10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Editors Note: Two Card Trips is a series of articles that show how you could book a trip using points/miles earned from just two different credit cards. Today’s two card trip takes us to Peru with bonuses from the Chase Sapphire Preferred and Marriott Bonvoy Boundless® Credit Cards.

Located on Peru’s west coast on the Pacific Ocean, Lima has quickly established itself as the gastronomical capital of South America. Originally famous for the popular Peruvian dish Ceviche, the No. 6 and No. 7 restaurants in the world (according to The World’s 50 Best Restaurants Academy) now call Lima home.

A delicious Peruvian dish made of raw fish.

Lima is known for more than just exquisite food, though. It has an exquisite architecture with notable cathedrals and monasteries that date back to the 1600s, as well as a world-class shopping district Miraflores that is a great place to take in a number of great restaurants or sip on a Pisco Sour, a popular Peruvian drink.

The Plaza de Armas in Lima, Peru.

The weather in Lima is another aspect that makes Lima popular among travelers. Its climate is such that it stays between 60-85 degrees Fahrenheit all year long with a calm and constant, yet refreshing, ocean breeze.

The coastline of the city of Lima, called la Costa Verde (The Green Coast)

So, whether you’re stopping in Lima as a launching off point for a trek through the Sacred Valley to Machu Picchu, visiting the Amazon, or making some other Peruvian adventure, you should definitely pencil in some time in Lima.

Llama in front of ancient Inca town of Machu Picchu

In this article, we’re going to show you how you can easily use just two Chase credit cards to make your visit to Lima cost you virtually nothing out of pocket.

The Two Credit Cards

The two cards we’re going to focus on for this trip are the Chase Sapphire Preferred® Card and the Marriott Bonvoy Boundless® Credit Card from Chase.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Night Awards

(each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. Certain hotels have resort fees. Last Chance! Offer ends 9 AM EST on 7/17/2025.

Annual Fee: $95

You’ll earn Chase Ultimate Rewards points as a welcome bonus for the Chase Sapphire Preferred once you meet the minimum spend requirement. These will be used to book round-trip flights from the US to Peru with some points leftover for your next trip.

With our other card, the Marriott Bonvoy Boundless® Credit Card, you’ll earn a welcome bonus once you meet the minimum spend .

With Ultimate Rewards points and Marriott Rewards points in hand, it’s time to plan your trip!

How To Get There

International travel, even in economy, isn’t cheap. In some quick searches for Spring 2019 flights, we found that average fares started at around $900 roundtrip and go way up from there.

Fortunately, miles and points can make this trip much more economical. In fact, your flights can be covered entirely with points earned from the aforementioned Chase Sapphire Preferred – all you’ll have to pay is ~$70 in taxes and fees. That’s only 8% of what roundtrip tickets would cost if you were paying cash!

For this trip, we’ve focused on utilizing Chase Ultimate Rewards points and some of their transfer partners to book the flights. Fortunately, we have a few different options for booking depending on your location in the US, so we’ll outline these below.

United MileagePlus

United MileagePlus is a transfer partner of Chase Ultimate Rewards, as well as a member of Star Alliance. This means not only can we book flights on United flights, but also some of their alliance partners as well.

