10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

Editors Note: All information about the American Express® Green Card has been collected independently by 10xTravel. The American Express Green Card is no longer available through 10xTravel.

Please note the Citi Premier® Card is no longer available to new applicants but you can read about its replacement card, the Citi Strata Premier℠ Card.

Earning transferable points is one of the key strategies for traveling for less. The flexibility to transfer points to a plethora of airlines or hotels is far superior to staking your travel future on one airline.

The most popular flexible points are Ultimate Rewards from Chase and Membership Rewards from American Express. Because conversations about flexible points normally involve one of these two currencies, you may have overlooked Citi ThankYou Points and the Citi Premier® Card.

Is it fair to overlook the Citi Premier® Card? Or is it the best-kept secret in the travel credit card space?

Let’s explore everything you need to know about the Citi Premier® Card to determine if it’s a dud or a stud of the flexible points credit card landscape.

Citi Premier Card Card Overview

Since Citi stopped receiving applications for the Citi Prestige, the Citi Premier® Card is the only travel card in Citi’s lineup that earns flexible points. It offers powerful earning potential on common spending categories and a solid list of transfer partners.

It’s competitively priced in the mid-tier credit card space with a $95 annual fee, and a $100 hotel statement credit can offset this out-of-pocket expense.

The Citi Premier® Card® Card earns 1X point on all spending and the following bonus rates on select categories:

- 3X at restaurants

- 3X at supermarkets

- 3X at gas stations

- 3X on air travel

- 3X on hotel stays

For many travelers, these categories represent the bulk of their credit card spending. There’s a lot to like about the Citi Premier® Card’s rewards structure, but there’s more to choosing the right card than simply racking up points.

Let’s take a look at what ThankYou Points can buy.

Redeeming ThankYou Points

ThankYou Portal

You can redeem Citi ThankYou Points through Citi’s ThankYou Travel Center where 1 point equals 1 cent. The ThankYou Rewards portal is powered by cxLoyalty, the same engine that Chase uses for the Ultimate Rewards travel portal. If you’re familiar with redeeming Ultimate Rewards, you’ll see identical availability on the Citi travel portal.

You can book everything from hotel stays, rental cars, flights or travel experiences on the Citi ThankYou portal. However, before you book a hotel stay or a flight, you may want to see if you could benefit from utilizing one of Citi’s transfer partners.

Travel

Citi Premier® Card Transfer Partners

Citi ThankYou Points can be transferred to 13 airlines, one retailer and three hotels, for a total of 17 transfer partners. Citi’s transfer partner list is strong for international travelers but misses some familiar favorites like American Airlines, Delta Air Lines and United Airlines. However, many of these partners are covered by airline alliances through the transfer partner list.

For instance, you can utilize Turkish Airlines Miles&Smiles to book a United flight to Hawaii because they’re both Star Alliance partners. Turkish Airlines uses a fixed award chart and is often cheaper than booking through United directly.

You could also transfer Qatar Airways Avios to the British Airways Executive Club program to book American Airlines tickets through the Oneworld alliance. Although these transfers may not be immediately obvious, they’re often cheaper than going through the airline reward program you intend to fly.

Most partners receive Citi ThankYou Points at a 1:1 ratio, except where noted below.

| Aeroméxico Club Premier | Qantas Frequent Flyer |

| Air France-KLM Flying Blue | Qatar Airways Privilege Club |

| Avianca LifeMiles | Sears Shop Your Way (1:10) |

| Cathay Pacific Asia Miles | Singapore Airlines KrisFlyer |

| Choice Privileges (1:2) | Thai Airways Royal Orchid Plus |

| Emirates Skywards | Turkish Airlines Miles&Smiles |

| Etihad Guest | Virgin Atlantic Flying Club |

| Eva Air Infinity MileageLands | Wyndham Reward |

| JetBlue TrueBlue |

Another underappreciated use of Citi points is transfers to Choice or Wyndham hotels. While transfers to hotels are less glamorous than first-class transpacific flights, the 1:2 transfer ratio to Choice hotels allows you to snag a low-cost hotel room as a base of operation for your international travels.

