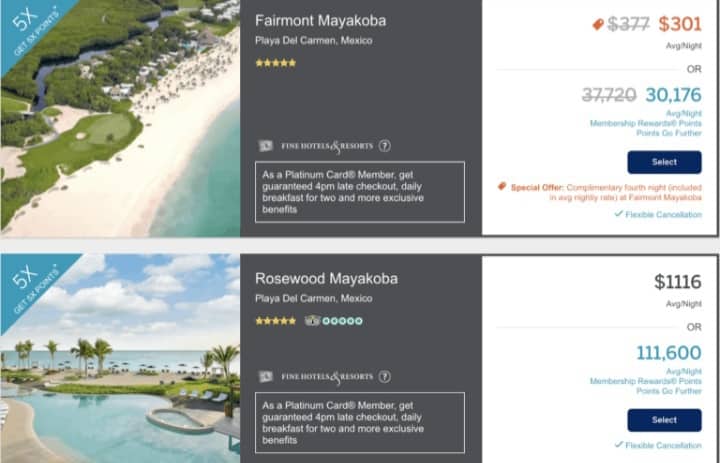

Fine Hotels & Resorts

Participation in the Fine Hotels & Resorts program is open to the Amex Platinum and Business Platinum cardholders only.

Fine Hotels & Resorts typically include elite-like benefits, such as early check-in, late checkout, daily breakfast for two, complimentary beverage and property credits, room upgrades, unlimited Wi-Fi and even complimentary nights when you book at least three or four nights, depending on the property.

Amex points redeemed toward these reservations are worth 1 cent each, which gives you an incentive to book these properties over regular hotels, especially during third and fourth night free night promos. Again, using points on these bookings is generally not a great idea.

As a reminder, you won’t earn elite status credit for these stays and your current elite status might not be recognized at these properties. However, the perks you get from Fine Hotels & Resorts do mimic many of the elite status benefits.

The Business Platinum Card® from American Express

150,000

Membership Rewards® Points

after you spend $20,000 in eligible purchases on the Card within the first 3 months of Card Membership.

Annual Fee:

$695

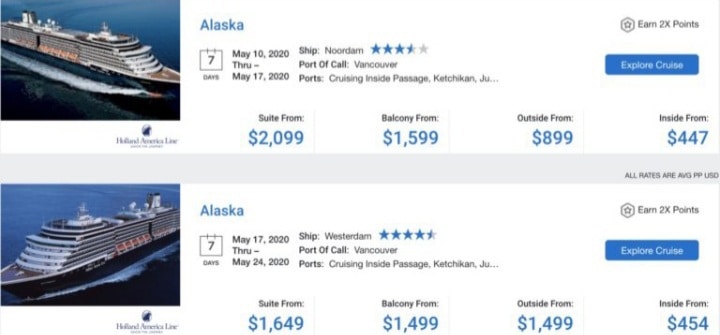

Cruises

To search for a cruise, select your preferred destination, a cruise line and a sailing date. Filter results by cruise duration, price, star rating, port and vessel name. Select your cabin and sail away.

Select cruise lines offer the Platinum Card and the Business Platinum Card members additional perks, such as shipboard credits and exclusive amenities, as part of the Cruise Privileges program. Membership Rewards points are worth 0.7 cent apiece toward a cruise booking.