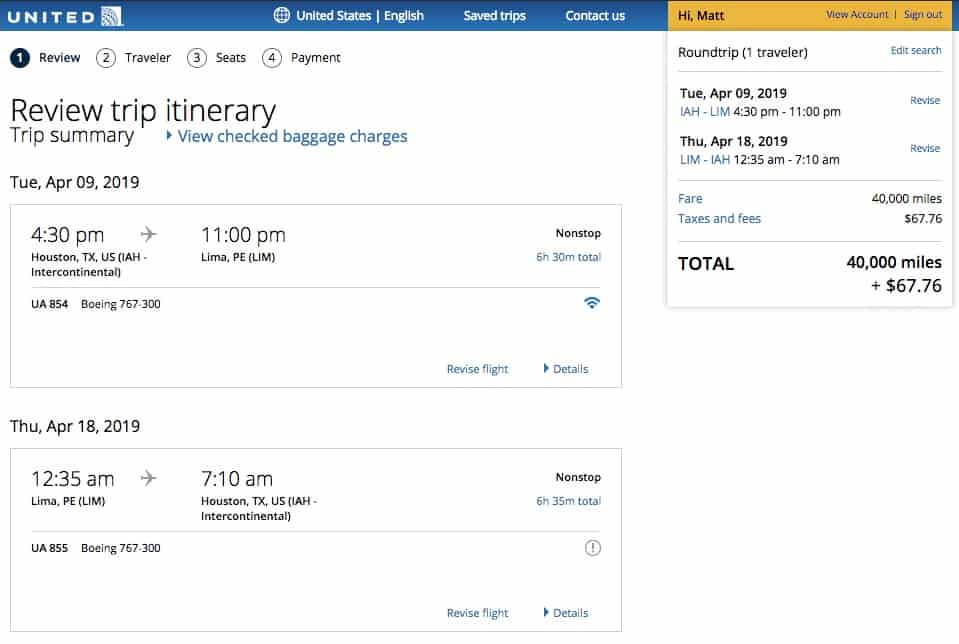

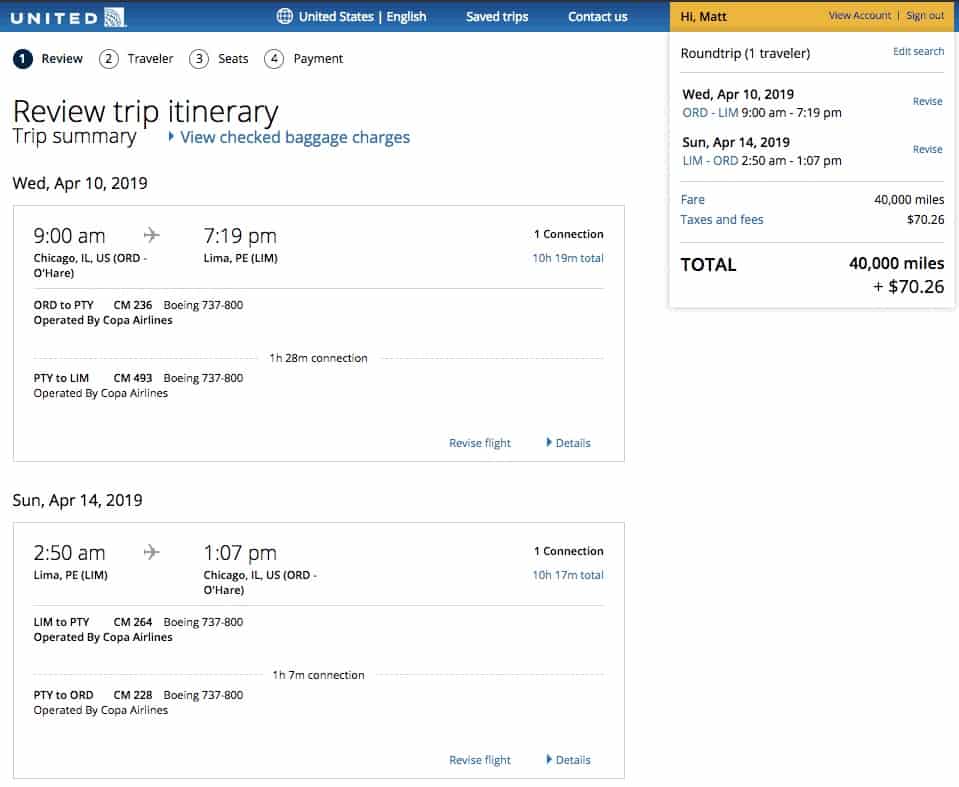

United itself operates daily nonstop flights to Lima from Houston (IAH). It also seasonally operates a daily nonstop from Newark (EWR). You may struggle to find saver award space on the United-operated nonstop flights, but if you do end up finding it, economy space is available for 40,000 miles round-trip.