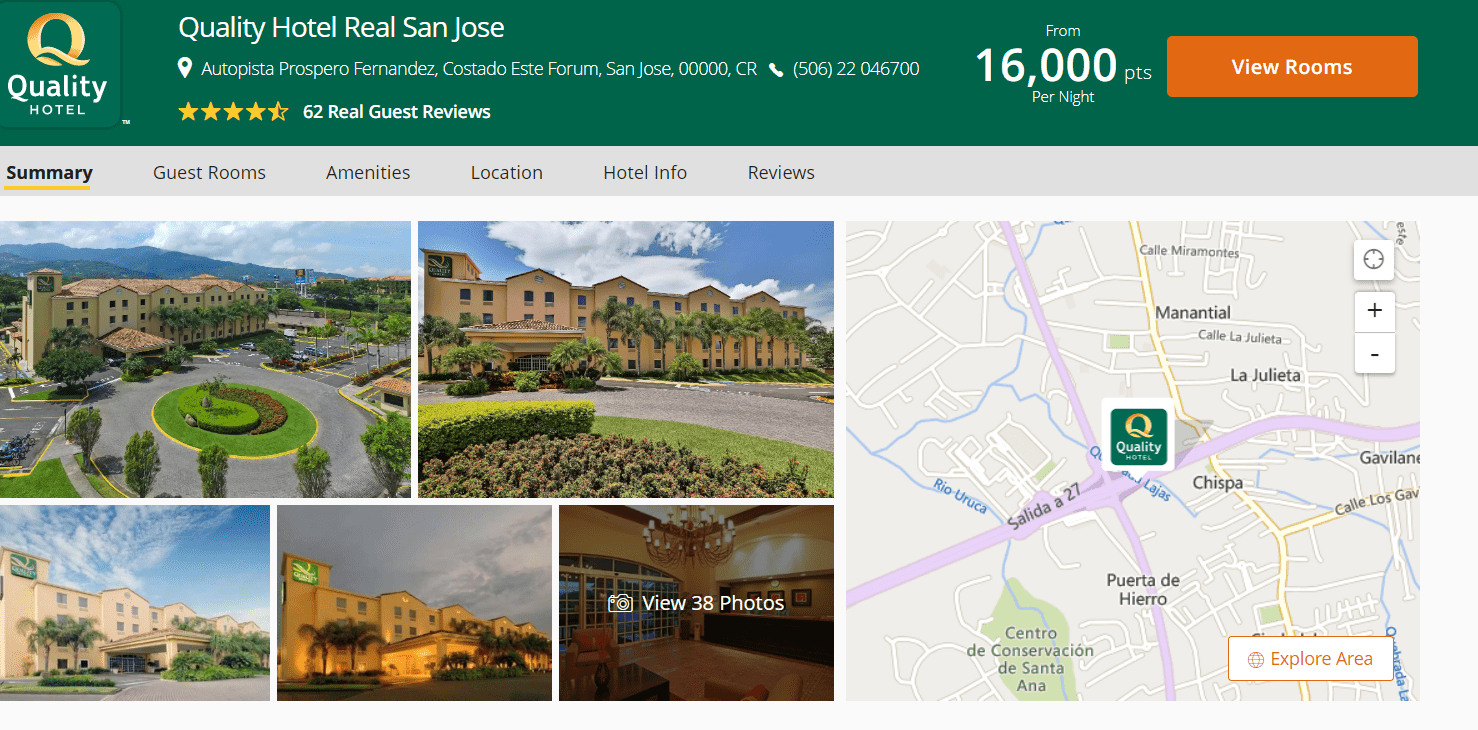

For instance, the Quality Inn Real San Jose requires only 16,000 points per night. You’d have to transfer just 8,000 ThankYou Points for this stay in Costa Rica.

