10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

This is a 5,000+ word guide on how to become a master of all things credit and credit scoring.

Yup, you read that right. 5,000+ words.

I am not a big fan of using 5,000 words when 500 will do, but a topic this important demands a thorough write up.

Why?

Your credit score is a vital part of your financial health, as well as your overall health. Having bad credit means more stress, more frustration, and more money needed to finance things like houses and cars.

Additionally, a disheartening amount of people in the US do not have an active awareness of their credit score, let alone any comprehension of how it is calculated or applied. Fortunately, there are plenty of resources to help folks understand the ins and outs of credit scores, and by reading this article, you’ll become more credit-savvy yourself.

Over the next 5,000+ words, you’ll learn everything you’ll ever need to know about credit and credit scoring.

Go ahead and bookmark this page because you’ll probably want to refer back to it a time or two.

Ready? Let’s get started.

Ultimate Guide to Understanding and Improving Your Credit Score

Why Should You Care About Your Credit Score?

Why should you care about your credit score (and therefore keep reading this 5,000+ word post)?

I was having dinner with some friends the other day when this very question came up. My response was cut off mid-sentence by the question: “Credit scores? What are you, 50 years old now?”

It’s that kind of ignorance that eventually causes years and years of financial stress.

The fact of the matter is your credit score will dictate how much money you pay for the largest purchases you will make in your lifetime.

Suppose you’d like to purchase a $250,000 home someday. If your credit score is subpar, it could cost you tens of thousands of dollars in extra interest. Borrowers with better credit scores are approved for lower annual interest rates, meaning they won’t pay as much as borrowers with low scores.

It’s the same deal with other types of loans, including auto loans. You can play with the numbers here if you like.

Hopefully, the enormous savings are enough to convince you that you should start paying attention to your credit if you haven’t been already.

Step one: understanding your credit report. This is where it all begins.

What Is a Credit Report?

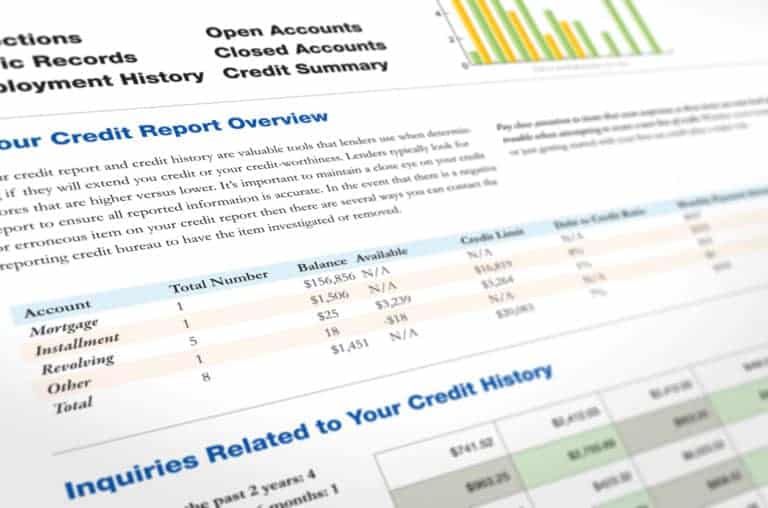

A credit report is a detailed report that contains information about your credit history.

Your credit report includes the status of your credit accounts, loans, bankruptcies, late payments, credit inquiries, public records, and even some personal information such as your address, social security number, and date of birth.

This information is collected by the three major credit reporting agencies (Equifax, Experian, and TransUnion) and each one compiles the information into their own single credit report.

Although each reporting agency has their own credit report, the information collected by each of them is very similar.

The credit reporting agencies then sell this information to businesses such as banks, credit card companies, insurance companies, and even landlords where it is used to determine your creditworthiness.

Still with me? Great.

Let me make a quick analogy.

Think of your credit report like a transcript or report card from school.

It is simply a record that shows what classes (or in this case credit accounts) you have taken and what grade you received in each of them.

Like a school transcript, your credit report does not explicitly state whether you are a “good” or “bad” student (or borrower). Instead, it simply presents the historical information that has been gathered of by your lenders over your recent past indicating your payment performance on the credit extended to you.

Now, let’s talk about your actual credit score.

What Is a Credit Score?

Your credit score, on the other hand, is a numerical assessment that quantifies the risk that you present as a borrower. It is used by lenders to determine how much of a risk they will take by lending money to an individual.

So if your credit report is your report card, your credit score would be your grade point average (GPA).

