10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

The Chase Ink Business Preferred® Credit Card is Chase’s mid-range travel card offering for business owners. We consistently rank it one of the top credit cards for small businesses because of its generous welcome bonus for new cardholders, reasonable annual fee and the amazing value of the points it earns.

However, every business is different. Depending on factors, such as spending patterns and travel requirements, the value of the Ink Business Preferred card can vary wildly. Let’s look at all aspects of the Chase Ink Preferred and help you determine whether or not it’s worth adding to your wallet.

Card Overview

Let’s start by getting familiar with the basics of the Chase Ink Business Preferred® Credit Card.

Welcome Bonus

One of the most coveted aspects of the Ink Preferred is its amazing welcome bonus. Historically, this card has offered 100,000 Chase points after spending between $8,000 and $15,000 within the first three months. At the very minimum, this bonus is worth $1,000 when redeemed as cash back (though we can do much better than that).

For the average person, these spending requirements can be quite difficult to achieve. But if your business is able to do so, we recommend taking advantage of this offer. One hundred thousand points is usually one of Chase’s highest public offers for any of their cards, including those on the personal side. We’ll give you a taste of what you can redeem these points for later in the article.

Chase Ink Business Preferred® Credit Card

90,000

bonus points

after you spend $8,000 on purchases in the first 3 months after account opening.

Annual Fee: $95

Earning Categories

Another valuable benefit of the Chase Ink Business Preferred® Credit Card is that its bonus earning categories are tailored to many modern businesses. In particular, you’ll earn 3X Ultimate Rewards points on up to $150,000 worth of combined spending in the following categories each card anniversary year:

- Travel

- Shipping purchases

- Internet, cable and phone services

- Advertising purchases with social media sites and search engines

For all other purchases, you’ll earn 1X.

Some of these categories are unique across the cards that Chase offers (both business and personal). So if your business can take advantage of the 3X categories, that’s a pretty good reason to consider this card.

Ability to Transfer Points to Partners

The Chase Ink Business Preferred® Credit Card is the only Chase Ink card that unlocks the ability to transfer points to travel partners. This allows cardholders to convert their Chase points into airline miles or hotel points with partner programs.

Note that transferring points to partners is irreversible. It’s a good idea to have a plan in mind before initiating a transfer so you can maximize the value of your rewards.

Foreign Transaction Fees

The Ink Business Preferred has no foreign transaction fees. This makes sense as it’s designed to be a business travel card.

Annual Fee

The Chase Ink Business Preferred® Credit Card comes with an annual fee of $95. All things considered, that’s a pretty low annual fee for the amount of value you could potentially get from this card, but your business’s mileage may vary.

Chase Ink Business Preferred® Credit Card

90,000

bonus points

after you spend $8,000 on purchases in the first 3 months after account opening.

Annual Fee: $95

Additional Benefits of the Ink Business Preferred

Here are a few other notable benefits that come with the Ink Business Preferred:

- Primary rental car collision damage waiver: This benefit provides reimbursement for damages due to collision or theft, up to the actual cash value of the vehicle rented for business purposes. The Ink Business Preferred offers primary coverage, which means that your credit card insurance benefits take precedence over other auto insurance policies, including your own.

- Purchase protection: Eligible items purchased using your Ink Preferred card are protected against damage and theft for up to 120 days. The protection covers up to $10,000 per claim (maximum $50,000 per account). Keep receipts for larger purchases so you have an easier time using this benefit.

- Extended warranty protection: The Ink Preferred provides an additional year of warranty protection for any eligible purchased items with a warranty shorter than three years.

- Cell phone protection: This benefit provides insurance coverage for eligible cell phones against theft or damage. For each claim, you could receive up to $1,000. We highly recommend putting your cell phone bill on this card, since the 3X multiplier in that category stacks well with this benefit.

- Baggage delay and lost luggage protection: This benefit provides reimbursement for lost luggages (including theft) or baggage delayed for more than six hours while on a covered trip.

