10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Hi Travel Junkies,

Today, we’re going to set travel aside and talk about the often overlooked, but vitally important subject of your credit.

Sexy topic, I know. But, hear me out.

Over the past 5 years, you’ve seen me write a lot about credit cards, travel and a little bit about credit. The first two subjects certainly make for more exciting articles than the last one.

I’m guessing you don’t follow a lot of “credit influencers” on Instagram

What you haven’t seen publicly is my one-on-one work with thousands of people to help eliminate credit card debt, repair credit scores and optimize credit prior to applying for a mortgage, student loan, etc. I’m convinced that I’m one of the less than 10 people on earth who actually enjoys talking about these things.

Anyway, like anyone who has been working in a field for a long time, this has allowed me to spot common trends in the way people approach their credit.

So, today I want to cover one of the most common mistakes I see in the world of credit and credit scores.

We’ll use a recent client of mine who we will call “Jeff”, as an example.

Meet “Jeff”

Jeff is your typical upper 20-something year-old guy who is in the market to buy his first home. He has been putting money aside for years to save for a down payment and finally has enough to make his move.

Like most people, Jeff has never actively paid attention to his credit score. He checks it on occasion, often using websites that don’t provide a “real” FICO score, but only has a general idea of how his score is calculated.

Jeff opened one credit card after graduating from college (with a $5,000 limit), pays his bill in full each month and hasn’t made any other major credit mistakes (missed payments, collections accounts, etc.).

But, he was confused as to why his credit score was only 705, which is what led him to me.

His initial email to me read like the dozens of others I see on a monthly basis, “I don’t get why my score isn’t higher. I’ve done everything right so far. Is it just because I am young and don’t have much credit history?”

Nope.

It’s because Jeff doesn’t have enough credit. This is by far the most common credit mistake I encounter.

Let’s take a look at how this works.

The Most Common Mistake I See

Your credit score is calculated using the following criteria.

Source: MyFico.com

I’m not going to walk you through every factor in today’s piece. You can check out my Ultimate Guide to Credit if you want the rundown on that.

Today, I’m only going to focus on Jeff’s issue which is the “Amounts Owed” factor that is displayed in green. This is commonly referred to as “credit utilization” and it’s the second biggest factor in calculating your credit score behind payment history.

Credit utilization is a measure of the total percentage of your available credit that you are using at any given time. The lower the percentage, the better your score will be (unless its 0%).

Credit Utilization = Total Credit Balances / Total Credit Limits

So, what does this mean?

It means that using a high percentage of your available credit will harm your credit score, even if you’re paying your bill in full every single month.

Using a high percentage of your available credit will harm your credit score, even if you’re paying your bill in full every single month

Intuitive? Absolutely not.

Dumb? I think so.

But, this is just the way it works. Unfortunately, I can’t change that.

So, put simply, Jeff’s credit score was suffering because he didn’t have enough credit.

He was spending between $2,000 and $3,000 with his card every month (again, paying his bill in full every time), which was causing his credit utilization to be between 40-60%. High enough to have a significant negative impact on his score.

(We will talk about what an “ideal” percentage is in a bit).

Jeff’s reaction was identical to virtually every other client I work with when I brought this to his attention.

“Wow, I had no idea. My parents have always told me to only use one credit card and pay it off every month. Is that a bad move?”

He had been misinformed with the same advice that I am guessing you have heard a time or two.

Examples of bad credit advice (often given by our parents):

- Opening too many credit cards is bad for your credit score

- People with lots of credit cards have a ton of debt

- You should close credit cards that you don’t use anymore

All of this advice is well intentioned, but all of it is also false.

The best thing you can do for your credit is to have a TON of available credit that you rarely or never use.

How to Fix It

So, how do you fix this situation?

One solution; two options on how to do it.

The solution is that Jeff needs to lower his credit utilization percentage, which you will recall is just total credit balances divided by total available credit.

Credit utilization is a fraction, meaning the two options to reach this solution are 1) to lower the numerator (credit balances) or 2) To increase the denominator (available credit).

Sure, Jeff could go with route #1 by reducing his overall spending or paying off his credit card every week or so. But, the easier option is to increase the denominator by getting more credit. Which is exactly what Jeff decided to do.