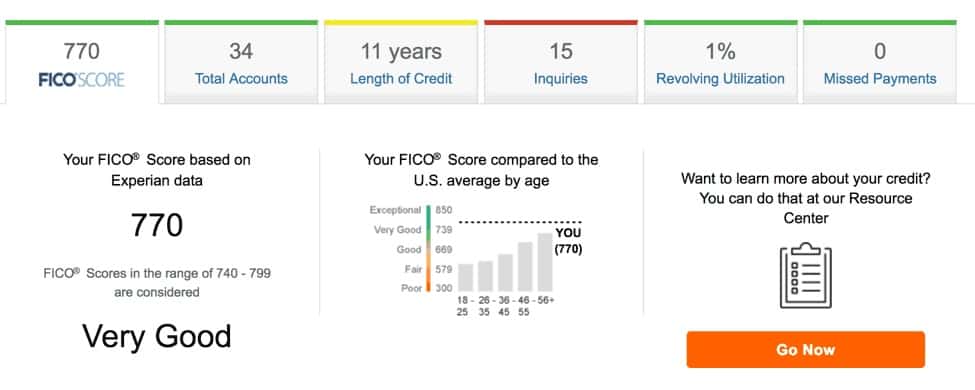

Your credit score is calculated by taking information from one of your credit reports and running it through an algorithm created by a company called FICO (formerly called Fair Isaac Corporation). The algorithm uses the information found on your credit report to generate a number between 300 and 850 that represents the risk you present as a borrower.

The higher your score, the more likely creditors are to approve you for higher loan amounts and lower interest rates.

While there are a variety of different credit scores that are used by lenders, the FICO credit score is by far the most common.

Let’s take a look at how it is calculated.

How Your Credit Score Is Calculated

Your credit score is calculated using the following 5 criteria: payment history (35%), amounts owed (30%), length of credit history (15%), new credit (10%), and types of credit used (10%).

Payment History (35%)

The most important factor in determining your credit score is your payment history. This metric reflects the number of times you have paid your bills on time, and it is significantly impacted by any delinquency.

The more on-time payments you make, the higher your score will be.

It is important to note that bills such as rent and utilities do not contribute to your payment history. FICO does not consider these types of bills to be credit accounts, so they do not include them when calculating your score. These items can, however, have a negative impact on your score if you fail to pay them and they are turned over to a collections agency.

Not only is your payment history the most heavily weighted metric, it is also the most volatile. If you miss just a couple of payments, your score could drop over 100 points. That big of a drop would limit your ability to qualify for any sort of credit card or loan because a 100 point chunk accounts for almost 20% of the entire span of credit scores. You really don’t want to deal with such a devastating blow over something that is preventable.

To avoid getting slammed by missed payments, consider setting up AutoPay through your creditor or lender. This is an easy way to set it, forget it, and always pay your bills on time.

Bottom Line: make all of your payments on time, every time.

Amounts Owed (30%)

The second largest factor in determining your credit score is the amount of debt you owe. This metric is broken down into a few subcategories.

Total Amount Owed: This is the total amount of debt that you owe on all of your credit cards, loans, etc. Generally speaking, the less debt that you have, the better your score will be.

However, having zero debt does not guarantee a good credit score. More on that later.

Total Amount Owed by Account: This is a measure of how much debt you have on each of your accounts. Creditors commonly refer to this as your credit utilization, which is expressed as a percentage of your credit limit that you are using.

For example, if you have a $1,000 limit on a credit card and have a balance of $500, then your utilization for that card would be ($500/$1000=) 50%.

Generally speaking, the lower your utilization, the higher your credit score will be.

The exception to this rule is having 0% utilization. 0% utilization indicates you don’t use credit, which research has shown is riskier than using some credit. So 0% credit utilization could have a negative effect on your credit score. Holding a utilization up to 30% is considered a healthy amount for your credit, but try not to let it get much higher than that and again, pay your bills on time and in full.

It’s also important to note that your credit utilization is not tracked historically. Only your current utilization counts, so there is no need to worry about what it was last month/year/etc.

How Many Accounts Have Balances: Carrying a balance on a large number of your credit lines indicates that you may be a high-risk borrower, and that can lower your credit score.

Original Amount of Installment Loans vs. Current Balances: Paying down installment loans (mortgages, car payments, etc.) is a good sign that you are able to manage and repay debt. Like credit card payments, you always want to make your installment debt payments on time and in full.

