10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more. All values of Membership Rewards are assigned based on the assumption, experience and opinions of the 10xTravel team and represent an estimate and not an actual value of points. Estimated value is not a fixed value and may not be the typical value enjoyed by card members.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

All information about Chase Freedom Flex® has been collected independently by 10x Travel. Chase Freedom Flex® is no longer available through 10xtravel.com.

Shopping online from the comfort of your own home is one of life’s luxuries. And earning rewards while doing so makes it double the fun.

Online buyers spent an average of $5,381 annually in the United States (U.S.) in 2023. If that amount was charged to a card that earned 2X points per dollar spent, that would work out to 10,762 extra points every year—enough to make an award travel booking. Alternatively, if you charged that spending to a card that earns 5% cash back, you’d get $269 back per year.

Let’s look at the best credit cards for online shopping and strategies to maximize the number of points you earn with every click.

Best 10 Credit Cards for Online Shopping: Overview

Before getting into the details, here’s an overview of the best credit cards for online shopping, including their annual fees and what they’re best suited to.

| Card | Annual fee | Best for |

|---|---|---|

| Blue Cash Everyday® Card from American Express | $0 (see rates and fees) | Earning 3% cash back on online retail merchant purchases on up to $6,000 per year (1% thereafter) |

| Prime Visa | $0 | Frequent Amazon shoppers |

| Chase Freedom Flex® | $0 | Earning up to 5% cash back on rotating bonus spending categories, up to $1,500 per quarter (1% thereafter) |

| Capital One Venture Rewards Credit Card | $95 | Earning 2X miles on all purchases |

| Bank of America® Customized Cash Rewards Credit Card | $0 | Earning 3% cash back on online shopping purchases |

| Citi Double Cash® Card | $0 | Earning 2% cash back on all purchases |

| U.S. Bank Shopper Cash Rewards™ Visa Signature® Card | $0 intro; $95 thereafter | Earning 6% cash back with specific online merchants on up to $1,500 per quarter |

| Ink Business Preferred® Credit Card | $95 | Business owners wanting a return on advertising purchases bought online |

| U.S. Bank Cash+® Visa Signature® Card | $0 | Earning 5% cash back on TV, streaming and internet purchases (up to $2,000 per quarter, in combination with a second bonus category of your choice) |

| The Blue Business® Plus Credit Card from American Express | $0 (see rates and fees) | Business owners who want to earn 2X points on all purchases on up to $50,000 per calendar year (1X points thereafter) |

Blue Cash Everyday® Card from American Express

The Blue Cash Everyday® Card from American Express enables you to earn significant cashback rewards while shopping online for a $0 annual fee (see rates and fees).

You can earn 3% cash back on U.S online retail merchants on up to $6,000 per year in purchases (1% cash back thereafter).* That’s up to $180 in cash back every year, assuming you hit the $6,000 spending cap.

Blue Cash Everyday® Card from American Express

$200

in Statement Credits

after you spend $2,000 in purchases on your new Card within the first 6 months.

American Express defines “U.S. online retail merchants” as those who:

“Sell physical goods and/or merchandise directly to consumers […] Purchases made at restaurants, supermarkets, gasoline stations, or automotive dealers, as well as purchases of travel, entertainment, or other services are not eligible for additional rewards. Payment must be made online and categorized as an internet transaction by the merchant for purchase to be eligible.”

The Blue Cash card also comes with up to $264 worth of statement credit perks, as well as 3% bonus cash back on groceries at U.S. supermarkets and gas stations, with each category having a maximum spending cap of up to $6,000 per year (1% thereafter).

For a $0 annual fee, the Blue Cash Everyday Card packs a punch for those looking to earn rewards on online shopping and everyday expenses.

Pros

- 3% cash back on groceries at U.S. supermarkets, on up to $6,000 per year in purchases (1% cash back thereafter)

- 3% cash back on U.S online retail merchants on up to $6,000 per year in purchases (1% cash back thereafter)

- 3% cash back at U.S. gas stations, on up to $6,000 per year in purchases (1% thereafter)

- 1% cash back on all other purchases

- $84 Disney bundle credit, given in $7 monthly increments, after you spend $9.99 or more each month on an eligible auto-renewing subscription to the Disney Bundle using your card

- $180 Home Chef credit, given in $15 monthly increments, after you purchase an auto-renewing subscription for Home Chef meal kits using your card

- Redeem Rewards Dollars as cash back at Amazon checkout for eligible items.

