10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Chase Ultimate Rewards are one of our favorite transferable currencies. Thanks to Chase’s great array of transfer partners you can fly anywhere in the world and stay at some really amazing hotels.

One of Chase’s transfer partners is United Airlines, a member of the Star Alliance, the largest airline alliance in the world. This is where knowing a little big about airline alliances and partnerships could come in handy. In addition to the most obvious way of transferring Ultimate Rewards directly to United, there are other ways to book United Airlines flights with its partners’ miles.

If you are thinking, why would I want to deal with partners, when I can just book United flights with United miles, you aren’t alone. But for all my fellow Forrest Gump fans, I am going to paraphrase the movie’s most famous quote. After the introduction of dynamic pricing a couple years ago, United is like a box of chocolates. You never know what you’re gonna get.

Booking United flights through a partner program often makes more sense than booking direct.

How to Transfer Ultimate Rewards Points to Partners

Let’s quickly review how you can transfer Ultimate Rewards points to partner airlines. Only points earned with a premium card, i.e. a card with an annual fee can be transferred to travel partners. So if you have a no annual fee Ultimate Rewards earning card, such as the Chase Freedom Flex®, you’d first have to combine points with points earned with a premium card.

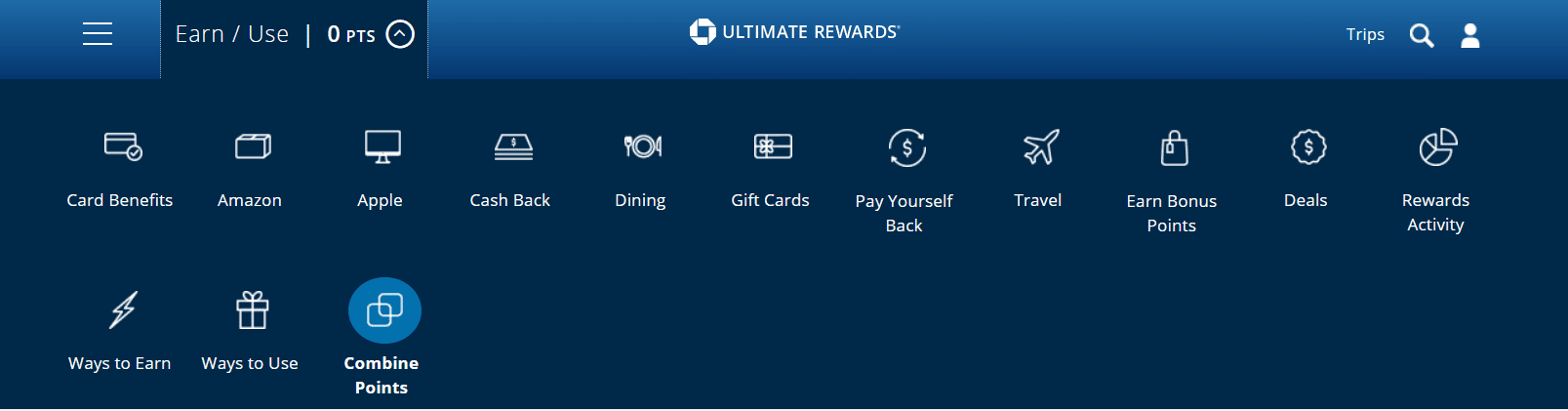

It’s easy to do so right from Chase Travel℠. Just navigate to your Ultimate Rewards account and click on the drop down arrow next to Earn/Use, then click Combine points.