Bottom Line: Don’t max out your credit accounts even if you’re paying the bills on time. Credit utilization of 30% or lower is best, but avoid 0% utilization to demonstrate that you can manage credit.

Length of Credit History (15%)

Your length of credit history is a measure of the total amount of time that you have been using credit. This metric takes into account the age of your oldest account, the age of your newest account, and the average age of all of your accounts. In general, a longer credit history will lead to a higher credit score.

All tradelines, whether opened or closed, will contribute to your average age of accounts until they fall off of your credit report at the 10-year mark.

Bottom Line: Don’t close old accounts just because you’ve paid them down. More on this later.

New Credit (10%)

New credit is a measure of your credit seeking activity. By applying for and opening a lot of new accounts in a short period of time, you are unintentionally flagging yourself as a risky borrower because this type of behavior could be the result of a sudden financial crisis. Some banks have a limit on the number of credit cards you can open in a certain amount of time, like the Chase 5/24 rule. As a general guideline, try not to shock your credit report too much by instigating a flood of credit inquiries due to several new applications.

Bottom Line: Don’t apply for a ton of credit accounts at once.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Types of Credit Used (10%)

This factor looks at your mix of credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans. Ideally, you want to have a healthy balance of credit card debt and installment loans to show that you know how to manage both types of debt. However, it’s counterintuitive to take out one of every type of loan just to satisfy this facet of your score. This 10% is not as important as paying your bills on time or keeping your utilization in check.

Bottom line: Having mortgages, car loans, etc. can be beneficial for your credit score.

Now that you know how your credit score is calculated, let’s take a look at how your score is evaluated by creditors.

What Is a Good Credit Score?

As we discussed earlier, FICO credit scores range from 300 to 850, with 300 being the absolute minimum and 850 being the almost unattainable maximum.

Your score likely falls between the two extremes, so to put it into perspective, here is a chart that shows how credit scores are typically graded.

As you can see, credit scores are lumped into categories when being evaluated by creditors. While different creditors might use different categories, they are generally pretty close to the ones you see above.

Scores within each range are typically treated equally, so there is no need to obsess over minor fluctuations in your score. As long as you stay within your desired range you will not see any major change in interest rates or approvals for credit cards and loans.

Continuing with our report card analogy, an A is an A, a B is a B, and so on regardless of where exactly you may fall within the range.

With that, there is no need to be that guy who freaks out about their credit score dropping 5 points.

It is also important to note that there is a diminishing return in having a credit score that is higher than the mid 700’s. Creditors typically treat scores in the “excellent” range equally, so you do not need to worry about trying to reach the maximum score.

How Do You Check Your Credit Score?

There are dozens of websites that promise to give you a free credit score (one particular TV jingle comes to mind) but very few of them actually do.

Most of these sites require you to purchase some sort of credit monitoring package before showing you your score. These packages typically cost $10 to $20 a month.

Do not sign up for these services. They are a total waste of money.

Instead, I recommend using reporting agencies such as Credit Karma or Credit Sesame. These are 100% free websites that provide a credit score as soon as you sign up. You’ll never be asked to provide credit card information or submit any form of payment.

You will have to provide some personal information (including your social security number) to verify your identity and pull your credit, but rest assured that you will never be charged a dime to use these services.

Websites like Credit Karma and Credit Sesame make money by advertising credit products based on your credit report or credit score. Always do your own research, as they have a financial incentive to recommend some products over others.

In full disclosure, the scores that are provided by these sites are not your actual credit score. They are simply approximations (called “FAKO” scores).

However, they are incredibly accurate (I check them frequently against my actual FICO score) and good enough for a rough estimate.

If you want to see your actual FICO score, it’s best to get a credit card that provides a free monthly FICO score. The Chase Sapphire Reserve® is just one of many that provide this service.

Earn 100,000

bonus points + $500 Chase Travel℠ promo credit

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

You can also take a look at some of my other favorite credit cards by visiting my credit card page.

Additionally, you are entitled to one free copy of your credit report every 12 months from each of the major credit bureaus. You can make this request at www.annualcreditreport.com.

Remember: your credit report doesn’t show you your credit score but reviewing it each year is a great way to make sure that everything is in order.

Be careful, because there are a number of websites out there that try to mimic this site and charge you for your reports. Again, you should never have to provide credit card information to view your reports.

How to Build and Maintain a Good Score

By now, you now know what a credit score is, how it is calculated, how credit scores are viewed by lenders, and how to check it (for free).

But how do you make sure that you are able to build and maintain a good score?