- Car rental loss and damage insurance¹

Cons

- Cashback earnings are capped at $6,000 per year.

- Foreign transaction fee of 2.7%

*Cash back is received in the form of Reward Dollars that can be redeemed as a statement credit.

Prime Visa

The Prime Visa is geared toward existing Amazon Prime members who want to earn rewards on Amazon as well as on everyday purchases.

You’ll earn 5% cash back at Amazon.com, Amazon Fresh and Whole Foods Market, making the Prime Visa the perfect card for avid Amazon shoppers. You can also earn up to 10% cash back or more on a rotating selection of items and categories on Amazon.com.

When you’re approved for the card, you’ll be rewarded with a $100 Amazon gift card, making signing up for this card even more valuable for Amazon shoppers.

Additionally, the Prime Visa earns 2% cash back at gas stations, restaurants and on local transit and commuting purchases (including rideshare), as well as 5% cash back on Chase Travel℠ purchases. That enables you to earn a return when making cash bookings through Chase Travel℠.

The Prime Visa card also comes with a solid array of Chase’s travel protections, including baggage delay insurance, travel accident insurance, lost luggage reimbursement and an auto rental collision damage waiver.

While the card doesn’t charge an annual fee, you’ll need to be an Amazon Prime member to be eligible, which will cost you $139 per year. That means you’d need to spend $2,780 per year in the 5% cash back category to break even on the cost of Prime membership. However, if you’re a Prime member anyway and can offset the cost through different uses, applying for the card could be worth it.

Pros

- 5% cash back at Amazon.com, Amazon Fresh, Whole Foods Market

- 5% cash back on Chase Travel℠ purchases

- 2% cash back at gas stations, restaurants and on local transit and commuting purchases (including rideshare)

- 10% cash back or more on a rotating selection of items and categories on Amazon.com

- $100 Amazon gift card upon approval of your card application

- No foreign transaction fees

- Baggage delay insurance

- Travel accident insurance

- Lost luggage reimbursement

- Auto rental collision damage waiver

Cons

- Amazon Prime membership required, which costs $139 per year

Chase Freedom Flex®

The Chase Freedom Flex® offers the best of both worlds—fixed cashback categories combined with rotating quarterly cashback categories.

You’ll earn 5% cash back on up to $1,500 in combined purchases in bonus categories every quarter you activate them. These categories often include major online merchants and payment platforms, such as Amazon and PayPal. That’s up to $75 in cash back every quarter.

Chase Freedom Flex®

$200

Bonus

after you spend $500 on purchases in your first 3 months from account opening

Additionally, the Freedom Flex earns 5% cash back on travel purchased through Chase Travel℠ and 3% cash back on dining, including takeout and drug stores.

For a $0 annual fee card, the Freedom Flex includes a range of competitive travel protections, such as trip cancellation and interruption insurance as well as an auto rental collision damage waiver. It’s also one of the few cards to offer a cell phone protection plan.

Overall, the Freedom Flex is a solid option when it comes to earning rewards on online shopping purchases among other categories.

Pros

- 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate them

- 5% cash back on travel purchased through Chase Travel℠

- 3% cash back on dining including takeout and drug stores

- 1% cash back on all other purchases

- Complimentary three months of DashPass, unlocking $0 delivery fees and lower service fees on eligible orders with DoorDash and Caviar. After that, you’ll be automatically enrolled in DashPass at a discount rate of 50% for the subsequent nine months (activate by Jan. 31, 2025).

- Trip cancellation and interruption insurance

- Auto rental collision damage waiver

- Cell phone protection

Cons

- 5% rotating cashback category is capped at $1,500 in combined purchases every quarter.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card gives you maximum freedom when shopping online.

Every time you pay with your Venture Rewards card at the online checkout, you’ll earn 2X miles for every dollar spent. The Venture Rewards card earns 2X miles on all purchases, giving you maximum earning flexibility regardless of what you’re buying.

Capital One Venture Rewards Credit Card

75,000

miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Annual Fee: $95

The Venture card also has value beyond online shopping, earning you 5X miles per dollar spent on hotels, vacation rentals and rental cars booked through Capital One Travel. Additionally, you’ll receive a statement credit to help with the cost of Global Entry/TSA PreCheck.

Capital One has up to 15+ airline and hotel partners, including all three airline alliances, to whom you can transfer your miles for lucrative award travel redemptions. The Venture Rewards card also has a wide range of travel protections, making it ideal for the traveler.²

For an annual fee of $95, the Venture Rewards card offers significant value.

