10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This site may earn compensation when a customer clicks on a link, when an application is approved, or when an account is opened. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Imagine this very real and not at all made up scenario. I’m out with a long-time friend having the greatest time catching up, and when the bill comes, we both whip out our rewards credit cards. I put down the Chase Sapphire Reserve® into the black bill booklet, but she chooses to use her Delta SkyMiles® Platinum American Express Card even though I know for a fact that she also holds the Chase Sapphire Preferred® Card.

Naturally, I’m perplexed so I ask, “Why don’t you use your Chase card? You earn more points, and they’re worth a lot more than Delta SkyMiles.” To which she replies, “Delta miles work better for me. I’m a Silver Medallion.” I suddenly feel like I’ve failed as a friend.

As a Salt Lake City resident, I see this scenario all the time. Delta Air Lines-hub captives think they have no other choice than to earn Delta SkyMiles, especially those with Medallion status. Although earning SkyMiles by flying Delta isn’t the worst move, spending on the Delta cards is.

Seasoned points and miles enthusiasts know that Delta credit cards have useful benefits, such as free checked bags and Companion Certificates, but you shouldn’t use them for purchases (unless you’re working on a welcome bonus). So, here are the reasons you should stop using your Delta card and start using a card that earns flexible rewards instead.

Reasons to Stop Using Your Delta Cards for Purchases

Delta SkyMiles Are Not Flexible

Delta SkyMiles are Delta-specific rewards, and no matter what you do, they’re stuck in your Delta SkyMiles account. Even though you can book Delta flights and SkyTeam partner flights with SkyMiles, you can’t move them to a transferable program or combine them with another frequent-flyer program. It’s possible to transfer your SkyMiles to another person, but it would cost you 1 cent per mile, which erases most of their value.

So, because Delta SkyMiles aren’t flexible, they’re not worth as much as transferable points, such as American Express Membership Rewards, Capital One Miles, Chase Ultimate Rewards or Citi ThankYou Points.

Think of it this way. Delta SkyMiles are Mongolian tugriks, and flexible points are U.S. dollars. You can exchange the U.S. dollar to a foreign currency in almost every country on earth, but you have to use Mongolian tugriks in Mongolia only. Just as Mongolian tugriks don’t have much value outside of their country, neither do Delta SkyMiles.

If you collect Amex, Capital One, Chase or Citi points, you have plenty of options when it comes to redeeming them. In the end, transferable points give you access to more redemption choices with various loyalty programs.

Additionally, you can transfer Ultimate Rewards points and Citi ThankYou Points to another person at no cost (must be a household member or an authorized user for Chase accounts).

Flexible Programs Offer Transfer Bonuses

Another reason you should collect transferable points instead of airline-specific points is that transfer programs often run special promotions on point transfers. Depending on the transfer bonus, you can get a bonus of as high as 40% on your point transfer.

The promos are random, and you never know when the next one is going to come around, but they can be a nice surprise when you need a flight.

Let’s take a look at an example of how it works in real life. Let’s say that Chase is running a transfer bonus of 25% to Flying Blue, a joint frequent-flyer program of Air France and KLM. So, for every 1,000 Ultimate Rewards points you transfer to Flying Blue, you’ll have 1,250 Flying Blue miles in your account.

Here’s how to take advantage of a transfer bonus. Flying Blue runs monthly Promo Rewards by selling award flights from select cities at lower-than-usual mileage rates. For instance, April’s Promo Rewards have included flights from many U.S. cities to Europe for as few as 10,500 miles each way.

