10xTravel is part of an affiliate sales network and receives compensation for sending traffic to partner sites, such as CreditCards.com. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit americanexpress.com to learn more.

Note: Some of the offers mentioned below may have changed or may no longer be available. The content on this page is accurate as of the posting date; however, some of our partner offers may have expired. You can view current offers here.

American Express has always been one of our favorite banks, but it keeps surprising us with great new welcome offers. The latest surprise came in the form of a widely targeted 100,000 Membership Rewards welcome bonus for $6,000 in spending over the first six months for its flagship premier card, The Platinum Card® from American Express. We’ve also seen some people get 125,000 points offers with the same spending requirements!

Usually, the welcome bonus is 75,000 Membership Rewards points after spending $5,000 in the first six months, so not only are you getting more points, but you also have extra three months to meet minimum spending requirements!

The Amex Platinum is truly a classic and a mainstay of ultra-premium travel credit cards. It offers a ton of value in exchange for the $695 annual fee and offers a lot of great travel-related benefits. Some might experience sticker shock at its $695 annual fee, but fear not, you’ll get your money’s worth from using the card and then some!

Let’s have a look at how you can get the maximum value out of your Amex Platinum Card.

The Welcome Bonus

If it’s your first time getting an Amex Platinum Card, you might be wondering what you can do with the 100,000 Membership Rewards points. The possibilities are endless, but if you need a starting point or an inspiration, the 10xTravel writers have come up with some great ways to put Membership Rewards to use.

Take Advantage of Bonus Categories

The card really shines when it comes to travel perks and that holds true for the earning points part. You’ll earn 5X points on flights booked directly with an airline and for flights and prepaid hotels purchased through American Express Travel® on the first $500,000 spent each year, 1x thereafter.

The improved welcome offer also includes an elevated earning rate on gas and groceries. You will earn 10X points on eligible purchases at restaurants and when you shop small in the U.S. on up to $25,000 for the first 6 months.

The card earns 1X on all other purchases.

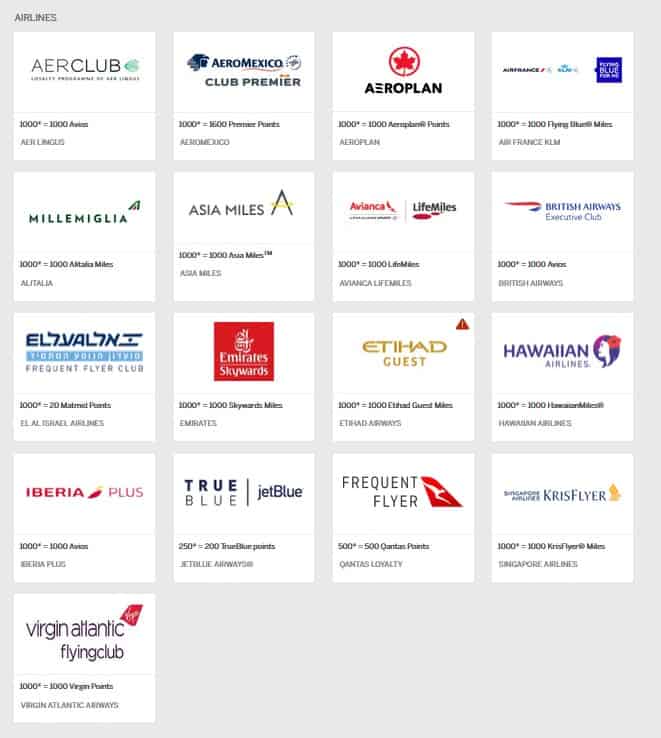

Use Airline Transfer Partners

Thanks to Amex’s extensive network of airline partners, you can travel anywhere in the world with Membership Rewards points. Amex has 17 airline partners and you’ll get the best value out of your Amex points by redeeming them on long-haul international flights. Your Membership Rewards points can take you anywhere, from Tokyo to Budapest or even around the world!

Amex hotel partners include Hilton, Marriott and Choice Hotels. Unless there’s a transfer bonus, it rarely makes sense to transfer Membership Rewards points to these hotel programs.

Maximize All the Annual Credits

Amex Platinum comes with a whole slew of valuable credits that help offset its annual fee.

$200 Uber Credits

The card comes with up to $200 in yearly Uber Credits plus Uber VIP Status. You’ll get up to $15/month in Uber credits in January through November and up to $35 in December. This is a “use it or lose it credit”, which means you need to use it up every month since the credit doesn’t roll over. However, it can also be used on Uber Eats, not just Uber rides, so go ahead and take a break from cooking dinner and let the food come to you!

All you need to do is add your Platinum card to your Uber account as a payment method.

Up To $200 Airline Incidentals Credit

The yearly credit can be used on purchases with the following airlines: Alaska, American, Delta, Frontier, Hawaiian, JetBlue, Spirit, Southwest or United. The credit can be used on change fees, pet flight fees, seat choice and in-flight food purchases. Don’t forget to select your airline first, then use your Amex Platinum for incidentals.