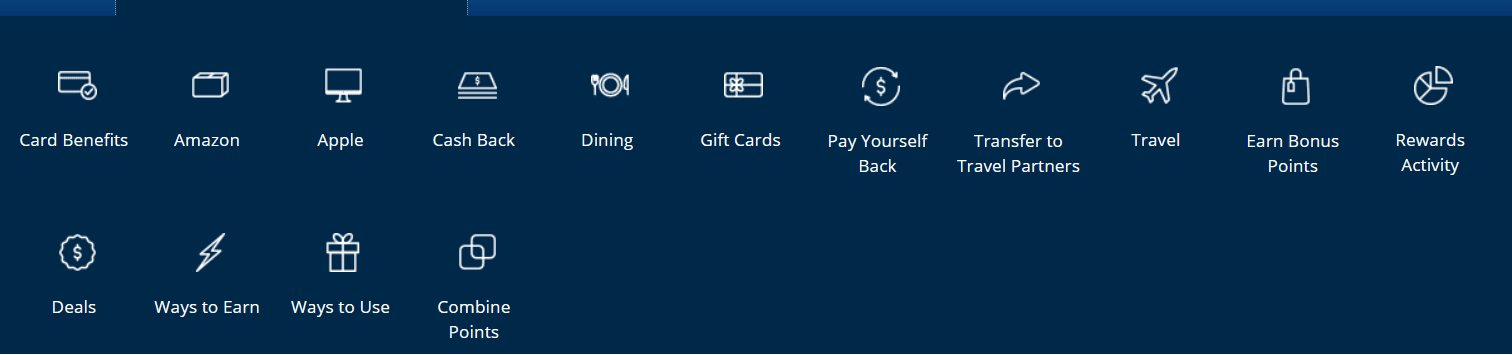

The next step would be to switch over to your premium card’s Ultimate Rewards account and click on Transfer to Travel Partners.

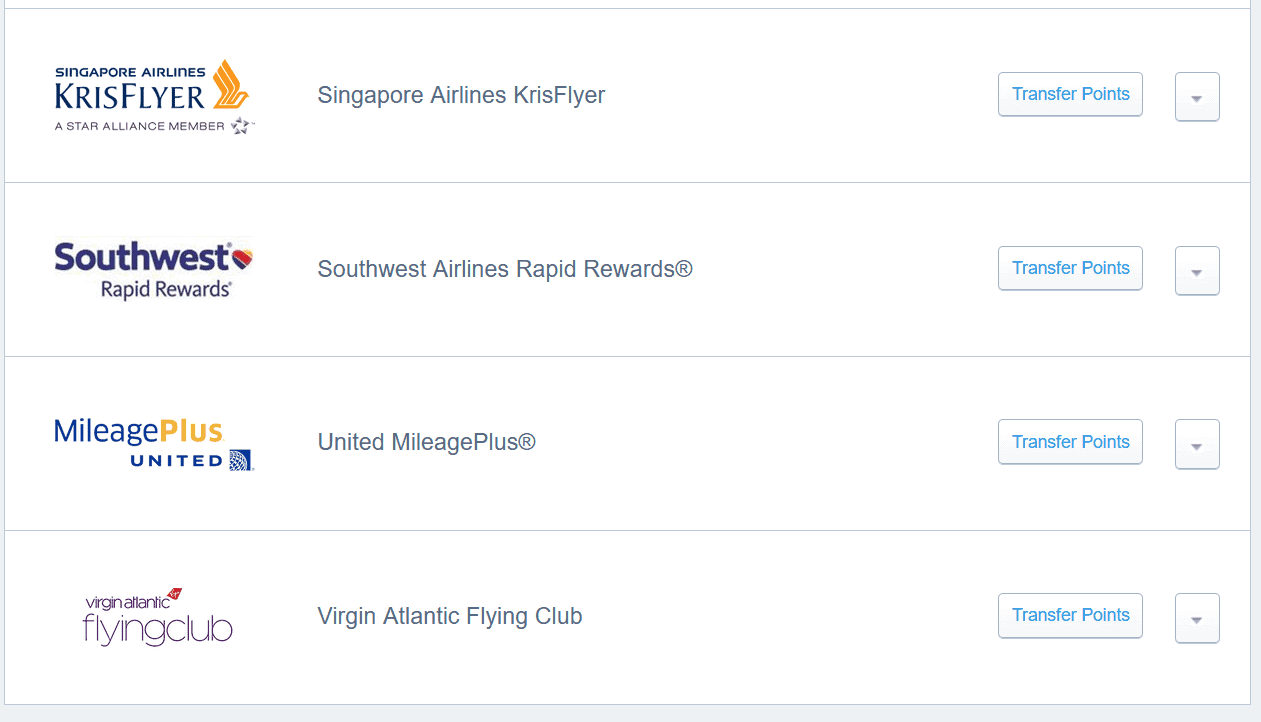

Then all you have to do is find the transfer partner airline, link your frequent flyer account with your Ultimate Rewards account and transfer as many points as you need. Don’t transfer points speculatively, as it’s always best to keep the points as a flexible currency. The transfer is one-way only, and once the points are moved to an airline, you can’t bring them back.

