10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

The Platinum Card® from American Express was one of the first readily available premium cards to hit the market. It brought exclusive benefits that weren’t seen on other cards and it continues to offer a premium suite of benefits and perks to its cardholders.

Although the Amex Platinum now faces some competition, it still commands its presence as one of the premier cards on the market. With an annual fee of $695, it commands a high price tag for the benefits (rates and fees). Despite the fee, many people find the Amex Platinum benefits and perks worth it.

The Platinum Card® from American Express

You may be eligible for as high as 175,000

Membership Rewards® Points

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$695

Let’s take a deeper dive into the benefits and perks of the Amex Platinum to see what makes this card so desirable and why many cardholders keep it in their wallet permanently.

Welcome Bonus

What draws most people into the Amex Platinum is the welcome bonus. The standard bonus is 80,000 Membership Rewards points after spending $8,000 in 6 months, but some people get targeted offers of up to 125,000 points.

You can use the CardMatch tool to see if you’re targeted. Even with CardMatch, the 125,000-point welcome offer won’t always pop up, but it’s worth a shot when you consider Amex only allows you to get one bonus per card per lifetime.

The Platinum Card® from American Express

You may be eligible for as high as 175,000

Membership Rewards® Points

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$695

Bonus Categories

Most purchases made with your Platinum Card will earn 1X Membership Reward point per dollar. For any flights and prepaid hotels purchased through American Express Travel® earn 5X Membership Rewards points. You’ll also earn 5X points for any flights booked directly through an airline.

Valuable Transfer Partners

One of the best ways to get the most value out of any flexible points currency is through using transfer partners. There’s a lot of great ways to use Membership Rewards Points.