If you can’t find saver space on United-operated flights, you’ll likely find space on some of their Star Alliance partners for the same 40,000 miles roundtrip. In the example below, we found a great 1-stop redemption on Star Alliance partner Copa Airlines from Chicago on Copa Airlines using 40k United Miles + $70.26 in taxes/fees for the roundtrip flight.

British Airways Avios

British Airways Avios program is also a transfer partner of Chase Ultimate Rewards and also a part of the OneWorld Alliance. But British Airways doesn’t fly from anywhere in the US to Peru, so you may be asking yourself how can Avios be of value in getting there?

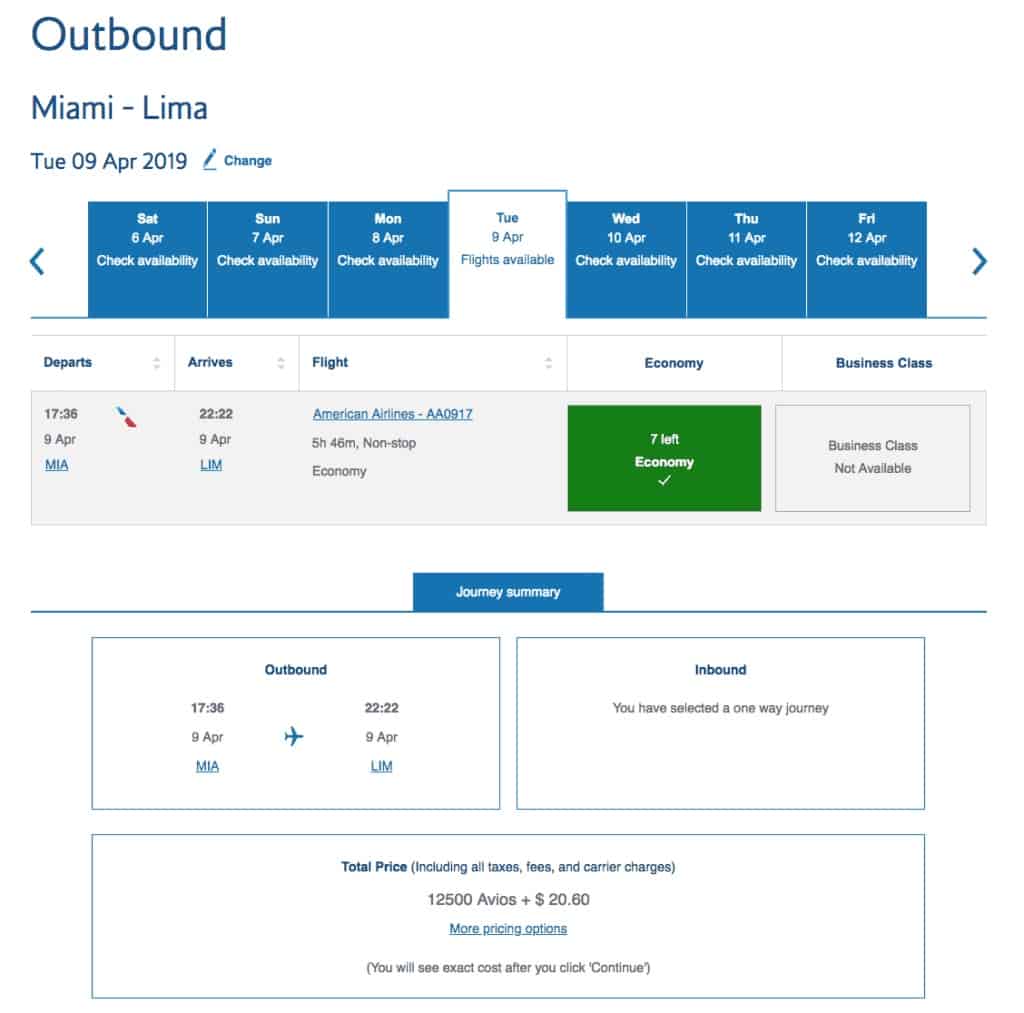

Since British Airways is part of Oneworld, it means that we can use Avios to book flights on other Oneworld partners. Here in the US, that means American Airlines – you’ve probably heard of them!