- Trip cancellation and trip interruption: The Ink Preferred provides reimbursement for when your trip gets canceled due to a covered reason, including serious illness or a natural disaster. You also get trip interruption insurance, which can be useful if you fall ill during a trip and need to return home early.

- Trip delay insurance: This benefit provides up to $500 in reimbursements if your trip is delayed by a covered hazard for more than 12 hours or requires an overnight stay.

- Employee cards: With the Ink Preferred, you can issue employee cards at no additional cost.

Overall, this is a pretty comprehensive set of travel benefits, especially for a card that charges a $95 annual fee. If your business does any amount of regular travel, these are all great benefits to help protect your next trip.

Please note that you do need to be under Chase’s 5/24 rule to apply for this card. However, adding a Chase Ink card won’t put you over the 5/24 limit, since most business cards don’t show up on your credit report. Getting the Ink preferred is a great way to continue gathering valuable Ultimate Rewards points without hurting your ability to apply for other Chase personal cards.

Drawbacks of the Ink Business Preferred

The Chase Ink Business Preferred® Credit Card comes with a lot of benefits, but not all businesses may be able to take advantage of them. Here are some potential drawbacks that you should be aware of:

- No statement credits to offset $95 annual fee: Many cards that have annual fees offer some sort of credits to help offset the annual fee. For example, the most similar card to the Ink Preferred is the Chase Sapphire Preferred® Card, which also charges a $95 annual fee. However, it has an annual $50 hotel credit, effectively bringing the annual fee down to $45. The Ink Preferred doesn’t come with any statement credits so you’ll have to justify the annual fee in other ways.

- Limited 3X categories: The Ink Preferred does offer 3X points on a variety of modern business categories, but it won’t matter if you don’t have significant spending in these areas. The card earns only 1X on other expenses, so you’re better off using a card like the Chase Ink Business Unlimited®, which earns a baseline of 1.5X on all purchases.

- Travel benefits overlap: Some other travel cards, including the Chase Sapphire Preferred and the Chase Sapphire Reserve®, have many of the same travel benefits as the Ink Business Preferred. This applies to cards outside of the Chase ecosystem as well. If you already hold one of these travel cards, you won’t find much value with these extra benefits.

Alternatives to the Ink Business Preferred

There are a couple cards out there that could be better alternatives to the Ink Business Preferred. Depending on your business, you might find better value with some of these cards instead.

Capital One Spark Miles for Business

One of the most popular travel business cards is undoubtedly the Spark Miles for Business card from Capital One. This card earns 2X back on all purchases and also offers a $120 Global Entry or TSA PreCheck credit, making the $95 annual fee (waived for the first year) easier to justify. You also get many of the same travel benefits as you get with the Ink Business Preferred.

Just note that Capital One typically does report business cards onto your personal credit report, so it can impact your ability to apply for Chase cards due to the 5/24 rule.

Capital One Spark Miles for Business

50,000

Bonus Miles

after you spend $4,500 in the first 3 months

Annual Fee: $0 for your first year, then $95.

Chase Ink Business Unlimited® Credit Card

This card earns a flat 1.5X points on all purchases, so it’s a good option for those looking for a simpler setup that still offers decent rewards. It also comes with a $0 annual fee, so it works great as a catch-all card for your business.

Chase Ink Business Unlimited® Credit Card

Earn $750

bonus cash back

after you spend $6,000 on purchases in the first 3 months from account opening

American Express Blue Business Cash™ Card

Similar to the Chase Ink Unlimited, the American Express Blue Business Cash™ Card offers a 2% cash back on all purchases (up to $50,000 per calendar year, 1% after that). It also has a $0 annual fee (see rates & fees), so it’s another great catch-all option.

American Express Blue Business Cash™ Card

$250 statement credit

after you make $3,000 in purchases on your Card in your first 3 months.