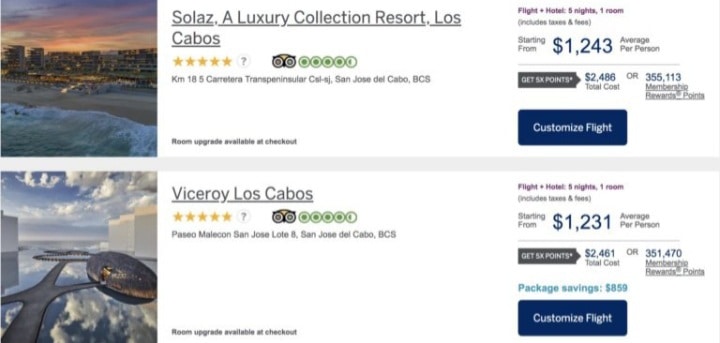

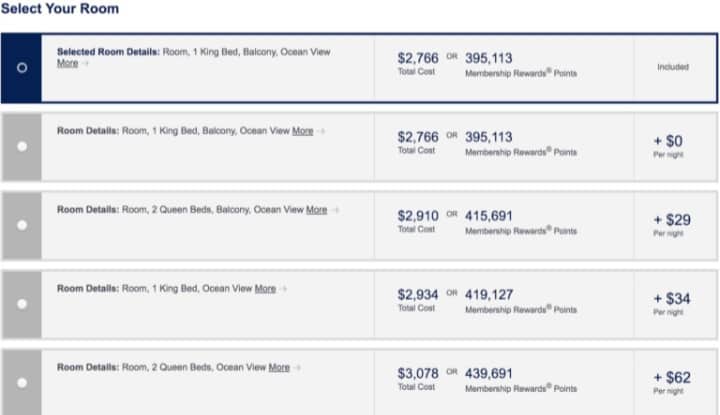

Vacations

Booking vacation packages, such as flight + hotel reservations often can save you more money than if you were to book everything separately. Enter your destination, travel dates, number of rooms and the number of travelers per room to begin searching for a perfect package. Sort your results by recommended, price, star rating and hotel name.

You can customize your flight and add a room upgrade by the time you check out and pay.

The redemption rate comes to 0.7 cent per point toward a vacation package. Compare how much money you’d save by booking a similar package to the extra points you’d redeem.

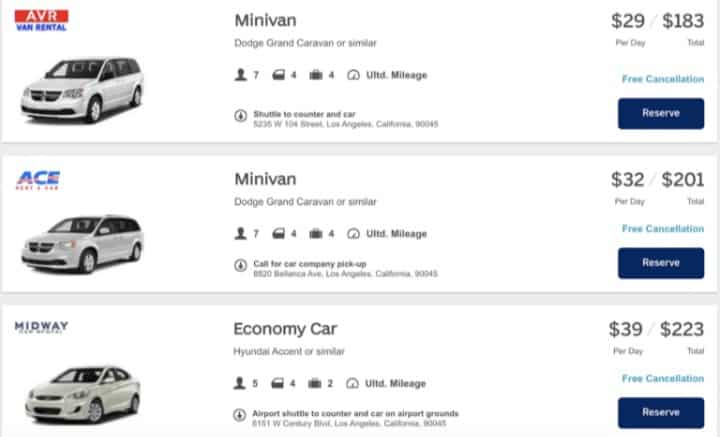

Cars

Those looking to redeem points for a rental car can do so at a rate of 0.7 cent each. Again, it’s not the best and you might want to look for other ways of redeeming Amex points to maximize their potential.

To search for a rental car, enter your destination, pickup and drop-off date and time. Filter results by car type, price per day, rental car company, features, such as type of transmission and mileage options, and whether you want to pick up the car at the airport or at an off-airport location. That’s it. You’re just a few clicks away from renting a car in your desired destination.

Final Thoughts

When it comes to booking travel with points, American Express Travel® is really only useful if you have the Amex Platinum or Amex Gold and want to book flights because of the rebate. If you don’t have one of these cards, it’s usually a better idea to leave American Express Travel® for cash bookings – assuming it’s the best deal you can find.

Don’t get me wrong, there’s a ton of value if you have a Business Platinum or Gold in select circumstances, and access to the International Airline Program with either the business or personal Platinum Card is also valuable.

However, if you want to use points in a travel portal for high-value redemptions, the Chase Ultimate Rewards Travel Portal can be superior due to its ‘Points Boost’ feature for premium travel, though it’s become less advantageous for a wide variety of general travel expenses.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.