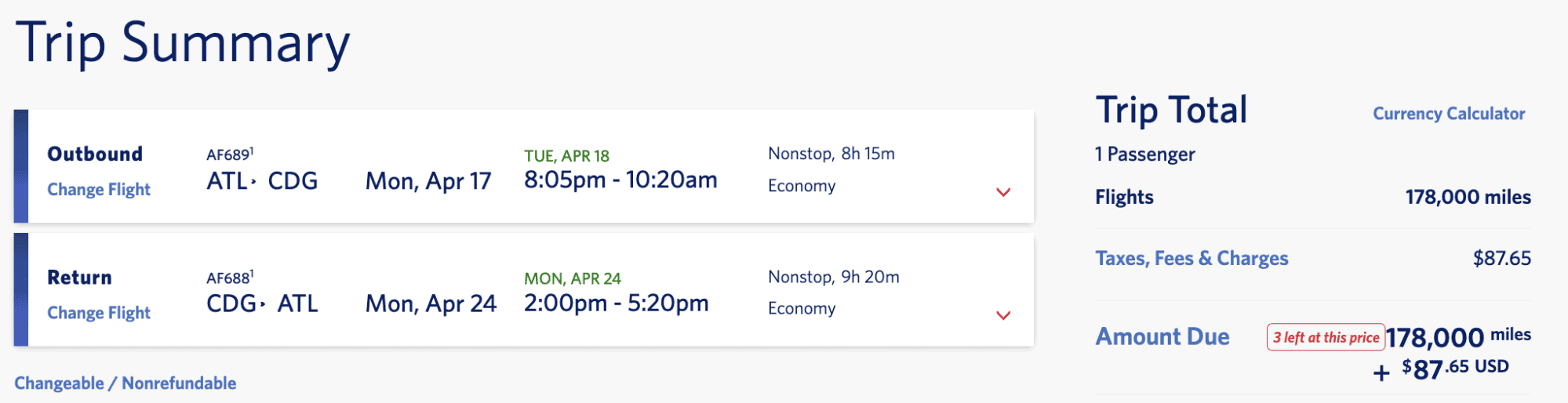

A quick search turned up a round-trip flight from Atlanta (ATL) to Paris (CDG) for 21,000 Flying Blue miles + $201. However, by taking advantage of this month’s Promo Rewards, you can book this trip for just 16,800 miles.

Because points transfers have to be made in increments of 1,000, you’d have to transfer 17,000 Chase Ultimate Rewards to Flying Blue, but still—booking a round-trip flight from the U.S. to Europe with 17,000 points is a steal.

When you earn flexible points, you have a choice of where to transfer them. Unfortunately, when you earn miles with Delta, you don’t have a choice and must shell out 178,000 SkyMiles for the same trip instead of transferring 17,000 Chase points to Flying Blue. If my math is right, Delta’s mileage rate is more than 10 times higher than that of Flying Blue’s.

I wish I could say that this is a fluke, but it’s not that rare for Delta to require an insane number of miles for a simple round trip to Europe.

This is a perfect example of why you shouldn’t be spending on your Delta cards. Make it a habit to use a credit card that earns transferable points instead. You can earn many more trips by paying with the right card and transferring points to the right program, especially when a transfer bonus is in play.

Delta Charges Too Many Miles for Flights

As already illustrated in the previous section, Delta award flights are sky high. I’m not saying they’re always outrageous, but the mileage rates are consistently more expensive than what you can find with other programs.

The last time Delta published award charts was when Tom Brady had just won his fourth ring (since then, he’s won three more and has retired twice). Let that sink in for just a minute. Since 2015, Delta has been charging whatever mileage rates it wants without telling you what the standard rate should be. To no one’s surprise, the rates have been higher than Tommy Chong and Snoop Dogg summiting Everest together.

Let’s take a look at some examples, and you’ll know exactly what I mean.