Pros

- 5X miles on hotels, vacation rentals and rental cars booked through Capital One Travel

- 2X miles on all other purchases

- Comes with statement credit to help with the cost of Global Entry/TSA PreCheck

- Complimentary Hertz Five Star® status

- No foreign transaction fees

- Trip cancellation and interruption insurance

- Trip delay reimbursement

- Baggage delay reimbursement

- Auto rental collision damage waiver

- Travel accident insurance

Cons

- Limited range of bonus spending categories

Bank of America® Customized Cash Rewards Credit Card

The Bank of America® Customized Cash Rewards Credit Card earns 3% cash back in one category of your choice, one of which is online shopping.

Bank of America include examples of how they define the online shopping category, including but not limited to:

- Bookstores

- Cable, internet and streaming services

- Clothing and apparel

- Department stores

- Discount stores

- Electronics

- Landline and mobile phone providers

- Specialty retail stores

- Sporting goods

This gives you a wide range of possibilities when it comes to earning 3% cash back on online purchases. You can find their full list of exclusions to this category, which mainly includes non-retail merchants.

This card enables you to earn 2% cash back at wholesale clubs and grocery stores.

Keep in mind that the 3% and 2% cashback categories are capped at $2,500 in combined purchases each quarter.

If you also happen to be a Preferred Rewards® member, you can earn between 25% and 75% more cash back on every purchase. That means you could earn up to 5.25% cash back.

For a $0 annual fee, the Customized Cash Rewards card offers significant value for online shopping purchases—particularly for Preferred Rewards members.

Pros

- Ability to choose the 3% cashback category of your choice from the following options: gas and EV charging stations; online shopping, including cable, internet, phone plans and streaming; dining; travel; drug stores and pharmacies; home improvement and furnishings

- 2% cash back at wholesale clubs and grocery stores

- 1% cash back on all other purchases

- Bank of America Preferred Rewards® members earn 25% to 75% more cash back on every purchase.

Cons

- 3% and 2% cash back categories are capped at $2,500 in combined purchases each quarter; thereafter, you’ll earn 1% cash back.

Citi Double Cash® Card

The Citi Double Cash® Card is a card you can use in every situation.

It earns 2% cash back on all purchases—1% when you buy and 1% when you pay. This makes it perfect for online shopping, as you’ll always get 2% cash back, without having to worry about how your purchases code.

Citi Double Cash® Card

$200

cash back

after you spend $1,500 on purchases in the first 6 months of account opening. This bonus offer will be fulfilled as 20,000 ThankYou® Points, which can be redeemed for $200 cash back.

If you prefer cash back instead of points, the Citi Double Cash Card is a good alternative to the Capital One Venture Rewards Credit Card.

Alternatively, if you also hold the Citi Strata Premier® Card, you can convert your cashback earnings to Citi ThankYou Points, enabling you to transfer them to Citi’s full list of airline and hotel transfer partners.

For a $0 annual fee, the Citi Double Cash Card could be a great complement to your wider card strategy and also help you earn points on miscellaneous online shopping purchases.

Pros

- 2% cash back on all purchases (1% when you buy and 1% when you pay)

- 5% total cash back on hotel and car rentals booked on the Citi Travel℠ portal through Dec. 31

Cons

- Limited range of bonus spending categories and perks

U.S. Bank Shopper Cash Rewards™ Visa Signature® Card

The U.S. Bank Shopper Cash Rewards™ Visa Signature® Card offers 6% cash back on the first $1,500 spent in combined purchases each quarter with two retailers of your choice.

Current retailers included in this category are:

| Ace Hardware | Lowe's |

| Apple | Lululemon |

| Amazon.com | Macy's |

| Anthropologie | Menards |

| Bed, Bath, & Beyond | Nordstrom |

| Best Buy | Pottery Barn |

| Chewy.com | QVC |

| Crate and Barrel | Restoration Hardware |

| Disney | Target |

| Home Depot | Walmart |

| Ikea | Wayfair.com |

| Kohl's | Williams Sonoma |

This card offers 3% cash back on the first $1,500 spent in your choice of one everyday category, such as wholesale clubs, gas and EV charging stations, bills and utilities, as well as 1.5% cash back on all other purchases.

It has a $0 intro annual fee, followed by a $95 annual fee in subsequent years of card membership.