Here are 4 tips that will help:

Understand How Your Credit Score Works

Your credit is one of the most valuable assets that you own and ruining it will have lasting effects on your financial well-being. For this reason, it is important that you take the time to learn how it works.

This helps you make informed credit decisions and take the necessary steps to maintain a good credit score.

By taking the time to read this overview you are already taking the first step. It may help to review it a couple of times to make sure that you didn’t miss anything.

In addition to understanding how your score works, it is also important to check it regularly to avoid issues such as account errors or fraud. Remember that you should never pay to do this.

Always Make Your Payments on Time

Put simply, missing credit payments has the potential to wreak havoc on your credit score. Having just one or two missed payments can drop your score by more than 100 points and make it very difficult for you to qualify for any sort of loan.

You absolutely must make all of your payments on time and in full if you want to maintain a good credit score.

If you’re worried about missing payments, I highly suggest you take advantage of AutoPay features offered by banks/credit card companies.

Build a Solid Credit History

The more credit history you have, the more evidence there is that you are a responsible borrower. This will help to boost your score and insulate it against minor ups and downs that can be caused by things like new credit inquiries or accounts.

The best way to build a solid credit history is to continually stick to the first two tips that you just read. If you continue to monitor your credit score and make your payments on time, you will be able to build a solid credit history of being a responsible borrower.

It is also a good idea to keep your older credit accounts open and in good standing.

Although it can be tempting to close credit accounts that you no longer use, keeping them open helps to build your credit history and thus boost your credit score.

As a general rule, I would suggest that you never close any credit accounts that do not have an annual fee.

Keep Your Credit Card Balances Low

The last tip for maintaining a good credit score is to keep your credit card balances low. Generally speaking, the higher your credit card balance is, the lower your credit score will be.

To prevent this from occurring, it is best to keep your credit utilization below 30% at all times (That’s $300 on a credit card with a $1,000 credit limit). Going above 30% could cause your score to fall even if you are paying your balance every month.

By understanding how your score works, always making your payments on time, building a solid credit history, and keeping your balances low, you will easily maintain a good credit score.

Now let’s tackle a few common credit myths.

Common Credit Myths

Credit Myth #1: Paying cash for everything will help your credit score

The logic behind this myth is pretty simple. Paying cash means no missed or late payments, which would maintain a good credit score.

The assumption behind this idea is that “good” credit is the default, which is completely false.

Paying cash (or using debit cards, gift cards, checks, etc.) for everything prevents you from building credit history, which means you will likely have a low credit score.

In some cases, you might not have a credit score at all — this is called a “thin file.”

Again with the report card analogy: you cannot have a great GPA if you never take any classes.

Credit Myth #2: Having too many credit cards will hurt your credit score

This is the age-old question of credit cards. What is the right number of cards to have?

I hesitate to say that it depends, but in this case, it truly does depend.

As we discussed above, 30% of your credit score is based on the amount of debt that you owe with respect to your total available credit (called “credit utilization”).

In an ideal world you would always keep your utilization below 30% (i.e. $300 on a credit limit of $1,000).

Below 15% would be even better, but 30% is a decent benchmark.

With that, take the amount of money that you spend in a typical month, triple it (and then some) and that’s the minimum amount of credit that you should have available at any given time. If your credit limit is any lower than that, then you should probably apply for another credit card or two.

If triple your utilization is the minimum, what is the maximum? Will having a bunch of credit cards hurt your score?

Not on face value, no. Holding multiple credit cards can bottom out your utilization and up the number of on-time payments you make, and both of those things increase your credit score. Generally speaking, there is no such thing as having “too much credit.” As long as you are making all of your payments on time, extra available credit will actually help your score.

Credit Myth #3: Checking your credit will hurt your score

In the world of credit scores there are two types of credit checks, “hard inquiries” and “soft inquiries”.

A “hard inquiry” occurs when your credit report is pulled as a result of an application for credit (credit cards, mortgages, car loans, etc.). Each hard inquiry dings your credit score by roughly 2-5 points, depending on a variety of other factors. As I mentioned before, 2-5 points generally won’t kick you into a lower category unless you’re right on the edge, and even then, your continued good habits can kick it back up.

A “soft inquiry” occurs when you pull your own credit report or when a company pulls your report for a non-credit use such as a background check. Unlike a hard inquiry, a soft inquiry has no effect on your credit score.

To check your score, I personally recommend that you use Credit Karma or Credit Sesame (or both). These two sites are very user-friendly and completely free. You will never be asked for your credit card information in order to see your score. Don’t bother with sites that ask you for credit card information in order to check your score — they will probably try to con you into paying a monthly fee for unnecessary credit monitoring services.