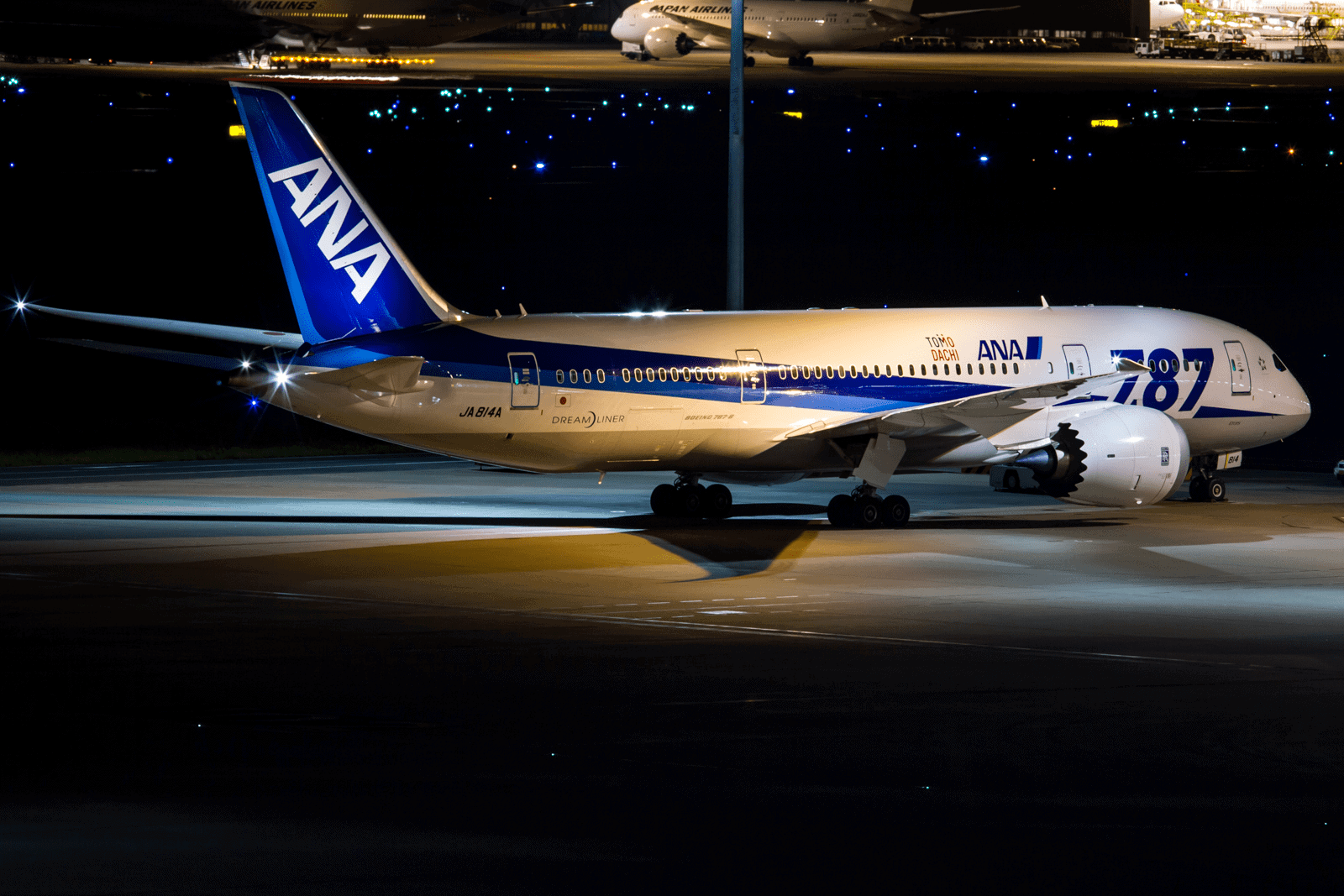

You can book an around the world trip with ANA or fly first class to Tokyo by transferring to Virgin Atlantic or use a number of other transfer partners.

Most often, Membership Rewards points are used for flights, but you can also transfer them to Choice, Hilton or Marriott. However, it rarely makes sense to transfer Amex points to hotels with the exception of Choice for stays in some parts of Europe.

Statement Credits

The Amex Platinum comes with a bunch of statement credits that can help offset the annual fee. Just make sure you read the rules for using each statement credit so you can get the most out of them.

Airline Fee Credit

Platinum cardholders receive an annual, up to $200 airline fee credit. Once a year, you can select the airline on which you want to receive the credit. The credit can be used for onboard refreshments, baggage, or seat selection fees.

Checked bags and seat selections are some of the most common uses. Just be sure to purchase your seat selection separate from your ticket so that it will be coded correctly on your card. If you find a credit wasn’t properly applied, send a message to Amex customer support to get it resolved.

Uber Credit (Monthly)

The Uber credits come monthly. You’ll receive $15 per month from January to November. In December, you’ll receive an additional $20 for a total of $35. Credits do not roll over month to month, so be sure to use them before they expire.

If you’re not a frequent rideshare user, you can use the credits to order food from Uber Eats.

Saks Fifth Avenue Credit

Every six months, cardholders receive an up to $50 credit to spend at Saks. In total, this means you get $100 every year. Similar to the Uber credit, the Saks credit is use it or lose it. The first credit is available from January through June while the second credit is available from July through December.

If you don’t need anything, you can search the clearance items under $50 to find small gifts for friends and family.

Global Entry or TSA PreCheck Credit

Cardholders receive a credit to cover the cost of Global Entry or TSA PreCheck every 4 years. If you already have Global Entry or PreCheck, you might consider using the credit to help out a friend or family member.

Lounge Access

One of the benefits that really stands out from the competition is the lounge access that you receive with the card. While most premium credit cards offer lounge access via a Priority Pass Select membership, the Amex Platinum offers access to even more lounges.

While you’ll have a Priority Pass Select membership with the Amex Platinum, you’ll get access to a bunch of other lounges as well. Let’s discuss a few of the standouts!

Photo Credit: The Centurion Lounge

Amex Centurion Lounges

Centurion Lounge access is one of the main reasons people choose to open an Amex Platinum.

These lounges are often better than other lounges in the U.S. Centurion Lounges provide good food and always have great drinks available at the bar. Although some drink selections are restricted to Centurion Card members, you’ll still find high quality options.

As the popularity of Centurion Lounges have grown, they can get crowded during peak travel dates and times. Currently, you cannot enter more than 3 hours prior to departure.