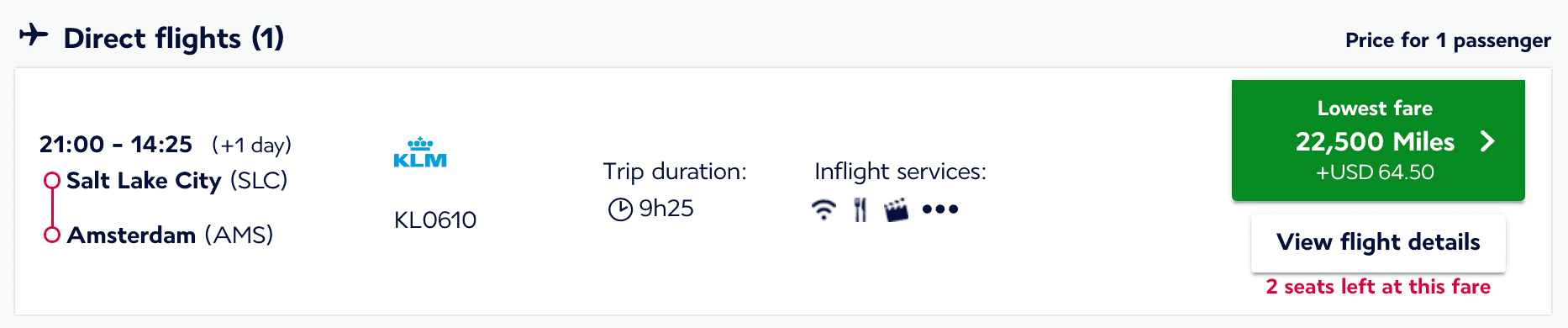

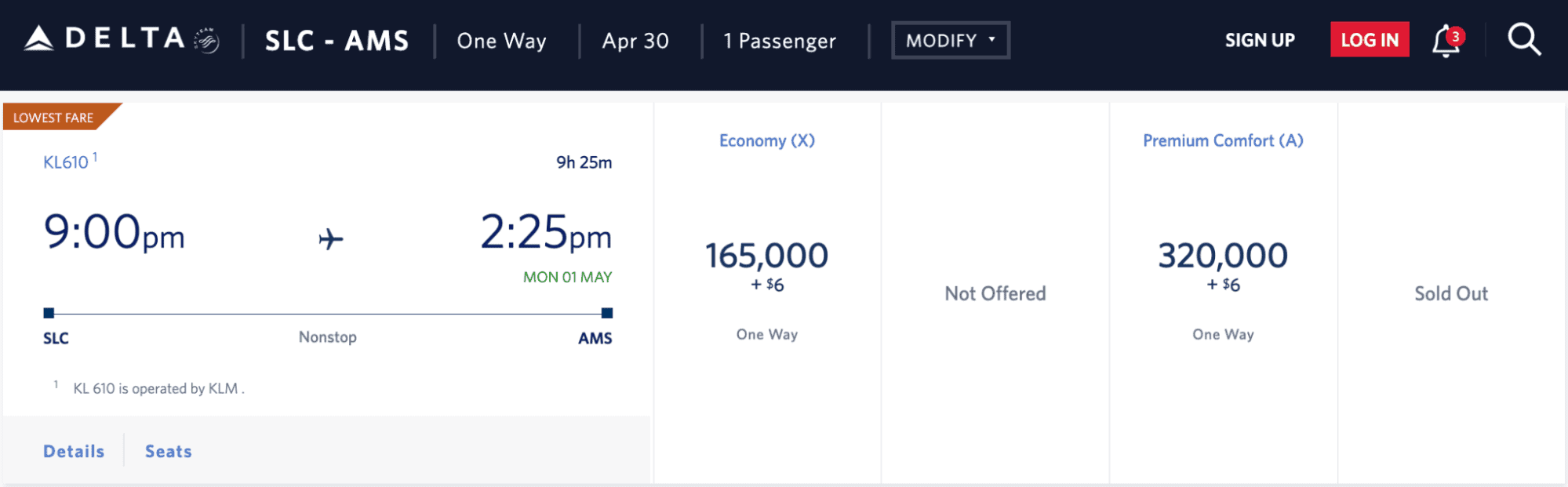

Here’s a one-way flight from Salt Lake City (SLC) to Amsterdam (AMS) operated by KLM. Because KLM is a SkyTeam partner, it can be booked using miles from multiple programs. Let’s start with Flying Blue, KLM’s loyalty program. It charges 22,500 miles + $64.50 for this flight.