Credit Myth #4: You should close accounts after paying them off

This myth is related to the number of credit cards myth, but the number of questions I receive about it on a weekly basis justify a separate question.

Generally speaking, you should never close a credit account unless you have a reason to.

Common reasons include avoiding an annual fee, transferring your credit to another card, etc. Never close an account just for convenience.

Closing accounts reduces your total available credit, causing your credit card utilization to increase and your credit score to fall. Remember: you want to avoid utilization over 30%, and closing an account can cause you to breach that number.

Closing accounts will also prevent you from continuing to build credit history, which makes up 15% of your score.

This myth persists because people think that closing an account will remove it from their credit report, therefore hiding any bad history from future lenders.

Unlike bad relationships, you can’t just delete all of the evidence of a bad credit account and forget that it ever happened. The account will remain on your credit report for up to 10 years.

The best course of action is to keep the account open and in good standing, allowing you to build credit history and maintain a good credit utilization ratio.

Credit Myth #5: You need to carry a balance to build your credit score

I have never really understood this myth. I’m supposed to believe that by not making all of my payments on time I am somehow improving a metric that measures my likelihood of making my payments on time?

Conventional credit card wisdom continues to baffle me.

The most common justification for this practice is the belief that carrying a balance on your credit card is the only way to build credit history, which makes up 15% of your score. After all, having no balance means you have no credit history, right?

This is completely false.

You are building credit history regardless of whether or not you carry a balance on your card, because the account is open and contributing to your number of active accounts. Carrying a balance will only leave you with tons of late fees and interest charges.

Credit Myth #6: Paying all of your debts will instantly fix your credit score.

As with all myths surrounding instant gratification, this is unfortunately untrue.

The truth is that your credit report reflects your history of using credit, not just a snapshot of your current situation. Even after being paid off, it can take as many as 7-10 years for a debt to fall off of your credit report.

If you are looking for a quick fix for your credit score, it isn’t as easy as debt payment or refinancing.

Credit Myth #7: You only have one credit score.

This myth is perpetuated by all of the advertisements that encourage you to “check your credit score” as if there is only one score that is used for everyone.

I wish it were that simple.

The truth is that there are dozens of credit scoring models that are used to predict your likelihood of default. Each one is a little different and at times can produce drastically different scores.

At the end of the day, the most widely used credit score is the FICO Score, which ranges from 300-850. This is the score that you want to pay attention to.

Your FICO Score is calculated from several different pieces of data in your credit report that are grouped into 5 basic categories. We talked about how this works in the above sections.

Other credit scoring models are often referred to as “FAKO” scores. While these scores can be useful for getting a basic idea of where you stand, the FICO score is the one that really counts.

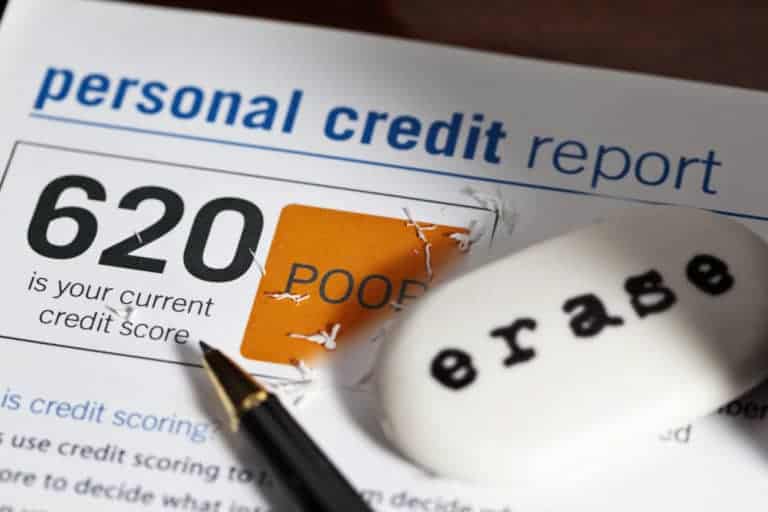

Credit Myth #8: Once a credit score falls, it cannot be improved

I have found that this is more of an excuse than a myth. People with bad credit tend to bring this up when they are confronted with the idea of repairing their credit score.

In reality, they are likely uninformed or unwilling to make productive changes to improve their score.

While there are certainly no “quick fixes” for a credit score, it can be rebuilt with a little bit of patience and discipline. The key is to start making your payments on time and building a history of responsible credit use. Eventually, scores improve with good practice and diligence.