You may bring two guests with you at no charge while additional guests will cost $50 each. This includes children, except for children under the age of 2 which are permitted free with a lap infant ticket.

Currently there are 12 Centurion Lounges worldwide, with three new lounges scheduled to open soon.

| Amex Centurion Lounge Locations | ||

|---|---|---|

| Charlotte (CLT) | Las Vegas (LAS) | Philadelphia (PHL) |

| Dallas (DFW) | Los Angeles (LAX) | Phoenix (PHX) |

| Hong Kong (HKG) | New York Laguardia (LGA) | Seattle (SEA) |

| Houston (IAH) | Miami (MIA) | San Francisco (SFO) |

Delta Sky Club

Amex Platinum members can access Delta Sky Club lounges when flying Delta in any class. Guests are not free, but cost $39 per guest.

Despite being more restrictive since you can only access Sky Club lounges when flying Delta, there are substantially more Sky Club locations around the US. For Delta frequent fliers, this benefit will surely be valuable.

Other Lounges

Additionally, the Amex Platinum comes with complimentary Priority Pass Membership, and access to Escape Lounges, and AirSpace Lounges. Many Plaza Premium Lounges around the globe are already part of Priority Pass. Escape Lounges are quickly growing in the US, with locations typically in smaller airports such as Cincinnati and Reno. Airspace currently operates one lounge in San Diego.

Although these other lounge programs won’t provide the same experience as the Centurion Lounge, the expansive offerings nearly guarantee you should have lounge access anywhere you travel in the US.

Overwater bungalows boardwalk of the Maldives

Hotel Status

In addition to flight benefits, the Amex Platinum offers mid-tier Gold status with two hotels: Hilton and Marriott.

Marriott Bonvoy Gold Elite Status

While Marriott Gold status doesn’t provide a ton of significant benefits, it provides just enough to make it worth having. Besides, it comes with the Amex Platinum, so you might as well use the perks if you don’t already have Marriott Gold status (or above). Some of the benefits include:

- Enhanced room upgrades

- 25% more points on stays

- Faster WiFi in your room

Marriott Gold status also gets you an enhanced room upgrade when available. You’ll be upgraded to the best available room subject to availability upon check in. Although this technically excludes suites, it isn’t unheard of for a Gold Elite status member to get a suite upgrade. I received an upgrade on a weeknight stay at the Ritz-Carlton Dallas a few years ago as a Gold Elite member. Take it as a nice perk if it happens, but don’t expect it.

Other notable benefits of Gold Elite status include 2PM late checkout, and 25% bonus points on all stays. Unfortunately, free breakfast is not offered until you get to the next tier, Platinum Elite.

Hilton Honors Gold Status

Unlike Marriott Gold, Hilton Gold status provides some compelling benefits that could make you choose a Hilton property over another hotel chain. Some of the benefits include:

- Complimentary room upgrades

- Fifth night free on award stays

- Free breakfast

With Hilton Honors Gold status from the Amex Platinum, you won’t pay any resort fees on award stays. You’ll be eligible for complimentary upgrades subject to availability, and you will receive free continental breakfast for you and another registered guest on all stays.

With Hilton Gold status, room upgrades extend all the way to the Executive level. You’ll also receive an additional 80% bonus points on all stays.

Your complimentary Hilton Honors Gold status will help your stays at Hilton Hotels feel even more exceptional. Although you could go higher to Hilton Diamond with the Hilton Honors American Express Aspire Card, you’ll find it is more an enhancement of Gold benefits rather than new benefits being added. Receiving Gold status from the Amex Platinum is a great starting point for the Hilton Honors program.

Travel Protections

Travel insurance is an increasingly popular benefit on premium credit cards. Although American Express was late to adding trip delay and interruption insurance, the Amex Platinum now has travel insurance comparable to other premium credit cards on the market.

Trip Delay and Cancellation Insurance

You can get up to $10,000 per trip, and up to $20,000 per year for any delays and cancellations that you incur while traveling if you booked with your Amex Platinum. To be eligible, the travel must be round-trip which can include a round-trip booking or a combination of one-way flights that ultimately returns to your home destination.