American Express® Business Gold Card

If your business can’t take advantage of the Ink Preferred’s 3X categories but has high spend in a few other areas, this could be another option. This card earns 4X American Express Membership Rewards points on the top two categories each billing statement with the highest spend on the first $150,000 in combined purchases from these categories each year, then 1X. However, make sure your business spending is high enough to justify the hefty $375 annual fee (see rates & fees) that this card charges.

American Express® Business Gold Card

100,000

Membership Rewards® Points

after spending $15,000 in the first 3 months. Terms apply.

Annual Fee:

$375

Maximizing the Ink Business Preferred

Let’s discuss how you can get the most out of the Ink Business Preferred. There are two main areas you can work on maximizing the value: the 3X earning categories and redemptions with Chase’s travel partners.

1.25x = 9,500

x = 7,600

So, we need to earn 7,600 points to break even. How much would you have to spend in the 3X categories to achieve this? We can solve the following formula for y to find out:

3y = 7,600

y = 2,533.33

In other words, if your business spends more than $2,533.33 in travel, shipping purchases, internet, cable, phone services and advertising per year, you’ll come out ahead using this card.

However, we can dig a little deeper into these categories. Travel is a category that shows up on a lot of Chase cards, notably:

- Chase Sapphire Reserve®: Earn 8x points on all purchases through Chase TravelSM, including The EditSM and 4x points on flights and hotels booked direct. Plus, earn 3x points on dining worldwide & 1x points on all other purchases.

- Chase Sapphire Preferred® Card: 5X if booked through Chase Travel℠ and 2X on all other travel

- Chase Freedom Flex®: 5X if booked through Chase Travel℠

- Chase Freedom Unlimited®: 5X if booked through Chase Travel℠

What we notice is that if you book your travel through Chase Travel℠, a lot of these multipliers actually beat the 3X rate on the Ink Preferred. This means that this category may not mean much to you.

In addition, the Chase Ink Business Cash® Credit Card earns 5% cashback issued as Ultimate Rewards points multiplier on internet and phone bills (on the first $25,000 per year across all 5% back categories), which makes the 3X rate on the Ink Preferred also relatively useless.

Effectively, we’re left with the shipping and advertising categories that are unique to the Ink Preferred. To maximize the points you can earn on this card, as well as other Chase cards you might hold, concentrate your spending in these two categories. More specifically, spending more than $2,533.33 per year in shipping and advertising helps justify the annual fee year after year.

Chase Transfer Partners

It’s widely accepted that one of Chase’s best travel partners is World of Hyatt. While most other major hotel programs have shifted to dynamic pricing, Hyatt uses a fixed award redemption chart, allowing us to get great value at some amazing properties.