Transfer Ultimate Rewards Points to United

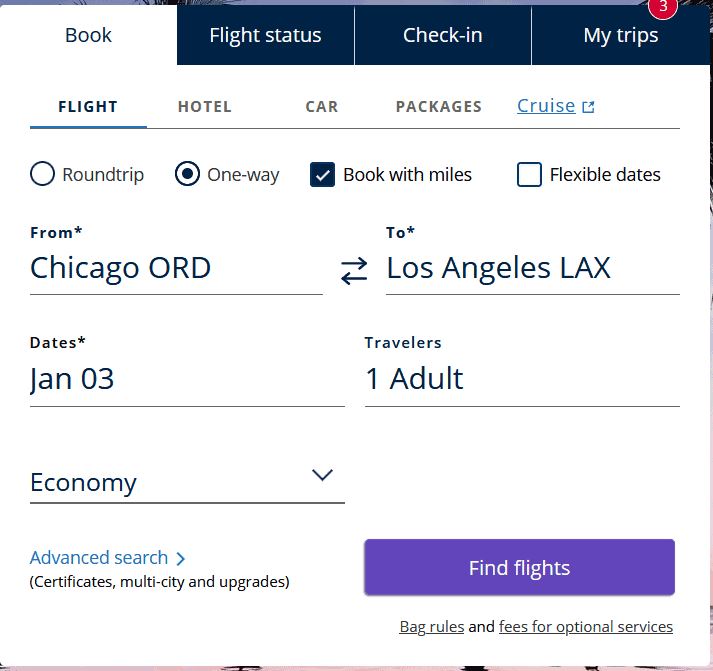

Now that you know how to transfer points, you’ll just need to move the Ultimate Rewards points to United. United’s search engine is one of the easiest to use. All you need to do is plug in your dates, departure and destination airports and to make sure that Book with miles is checked.

If you have an elite status with United or have one of the United co-branded credit cards, make sure to login first. United will show better economy award space availability to its own elites and United co-branded credit holders.

Transfer Ultimate Rewards Points to Aeroplan

Aeroplan is a fairly recent addition to Chase’s stable of transfer partners. While United has moved to dynamic pricing, Aeroplan has both a zone and a distance-based award chart so it’s possible to book United flights with fewer Aeroplan miles than with United miles.