To receive trip delay and cancellation insurance on the Amex Platinum, you’ll need to pay for the entire trip with your card. This doesn’t mean the entire trip has to be a cash trip, as you can book with any award program and pay the taxes and fees with your Amex Platinum to receive coverage.

The trip delay and cancellation insurance on the Amex Platinum is secondary to any refunds or rebates offered by the travel company. Anything nonrefundable is eligible under the coverage offered by American Express.

Car Rental coverage

Car Rental Loss and Damage Insurance

When you pay for your entire rental car with your Amex Platinum and decline the collision damage waiver offered by the rental company, you’ll receive rental loss and damage insurance.

You’re also eligible if you pay with Membership Rewards, or pay a portion with your card and a portion with Membership Rewards. Any third party rewards program combined with the card is not eligible to receive car rental loss and damage insurance.

You’ll receive up to $75,000 in coverage for damage towards the vehicle, and up to $300,000 in accidental death and dismembership insurance in case of an accident.

This coverage is not liability insurance, and is secondary to any liability insurance you may carry. Coverage also isn’t available everywhere, as Australia, New Zealand, and Italy are excluded.

This is comparable to what you’ll find on other cards in the same category. Offering rental car insurance is a nice benefit to have that helps make the Amex Platinum benefits more in line with the competition.

Shopping Benefits

In addition to the travel benefits, American Express knows that Platinum cardholders aren’t just travelers. They’re shoppers too. That’s why you’ll find some helpful shopping benefits as part of your card membership too. You can get help ranging from shopping protections to dedicated concierge services to help you get those hard to get items or reservations.

Return Protection

A unique benefit to the Amex Platinum is return protection. American Express will reimburse you for purchases up to $300, and up to $1,000 per year if a seller won’t take back an item within 90 days.

It may seem odd to think of a seller not accepting a return, but this is especially helpful if you purchase a shirt at a concert, or an item while traveling abroad that malfunctions shortly before returning home.

Not many cards have this benefit, and while it isn’t unlimited, it adds some good assurance when making a purchase that might not be easily returnable.

Concierge desk at luxury hotel

Concierge

The Amex Concierge is an underused benefit of the Amex Platinum. Concierge services can help you score a hard to get reservation, send last minute gifts, or help you find event space for a special event.

One way the Concierge can be very helpful is they can book tickets that sell on Ticketmaster and avoid Ticketmaster fees. They can even often get you tickets to a sold out show.

I’ve used the Concierge service numerous times. Once, I needed a last minute rental car when I showed up at the counter and they told me all cars were gone despite having a reservation. I even used them in Spain to get a last minute reservation to a Michelin-starred restaurant when my plans for how to spend my time changed last minute.

Whether you need tickets to a show, or you’re looking for the perfect genuine Italian leather jacket, the Concierge service can help put in the legwork to find the answers, or the seats, for you.

Extended Warranty

When you purchase an item that typically comes with a warranty, you can get a free additional year when you make the purchase with the Amex Platinum. The original warranty must be 5 years or less in order to be covered, and obvious exclusions such as cars or perishable items apply.

For your home electronics and appliances, extended warranty protection can be a great benefit of purchasing with your Amex Platinum. You can avoid paying for the pricey extended warranty at check-out simply by swiping your card instead.

The Platinum Card® from American Express

You may be eligible for as high as 175,000

Membership Rewards® Points

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

Annual Fee:

$695

Final Thoughts

There’s a lot to love about the Amex Platinum. From Centurion Lounge Access to return protection, there are a ton of benefits and perks that can more than make up for the annual fee.

Overall, the Amex Platinum remains one of the top premium cards on the market for a reason. Many cardholders find the benefits invaluable and won’t hesitate to renew year after year.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $8,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Welcome offers vary and you may not be eligible for an offer. Apply to know if you’re approved and find out your exact welcome offer amount – all with no credit score impact. If you’re approved and choose to accept the Card, your score may be impacted.

after you spend $6,000 in purchases on the Card within your first 6 months of Card Membership. Offer ends 8/13/2025.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.