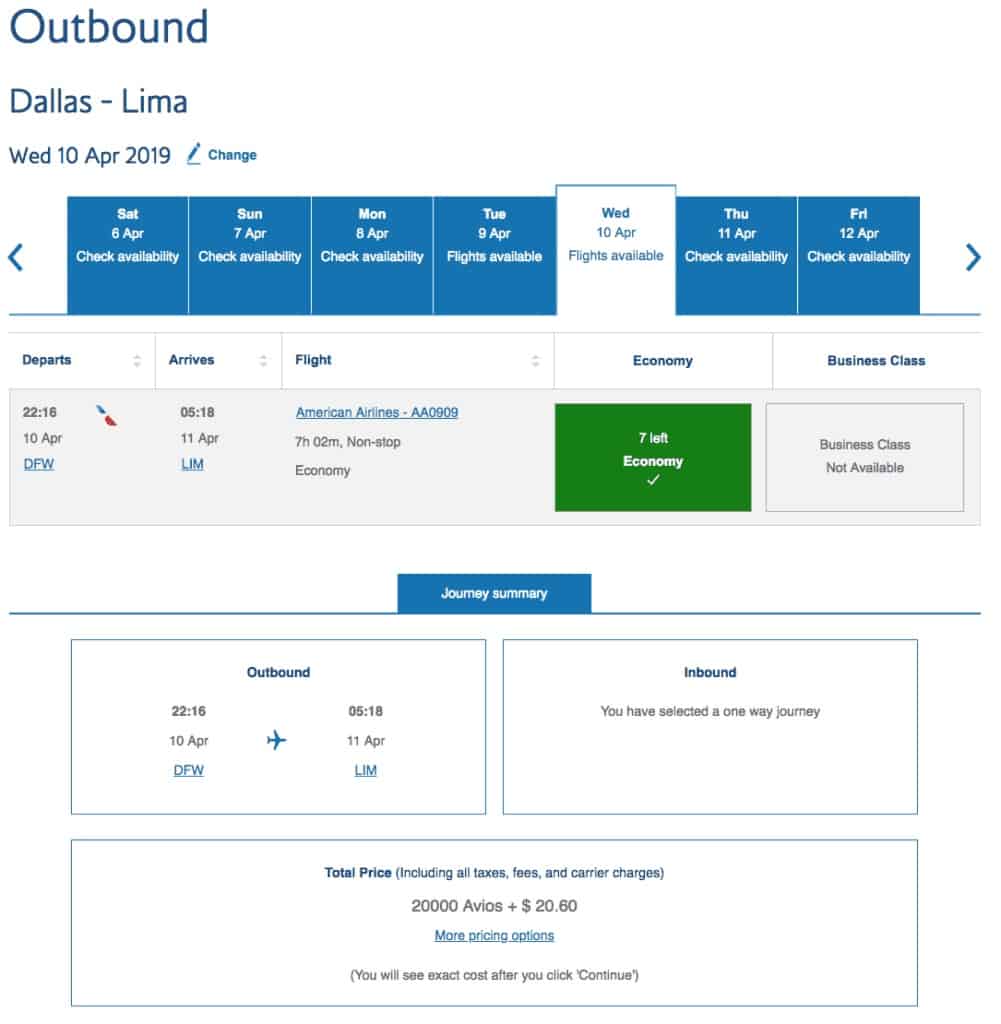

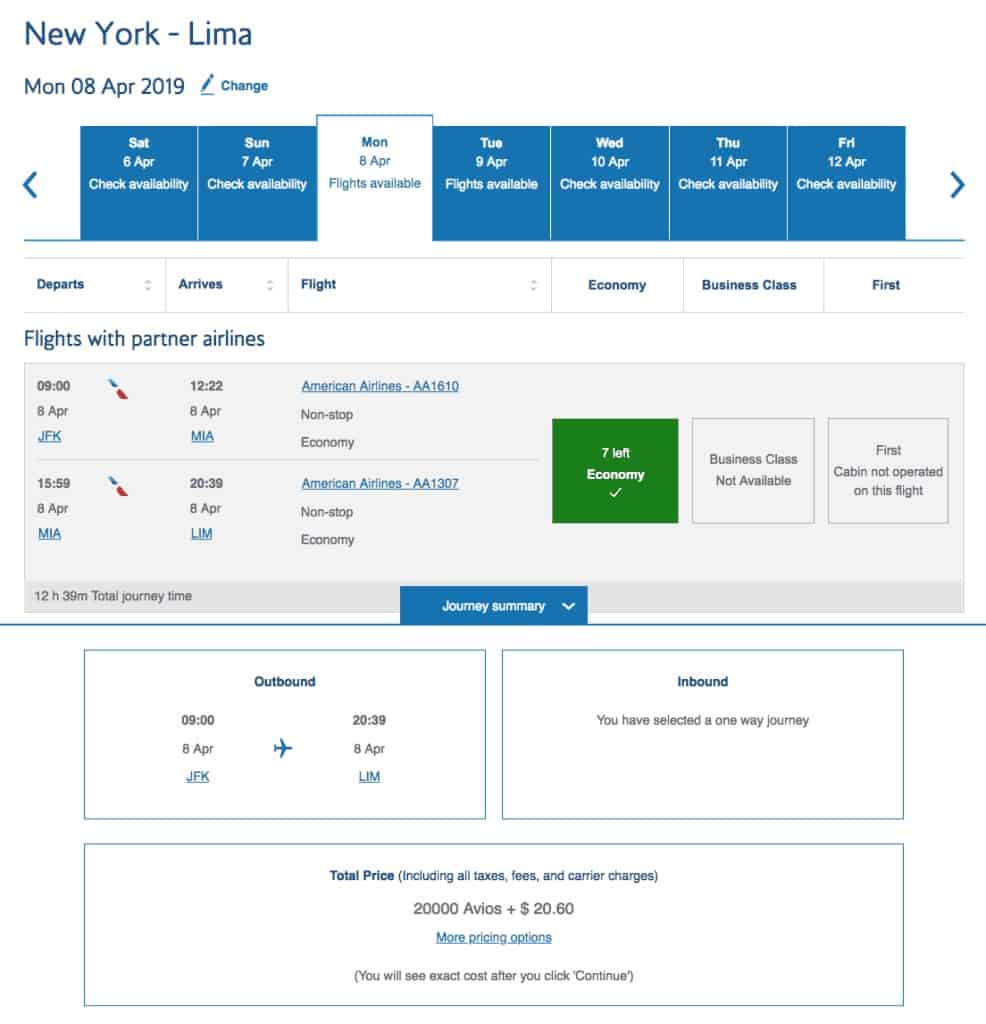

American Airlines flies daily nonstop flights to Lima from its hubs in Dallas (DFW) and Miami (MIA). American Airlines does offer a decent amount of economy saver-level space on these flights, but you’ll pay 17,500 (off-peak) or 20,000 (peak) American AAdvantage miles per person each way.

However, depending on where you’re flying from, what mileage currencies you have, and when you’re going, you could likely do better with British Airways Avios, especially since they are a transfer partner of Ultimate Reward and are relatively easy to earn.