This is a yearly credit and it resets every year, so if you apply for this card in November or December of 2020, you’ll get the credit in 2020 and then again in January of 2021. You can change your airline selection every January.

Up To $100 Saks Fifth Avenue Credit

The Platinum Card from American Express comes with an up to $50 statement credit toward Saks purchases from January through June, and a second credit up to $50 from July through December, for a total of up to $100. If you get a new Amex Platinum at the end of the year, you’ll get up to $50 in 2020 and up to $100 in 2021.

If you are not a frequent Saks shopper and aren’t sure how to maximize the Saks credit, check out their sales section. You’ll often find great gifts on sale, including kids clothes and cool accessories.

Saks also sells a lot of mainstream skincare brands and the prices are the same as at other department stores. Or you can get a nice pair of sneakers without breaking the bank.

Don’t forget to use a shopping portal to maximize your Saks purchase.

$120 Global Entry or $85 TSA Precheck Credit

The credit can be used every four years to pay the Global Entry or TSA Precheck fee. If you are already enrolled in the trusted traveler program, use the card to pay for your friend’s or family member’s application. You’ll make their day when they don’t have to take their shoes off when going through airport security and when they skip the long line to passport control!

Take Advantage of the Elite Status

One of the best perks of American Express Platinum Card is its elite status perks. You’ll first have to enroll in each program and then enroll on Amex’s benefits page. As Amex Platinum cardmember, you get elite status in the following programs:

- Hilton Honors (Gold)

- Marriott Bonvoy (Gold)

- Hertz Gold Plus Rewards

- Avis Preferred

- National Emerald Club Executive

So make sure to take advantage of these benefits before your next trip.

Visit The Global Lounge Collection

This is one of the most valuable benefits of Amex Platinum. As a Platinum cardholder, you get access to a network of more than 1,200 lounges in 130 countries. You and two guests can visit the following lounges:

- The Centurion Lounge

- Delta SkyClub (when flying on Delta)

- Priority Pass Select

- Airspace

- Escape Lounges

This benefit requires enrollment, so make sure to enroll as soon as you get your card in the mail.

In addition to a quiet space to spend a few minutes before your flight or a long layover, the lounges offer food and drinks and sometimes even showers! Who wouldn’t want to relax in a lounge instead of waiting with hundreds of people at the gate? And you’ll save a bundle on food and drink – airport food is notoriously overpriced.

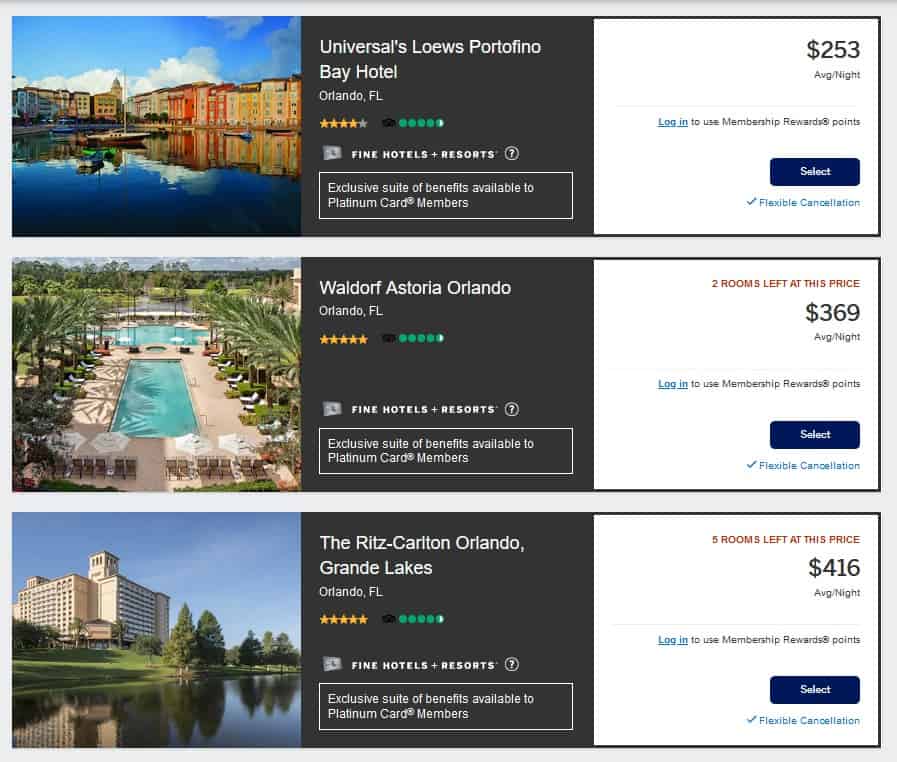

Take Advantage of Luxury Hotel Benefits

The Fine Hotels & Resorts program is a collection of luxury hotels where American Express Platinum cardholders get additional perks when they book their stay through American Express Travel®:

- Room upgrade upon arrival, when available

- Daily breakfast for two people

- Guaranteed 4pm late check-out

- Noon check-in, when available

- Complimentary Wi-Fi

- Unique amenity valued at US$100, such as a spa or food and beverage credit

You don’t have to travel far to enjoy these benefits at some of the world’s best hotels. If you prefer to vacation in the U.S. right now, there are lots of amazing properties where you can get the royal treatment, no elite status required!