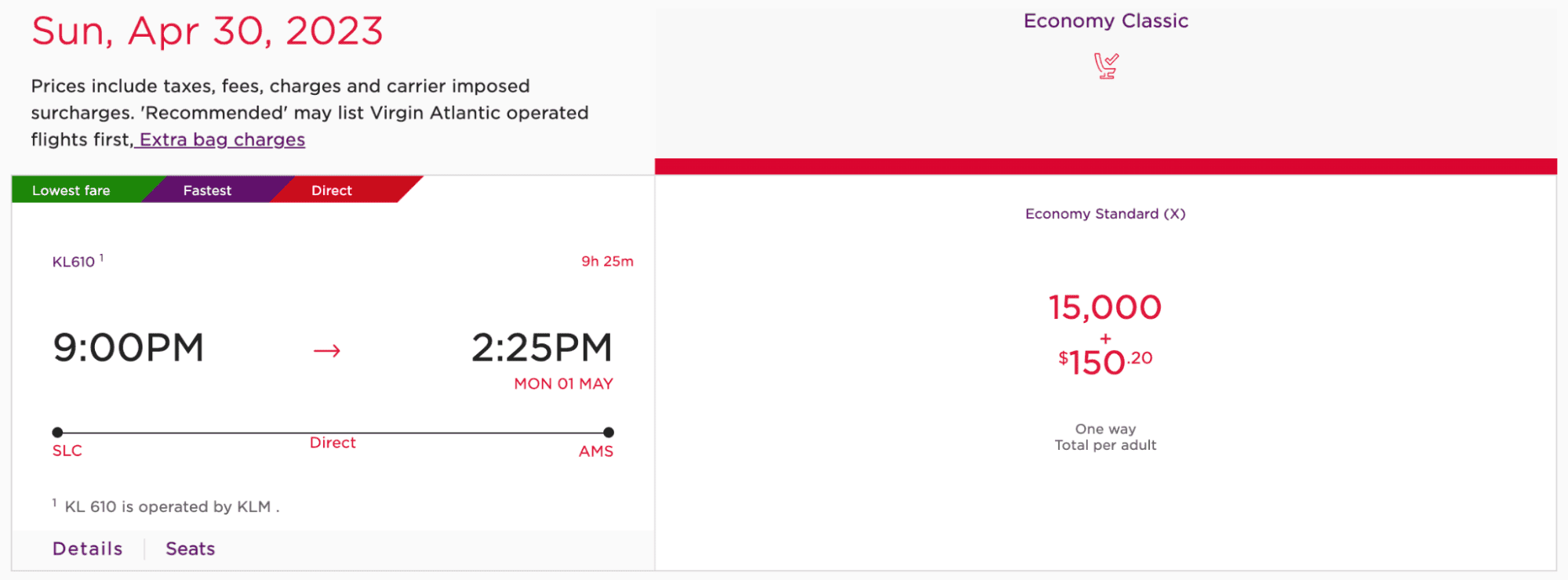

Not horrible, but perhaps we can do even better. The same flight shows up on Virgin Atlantic Flying Club for 15,000 + $150. Sure, the taxes are higher, but the mileage rate is slightly lower and you can possibly get it down even more with a transfer bonus.

Now, what do you think Delta charges for the same flight? Wait for it—a whopping 165,000 miles! The taxes are only $5.60, so that’s good, right? Right?!

Let’s compare the type of spending you have to complete to book these flights and let’s use the Chase Sapphire Preferred® Card and the Delta SkyMiles® Gold American Express Card (see rates & fees) in this example because the two cards charge comparable annual fees—$95 and $150 (the annual fee for the Delta Gold card is $0 for the 1st year), respectively.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred Card earns points at the following rates:

- 5X points on travel purchased through Chase Ultimate Rewards

- 3X points on dining

- 3X points on online groceries

- 3X points on select streaming services

- 2X points on other travel

- 1X point on all other purchases

Delta SkyMiles® Gold American Express Card

The Delta SkyMiles® Gold American Express Card earns miles at the following rates:

- 2X SkyMiles on Delta purchases

- 2X SkyMiles on dining

- 2X SkyMiles on groceries at U.S. supermarkets

- 1X SkyMiles on all other purchases

So, the Chase Sapphire Preferred Card earns 3X on dining and 2X on all travel, and the Amex Delta Gold Card earns 2X on dining and 2X on Delta travel only. In other words, the Chase Sapphire Preferred Card should be the card to use for dining and travel purchases.

As for the required spending to earn the necessary points, you’d have to spend $5,000 on dining (at 3X points per dollar) on the Chase Sapphire Preferred Card to earn the points required to book the aforementioned Delta flight through Virgin Atlantic because Virgin Atlantic Flying Club is a Chase transfer partner. Booking it through Flying Blue, which is also a Chase transfer partner, would require $7,500 in spending with the Chase card on dining with a 3X bonus.