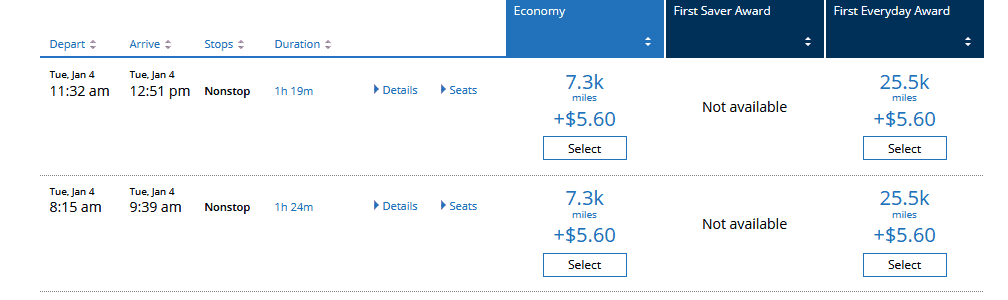

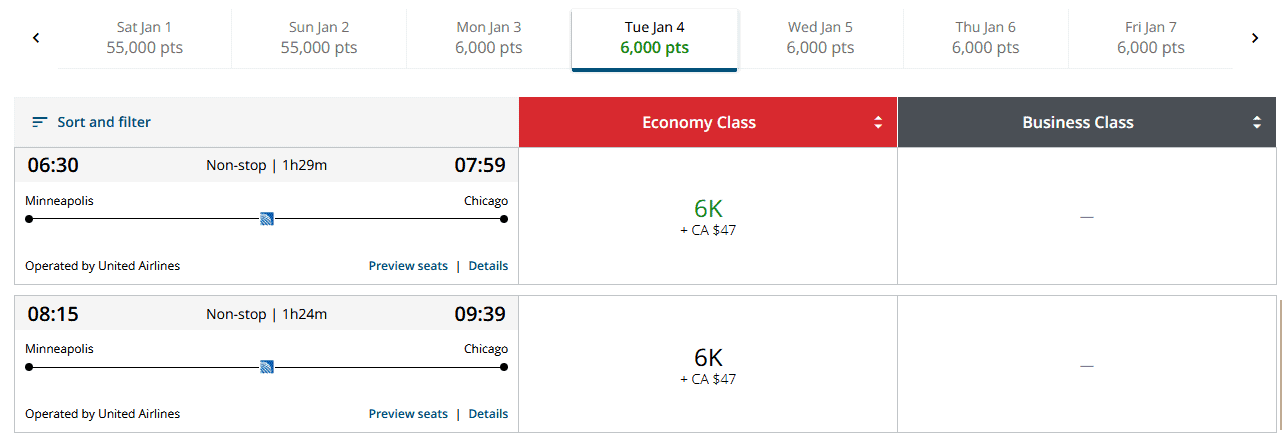

So always check both programs to see who’s got a better rate. Here’s an example – let’s say I wanted to book a short domestic flight.

Thanks to the unpredictability of United’s dynamic award prices, you can book the same flight with fewer Aeroplan miles. Here’s the same flight available via Aeroplan. I’d save 1,300 Ultimate Rewards points on the same flight by going through Aeroplan.

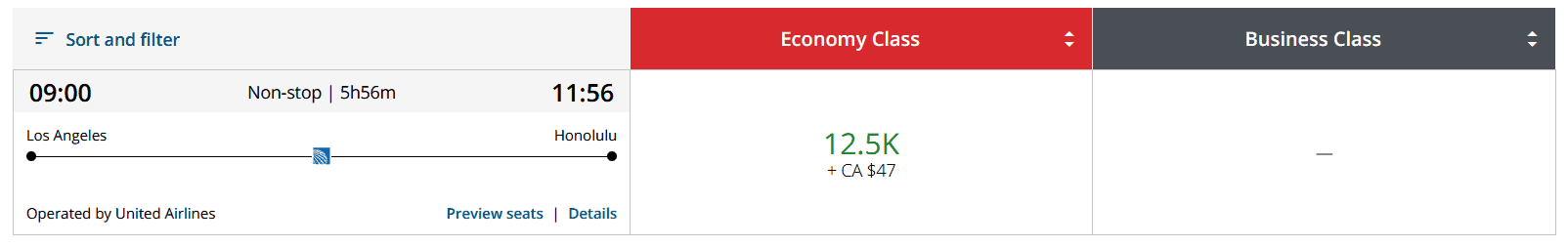

Heading over to Hawaii? Because there’s an award chart, you know that you’ll need 12,500 Aeroplan miles to fly from the West Coast to Hawaii one-way in economy.

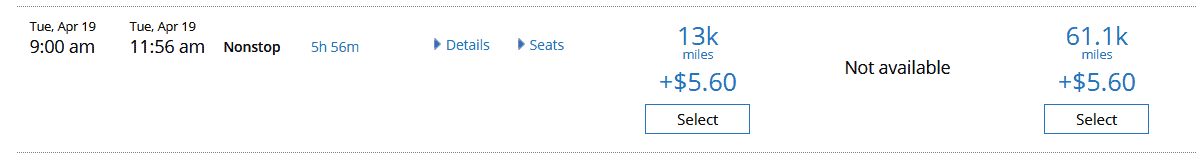

United, however, can charge you anything they want. When I was writing this, United wanted 500 more miles for the same flight. United can adjust its price up or down, however, at any moment, so these are the “joys” of dynamic pricing!

Aeroplan allows stopovers for 5,000 miles. One stopover is allowed on a one-way ticket, and two stopovers are allowed on round-trip tickets. You’ll have to call Aeroplan to book an itinerary that involves a stopover.

Also consider Using Aeroplan if you are flying with a lap infant. You’ll pay just 25 CAD (roughly $19 USD) or only 2,500 points to add an infant to your ticket. Lap infants for flights within the U.S. and Canada are free.

United also allows lap infants under the age of two to fly for free on domestic awards, but you’ll have to pay between $25 and $250 plus tax to add an infant to an international award ticket. Unfortunately, right now we don’t have more information on how much exactly it’ll cost to add your baby to a United reservation.