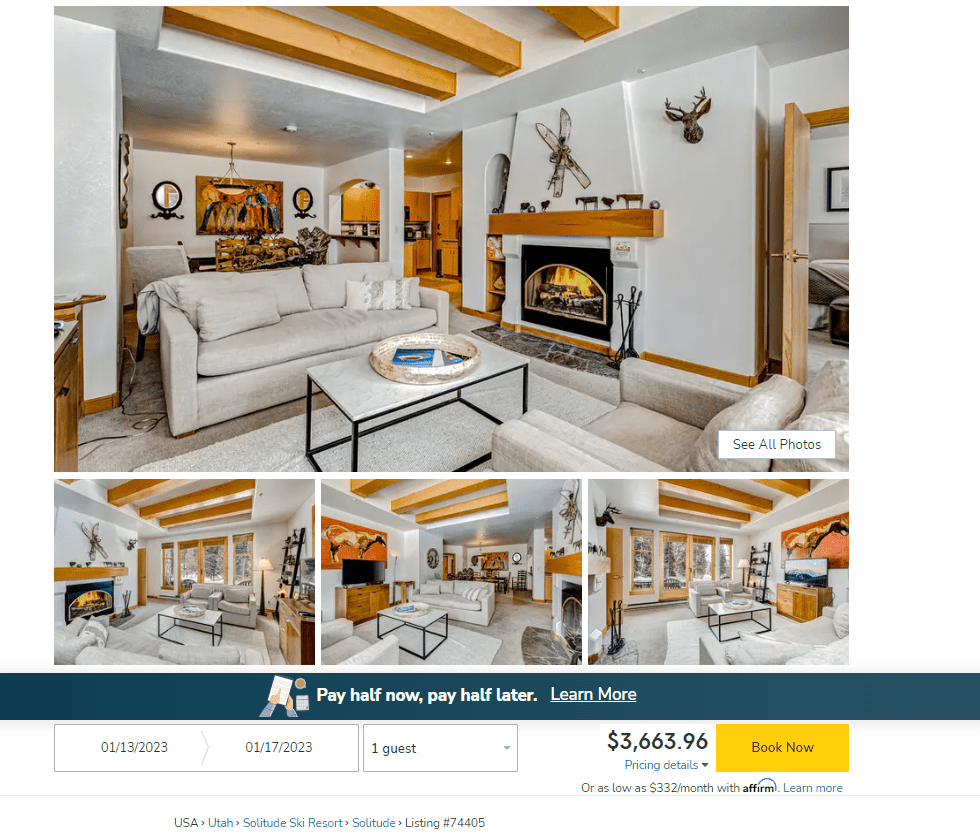

Wyndham Rewards allows you to book Vacasa rental properties for 15,000 points per bedroom per night. If you want to take your family on a ski vacation in Salt Lake City, you could redeem 120,000 ThankYou Points to cover this $3663.96 stay. That’s more than 3 cents per point in value!

Redeem for Cash or Gift Cards

You can redeem Citi ThankYou Points for cash via a check or statement credit. Each point is worth 1 cent. Additionally, you can order gift cards to a large variety of retailers. In general, points are worth 1 cent each, but sometimes you can find sales that will allow your points to go further. Either way, you likely can find more value transferring your points to a partner airline or hotel. However, if you need cash, Citi ThankYou Points can help.

Shop with Points

Shop with points allows you to connect your Citi ThankYou account with the loyalty account of your chosen retailer. Upon checkout, you’ll be able to select “Pay with Points.” There are currently six participating vendors.

The Shop with Points partner retailers are:

- 1-800-Flowers

- Amazon

- Best Buy

- BP and Amoco gas stations

- CVS

- PayPal

- Shell gas stations

Give to Charity

Using your ThankYou Points to send money to a charity is just as easy as requesting cash and then sending it to the charity yourself. For record-keeping purposes, it would likely be easier to donate from a cash account rather than using ThankYou Points. However, if you want to initiate your generosity with your Citi ThankYou Points, you’ll get a value of 1 cent per point.