Meanwhile, you’d have to spend $82,500 on the Delta credit card in the dining category (at 2X points per dollar) to earn enough miles to book the same flight through Delta SkyMiles.

I rest my case.

What Delta Credit Cards Are Good For

Although co-branded Delta credit cards shouldn’t be used for everyday spending, they have some decent perks. If you can utilize all their benefits, you can offset annual fees, and the cards can earn their keep in your sock drawer, just not in your wallet. So, here’s why you should open a Delta credit card (but not until after you hit the 5/24 card count with Chase).

Free Checked Bags

Delta credit card holders can check one bag at no cost any time they fly Delta, which also applies to up to eight companions traveling on the same reservation. This benefit can save you $60 per passenger per round-trip journey. And the best part is you don’t even have to use your card to pay for the flight. Being a cardholder and adding your SkyMiles number to your ticket does the trick.

Companion Certificate

If you hold either the Delta SkyMiles® Platinum American Express Card or the Delta SkyMiles® Reserve American Express Card, you get what’s called a Companion Certificate good for one complimentary round-trip flight (not including taxes) valid on select itineraries.

Delta SkyMiles Platinum Amex cardholders receive a Companion Certificate that’s good in economy class only. The certificate that comes with the Delta SkyMiles Reserve Amex card can be used in first class and Delta Comfort+ as well as economy.

The Companion Certificate is the best perk of the Delta Platinum Amex Card, provided you can use it to its full potential every year you hold the card. The annual fee on the Delta SkyMiles® Platinum American Express Card is $350 (see rates & fees). As long as you book a flight that costs more than that and redeem the Companion Certificate, you can offset the fee each card membership year.

Sky Club Access

The premium Delta SkyMiles® Reserve American Express Card charges a hefty $650 annual fee (see rates & fees) and includes limited access to Delta Sky Clubs. One-year individual Sky Club access costs $695 when you buy it from Delta, so you actually get a membership discount by signing up for the Delta Reserve Amex Card. Plus you get all the other card’s benefits with it, such as free checked bags, Companion Certificate and even The Centurion Lounge access with a same-day Delta ticket.

Effective 2/1/25, Reserve Card Members will receive 15 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

SkyMiles Deals

Chances are, once you earn a welcome bonus on an American Express Delta card, it’s going to sit in your SkyMiles account for a while because you’ll keep finding better redemption rates with other programs. Luckily, the Delta SkyMiles program isn’t a complete dud, and there are still ways to get decent value.

To find worthwhile redemption rates, we commend visiting the SkyMiles Deals page to look for ongoing sales. The flight deals might not be for the destinations you want or on the dates you can travel, but even a blind squirrel finds a nut every once in a while, and the stars might align for your dream trip using SkyMiles. In the past, we’ve seen some great deals using SkyMiles to Alaska, Tahiti and Europe.

The problem with these sales is we never know when they’re going to pop up, so you have to keep checking the page and be ready to book as soon as you see something you like. The deals usually don’t last long, so you have very little time to think.

Credit Cards We Recommend for Everyday Spending

Not Delta. All jokes aside, I recommend using the card whose minimum spending requirement you’re trying to meet first. Second, use one of the cards whose points can be transferred to an airline or a hotel loyalty program.

Some of the best consumer credit cards for everyday spending are:

- American Express® Gold Card

- Capital One Venture Rewards Credit Card

- Capital One Venture X Rewards Credit Card

- Chase Sapphire Preferred® Card

- Chase Sapphire Reserve®

- Citi® Double Cash Card

- Citi Premier® Card (not available to new applicants)

- American Express Platinum Card®

The reason to use a card that earns flexible points is you don’t want to be stuck with one program’s miles and be forced to redeem them at higher rates than necessary. You want to position yourself in a way that gives you redemption options from multiple programs so that you can pick the best one with not only the lowest rates but also available seats.

Final Thoughts

And there you have it. Not only do the Delta SkyMiles cards have subpar earning rates, the redemption rates are even more abysmal. Take a look at the numbers above and please stop spending on your Delta Amex card. Shift your preference to a flexible rewards card, earn transferable points and keep your Delta SkyMiles card in the sock drawer for the free bags.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase TravelSM Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.