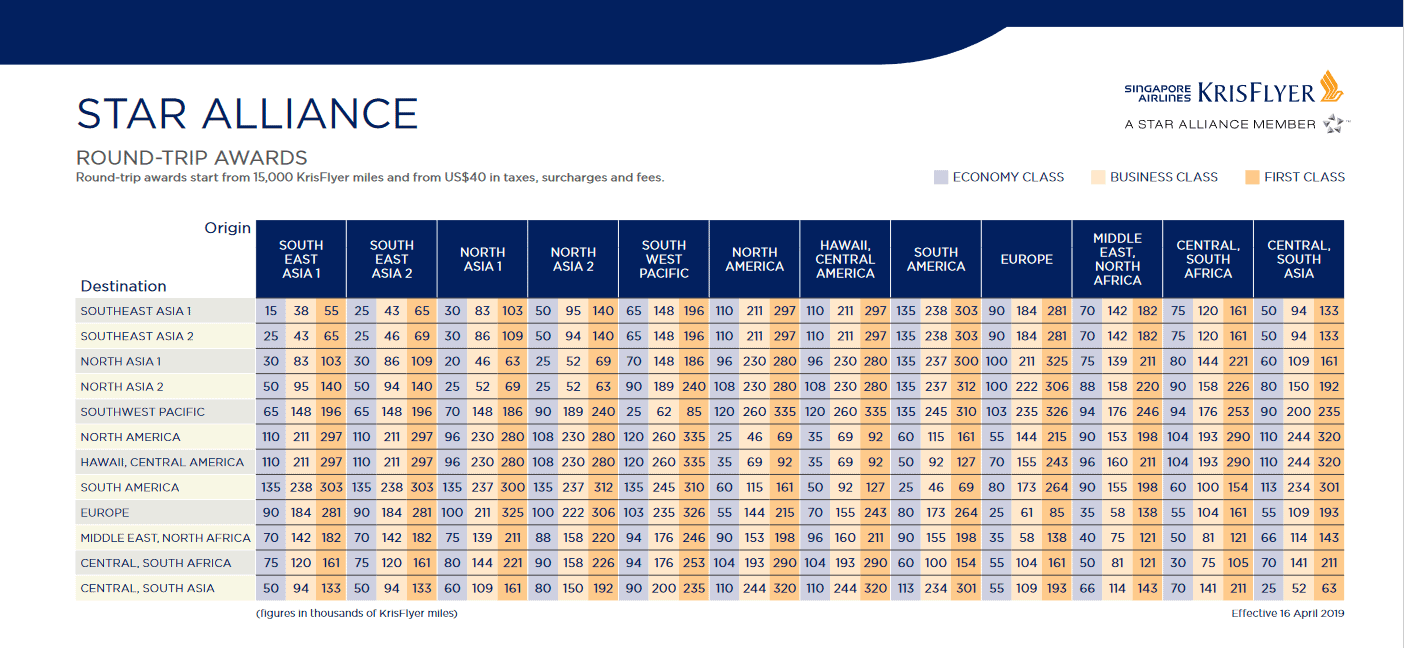

Transfer Ultimate Rewards Points to Singapore Airlines KrisFlyer

Singapore Airlines is a long-standing transfer partner of Chase. As is the case with Aeroplan, you might need fewer miles to book a United-operated flight. Singapore maintains a partner award chart and, for example, you can book a domestic business class one-way award for 23,000 KrisFlyer miles.