Citi Premier Card Card Extra Perks

The Citi Premier® Card is marketed as a rewards card as opposed to a travel card. The Citi Premier® Card used to offer travel-oriented benefits, such as travel insurance, auto collision damage waiver and luggage insurance. All those perks were canceled in 2019. Although those travel benefits are gone, the Citi Premier® Card does offer a few extra perks to help offset its annual fee.

- $100 hotel statement credit on a single hotel stay totaling more than $500 (not including taxes or fees) booked through the ThankYou travel portal

- No foreign transaction fees

While the $100 hotel credit seems like an easy offset for the annual fee, it’s hard to use. Points and miles enthusiasts typically avoid $500 hotel bills the best they can. Even when they do have such bills, they often want to book through the hotel directly instead of a third-party travel agent like the ThankYou Travel Center. This way they get points for their stay.

However, this credit is perfect for those small non-chain hotels or Airbnb’s without rewards programs. If that’s a way you often travel, this credit may be easy to use.

Citi Entertainment

Citi entertainment allows you early access to a long list of popular events across the country. You can access Citi Entertainment with any Citi card. Some tickets are available for presale, giving you early access to purchasing marquee tickets, while others are preferred, a special allotment of tickets exclusively for Citi cardholders. Additionally, Citi Entertainment offers complimentary tickets for events like concerts, music festivals or VIP access. You can only access one complimentary ticket in any six-month period.

Is the Citi Premier Card Worth the Annual Fee?

The Citi Premier® Card is a solid rewards card, but it’s hardly a travel card. Although you can offset the annual fee with a $100 hotel credit, the credit is pretty restrictive and not everyone will get use out of it.

Whether you should pay the $95 fee to take advantage of the points earning potential alone depends on your spending patterns. Although building a sizable points balance with the Citi Premier® Card is easy, you can find cards that offer nearly equal points potential that include bells and whistles like travel insurance, rental car insurance or easily used statement credits.

If you think you can use the hotel credit every year, then the Citi Premier® Card can’t hurt to put in your wallet. If not, you probably won’t get the value out of your $95 fee.

Should You Apply for the Citi Premier® Card?

The Citi Premier® Card has lost a lot of its luster since getting rid of all the travel benefits and reducing the value of ThankYou Point redemptions through the portal from 1.25 cents to 1 cent.

The Citi Premier® Card regularly offers a fairly attractive welcome bonus. Even if you don’t use the statement credit, it’s likely worth applying for an elevated welcome bonus if you’re above 5/24. As a permanent card in your wallet, we’d suggest you look elsewhere.

The Citi Premier® Card isn’t a bad card by any stretch of the imagination. It simply doesn’t stand apart from the competition of similarly priced cards. It seems that every other issuer is packing additional benefits into their cards while Citi is stripping them out. Until this changes, the card is worth grabbing when there’s an enticing welcome bonus, but we wouldn’t suggest renewing the card.

Other Cards in the Same Price Range

Since the Citi Premier® Card can’t earn a place in your wallet, you should turn to other options. Luckily, the mid-price travel card space is jam-packed with competitors, so you’ll have lots to choose from. Let’s dive into some of the best alternatives to the Citi Premier® Card.

Capital One Venture Rewards Credit Card

The Capital One Venture Rewards Credit Card is best known for its 2X miles on all purchases. While this falls short of the Citi Premier® Card’s 3X rewards for some categories, the extra miles on categories that the Citi Premier® Card doesn’t elevate likely evens out.

You’ll also earn extra miles on two bonus categories:

- 5X on Turo rentals

- 5X on hotels and car rentals through the Capital One travel portal

Capital One Venture Rewards Credit Card

75,000

miles

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

Annual Fee: $95

Like the Citi Premier® Card, this card carries a $95 annual fee, but offers travel benefits that make the fee worth it.

- TSA PreCheck or Global Entry statement credit once every four years

- Two Capital One Lounge or Plaza Premium Lounge visits

- Secondary auto rental collision coverage

Carrying a card with some form of rental coverage is better than none. A $95 fee is worth this coverage alone. Although the Citi Premier® Card offers up to 3X on spending, the Capital One Ventures indiscriminate 2X miles will likely net you a similar point total, and you won’t have to worry about pulling out the right card every time you spend.