Jeff's score was suffering because he didn't have enough credit to his name

Jeff applied for a new credit card and was approved with a limit of $20,000. His utilization fell to ~10-12% and his credit score jumped in to the upper middle 700s (765 last I heard from him) within a month.

The Cost of this Mistake

What would have happened had Jeff never realized this mistake before applying for a mortgage?

Let’s run some numbers to see.

I have no idea as to the details of Jeff’s home purchase process to I am going to make 3 assumptions:

- Jeff is buying a $300,000 house

- Jeff was planning on putting 20% down

- Jeff is going to opt for a fixed rate mortgage with a 30 year payback period

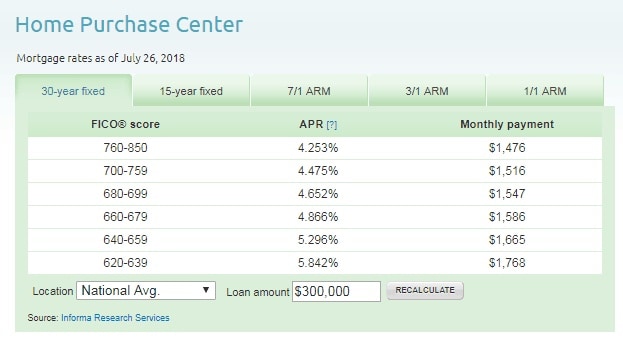

Here is a chart of today’s 30-year mortgage rates from MyFico.com.

Jeff’s 705 credit score likely would have resulted in an interest rate of 4.475% and a monthly payment of $1,516. Not bad in the grand scheme of things.

His 765 on the other hand would have dropped that rate to 4.253% with a monthly payment of $1,476 per month.

Meaning that this one small tweak to Jeff’s credit score saved him $40 a month.

Which sounds small, but adds up to $480 a year.

Times 30 years adds up to $14,400 over the life of the mortgage, and this ignores the possible earnings on investing the difference.

This means Jeff could reasonably claim that “this one small tweak to his credit saved him $14,400!”

Thankfully, 10xT Editor in Chief Spencer Howard wouldn’t allow me to make that the title of this article

This mistake can cost you $14,000+ on your mortgage

All it took was about 5 minutes of work to correct the bad advice that he had previously been given.

As I mentioned earlier, I see this situation multiple times per week. The number of people overpaying on their mortgages because they are afraid of having too much credit is too damn high.

Yes, I just used a meme in an article about credit scores

So What’s the Magic Number?

Back to our question from earlier. What is the “magic number” for credit utilization that you need to stay under?

If you google that question you’ll find answers all over the board from 10% to 40%, each of them proclaiming that their particular percentage is the threshold that you absolutely must stay under. This drives me nuts.

The truth is that there is no magic number.

Lower is better, unless its 0%.

Say it with me this time…. lower is better, unless its 0%.

10% is better than 15% is better than 20% is better than 25%.

Now of course some people will take this too far. Don’t freak out because your utilization went from 5% to 7%. The impact to your credit score will be nonmaterial.

Just make sure that you always have enough credit to keep your utilization comfortably low, even in higher spending months.

But what about that “…unless its 0%”? What happens if my utilization is 0%?

This is another one of those counterintuitive dumb rules of credit scoring. Having 0% utilization can actually ding your score a bit, though the impact is less significant than having high utilization.

Note that this does not mean you have to carry a balance and pay interest on your credit cards in order to build credit. This gross misinterpretation of credit scoring is sadly another common myth that I run into at least once a week. Please slap anyone who tries to tell you to do this.

Please slap anyone who tells you to "carry a balance on your card to help your credit score"

It simply means that you should be using credit in some capacity.

And finally, know that credit utilization is not tracked historically on your credit report. Meaning that once you get it down to an acceptable level it’s as if the problem never existed.

Bottom Line

Don’t throw your money down the drain by falling in to this common (and very avoidable) credit trap.

Take 2 minutes to check your credit score to ensure that you have enough available credit to avoid any possible utilization issues. If your utilization is too high, consider opening a new credit card or two.

Your monthly budget will thank you for it.

Happy Travels,

Bryce

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.