British Airways utilizes a distance-based award chart, so one-way flights from MIA cost 12,500 Avios.

However, one-way flights from DFW cost 20,000 Avios.

And flights from New York, even while connecting in MIA, cost 20,000 Avios one-way.

So, with the Ultimate Rewards points in hand, you’ll see you have a variety of options for one round-trip ticket to Lima, Peru. Depending on where you’re flying from, you may even have enough points for roundtrip tickets for two!

Limited-Time Offer: Earn 60,000

Bonus Miles

after you spend $3,000 on purchases in the first 3 months your account is open.

Annual Fee: $0 for your first year, then $150.

Being able to choose between booking your flights with United MileagePlus and British Airways Avios should work for most people traveling in the US to get to Peru. Having this flexibility with your award currencies is one of the reasons we highly recommend earning flexible reward currencies like Ultimate Rewards because it gives you the flexibility to transfer your points when you need them to various transfer partners that best fit your goals instead of being locked into just one rewards program.

Where to Stay

You have a few options of places to stay in Lima – your location depends on how many nights you want to spend in Lima. After earning the points you received from a Marriott card, here are a few options for you.

Marriott Bonvoy Boundless® Credit Card

Earn 5 Free Night Awards

(each night valued up to 50,000 points) after spending $5,000 on eligible purchases within 3 months of account opening. Certain hotels have resort fees. Last Chance! Offer ends 9 AM EST on 7/17/2025.

Annual Fee: $95

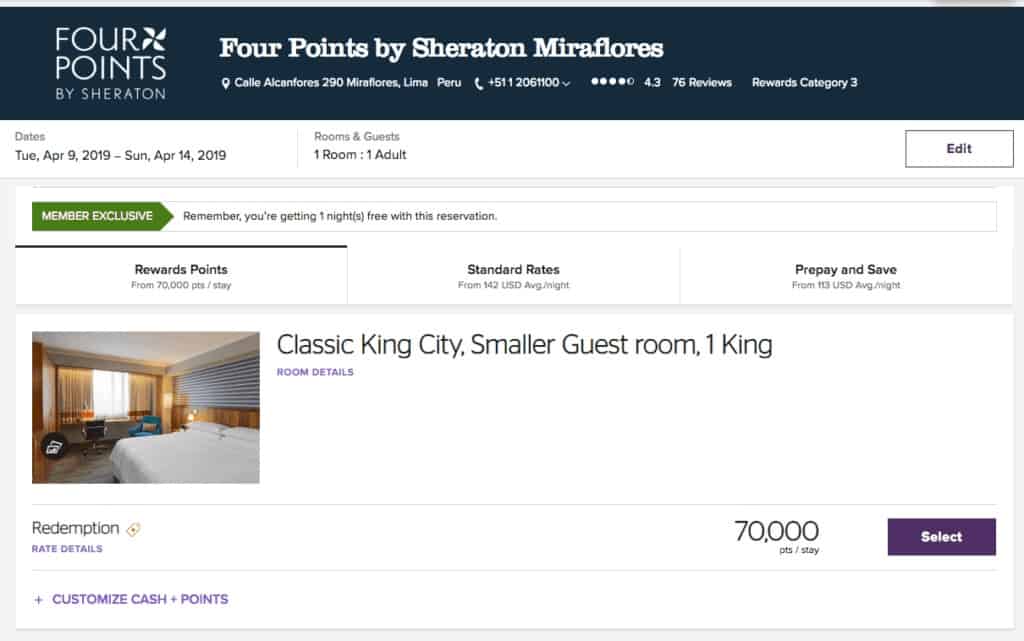

If you want to spend 5 nights in Lima, then your best bet would be to stay at the Four Points by Sheraton Miraflores. This hotel costs 17,500 Marriott points per night, but with the added benefit of the 5th night free on award stays of 4 nights or more, your 5-night stay will run you a total of just 70,000 Marriott points.