American Express® Green Card

At $150, the American Express® Green Cards’ annual fee is a bit higher than the Citi Premier®. However, the Amex Green Card adds travel benefits that the Citi Premier® Card skips, and it doesn’t slouch on points-earning potential either.

All information about the American Express® Green Card has been collected independently by 10xTravel.

With the American Express® Green Card, you’ll earn:

- 3X Membership Rewards points on travel

- 3X points at restaurants

- 3X points on transit

- 1X point on all other purchases

American Express® Green Card

40,000

Membership Rewards® Points

after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. All information about the American Express® Green Card has been collected independently by 10xTravel.

Annual Fee:

$150

Membership Rewards are powerful points that can be transferred to 18 transfer partners. Although many overlap with Citi, some standout transfer partners exclusive to Membership Rewards are Delta Air Lines and Hawaiian Airlines. You also can transfer Membership Rewards to Marriott Bonvoy, Hilton Honors and Radisson Rewards at a 1:1 ratio.

Along with solid earning potential and a plethora of partners, the Amex Green Card offers travel benefits that can enhance your travels, including:

- Up to $100 LoungeBuddy credit per year

- $199 CLEAR® Plus Credit: Receive up to $199 per calendar year in statement credits when you pay for your CLEAR Plus membership (subject to auto-renewal) with the American Express® Green Card

- Luggage reimbursement insurance

- Secondary rental car coverage

- Trip delay insurance

If you’re looking for a card with additional travel benefits, the Amex Green Card is a solid offering despite a higher fee.

Chase Sapphire Preferred® Card

The Chase Sapphire Preferred® Card is the go-to recommendation for points and miles newbies. Not only does it have a solid points earning structure, but each point is worth 1.25 cents on the Ultimate Rewards travel portal.

Combining points from other Ultimate Rewards earning cards, like the Chase Freedom Flex®, with your Sapphire Preferred account effectively increases their value by 25% if used in the travel portal.

Chase Sapphire Preferred® Card

75,000

bonus points

after you spend $5,000 on purchases in the first 3 months from account opening.

Annual Fee: $95

The Chase Sapphire Preferred® Card earns 1X Ultimate Rewards point per dollar spent but offers bonus earning on the following categories:

- 5X on hotels booked through the Ultimate Rewards travel portal

- 2X on other travel

- 3X at restaurants or select food delivery services

- 3X on online grocery purchases (except for Amazon or food clubs)

- 3X on select streaming services

- 5X on Lyft rides (through September 30 2027)

The Chase Sapphire Preferred® Card makes the $95 annual fee worth it by offering the following perks:

- $50 in statement credits for hotels booked through the Ultimate Reward travel portal

- Free credit score with Chase Credit Journey

- $10 monthly Gopuff statement credit

- 12 months of DoorDash DashPass

- Trip cancellation / interruption insurance

- Auto rental collision coverage (primary coverage)

- Trip delay insurance

- No foreign transaction fees

Final Thoughts

The Citi Premier® Card is a great points earning card, but what you see is what you get. No extra benefits means you’ll have to justify this card on the points earning potential or hotel statement credit alone.

The statement credit is very specific, making it difficult to take advantage of. While a lucrative welcome bonus may make the Citi Premier® Card worth an application, Citi will have to sweeten the pot to convince us to keep it in our wallet.

If you’re above 5/24 and are in points accrual mode, give the Citi Premier® Card a look. Otherwise, look at one of the other options above or peruse our best cards page to find the right card for you.

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

once you spend $4,000 on purchases within 3 months from account opening, equal to $750 in travel.

after you spend $3,000 on purchases on your new Card in your first 6 months of Card Membership. All information about the American Express® Green Card has been collected independently by 10xTravel.

after you spend $5,000 on purchases in the first 3 months from account opening.

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.