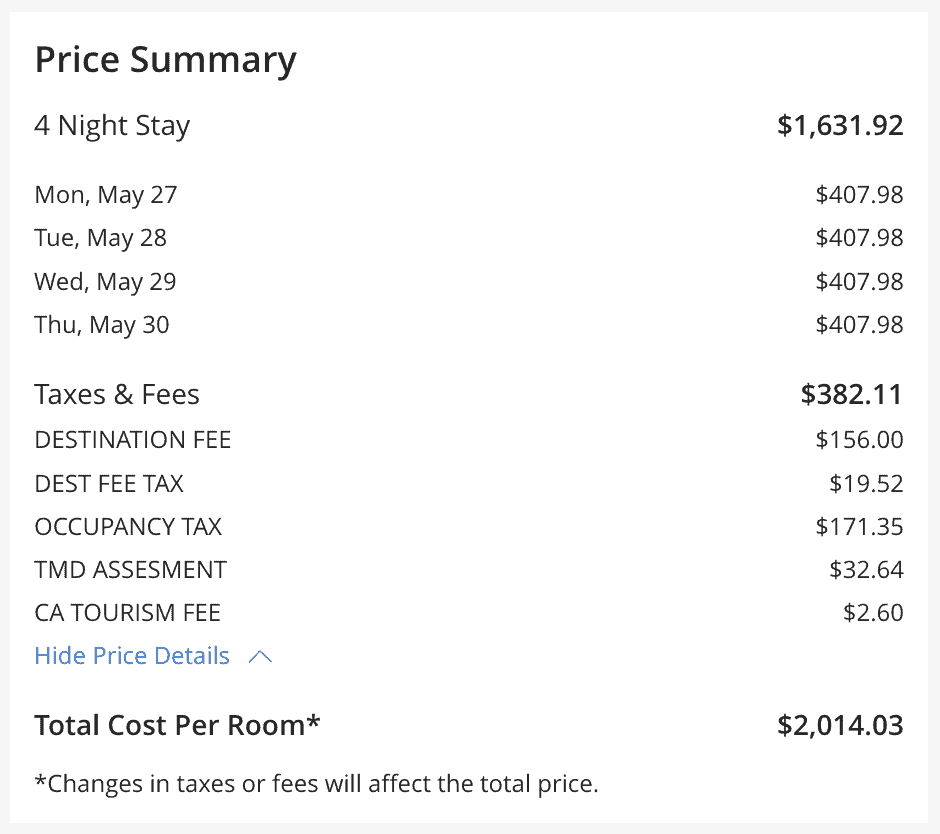

Consider the Manchester Grand Hyatt San Diego, a Category 4 Hyatt hotel. A week-long business trip in a One King Bed room could run as high as $2,014.03, including taxes and fees.

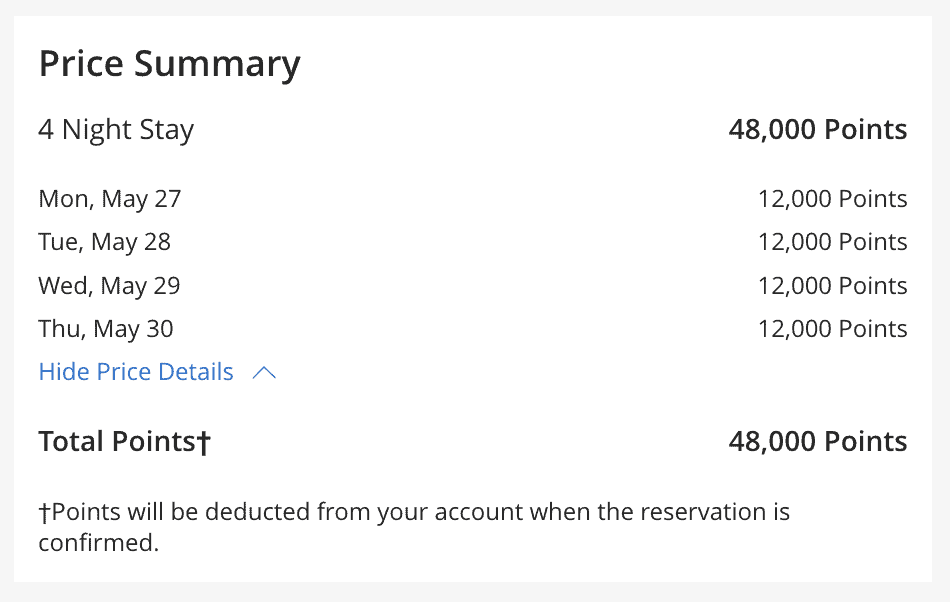

The same room costs 12,000 Hyatt points per night for the same dates (at off-peak pricing):

For this redemption, the Chase points are worth 4.2 cents apiece. That’s an excellent deal, especially considering that the sign-up bonus for this card alone can get you up to eight nights at this property at off-peak pricing.

Final Thoughts

The Chase Ink Business Preferred® Credit Card is an interesting option for many modern businesses. If you’re able to meet the minimum spend requirements to earn the sign-up bonus, we think this card definitely makes sense, at least in the short term. You can always consider canceling the card later. Longer term, this card makes sense for businesses that can consistently take advantage of the 3X categories.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

after you spend $8,000 on purchases in the first 3 months after account opening.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.