If you want to earn cash back on a wide array of merchants, the U.S. Bank Shopper Cash Rewards Visa Signature Card is a great option.

Pros

- 6% cash back on the first $1,500 spent in combined purchases each quarter with two retailers of your choice

- 3% cash back on the first $1,500 spent in your choice of one everyday category such as wholesale clubs, gas and EV charging stations, bills and utilities

- 1.5% cash back on all other purchases

- 5.5% cash back on hotel and car reservations booked directly in the Rewards Travel Center

Cons

- 6% and 3% cashback categories are capped at $1,500 each per quarter.

Ink Business Preferred® Credit Card

For small business owners looking for lucrative rewards, the Ink Business Preferred® Credit Card is a solid option.

Chase Ink Business Preferred® Credit Card

90,000

bonus points

after you spend $8,000 on purchases in the first 3 months after account opening.

Annual Fee: $95

The Ink Business card earns 3X points per dollar on the first $150,000 spent in combined purchases across the following categories:

- Advertising purchases made with social media sites and search engines

- Internet, cable and phone services

- Shipping purchases

- Travel

When it comes to business purchases made online, the Ink Business Preferred can earn you a competitive return, up to 350,000 Ultimate Rewards points per year—assuming you hit the spending cap. For Ink Business Preferred cardholders points are worth more when you redeem thru Chase TravelSM, or transfer them to one of Chase’s 14 airline or hotel partners. And when it comes to traveling, you’ll enjoy a robust selection of travel protections.

For online business shopping purchases, the Ink Business Preferred card is a great choice, all for an annual fee of $95.

Pros

- 3X points on the first $150,000 spent in combined purchases across the following categories: shipping purchases; advertising purchases made with social media sites and search engines; internet, cable and phone services; travel

- 1X points on all other purchases

- Points are worth more when you redeem thru Chase TravelSM

- No foreign transaction fees

- Trip cancellation and interruption insurance

- Auto rental collision damage waiver

- Cell phone protection

Cons

- 3X points category is capped at $150,000 in spending.

U.S. Bank Cash+® Visa Signature® Card

The U.S. Bank Cash+® Visa Signature Card offers up to 5% cash back on the first $2,000 spent in combined eligible purchases each quarter in two categories of your choice. These categories include TV, internet and streaming, cell phone and other purchases which could be relevant to the online shopper.

U.S. Bank Cash+® Visa Signature® Card

$200

bonus

after spending $1,000 in eligible purchases within the first 120 days of account opening.

That could net you up to $100 in cash back every quarter, working out to $400 per year. For a $0 annual fee, this offers significant value.

This card offers rewards beyond online shopping, earning you 2% cash back on one everyday category of your choice every quarter, including gas and EV charging stations, grocery stores or restaurants.

Overall, for cashback-lovers and online shoppers alike, the U.S. Bank Cash Visa Signature Card is a solid choice.

Pros

- 5% cash back on the first $2,000 spent in combined eligible purchases each quarter on two categories of your choice, including: fast food; TV, internet and streaming; cell phone; home utilities; department stores; electronic stores; sporting good stores; movie theaters; gyms and fitness centers; furniture stores; ground transportation; and select clothing stores

- 2% cash back on one everyday category of your choice each quarter, such as gas and EV charging stations, grocery stores or restaurants

- 5% cash back on prepaid hotel, air and car reservations made through the Rewards Center

Cons

- Can be difficult to keep track of and opt into bonus spending categories every quarter.

The Blue Business® Plus Credit Card From American Express

The Blue Business® Plus Credit Card from American Express offers a simple and competitive earnings structure for online shopping.

The Blue Business card earns 2X Membership Rewards points per dollar spent on all purchases, up to $50,000 per calendar year (1X points thereafter). This means you can always pull this card out at the online checkout and be confident that you’re earning double points on your spending. You can also use this card in any other situation where your spending would fall outside of typical bonus categories offered by other cards.

The Blue Business® Plus Credit Card from American Express

15,000

Membership Rewards®

after you spend $3,000 in eligible purchases on the Card within your first 3 months of Card Membership

With an annual spending cap of $50,000, you can earn up to 100,000 Membership Rewards points, worth at least $1,000—if not more when transferred to partner airlines or hotels.

For a $0 annual fee (see rates and fees), small business owners can leverage this card to earn a competitive return on all online shopping purchases.