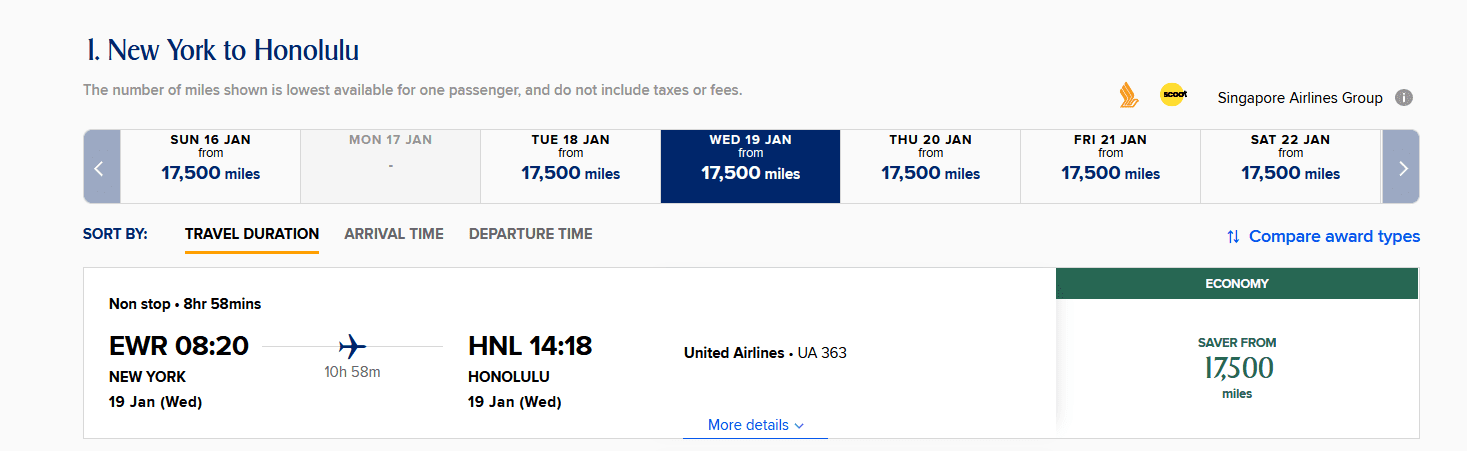

KrisFlyer has Hawaii as a separate region, but the rates are still excellent. You can get there one-way in economy for 17,500 miles or in business for 34,500 miles.

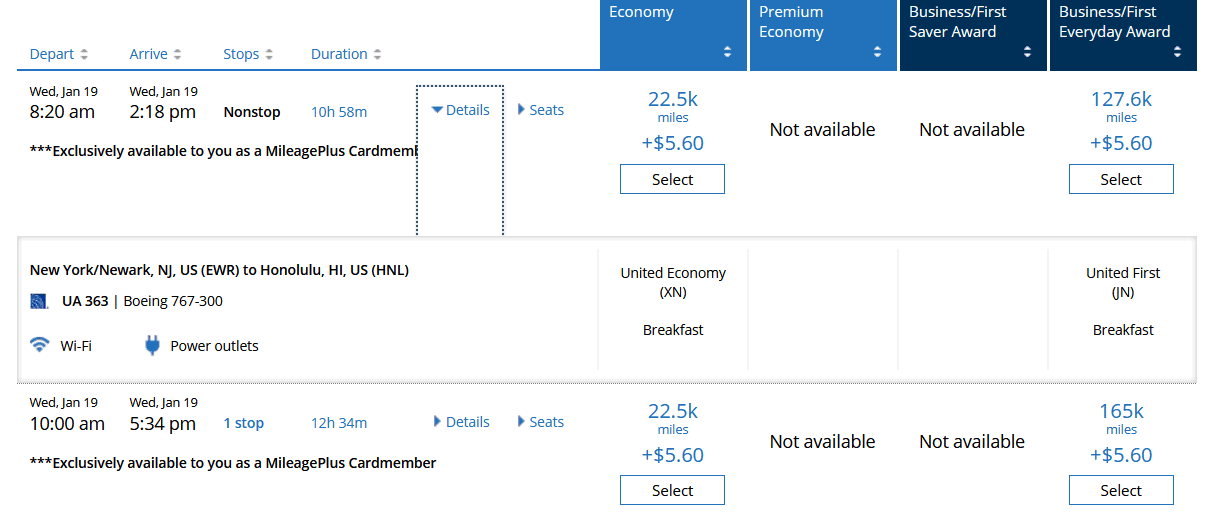

And here’s what United charges for the same flight.

By simply checking both programs, you can save 5,000 miles!