Credit Myth #9: Income/education/net worth can affect a credit score

Your income, education, net worth, etc. have absolutely zero effect on your credit score.

Your credit score is a reflection of your ability to pay your bills on time, not your current financial standing. It cannot be improved simply by earning or saving a lot of money.

Credit Myth #10: Credit reports are only used for financial purposes

In addition to being used in credit decisions, credit reports can be used by current and potential employers to aid in employment decisions. While they cannot see your actual credit score, employers are able to view a modified version of your credit report that includes information about loans and credit cards listed in your credit report.

This practice is especially common in industries such as banking or finance, where employees are responsible for dealing with a client’s personal finances.

This is just another reason why your credit score is such a crucial component of your overall financial well-being — it can affect every facet of your life.

How to Improve Your Credit Score

Don’t be discouraged if you happen to find yourself with a credit score that is lower than you would like it to be. Your credit score is never permanent and it can be improved with a little bit of patience and the right habits.

With that said, let’s take a look at five steps that you can take to improve your credit score.

Check for Errors on Your Credit Report

The first step to improving your credit score is to check for any errors on your credit report. Errors are relatively common and can have serious effects on your credit score if they are not addressed quickly.

Make sure to only request a copy of your report from www.annualcreditreport.com, as we discussed above. You will not have to provide credit card information to do this. If they ask for any sort of payment, then you are on the wrong website.

Common errors to look for are duplicate account listings, inaccurate personal information, or identity theft.

Look over the entire report for any inaccuracies and send any disputes to the credit bureaus in writing. The bureaus are required to investigate any information that you dispute and will make corrections where needed.

Make sure to continually follow up with the credit bureaus until any mistakes are corrected.

Pay Your Bills on Time

The next step is to do everything you can to start paying your credit bills on time. This is pretty obvious, as your payment history is the biggest factor in calculating your credit score, but it is crucial to improving your score.

Continuing to miss payments will not only prevent you from improving your score, but it could also cause it to fall even further and we want to avoid this as much as possible.

Start by targeting the accounts that are in collections first, as these are the most harmful to your score. You might even be able to negotiate a lower debt by offering to do a “pay for delete”, but this is not as common as it used to be.

Make sure to document all of your correspondence with your debtors and to request a “paid in full” letter when your debt has been paid. Things can get pretty dicey when you are disputing debts so you’ll want to make sure to cover all of the bases and keep records of everything.

Phone conversations should be avoided if possible.

After your collections debts are paid, work your way up to more recent debts. Begin with the debts that are closest to maxed out, as those are the debts with the highest utilization and you’ll want to work on lowering that measure.

Reduce Your Spending

Expenses caused by medical emergencies, unexpected job loss, unforeseen car or home repairs, etc. can occur suddenly and cause financial distress. But in some situations, bad credit is caused simply by spending beyond your means.

Regardless of what caused your credit to be damaged, you will likely need to make extra sacrifices to fix it. This is a good opportunity to consider making a basic budget and breaking your spending into necessary, ideal, and unnecessary expense categories. That way, you may be able to get a handle on the nitty-gritty of your financial habits and find a way to adjust accordingly.

Don’t Close Old Accounts

While it is tempting to close credit cards after paying them off, it is best to keep them open if you want to improve your credit score.

When you close a credit account, it reduces your total available credit, which causes your credit utilization to rise and your credit score to fall. Closing old accounts can also reduce your length of credit history (15% of your score) especially if one of them happens to be your oldest line of credit.

Closing old accounts also does not make them go away. Items such as delinquencies or bankruptcy can remain on your credit report for years, regardless of whether or not the accounts have been closed.

Open a New Account — Or Not

How you approach this step depends on your credit history.

If your credit score is low because you have little to no credit history, then you should try to open a new credit card account. This will help to establish some credit history and start improving your credit score.

You should only apply for a card for which you are likely to be approved, so it might be a good idea to start with some of the more basic credit cards offered in the market. Opting to go for a secured card might also be a good option.

If you already have an extensive credit history, then you should avoid opening new credit card accounts if at all possible. Applying for cards could cause your score to fall due to the hard inquiry, and you are likely to be denied.

Remember to be patient! Improving your credit score won’t happen overnight but it can be done with discipline and persistent effort.

That’s it! You’re now a credit score master. Congrats!

Don’t forget to bookmark this page for future reference. And if you want to share it with your friends (click below) I would really appreciate it!

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.