Pros

- 2X points on all purchases, up to $50,000 per calendar year (1X points thereafter)

Cons

- Limited range of bonus spending categories and cardholder perks

- Foreign transaction fee of 2.7%

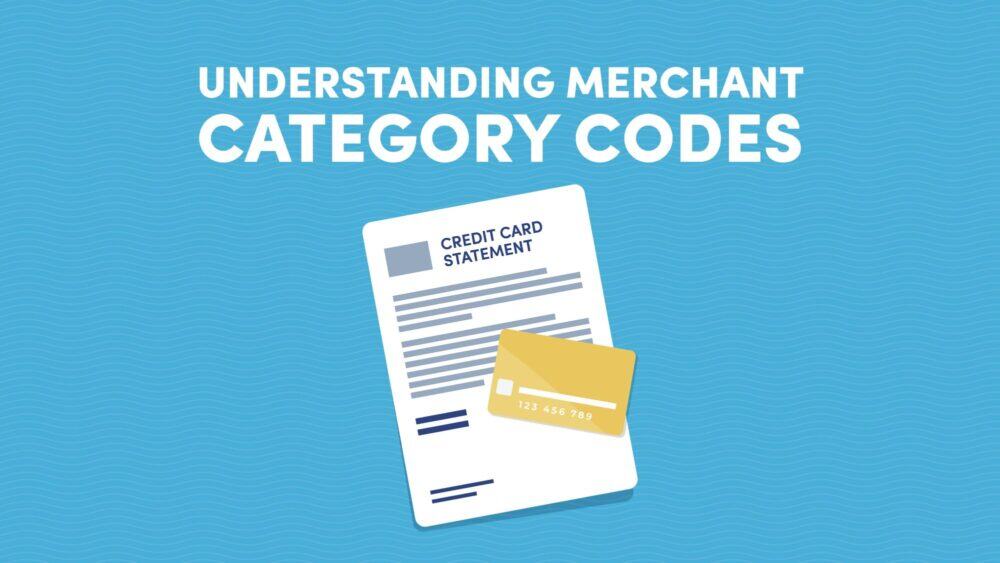

What Counts as Online Shopping?

Generally speaking, credit card issuers define online shopping purchases as the purchase of retail goods through an online store or app. The purchase of services or non-retail goods such as travel, tax payments or medical bills usually don’t count as online shopping.

That said, it all depends on the merchant category code (MCC) at the time of purchase.

Before choosing a card, consider contacting the card issuer to find out its specific definition of online shopping purchases. You can also use an existing credit card with a prospective online retailer to find out how their purchases code.

Strategies for Maximizing Rewards When Shopping Online

When it comes to maximizing rewards when shopping online, there are two strategies to consider.

The first is to open a card that offers bonus rewards with a specific merchant or platform. For instance, the Prime Visa specifically rewards purchases made on Amazon.

The second option is to open a card that offers a competitive baseline rewards rate on all purchases. That includes cards such as the Capital One Venture Rewards Credit Card and Citi Double Cash Card.

If you shop frequently with a specific merchant, the first strategy may be the better choice. Alternatively, if you want the flexibility of a general travel rewards card or if you shop online across multiple different platforms and retailers, going for the second strategy would be the better option.

You should also consider the value of the card outside of its online shopping rewards category—particularly if it has an annual fee. Online shopping purchases tend not to make up the greatest portion of the average household’s monthly expenditure. Therefore, you need to consider what value the card can confer outside of this category and how you’ll offset its annual fee.

That’s where general travel rewards cards, which often earn a higher baseline rewards rate on all purchases as well as offer travel protections, can be of greater value. These cards can serve you well beyond online shopping purchases, allowing you to earn points across multiple spending categories, benefit from additional cardholder perks and offset their annual fee with greater ease.

Whichever card you choose, you should also consider shopping through an online shopping portal to double-dip on your earnings.

Final Thoughts

The points and miles game is all about maximizing your natural expenditure to earn rewards. Leveraging your online shopping spending to earn some extra points, and cash back can add up to big rewards. In some cases, the extra points earned could be enough to make an award travel booking.

Whether you choose a card that earns you rewards with a specific merchant or a general travel rewards card depends on your individual spending habits. When judging the value proposition of credit cards for online shopping, consider what they can offer you beyond rewards on online purchases. The more rewards and perks they offer beyond online shopping purchases, the easier it will be to offset their annual fees and justify keeping them in your wallet.

¹ Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.

² For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through the Chase Travel Portal and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.