This hotel is in Miraflores and will have you located right in the heart of the action in one of the main cultural hubs of the city, allowing you to explore some of the finest restaurants and shopping that Lima has to offer.

By taking advantage of Marriott’s 5th Night free on award stays, all 5 nights of your stay would be covered by one credit card welcome bonus.

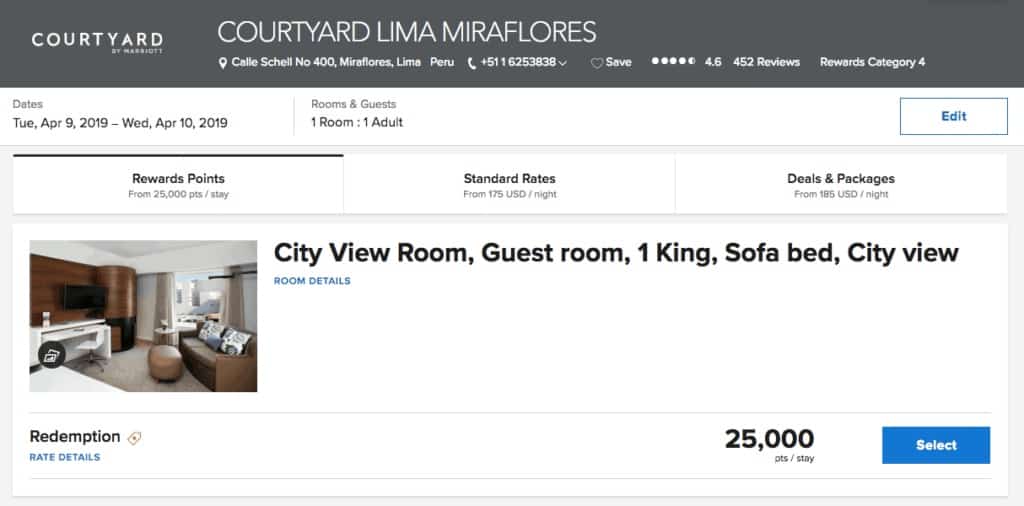

Another option for your stay would be the Courtyard Lima Miraflores. Also in the popular Miraflores area of Lima, you’ll be close to all of the action. Three nights in Lima can be more than sufficient, especially if you’re exploring other areas of Peru on your trip!

Welcome Bonus Restrictions

Both of the recommended cards, the Chase Sapphire Preferred and the Marriott Bonvoy Boundless® Credit Card, are subject to Chase’s 5/24 rule. In short, this rule means that you can’t get approved for a Chase card if you have opened 5 or more personal credit cards with any bank — plus Capital One and Discover business cards — within the prior 24 months.

Along with adhering to 5/24, the Marriott Bonvoy Boundless card has some additional restrictions since their merger with SPG. You can’t receive a welcome bonus for this card if any of the following conditions are true:

- You are a current cardholder of the Marriott Rewards Premier or Premier Plus Credit Card from Chase, or you received a welcome bonus on either of these cards in the prior 24 months

- You are a current cardholder of the Starwood Preferred Guest personal credit card from American Express or opened it within the prior 30 days

- You opened a Starwood Preferred Guest personal, Business, or Luxury card with American Express in the prior 90 days

- You received a welcome or upgrade bonus for a Starwood Preferred Guest Business or Luxury credit card from American Express in the prior 24 months

Peruvian seviche LECHE DE TIGRE. Raw fish cocktail ceviche with lime, grinder, chili, and cilantro. Traditional Peruvian food decorated with crabs, shrimps and banana chips.

Bottom Line

Lima, Peru is a wonderful travel destination for a variety of reasons. It has become one of the main food capitals in South America and offers a number of rich cultural experiences for all to enjoy.

It’s not a super expensive city, but being able to use points and miles thanks to just two credit card sign-up bonuses, you can save your cash and be eating your way through Lima in no time.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.