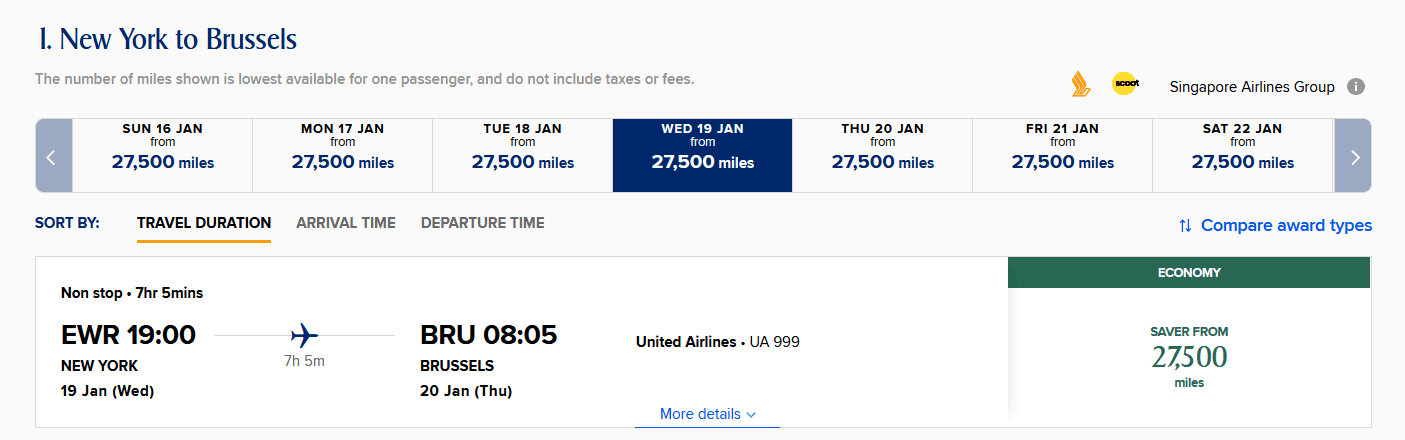

Another “sweet spot” of Singapore KrisFlyer are economy awards from the U.S. to Europe. You can save at least 2,500 miles by booking a flight with Singapore miles. You’ll need just 27,500 miles one-way as opposed to United’s 30,000 miles.

Pay Yourself Back

Chase has introduced a Pay Yourself Back option which allows you to “erase” certain purchases at a much better rate than the standard 1cent/point. Depending on what card you have, you can pay yourself back for some purchases, such as dining or groceries.

This is sort of a backdoor way to use Ultimate Rewards points for United flights. Just use your eligible card to make eligible purchases and then reimburse yourself. You can then use the cash you saved this way to book a United flight. By doing this you are earning miles for the future flight and you have the ultimate flexibility. And there’s no need to search for award space, always a bonus!

Chase Travel Portal

Before Chase introduced the Pay Yourself Back option, the travel portal was the best cash-like way to book United flights with Ultimate Rewards points. If you have the Chase Sapphire Preferred® Card or the Ink Business Preferred® Credit Card, the points are worth up to 1.75 cents each. If you have the Chase Sapphire Reserve®, the points are worth up to 2 cents each.

By booking the flights through the portal, you are purchasing a cash fare (even though you are paying with points), so you’ll also earn miles and elite qualifying segments. And, of course, there’s a huge degree of flexibility too, so you aren’t constrained by the available award space.

When using the portal or the pay yourself back method, always compare the cost in points with what you can find through one of Chase’s transfer partners because the cost in points is directly linked to the cash price. Once you’ve established which way is cheaper, you can decide which method to use to book your flights.

Earn 100,000

bonus points + $500 Chase Travel℠ promo credit

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $795

Cards to Help You Earn Ultimate Rewards

Chase has an excellent lineup of Ultimate Rewards earning cards. The Chase Sapphire Preferred® card is a popular Ultimate Rewards earning card.

If you are a business owner, then the Chase Ink Business Preferred® Credit Card tends to have a valuable sign up bonus as well.

Some of the best earning cards in Chase’s portfolio are actually the no annual fee Freedom cards. Keep in mind that you’ll still need one of the premium cards (a card with an annual fee) to be able to transfer the points to partners or book travel through the portal. The points you earn with a no fee card can be easily combined with points earned with premium cards for maximum value.

You do have to be under 5/24 to get approved for the Chase credit cards.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

Chase Ink Business Preferred® Credit Card

90,000

bonus points

after you spend $8,000 on purchases in the first 3 months after account opening.

Annual Fee: $95

Final Thoughts

There are several ways to book United flights using Ultimate Rewards points. Because United has moved to dynamic pricing, there’s no one best way to book a flight with points. But if you have the patience to compare all the options, you can potentially stretch your points much further and have more free travel in your life.

Travel well,

Anna

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $5,000 on purchases in the first 3 months from account opening.

after you spend $5,000 on purchases in the first 3 months from account opening.

after you spend $8,000 on purchases in the first 3 months after account opening.

after you spend $500 on purchases in your first 3 months from account opening

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.