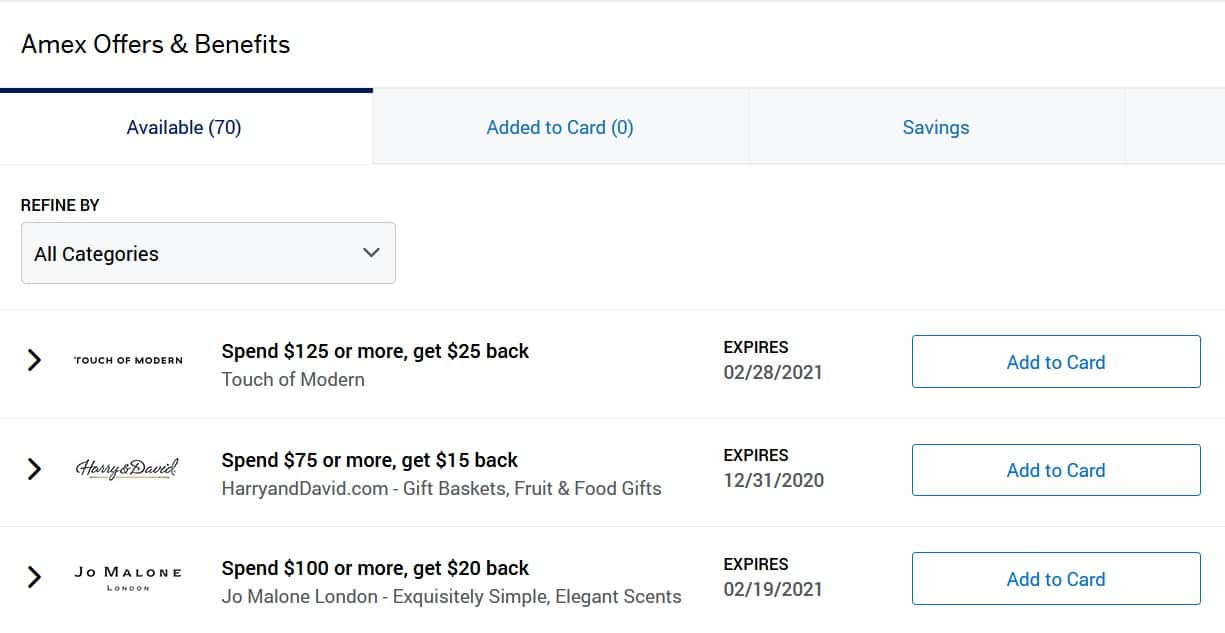

Check Out Your Amex Offers

If you are new to American Express ecosystem, you’ll find that Amex offers discounts to dozens of merchants, some of which you probably never heard of, and some of which will be very familiar. You’ll find Amex offers just below your current transactions.

To take advantage of the discount, you’ll need to add an offer to your card first. And here’s a little known fact about Amex offers. Amex won’t display more than 100 offers at a time, so keep adding offers, even if you don’t intend to use them. That’ll “free up” space for the new offers to load, and maybe you’ll get one of those really valuable offers like $100 off at Dell or a great discount on a paid hotel stay.

I check the offers every few days, and if I see an offer I might use in the future, I immediately add it to my card in case this offer disappears or Amex decides enough people have added it to their cards and pulls the offer.

Final Thoughts

American Express Platinum is a great card with generous benefits. It’s annual fee is easily offset by the multiple credits that come with the card, especially during the first year of card membership. Now is the perfect time to apply for a new American Express Platinum and take advantage of yearly credits in 2020 and again in 2021.

Here we’ve covered some of the benefits to help you get the most out of your new Amex Platinum card. But we just scratched the surface, as the card has a lot of other valuable benefits such as travel protection, rental car insurance and concierge services. If you can maximize the benefits, this card’s a keeper, and you’ll get great value out of its benefits year after year.

Travel well,

Anna

New to the world of points and miles? The Chase Sapphire Preferred® Card is the best card to start with.

With a bonus of 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening. , 5x points on travel booked through Chase Travel℠ and 3x points on restaurants, streaming services, and online groceries (excluding Target, Walmart, and wholesale clubs), this card truly cannot be beat for getting started!

Editors Note: Opinions expressed here are author’s alone, not those of any bank, credit card issuer, hotel, airline, or other entity. This content has not been reviewed, approved or otherwise endorsed by any of the entities included within the post.